Blank Nj Cn 10482 PDF Template

The Nj CN 10482 form, an essential document within the New Jersey legal system, especially in family law disputes, offers a comprehensive overview of financial details crucial for the resolution of cases relating to alimony, child support, and other financial matters between parties. This form, recognized for its confidentiality under specific court rules, requires detailed information about the income, expenses, assets, and liabilities of the parties involved. It serves as a foundation for establishing a fair and accurate financial overview of each party's situation, making it a pivotal part of the legal process in family court cases. The form mandates the inclusion of income from all sources, detailed monthly expenses, and an itemization of assets and liabilities, underscoring the importance of accuracy through the requirement of attaching relevant documents such as tax returns and pay stubs. It also accommodates updates to reflect significant changes in the parties' financial circumstances, ensuring the information remains current throughout the legal proceedings. Moreover, the Nj CN 10482 form includes sections that address insurance coverage, dependents, employment, and other miscellaneous information, providing a holistic view of each party's financial standing. To emphasize the importance of precision, the form cautions about the need for complete and truthful disclosures, with instructions that guide the parties on how to compile and present their financial data. All these aspects collectively highlight the critical role this form plays in family law cases, assisting in the determination of equitable solutions in disputes surrounding financial support and asset distribution.

Preview - Nj Cn 10482 Form

Save

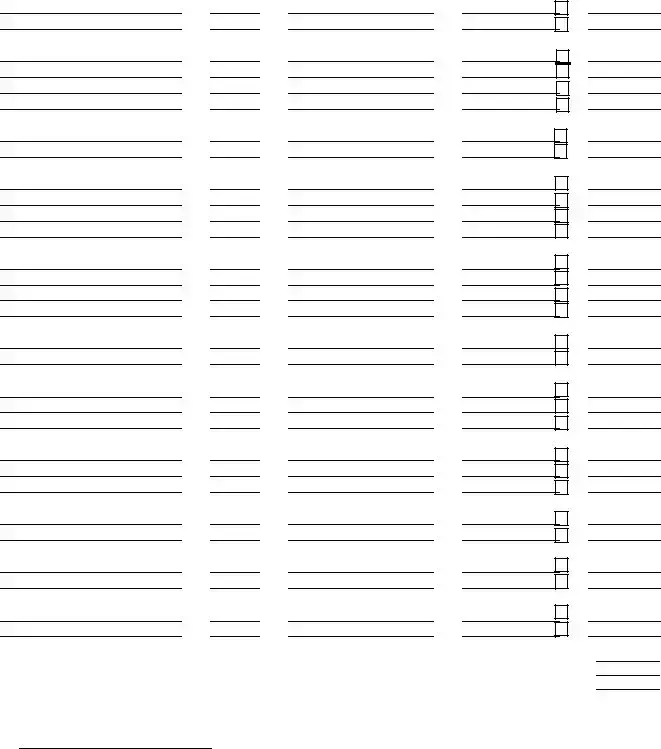

Appendix V

Family Part Case Information Statement

Clear

This form and attachments are confidential pursuant to Rules

Attorney(s):

Office Address:

Tel. No./Fax No.

Attorney(s) for:

Plaintiff,

vs.

Defendant.

SUPERIOR COURT OF NEW JERSEY

CHANCERY DIVISION, FAMILY PART

COUNTY

DOCKET NO.

CASE INFORMATION STATEMENT

OF

NOTICE: This statement must be fully completed, filed and served, with all required attachments, in accordance with Court Rule

INSTRUCTIONS:

The Case Information Statement is a document which is filed with the court setting forth the financial details of your case. The required information includes your income, your spouse's/partner's income, a budget of your joint life style expenses, a budget of your current life style expenses including the expenses of your children, if applicable, an itemization of the amounts which you may be paying in support for your spouse/partner or children if you are contributing to their support, a summary of the value of all assets referenced on page 8 – It is extremely important that the Case Information

Statement be as accurate as possible because you are required to certify that the contents of the form are true. It helps establish your lifestyle which is an important component of alimony/spousal support and child support.

The monthly expenses must be reviewed and should be based on actual expenditures such as those shown from checkbook registers, bank statements or credit card statements from the past 24 months. The asset values should be taken, if possible, from actual appraisals or account statements. If the values are estimates, it should be clearly noted that they are estimates.

According to the Court Rules, you must update the Case Information Statement as your circumstances change. For example, if you move out of your residence and acquire your own apartment, you should file an Amended Case Information Statement showing your new rental and other living expenses.

It is also very important that you attach copies of relevant documents as required by the Case Information Statement, including your most recent tax returns with

If a request has been made for college or

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 1 of 10 |

Part A - Case Information: |

Issues in Dispute: |

|||||||||||||

Date of Statement |

|

Cause of Action |

|

|||||||||||

Date of Divorce, Dissolution of Civil |

Custody |

|

||||||||||||

Union or Termination of Domestic |

|

|

Parenting Time |

|

||||||||||

Partnership |

Alimony |

|

||||||||||||

Date(s) of Prior Statement(s) |

Child Support |

|

||||||||||||

|

|

|

|

|

|

|

Equitable Distribution |

|

||||||

Your Birthdate |

|

Counsel Fees |

|

|||||||||||

Birthdate of Other Party |

|

Anticipated College/Post- |

||||||||||||

Date of Marriage, or entry into Civil Union |

Secondary Education |

|||||||||||||

or Domestic Partnership |

|

|

Expenses |

|

||||||||||

|

|

|

|

|

|

|

Other issues (be specific) |

|||||||

Date of Separation |

|

|

|

Date of Complaint |

|

|

|

Does an agreement exist between parties relative to any issue? |

Yes |

No. |

|

If Yes, ATTACH a copy (if written) or a summary (if oral). |

|

|

|

1.Name and Addresses of Parties: Your Name

Street Address |

|

City |

|

State/Zip |

|

||

Email: |

|

|

|

|

|

||

Other Party’s Name |

|

|

|

|

|

||

Street Address |

|

City |

|

State/Zip |

|

||

Email: |

|

|

|

|

|

||

2.Name, Address, Birthdate and Person with whom children reside: a. Child(ren) From This Relationship

Child’s Full Name |

|

Address |

|

Birthdate |

|

Person’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Child(ren) From Other Relationships |

|

|

|

Child’s Full Name |

Address |

Birthdate |

Person’s Name |

Part B - Miscellaneous Information:

1. Information about Employment (Provide Name & Address of Business, if |

|

|

|

|

||||||||||

Name of Employer/Business |

|

|

|

|

Address |

|

|

|

|

|

||||

Name of Employer/Business |

|

|

|

|

Address |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||||||

2. Do you have Insurance obtained through Employment/Business? |

|

Yes |

No. |

Type of Insurance: |

|

|

||||||||

Medical |

Yes |

No; Dental |

Yes |

No; Prescription Drug |

Yes |

No; Life |

Yes |

No; Disability |

Yes |

No |

||||

Other (explain) |

|

|

|

|

|

|

|

|

|

|

|

|

||

Is Insurance available through Employment/Business? |

Yes |

|

No |

|

|

|

|

|

||||||

Explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 2 of 10 |

3.ATTACH Affidavit of Insurance Coverage as required by Court Rule

4.Additional Identification:

Confidential Litigant Information Sheet: Filed |

Yes |

No |

5.ATTACH a list of all prior/pending family actions involving support, custody or Domestic Violence, with the Docket Number, County, State and the disposition reached. Attach copies of all existing Orders in effect.

Part C. - Income Information:

Complete this section for self and (if known) for other party. If

1. Last Year’s Income

|

|

|

Yours |

|

Joint |

Other Party |

|

1. |

Gross earned income last calendar (year) |

$ |

|

$ |

|

$ |

|

2. |

Unearned income (same year) |

$ |

|

$ |

|

$ |

|

3. |

Total Income Taxes paid on income (Fed., State, |

$ |

|

$ |

|

$ |

|

|

F.I.C.A., and S.U.I.). If Joint Return, use middle |

|

|

|

|

|

|

|

column. |

|

|

|

|

|

|

4. |

Net income (1 + 2 - 3) |

$ |

|

$ |

|

$ |

|

ATTACH to this form a corporate benefits statement as well as a statement of all fringe benefits of employment. (See Part G)

ATTACH a full and complete copy of last year’s Federal and State Income Tax Returns. to show total income plus a copy of the most recently filed Tax Returns. (See Part G) Check if attached:

ATTACH

Other |

2. Present Earned Income and Expenses

|

|

|

|

|

Yours |

|

Other Party |

|

|

|

|

|

|

|

(if known) |

1. |

Average gross weekly income (based on last 3 pay periods – |

$ |

|

$ |

|

||

|

ATTACH pay stubs) |

|

|

|

|

|

|

|

Commissions and bonuses, etc., are: |

|

|

|

|

|

|

|

included |

not included* |

not paid to you. |

|

|

|

|

*ATTACH details of basis thereof, including, but not limited to, percentage overrides, timing of payments, etc. |

|

|

|||||

ATTACH copies of last three statements of such bonuses, commissions, etc. |

|

|

|

|

|||

2. |

Deductions per week (check all types of withholdings): |

$ |

|

$ |

|

||

|

Federal |

|

State |

|

F.I.C.A. |

3. Net average weekly income (1 - 2)

S.U.I.

Other

$ |

|

$ |

3. Your Current

|

|

|

|

Provide Dates: From |

|

To |

||||

1. GROSS EARNED INCOME: $ |

|

|

Number of Weeks |

|

|

|||||

2. TAX DEDUCTIONS: (Number of Dependents: |

|

) |

|

|

|

|

|

|

||

a. |

Federal Income Taxes |

|

a. |

$ |

|

|

|

|

||

b. |

N.J. Income Taxes |

|

b. |

$ |

|

|

|

|

||

c. |

Other State Income Taxes |

|

c. |

$ |

|

|

|

|

||

d. |

F.I.C.A. |

|

d. |

$ |

|

|

|

|

||

e. |

Medicare |

|

e. |

$ |

|

|

|

|

||

f. |

S.U.I. / S.D.I. |

|

f. |

$ |

|

|

|

|

||

g. |

Estimated tax payments in excess of withholding |

|

g. |

$ |

|

|

|

|

||

h. |

|

|

|

|

h. |

$ |

|

|

|

|

i. |

|

|

|

|

i. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

$ |

|

|

|

|

|

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 3 of 10 |

3. GROSS INCOME NET OF TAXES $ |

|

$ |

|

|

||||

4. OTHER DEDUCTIONS |

|

|

|

If mandatory, check box |

||||

a. |

Hospitalization/Medical Insurance |

a. |

$ |

|

|

|||

b. |

Life Insurance |

b. |

$ |

|

|

|||

c. |

Union Dues |

c. |

$ |

|

|

|||

d. |

401(k) Plans |

d. |

$ |

|

|

|||

e. |

Pension/Retirement Plans |

e. |

$ |

|

|

|||

f. |

Other Plans - specify |

f. |

$ |

|

|

|||

|

|

|

|

|

|

|

|

|

g. |

Charity |

g. |

$ |

|

|

|||

h. |

Wage Execution |

h. |

$ |

|

|

|||

i. |

Medical Reimbursement (flex fund) |

i. |

$ |

|

|

|||

j. |

Other: |

j. |

$ |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

$ |

|

|

|

5. NET |

|

$ |

|

|

|

|||

NET AVERAGE EARNED INCOME PER MONTH: |

|

$ |

|

|

|

|||

NET AVERAGE EARNED INCOME PER WEEK |

|

$ |

|

|

|

|||

4. Your

(including, but not limited to, income from unemployment, disability and/or social security payments, interest, dividends,

rental income and any other miscellaneous unearned income)

Source |

|

How often paid |

Year to date amount |

||

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

TOTAL GROSS UNEARNED INCOME YEAR TO DATE |

|

|

$ |

|

|

5. Additional Information:

1. |

How often are you paid? |

|

|

|

|

|

|

|

|

2. |

What is your annual salary? |

$ |

|

|

|

|

|

||

3. |

Have you received any raises in the current year? |

Yes |

No |

||||||

|

If yes, provide the date and the gross/net amount. |

|

|

|

|||||

4. |

Do you receive bonuses, commissions, or other compensation, including distributions, taxable or non- |

Yes |

No |

||||||

|

taxable, in addition to your regular salary? |

|

|

||||||

|

If yes, explain: |

|

|

|

|

|

|

|

|

5. |

Does your employer pay for or provide you with an automobile (lease or purchase), automobile expenses, |

Yes |

No |

||||||

|

gas, repairs, lodging and other. |

|

|

|

|

|

|

||

|

If yes, explain.: |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 4 of 10 |

6. |

Did you receive bonuses, commissions, or other compensation, including distributions, taxable or non- |

Yes |

No |

||

|

taxable, in addition to your regular salary during the current or immediate past 2 calendar years? |

|

|

||

|

If yes, explain and state the date(s) of receipt and set forth the gross and net amounts received: |

|

|

||

|

|

|

|

|

|

7. |

Do you receive cash or distributions not otherwise listed? |

Yes |

No |

||

|

If yes, explain. |

|

|

|

|

8. |

Have you received income from overtime work during either the current or immediate past calendar year? |

Yes |

No |

||

|

If yes, explain. |

|

|

||

9. |

Have you been awarded or granted stock options, restricted stock or any other |

Yes |

No |

||

|

entitlement during the current or immediate past calendar year? |

|

|

||

|

If yes, explain. |

|

|

|

|

10. |

Have you received any other supplemental compensation during either the current or immediate past calendar |

Yes |

No |

||

|

year? |

|

|

||

|

If yes, state the date(s) of receipt and set forth the gross and net amounts received. Also describe the nature |

|

|

||

|

of any supplemental compensation received. |

|

|

||

|

|

|

|

||

|

|

|

|

||

11. |

Have you received income from unemployment, disability and/or social security during either the current or |

Yes |

No |

||

|

immediate past calendar year? |

|

|

||

|

If yes, state the date(s) of receipt and set forth the gross and net amounts received. |

|

|

||

12.List the names of the dependents you claim:

13. |

Are you paying or receiving any alimony? |

Yes |

No |

|

|

If yes, how much and from or to whom? |

|

|

|

|

|

|

|

|

14. |

Are you paying or receiving any child support? |

Yes |

No |

|

|

If yes, list names of the children, the amount paid or received for each child and to whom paid or from whom |

|

|

|

|

received. |

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

Is there a wage execution in connection with support? |

Yes |

No |

|

|

If yes explain. |

|

|

|

16. |

Does a Safe Deposit Box exist and if so, at which bank? |

Yes |

No |

|

17. |

Has a dependent child of yours received income from social security, SSI or other government program |

Yes |

No |

|

|

during either the current or immediate past calendar year? |

|

|

|

|

If yes, explain the basis and state the date(s) of receipt and set forth the gross and net amounts received |

|

|

|

18.Explanation of Income or Other Information:

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 5 of 10 |

Part D - Monthly Expenses (computed at 4.3 wks/mo.)

Joint Marital or Civil Union Life Style should reflect standard of living established during marriage or civil union. Current expenses should reflect the current life style. Do not repeat those income deductions listed in Part C – 3.

|

|

|

|

Joint Life Style |

Current Life Style |

||||

|

|

|

Family, including |

|

Yours and |

||||

|

|

|

|

|

children |

|

|

|

children |

SCHEDULE A: SHELTER |

|

|

|

|

|

|

|

|

|

If Tenant: |

|

|

|

|

|

|

|

|

|

Rent |

$ |

|

|

$ |

|

|

|||

Heat (if not furnished) |

$ |

|

|

$ |

|

|

|||

Electric & Gas (if not furnished) |

$ |

|

|

$ |

|

|

|||

Renter’s Insurance |

$ |

|

|

$ |

|

|

|||

Parking (at Apartment) |

$ |

|

|

$ |

|

|

|||

Other charges (Itemize) |

$ |

|

|

$ |

|

|

|||

If Homeowner: |

|

|

|

|

|

|

|

|

|

Mortgage |

$ |

|

|

$ |

|

|

|||

...........................Real Estate Taxes (if not included w/mortgage payment) |

$ |

|

|

$ |

|

|

|||

...........................Homeowners Ins. (if not included w/mortgage payment) |

$ |

|

|

$ |

|

|

|||

Other Mortgages or Home Equity Loans |

...................................................... |

$ |

|

|

$ |

|

|

||

Heat (unless Electric or Gas) |

$ |

|

|

$ |

|

|

|||

Electric & Gas |

$ |

|

|

$ |

|

|

|||

Water & Sewer |

$ |

|

|

$ |

|

|

|||

Garbage Removal |

$ |

|

|

$ |

|

|

|||

Snow Removal |

.............................................. |

$ |

|

|

$ |

|

|

||

Lawn Care |

$ |

|

|

$ |

|

|

|||

Maintenance/Repairs |

$ |

|

|

$ |

|

|

|||

..........................................................Condo, |

$ |

|

|

$ |

|

|

|||

Other Charges (Itemize) |

$ |

|

|

$ |

|

|

|||

Tenant or Homeowner: |

|

|

|

|

|

|

|

|

|

Telephone |

$ |

|

|

$ |

|

|

|||

Mobile/Cellular Telephone |

$ |

|

|

$ |

|

|

|||

Service Contracts on Equipment |

$ |

|

|

$ |

|

|

|||

Cable TV |

$ |

|

|

$ |

|

|

|||

Plumber/Electrician |

$ |

|

|

$ |

|

|

|||

Equipment & Furnishings |

$ |

|

|

$ |

|

|

|||

Internet Charges |

$ |

|

|

$ |

|

|

|||

Home Security System |

.............................................. |

$ |

|

|

$ |

|

|

||

Other (itemize) |

|

$ |

|

|

$ |

|

|

||

|

|

TOTAL |

$ |

|

|

$ |

|

|

|

SCHEDULE B: TRANSPORTATION |

|

|

|

|

|

|

|

|

|

Auto Payment |

$ |

|

|

$ |

|

|

|||

Auto Insurance (number of vehicles: |

|

) |

$ |

|

|

$ |

|

|

|

Registration, License |

$ |

|

|

$ |

|

|

|||

Maintenance |

$ |

|

|

$ |

|

|

|||

Fuel and Oil |

$ |

|

|

$ |

|

|

|||

Commuting Expenses |

$ |

|

|

$ |

|

|

|||

Other Charges (Itemize) |

$ |

|

|

$ |

|

|

|||

|

|

TOTAL |

$ |

|

|

$ |

|

|

|

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 6 of 10 |

SCHEDULE C: PERSONAL |

Joint Life Style |

Current Life Style |

||||||

|

Family, including |

|

|

Yours and |

||||

|

|

|

|

children |

|

|

|

children |

Food at Home & household supplies |

$ |

|

|

$ |

|

|

||

Prescription Drugs |

$ |

|

|

$ |

|

|

||

$ |

|

|

$ |

|

|

|||

School Lunch |

$ |

|

|

$ |

|

|

||

Restaurants |

$ |

|

|

$ |

|

|

||

Clothing |

$ |

|

|

$ |

|

|

||

Dry Cleaning, Commercial Laundry |

$ |

|

|

$ |

|

|

||

Hair Care |

$ |

|

|

$ |

|

|

||

Domestic Help |

$ |

|

|

$ |

|

|

||

Medical (exclusive of psychiatric)* |

$ |

|

|

$ |

|

|

||

Eye Care* |

$ |

|

|

$ |

|

|

||

Psychiatric/psychological/counseling* |

$ |

|

|

$ |

|

|

||

Dental (exclusive of Orthodontic* |

$ |

|

|

$ |

|

|

||

Orthodontic* |

$ |

|

|

$ |

|

|

||

Medical Insurance (hospital, etc.)* |

$ |

|

|

$ |

|

|

||

Club Dues and Memberships |

$ |

|

|

$ |

|

|

||

Sports and Hobbies |

$ |

|

|

$ |

|

|

||

Camps |

$ |

|

|

$ |

|

|

||

Vacations |

$ |

|

|

$ |

|

|

||

Children’s Private School Costs |

$ |

|

|

$ |

|

|

||

Parent’s Educational Costs |

$ |

|

|

$ |

|

|

||

Children’s Lessons (dancing, music, sports, etc.) |

$ |

|

|

$ |

|

|

||

Babysitting |

$ |

|

|

$ |

|

|

||

$ |

|

|

$ |

|

|

|||

Entertainment |

$ |

|

|

$ |

|

|

||

Alcohol and Tobacco |

$ |

|

|

$ |

|

|

||

Newspapers and Periodicals |

$ |

|

|

$ |

|

|

||

Gifts |

$ |

|

|

$ |

|

|

||

Contributions |

$ |

|

|

$ |

|

|

||

Payments to |

$ |

|

|

$ |

|

|

||

Prior Existing Support Obligations this family/other families |

|

|

|

|

|

|

|

|

(specify) |

$ |

|

|

$ |

|

|

||

Tax Reserve (not listed elsewhere) |

$ |

|

|

$ |

|

|

||

Life Insurance |

$ |

|

|

$ |

|

|

||

Savings/Investment |

$ |

|

|

$ |

|

|

||

Debt Service (from page 7) (not listed elsewhere) |

$ |

|

|

$ |

|

|

||

Parenting Time Expenses |

$ |

|

|

$ |

|

|

||

Professional Expenses (other than this proceeding) |

$ |

|

|

$ |

|

|

||

Pet Care and Expenses |

$ |

|

|

$ |

|

|

||

Other (specify) |

$ |

|

|

$ |

|

|

||

*unreimbursed only |

|

|

|

|

|

|

|

|

TOTAL |

$ |

|

|

$ |

|

|

||

Please Note: If you are paying expenses for a spouse or civil union partner and/or children not reflected in this budget, attach a schedule of such payments.

Schedule A: Shelter |

$ |

|

$ |

Schedule B: Transportation |

$ |

|

$ |

Schedule C: Personal |

$ |

|

$ |

Grand Totals |

$ |

|

$ |

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 7 of 10 |

Part E - Balance Sheet of All Family Assets and Liabilities

Statement of Assets

|

Title to |

Date of purchase/acquisition. |

|

Date of |

|

|

If claim that asset is exempt, |

Value $ |

|||

Description |

Property |

Evaluation |

|||

state reason and value of |

Put * after exempt |

||||

|

(P, D, J)1 |

Mo./Day/ Yr. |

|||

|

what is claimed to be exempt |

|

|||

|

|

|

|

1.Real Property

2.Bank Accounts, CD’s (identify institution and type of account(s))

3.Vehicles

4.Tangible Personal Property

5.Stocks, Bonds and Securities (identify institution and type of account(s))

6.Pension, Profit Sharing, Retirement Plan(s), 40l(k)s, etc. (identify each institution or employer)

7.IRAs

8.Businesses, Partnerships, Professional Practices

9.Life Insurance (cash surrender value)

10.Loans Receivable

11.Other (specify)

TOTAL GROSS ASSETS: $

TOTAL SUBJECT TO EQUITABLE DISTRIBUTION: $

TOTAL NOT SUBJECT TO EQUITABLE DISTRIBUTION: $

1 P = Plaintiff; D = Defendant; J = Joint

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 8 of 10 |

Statement of Liabilities

|

Name of |

|

|

|

|

|

Description |

Responsible |

If you contend liability should |

Monthly |

Total |

Date |

|

Party |

not be shared, state reason |

Payment |

Owed |

|||

|

|

|||||

|

(P, D, J) |

|

|

|

|

1.Real Estate Mortgages

2.Other Long Term Debts

3.Revolving Charges

4.Other Short Term Debts

5.Contingent Liabilities

TOTAL GROSS LIABILITIES: |

$ |

|

|

(excluding contingent liabilities) |

|

|

|

NET WORTH: |

$ |

|

|

(subject to equitable distribution) |

|

|

|

TOTAL SUBJECT TO EQUITABLE DISTRIBUTION: $ |

|

||

TOTAL NOT SUBJECT TO EQUITABLE DISTRIBUTION: |

$ |

|

|

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 9 of 10 |

Part F - - Statement of Special Problems

Provide a Brief Narrative Statement of Any Special Problems Involving This Case: As example, state if the matter involves complex valuation problems (such as for a closely held business) or special medical problems of any family member, etc.

Part G - Required Attachments

Check If You Have Attached the Following Required Documents

1. A full and complete copy of your last federal and state income tax returns with all schedules and attachments. (Part

2. Your last calendar year’s

3. Your three most recent pay stubs.

4. Bonus information including, but not limited to, percentage overrides, timing of payments, etc.; the last three statements of such bonuses, commissions, etc. (Part C)

5. Your most recent corporate benefit statement or a summary thereof showing the nature, amount and status of retirement plans, savings plans, income deferral plans, insurance benefits, etc. (Part C)

6. Affidavit of Insurance Coverage as required by Court Rule

7. List of all prior/pending family actions involving support, custody or Domestic Violence, with the Docket Number, County, State and the disposition reached. Attach copies of all existing Orders in effect. (Part

8. Attach details of each wage execution (Part

9. Schedule of payments made for a spouse or civil union partner and/or children not reflected in Part D.

10. Any agreements between the parties.

11. An Appendix IX Child Support Guideline Worksheet, as applicable, based upon available information.

12. If a request has been made for college or

I certify that, other than in this form and its attachments, confidential personal identifiers have been redacted from documents now submitted to the court, and will be redacted from all documents submitted in the future in accordance with Rule

I certify that the foregoing information contained herein is true. I am aware that if any of the foregoing information contained therein is willfully false, I am subject to punishment.

DATED: |

|

SIGNED: |

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 10 of 10 |

Form Data

| Fact Name | Description |

|---|---|

| Form Identifier | The form is identified as CN: 10482, known as Appendix V for the Family Part Case Information Statement. |

| Relevant Governing Law | The form is governed by Court Rules 1:38-3(d)(1) and 5:5-2(f), highlighting its confidentiality and procedural requirements within the New Jersey Superior Court, Chancery Division, Family Part. |

| Purpose of the Form | It is designed to provide a comprehensive outline of the financial details of parties in family-related cases, crucial for determining alimony/spousal support and child support. |

| Filing Requirements | Must be fully completed, filed, and served with all required attachments within 20 days after the filing of the Answer or Appearance, with failure to do so potentially resulting in the dismissal of a party’s pleadings. |

| Update Necessity | The filer is mandated to update the Case Information Statement as circumstances change, to accurately reflect current financial status and living expenses. |

Instructions on Utilizing Nj Cn 10482

Before starting to fill out the NJ CN 10482 form, it's important to gather all the necessary documents and information. This form, required in certain family law cases in New Jersey, helps paint a detailed picture of the financial situation of both parties involved. It covers income, expenses, assets, and liabilities. Accuracy is crucial, as the information provided will play a substantial role in decisions regarding alimony, child support, and the division of assets. Everything from your monthly expenses to your income and the valuation of your property should be at your fingertips, including the most recent tax returns, paystubs, and any documentation regarding shared children's expenses. Here is a step-by-step guide to completing the form:

- Start by filling out the top section of the form with the case and court information. This includes your name and the name of the other party, attorney details, and the type of legal matter you are dealing with (e.g., divorce, child support).

- Under the Part A - Case Information section, provide detailed information about the specific issues in dispute including custody arrangements, financial concerns, and any relevant dates (date of separation, date of marriage, etc.). Document both your and the other party's birthdates as well.

- In the section that asks for the Name and Addresses of Parties, fill in your current address details as well as those of the opposing party. Do not forget to include email addresses if available.

- For each child involved in the case, provide their full names, addresses, birthdates, and with whom they currently reside under the appropriate subsections for children from this relationship and children from other relationships.

- Move on to the Part B - Miscellaneous Information to detail employment information, insurance coverage obtained through employment, and additional identification details. This includes both your employer's information and that of the other party if known.

- If applicable, attach an Affidavit of Insurance Coverage as indicated. Also, provide a list of all prior or pending family actions involving support or custody if any exist.

- In the Part C - Income Information section, document all sources of income for both yourself and, if known, the other party. This includes last year's income, present earned income, and current year-to-date earnings. Make sure to attach documentation such as pay stubs, tax returns, W-2's, 1099's, or Schedule C's as required.

- Detail your deductions, including federal and state taxes, F.I.C.A., and other deductions either mandatory or voluntary, to calculate your net average weekly income.

- Under the segment for unearned income and additional information, disclose any bonuses, commissions, or other compensation details relevant to you. This section also asks about raises, other compensation like automobile expenses, and any distributions not listed elsewhere.

- If there are children involved, fill out information regarding child support or alimony payments, whether you are paying or receiving. Additionally, indicate if a dependent child of yours has received income from social security or other government programs.

- Conclude with the section on explaining any income or other information that was not covered in previous sections. This is a chance to provide context or additional details that could affect financial analyses in your case.

This completed form, together with all required attachments, should be filed with the court by the stipulated deadline. Remember, keeping your information current is vital, so be prepared to update the Case Information Statement as instructed by the court or as your situation changes.

Obtain Answers on Nj Cn 10482

What is the NJ CN 10482 form?

The NJ CN 10482 form, known as the Family Part Case Information Statement, is a critical document required in family law cases in New Jersey. It captures detailed financial information from the parties involved in cases like divorce, child support, and alimony. This form, along with its attachments, remains confidential and is crucial for establishing financial baselines for support and asset division.

When must the Case Information Statement be filed?

This statement should be filed within 20 days after the filing of an Answer or Appearance in a family law case. Failing to file this document can have significant consequences, including the dismissal of a party’s pleadings.

What information must be included in the Case Information Statement?

The form requires comprehensive financial data, including but not limited to, income details, a budget of lifestyle expenses, support payments being made, and an asset summary. Accuracy is paramount, with the form necessitating confirmation through attached relevant documents like tax returns and recent pay stubs.

Why is accurate completion of the form important?

Accuracy in completing the form is essential because it affects financial determinations like alimony, child support, and the division of assets. Inaccurate or incomplete information can significantly impact these proceedings.

How should I estimate expenses and assets if actual figures are not available?

When actual figures are not available, estimates can be used, but it should be clearly noted that they are estimates. These estimates should be based on the best information available, aiming for the closest accuracy possible.

What documents need to be attached to the Case Information Statement?

Attachments should include your most recent tax returns with W-2 forms, 1099s, your three most recent pay stubs, and, if applicable, documentation relevant to requests for post-secondary education contributions. It’s important to provide all necessary documentation to support the financial information provided in the statement.

How often do I need to update the Case Information Statement?

You must update the Case Information Statement as your circumstances change. This includes any significant life changes like moving to a new residence, changes in employment, or any alterations in your financial situation.

What happens if I fail to file or update the Case Information Statement?

Failure to file or properly update the Case Information Statement can lead to negative consequences, including the possible dismissal of your pleadings. This can severely impact your case and the judicial considerations of your financial circumstances.

Is the Case Information Statement confidential?

Yes, the Case Information Statement and its attachments are confidential, protected under specific court rules. This confidentiality is designed to protect the sensitive financial information that the form requires.

What should I do if I have changes to report after submitting the form?

If there are changes to your financial situation or any other information provided in the form after you’ve submitted it, you should file an Amended Case Information Statement. This updated document should reflect your new financial circumstances or any other pertinent changes.

Common mistakes

When completing the NJ CN 10482 form, a Case Information Statement crucial for various family law proceedings in New Jersey, individuals frequently make several common errors that can impact the outcome of their case. Recognizing and avoiding these mistakes ensures the accurate portrayal of financial circumstances, crucial for fair legal proceedings. Here's a detailed look at seven common pitfalls:

Not fully completing the form: Many individuals fail to provide all the required information. Every section of the form is designed to capture essential details about your financial situation, and skipping parts can lead to inaccurate assessments by the court.

Incorrect financial information: Accurately reporting income, expenses, assets, and liabilities is crucial. Errors, whether inadvertent or intentional, can lead to unfavorable outcomes. Using actual data from financial statements and tax returns, rather than estimates, helps avoid this mistake.

Failure to include all necessary attachments: The form requires specific attachments, including tax returns, W-2 forms, 1099s, and recent paystubs. Not attaching these documents can delay proceedings and affects the credibility of the provided information.

Not updating the statement: The financial situation can change rapidly. Failing to file an amended Case Information Statement when significant changes occur, such as a change in employment, income, or living expenses, will result in outdated information being considered by the court.

Underestimating expenses: It is common to overlook or underestimate monthly expenses. Accurate monthly expenses are critical, especially when child support or alimony might be determined. A detailed review of past expenditures ensures a more accurate representation.

Not disclosing all assets: All assets must be disclosed in the Case Information Statement, including those believed to be separate property or not directly in your name. Failure to disclose can have legal consequences and affect the equitable distribution of assets.

Overlooking the importance of accuracy: The form ends with a certification that the information provided is accurate to the best of your knowledge. Inaccuracies, even minor, can be seen as deliberate misstatements and affect the outcome of your case. Ensuring everything is correct before submission is imperative.

Avoiding these mistakes can significantly impact the resolution of family law issues, including alimony, child support, and the division of assets and liabilities. The key to successfully navigating this process is paying meticulous attention to detail and ensuring all information is current, comprehensive, and accurate.

Documents used along the form

When managing a case in the Superior Court of New Jersey, especially within the Family Part, completing the NJ CN 10482 form, known as the Case Information Statement, is a critical step. This document by itself provides a detailed financial snapshot, but it rarely stands alone. Several other forms and documents often accompany it to paint a full picture of the individuals' financial standings and needs. Here's a rundown of those forms and documents that are usually filed alongside or as part of the process:

- Confidential Litigant Information Sheet: This form collects basic but essential information about the parties involved, ensuring confidentiality and aiding the management of case files.

- Family Part Case Information Sheet: Acts as a cover sheet for family law cases, providing a summary of the case at a glance, including case type and involved parties.

- Notice of Motion: When one party wishes to request a court order or a change to an existing order, this document outlines the details of that motion and the legal basis for it.

- Child Support Guidelines Worksheet: Essential for cases involving child support, this worksheet helps in calculating the appropriate support amount following New Jersey’s guidelines.

- Certification of Insurance Coverage: Lists all current insurance coverages for parties and children involved, including health, dental, and life insurance, as required by court rule 5:4-2(f).

- Current Income Proof: Comprising recent pay stubs, this helps verify the income details provided in the Case Information Statement and supports calculations for support and maintenance.

- Last Three Years' Tax Returns: Offers a longer-term view of an individual's financial situation, including income, deductions, and tax payments, critical for assessing financial capabilities and obligations.

- Property Settlement Agreement (if applicable): If the parties have reached an agreement about the division of their property, this document outlines those decisions and is critical for the equitable distribution aspect of a divorce or dissolution.

- Certification of Notification of Complementary Dispute Resolution Alternatives: A form that certifies parties have been informed about alternative dispute resolution (ADR) options, which may be required in cases involving custody or parenting time issues.

Gathering these documents can seem overwhelming, but each plays a vital role in ensuring the court has a comprehensive understanding of the financial and personal circumstances surrounding a case. This thorough approach helps in reaching fair and equitable decisions, especially in matters of alimony, child support, and the equitable distribution of assets. Keeping everything organized and submitted on time can significantly smoothen the process for all parties involved.

Similar forms

The NJ CN 10482 form, known as the Case Information Statement (CIS) in Family Part Cases, is used primarily in divorce, separation, or family law matters to provide a detailed financial snapshot of the parties involved. This form helps the court make informed decisions regarding alimony, child support, and the equitable distribution of assets. Several other legal documents fulfill similar roles in providing detailed information for specific legal procedures or requirements. Here are ten such documents:

- Financial Affidavit: Like the CIS, a Financial Affidavit is used in family law cases to disclose one’s financial situation, including income, expenses, assets, and liabilities. It serves as a basis for determining support obligations and property division.

- Income and Expense Declaration (FL-150): Employed within family law, particularly in jurisdictions like California, this form outlines an individual’s monthly income and expenses. It is crucial for calculating spousal and child support amounts.

- Uniform Residential Loan Application: While used in mortgage lending processes, this comprehensive form collects detailed financial information from an applicant, similar to the CIS, to assess their creditworthiness for a loan.

- FAFSA (Free Application for Federal Student Aid): This form collects financial information from students and families to determine eligibility for student financial aid. It requires detailed income, asset, and tax return information, paralleling the CIS’s financial disclosure requirements.

- IRS Form 1040: The U.S. individual income tax return form requires detailed financial information, including income sources, tax deductions, and credits. Similar to the CIS, it provides a comprehensive view of an individual’s financial status.

- Child Support Guidelines Worksheet: Used to calculate child support obligations based on parents’ financial information, this worksheet requires detailed income, expense, and child care cost information, reflective of the CIS’s purpose in family law cases.

- Assets and Liabilities Statement: Common in various legal and business contexts, this statement itemizes an individual’s or entity’s assets and liabilities. It's akin to the financial disclosure part of the CIS, offering a snapshot of financial health.

- Probate Inventory Form: This document lists all assets (and sometimes liabilities) of a deceased person’s estate. It is similar to the asset disclosure component of the CIS but is used in the context of estate administration.

- Bankruptcy Schedules: In bankruptcy filings, these schedules require detailed listings of an individual’s or business’s assets, liabilities, income, and expenses, closely mirroring the financial disclosure aspect of the CIS.

- Pre-Martial (Prenuptial) Agreement Disclosure: These disclosures, part of prenuptial agreements, require parties to reveal their financial situations to each other before marriage, including assets and liabilities, akin to the financial revelations in the CIS.

Though these documents are utilized in distinct legal contexts, each requires detailed financial information from the parties involved, similar to the NJ CN 10482 form's use in family law to present a comprehensive financial picture.

Dos and Don'ts

When completing the New Jersey Case Information Statement (NJ CN 10482 form), it's pivotal to approach the process with diligence and accuracy. This document plays a crucial role in the legal proceedings of family law cases, offering a comprehensive overview of your financial situation. The information provided will significantly influence decisions regarding alimony, child support, and the equitable distribution of assets. Below are key guidelines to keep in mind:

Do:- Read the instructions carefully before beginning to fill out the form. Understanding the requirements can help ensure that all necessary information is accurately provided.

- Gather all relevant documents including the most recent tax returns, W-2 forms, 1099s, pay stubs, and documents related to assets and liabilities. These will provide the factual basis for the information you enter.

- Use actual numbers when reporting income, expenses, and asset values. If estimations are necessary, clearly indicate that these figures are estimated.

- Review and verify the accuracy of all entered information. Double-check calculations and ensure that all required fields are filled out.

- Update the Case Information Statement as your circumstances change. Amendments should be filed to reflect significant changes in income, expenses, or assets.

- Leave sections blank. If a section does not apply, indicate this by writing "N/A" (not applicable) or "0" if a numerical response is required but the actual answer is none.

- Forget to attach required documentation. Failing to provide necessary attachments such as tax returns or pay stubs can result in delays or the need to resubmit the form.

- Underestimate the importance of accuracy. Inaccurate information can lead to unfavorable legal outcomes or the need for correction and re-submission, delaying proceedings.

- Submit the form without first making a copy for your records. It's crucial to have a personal copy for reference or in case the original submission is lost or questioned.

Adhering to these guidelines can significantly influence the effectiveness and efficiency of the legal process in family court matters. The Case Information Statement is a tool to communicate your financial reality accurately and comprehensively, and proper preparation can help ensure it fulfills its purpose in your case.

Misconceptions

When navigating through the complexities of the New Jersey Case Information Statement (CIS), Form CN 10482, individuals often stumble across numerous misconceptions. Understanding the realities behind these misconceptions can significantly streamline the process of completing and filing this essential document.

Misconception 1: The form is optional. Many believe that the Case Information Statement is optional in family law proceedings in New Jersey. However, this form is mandatory in divorce and post-judgment motions where financial matters are at issue. Failing to file this form can lead to the dismissal of your pleadings.

Misconception 2: Estimates are sufficient for all numbers. While the form allows for estimates, it is crucial to provide accurate figures wherever possible, especially regarding income and expenses. Estimates are only acceptable when documentation or exact numbers are unavailable, and it must be noted that they are indeed estimates.

Misconception 3: Only current financial data is necessary. The Case Information Statement requires information from the past, present, and even future projections in certain instances. This includes previous tax returns and a detailed account of expenses and incomes, not just current financial situations.

Misconception 4: Personal information is public record. Given the sensitive nature of the information provided, many assume it becomes public record. This form and its attachments, however, are confidential, protected under specific court rules from public access.

Misconception 5: You only need to file it once. Another common misunderstanding is that the CIS is a one-time requirement. In reality, you must update and possibly re-file the form if there are significant changes in your financial situation or personal circumstances.

Misconception 6: Attachments are rarely required. Contrary to this belief, attachments such as tax returns, pay stubs, and documentation regarding assets are frequently essential to support the information within the form. These documents are vital for providing a clear and complete financial picture.

Misconception 7: It only pertains to divorce cases. While the CIS is commonly associated with divorce proceedings, it is also required in other family law matters, including but not limited to child support and alimony modifications, which may arise after the initial judgment.

By clarifying these misconceptions, individuals can better navigate the process of completing and submitting the NJ CIS form with accuracy and confidence, ensuring that they meet all legal requirements and adequately present their financial situation to the court.

Key takeaways

Filing the New Jersey Case Information Statement (Form CN: 10482) is an essential step in family court proceedings, particularly in divorce or custody cases. Understanding the key takeaways from this document can significantly impact the outcome of your case. Here are seven crucial points to remember:

- Timeliness and Accuracy are Crucial: This form must be completed, filed, and served with all necessary attachments within 20 days after filing an Answer or Appearance. Ensuring accuracy and submitting it on time is crucial to avoid potential dismissal of your pleadings.

- Confidentiality of Information: The Case Information Statement and its attachments are confidential, protected under specific court rules to safeguard your personal and financial information.

- Comprehensive Financial Disclosure: The form requires detailed information about your income, your spouse's or partner's income, budgets reflecting your joint and current lifestyle expenses, and assets among other financial details. These elements are vital for a fair assessment of alimony, child support, and division of assets.

- Document Attachments: You must attach relevant documents, including your most recent tax returns with all W-2 forms, 1099s, and your three most recent pay stubs. If applicable, information regarding college or post-secondary educational contributions must also be included.

- Estimates vs. Actuals: Whenever possible, provide actual figures rather than estimates, especially regarding asset values and monthly expenses. If estimates are necessary, clearly identify them as such.

- Updating the Form as Circumstances Change: If there are any significant life changes, such as moving to a new house or a substantial change in income, the Case Information Statement should be updated to reflect these changes accurately.

- Legal Representation Information: The document requires information regarding your legal representation, if applicable. This includes attorney details, office address, and contact information, highlighting the importance of legal advice and representation in managing your case effectively.

Overall, the New Jersey Case Information Statement is a fundamental document that requires careful attention to detail. By providing accurate, timely, and comprehensive information, you help ensure that your financial interests and obligations are appropriately considered throughout the court proceedings.

Popular PDF Forms

Renew Cosmetology License Ca - Address changes for personal records are simple, but remember to follow proper procedures for establishments or mobile units.

Mt 199 Swift Nedir - The MT199 form plays a crucial role in international trade and finance by securing transactions and providing a reliable method of communicating financial commitments.