Blank Nf 2 PDF Template

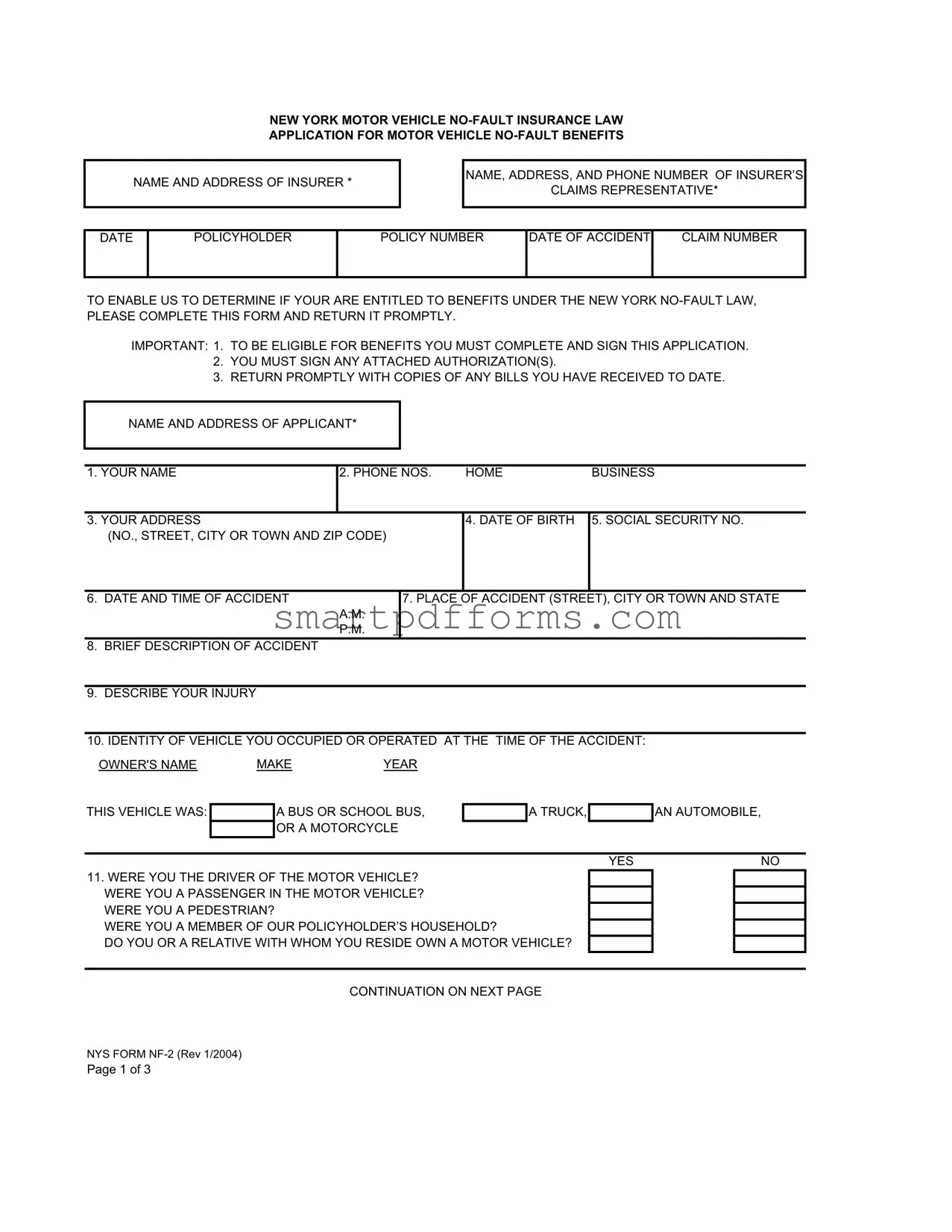

When you're involved in a motor vehicle accident in New York, navigating the aftermath can be overwhelming. That's where the New York Motor Vehicle No-Fault Insurance Law Application for Motor Vehicle No-Fault Benefits, commonly known as the NF-2 form, comes into play. This essential document is the first step toward claiming benefits under the state's no-fault insurance law. Designed to streamline the process of obtaining insurance benefits for accident-related expenses, the NF-2 form requires detailed information about the insurer, the claimant, the accident, and the injuries sustained. Completing and returning it promptly is crucial for eligibility. The form not only collects basic personal information but dives deeper, asking for specifics about the accident, the nature of injuries, treatments received or anticipated, and any loss of earnings due to the accident. Additionally, it inquires about other possible compensations like New York State Disability or Workers' Compensation, ensuring a thorough assessment of the claimant’s situation. With robust sections dedicated to authorization for the release of both work and health service or treatment information, the NF-2 form embodies a comprehensive approach to no-fault claims, stressing the importance of honesty and accuracy with stern warnings against fraudulent claims. It's your gateway to navigating the choppy waters post-accident, aiming to aid recovery by ensuring financial burdens are covered, allowing for a focus on healing.

Preview - Nf 2 Form

NEW YORK MOTOR VEHICLE

NAME AND ADDRESS OF INSURER *

NAME, ADDRESS, AND PHONE NUMBER OF INSURER’S

CLAIMS REPRESENTATIVE*

DATE

POLICYHOLDER

POLICY NUMBER

DATE OF ACCIDENT

CLAIM NUMBER

TO ENABLE US TO DETERMINE IF YOUR ARE ENTITLED TO BENEFITS UNDER THE NEW YORK

IMPORTANT: 1. TO BE ELIGIBLE FOR BENEFITS YOU MUST COMPLETE AND SIGN THIS APPLICATION.

2.YOU MUST SIGN ANY ATTACHED AUTHORIZATION(S).

3.RETURN PROMPTLY WITH COPIES OF ANY BILLS YOU HAVE RECEIVED TO DATE.

NAME AND ADDRESS OF APPLICANT*

1. YOUR NAME |

2. PHONE NOS. |

HOME |

BUSINESS |

|

|

|

|

3. YOUR ADDRESS |

|

4. DATE OF BIRTH |

5. SOCIAL SECURITY NO. |

(NO., STREET, CITY OR TOWN AND ZIP CODE) |

|

|

|

|

|

|

|

6. DATE AND TIME OF ACCIDENT |

7. PLACE |

OF ACCIDENT (STREET), CITY OR TOWN AND STATE |

|

|

A.M. |

|

|

|

P.M. |

|

|

8.BRIEF DESCRIPTION OF ACCIDENT

9.DESCRIBE YOUR INJURY

10.IDENTITY OF VEHICLE YOU OCCUPIED OR OPERATED AT THE TIME OF THE ACCIDENT:

OWNER'S NAME |

MAKE |

YEAR |

THIS VEHICLE WAS:

A BUS OR SCHOOL BUS, OR A MOTORCYCLE

A TRUCK,

AN AUTOMOBILE,

YESNO

11.WERE YOU THE DRIVER OF THE MOTOR VEHICLE? WERE YOU A PASSENGER IN THE MOTOR VEHICLE? WERE YOU A PEDESTRIAN?

WERE YOU A MEMBER OF OUR POLICYHOLDER’S HOUSEHOLD?

DO YOU OR A RELATIVE WITH WHOM YOU RESIDE OWN A MOTOR VEHICLE?

CONTINUATION ON NEXT PAGE

NYS FORM

Page 1 of 3

APPLICATION FOR MOTOR VEHICLE

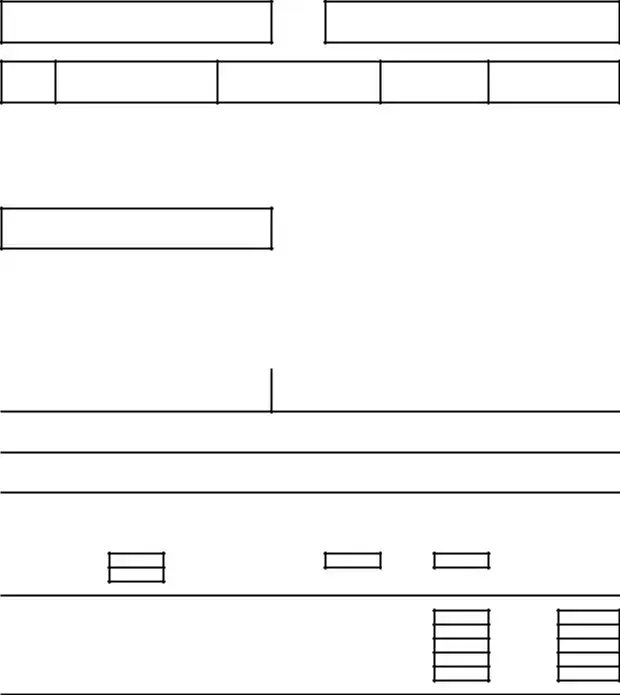

12. WERE YOU TREATED BY A DOCTOR(S) OR OTHER PERSON(S) FURNISHING HEALTH SERVICES?

|

|

|

YES |

|

NO |

|

|

|

|

|

|

|

IF YES, NAME AND ADDRESS OF SUCH DOCTOR(S) OR PERSON(S): |

|

|

||||||||

|

|

|

|

|

|

|

|

||||

13. IF YOUR WERE TREATED AT A HOSPITAL(S), WERE YOU AN |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

DATE OF ADMISSION: |

|

|

|

|

|

|

|

|||

|

HOSPITAL'S NAME AND ADDRESS: |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

14. AMOUNT OF HEALTH |

15. WILL YOU HAVE MORE HEALTH |

16. AT THE TIME OF YOUR ACCIDENT WERE |

|||||||||

BILLS TO DATE: |

|

TREATMENT(S)? |

|

|

YOU IN THE COURSE OF YOUR |

||||||

|

|

|

|

|

YES |

NO |

EMPLOYMENT? |

|

|

||

$ |

|

|

|

|

|

|

|

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

17. DID YOU LOSE TIME |

|

|

DATE ABSENCE FROM |

HAVE YOU RETURNED TO |

|||||||

FROM WORK? |

|

|

WORK BEGAN: |

WORK? |

|

|

|||||

|

YES |

NO |

|

|

|

|

|

YES |

NO |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

IF YES, DATE RETURNED TO |

WORK: |

|

AMOUNT |

OF TIME LOST FROM WORK: |

||||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

||||||||

18. WHAT ARE YOUR GROSS AVERAGE NUMBER OF DAYS |

YOU WORK |

|

NUMBER OF HOURS YOU WORK |

||||||||

WEEKLY EARNINGS? |

|

PER WEEK: |

|

PER DAY: |

|

|

|||||

19. WERE YOU RECEIVING UNEMPLOYMENT BENEFITS AT THE TIME OF THE ACCIDENT?

YES

NO

20.LIST NAMES AND ADDRESS OF YOUR EMPLOYER AND OTHER EMPLOYERS FOR ONE YEAR PRIOR TO ACCIDENT DATE AND GIVE OCCUPATION AND DATES OF EMPLOYMENT:

EMPLOYER AND ADDRESS |

|

OCCUPATION |

FROM |

TO |

|

|

|

|

|

|

|

EMPLOYER AND ADDRESS |

|

OCCUPATION |

FROM |

TO |

|

|

|

|

|

|

|

EMPLOYER AND ADDRESS |

|

OCCUPATION |

FROM |

TO |

|

|

|

||||

21. AS A RESULT OF YOUR INJURY HAVE YOU HAD ANY OTHER EXPENSES? |

|

||||

YES |

|

NO |

|

|

|

IF YES, ATTACH EXPLANATION AND AMOUNTS OF SUCH EXPENSES.

22.DUE TO THIS ACCIDENT HAVE YOU RECEIVED OR ARE YOU ELIGIBLE FOR PAYMENTS UNDER ANY OF THE FOLLOWING:

YES NO

NEW YORK STATE DISABILITY?

WORKERS' COMPENSATION?

CONTINUATION ON NEXT PAGE

NYS FORM

Page 2 of 3

APPLICATION FOR MOTOR VEHICLE

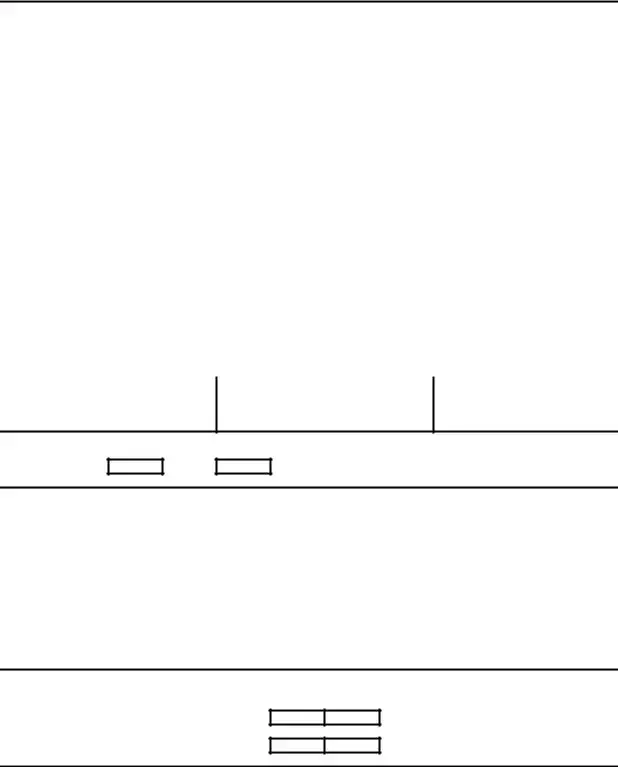

THE APPLICANT AUTHORIZES THE INSURER TO SUBMIT ANY AND ALL OF THESE FORMS TO ANOTHER PARTY OR INSURER IF SUCH IS NECESSARY TO PERFECT ITS RIGHTS OF RECOVERY PROVIDED FOR UNDER THE

THIS FORM IS SUBSCRIBED AND AFFIRMED BY THE

APPLICANT AS TRUE UNDER THE PENALTIES OF PERJURY

ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD ANY INSURANCE COMPANY OR OTHER PERSON FILES AN APPLICATION FOR COMMERCIAL INSURANCE OR A STATEMENT OF CLAIM FOR ANY COMMERCIAL OR PERSONAL INSURANCE BENEFITS CONTAINING ANY MATERIALLY FALSE INFORMATION, OR CONCEALS FOR THE PURPOSE OF MISLEADING, INFORMATION CONCERNING ANY FACT MATERIAL THERETO, AND ANY PERSON WHO, IN CONNECTION WITH SUCH APPLICATION OR CLAIM, KNOWINGLY MAKES OR KNOWINGLY ASSISTS, ABETS, SOLICITS OR CONSPIRES WITH ANOTHER TO MAKE A FALSE REPORT OF THE THEFT, DESTRUCTION, DAMAGE OR CONVERSION OF ANY MOTOR VEHICLE TO A LAW ENFORCEMENT AGENCY, THE DEPARTMENT OF MOTOR VEHICLES OR AN INSURANCE COMPANY, COMMITS A FRAUDULENT INSURANCE ACT, WHICH IS A CRIME, AND SHALL ALSO BE SUBJECT TO A CIVIL PENALTY NOT TO EXCEED FIVE THOUSAND DOLLARS AND THE VALUE OF THE SUBJECT MOTOR VEHICLE OR STATED CLAIM FOR EACH VIOLATION.

SIGNATURE |

|

DATE |

DO NOT DETACH

AUTHORIZATION FOR RELEASE OF WORK AND OTHER LOSS INFORMATION

THIS AUTHORIZATION OR PHOTOCOPY THEREOF, WILL AUTHORIZE YOU TO FURNISH ALL INFORMATION YOU MAY HAVE REGARDING MY WAGES, SALARY OR OTHER LOSS WHILE EMPLOYED BY YOU. YOUR ARE AUTHORIZED TO PROVIDE THIS INFORMATION IN ACCORDANCE WITH THE NEW YORK COMPREHENSIVE MOTOR VEHICLE INSURANCE REPARATIONS ACT

NAME (PRINT OR TYPE) |

|

SOCIAL SECURITY NO. |

|

|

|

SIGNATURE |

|

DATE |

DO NOT DETACH

AUTHORIZATION FOR RELEASE OF HEALTH SERVICE OR TREATMENT INFORMATION

THIS AUTHORIZATION OR PHOTOCOPY THEREOF, WILL AUTHORIZE YOU TO FURNISH ALL INFORMATION YOU MAY HAVE REGARDING MY CONDITION WHILE UNDER YOUR OBSERVATION OR TREATMENT, INCLUDING THE HISTORY OBTAINED,

NAME (PRINT OR TYPE)

SIGNATURE |

|

DATE |

(IF THE APPLICANT IS A MINOR, PARENT OR GUARDIAN SHALL SIGN AND INDICATE CAPACITY AND RELATIONSHIP).

*LANGUAGE TO BE FILLED IN BY INSURER OR

Page 3 of 3

Form Data

| Fact Name | Description |

|---|---|

| Purpose of the Form | The NYS Form NF-2 is designed for individuals seeking to obtain benefits under the New York No-Fault Law after a motor vehicle accident. It is essential for initiating a claim for no-fault benefits. |

| Completion Requirements | To be eligible for no-fault benefits, the claimant must fully complete and sign the NF-2 form, including any attached authorization(s) for the release of medical and employment information. |

| Submission Instructions | After completing the NF-2 form, it must be returned promptly to the insurer along with copies of any medical bills or related expenses incurred as a result of the accident. |

| Anti-Fraud Warning | The form includes a stern warning against insurance fraud, indicating that providing false information or concealing information is a crime and may result in civil penalties. |

| Governing Law | The form is governed by the New York Comprehensive Motor Vehicle Insurance Reparations Act, commonly referred to as the No-Fault Law, which aims to provide prompt financial support to accident victims regardless of fault. |

Instructions on Utilizing Nf 2

Filling out the NF-2 form is essential for those seeking benefits under the New York No-Fault Law after a motor vehicle accident. This form is your first step towards claiming benefits for medical expenses, lost earnings, and other necessary costs resulting from an accident. It's critical to complete and return this form promptly, along with any required authorizations and relevant bills, to ensure your eligibility for benefits. Follow the steps below to accurately complete the NF-2 form.

- Start by entering the name and address of your insurer, along with the name, address, and phone number of the insurer's claims representative at the top of the form.

- Fill in your policyholder name, policy number, date of the accident, and your claim number, if available.

- Under "Name and Address of Applicant", provide your full name, both home and business phone numbers (if applicable), and your complete address.

- Enter your date of birth and Social Security Number.

- Detail the date and time of the accident, including whether it occurred in the AM or PM.

- Specify the place of the accident with as much detail as possible (street, city, town, and state).

- Provide a brief description of the accident and describe your injury.

- Indicate the identity of the vehicle you were in at the time of the accident, including the owner's name, make, and year of the vehicle. Also, check the appropriate box regarding the type of vehicle involved.

- Answer yes or no to whether you were the driver, a passenger, a pedestrian, a member of the policyholder's household, or if you or a relative own a motor vehicle.

- On the next page, if you were treated by doctors or other health service providers, list their names and addresses. Also indicate if you were treated as an out-patient or in-patient at a hospital, including dates of admission and the hospital's name and address.

- Fill in the amount of health bills to date and whether you will have more health treatment(s).

- Indicate if the accident occurred in the course of your employment, and if you lost time from work, including dates and amount of time lost.

- Provide details on your gross weekly earnings, average number of days and hours you work per week, and if you were receiving unemployment benefits at the time of the accident.

- List names, addresses, occupations, and dates of employment for your employer and other employers for one year prior to the accident date.

- If you've had other expenses as a result of your injury, attach an explanation and amounts of such expenses. Also, indicate if due to the accident, you have received or are eligible for payments under New York State Disability or Workers' Compensation.

- Sign and date the form, affirming the information provided is true under penalty of perjury. Also, complete the "Authorization for Release of Work and Other Loss Information" and "Authorization for Release of Health Service or Treatment Information" sections.

After completing the NF-2 form, review your information for accuracy, and ensure all required sections are filled out. Return this form promptly along with any accompanying authorizations and bills to your insurer to process your no-fault benefits claim. Remember, the timeline and correct completion of this form play significant roles in your benefits claim process.

Obtain Answers on Nf 2

- What is the NF-2 Form?

The NF-2 Form, also known as the Application for Motor Vehicle No-Fault Benefits, is a document required under the New York Motor Vehicle No-Fault Insurance Law. This form is used by individuals involved in a motor vehicle accident in New York to apply for no-fault benefits from their insurance provider. These benefits may cover medical expenses, lost earnings, and other necessary expenses related to injuries sustained in the accident.

- Who needs to complete the NF-2 Form?

Any individual involved in a motor vehicle accident in New York who seeks to claim no-fault benefits under the New York No-Fault Law must complete and submit the NF-2 Form. This includes drivers, passengers, pedestrians, and cyclists who are injured as a result of the accident.

- How do I obtain the NF-2 Form?

You can obtain the NF-2 Form from your insurance company, their claims representative, or online through the official website of the New York State Department of Financial Services. It's important to contact your insurer as soon as possible after an accident to ensure you receive and submit the form within the required timeframe.

- What information do I need to provide on the NF-2 Form?

You'll need to provide detailed information about the accident, your injuries, any medical treatment received, and any economic losses such as lost wages. This includes the date and time of the accident, a brief description of how it occurred, details of the vehicle you were in, and information about your employment and earnings if you lost time from work due to your injuries.

- Is there a deadline for submitting the NF-2 Form?

Yes, there is a deadline. To be eligible for no-fault benefits, you must submit the completed NF-2 Form to the relevant insurance company within 30 days from the date of the accident. Failing to meet this deadline could result in a denial of benefits.

- What happens after I submit the NF-2 Form?

After you submit the NF-2 Form, your insurance company will review your application to determine if you are entitled to no-fault benefits. They may request additional information from you, your healthcare providers, or your employer to assess your claim. Once all necessary information has been received and reviewed, the insurance company will decide on your eligibility for benefits.

- Can I appeal if my no-fault benefits claim is denied?

Yes, if your claim for no-fault benefits is denied, you have the right to appeal the decision. You should review your insurance policy for specific instructions on how to appeal a denial of benefits. Often, this involves submitting a written appeal to the insurance company or taking legal action.

- Are there any penalties for providing false information on the NF-2 Form?

Yes, providing false or misleading information on the NF-2 Form, or any insurance claim form, is considered insurance fraud. It is a criminal offense that may result in penalties, including fines and imprisonment. Moreover, individuals found guilty of insurance fraud may also face civil penalties.

Common mistakes

Filling out the New York Motor Vehicle No-Fault Insurance Law Application (NYS Form NF-2) correctly is crucial for claimants hoping to receive benefits without unnecessary delays. However, individuals often make mistakes during this process, leading to complications. Below are four common errors encountered:

-

Incomplete or incorrect information about the insurer: The form requires detailed information about the insurer, including the name, address, and phone number of the insurer’s claims representative. Failure to provide accurate and complete information in this section can lead to delays in the processing of the application.

-

Failure to sign the application and attached authorization(s): For the application to be processed, it must be signed by the applicant. Additionally, any attached authorizations, which allow the insurer to request further information regarding the claim, must also be signed. Overlooking these signatures can invalidate the application.

-

Omitting details of the accident, injury, or treatment: The form requests specific details about the accident, descriptions of the injuries sustained, and information regarding any treatment received or planned. Leaving these sections incomplete can prevent the assessor from fully understanding the extent of the injuries and the treatments necessary, thereby affecting the determination of benefits.

-

Neglecting to list all relevant expenses and potential compensatory sources: Applicants are required to list their healthcare expenses to date, any ongoing or anticipated treatments, lost wages, and other accident-related expenses. Additionally, there's a section to indicate whether the applicant is receiving or eligible for payments from other sources like New York State Disability or Workers' Compensation. Failure to accurately report these can not only impact the benefits received but also lead to legal penalties for misinformation.

Understanding and avoiding these common mistakes can significantly improve the likelihood of the application being processed swiftly and benefits being allocated accurately. Claimants are encouraged to review their applications carefully and consult with a legal advisor or the insurer for clarification on any ambiguous sections.

Documents used along the form

When dealing with the complexities of motor vehicle accidents under the New York No-Fault Law, the NYS Form NF-2 becomes a critical document for initiating a claim for no-fault benefits. However, to comprehensively process a claim and potentially obtain the benefits entitled under the law, several other forms and documents often play pivotal roles. Their necessity varies depending on the specifics of the accident, the injuries sustained, and the requirements of the insurance carrier. Let's delve into some of these essential documents that typically accompany or are required after the submission of the NYS Form NF-2.

- Police Accident Report (MV-104A): This is a report filed by the police after an accident. It provides an official account of the events, which insurers often require for verification purposes.

- Medical Records Release Form: Authorizes healthcare providers to release the claimant's medical records to the insurance company, ensuring that the insurer can verify the nature and extent of injuries.

- Wage and Salary Verification Form: Employers fill out this form to verify the claimant's earnings and work hours, which is crucial for calculating lost wages benefits.

- Proof of Claim Form: Specific to property damage or additional personal injury claims under certain circumstances, this form details the damage to property or additional injuries not covered under the initial NF-2 claim.

- Attending Physician's Report (NF-3): Completed by the claimant's doctor to provide detailed information on the injuries suffered, the treatment plan, and the prognosis.

- Application for Motor Vehicle Exemption: For individuals seeking exemption from certain no-fault coverage aspects, particularly when other insurance coverages apply.

- Assignment of Benefits Form: Allows the healthcare provider to bill the insurance company directly for the medical services provided to the claimant.

- Household Affidavit: A document clarifying the number of individuals in the claimant's household, which can affect benefits under certain policies.

- Death Certificate: In the unfortunate event of a fatal accident, this official document is required to process claims related to the deceased party.

- Mileage Reimbursement Form: For claiming reimbursement for travel expenses related to medical appointments, therapy sessions, and more.

Each document mentioned serves its unique purpose in the no-fault claim process, providing crucial information that supports the claimant's case. Understanding and compiling the necessary documentation is essential in ensuring a smooth claim process and securing the benefits to which the claimant is entitled. Navigating through the aftermath of a motor vehicle accident can be overwhelming, and being prepared with the right set of documents can alleviate some of that burden by setting the stage for a successful claim under the New York No-Fault Law.

Similar forms

The Workers' Compensation claim form is similar to the NF-2 form in several ways. Both forms are designed for individuals who have experienced an injury, either at the workplace in the case of the Workers' Compensation form or in a motor vehicle accident for the NF-2 form. Each form collects detailed information about the incident, the nature of the injuries sustained, and the medical treatment received. They also inquire about the claimant's employment status and lost wages due to the injury, aiming to determine the benefits the claimant is entitled to under specific legal frameworks.

The Personal Injury Protection (PIP) application form also bears resemblance to the NF-2 form. PIP application forms are used in states that have no-fault insurance laws for auto insurance, similar to New York's No-Fault Law. These forms collect personal information, details about the accident, descriptions of injuries, information on medical treatment, and employment details to assess coverage of medical expenses, lost earnings, and other applicable benefits under the insured's auto insurance policy.

The General Liability Claim form shares similarities with the NF-2 form in terms of its purpose to gather necessary information from individuals seeking coverage for damages or injuries for which they believe someone else is liable. Both forms require detailed documentation of the incident (including the date, time, and location), a description of injuries or damages sustained, and an accounting of medical treatment and other expenses incurred as a result of the incident. This thorough collection of information aids in the evaluation and processing of the claim.

The Health Insurance Claim form parallels the NF-2 form in its collection of information about medical treatments received as a result of an accident or health condition. Both documents require the claimant to provide their personal information, details about the treatment provider, dates of service, and the nature of the medical services received. This information helps insurance companies to determine the extent of coverage and benefits the claimant is entitled to for the medical expenses incurred.

Dos and Don'ts

When completing the New York Motor Vehicle No-Fault Insurance Law Application (NF-2 form), it's important to follow specific guidelines to ensure the process is done correctly and efficiently. Here is a list of dos and don'ts:

- Do read the entire form carefully before filling it out to understand all the requirements.

- Do provide accurate and complete information in every section to avoid delays in your claim.

- Do sign the form and any attached authorization(s) as required to validate the application.

- Do attach copies of any bills or receipts related to the accident to support your claim.

- Don't leave any sections blank. If a section does not apply to you, write "N/A" (Not Applicable) to indicate this.

- Don't guess dates, times, or details. Verify all information to ensure its accuracy before submission.

- Don't forget to list all medical providers, treatments received, and any other expenses incurred as a result of the accident.

- Don't submit the form without reviewing it for errors or omissions to make sure every detail is correct.

Following these recommendations will help streamline the application process for motor vehicle no-fault benefits and assist in receiving the appropriate compensation for your claim.

Misconceptions

Many people hold misconceptions about the New York Motor Vehicle No-Fault Insurance Law Application for Motor Vehicle No-Fault Benefits, commonly referred to as the NF-2 form. Understanding these misconceptions can help insured individuals navigate their claims more effectively. Here are five common misunderstandings:

- Misconception 1: Signing the NF-2 form is optional for receiving benefits. In truth, completing and signing the NF-2 form is mandatory for those seeking to avail themselves of No-Fault benefits. This form initiates the process and is essential for the insurer to start evaluating your eligibility for benefits.

- Misconception 2: The NF-2 form only needs to be filled out if you were the driver in an accident. Regardless of whether you were the driver, a passenger, a pedestrian, or even a cyclist involved in a motor vehicle accident, you need to fill out and submit an NF-2 form to apply for No-Fault benefits. This includes medical expenses coverage and, in some cases, loss of earnings.

- Misconception 3: You can delay submitting the NF-2 form indefinitely without consequences. Timing is critical. There is a set period within which you must submit the NF-2 form to your insurance company to be eligible for No-Fault benefits. Failing to submit the form in a timely manner can result in the denial of benefits.

- Misconception 4: The information provided on the NF-2 form is only used to evaluate your No-Fault benefits claim. While the primary purpose of the NF-2 form is to assess your eligibility for No-Fault benefits, the information you provide can also be used by the insurance company to perfect its rights of recovery against a responsible third party. This means the insurer can seek reimbursement from the party at fault in the accident.

- Misconception 5: Completing the NF-2 form by yourself guarantees accuracy and compliance. While individuals can complete the NF-2 form on their own, it can be beneficial to seek guidance from a legal professional, especially if there are complexities in your case. Misunderstandings or inaccuracies in filling out the form can lead to delays or denials of benefits. Legal professionals are familiar with the nuances of No-Fault claims and can assist in ensuring that the form is filled out accurately and comprehensively, covering all necessary aspects of your claim.

Correcting these misconceptions is crucial for individuals involved in motor vehicle accidents in New York State. By understanding the requirements and purpose of the NF-2 form, claimants can navigate the No-Fault benefits process more smoothly and effectively.

Key takeaways

When dealing with a New York Motor Vehicle No-Fault Insurance Law Application (NF-2 Form), there are several crucial points to remember for a smooth process:

- Timely submission is essential. To be considered for benefits, you must complete, sign, and return the form promptly, along with any necessary authorization(s) and copies of received bills.

- Accuracy and completeness in filling out the form cannot be overstated. Providing all requested details such as personal information, accident details, injuries, treatments, and lost wages ensures your eligibility is assessed correctly.

- Understanding the requirement to sign additional authorizations is key. These may include authorizations allowing your insurer to access further medical or work-related information necessary to process your claim.

- It is critical to report any bills related to your accident promptly. Include copies of all relevant bills when you return the completed form to expedite the evaluation of your claim.

- Be aware of the consequences of fraudulent claims. Providing false information or concealing facts relevant to your claim not only constitutes insurance fraud, but it also exposes you to potential criminal charges and civil penalties.

- Eligibility for benefits may be influenced by other factors such as receiving New York State Disability or Workers' Compensation benefits. Disclose any such benefits you're receiving or eligible for, as this information is crucial for the processing of your claim.

- Finally, the form includes a section where the applicant authorizes the insurer to submit the form to another party if necessary. This is crucial for facilitating the recovery rights provided under the no-fault law.

Insights into handling an NF-2 form correctly can significantly impact the efficiency and outcome of your claims process. Paying attention to these details ensures that your rights are preserved while also facilitating a smoother claim resolution process.

Popular PDF Forms

Boeing Phone Number - An effective channel for Boeing employees to transmit new address information, crucial for accurate payroll and communication.

Credit Repair Agreement Template - The contract ensures clients have the right to copies of all documents and the full file created during the credit repair process, enhancing transparency.