Blank Next Of Kin PDF Template

The Next of Kin form serves a crucial function in establishing a clear legal link between a deceased individual and their surviving relatives. Originating from the U.S. Department of State, this affidavit specifically caters to Americans who encounter death outside of their home country, ensuring their estate can be rightfully claimed by the designated successor. Although the idea might sound technical, its essence is simple: it provides a structured way for surviving spouses, children, parents, siblings, or other relatives to declare their relationship to the deceased. This declaration is not merely for formality's sake; it's a foundational step for consular officers to act as provisional conservators of the deceased's estate. This includes safeguarding personal effects until the rightful heir is recognized. The document requires detailed information such as the names and relationships of surviving relatives, and also addresses whether the deceased had a will or trust in place. Additionally, it outlines the legal responsibilities of U.S. consular officers in these circumstances and emphasizes the importance of completing the affidavit to avoid the need for alternative documentation. By doing so, it not only respects the procedural aspects of international law but also the personal and often sensitive nature of claiming a deceased relative's estate. Failure to properly complete this form can complicate the process, making it a key piece of administration for Americans abroad and their families.

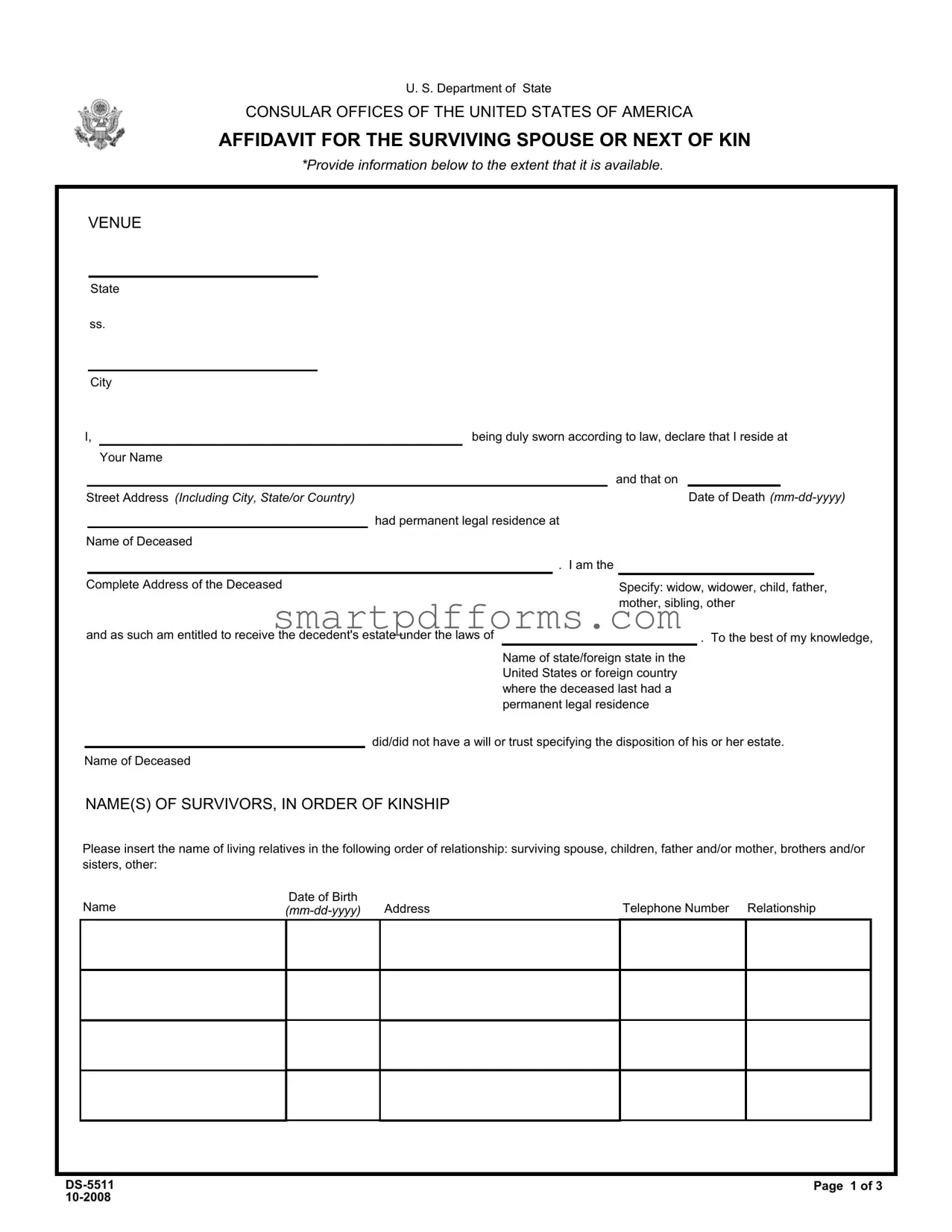

Preview - Next Of Kin Form

U. S. Department of State

CONSULAR OFFICES OF THE UNITED STATES OF AMERICA

AFFIDAVIT FOR THE SURVIVING SPOUSE OR NEXT OF KIN

*Provide information below to the extent that it is available.

VENUE

State

ss.

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

I, |

|

being duly sworn according to law, declare that I reside at |

|||||||||||

|

|

|

Your Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and that on |

|

|

|||

Street Address (Including City, State/or Country) |

|

|

|

|

|

|

Date of Death |

||||||

|

|

|

|

had permanent legal residence at |

|||||||||

Name of Deceased |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

. I am the |

|

|

||||

Complete Address of the Deceased |

|

|

|

|

|

Specify: widow, widower, child, father, |

|||||||

|

|

|

|

|

|

|

|

|

mother, sibling, other |

||||

and as such am entitled to receive the decedent's estate under the laws of |

|

|

|

|

|

. To the best of my knowledge, |

|||||||

|

|

|

|

|

|

Name of state/foreign state in the |

|||||||

United States or foreign country where the deceased last had a permanent legal residence

did/did not have a will or trust specifying the disposition of his or her estate.

Name of Deceased

NAME(S) OF SURVIVORS, IN ORDER OF KINSHIP

Please insert the name of living relatives in the following order of relationship: surviving spouse, children, father and/or mother, brothers and/or sisters, other:

Name |

Date of Birth |

Telephone Number Relationship |

Page 1 of 3 |

|

|

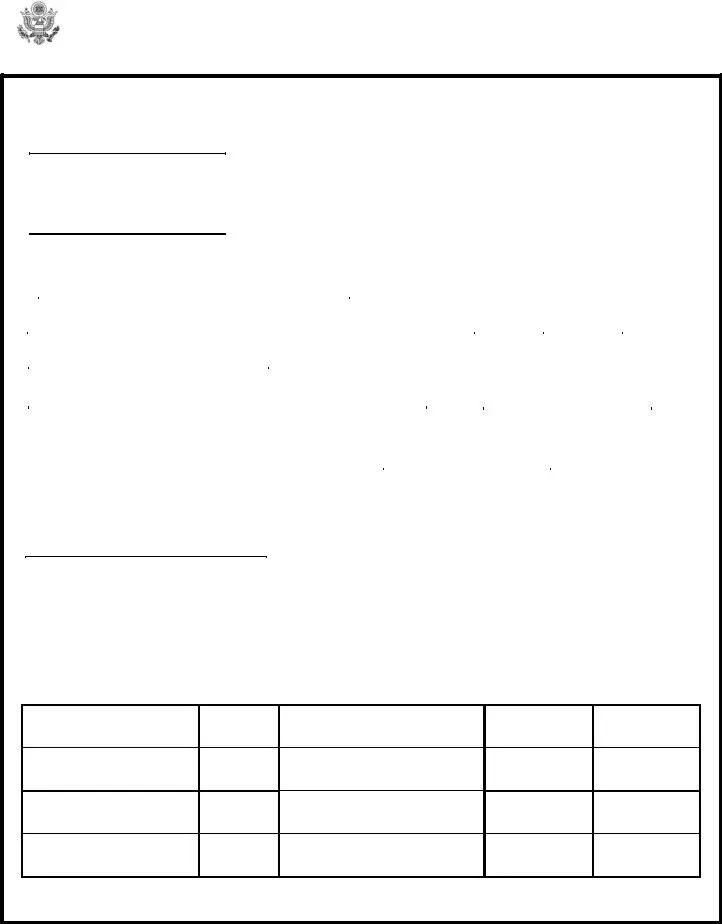

Name |

Date of Birth |

Address |

Telephone Number Relationship |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscribed and sworn to before me by

|

Signature of Affiant |

|

||||

|

|

|

|

|

|

|

Type Name of Affiant |

|

|

|

Date |

|

|

|

|

|

|

|

|

|

Address of Notary Public |

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Notary Public |

|

|

|

Type Name of Notary Public |

|

|

Page 2 of 3 |

PRIVACY ACT STATEMENT

The information on this form is requested to assist U.S. Consular Officers to fulfill the requirements of 22 U.S.C. 2715c and determine the

Providing the information in the affidavit is voluntary, but, failure to complete this form will require the person claiming to be

ROUTINE USES: The information solicited on this form may be made available to federal, state, local, or foreign government entities for administrative or law enforcement purpose, including for the notification of kin or judicial matters involving contested estates and related issues.

Page 3 of 3 |

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form | This form is used to identify and confirm the next of kin of a deceased American citizen abroad, facilitating the legal transfer of the deceased's estate in accordance with 22 U.S.C. 2715c. |

| Roles of U.S. Consular Officers | U.S. Consular Officers may serve as "provisional conservators" of the personal effects of deceased U.S. citizens abroad, or as estate administrators in exceptional cases, to ensure the property is managed appropriately until a legal representative or next of kin is identified. |

| Information Required | The form requests detailed information regarding the deceased, including the last permanent address, information on living relatives, and the legal next of kin’s relationship to the deceased. |

| Voluntary Provision of Information | Completion of this form is voluntary but necessary for those claiming next-of-kin status without alternative legal documents, such as Letters Testamentary or Administration. |

| Routine Uses of Information | The information provided can be shared with various governmental agencies, both domestic and foreign, for purposes including administrative actions, law enforcement, and notification of kin in judicial cases involving contested estates. |

| Governing Law | The process is governed by federal law, specifically 22 U.S.C. 2715c, directing how the estates of U.S. citizens who die abroad are to be managed in the absence of a legal representative or next of kin. |

Instructions on Utilizing Next Of Kin

Filling out the Next Of Kin form is a crucial step in ensuring that the estate of a deceased person is properly managed and distributed according to legal requirements, especially when the death occurs abroad. This form helps U.S. Consular Officers identify and communicate with the deceased's relatives, ranging from the surviving spouse to distant relatives, as per the laws governing estate succession. It streamlines the process of estate administration, reducing the need for more complex legal documentation. Follow these steps carefully to complete the form accurately and thoroughly.

- Start with the section titled AFFIDAVIT FOR THE SURVIVING SPOUSE OR NEXT OF KIN. Enter the specific State and City under the VENUE at the top of the form.

- In the sentence starting with "I, being duly sworn according to law, declare that I reside at," fill in Your Name and your complete Street Address (Including City, State/or Country).

- Fill in the Date of Death (mm-dd-yyyy) of the deceased.

- Enter the Name of Deceased and their Complete Address where they had permanent legal residence at the time of death.

- Specify your relationship to the deceased by checking the appropriate box (widow, widower, child, father, mother, sibling, other) and state your entitlement to the decedent's estate under the laws of the named state/foreign state or country.

- Indicate whether the deceased did/did not have a will or trust specifying the disposition of his or her estate.

- Under the NAME(S) OF SURVIVORS, IN ORDER OF KINSHIP section, list the name, date of birth (mm-dd-yyyy), telephone number, relationship, and address of living relatives in the specified order: surviving spouse, children, father and/or mother, brothers and/or sisters, other.

- At the bottom of the form, the Affiant (you) must sign and date (mm-dd-yyyy) in the presence of a Notary Public, who will also sign and provide their address and type their name.

By carefully following these steps, individuals can provide essential information to the U.S. Department of State, assisting Consular Officers in the administration of the deceased's estate. It's important to provide accurate and complete information to ensure that the estate is handled smoothly and in accordance with the law.

Obtain Answers on Next Of Kin

Frequently Asked Questions about the Next Of Kin Form

- What is the purpose of the Next of Kin form?

The purpose of the Next of Kin form, officially known as the "Affidavit for the Surviving Spouse or Next of Kin," is to identify and document the legal next of kin of a deceased U.S. citizen, especially when the death occurs abroad. It helps U.S. Consular Officers fulfill legal duties by verifying who is entitled to take care of the deceased's estate. This form plays a crucial role in situations where there is no legal representative, partner in trade, or trustee appointed for the decedent's estate.

- What information do I need to provide on this form?

Information required on the form includes your relationship to the deceased, your personal details, details of the deceased including their date of death and last legal residence, and details of any surviving relatives in order of kinship. Providing detailed kinship information helps in the lawful distribution of the decedent's estate, as per their last legal residence laws.

- Is it mandatory to complete the Next of Kin form?

Completing the Next of Kin form is voluntary. However, if the form is not filled out, the person claiming to be the next of kin must obtain and present alternative legal documents, such as certified copies of Letters Testamentary, Letters of Administration, or trust documents, to assume responsibility for the decedent’s estate.

- Who can serve as a Next of Kin?

The next of kin can be a surviving spouse, children, parents, siblings, or other relatives, as specified under the laws of the state or foreign country where the deceased last had a permanent legal residence. The form requires specifying your relationship to the deceased to establish your legal right under these laws.

- What happens to the information provided on this form?

The information collected on the Next of Kin form may be shared with various federal, state, local, or foreign government entities for administrative or law enforcement purposes. It is also used for notifying relatives or managing judicial matters that may involve contested estates and related issues.

- What should I do if the deceased did not have a permanent legal residence?

If the deceased did not have a permanent legal residence, it is important to provide as much information as possible regarding their last known address or location. Consult a U.S. Consular Officer for guidance on how to proceed in these circumstances, as local laws and the international treaties might influence the process of identifying the next of kin and handling the estate.

Common mistakes

Not providing complete information: A common mistake made by individuals when filling out the Next Of Kin form is failing to provide complete information for both themselves and the deceased. This includes leaving out full addresses, contact numbers, or not specifying the exact relationship to the deceased. Ensuring all details are accurately and fully provided is crucial for the proper processing of the form.

Incorrectly specifying the relationship: It is critical to correctly specify the relationship to the deceased, as entitlements under the law may vary based on this factor. For example, mistaking 'sibling' for 'step-sibling' could lead to unnecessary complications or even disputes concerning the decedent's estate.

Omitting survivors in order of kinship: The form requires the names of living relatives in a specific order of relationship. Omitting or incorrectly ordering survivors can disrupt the intended distribution of the estate, leading to delays and possibly legal challenges.

Not considering whether the deceased had a will: Failure to acknowledge whether the deceased had a will or trust afects how their estate is managed and distributed. This may result in the disregarding of the deceased's wishes and the defaulting to standard legal procedures that might not align with the decedent's intentions.

Signature verification issues: The affidavit must be sworn before a notary public and signed accordingly. Neglecting to have it properly signed or failing to include the address and signature of the notary public can invalidate the document. This seemingly small oversight might significantly delay legal proceedings.

Documents used along the form

When handling affairs related to the death of a loved one, particularly for Americans who die abroad, the Next Of Kin form plays a crucial role. However, this form is often just one part of a suite of documents required to comprehensively manage the deceased's estate or personal affairs. Several other forms and documents are commonly used in conjunction with the Next Of Kin form to ensure that all aspects of the estate and legal matters are properly addressed.

- Death Certificate: This official document certifies the death of an individual. It includes vital information such as the date, location, and cause of death. The death certificate is necessary for legal purposes, including the settlement of the estate, claiming life insurance, and accessing pension benefits. It serves as an essential document for verifying the death to various institutions and authorities.

- Will or Testament: A legal document in which the deceased has specified how their property and affairs should be managed and distributed after their death. If the Next Of Kin form suggests that the deceased had a will, having access to this document is crucial for executing the deceased's wishes. It outlines beneficiaries, guardians for minors, and the executor of the estate.

- Letters Testamentary or Letters of Administration: These documents are issued by a probate court and give authority to the person named therein to administer the deceased's estate according to the will (Letters Testamentary) or, in the absence of a will, according to state law (Letters of Administration). They are necessary to manage and distribute the estate's assets legally.

- Trust Document: This document comes into play if the deceased established a trust to manage their assets. A trust document outlines how these assets should be distributed to the beneficiaries. This is an important document for those named as trustees, guiding them in managing and distributing assets as per the deceased's wishes.

Collectively, these documents assist in the smooth transition of affairs after someone's death, ensuring that the deceased's wishes are honored and legal obligations are met. For those dealing with the loss of an American citizen abroad, it is important to understand the roles these documents play, alongside the Next Of Kin form, in managing the aftermath of a loved one's passing.

Similar forms

A Will: Just like a Next of Kin form, a will is a document where an individual outlines how they want their estate (money, property, personal belongings) to be distributed after their death. Both documents play crucial roles in estate planning and ensure that an individual's wishes are respected and legally recognized following their passing.

A Power of Attorney (POA): Although a Power of Attorney focuses on giving someone the authority to make decisions on behalf of the person issuing it while they're still alive, it is similar to a Next of Kin form in that it designates someone to act in personal or business matters. Both documents involve trust and legal recognition of a representative or successor.

Advanced Healthcare Directive (Living Will): This is a document that specifies what actions should be taken for a person's health if they are no longer able to make decisions for themselves due to illness or incapacity. Like the Next of Kin form, it addresses situations where someone must make critical decisions on behalf of someone else, focusing on medical and end-of-life care.

Beneficiary Designations on Financial Accounts: Similar to the Next of Kin form, where an individual names their surviving relatives or next of kin, beneficiary designations directly name who will inherit specific assets, such as retirement accounts, life insurance policies, or bank accounts, without the need for probate. These designations can supersede even the directives in a will, highlighting the importance of clearly specifying intended recipients of one's estate.

Dos and Don'ts

Filling out the Next Of Kin form is a crucial step in managing the affairs of a loved one who has passed away, especially when it comes to dealing with the U.S. Department of State and Consular Offices abroad. It ensures that the estate of the deceased can be properly handled and distributed according to their wishes, or in the absence of such, by the law of the land. To navigate this process smoothly, here is a list of dos and don'ts to keep in mind:

Do's:

- Provide accurate and complete information: Confirm all details before submission, including names, addresses, and your relationship to the deceased. Incorrect information can lead to delays.

- Specify your relationship clearly: Clearly state how you are related to the deceased (e.g., spouse, child, sibling) to avoid any confusion about your entitlement to receive the estate.

- Be aware of the legal implications: Understand the laws of the state or country where the deceased last had a permanent legal residence, as these can affect the estate distribution.

- Seek legal assistance if needed: If you're unsure about any of the details or the process itself, consulting with a legal professional can provide clarity and ensure the form is filled out correctly.

Don'ts:

- Omit any known survivors: Ensure all living relatives are listed in the correct order of kinship. Leaving someone out, even unintentionally, can complicate the process.

- Guess information: If you're unsure about a specific detail, like the exact date of death or the presence of a will, it's better to seek out the correct information rather than guessing.

- Ignore the privacy act statement: The information on this form has serious implications and can be shared with various governmental entities. Understand what this means for you and your deceased relative's estate.

- Forget to review before submitting: Check the form thoroughly for any errors or incomplete sections to ensure that the process moves forward without unnecessary hindrances.

Misconceptions

A common misconception is that completing a Next Of Kin form automatically allows an individual to make legal or medical decisions on behalf of the deceased. In reality, the form is primarily intended for the identification and administration of the decedent's personal effects by consular officials abroad, not for broader legal authority.

Many people believe that the Next Of Kin form is only for US citizens residing outside of the United States. While it is designed for use by U.S. Consular Officers to assist in the management of the estates of American citizens who die abroad, its principles offer a framework for understanding how next of kin may be determined in other contexts as well.

There's a misconception that the information provided on the form can only be accessed by government officials. Although the primary use is by U.S. Consular Officers, the information may also be made available to federal, state, local, or foreign government entities for various administrative, law enforcement purposes, and notifying kin or addressing judicial matters involving contested estates.

People often mistakenly believe that all relatives have equal standing on the Next Of Kin form. The form, however, outlines a specific order of kinship for listing survivors, prioritizing closer familial relationships like spouses and children over more distant relatives.

There's a false assumption that if the deceased did not have a will, the Next Of Kin form is sufficient for relatives to claim the estate. While the form does help identify the next of kin, additional legal documentation, such as Letters Testamentary or Letters of Administration, may be required to legally administer the estate.

Some think that filling out the Next Of Kin form is mandatory in all circumstances following a death. The completion of this form is voluntary but failing to do so would necessitate the next of kin to obtain and present alternative documents to claim the decedent’s estate.

It is often misconceived that the Next Of Kin form grants immediate access to the decedent’s financial assets. The form helps in the provisional conservation of personal effects but does not address financial assets directly. Legal processes and additional documentation are required to access or claim financial assets.

Many assume that the form is sufficient proof of one’s legal status as next of kin for all purposes. In fact, the form is specifically designed to assist U.S. Consular Officers and may not be recognized by all institutions or for all legal purposes requiring next-of-kin status verification.

Lastly, there is a misconception that the affidavit for the surviving spouse or next of kin must be completed in the consular office. While it is necessary for the affidavit to be sworn to before a notary or consular officer, the individual claiming to be next of kin may initially fill out the form outside of the consulate before it is officially notarized.

Key takeaways

Filling out and using the Next of Kin form, formally known as the Affidavit for the Surviving Spouse or Next of Kin, is an important process for legally acknowledging a person's closest relative(s) in matters concerning the disposition of estates of U.S. citizens who die abroad. Here are five key takeaways that individuals should be aware of when dealing with this form:

- The form serves as a declaration by the next of kin that they are entitled to receive the deceased’s estate under the laws of the state or foreign country where the deceased had permanent legal residence. This reinforces the importance of accurately completing the document to ensure lawful claims.

- It is crucial to specify the relationship of the affiant to the deceased, such as widow, widower, child, father, mother, sibling, etc., as this establishes the legal basis for the claim to the estate.

- Providing detailed information about the deceased, including their name, date of death, and last permanent legal residence, alongside the affiant's relationship to the deceased, is mandatory. This information assists U.S. Consular Officers in fulfilling their duties under the requirements of 22 U.S.C. 2715c and in determining the rightful next of kin.

- Completing this form is voluntary. However, failure to provide the requested information requires the claimant to present alternative documentation such as certified copies of Letters Testamentary, Letters of Administration, or trust documents to prove their claim. This emphasizes the importance of the Next of Kin form as a simplified means of establishing entitlement.

- The provided information could be shared with various governmental entities, both domestic and foreign, for administrative, law enforcement, notification of kin, or judicial matters involving contested estates and related issues. This underscores the need for accuracy and honesty when filling out the form, as the information will be used in official capacities.

Understanding these key aspects can help individuals navigate the complexities surrounding the disposition of estates for U.S. citizens who have passed away abroad, ensuring that their rights and those of their loved ones are protected during a difficult time.

Popular PDF Forms

Ets Military Acronym - The form allows for changes to be promptly reflected in pay systems, aiding in the efficient management of military and civilian payrolls.

Can You Refuse Part of an Inheritance - An essential tool for heirs who intend to refuse corporate shares, simultaneously aiding corporations in avoiding complications in share distribution.