Blank Nevada Nucs 4072 PDF Template

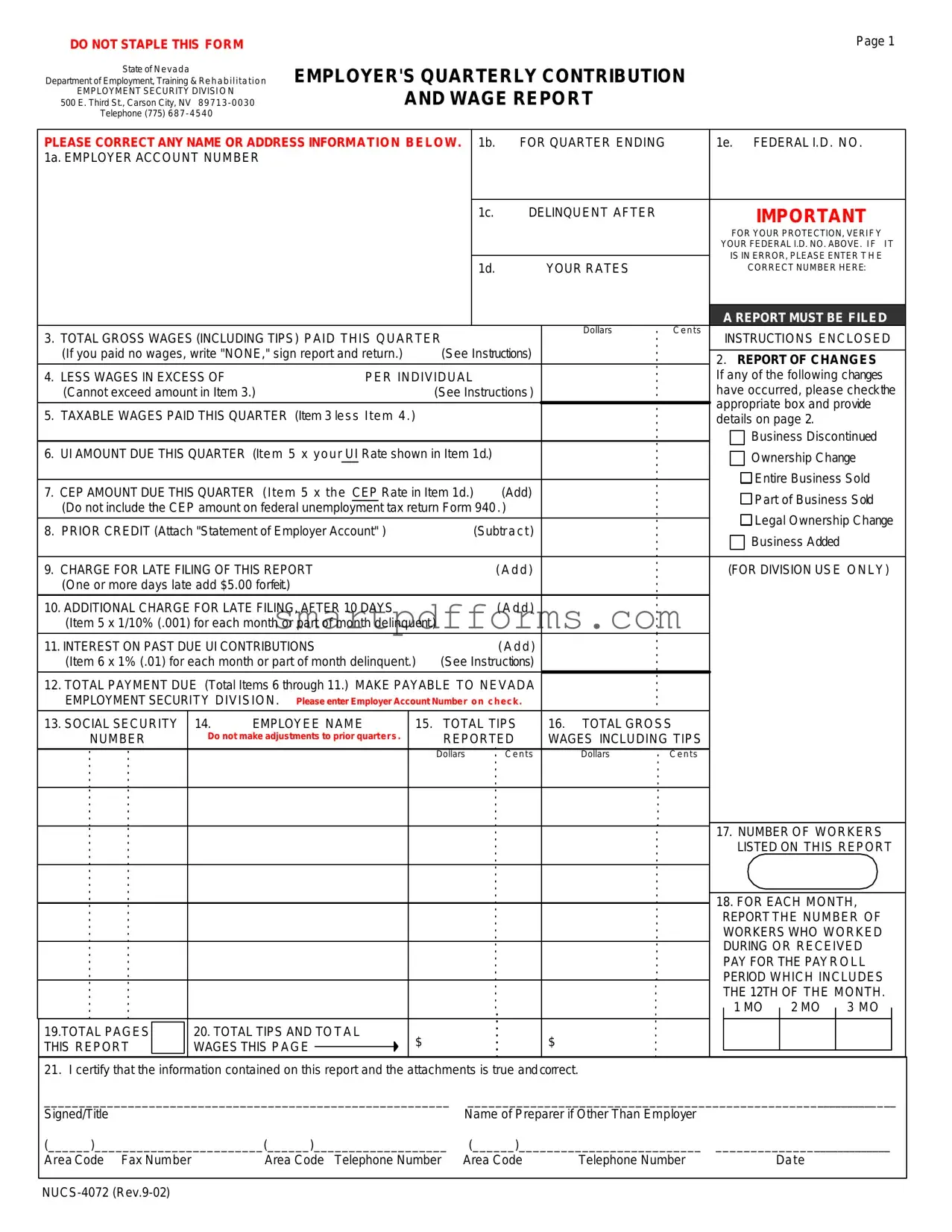

The Nevada NUCS 4072 form, issued by the State of Nevada Department of Employment, Training, and Rehabilitation's Employment Security Division, is an integral document for employers in Nevada. Serving as the Employer's Quarterly Contribution and Wage Report, this form plays a critical role in the unemployment insurance program, facilitating the accurate recording and reporting of wages paid to employees within a specific quarter. It requires employers to detail total gross wages, adjustments for excess wages, and calculate taxable wages. This calculation then helps in determining the unemployment insurance amount due for that quarter based on the employer's UI rate. Additionally, the form provides space for reporting any changes in business ownership, discontinuation of the business, or any other significant modifications. Employers are also reminded to verify their Federal I.D. Number for their protection and to ensure that taxes are correctly credited to their account. Moreover, instructions for calculating interest on past due contributions and fees for late filing underscore the importance of timely submission. Employers must fill out and return this form by the specified deadline to avoid penalties, making it essential for maintaining compliance with state employment regulations.

Preview - Nevada Nucs 4072 Form

DO NOT STAPLE THIS FORM

State of Nevada

Department of Employment, Training & Rehabilitation

EMPLOYMENT SECURITY DIVISION

500 E. Third St., Carson City, NV

Telephone (775)

Page 1

EMPLOYER'S QUARTERLY CONTRIBUTION

AND WAGE REPORT

PLEASE CORRECT ANY NAME OR ADDRESS INFORMATION BELOW. |

1b. |

FOR QUARTER ENDING |

|

|

1e. |

|

FEDERAL I.D. NO. |

||||||||||

1a. EMPLOYER ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1c. |

DELINQUENT AFTER |

|

|

|

|

|

IMPORTANT |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR YOUR PROTECTION, VERIFY |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YOUR FEDERAL I.D. NO. ABOVE. IF IT |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IS IN ERROR, PLEASE ENTER T H E |

||

|

|

|

|

|

|

|

|

1d. |

|

|

YOUR RATES |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CORRECT NUMBER HERE: |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A REPORT MUST BE FILED |

|||

3. TOTAL GROSS WAGES (INCLUDING TIPS) PAID THIS QUARTER |

|

|

Dollars |

Cents |

INSTRUCTIONS ENCLOSED |

||||||||||||

|

|

|

|

|

|||||||||||||

(If you paid no wages, write "NONE," sign report and return.) |

(See Instructions) |

|

|

|

|

|

|

|

|||||||||

|

|

|

2. |

|

REPORT OF CHANGES |

||||||||||||

4. LESS WAGES IN EXCESS OF |

|

|

|

PER INDIVIDUAL |

|

|

|

|

|

If any of the following changes |

|||||||

(Cannot exceed amount in Item 3.) |

|

|

(See Instructions ) |

|

|

|

have occurred, please checkthe |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

appropriate box and provide |

|||

5. TAXABLE WAGES PAID THIS QUARTER (Item 3 less Item 4.) |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

details on page 2. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Discontinued |

6. UI AMOUNT DUE THIS QUARTER (Item 5 x your |

UI |

Rate shown in Item 1d.) |

|

|

|

|

|

|

|

|

Ownership Change |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entire Business Sold |

7. CEP AMOUNT DUE THIS QUARTER (Item 5 x the CEP Rate in Item 1d.) |

(Add) |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

Part of Business Sold |

|||||||||||

(Do not include the CEP amount on federal unemployment tax return Form 940.) |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

Legal Ownership Change |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. PRIOR CREDIT (Attach "Statement of Employer Account" ) |

|

(Subtract) |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

Business Added |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. CHARGE FOR LATE FILING OF THIS REPORT |

|

|

|

|

(Add) |

|

|

|

(FOR DIVISION USE ONLY) |

||||||||

(One or more days late add $5.00 forfeit.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

10. ADDITIONAL CHARGE FOR LATE FILING, AFTER 10 DAYS |

|

|

(Add) |

|

|

|

|

|

|

|

|||||||

(Item 5 x 1/10% (.001) for each month or part of month delinquent.) |

|

|

|

|

|

|

|

|

|

||||||||

11. INTEREST ON PAST DUE UI CONTRIBUTIONS |

|

|

|

|

(Add) |

|

|

|

|

|

|

|

|||||

(Item 6 x 1% (.01) for each month or part of month delinquent.) |

(See Instructions) |

|

|

|

|

|

|

|

|||||||||

12. TOTAL PAYMENT DUE (Total Items 6 through 11.) MAKE PAYABLE TO NEVADA |

|

|

|

|

|

|

|

||||||||||

EMPLOYMENT SECURITY DIVISION. Please enter Employer Account Number on check . |

|

|

|

|

|

|

|

||||||||||

13. SOCIAL SECURITY |

14. |

EMPLOYEE NAME |

|

15. |

TOTAL TIPS |

16. TOTAL GROSS |

|

|

|

|

|||||||

NUMBER |

Do not make adjustments to prior quarters . |

|

REPORTED |

WAGES INCLUDING TIPS |

|

|

|

||||||||||

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

Dollars |

Cents |

Dollars |

Cents |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. NUMBER OF WORKERS |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

LISTED ON THIS REPORT |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. FOR EACH MONTH, |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

REPORT THE NUMBER OF |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

WORKERS WHO WORKED |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

DURING OR RECEIVED |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

PAY FOR THE PAYROLL |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

PERIOD WHICH INCLUDES |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

THE 12TH OF THE MONTH. |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

1 MO |

|

|

2 MO |

|

3 MO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19.TOTAL PAGES |

|

|

20. TOTAL TIPS AND TOTAL |

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

THIS REPORT |

|

|

WAGES THIS PAGE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. I certify that the information contained on this report and the attachments is true and correct. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

__________________________________________________________ |

_______________________________________________________________ |

|

|||||||||||||||||||

Signed/Title |

|

|

|

|

Name of Preparer if Other Than Employer |

|

|

|

|

|

|

|

|

||||||||

(______)________________________(______)___________________ |

(______)__________________________ ___________________________ |

|

|

||||||||||||||||||

Area Code Fax Number |

Area Code Telephone Number |

Area Code |

Telephone Number |

Date |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

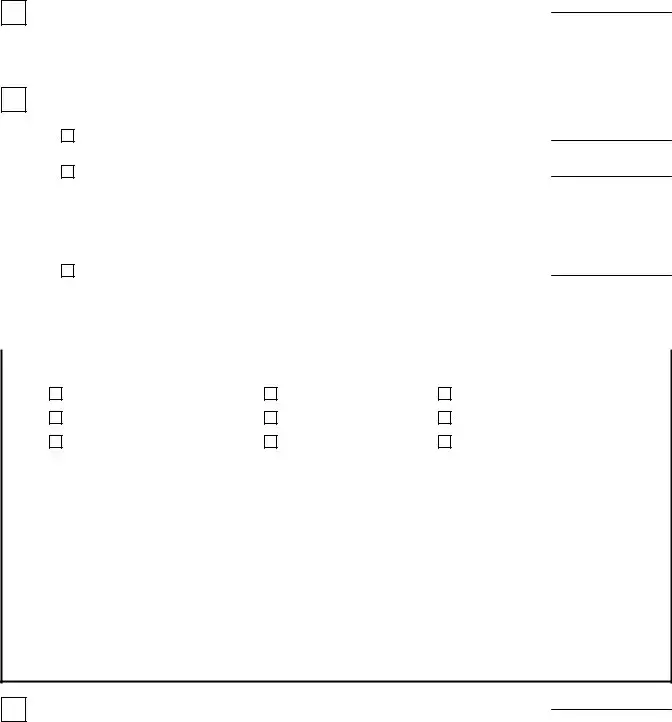

E M P L O Y E R ' S R E P O R T O F C H A N G E S

P a g e 2

E m p l o y e r A c c o u n t N u m b e r : _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ T e l e p h o n e N u m b e r : _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Business Discontinued (no new ownership) ..........................................................

M o n t h / D a y / Y e a r

( P l e a s e n o t i f y t h e D i v i s i o n i f , o r w h e n , b u s i n e s s r e s u m e s . )

E x a c t D a t e o f L a s t P a y r o l l _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

M o n t h / D a y / Y e a r

C h a n g e i n B u s i n e s s O w n e r s h i p - C o m p l e t e N E W O W N E R ( S ) s e c t i o n b e l o w .

Sale of Entire Business .............................................................................

M o n t h / D a y / Y e a r

Partial Sale (not out of business) ..............................................................

M o n t h / D a y / Y e a r

D e s c r i b e P a r t S o l d _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Change in Legal Ownership .....................................................................

( s u c h a s a d d i n g o r d r o p p i n g a p a r t n e r , i n c o r p o r a t i n g , e t c . )

M o n t h / D a y / Y e a r

N E W O W N E R ( S ) |

N e w F e d e r a l I d e n t i f i c a t i o n N u m b e r ( i f a p p l i c a b l e ) : |

|

|

|

|

|

|

C h e c k T y p e o f O r g a n i z a t i o n: |

|

|

|

S C o r p o r a t i o n |

S o l e P r o p r i e t o r |

L i m i t e d L i a b i l i t y P a r t n e r s h i p |

|

P u b l i c l y T r a d e d C o r p o r a t i o n |

A s s o c i a t i o n |

L i m i t e d L i a b i l i t y C o m p a n y |

|

P r i v a t e l y H e l d C o r p o r a t i o n |

P a r t n e r s h i p |

O t h e r |

|

N a m e a n d a d d r e s s o f n e w o w n e r ( s ) , p a r t n e r ( s ) , c o r p o r a t e o f f i c e r ( s ) , m e m b e r ( s ) , e t c . _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

R e m a r k s _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

New Business Units Added to Present Ownership .................................................

M o n t h / D a y / Y e a r

T r a d e N a m e _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

L o c a t i o n _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

N a t u r e o f O p e r a t i o n _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

P r e v i o u s O w n e r ( s ) _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

N U C S - 4 0 7 2 ( R e v . 9 - 0 2 )

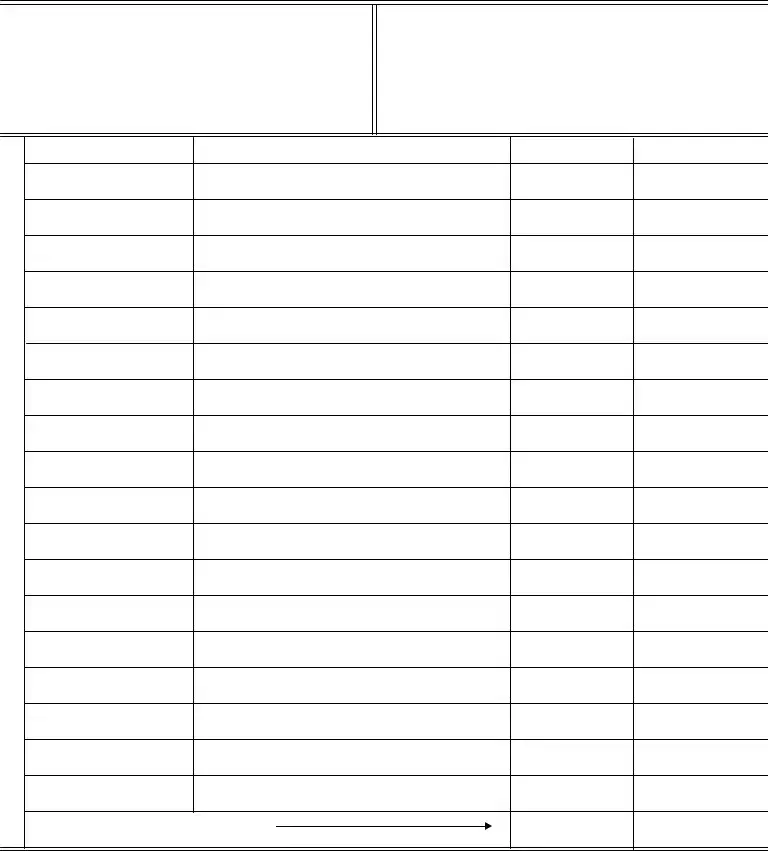

STATE OF NEVADA

DEPARTMENT OF EMPLOYMENT, TRAINING AND REHABILITATION

EMPLOYMENT SECURITY DIVISION

500 E. Third Street

Carson City, Nevada

CONTINUATION SHEET

EMPLOYER'S QUARTERLY LIST OF WAGES PAID

EMPLOYER ACCOUNT NUMBER

NAME

ADDRESS

FOR QUARTER ENDING |

PAGE NUMBER |

|

|

|

|

ENCLOSE THIS FORM WITH THE "EMPLOYER'S QUARTERLY CONTRIBUTION AND WAGE REPORT" (FORM

Report Not Complete if Social Security Numbers Are Missing

SOCIAL SECURITY NUMBER

EMPLOYEE'S NAM E

TOTAL TIPS REPORTED

THIS QUARTER

TOTAL WAGES (INCLUDING REPORTED TIPS) THIS QUARTER

TOTAL TIPS AND TOTAL WAGES THIS PAGE

$

$

Form Data

| Fact Name | Description |

|---|---|

| Form Title | Employer's Quarterly Contribution and Wage Report |

| Form Number | NUCS-4072 |

| Issuing Agency | State of Nevada Department of Employment, Training & Rehabilitation, Employment Security Division |

| Agency Location | 500 E. Third St., Carson City, NV 89713-0030 |

| Contact Information | Telephone (775) 687-4540 |

| Governing Law(s) | Nevada state law pertaining to employment security and unemployment insurance contributions |

Instructions on Utilizing Nevada Nucs 4072

Completing the Nevada NUCS 4072 form is an essential task for employers every quarter, ensuring that employee contributions and wage details are accurately reported to the State of Nevada Department of Employment, Training, and Rehabilitation. Here is a step-by-step guide to help you through filling out the form confidently and correctly.

- Begin by verifying the pre-filled employer name and address. Make any necessary corrections directly on the form.

- Fill in the quarter ending date in the field labeled 1b, ensuring it matches the quarter for which you are reporting.

- Double-check the Federal I.D. No. (1e) listed. If incorrect, write the correct number in the provided space (1d).

- Enter your Employer Account Number in the designated area (1a).

- Update your rates under 1d if they have changed. This section requires you to know your current Unemployment Insurance (UI) rate and Career Enhancement Program (CEP) rate.

- Report the total gross wages paid this quarter (including tips) in section 3, making sure to include every dollar and cent.

- If applicable, fill in the less wages in excess of the individual limit in section 4 as directed by the instructions.

- Calculate the taxable wages paid this quarter (Item 3 minus Item 4) and enter this total in section 5.

- Compute the UI amount due this quarter by multiplying Item 5 by your UI rate shown in Item 1d. Enter the result in section 6.

- Similarly, calculate the CEP amount due this quarter (Item 5 times the CEP rate in Item 1d) and record it in section 7.

- If you have any prior credit from previous payments or corrections, attach the "Statement of Employer Account" and subtract this amount in section 8.

- For late filings, add the corresponding charges as instructed in sections 9 and 10.

- Interest on past due UI contributions is calculated and added in section 11 following the provided formula.

- Add up the total payment due (Items 6 through 11) and write this sum in section 12.

- Ensure that each employee's social security number, name, total tips, and total gross wages including tips are accurately reported in sections 13-16.

- Indicate the number of workers listed on this report in section 17.

- For each month, report the number of workers who worked or received pay for the payroll period including the 12th in section 18.

- State the total pages included in your report and the aggregate of total tips and wages on this page in sections 19 and 20, respectively.

- Sign and date the form, providing your title in the space indicated. If someone other than the employer prepared the form, they should fill their name and contact information in the designated area.

After completing the form, you should make your payment payable to the Nevada Employment Security Division and include the employer account number on the check. Carefully review the entire form to ensure accuracy and completeness. Then, send the form and any accompanying payment or documents to the address provided at the top of the form. This process ensures your business stays compliant with Nevada's employment reporting requirements.

Obtain Answers on Nevada Nucs 4072

Frequently Asked Questions about the Nevada NUCS 4072 Form

- What is the purpose of the Nevada NUCS 4072 form?

The NUCS 4072 form is used by employers in Nevada to report quarterly contributions, wages paid to employees, and other relevant employment information to the State of Nevada Department of Employment, Training & Rehabilitation, Employment Security Division. It ensures accurate record-keeping for unemployment insurance purposes.

- How do I know if I need to fill out the NUCS 4072 form?

If you are an employer in Nevada who pays wages to employees, you are required to fill out and submit the NUCS 4072 form every quarter. This requirement applies regardless of whether your employees earned wages in excess of the taxable wage base or not.

- When is the NUCS 4072 form due?

This form is due every quarter. The specific deadlines are April 30th for the first quarter, July 31st for the second quarter, October 31st for the third quarter, and January 31st for the fourth quarter. It is considered delinquent after these dates.

- What information do I need to complete the form?

To accurately complete the form, you will need your Federal Identification Number, Employer Account Number, the total gross wages paid during the quarter, information on any changes in business ownership or legal structure, and detailed employee wage information including total tips and social security numbers.

- What happens if I submit the form late?

Late submissions are subject to a late filing charge. If the report is one or more days late, a $5.00 forfeit is added. Additionally, there is an extra charge for filings that are more than 10 days late, calculated at 0.1% (0.001) for each month or part of a month delinquent. Interest on past due contributions is also charged at 1% (0.01) per month or part thereof.

- Can adjustments to prior quarters be made on this form?

No, adjustments to prior quarters should not be made on this form. The NUCS 4072 form is designed for reporting within the specified quarter only. Any necessary adjustments to reports from previous quarters require a different process.

- Where do I send the completed form?

The completed form, along with the correct payment, should be made payable and sent to the Nevada Employment Security Division at the address provided on the form: 500 E. Third Street, Carson City, Nevada 89713-0030.

- What if I have no wages to report for the quarter?

If you have no wages to report for a specific quarter, you should still complete the form by writing "NONE" in the appropriate section, signing it, and returning it by the due date to remain in compliance.

Common mistakes

Filling out the Nevada NUCS 4072 form can be complex and making mistakes can lead to issues with your filing. Here are six common mistakes to avoid:

Not verifying the Federal I.D. No. listed at the top of the form. Always cross-check this number to ensure it matches your business's official federal identification number.

Leaving the Total Gross Wages section blank if no wages were paid this quarter. If no wages were disbursed, you must write "NONE" in this section to comply with the instructions.

Failing to report changes in business ownership, name, or address. The Report of Changes section is crucial for updating the Employment Security Division on any significant alterations to your business structure or contact information.

Incorrectly calculating Taxable Wages. Remember, this is the total gross wages minus any wages in excess of the cap established for the individual. Many mistakenly overlook or miscalculate this subtraction.

Omitting the number of workers in the Number of Workers Listed on This Report and For Each Month, Report The Number of Workers sections. These figures are vital for accurate record-keeping and compliance.

Forgetting to sign and date the form. An unsigned or undated form is considered incomplete and can result in processing delays or penalties for late filing.

When completing the NUCS 4072, attention to detail is key. Avoid these common errors to ensure your report is accurate and compliant.

Documents used along the form

When filing the Nevada NUCS 4072 form, employers in Nevada navigate a detailed process within the realm of employment reporting and compliance. This form is a critical piece, yet it often coexists with other documents and forms that ensure business operations align with legal and regulatory standards. It's not just about reporting wages accurately; it's about understanding the broader scope of documentation that supports various aspects of employment and business changes.

- Form NUCS 4073 - Employer's Quarterly List of Wages Paid: This continuation sheet accompanies the NUCS 4072, providing detailed reporting on each employee’s wages and tips for the quarter, ensuring comprehensive wage reporting.

- Form UI-1 - Report to Determine Liability under the Nevada Unemployment Compensation Law: Businesses new to Nevada use this form to determine if they meet the criteria for paying state unemployment tax.

- Form UI-3 - Employer's Quarterly Wage and Contribution Report: Similar to NUCS 4072, this form is used in specific scenarios for reporting wages and contributions, particularly when adjustments are necessary.

- Form DE-34 - Report of New Employee(s): Employers submit this form to report new hires to the state, which helps in tracking employment and ensuring compliance with child support enforcement efforts.

- Form 940 - Federal Unemployment Tax Act (FUTA) Tax Return: Annually, employers must file this federal form that reports the total amount of unemployment taxes paid to the state. This is particularly relevant as state payments can affect FUTA tax obligations.

- Form W-4 - Employee's Withholding Certificate: Though primarily used for federal tax withholding purposes, the information on this form impacts state income tax reporting and withholding calculations where applicable.

- Business Registration Form: For any changes in business status, such as those indicated in NUCS 4072, a business may also need to update or register anew with the Nevada Secretary of State, using the appropriate business registration forms.

Together, these documents create a framework for employment and tax reporting that supports a transparent and compliant business environment in Nevada. Employers should stay informed about the specific requirements and deadlines associated with each form, as this knowledge ensures smoother operations and minimizes the risk of penalties or errors in reporting. Accurate and timely completion of these forms not only meets legal obligations but also contributes to the stability and reliability of Nevada’s employment and economic data.

Similar forms

The Form 940, known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is similar because it also reports wages paid and calculates unemployment tax due, but on an annual basis for federal purposes, unlike the Nevada Nucs 4072 form which does so on a quarterly basis for state purposes.

The W-2 form, or Wage and Tax Statement, resembles the Nucs 4072 as both documents require detailed employee wage information, including tips and social security numbers, to report earnings to government agencies.

The W-3 form, the Transmittal of Wage and Tax Statements, is akin to the continuation sheet of Nucs 4072 as it summarizes employee wage information for multiple employees. Both forms compile and report earnings and deductions for a group of workers, though the W-3 does this annually for federal taxes.

The Form 941, known as the Employer's Quarterly Federal Tax Return, shares similarities with the Nevada Nucs 4072 by reporting wages paid, taxes withheld from employees, and the employer's portion of social security or Medicare tax on a quarterly basis.

The State Unemployment Insurance (SUI) reporting forms of other states share a direct resemblance with the Nevada Nucs 4072 form in that they both require employers to report wages and calculate unemployment insurance contributions on a periodic basis for state-level unemployment insurance programs.

The Form W-4, or Employee's Withholding Certificate, while primarily used for determining federal income tax withholding, is indirectly related because the accurate completion of forms like the Nucs 4072 relies on correct W-4 information for each employee, affecting how wages and withholdings are reported.

The Form I-9, Employment Eligibility Verification, though not a tax form, is tangentially similar as it is another critical document employers must complete for new hires to verify their eligibility to work in the U.S., ensuring that wage reports like those filed on Nucs 4072 forms are for legally authorized workers.

The New Hire Reporting forms, which employers submit to state agencies to report newly hired or rehired employees, complement the Nucs 4072 by ensuring that all employees' wages are accounted for and that appropriate state unemployment contributions are calculated.

The Quarterly Federal Excise Tax Return (Form 720) parallels the Nucs 4072 in its quarterly reporting requirement, though it focuses on taxes related to the sale or use of certain products, services, and activities, illustrating the varied purposes for which businesses must regularly report to both federal and state authorities.

Dos and Don'ts

When filling out the Nevada NUCS 4072 form, which is crucial for reporting an employer's quarterly contribution and wage details to the State of Nevada Department of Employment, Training & Rehabilitation, certain practices should be followed to ensure accuracy and compliance. Below are several do's and don'ts to consider:

Do:

- Verify the Federal I.D. Number listed on the form to ensure it matches the official records for your business.

- Accurately report all gross wages paid during the quarter, including tips, to avoid underpayment or overpayment of taxes.

- Use the correct rates provided in Item 1d for calculating UI (Unemployment Insurance) and CEP (Career Enhancement Program) amounts due.

- Make any necessary corrections to name or address information directly on the form to ensure the Employment Security Division has the most current details.

- Report any changes in business ownership, legal structure, or status using the appropriate check boxes and provide detailed information as requested on page 2.

- Enter the total number of workers and the respective numbers who worked during or received pay for the specified payroll periods.

- Sign and date the form, certifying that the information provided is true and correct, and include contact details.

Don't:

- Staple the form, as it can interfere with processing. Use a paper clip if necessary to keep pages together.

- Leave social security numbers, employee names, or wage details blank on the continuation sheet, as this can render the report incomplete.

- Alter prior quarter adjustments on this form; it is intended only for the current reporting period.

- Forget to attach a "Statement of Employer Account" if claiming a prior credit towards this quarter's liabilities.

- Ignore the deadlines for filing to avoid late filing charges, additional charges, and interest on past due contributions.

- Exclude the CEP amount from your federal unemployment tax return. This amount is specific to Nevada and should not be included when reporting federal unemployment taxes.

- Omit the employer account number when making payment. This number ensures that your payment is applied correctly to your account.

Misconceptions

Understanding the intricacies of employment forms can be crucial for employers. The Nevada Nucs 4072 form, required by the Department of Employment, Training & Rehabilitation, often comes with its share of misconceptions. It's important to dispel these misunderstandings to ensure accurate and efficient reporting.

- Misconception 1: All wages must be reported, without exceptions.

This belief is partially incorrect. While the form is designed to gather comprehensive wage data, there are specific exclusions outlined by the instructions. For example, it specifies that one should report "TOTAL GROSS WAGES (INCLUDING TIPS) PAID THIS QUARTER" but also allows for wages in excess of a certain amount per individual to be deducted. This means not all wages may be subject to reporting or taxation, highlighting the importance of thoroughly reviewing the instructions.

- Misconception 2: The form is only applicable to businesses with a certain number of employees.

There's a common misunderstanding that the form applies exclusively to larger businesses or those with employees above a certain number. However, any employer that pays wages to employees in Nevada is required to complete and submit the NUCS-4072 form. The size of the business does not exempt an employer from this responsibility, ensuring all workers are accounted for in the state's employment records.

- Misconception 3: Penalties for late filing are negotiable or can be easily waived.

Some employers might underestimate the consequences of late filing, believing penalties are lenient and can be waived with a simple explanation. The form clearly states the charges for late filing, including an initial forfeit plus additional charges after 10 days, highlighting the state's strict stance on deadlines. These penalties emphasize the importance of timely submission and the non-negotiable nature of these charges unless specific appeal procedures are followed and approved.

- Misconception 4: Information about business changes is optional.

A critical misunderstanding is the belief that updates regarding business changes are optional or only necessary for annual filings. The second section of the form, titled "REPORT OF CHANGES," requires employers to report any alterations in ownership, legal structure, or business status. This section ensures that the state's employment records remain current and accurately reflect the active business landscape, thereby making it essential for timely and accurate compliance.

The Nevada Nucs 4072 form is an essential document for accurately reporting employment data to state authorities. By clarifying these misconceptions, employers can better navigate the complexities of compliance, ensuring both the state's and the employees' needs are met. Always refer to the latest guidelines and seek clarification when in doubt, to remain in good standing.

Key takeaways

Filling out and using the Nevada Nucs 4072 form, a crucial document for employers within the state of Nevada, demands careful attention to detail and an understanding of its specific requirements. Here are seven key takeaways to guide you through this process efficiently:

- Ensure all employer information, including the name and address, is accurate and up-to-date. Corrections should be made directly on the form to avoid processing delays.

- Verify your Federal I.D. Number (FEDERAL I.D. NO.) as listed on the form. If you find any discrepancies, correct the number on the form immediately to ensure your report is properly attributed to your account.

- Report total gross wages paid during the quarter, which includes all forms of compensation such as tips. If no wages were paid during the quarter, indicate this by writing "NONE."

- Understanding the difference between total gross wages and taxable wages is crucial. Taxable wages are calculated by subtracting any wages in excess of the threshold (as noted in the form's instructions) from total gross wages.

- Detail any changes in business operations on the second page, such as business discontinuation, ownership changes, or legal ownership changes. This information is critical for maintaining up-to-date records with the Employment Security Division.

- Calculate your contributions accurately. This involves applying the appropriate rates to your taxable wage base for both Unemployment Insurance (UI) and Career Enhancement Program (CEP) contributions.

- Be aware of late filing charges and other penalties. Late filing can result in both a flat fee and additional charges that compound over time, making timely filing essential to avoid unnecessary costs.

Timely and accurate completion of the Nucs 4072 form is not just a regulatory requirement; it also protects businesses and ensures that unemployment insurance funds are properly allocated. Always consult the form's instructions or seek professional guidance if you have any doubts about how to accurately complete and submit this important document.

Popular PDF Forms

What Is a Physical for a Job - The form bridges the gap between health status and employment suitability, supporting decisions that promote safety and productivity.

What Is Waiver of Service Divorce Texas - Provides contact information for legal aid, offering resources to those without legal representation.

Mass Ez Pass Login - There are specific instructions on how to properly affix the transponder to the vehicle to avoid misuse and potential fines.