Blank Nevada Homestead PDF Template

In the heart of Nevada's legal landscape lies the critical Homestead Declaration form, a pivotal document designed to protect homeowners' equity from being entirely consumed by creditors in the case of financial upheaval. This document is not just a piece of paper; it's a declaration of stability and safety, allowing residents to firmly plant their roots without fear of total loss. Whether you're married, single, widowed, or head of a family, the form accommodates various statuses, making it flexible for different household structures. It caters to both regular homes and manufactured homes, acknowledging the diversity in living situations. The necessity to provide a detailed description of the property ensures that the declaration is precise and tailored to the individual's circumstances. The process formalizes with signatures, witnessed by a notary, underscoring the document's legal significance. Encouraged to be completed with the advice of an attorney, this form embodies a crucial safeguard for Nevada residents, offering a shield against the unpredictable storms of financial challenges. Modified last in September 2019, this document remains a cornerstone of personal asset protection strategies in Nevada.

Preview - Nevada Homestead Form

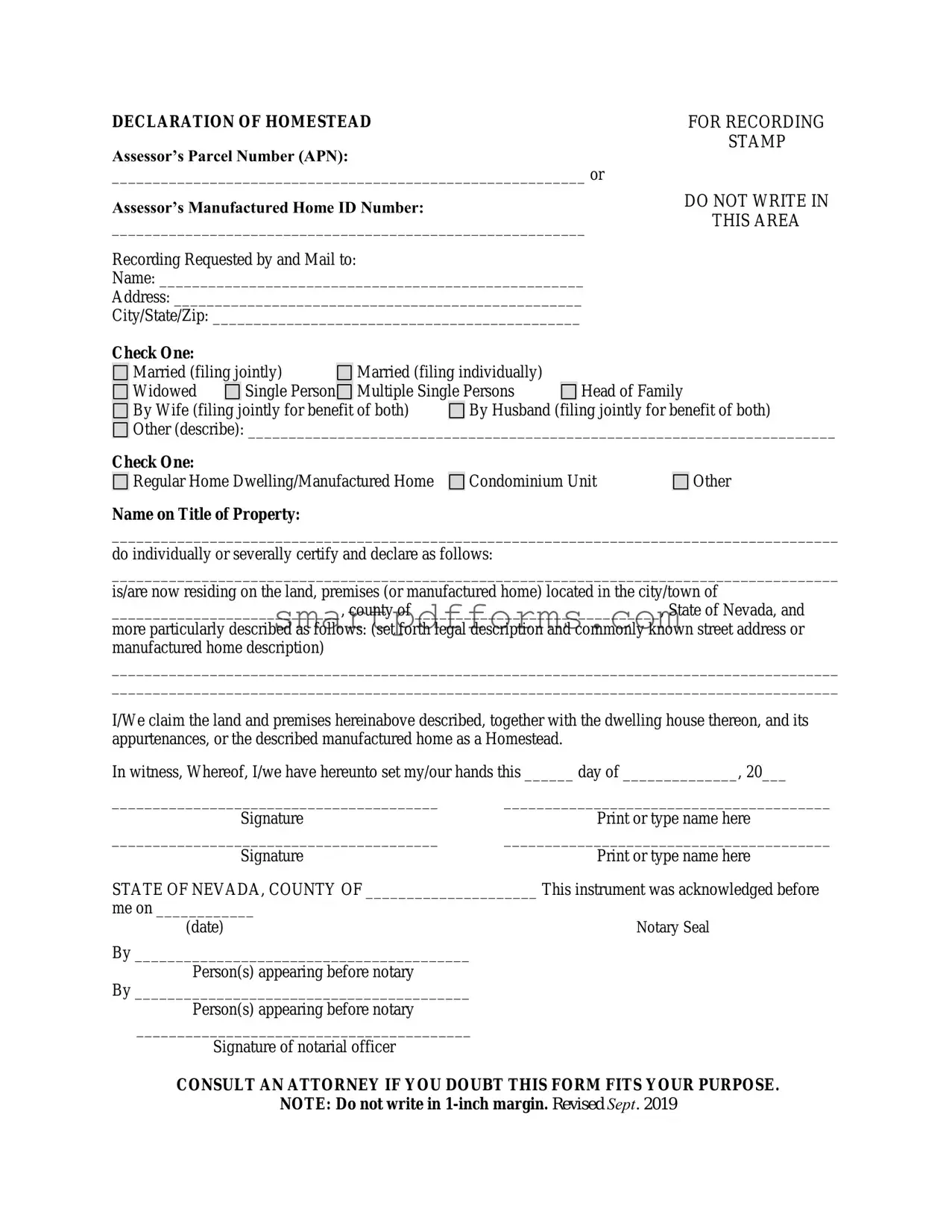

DECLARATION OF HOMESTEAD

Assessor’s Parcel Number (APN):

__________________________________________________________ or

Assessor’s Manufactured Home ID Number:

__________________________________________________________

Recording Requested by and Mail to:

Name: ____________________________________________________

Address: __________________________________________________

City/State/Zip: _____________________________________________

FOR RECORDING

STAMP

DO NOT WRITE IN

THIS AREA

Check One: |

|

|

|

|

|

|

|

|

|

|

Married (filing jointly) |

|

Married (filing individually) |

|

|

||||

|

Widowed |

|

Single Person |

|

Multiple Single Persons |

|

Head of Family |

||

|

By Wife (filing jointly for benefit of both) |

|

By Husband (filing jointly for benefit of both) |

||||||

Other (describe): ________________________________________________________________________

Other (describe): ________________________________________________________________________

Check One: |

|

|

Regular Home Dwelling/Manufactured Home |

Condominium Unit |

Other |

Name on Title of Property:

_________________________________________________________________________________________

do individually or severally certify and declare as follows:

_________________________________________________________________________________________

is/are now residing on the land, premises (or manufactured home) located in the city/town of

____________________________, county of ______________________________, State of Nevada, and

more particularly described as follows: (set forth legal description and commonly known street address or manufactured home description)

_________________________________________________________________________________________

_________________________________________________________________________________________

I/We claim the land and premises hereinabove described, together with the dwelling house thereon, and its appurtenances, or the described manufactured home as a Homestead.

In witness, Whereof, I/we have hereunto set my/our hands this ______ day of ______________, 20___

________________________________________ |

________________________________________ |

Signature |

Print or type name here |

________________________________________ |

________________________________________ |

Signature |

Print or type name here |

STATE OF NEVADA, COUNTY OF _____________________ This instrument was acknowledged before

me on ____________

(date)

By _________________________________________

Person(s) appearing before notary

By _________________________________________

Person(s) appearing before notary

_________________________________________

Signature of notarial officer

CONSULT AN ATTORNEY IF YOU DOUBT THIS FORM FITS YOUR PURPOSE.

NOTE: Do not write in

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The Nevada Homestead form is used to declare a homestead in the State of Nevada. |

| 2 | The form requires the Assessor’s Parcel Number (APN) or the Assessor’s Manufactured Home ID Number. |

| 3 | It includes options to specify the filing status such as Married (filing jointly or individually), Widowed, Single Person, Multiple Single Persons, Head of Family, and others. |

| 4 | Filers must check one type of residence: Regular Home Dwelling/Manufactured Home, Condominium Unit, or Other. |

| 5 | The form requires the name(s) on the title of the property and a declaration stating the occupants reside on the premises located in Nevada. |

| 6 | A detailed description of the land, premises, or manufactured home must be included. |

| 7 | Signatures are required from the declarants to claim the property as a homestead. |

| 8 | The form must be notarized in the county of residence in the State of Nevada. |

| 9 | A margin note advises consulting an attorney if there's doubt about the form's applicability to the filer's situation. |

| 10 | The form was last revised in September 2019, indicating the most recent update to its contents or format. |

Instructions on Utilizing Nevada Homestead

When homeowners in Nevada decide to protect their property through declaring it a homestead, they embark on a journey that shields their home from certain types of creditors, securing their family's financial future. The process involves filling out the Nevada Homestead Declaration form—a straightforward document designed to formally register one’s home as a homestead. This process, while it may seem daunting at first, involves clear steps to ensure the property is protected under Nevada law.

Here's how to complete the Nevada Homestead form:

- Start by locating the Assessor’s Parcel Number (APN) or the Assessor’s Manufactured Home ID Number specific to your property. These numbers can typically be found on your property tax bill or by contacting your local assessor's office.

- Enter your details under the "Recording Requested by and Mail to" section. This includes your full name, address, city, state, and zip code. This information is crucial as it tells the county recorder where to return the document once it's recorded.

- Under the section that asks you to "Check One" regarding your marital status and filing status, select the option that accurately reflects your situation. This helps in determining the extent of homestead protection applicable based on your marital status.

- Select the type of residence you are declaring as a homestead by checking the appropriate box—be it Regular Home Dwelling/Manufactured Home, Condominium Unit, or other (in which case you must provide a description).

- Insert the Name on Title of Property to ensure there's no discrepancy between the homestead declaration and the official property records.

- In the section provided, accurately describe the property you are claiming as your homestead. This includes providing a legal description and commonly known address. If you're unsure about the legal description, it can often be found on your deed or by consulting the local assessor’s office.

- State your claim over the property by including details about the land, premises, dwelling house, and any appurtenances, or describe the manufactured home you’re declaring as a homestead.

- In the witness statement area, sign and print your name(s) to validate the declaration. Make sure this is done in the presence of a notary public. Don't forget to fill in the date correctly.

- The form must be notarized, so visit a notary public who will witness your signature(s) and add their notarization to the document. The notary will fill out the STATE OF NEVADA, COUNTY OF section, confirming your identity and the act of signing.

Once the form is fully completed and notarized, submit it to the county recorder's office in the county where your property is located. Be mindful of any recording fees required by the county. After submitting your Nevada Homestead Declaration, the recorder’s office will process it and mail a recorded copy back to you as confirmation. This officially solidifies your property’s status as a homestead, offering protections uniquely available under Nevada law.

Obtain Answers on Nevada Homestead

Frequently Asked Questions about the Nevada Homestead Declaration Form

- What is the Nevada Homestead Declaration?

The Nevada Homestead Declaration is a legal document that allows homeowners to protect up to a certain value of their home from general creditors. When filed, this declaration safeguards the equity of the homeowner’s principal residence, including houses, condos, and manufactured homes, against claims from most creditors.

- Who should file a Nevada Homestead Declaration?

Any homeowner in the state of Nevada who wants to protect the equity of their primary residence from creditors should consider filing a Homestead Declaration. This includes homeowners who are single, married (whether filing jointly or individually), widowed, head of family, or multiple single persons owning a property together.

- What information is needed to fill out the form?

To complete the Nevada Homestead Declaration, you will need the Assessor’s Parcel Number (APN) or Assessor’s Manufactured Home ID Number of the property, the legal description of the property, the common address, your marital status, and the property’s title name. Additionally, you will need to identify the type of dwelling it is (regular home dwelling, manufactured home, condominium unit, etc.).

- Can I file if I have a mortgage on my property?

Yes, property owners can still file a Homestead Declaration even if they have an outstanding mortgage on their property. The declaration protects the equity of the property, not the full value, meaning the protected amount is the difference between the market value of your home and the amount owed on any mortgages or liens.

- Where do I file the Nevada Homestead Declaration?

The Nevada Homestead Declaration should be filed with the county recorder’s office in the county where the property is located. It is important to ensure the form is filled out accurately and notarized before filing.

- Is there a fee to file the form?

Yes, counties in Nevada typically require a filing fee for the Homestead Declaration. The exact amount can vary by county, so it is advisable to contact the local county recorder’s office to determine the current fee.

- How long does the protection last?

Once filed, the Homestead Declaration's protection lasts indefinitely for as long as the person who filed the declaration, or their legal heirs, continue to own the property and use it as their primary residence. However, updating the declaration may be necessary if significant changes occur, such as changes in marital status or property ownership.

- Does the Homestead Declaration protect against all types of debts?

No, the Homestead Declaration does not protect against all types of debts. While it provides broad protection against general creditors, certain obligations such as mortgages, taxes, alimony, child support, and specific other debts are not protected under the Homestead Declaration.

Common mistakes

When filling out the Nevada Homestead form, there are several common mistakes that individuals often make. Acknowledging and correcting these errors can help ensure the form is properly processed and that one's homestead is legally recorded. Below is an expanded list of these common errors:

Incorrectly identifying the Assessor’s Parcel Number (APN) or Assessor’s Manufactured Home ID Number. This identification is crucial for locating the property in county records.

Not correctly specifying the filing status, such as "Married (filing jointly)" versus "Married (filing individually)". This affects how the protection is applied and to whom it extends.

Failing to accurately record the name and address of the person requesting the recording. This information is necessary for any correspondence or legal documentation to be correctly mailed.

Omitting or inaccurately describing the property type (e.g., Regular Home Dwelling/Manufactured Home, Condominium Unit, etc.). Each property type has specific legal considerations.

Leaving out the Name on Title of Property, or inaccuracies in this section, can create issues in the homestead's validation, given that the titleholder's name must match the name on the homestead declaration.

Incorrectly describing or failing to provide a legal description of the property. The legal description is essential for identifying the property boundaries and ensuring they match public record.

Not properly executing the document in front of a notary, or errors in the notary section, such as wrong dates or missing signatures. Proper notarization is crucial for the form’s validity.

Writing in the 1-inch margin, which is reserved for the recording stamp. Notes or entries in this area can make processing the form difficult or result in its rejection.

In addition to these common mistakes, it's always advisable for individuals to seek legal guidance when uncertain about any aspect of the homestead declaration. An attorney can provide clarity and ensure that all legal requirements are met, thus protecting one’s homestead as intended.

Documents used along the form

When individuals or families decide to declare their property as a homestead in Nevada, it's a significant step towards protecting their home from certain types of creditors. To ensure this declaration is properly recorded and fully protective, several other forms and documents may be used in conjunction with the Nevada Homestead Declaration form. Understanding these additional documents can help in ensuring that the homestead declaration process is completed accurately and effectively.

- Proof of Ownership: This includes a deed or title showcasing the individual's ownership of the property. It is crucial for establishing the legal basis for the homestead declaration.

- Property Tax Records: Providing recent property tax documents can help in verifying the ownership and assessing the value of the property for homestead purposes.

- Mortgage Statement: If the property is currently under a mortgage, a recent mortgage statement may be required to prove the financial status of the property and the owner's equity in it.

- Identification Documents: Valid photo ID, such as a driver’s license or passport, is often necessary to verify the identity of the person(s) filing for a homestead exemption.

- Marriage Certificate or Divorce Decree: For those filing as married (jointly or individually) or as a head of family, legal documents proving marital status may be required.

- Notarization Acknowledgement: This form is an acknowledgment that the homestead declaration was sworn in front of a notary, which is a crucial step for the document to be legally binding.

- Legal Description of the Property: In addition to the homestead form’s description, a detailed legal description provided by a surveyor or found in property records may be needed for accuracy.

Completing and gathering these documents can feel daunting, but they play a vital role in successfully declaring a property as a homestead in Nevada. Each document serves to affirm the legitimacy of the claim, the identity of the claimant(s), and the specifics of the property in question. Especially when facing financial uncertainties, securing a property through the homestead declaration can provide a significant layer of protection and peace of mind to homeowners. Understanding and preparing these documents thoroughly ensures the process is handled correctly and efficiently.

Similar forms

The Warranty Deed serves a similar purpose by establishing an individual's or entity's legal right to a piece of property. This document, much like the Nevada Homestead form, requires details about the property, the parties involved, and must be notarized to confirm authenticity. Both documents are integral to legally defining ownership and rights associated with a property, but the Homestead specifically focuses on the principal residence for the purpose of protecting it from certain creditors.

A Quitclaim Deed is another document that shares similarities. It transfers interest in real property from one party to another with no guarantees about the transferring party's interest. Like the Nevada Homestead form, it must include a legal description of the property, the names of the parties involved, and be filed with the county recorder. Both documents play a role in defining and transferring property rights, with the Homestead form specifically designating a residence for protection.

The Power of Attorney is a legal document that grants one person the power to act on another's behalf in various legal and financial matters. Similar to the Nevada Homestead form, it often requires notarization to ensure its legitimacy and has designated spots for signatures and personal information. While it covers broader legal powers beyond property rights, both documents facilitate the management and protection of an individual's assets.

Trust Agreement documentation is also comparable. These documents formalize the creation of a trust for managing an individual’s assets, including real estate. The similarity to the Nevada Homestead form lies in its focus on property and asset protection. Both require detailed descriptions of the assets, identification of the parties involved, and legal formalities, such as notarization, to solidify their validity.

Dos and Don'ts

When you're filling out the Nevada Homestead form, it's crucial to ensure that you follow specific guidelines to safeguard your property rights efficiently. Here are some dos and don'ts to guide you through the process:

Things You Should Do

Ensure that the Assessor’s Parcel Number (APN) or the Assessor’s Manufactured Home ID Number is accurately filled out. This number is pivotal in identifying your property correctly.

Choose the correct status that applies to you (e.g., Married filing jointly, Single Person, Head of Family, etc.) to ensure your declaration is precise and tailored to your specific living arrangement.

Provide a thorough description of the property, including the legal description and commonly known street address or manufactured home description. This clarity helps in confirming the property you intend to homestead.

Sign and print your name where indicated to validate the form. Your signature is the seal of your declaration, making it legally binding.

Things You Shouldn't Do

Do not leave the "Recording Requested by and Mail to" section blank. This information is essential for ensuring that the recorded document is returned to the correct person or entity.

Do not ignore the space provided for describing the property as a Regular Home Dwelling/Manufactured Home, Condominium Unit, or Other. Failing to check the appropriate box could lead to confusion regarding the nature of your homestead.

Avoid writing in the 1-inch margin reserved for the Recording Stamp. This space is strictly for office use and must be left untouched to avoid any processing issues.

Do not forget to consult an attorney if you are unsure about the form fitting your purpose. The note at the bottom of the form is a vital reminder that seeking legal advice can prevent potential mistakes.

Misconceptions

Understanding the Nevada Homestead Declaration form involves navigating through common misconceptions that can cloud its purpose and benefits. Here, we dispel four popular myths:

- Completeness Equals Protection for All Property Types: A common belief is that once you complete the Nevada Homestead form, all your property types are automatically protected. However, the form specifically applies to your principal residence, which can include a house, condo, or manufactured home. This means other property types, such as second homes or investment properties, are not covered under this declaration.

- Marital Status Affects Filing Validity: Some people mistakenly think that your marital status can invalidate your Homestead declaration. Whether married, single, widowed, or in any other marital status, you can file for a Homestead exemption. The form does require specifying your marital status to ensure the correct processing and to clarify rights under the exemption, but it does not affect the validity of the claim itself.

- No Annual Renewal Required: A prevalent misconception is the idea that the Homestead exemption in Nevada requires an annual renewal. This is not the case. Once filed, the Homestead protection remains in effect until a change is made to the title of the property, such as selling the property or changing ownership status, rather than requiring yearly maintenance.

- Limit on Protection Amount: Some individuals mistakenly believe there is no cap on the amount of equity protected by filing a Homestead Declaration in Nevada. In reality, there is a statutory limit on the amount of equity in your home that can be protected from general creditor claims. This amount can vary, so reviewing the most current laws or consulting a legal professional is important to understand the extent of protection offered.

By addressing these misconceptions, individuals can better understand the Homestead Declaration in Nevada and take meaningful steps to protect their homes. Remember, consulting with a legal advisor can provide clarity and ensure that actions taken align with current laws and personal circumstances.

Key takeaways

Filing a Nevada Homestead Declaration is an important step for homeowners looking to protect their primary residence from general creditor claims. Understanding the key aspects of this process can ensure that individuals take full advantage of the protections offered under Nevada law. Here are eight key takeaways about filling out and using the Nevada Homestead form:

- Identification of Property Type: The form requires you to identify the type of property you are claiming as a homestead. This could be a regular home, a manufactured home, or a condominium unit. Clearly specifying this helps in the accurate processing of your declaration.

- Property and Owner Details: Accurately filling in details such as the Assessor’s Parcel Number (APN) or the Assessor’s Manufactured Home ID Number, as well as the name(s) on the title of the property, is crucial. These details verify the property’s identity and ownership.

- Marital Status: Indicating your marital status is required and impacts the declaration process. Nevada law provides different protections and considerations for married individuals, whether filing jointly or individually, and for widowed or single persons.

- Legal Description and Address: Providing both the legal description and the commonly known address of the property ensures the declaration accurately identifies your homestead. This detail is important for legal and record-keeping purposes.

- Signature Requirements: All owners listed on the title should sign the declaration. If the property is owned by multiple individuals, each person must sign to validate the form.

- Notarization: The declaration must be notarized, which means it needs to be signed in front of a notary public. This step formally verifies the identity of the signees and the authenticity of their signatures.

- Filing with the County Recorder: After completing and notarizing the form, it must be filed with the County Recorder’s office in the county where the property is located. Filing this form makes the homestead declaration a matter of public record, offering protection against creditors.

- Seek Legal Advice if Necessary: The form advises consulting an attorney if there are doubts about its applicability or how to fill it out properly. Given the legal complexities and financial implications, seeking professional advice can ensure that you fully understand and correctly utilize the homestead exemption.

The Nevada Homestead Declaration is a powerful tool for protecting one’s primary residence from certain types of creditor claims. Paying careful attention to the details and requirements of the form is essential in securing this protection effectively.

Popular PDF Forms

Illinois Title Application Pdf - The form includes sections for both the seller and buyer to acknowledge the odometer reading and provide their personal information.

D20 Modern Character Sheet - Engage with the world in unique ways through specialized skills like Craft, Perform, and Profession, reflecting your character’s individual interests and talents.