Blank Nj L 8 PDF Template

The NJ L-8 form plays a crucial role for individuals dealing with the assets of decedents who were residents of New Jersey, providing a streamlined process for the release of specific non-real estate investments without navigating through the complex and time-consuming process of court probate. Designed to be utilized for assets such as New Jersey bank accounts, stocks in New Jersey corporations, brokerage accounts, and New Jersey investment bonds, it offers a clear path for executors, administrators, surviving Class A joint tenants, or Class A Payable On Death (POD) beneficiaries to access funds. The form stipulates clear guidelines on eligibility, with a focus on Class A beneficiaries, which include spouses, civil union partners, domestic partners (applying the respective legal timelines), children (inclusive of stepchildren and legally adopted children), and parents or grandparents, hence excluding non-Class A beneficiaries from its purview. Additionally, it navigates through the succession of these assets, addressing whether they pass by law, will, or intestacy, all while clarifying instances where the form cannot be used, such as when assets pass through trusts or disclaimers not directly aligned with Class A beneficiaries. With sections also dedicated to assessing the necessity of New Jersey Estate Tax and detailing the specific properties and beneficiaries involved, the form culminates with a signature section that must be notarized, alongside instructions for institutions on releasing assets. Through its comprehensive yet specific requirements, the NJ L-8 form significantly eases the administrative burden on eligible beneficiaries, facilitating a smoother transition of assets during a time that is often laden with challenges.

Preview - Nj L 8 Form

Form

Use this form for release of:

New Jersey bank accounts;

Stock in New Jersey corporations;

Brokerage accounts; and

New Jersey investment bonds.

This form cannot be used for real estate.

For real estate investments, use Form

This form can be completed by:

The executor;

Administrator;

The surviving Class A joint tenant (often a spouse or civil union partner); or

Class A Payable On Death (POD) beneficiary of the assets for which release is sought.

PART I – ELIGIBLE BENEFICIARIES: Check the box or boxes corresponding to the type of beneficiary who is receiving the assets that will be listed in Part V. If at least one of the boxes does not apply, the

document their status.

The following are considered Class A beneficiaries:

Surviving spouse;

|

Surviving civil union partner when a decedent’s death is on or after February |

, |

; |

|

Surviving domestic partner when a decedent’s death is on or after July , |

4; |

|

Child, stepchild, legally adopted child, or issue of any child or legally adopted child (includes a grandchild and a great grandchild but not a

Parent and /or grandparent.

Note: You cannot use this form to release any asset passing to a beneficiary other than the Class A beneficiaries specifically listed in Part I.

For example, the following people cannot use this form (and must file a return to receive waivers):

Sisters and brothers of the decedent;

Nieces and nephews, aunts and uncles;

Mutually acknowledged children;

(02/18)

PART II – SUCCESSION: Check the box that shows how the assets pass to the beneficiary.

Check Box a if the assets on the form pass directly to the beneficiary by operation of law. This means they were jointly held, POD, or Transfer on Death (TOD). (A copy of the will is not needed);

Check Box b if the will states that these specific assets reported on the

Check Box c if there was no will (intestate) and all the beneficiaries in the entire estate are Class A beneficiaries as listed in Part I; or

Check Box c if there was a will (testate), but there were no specific bequests and all the beneficiaries in the entire estate are one of the Class A beneficiaries listed in Part I (attach a copy of the will).

Note: If at least one of the boxes does not apply, the

PART III – TRUSTS/DISCLAIMERS: If any of the assets you wish to release pass into or through a trust, where the

trust decides how the assets are distributed, you cannot use the

cases, a full return must be filed with the Inheritance Tax Branch, even if the assets all appear to be passing to Class A beneficiaries.

NOTE: Assets that are owned by or in the name of a trust do not require a waiver or

PART IV – ESTATE TAX: This section determines whether the estate may be required to pay New Jersey Estate Tax. You must be able to answer YES to either a , b , or c) to qualify to use this form. If the decedent died on or after

January 1, 2017, but before January 1, 2018, his/her entire taxable estate must be under $2 million. If the date of death was before January 1, 2017, the entire taxable estate must be under $675,000. Even if you qualify to use this form, a return is still required if the gross estate is over $675,000. If the decedent died on or after January 1, 2018, then there is no Estate Tax.

PART V – PROPERTY: List all the assets in this institution for which you are requesting a release. If this is a bank, list each account in this bank separately. Follow the column headings for each asset. Under How held/Registered, you may enter NOD Name of Decedent if the account was in the name of the decedent alone. If it was Paid on Death POD to a person, enter POD to and the person or persons’ names (e.g., POD Jane Doe and John Doe). If it was jointly held, enter NOD and/or the beneficiary’s name.

PART VI – BENEFICIARIES: List the name of each beneficiary and his/her relationship to the decedent. The relationship must be one of the Class A beneficiaries listed in Part I of the

NOTE: Executor, Estate, and |

Beneficiary are not correct relations to the decedent in this column. You must use |

terms such as Child, Spouse, |

or Grandchild. |

SIGNATURE: This form is an affidavit and must be signed by the executor, administrator, or beneficiary, and the signature must be notarized.

PART VII – RELEASING INSTITUTION: A representative of the institution releasing the funds must verify that all questions have been answered and that the beneficiaries reported are allowed per Part I, before signing the form and releasing any assets. If you have any question as to whether you are permitted to release assets, please call the Inheritance Tax general information number at (609)

(02/18)

Form

Take or send the completed form directly to the bank or other financial institution holding the funds.

Do not mail this form to the Division of Taxation. You will not receive a waiver.

Decedent’s Name ________________________________________________________ Decedent’s SSN: _____________________________________________________

(Last) |

(First) |

(Middle) |

Date of Death (mm/dd/yy) |

/ |

/ |

County of Residence ____________________________Testate (Will) |

You must answer the following questions:

I.ELIGIBLE BENEFICIARIES: Who is receiving the assets listed on the reverse side? Check all that apply:

Intestate (No Will)

a. |

Surviving spouse; |

b. |

Surviving civil union partner when a decedent’s death is on or after February , 2007; |

c. |

Surviving domestic partner when a decedent’s death is on or after July , 2004; |

d.Child, stepchild, legally adopted child, or issue of any child or legally adopted child (includes a grandchild and a great grandchild but not a

e. Parent and /or grandparent.

e. Parent and /or grandparent.

Were you able to check at least one of the boxes above?

|

Yes |

|

No If No, this form may not be used and an Inheritance Tax return must be filed. If Yes, continue to Part II. |

II.SUCCESSION: How were the assets received? Check any that apply:

a. The beneficiary succeeded to the assets by survivorship or contract; or

b.The property was specifically devised to the beneficiary; or

c.The property was not specifically devised, but all beneficiaries under the decedent’s will or intestate

Were you able to check at least one of the boxes above?

|

Yes |

|

No If No, this form may not be used. |

NOTE: If there are any assets passing to any beneficiary other than a member of the groups listed above, a complete Transfer Inheritance Tax Return must be filed in the normal manner. It must list all assets in the estate, including any which were acquired by means of this form.

III.TRUSTS/DISCLAIMERS: Do any portion of the assets listed on the reverse side pass into a trust or pass to the beneficiary as a result of a disclaimer?

Yes |

|

No If Yes, this form may not be used. |

IV. ESTATE TAX:

a.Was the decedent’s date of death on or after January 1, 2018; or

b.Was the decedent’s date of death on or after January 1, 2017, but before January 1, 2018, and his/her taxable estate less than $2 million as determined pursuant to Section 2051 of the Internal Revenue Code (I.R.C. § 2051)*; or

c.Was the decedent’s date of death before January 1, 2017, and is his/her taxable estate plus adjusted taxable gifts $675,000 or less as determined pursuant to the provisions of the Internal Revenue Code in effect on

December 31, 2001, (Line 3 plus Line 4 on 2001 Federal Estate Tax Form 706)?

|

|

|

|

Check Yes or No based on whether a, b, or c applies. |

|

|

|

Yes |

|

No If No, this form may not be used. |

|

|

|

|

|

||

*While this form may be used if the decedent died on or after January 1, 2017 but before January , |

if the decedent’s |

||||

taxable estate is under $2 million pursuant to Section 2051 of the Internal Revenue Code, a return must still be filed if the gross estate is over $2 million.

To Be Valid, This Form Must Be Fully Completed On Both Sides

(02/18)

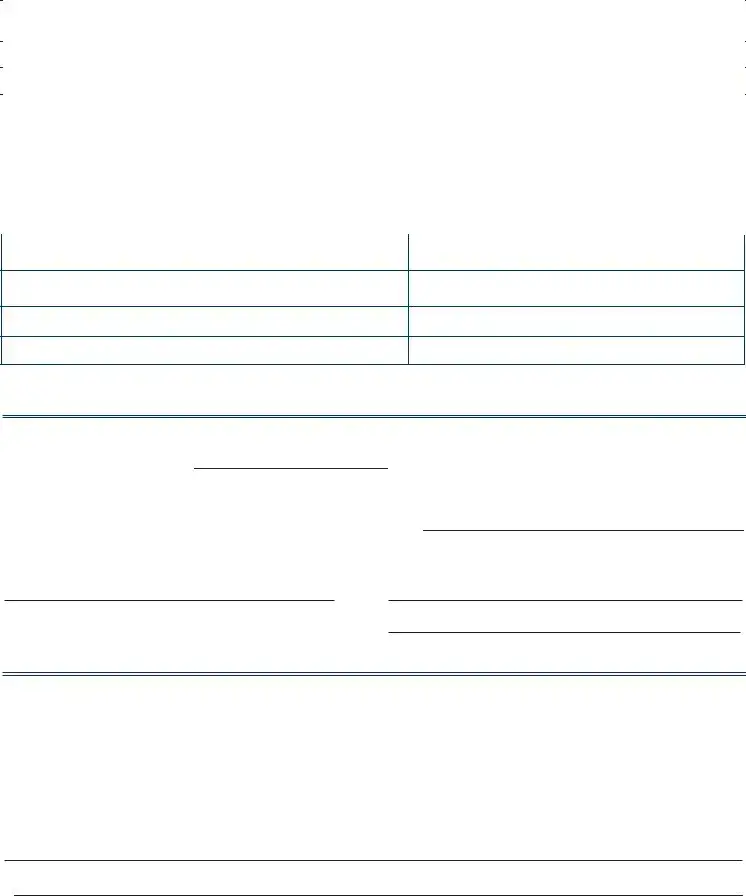

Description of Asset |

How held/Registered |

Date of Death Value* |

(Checking, Savings, CD, IRA, # of Shares, etc.) |

(Joint, POD, TOD, Individual, etc.) |

(Full Value) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relation to Decedent (Must be checked in Part I)

Town/CityState Zip

This Form Must Be Signed by the Releasing Institution Before Mailing to the Division of Taxation

VII. To Be Completed by Releasing Institution

A bank, trust company, association, other depository, transfer agent, or organization may release the assets herein set forth only if the first, second, and fourth boxes (Parts I, II and IV) on the front of this form are checked YES, the third box (Part III) is checked NO and Part VI includes only those relationships permitted in Part I, items 1 through 5. Also, if the decedent died testate and the assets do not pass by contract or survivorship, a complete copy of the will, separate writing, and all codicils must be attached.

The original of this affidavit must be filed by the releasing institution within five business days of execution with the Division of Taxation, Transfer Inheritance and Estate Tax Branch, 50 Barrack Street, PO Box 249, Trenton, NJ

Name of Institution Accepting AffidavitAddress

By__________________________________________________________________________________________________________________________________________________

Name |

Phone Number |

|

Riders May be Attached – This Form May Be Reproduced |

|

To Be Valid, This Form Must Be Fully Completed on Both Sides |

(02/18)

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The L-8 form is specifically for New Jersey resident decedents. |

| 2 | It is used for the release of non-real estate investments like New Jersey bank accounts, stock in New Jersey corporations, brokerage accounts, and New Jersey investment bonds. |

| 3 | The form cannot be used for real estate transactions. For such cases, Form L-9 is needed. |

| 4 | Eligible individuals to complete this form include the executor, administrator, surviving Class A joint tenant, or Class A Payable On Death (POD) beneficiary. |

| 5 | Class A beneficiaries are defined as surviving spouse, surviving civil union partner, surviving domestic partner, child/stepchild, legally adopted child, or parent/grandparent. |

| 6 | Succession options listed on the form include assets passed by survivorship or contract, specifically devised property, or intestate/testate without specific bequests to non-Class A beneficiaries. |

| 7 | Trusts or disclaimers affecting asset distribution restrict the use of L-8. |

| 8 | Estate tax eligibility for using L-8 varies by date of death, affecting estates with different tax thresholds for filing requirements. |

| 9 | After completion, the form should be taken or sent directly to the financial institution holding the assets, not to the Division of Taxation. |

| 10 | The form must be signed by the executor/administrator/beneficiary, notarized, and verified by the releasing institution before it can release any assets. |

Instructions on Utilizing Nj L 8

Filling out the NJ L-8 Form, known as the Affidavit for Non-Real Estate Investments for resident decedents, is a necessary step for obtaining the release of specific types of assets within New Jersey. The process involves providing detailed information about the deceased, their assets, and the eligible beneficiaries. This form is specifically tailored for non-real estate investments such as New Jersey bank accounts, stocks, brokerage accounts, and bonds. It’s crucial that the person completing the form has a clear understanding of the decedent's assets and beneficiary classifications to ensure an accurate and compliant submission. The following instructions outline the steps required to correctly fill out the form.

- Begin by determining if you, as the executor, administrator, the surviving Class A joint tenant, or Class A Payable On Death (POD) beneficiary, are eligible to complete the form.

- Under PART I – ELIGIBLE BENEFICIARIES, check the box that applies to your relationship to the decedent. If none apply, this form cannot be used.

- In PART II – SUCCESSION, check the appropriate box that describes how the assets are passed to the beneficiary. Attach a copy of the will if needed.

- For PART III – TRUSTS/DISCLAIMERS, indicate whether any assets pass into a trust or through a disclaimer. If yes, this form is not applicable.

- In PART IV – ESTATE TAX, check Yes or No after determining if the estate qualifies under the guidelines provided—we’re looking at the dates of death and taxable estate values.

- PART V – PROPERTY, list each asset separately, following the column instructions for detailed information such as account numbers, company names, value, and how it was held.

- Under PART VI – BENEFICIARIES, list the name and relationship to the decedent of each beneficiary. Make sure these relationships are eligible under PART I.

- The form requires a signature from the executor, administrator, or beneficiary in the designated section, acknowledging the affidavit's statements. The signature must be notarized.

- PART VII – RELEASING INSTITUTION is for the financial institution’s use. They must verify the form’s completeness and compliance with eligibility criteria before releasing assets. This part is to be completed by the institution, not the individual submitting the form.

- Once the form is fully completed, it should be taken or sent directly to the financial institution holding the assets for release. Do not mail this form to the Division of Taxation as it will not process waivers.

After completing these steps, the NJ L-8 Form will be in the hands of the financial institution, which will review it for compliance with the state's requirements. This process facilitates the transfer of assets to the rightful beneficiaries without the need for the assets to go through probate, provided all parts of the form are correctly completed and the eligibility criteria are met.

Obtain Answers on Nj L 8

Welcome to the FAQ section about the New Jersey Form L-8. This form, also known as the Affidavit for Non-Real Estate Investments for Resident Decedents, is an essential document for managing the assets of a deceased person in New Jersey. Below, find answers to common questions regarding this form.

- What is Form L-8?

- Who can complete Form L-8?

- Who are considered Class A beneficiaries?

- Can Form L-8 be used for real estate assets?

- How do assets pass to beneficiaries under Form L-8?

- What if the assets are meant to go into a trust or are subject to a disclaimer?

- Are there estate tax considerations with Form L-8?

- What information must be included for each asset?

- Who signs Form L-8?

- What should be done with the completed Form L-8?

Form L-8 is used to release New Jersey bank accounts, stocks in New Jersey corporations, brokerage accounts, and New Jersey investment bonds of a deceased resident. It allows for the transfer of these non-real estate assets to their rightful beneficiaries without the need for a tax waiver from the New Jersey Division of Taxation.

The executor, administrator of the estate, the surviving Class A joint tenant, or Class A Payable On Death (POD) beneficiary can complete this form for the assets they are entitled to.

Class A beneficiaries include the decedent's surviving spouse, civil union partner, domestic partner (from specific dates onward), children (including legally adopted children, stepchildren, and their descendants), and parents/grandparents.

No, Form L-8 cannot be used to release real estate assets. For those, Form L-9 is required.

Assets can pass directly by operation of law (e.g., joint accounts or POD), be specifically devised in the will, or pass through intestacy to Class A beneficiaries only.

Form L-8 cannot be used if any assets are passing into a trust (with certain exceptions for minors) or if the beneficiary is receiving the assets as a result of a disclaimer.

The form includes sections to determine eligibility based on the value of the decedent's estate and the date of death, which may affect the necessity for filing New Jersey Estate Tax returns.

For each asset, list the type (e.g., bank account, stock), how it was held (e.g., joint, POD), the full balance or value as of the date of death, and the relationship to the decedent.

The form must be signed by the executor, administrator, or beneficiary, and the signature must be notarized.

Take or send the completed Form L-8 directly to the bank or financial institution holding the assets. It should not be mailed to the Division of Taxation. The institution will then release the assets as indicated on the form.

For additional information or specific questions not covered here, beneficiaries or executors should consult the New Jersey Inheritance Tax Division or a professional legal advisor with experience in New Jersey estate and inheritance tax laws.

Common mistakes

Not checking all the eligible beneficiary boxes in Part I that apply to their situation. The form clearly states that it can only be used if assets are being released to Class A beneficiaries. If at least one applicable box is not checked, the form cannot be used. This mistake can lead to delays as it misrepresents the beneficiaries' eligibility.

Incorrectly stating how assets passed to the beneficiary in Part II. The form delineates three methods of succession: survivorship or contract, specific devise, or inheritance by Class A beneficiaries under a will or the law of intestacy. Selecting the wrong option or failing to attach a copy of the will when required can result in incomplete or incorrect information being submitted.

Attempting to use the form to release assets that pass into or through a trust, or as a result of a disclaimer, as mentioned in Part III. This is prohibited, and doing so can lead to incorrect processing of the estate's assets since such situations require a full inheritance tax return.

Failing to correctly acknowledge the estate tax requirement in Part IV. The form is only applicable under certain conditions related to the decedent's date of death and the size of the estate. Incorrect answers here could mean the form is used improperly, leading to potential tax issues.

Omitting or incorrectly listing the assets in Part V that are intended for release. Each asset needs to be listed separately with complete details as per the column headings. Failure to do this could result in incomplete release requests or the overlooking of certain assets.

In Part VI, incorrectly identifying the relationship of the beneficiary to the decedent, or listing beneficiaries not classified as Class A. This section must be filled out accurately to reflect the relationship as specified in Part I of the form. Incorrect entries here can invalidate the form, as it stipulates that only certain relationships qualify.

In summary, careful attention to detail is required when completing the NJ L-8 form to ensure accurate and timely release of the non-real estate assets of a resident decedent. Missteps can result in delays, the need to file additional paperwork, or in some cases, the inability to use the form altogether.

Documents used along the form

When navigating through the intricacies of settling a decedent's estate, particularly in New Jersey, the Form L-8 serves as a pivotal document for the release of non-real estate investments held within the state to the entitled beneficiaries. This affidavit for Non-Real Estate Investments necessitates the accompaniment of various documents to ensure a smooth and compliant transfer process. Such forms and documents complement Form L-8 by providing additional necessary details or by covering other aspects of estate settlement that Form L-8 does not address. Enumerated below are key forms and documents that frequently accompany Form L-8.

- Form L-9: Affidavit for Real Estate Investments – This form is critical for releasing New Jersey real estate assets. It is used in contrast to Form L-8 which cannot be applied for real estate holdings.

- Death Certificate: A certified copy of the decedent’s death certificate is essential for all transactions involving the estate to confirm the decedent's death.

- Form IT-R: Inheritance Tax Resident Return – Required when assets pass to beneficiaries not classified as Class A or if the estate is subject to New Jersey inheritance tax obligations beyond what Form L-8 can release.

- Form IT-NR: Inheritance Tax Non-Resident Return – Similar to Form IT-R but designed for non-resident decedents owning assets within New Jersey.

- Last Will and Testament: A complete copy of the will, including all codicils and amendments, is often required, especially if the estate distribution is guided by the stipulations within the will.

- Trust Documents: If assets are held in or are to be transferred into a trust, the relevant trust agreement and documentation outlining the trust’s terms must be supplied.

- Form 706: United States Estate (and Generation-Skipping Transfer) Tax Return – For estates that may be subject to federal estate tax, this form provides a detailed account of the estate’s federal tax obligations.

- Notarization: Notarized signatures on relevant documents, including Form L-8, authenticate the identity of the signatories, ensuring that the submissions are legitimate and accepted by financial institutions and the New Jersey Division of Taxation.

The appropriate collection and submission of these documents, in conjunction with Form L-8, streamline the process of asset release from New Jersey bank accounts, stocks, brokerage accounts, and investment bonds owned by the decedent. Each document plays a vital role in painting a comprehensive picture of the decedent's estate and guarantees that the transfer of assets to beneficiaries is conducted in compliance with New Jersey laws and regulations. Adequate preparation and understanding of these forms can significantly ease the administrative burden on executors and administrators in fulfilling their duties towards the estate and its lawful heirs.

Similar forms

The Form L-9 for Real Estate Investments is similar to the Form L-8, but specifically designed for releasing New Jersey real estate held by the deceased. While the L-8 focuses on non-real estate investments, the L-9 handles property matters, albeit both forms facilitate asset transfers post-death without the need for a full probate process.

Transfer on Death (TOD) Registration forms are akin to the Form L-8 in that they both allow for the direct transfer of assets to beneficiaries upon death, bypassing the complex probate process. TOD forms apply to securities and brokerage accounts, similar to some assets covered by the L-8.

The Payable on Death (POD) designation forms used by banks and financial institutions share similarities with the L-8 by permitting bank accounts and other assets to transfer to a designated beneficiary upon the account holder's death, thereby avoiding probate.

Joint Tenancy with Right of Survivorship agreements share the L-8’s aim of facilitating asset transfers outside of probate. When one joint tenant dies, the surviving joint tenant(s) automatically own the property by right of survivorship, a principle applicable to some assets managed through the L-8 form.

The Small Estate Affidavit is somewhat similar to the L-8 as it's another legal document used to manage the distribution of a deceased person's estate without formal probate, though it's primarily used when the total estate falls below a certain threshold and includes various types of assets, not just those specified in the L-8.

Executor’s or Administrator’s Deeds for transferring real estate from a decedent’s estate to a beneficiary parallel the essence of the L-8, albeit for real estate. While Executor’s or Administrator’s Deeds deal directly with property, the spirit of bypassing lengthy probate procedures aligns with the intention behind the L-8 form.

Dos and Don'ts

When it comes to handling the NJ L-8 form, an Affidavit for Non-Real Estate Investments for resident decedents, navigating the process correctly is critical. Here are essential do's and don'ts to help avoid common mistakes and ensure the form is completed accurately.

- Do read through the entire form before starting to fill it out to understand all the requirements and information you need to gather.

- Do ensure that the decedent's assets qualify for release via this form by verifying they are New Jersey bank accounts, stocks in New Jersey corporations, brokerage accounts, or New Jersey investment bonds.

- Do confirm the eligibility of the beneficiaries as Class A beneficiaries—this includes surviving spouses, civil union partners (for deaths on or after February 19, 2007), surviving domestic partners (for deaths on or after July 10, 2004), children (including legally adopted children, but not stepchildren), and parents/grandparents.

- Do accurately indicate how the assets are passing to the beneficiary, whether directly, through a will, or intestate (without a will), checking the correct box in Part II – SUCCESSION.

- Do attach a copy of the will if the assets reported on the L-8 form pass to a particular named beneficiary as per the will’s instructions.

- Do not use Form L-8 if any of the assets pass into or through a trust, as trusts generally require a full return to be filed with the Inheritance Tax Branch.

- Do not attempt to use this form for releasing assets to beneficiaries other than Class A beneficiaries. Assets passing to others, like siblings, nieces/nephews, ex-spouses, etc., require filing a Transfer Inheritance Tax Return.

- Do not forget to list all assets seeking release in Part V – PROPERTY. Each asset must be listed separately, indicating how it was held or registered.

- Do not overlook the requirement to have the form signed by the executor, administrator, or beneficiary in the presence of a notary. Ensure the signature is notarized to validate the affidavit.

- Do not mail this form to the Division of Taxation. It should be taken or sent directly to the financial institution holding the funds for the release of the assets.

Accurately completing the NJ L-8 form is crucial for the timely and efficient release of non-real estate assets belonging to a deceased resident's estate. Paying careful attention to the form's specific instructions and eligibility criteria can streamline the process, helping to avoid delays or complications. Always double-check entries for accuracy and completeness to ensure that all legal and procedural requirements are met.

Misconceptions

Understanding the intricacies of estate planning and asset distribution can be complex, particularly in the context of New Jersey's tax laws and forms such as the Form L-8. This form, officially titled "Affidavit for Non-Real Estate Investments: Resident Decedents," is commonly misunderstood in several respects. By clarifying these misconceptions, individuals can navigate the process more effectively, ensuring a smoother transfer of assets and compliance with state requirements.

First Misconception: The Form L-8 Can Release Any Type of Asset.

Many people mistakenly believe that the Form L-8 is a one-size-fits-all solution for releasing a decedent's assets. However, it's designed specifically for non-real estate investments within New Jersey, such as bank accounts, stocks in New Jersey corporations, brokerage accounts, and New Jersey investment bonds. Real estate or assets outside these categories require different forms and processes.

Second Misconception: The Form L-8 Applies to All Beneficiaries.

It's incorrect to assume that any beneficiary can use Form L-8 to gain access to a decedent's assets. The form is strictly limited to Class A beneficiaries, which include the surviving spouse, civil union partner (for deaths on or after February 19, 2007), surviving domestic partners (for deaths on or after July 10, 2004), children (including legally adopted ones), parents, and grandparents. Other potential beneficiaries, such as siblings, nieces, nephews, and ex-spouses, are not eligible to use this form.

Third Misconception: The Form L-8 Automatically Transfers Assets.

While the Form L-8 is an important step in releasing certain assets without necessitating an Inheritance Tax waiver, merely completing and submitting it does not automatically transfer the assets to beneficiaries. The institution holding the assets needs to process the form, and there may be additional steps and documentation required to complete the transfer.

Fourth Misconception: Any Executor or Administrator Can Complete the Form L-8.

Though executors and administrators are typically responsible for handling a decedent's estate, the Form L-8 specifies that only those acting on behalf of Class A beneficiaries can complete it. This limitation ensures that the form is used correctly and aligns with New Jersey's inheritance laws, emphasizing direct, eligible relations to the decedent.

Fifth Misconception: The Form L-8 Clears All Tax Obligations.

Some may believe that by using the Form L-8, they've met all the necessary tax obligations for the disposition of the decedent's assets. However, this form is primarily concerned with the release of specific non-real estate assets without an Inheritance Tax waiver. Depending on the size of the estate and the assets involved, there may still be Estate Tax considerations, and a separate Estate Tax return might be required if the gross estate exceeds certain thresholds.

In conclusion, when dealing with the distribution of a decedent's assets in New Jersey, it's crucial to understand the specific purposes and limitations of the Form L-8. This ensures not only compliance with state laws but also helps in the efficient and correct transfer of assets to eligible beneficiaries.

Key takeaways

When dealing with the transfer of assets for a New Jersey resident who has passed away, the Form L-8, titled "Affidavit for Non-Real Estate Investments: Resident Decedents," is used specifically for releasing assets such as New Jersey bank accounts, New Jersey corporation stocks, brokerage accounts, and New Jersey investment bonds. It is crucial to understand this form’s specific use and its limitations to ensure proper handling of the decedent's estate.

Only certain individuals can fill out Form L-8. These include the executor of the will, the administrator of the estate, the surviving Class A joint tenant, or a Class A Payable On Death (POD) beneficiary. Recognizing who is authorized to manage the form is the first step to correctly navigating the process.

The form outlines strict guidelines regarding beneficiaries. Only assets passing to Class A beneficiaries can be released using Form L-8. Class A beneficiaries include a surviving spouse, surviving civil union partner (for deaths on or after February 19, 2007), surviving domestic partners (for deaths on or after July 10, 2004), children (including legally adopted children, stepchildren, and their descendants), and parents/grandparents. Assets intended for any other relative or party require a different process involving an Inheritance Tax return.

Succession of assets must be clearly documented in Part II of the Form L-8. It is essential to indicate how the assets are passing to the beneficiary—whether by survivorship, according to the decedent’s will, or due to the absence of a will—and ensure all beneficiaries are Class A.

If the assets in question are handled through a trust or are subject to a disclaimer, Form L-8 cannot be used. This is a critical consideration for estates where trusts were set up prior to the decedent's passing or in instances where disclaimers affect how assets are distributed.

Estates with varying tax requirements need careful attention. Depending on the date of the decedent's death, the estate may or may not be subject to New Jersey Estate Tax. This tax aspect influences whether Form L-8 can be utilized, with distinctive criteria set for deaths occurring before and after specific dates.

Proper completion and submission of the form are essential. After filling out the form, it should be sent directly to the financial institution holding the decedent's assets—not the Division of Taxation. The individual completing the form must ensure it is fully and accurately completed to avoid delays in the asset release process.

In summary, Form L-8 offers a streamlined process for transferring certain non-real estate assets of a deceased New Jersey resident to appropriate Class A beneficiaries. Understanding who can complete the form, which beneficiaries qualify, how succession is determined, and the tax implications ensures that the form is used correctly. Proper completion and direct submission to the relevant financial institution facilitate the smooth transfer of assets, honoring the decedent's intentions and complying with New Jersey law.

Popular PDF Forms

How to Write a Landscaping Contract - Various fertilization options are available for different plant types, ensuring optimal growth and bloom throughout the seasons.

Nj Reg - Highlights the potential transfer of unemployment experience from a predecessor to a successor business under certain conditions.