Blank Ncui 101 PDF Template

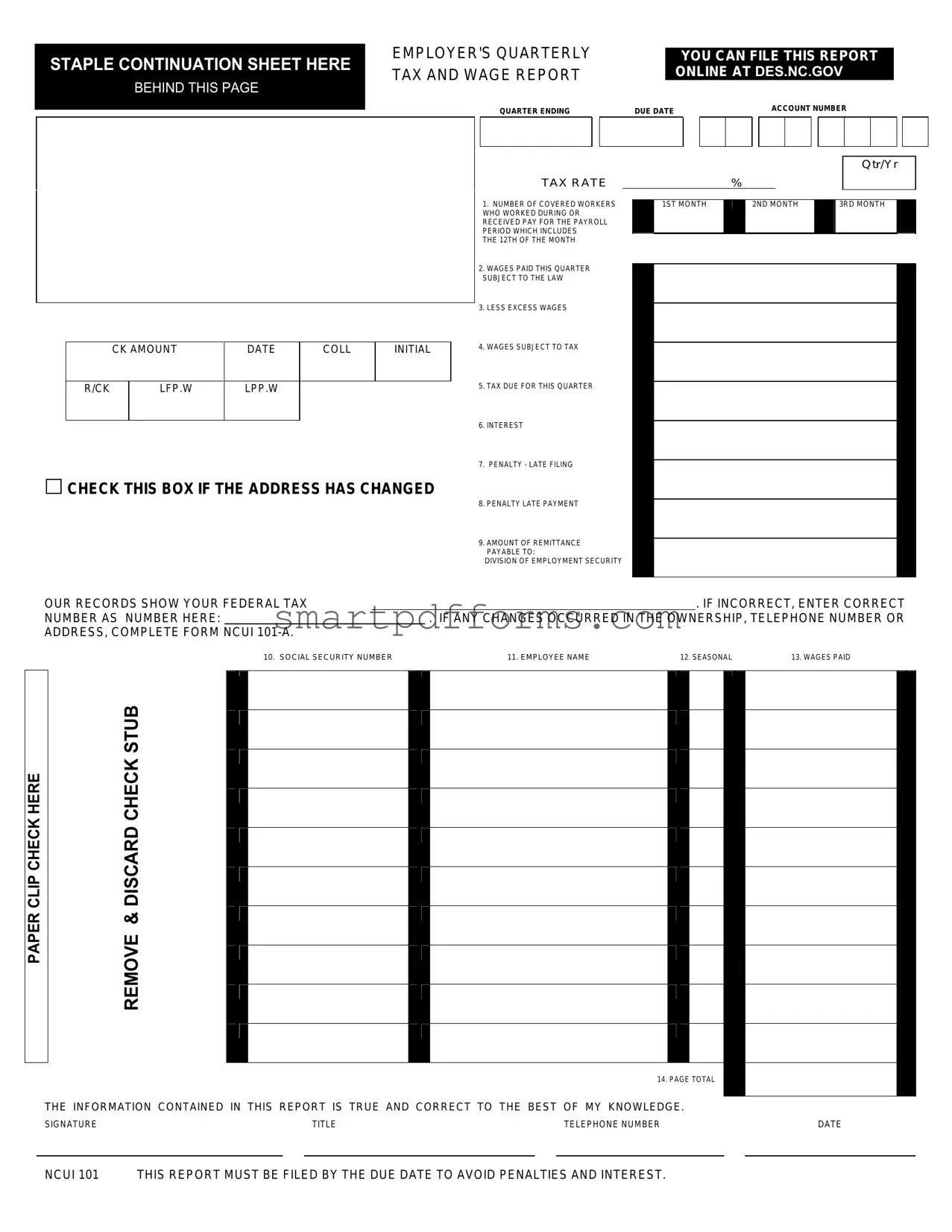

At the heart of simplified business and employee tax reporting in North Carolina lies the NCUI 101 Form, known officially as the Employer's Quarterly Tax and Wage Report. This critical document serves multifold purposes, primarily to detail wages paid to employees within a stipulated quarter, along with calculating and reporting the taxes due on said wages under state law. Tailored for businesses of various structures—be it corporations, partnerships, or sole proprietorships—the form accommodates detailed entries including the total number of workers, the wages subject to state tax laws, adjustments for excess wages, and the calculated tax payable to the Division of Employment Security. Moreover, it obliges the reporting of the federal identification number to ensure accurate state tax credits, while also catering to nuances such as seasonal employment and discrepancy adjustments. Intriguingly, it mandates the identification of every worker through social security numbers and names, further underscoring its thorough nature. The penalties for late filing or payment, calculated as percentages of the due tax, highlight the importance of timely compliance, supported by accessible filing options both online and through physical submission. This form embodies a blend of regulatory compliance and ease of use for employers ensuring accurate employment tax handling in North Carolina.

Preview - Ncui 101 Form

STAPLE CONTINUATION SHEET HERE

BEHIND THIS PAGE

EMPLOYER'S QUARTERLY TAX AND WAGE REPORT

QUARTER ENDING

TAX RATE

YOU CAN FILE THIS REPORT ONLINE AT DES.NC.GOV

DUE DATE |

|

|

|

ACCOUNT NUMBER |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Qtr/Yr

%

1. NUMBER OF COVERED WORKERS |

1ST MONTH |

2ND MONTH |

3RD MONTH |

WHO WORKED DURING OR |

|

|

|

RECEIVED PAY FOR THE PAYROLL |

|

|

|

PERIOD WHICH INCLUDES |

|

|

|

THE 12TH OF THE MONTH |

|

|

|

|

CK AMOUNT |

DATE |

COLL |

INITIAL |

R/CK |

LFP.W |

LPP.W |

|

|

CHECK THIS BOX IF THE ADDRESS HAS CHANGED

CHECK THIS BOX IF THE ADDRESS HAS CHANGED

2.WAGES PAID THIS QUARTER SUBJECT TO THE LAW

3.LESS EXCESS WAGES

4.WAGES SUBJECT TO TAX

5.TAX DUE FOR THIS QUARTER

6.INTEREST

7.PENALTY - LATE FILING

8.PENALTY LATE PAYMENT

9.AMOUNT OF REMITTANCE PAYABLE TO:

DIVISION OF EMPLOYMENT SECURITY

OUR RECORDS SHOW YOUR FEDERAL TAX |

|

|

. IF INCORRECT, ENTER CORRECT |

|

NUMBER AS NUMBER HERE: |

|

. IF ANY CHANGES OCCURRED IN THE OWNERSHIP, TELEPHONE NUMBER OR |

||

ADDRESS, COMPLETE FORM |

NCUI |

|

|

|

CLIP CHECK HERE |

DISCARD CHECK STUB |

PAPER |

REMOVE & |

|

|

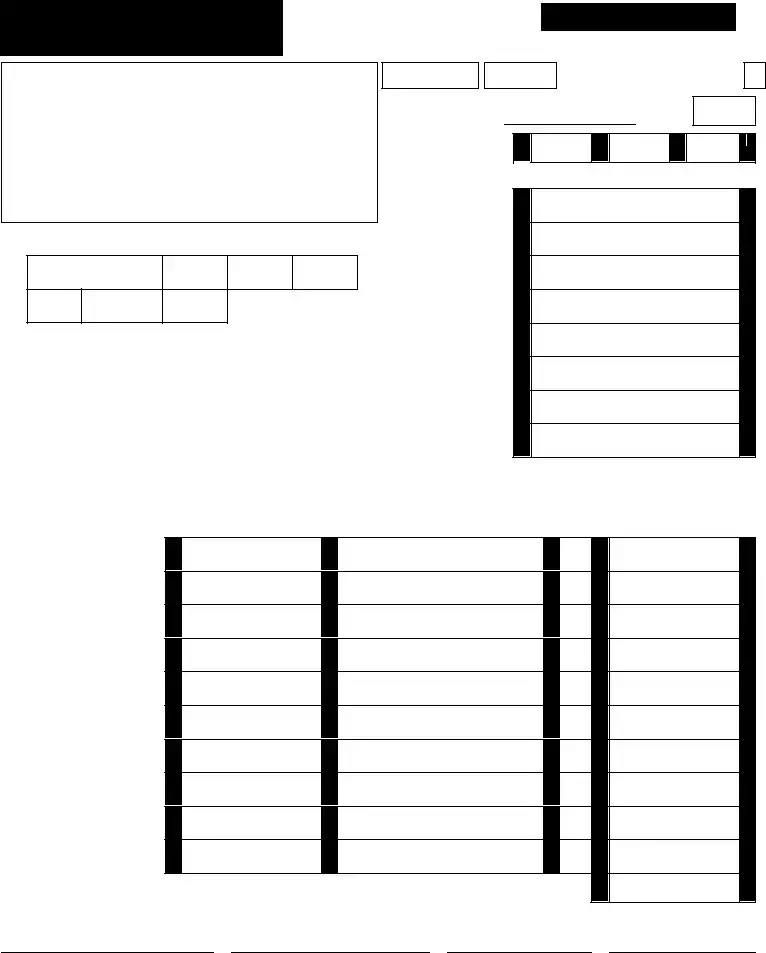

10. SOCIAL SECURITY NUMBER |

11. EMPLOYEE NAME |

12. SEASONAL |

13. WAGES PAID |

|

|

14. PAGE TOTAL |

|

THE INFORMATION CONTAINED IN THIS REPORT IS TRUE AND CORRECT TO THE BEST OF MY KNOWLEDGE.

SIGNATURE |

TITLE |

TELEPHONE NUMBER |

DATE |

NCUI 101 THIS REPORT MUST BE FILED BY THE DUE DATE TO AVOID PENALTIES AND INTEREST.

INSTRUCTIONS FOR COMPLETING FORM NCUI 101, EMPLOYER'S QUARTERLY TAX AND WAGE REPORT

ITEM 1: For each month in the calendar quarter, enter the number of all

ITEM 2: Enter all wages paid to all employees, including

(A)CORPORATION, the wages paid to all employees who performed services in North Carolina should be reported. Corporate officers are employees and their wages and/or draws are reportable.

(B)A PARTNERSHIP, the draws or payments made to general partners should not be reported.

(C)A PROPRIETORSHIP, the draws or payments made to the legal owner of the business (the proprietor) should not be reported. Wage paid to the children of the proprietor under the age of 21 years, as well as wages paid to the spouse or parents of the proprietor, should not be reported.

Special payments given in return for services performed, I.E., commissions, bonuses, fees, prizes, are wages and reportable under the Employment Security Law of North Carolina. These payments (or dollar value of the gifts/prizes) are to be included in the payroll of each employee by the employer for the calendar quarter(s) in which they are given.

If no wages were paid, enter NONE.

ITEM 3: Enter the amount of wages paid during this quarter that is in excess of the applicable North Carolina taxable wage base. This entry cannot be more than item 2.

Example: An employer using the 2012 taxable wage base of $20,400 and reporting one employee, John Doe, earning $6,000 per quarter.

1ST QTR 2ND QTR 3RD QTR 4TH QTR

ITEM 2: |

$6,000.00 |

$6,000.00 |

$6,000.00 |

$6,000.00 |

ITEM 3: |

$3,600.00 |

|||

ITEM 4: |

$6,000.00 |

$6,000.00 |

$6,000.00 |

$2,400.00 |

ITEM 4: Subtract Item 3 from Item 2. THE RESULTS CANNOT BE A NEGATIVE AMOUNT.

ITEM 5: Multiply Item 4 by the tax rate shown on the face of this report. (Example: .012% = .00012) If the tax due is less than $5.00, you do not have to

pay it, but you must file a report.

NOTE: ITEMS 6,7, AND 8 MUST BE COMPUTED ONLY IF THE REPORT IS NOT FILED (POSTMARKED) BY THE DUE DATE.

ITEM 6: Multiply the tax due (Item 5) by the current interest rate for each month, or fraction thereof, past the due date. The applicable interest rate may be obtained at des.nc.gov or by contacting the nearest Division of Employment Security Office.

ITEM 7: Multiply the tax due (Item 5) by 5% (.05) for each month, or fraction thereof, past the due date. The maximum late filing penalty is 25% (.25).

ITEM 8: Multiply the tax due (Item 5) by 10% (.1). The minimum late payment penalty is $5.00.

ITEM 9: Enter the sum of Items 5, 6, 7 and 8. Remittance should be made payable to the Division of Employment Security.

IF YOUR FEDERAL IDENTIFICATION NUMBER AS PRINTED ON THE REPORT IS INCORRECT, ENTER THE CORRECT NUMBER IN THE SPACE PROVIDED. STATE TAX CREDITS WILL BE REPORTED TO THE INTERNAL REVENUE SERVICE USING THIS NUMBER. IF YOUR FEDERAL IDENTIFICATION NUMBER IS NOT PREPRINTED; ENTER IT IN THIS SPACE.

ITEM 10: Enter the federal Social Security number of every worker whose wages are reported on this form.

ITEM 11: Enter the name of every worker whose wages are reported on his form. If the last name is listed first, it must be followed by a comma.

ITEM 12: Enter an 'S' in this space if the wages reported are seasonal, otherwise leave this space blank. To report seasonal wages you must have

been determined a seasonal pursuit by this agency.

ITEM 13: Wages are reportable in the quarter paid to the employee, regardless of when the wages were earned. Enter each worker's total quarterly

wages paid, whether or not the worker has exceeded the taxable wage base for this year. Do not show credit or minus amounts to adjust for

ITEM 14: Enter the sum of wages shown in Item 13 for this page only. The sum of the page totals of all pages must equal the amount shown in Item 2.

Additional information is available at: des.nc.gov

Form Data

| Fact Name | Detail |

|---|---|

| Form Purpose | Employer's Quarterly Tax and Wage Report |

| Online Filing Option | Available at des.nc.gov |

| Key Information Required | Number of covered workers, wages paid, and tax due |

| Special Instructions for Different Business Types | Different reporting for corporations, partnerships, and proprietorships |

| Penalties | Interest, late filing, and late payment penalties apply if not filed by due date |

| Governing Law | Employment Security Law of North Carolina |

Instructions on Utilizing Ncui 101

Filling out the NCUI 101 form, the Employer's Quarterly Tax and Wage Report, requires attention to detail and precision. This document is crucial for reporting wages paid to employees, calculating taxes due, and ensuring compliance with employment security laws in North Carolina. To successfully complete the form, follow these steps meticulously to avoid any errors that could lead to penalties or delays.

- Start by checking whether your address has changed. If it has, mark the appropriate box on the form to indicate this change.

- In item 1, accurately enter the number of covered workers who worked during or received pay for the pay period including the 12th of each month in the quarter.

- For item 2, input all wages paid this quarter to employees. Consider the nature of your business entity (corporation, partnership, or proprietorship) to determine the correct wages to report as subject to the law.

- Calculate the excess wages in item 3. This is the amount paid during this quarter that exceeds the North Carolina taxable wage base. It cannot be more than the amount in item 2.

- In item 4, subtract the excess wages (item 3) from the total wages paid (item 2) to find the wages subject to tax.

- Multiply the taxable wages (item 4) by your tax rate (shown on the form) to determine the tax due for the quarter in item 5.

- If your report is late, compute the interest (item 6), the late filing penalty (item 7), and the late payment penalty (item 8) as instructed on the form. These are only required if the report is not postmarked by the due date.

- Sum the amounts in items 5, 6, 7, and 8 to determine the total remittance payable to the Division of Employment Security for item 9.

- If the Federal Identification Number on the report is incorrect, provide the correct number in the space provided for adjustments related to state tax credits.

- For each employee whose wages are reportable, enter their federal Social Security number in item 10 and their name in item 11. Pay attention to the formatting required for listing names.

- Indicate by entering an ‘S’ in item 12 if the reported wages are seasonal. Leave it blank if not.

- Item 13 requires you to report each worker's total quarterly wages paid. Ensure that these are wages actually paid out during the quarter, without making adjustments for any previous reporting errors.

- Sum the wages listed in item 13 for this page and enter this in item 14. If using multiple pages, the sum of the page totals must equal the total wages paid as shown in item 2.

- Finally, review the entire form for accuracy. Sign and date the form at the bottom, affirming that the information provided is true and correct to the best of your knowledge.

By following these steps with care and precision, you ensure compliance with the Employment Security Law of North Carolina. Proper completion and submission of the NCUI 101 form contribute to the efficient processing of your report, helping to avoid any unnecessary penalties or interest due to errors or omissions.

Obtain Answers on Ncui 101

-

What is the NCUI 101 form used for?

The NCUI 101 form, known as the Employer's Quarterly Tax and Wage Report, is utilized by employers in North Carolina to report wages paid to employees, the number of workers covered, and any taxes due for the quarterly period. It ensures compliance with the state's Employment Security Law.

-

Can I file the NCUI 101 form online?

Yes, employers have the option to file this report online at des.nc.gov, providing a convenient and efficient way to fulfill their reporting obligations.

-

What information is required on the NCUI 101 form?

Employers must provide data including the number of covered workers per month, total wages paid subject to the law, excess wages, wages subject to tax, tax due, interest, penalties for late filing and late payment, and the total amount of remittance. Additionally, employer-specific information, such as account number and federal identification number, is also required.

-

How do I calculate the wages subject to tax on the NCUI 101 form?

To calculate the wages subject to tax, subtract the total excess wages (item 3) from the total wages paid this quarter subject to the law (item 2). The resulting figure (item 4) is the amount of wages subject to tax.

-

What should I do if my Federal Identification Number on the report is incorrect?

If the preprinted Federal Identification Number on your NCUI 101 form is incorrect, enter the correct number in the space provided on the form to ensure proper identification and processing of your report.

-

How are seasonal wages reported on the NCUI 101 form?

To report seasonal wages, mark an 'S' in the space provided (item 12). Remember, your business must have been determined as a seasonal pursuit by the agency to report wages in this manner.

-

Are penalties applied for late filing or late payment?

Yes, penalties are applied for late filings and late payments. The penalty for late filing is 5% of the tax due for each month or fraction thereof past the due date, up to a maximum of 25%. For late payments, a 10% penalty is applied, with a minimum penalty amount of $5.00.

-

How do I correct a mistake made on a previously filed NCUI 101 form?

To correct errors on a previously filed NCUI 101 form, you must request or download form NCUI 685 for the quarter that needs correction. This form allows you to make adjustments to previously reported wages or tax information.

-

What are the due dates for filing the NCUI 101 form?

The NCUI 101 form needs to be filed by the end of the month following the close of each quarter. Specifically, the due dates are April 30th, July 31st, October 31st, and January 31st for the respective quarters ending March, June, September, and December.

-

Where can I find additional information or assistance with the NCUI 101 form?

For more information or assistance with completing and filing the NCUI 101 form, visit the Division of Employment Security's official website at des.nc.gov, or contact the nearest Division of Employment Security Office.

Common mistakes

Filling out paperwork is often seen as a straightforward task, but when it comes to official forms like the NCUI 101, Employer's Quarterly Tax and Wage Report, common mistakes can lead to unnecessary delays or errors in processing. This document is crucial for employers in North Carolina, as it impacts tax liabilities and ensures compliance with the state's employment security law. To help navigate this task more effectively, here are ten common mistakes to avoid:

- Incorrectly Counting Workers: Not accurately reporting the number of covered workers for each month. Employers must include all full-time, part-time workers who worked or received pay for the period including the 12th of each month.

- Underreporting Wages: Failing to enter all wages paid to employees during the quarter. This encompasses all compensation forms, including regular pay, commissions, bonuses, and other special payments.

- Excess Wages Miscalculation: Not properly calculating or misunderstanding the 'Less Excess Wages' section, leading to incorrect taxable wage figures.

- Ignoring Ownership Changes: Overlooking the section that requires updates if there have been any changes in ownership, telephone number, or address since last reported. This is crucial for maintaining up-to-date records.

- Misunderstanding Tax Rate Application: Applying the incorrect tax rate when calculating taxes due. It's important to use the rate provided on the form's face.

- Late Penalties Miscomprehension: Not correctly computing interest and penalties for late filing or payment. This mistake can lead to under or overestimation of amounts due.

- Incorrect Federal Identification Number: Either not correcting a preprinted incorrect federal identification number or failing to provide one if it's not preprinted. This number is critical for state tax credits and IRS reporting.

- Federal Social Security Numbers Omission: Neglecting to enter the federal Social Security number of every worker whose wages are reported. This omission can lead to processing delays.

- Incorrect Employee Name Format: Failing to follow the prescribed format when listing employee names. If the last name is listed first, it must be followed by a comma.

- Inaccurate Seasonal Wages Reporting: Incorrectly marking or failing to mark wages as seasonal when applicable, or not understanding the requirement to have been determined a seasonal pursuit by the agency.

By circumventing these errors, employers can ensure a smoother filing process. Accurate and timely submission of the NCUI 101 form not only adheres to legal obligations but also reflects well on an employer's commitment to regulatory compliance. Attention to detail and a thorough review can prevent the common pitfalls that lead to discrepancies in employment records and financial liabilities.

Documents used along the form

When businesses in North Carolina submit the Ncui 101 form, also known as the Employer's Quarterly Tax and Wage Report, they often find that they need to provide additional documentation to fully comply with reporting requirements. The Ncui 101 form is essential for reporting quarterly wages and calculating taxes due for employees, but it's usually just one piece of the puzzle. Here are four other documents that businesses frequently use alongside the Ncui 101 form to ensure compliance and streamline their reporting process.

- NCUI 101-A - Change in Status Report: This form is used by employers to notify the Division of Employment Security of any changes in their business status, such as changes in ownership, address, or telephone number. This ensures that all communications and records are up-to-date.

- Form NCUI 685 - Quarterly Tax and Wage Adjustment Report: Employers utilize this form to correct previously submitted wage and tax information for a particular quarter. This might be necessary if errors were made in reporting an employee's wages or if the amount of taxes owed needs adjustment.

- Form DES, Employer’s Application for Tax Account Number: New businesses or businesses new to North Carolina must complete this application to receive a tax account number, which is required to file the Ncui 101 form. It's the first step for a new employer to become compliant with state employment tax laws.

- Form NCUI 604 - Employer Status Report: This document is for businesses to report their initial employment status or when there is a reactivation of employment. It helps determine an employer's liability under the state's Unemployment Insurance Program.

Together with the Ncui 101 form, these documents facilitate an employer's full compliance with North Carolina's employment security laws. Each serves a unique purpose, from updating company details to correcting submitted data, ensuring accurate reporting of employee wages and taxes. Timely and accurate completion of these forms not only fulfills legal obligations but also avoids potential penalties for late or incorrect filing. It's essential for employers to familiarize themselves with these forms to maintain smooth operations and stay compliant.

Similar forms

Form 940 (Employer's Annual Federal Unemployment (FUTA) Tax Return): Similar to the NCUI 101 Form, the Form 940 is used by employers to report annual federal unemployment taxes. Both forms require information on the total wages paid to employees and are integral to unemployment tax reporting, although the NCUI 101 focuses on a quarterly basis while Form 940 is filed annually.

Form 941 (Employer's Quarterly Federal Tax Return): This form is closely related to the NCUI 101 because it is also filed on a quarterly basis. It deals with federal withholdings, Social Security, and Medicare taxes. The similarity lies in the reporting of wages and the frequency of submission, aiding in the overall reporting of employment taxes.

Form W-2 (Wage and Tax Statement): While the NCUI 101 form details wages paid by the employer on a quarterly basis for state unemployment purposes, Form W-2 summarizes an employee's annual wages and taxes withheld. Both are critical in the overall framework of wage reporting and tax compliance.

Form W-3 (Transmittal of Wage and Tax Statements): Form W-3 works in conjunction with Form W-2 to report wages and taxes to the Social Security Administration. It’s similar to the NCUI 101 in that it aggregates information for governmental reporting, although Form W-3 focuses on annual, rather than quarterly, aggregation.

State Quarterly Business Taxes: Many states require quarterly business tax reports similar to the NCUI 101. These documents typically include information about wages paid, taxes due, and other employment figures. The specifics vary by state but the overall purpose aligns with the NCUI 101, focusing on state-level tax and employment reporting.

Form W-4 (Employee's Withholding Certificate): Although the Form W-4 is more directly related to federal tax withholdings and not unemployment, it indirectly influences the calculations on forms like the NCUI 101 by determining the amount of taxes withheld from an employee's paycheck.

Form I-9 (Employment Eligibility Verification): While not a tax form, the I-9 is required by employers to verify an employee's eligibility to work in the United States, impacting who is counted in wage reports like the NCUI 101. Both forms are necessary for compliance in the hiring and employment process.

UC-2 (Employer's Report of Wages Paid): Similar to the NCUI 101, the UC-2 form is used in certain states to report wages paid to employees for unemployment compensation purposes. Each outlines the wages subject to unemployment taxes on a periodic basis, though the exact form and name can vary by state.

Annual Report Forms for LLCs and Corporations: Though not directly related to employment taxes, annual report forms for LLCs and corporations often require a summary of financials and can include information on payroll as part of their broader financial disclosures. The link to the NCUI 101 comes from the necessity of accurate wage reporting for both forms.

Form 1099-MISC (Miscellaneous Income): For contractors and freelancers, the 1099-MISC reports payments similarly to how the NCUI 101 and W-2 report wages for employees. The connection lies in the responsibility of the payer to report payments made during the tax year, important for overall financial and tax reporting purposes.

Dos and Don'ts

When completing the NCUI 101 form, understanding the do's and don'ts can significantly streamline the process, ensuring accuracy and compliance with the requirements of the North Carolina Division of Employment Security. Below are critical guidelines to follow:

- Do accurately report the number of covered workers for each month of the quarter, including all full-time and part-time workers who worked during or received pay for the payroll period including the 12th of the month.

- Do include all wages paid to employees within the quarter, taking care to report corporate officers’ wages under a corporation, but excluding draws or payments made to legal owners or partners under proprietorships and partnerships.

- Do subtract the amount of wages paid during the quarter that are in excess of the applicable North Carolina taxable wage base from the total wages paid, to accurately complete Item 3.

- Do ensure to file the report by the due date to avoid penalties and interest, which are calculated based on late filing and late payment parameters specified in the form’s instructions.

- Don't neglect to include special payments such as commissions, bonuses, and other non-regular payments in the employee's total quarterly wages, as these are considered wages under the Employment Security Law of North Carolina.

- Don't leave any fields blank that are relevant to your business's and employees' details. For example, if your federal identification number is incorrect or not preprinted on the form, enter the correct number in the space provided to ensure proper processing and credit of state tax contributions.

By adhering to these guidelines, employers can accurately and efficiently complete the NCUI 101 form, meeting legal obligations and contributing to the smooth operation of North Carolina's unemployment insurance system.

Misconceptions

Understanding the NCUI 101 form, or the Employer's Quarterly Tax and Wage Report, is crucial for employers in managing their payroll taxes correctly. However, several misconceptions about this form can lead to errors or misunderstandings. Let's clarify some of these misconceptions to ensure accurate reporting and compliance with North Carolina's Employment Security Law.

Misconception 1: All payments to employees are not taxable. Some employers believe that certain payments, such as bonuses or commissions, are not subject to tax and therefore do not need to be reported on the NCUI 101 form. This is incorrect. The form requires employers to report all wages paid to employees, including part-time and temporary workers, during the calendar quarter. Special payments, such as commissions, bonuses, fees, prizes, etc., are considered wages under the Employment Security Law of North Carolina and must be included in the payroll for the quarter(s) in which they are given.

Misconception 2: Wages paid to corporate officers are exempt. Another common misunderstanding is that wages paid to corporate officers or company owners do not need to be included in the NCUI 101 report. This is not accurate. For corporations, wages paid to all employees who performed services in North Carolina, including corporate officers, are reportable. However, draws or payments to general partners in a partnership and proprietors in a sole proprietorship are exceptions and not reportable.

Misconception 3: Late penalties are negotiable. Some employers may believe that if they file the NCUI 101 form late, they can negotiate or waive late filing and payment penalties. Late penalties, however, are clearly defined in the form's instructions. The penalty for late filing is 5% of the tax due for each month, or fraction thereof, past the due date, up to a maximum of 25%. For late payment, the penalty is 10% of the tax due, with a minimum of $5.00. These penalties are not subject to negotiation and are enforced to encourage timely filing and payment.

Misconception 4: The form cannot be filed if the federal identification number is incorrect or not preprinted. Incorrect or missing federal identification numbers on the NCUI 101 form can cause confusion. Employers might presume that they cannot file their report if their federal identification number is incorrect or not preprinted on the form. However, the form specifically provides a space for the employer to enter the correct federal identification number if the one printed is incorrect or to include it if it's not preprinted. This ensures that state tax credits are accurately reported to the Internal Revenue Service using the correct number.

By clarifying these misconceptions, employers can better understand how to complete the NCUI 101 form accurately, ensuring compliance with state tax and employment security requirements. It’s important for all data reported to be accurate and for all necessary payments to be made in a timely manner to avoid any penalties.

Key takeaways

Filling out the NCUI 101 form, the Employer's Quarterly Tax and Wage Report, is a critical process that employers must complete accurately to ensure compliance with North Carolina employment security law. Here are six key takeaways to guide you through filling out and using the form:

- Report Accurately: It’s essential to enter the number of all full-time and part-time workers who worked or received pay during the payroll period that includes the 12th of each month in the calendar quarter.

- Include All Wages: All wages paid to employees, whether they are part-time, temporary, or corporate officers, must be reported for the quarter. However, certain exceptions apply, such as wages paid to the proprietor's family members under specific conditions, and payments to general partners in a partnership.

- Understand Excess Wages: When reporting wages, you must deduct the amount of wages paid during the quarter that exceeds the North Carolina taxable wage base from your total for the quarter. This ensures you're not taxed on wages beyond the set limit. If no wages were paid in the quarter, you should still file the report with "NONE" entered.

- Tax Calculations: Calculating the tax due is straightforward after identifying wages subject to tax. Multiply these wages by your tax rate, as indicated on the form. Remember, if the tax due is less than $5.00, payment is not required, but filing the report is still necessary.

- Late Fees and Penalties: If your report is filed or paid late, additional penalties and interest apply. These include a percentage of the tax due for late filing and a minimum fee for late payment, along with monthly interest on the overdue tax amount. Calculations for these penalties and interest are detailed on the form.

- Payment and Submission: Once all information has been accurately completed and reviewed, the sum of items 5, 6, 7, and 8 determines the total amount due to the Division of Employment Security. It's vital to submit this payment along with the report by the due date to avoid penalties or interest charges for late submission.

Completing form NCUI 101 with diligence ensures compliance with state laws and contributes to the smooth operation of services provided by the Division of Employment Security. Employers are encouraged to utilize available resources and seek clarification as needed to accurately complete and submit this important documentation.

Popular PDF Forms

Labor Laws for 16 Year Olds - Details for Maryland employers the process of verifying a minor's eligibility for work, including reviewing the work permit and ensuring it's properly obtained.

Beneficiary Planner - A practical resource that emphasizes the importance of clarity and organization in estate planning, offering peace of mind to both the user and their loved ones.

Joint Custody in Florida Form - This form serves as an attachment to petitions, responses, or requests for orders, making it versatile in its application within family court proceedings.