Blank Net 30 Terms Order PDF Template

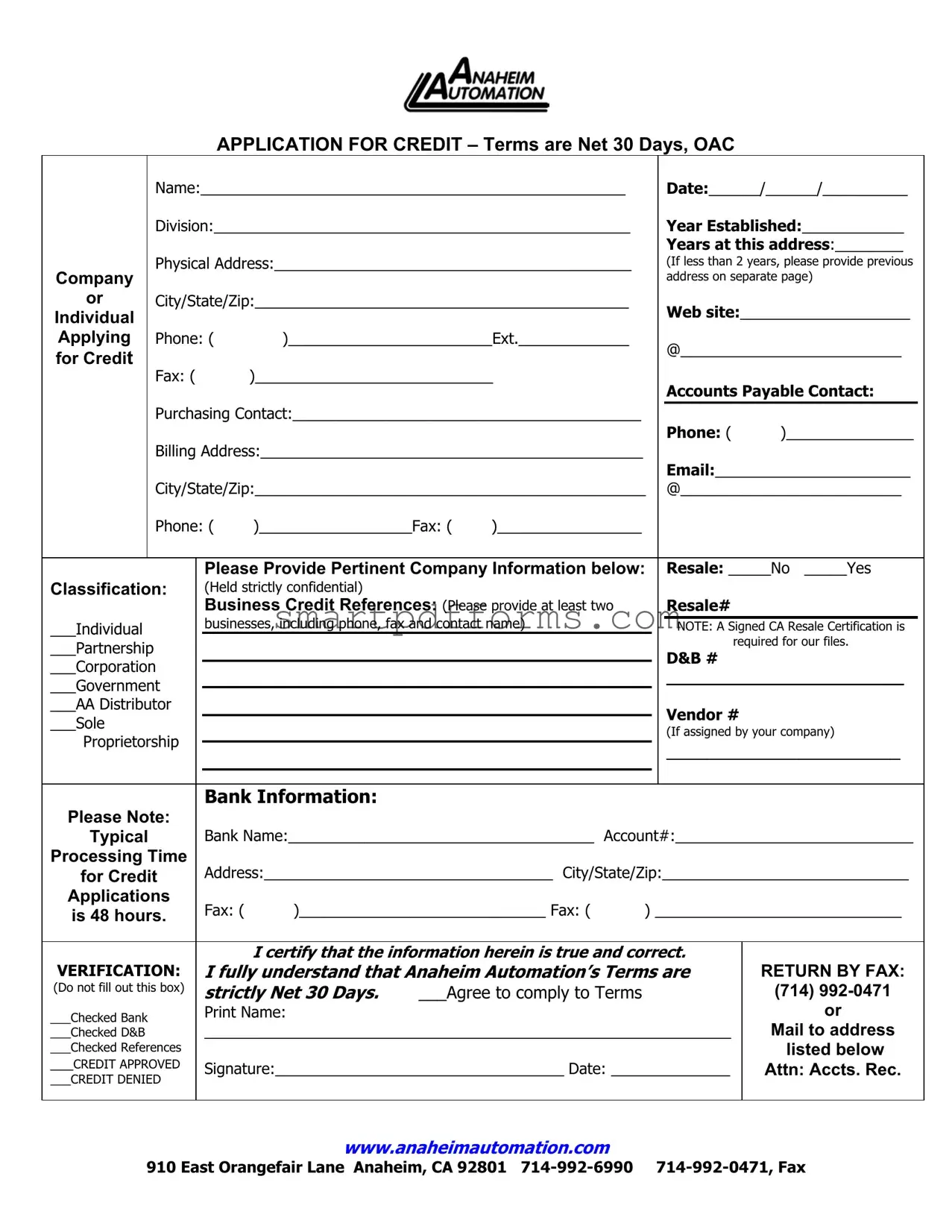

Navigating through the intricacies of business transactions can often seem daunting, especially when it comes to establishing credit terms with new partners. The Net 30 Terms Order Form provides a streamlined process for businesses looking to apply for credit, delineating clear, 30-day payment terms upon credit approval. This crucial document is designed to gather all necessary information from applicants, ranging from basic identification details to more specific business classifications and financial references. It begins with space for the applicant's name, the date of application, and relevant division and establishment details, including the number of years the business has been operational and at its current address. For businesses that have relocated in the last two years, additional information on the previous address is required, ensuring a thorough background check can be conducted. Furthermore, the form requests details on the individual applying for credit, accounts payable, and purchasing contacts, alongside the billing address, enhancing communication lines. An important part of the application is the provision of pertinent company information, such as resale activity, type of business classification, and credit references, which must include at least two businesses. Additionally, bank information is sought to validate financial stability and the capability to adhere to the Net 30 day terms. The form meticulously emphasizes the need for compliance with these terms, alongside the necessary verifications—bank details, DUNS Number, reference checks—and the status of the credit application, whether approved or denied. With a standard processing time of 48 hours noted, the form clearly outlines the steps and expectations for granting credit, setting the foundation for a transparent and efficient financial relationship between businesses.

Preview - Net 30 Terms Order Form

APPLICATION FOR CREDIT – Terms are Net 30 Days, OAC

|

|

Name:__________________________________________________ |

|

Date:______/______/__________ |

|

|||||||||

|

|

Division:_________________________________________________ |

|

Year Established:____________ |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

Years at this address:________ |

|

||

|

|

Physical Address:__________________________________________ |

|

(If less than 2 years, please provide previous |

|

|||||||||

Company |

|

|

|

|

|

|

|

|

|

|

address on separate page) |

|

||

or |

|

City/State/Zip:____________________________________________ |

|

Web site:____________________ |

|

|||||||||

Individual |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Applying |

|

Phone: ( |

)________________________Ext._____________ |

|

@__________________________ |

|

||||||||

for Credit |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax: ( |

|

)____________________________ |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Accounts Payable Contact: |

|

||

|

|

Purchasing Contact:_________________________________________ |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Phone: ( |

)_______________ |

|

|

|

|

Billing Address:_____________________________________________ |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Email:_______________________ |

|

||

|

|

City/State/Zip:______________________________________________ |

|

@__________________________ |

|

|||||||||

|

|

Phone: ( |

)__________________Fax: ( |

)_________________ |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Please Provide Pertinent Company Information below: |

|

Resale: _____No _____Yes |

|

|||||||

Classification: |

|

(Held strictly confidential) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Business Credit References: (Please provide at least two |

|

Resale# |

|

|

|

|||||

___Individual |

|

|

businesses, including phone, fax and contact name) |

|

|

|

NOTE: A Signed CA Resale Certification is |

|

||||||

|

|

|

|

|

|

|

|

|

|

required for our files. |

|

|||

___Partnership |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

D&B # |

|

|

|

||

___Corporation |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

________________________ |

|

|||||

___Government |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

___AA Distributor |

|

|

|

|

|

|

|

|

Vendor # |

|

||||

___Sole |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

(If assigned by your company) |

|

||||

Proprietorship |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

_______________________ |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank Information: |

|

|

|

|

|

|

|

|

|

|

Please Note: |

|

|

|

|

|

|

|

|

|

|

|

|

||

Typical |

|

|

Bank Name:____________________________________ |

Account#:____________________________ |

|

|||||||||

Processing Time |

|

|

|

|

|

|

|

|

|

|

|

|

||

for Credit |

|

Address:__________________________________ City/State/Zip:_____________________________ |

|

|||||||||||

Applications |

|

Fax: ( |

)_____________________________ Fax: ( |

) _____________________________ |

|

|||||||||

is 48 hours. |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

I certify that the information herein is true and correct. |

|

|

|

||||||

VERIFICATION: |

|

I fully understand that Anaheim Automation’s Terms are |

|

RETURN BY FAX: |

|

|||||||||

(Do not fill out this box) |

|

strictly Net 30 Days. |

___Agree to comply to Terms |

|

|

(714) |

|

|||||||

___Checked Bank |

|

|

Print Name: |

|

|

|

|

|

|

|

or |

|

||

|

|

|

|

|

|

|

|

|

|

|

Mail to address |

|

||

___Checked D&B |

|

|

______________________________________________________________ |

|

|

|||||||||

___Checked References |

|

|

|

|

|

|

|

|

|

|

listed below |

|

||

___CREDIT APPROVED |

|

Signature:__________________________________ Date: ______________ |

|

Attn: Accts. Rec. |

|

|||||||||

___CREDIT DENIED |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

www.anaheimautomation.com

910 East Orangefair Lane Anaheim, CA 92801

Form Data

| Fact Name | Description |

|---|---|

| Core Purpose | The application is designed for businesses seeking to establish a credit line with Anaheim Automation, where the terms are Net 30 Days, contingent on approval of credit (OAC). |

| Application Information Required | Applicants must provide detailed company information, including the physical and billing addresses, company type, bank details, and at least two business credit references, to facilitate the credit evaluation process. |

| Processing Timeframe | It takes approximately 48 hours for Anaheim Automation to process credit applications, a detail critical for businesses planning their financial arrangements. |

| Governing Law | The application process and subsequent credit agreement will be governed by the laws of the state where Anaheim Automation is located, in this instance, assumed to be California. |

Instructions on Utilizing Net 30 Terms Order

Completing the Net 30 Terms Order form is a key step in setting up a deferred payment agreement that allows paying an invoice within 30 days of the invoice date, typically subject to credit approval (OAC). Understanding how to accurately fill out this form is essential for businesses seeking to manage their cash flow more effectively. The process requires providing detailed business and personal information to facilitate credit assessment and approval. After submitting the form, the processing time is generally 48 hours, during which the information provided will be verified for accuracy and completeness.

- Begin by entering the Name of the individual applying for credit and the Date in the designated spaces at the top of the form.

- Under Division, specify the part of your business for which you're seeking credit, and provide the Year Established to give an indication of your business's longevity.

- For businesses at their current location for less than two years, fill in the Years at this address field, and be prepared to provide a previous address on a separate page.

- Input the Physical Address of your business or the specific division for which the credit is being requested.

- Supply the desired contact information, including a City/State/Zip for the physical address and the business's Web site.

- Fill in the Individual Applying for Credit Phone number, extension (if applicable), and email address to ensure communication regarding the application.

- Indicate the Accounts Payable Contact and Purchasing Contact information, including phone numbers and email addresses.

- Provide a Billing Address if different from the physical address, including Email and Phone/Fax numbers for billing communication.

- Select whether your business is involved in Resale, and specify the business Classification (e.g., Individual, Partnership, Corporation, etc.).

- List at least two Business Credit References, including phone, fax, and contact names, to support your credit request. Include D&B and Vendor numbers if available.

- Supply your primary Bank Information, including the Bank Name, Account Number, Address, City/State/Zip, and Bank Fax Number.

- At the bottom of the form, certify the accuracy of the information by signing and dating the form under the VERIFICATION section. This affirms understanding and agreement to comply with Net 30 Day Terms.

After the form is completed and checked for accuracy, it should be returned via fax to the number provided or mailed to the address listed. Remember, accurate and thorough completion of the form expedites the credit approval process. Following submission, anticipate a review period which typically does not exceed 48 hours, resulting in either credit approval or denial. This swift process ensures your business can soon benefit from the flexibility that Net 30 terms offer.

Obtain Answers on Net 30 Terms Order

-

What does "Net 30 Days, OAC" mean on the application form?

"Net 30 Days, OAC" means that the amount due for the goods or services purchased must be paid in full within 30 days after the invoice date, subject to On Approved Credit (OAC). This implies that the credit terms are contingent upon the approval of the buyer's creditworthiness.

-

Why do I need to provide a previous address if I've been at my current address for less than 2 years?

Providing a previous address helps the company verify the stability and reliability of your business. It is used to obtain a more accurate and comprehensive credit history, ensuring that credit terms are offered based on robust and complete information.

-

What is the purpose of the Resale Certification requirement?

The Resale Certification is required for businesses intending to purchase goods for resale rather than personal use. It allows the purchaser to buy goods tax-free, with the intention of collecting sales tax on the resale of the goods. This certification is a legal document that demonstrates compliance with state tax laws.

-

What information do I need to provide about my company?

You must provide detailed information about your company, including physical address, years in business, and whether you're an individual, partnership, corporation, government entity, or sole proprietorship. Additionally, resale information, business classification, and detailed contact information for both accounts payable and purchasing contacts are required. Bank and business credit references are also necessary to process the credit application.

-

Why do I need to provide business credit references?

Business credit references help in assessing your company's creditworthiness by providing insight into your payment habits and fiscal responsibility. These references are contacted to verify your company's reliability in meeting financial obligations, ultimately influencing the approval of your credit application.

-

How long does it take to process the credit application?

Typically, the processing time for credit applications is 48 hours. This timeframe allows the company to thoroughly check the provided references, credit scores, and other pertinent information to make an informed decision regarding your credit request.

-

What happens if my credit application is denied?

If your credit application is denied, you will be informed of the decision. It's advisable to directly contact the company to understand the reasons behind the denial and discuss possible steps or alternative arrangements for conducting business without credit terms.

-

How do I comply with the Net 30 Terms?

To comply with the Net 30 Terms, ensure that full payment for invoices is made within 30 days of the invoice date. Late payments may result in late fees, impact your credit terms with the company, and affect future credit approvals.

-

Can the credit terms be negotiated?

Credit terms are typically based on the assessment of the creditworthiness and financial stability of your business. However, if your business's financial situation changes or you have a longstanding and positive history with the company, there might be room for negotiation. It is recommended to discuss any desired changes directly with the company's accounts receivable department.

-

What should I do if my business information changes after submitting the application?

If there are any changes to your business information after you've submitted the application, promptly notify the company. This includes changes to your business address, contact information, or business status. Keeping your information current is crucial to maintain accurate records and ensure smooth financial transactions.

Common mistakes

Filling out a Net 30 Terms Order form accurately is crucial for businesses seeking credit terms. However, there are several common errors that applicants often make, which can lead to delays or even denial of credit. Here's an overview of these mistakes:

Not providing complete Name or Date details: It's essential to fill in the full legal name of the applying entity and the accurate date to ensure there's no ambiguity regarding the entity applying for credit or the application's submission date.

Omitting the division and Year Established: This information helps the credit provider understand more about the structure and longevity of a business, which can influence credit decisions.

Leaving Years at this address blank or inaccurate: Businesses less stable in their location might be seen as a higher risk, so accurate reporting is critical. If under two years, failing to provide a previous address can be particularly damaging.

Incomplete or incorrect Physical Address: A precise address is necessary for verification and correspondence purposes. Any error here can cause unnecessary delays.

Not listing an Individual Applying for Credit, Accounts Payable Contact, and Purchasing Contact correctly: The names and contact information for these roles are vital for clear communication and verification processes.

Forgetting to fill out the Resale number or checking the appropriate business Classification: These details are essential for tax purposes and understanding the nature of the business applying for credit.

Providing insufficient Business Credit References: Failing to include at least two references or giving incomplete information can halt the credit evaluation process.

Leaving Bank Information blank or incomplete: Accurate financial institution details support the creditworthiness assessment and are often a requirement for credit approval.

Verification and agreement to terms not marked or signed: The lack of a signature and date at the bottom fails to legally bind the agreement and shows a lack of acknowledgment of the terms.

Applicants should be diligent in reviewing their Net 30 Terms Order form submissions to avoid these mistakes. This attention to detail not only demonstrates professionalism but also expedites the credit approval process.

Documents used along the form

When handling transactions with Net 30 Terms Order forms, businesses often rely on a suite of additional documents to ensure a comprehensive and secure process. These documents facilitate various aspects of the credit and transaction process, from verifying the creditworthiness of a company to ensuring that goods and services are exchanged according to agreed terms. Understanding these documents can streamline business operations and reduce financial risks.

- Credit Application Form: Detailed form that businesses fill out to request credit from suppliers. It usually includes business information, banking details, trade references, and a request for the specific credit terms.

- Purchase Order (PO): A document issued by a buyer to a seller, detailing the products, quantities, and agreed prices for products or services. It serves as a contractual agreement between the two parties.

- Invoice: Issued by the seller, it specifies the amount due for the goods or services provided, referencing the purchase order and including payment terms, such as Net 30.

- Credit Reference Sheet: Contains contact information for trade references provided by a business applying for credit. It is used by creditors to verify the creditworthiness of the applicant.

- Resale Certificate: Used by businesses purchasing goods for resale to avoid paying sales tax. It certifies that the goods are for resale and not end-use.

- Bank Information Form: This document provides the seller with the buyer's banking details, necessary for setting up direct payments or assessing the financial stability of the buyer.

- Personal Guarantee: In cases where a business is not established enough to secure credit on its own, a personal guarantee by the owner or key officers may be required, holding them personally liable if the business fails to pay.

- Delivery and Acceptance Certificate: Used to confirm that the goods or services were delivered and accepted by the buyer. This document can be crucial in the event of a dispute.

Together, these complementary documents form a robust framework that supports the Net 30 Terms Order form. They not only provide a detailed record of the transaction but also help in establishing trust between the trading partners. Each document plays a vital role in streamlining transactions, ensuring transparency, and mitigating risks, making them indispensable tools in modern commerce.

Similar forms

A Loan Application shares similarities as it typically requires the applicant's personal and financial information to assess creditworthiness before approving a loan, just as the Net 30 Terms Order form requires information to establish credit terms for business transactions.

A Commercial Credit Application is similar because it collects business information and credit references to determine the credit terms a business is eligible for, paralleling the process of assessing a company's credit for net 30 terms.

A Lease Agreement Application also collects detailed applicant information and references to evaluate whether to enter into a lease agreement, mirroring the credit evaluation aspect of the Net 30 Terms Order form.

The Rental Application for property has similar requirements, including personal details, rental history, and financial information to assess the potential tenant's creditworthiness, akin to the Net 30 application process.

A Mortgage Application involves providing comprehensive personal and financial information to determine loan eligibility, similar to the Net 30 Terms Order form's requirement for business and credit information.

The Vendor Onboarding Form that companies use to gather information from new vendors often includes asking for company details and credit references, which is similar to the Net 30 Terms Order form's approach to establishing new business credit relationships.

An Employment Application collects information about the applicant’s background, experience, and references, similar to how the Net 30 Terms Order form collects business information and references to establish credit terms.

A Business License Application requires detailed information about the business, including its legal structure and financial information, comparable to the detailed company information required on the Net 30 Terms Order form.

The Customer Information Form used by businesses to gather information about their customers for various purposes, including billing and shipping, has parallels in collecting contact and business-specific information, similar to the data collection aspect of the Net 30 Terms Order form.

A Credit Card Application also seeks personal and financial information to evaluate creditworthiness and set terms, reflecting the credit verification steps of the Net 30 Terms Order form.

Dos and Don'ts

Filling out the Net 30 Terms Order form correctly is vital for ensuring a smooth transaction and establishment of a credit line with vendors. To assist you, here are some key dos and don'ts to consider:

- Do ensure all information provided is accurate and up-to-date. Mistakes or outdated information can lead to delays or rejection of your application.

- Do provide a complete history if your business has been at its current address for less than two years. This shows stability and reliability.

- Do include at least two business credit references. These references are crucial for verifying your business’s creditworthiness.

- Do sign and date the application form. An unsigned or undated form may be considered incomplete and can delay processing.

- Don't leave any fields blank. If a section does not apply, indicate with “N/A” (Not Applicable) rather than leaving it empty.

- Don't forget to check the box agreeing to comply with the Net 30 Days terms. This acknowledgment is necessary to process your application.

- Don't overlook the need for a signed CA Resale Certification if you're applying for resale terms. This document is essential for tax purposes.

- Don't rush through filling out the form. Take your time to review all the information thoroughly before submission to avoid any unnecessary setbacks.

Following these guidelines will help streamline the credit application process and set the foundation for a beneficial partnership between your business and the vendor. Remember, transparency and thoroughness are key when completing the Net 30 Terms Order form.

Misconceptions

When dealing with Net 30 terms on an order form, many misconceptions can arise, often leading to misunderstandings between vendors and clients. Misconceptions can range from the meaning and implications of Net 30 terms to the application process involved. Below are six common misconceptions accompanied by explanations that aim to shed light on these often misunderstood aspects.

- Net 30 terms offer a discount for early payment. - This is a common misconception. Net 30 simply means that the invoice amount is due in full 30 days from the invoice date. It does not inherently include a discount for early payment. Some vendors may offer such discounts as an incentive, but this is separate from the Net 30 terms themselves.

- Approval for Net 30 terms is guaranteed. - Believing that approval is a sure thing can lead to disappointment. The application for credit, as required by the Net 30 terms order form, undergoes a review process where several factors, including creditworthiness and business history, are assessed. Approval is not guaranteed and depends on the credit evaluation.

- Only large companies qualify for Net 30 terms. - While larger companies may have an easier time getting approved due to their established credit history, small businesses are not automatically disqualified. Many suppliers are willing to work with small businesses to establish Net 30 terms, especially if they can provide solid business credit references.

- The application process is lengthy and complex. - The misconception that the credit application process for Net 30 terms is overly burdensome may deter some businesses. However, as indicated, the typical processing time for credit applications is around 48 hours. The application itself requires straightforward information about the business, such as the physical address, banking information, and trade references.

- Net 30 terms apply to the order date. - It's crucial to understand that Net 30 terms apply from the invoice date, not the order date. This distinction is important because there can be a delay between when an order is placed and when the invoice is issued, especially for customized orders or those requiring backordering.

- Using Net 30 terms frequently harms your credit score. - On the contrary, utilizing and adhering to Net 30 terms can actually help build a business's credit history when payments are made on time. Mismanagement of these terms, such as late payments, can negatively impact your credit score, but responsible use demonstrates creditworthiness to future creditors.

Understanding these misconceptions and their realities can smooth the transaction process for both vendors and clients, ensuring clearer communication and expectations around Net 30 terms order forms.

Key takeaways

When dealing with the Net 30 Terms Order form, it's crucial to understand not only the process but also the implications for your business. Here's a breakdown of key takeaways to ensure clarity and compliance:

- Accuracy is paramount: Ensure all information provided on the form is accurate and current. This includes personal details, company information, and any credit references listed. Inaccuracies can delay or even derail the credit approval process.

- Understand the terms: Net 30 means that the payment for the goods or services purchased is due 30 days from the invoice date. Agreeing to these terms implies your company's commitment to making timely payments.

- Required documents: For businesses intending to resell purchased goods, a signed CA Resale Certification is mandatory. Make sure this document is filled out correctly and submitted along with the credit application.

- Comprehensive business information: It's not just about filling out current business details. If the business has been at its current address for less than two years, a previous address must be provided separately, indicating stability and traceability to your business operations.

- Credit references matter: Providing at least two solid business credit references can significantly expedite the credit approval process. These references should be relevant and contactable, offering positive insights into your business's creditworthiness.

- Bank information: Your bank details are crucial for the credit review process. They demonstrate your business's fiscal health and reliability. Ensure the bank name, account number, and contact information are current and accurate.

- Processing time: Be aware that the typical processing time for credit applications is 48 hours. Plan accordingly, especially if the purchase is time-sensitive to your business operations.

- Verification process: By signing the application, you certify that all information provided is true and correct. The form includes a verification process which may check your bank, Dun & Bradstreet (D&B) number, and other references to confirm their validity.

Successfully navigating the Net 30 Terms Order form can lead to a beneficial credit relationship with your supplier, provided you approach it with attention to detail and a clear understanding of the terms and conditions.

Popular PDF Forms

Chore Chart - Supports the development of responsibility and good habits in children.

Pregnancy Test - Allows Pact, an adoption alliance, to receive medical records related to a patient's prenatal care and a child's health post-birth.