Blank Notice Of Right To Cure Auto Loan Letter PDF Template

When an individual falls behind on their auto loan payments, navigating the next steps can be fraught with uncertainty and anxiety. However, one key document, the Notice of Right to Cure Auto Loan Letter form, stands out as a beacon of hope during such financially turbulent times. It is tailored to adhere to specific state regulations, exemplified by its reference to the Nebraska Revised Statutes §§ 45-1050 and 45-1051 (Reissue 2010) in this context. This notice serves as a formal communication to the borrower, signifying that they have defaulted on their loan for a period of at least ten days. More importantly, it outlines the borrower's entitlement to rectify this default by fulfilling a specified payment within a twenty-day grace period. The document meticulously outlines how and where the payment should be made, providing critical details such as the payee's name, address, and the exact amount due. Additionally, it gives a stern warning about the consequences of failing to remedy the situation, including potential cancellation of any credit insurance associated with the loan and a caution that future defaults may prompt actions without further notice. This introduction not only establishes the importance of the Notice of Right to Cure Auto Loan Letter but also underscores its role in offering a structured opportunity for borrowers to regain their financial standing and avoid further complications with their vehicle financing arrangements.

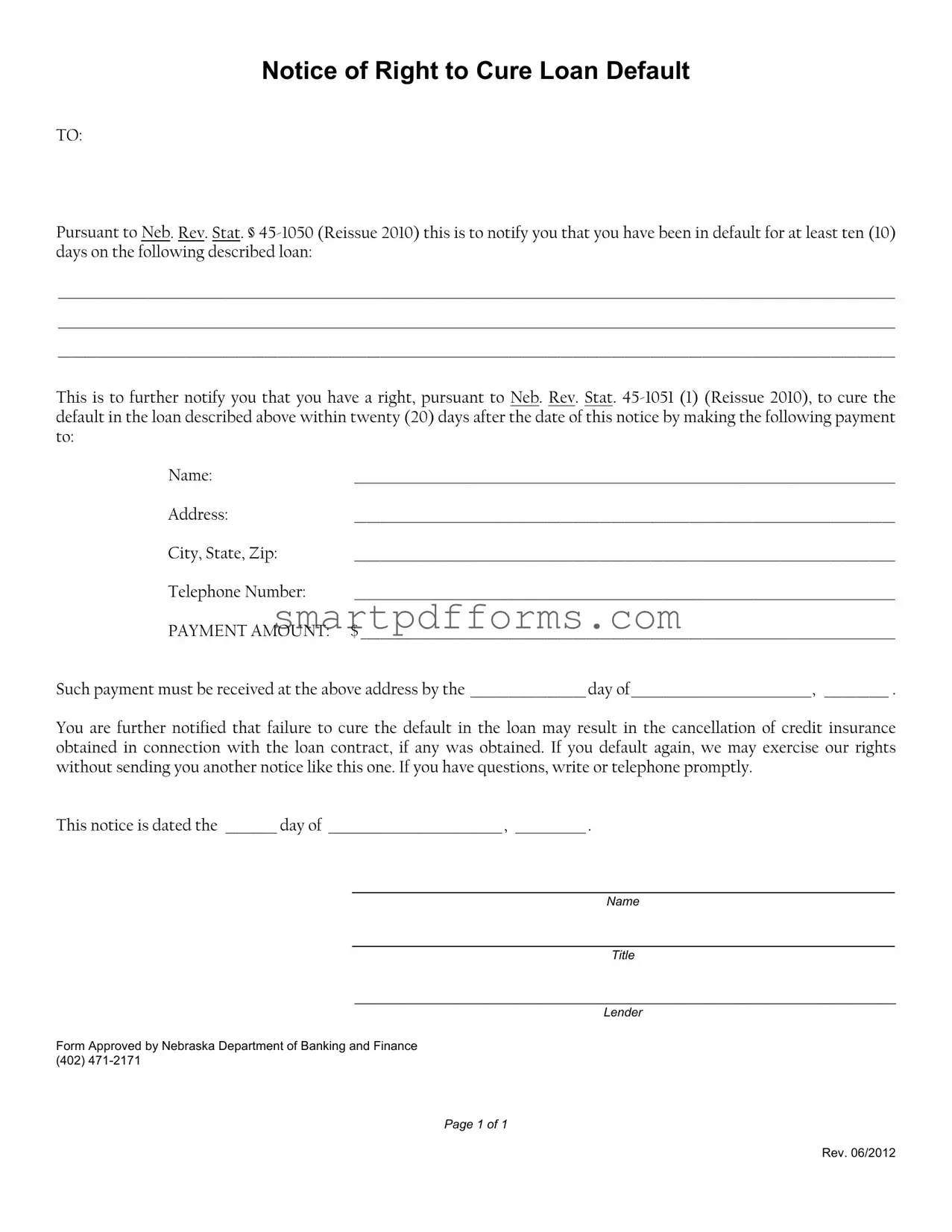

Preview - Notice Of Right To Cure Auto Loan Letter Form

Notice of Right to Cure Loan Default

TO:

Pursuant to Neb. Rev. Stat. §

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

This is to further notify you that you have a right, pursuant to Neb. Rev. Stat.

Name: |

____________________________________________________________________________________ |

Address: |

____________________________________________________________________________________ |

City, State, Zip: |

____________________________________________________________________________________ |

Telephone Number: |

____________________________________________________________________________________ |

PAYMENT AMOUNT: |

$ ___________________________________________________________________________________ |

Such payment must be received at the above address by the __________________ day of____________________________, __________ .

You are further notified that failure to cure the default in the loan may result in the cancellation of credit insurance obtained in connection with the loan contract, if any was obtained. If you default again, we may exercise our rights without sending you another notice like this one. If you have questions, write or telephone promptly.

This notice is dated the ________ day of ___________________________, ___________ .

_________________________________________________________

Name

_________________________________________________________

Title

__________________________________________________________

Lender

Form Approved by Nebraska Department of Banking and Finance (402)

Page 1 of 1

Rev. 06/2012

Form Data

| Fact Number | Description |

|---|---|

| 1 | The Notice of Right to Cure Auto Loan Default is governed by Nebraska law, specifically Neb. Rev. Stat. §§ 45-1050 and 45-1051 (Reissue 2010). |

| 2 | This notice is required when a borrower has been in default for at least ten days on their auto loan. |

| 3 | It provides the borrower with a 20-day period from the date of the notice to cure, or fix, the loan default. |

| 4 | The notice must include the amount required to cure the default and instructions on how to make the payment. |

| 5 | If the default is not cured within the specified time, the borrower risks cancellation of any credit insurance obtained with the loan contract. |

| 6 | Future defaults may lead to the lender exercising their rights without sending another notice. |

| 7 | The notice must include contact information for the borrower to ask questions or clarify details. |

| 8 | The form used for the notice must be approved by the Nebraska Department of Banking and Finance and bears the revision date of June 2012. |

Instructions on Utilizing Notice Of Right To Cure Auto Loan Letter

When you miss a payment on your auto loan, your lender must send you a Notice of Right to Cure before they can take further action. This document offers you the opportunity to fix the problem by paying off what you owe. If you're faced with filling out a Notice of Right to Cure Auto Loan Letter form, it's crucial to complete it accurately to protect your rights and potentially avoid harsher consequences. Follow these steps to fill it out correctly.

- At the top of the form, where it says "TO:", fill in your full name as it appears on your loan agreement.

- In the long space provided under the loan default description, specify the details of your loan. Include the loan number, the date the loan was taken out, and the vehicle's make, model, and year.

- Next, under the section that requests the payment to cure the default, fill in the contact details of the lender. This includes the name of the representative handling your case, their address, city, state, zip code, and telephone number.

- Write the exact payment amount needed to cure the default where it says "PAYMENT AMOUNT:".

- Read carefully through the dates provided. You must send your payment by the specified date to cure the loan default. Fill in the due date for your payment in the spaces provided.

- At the bottom of the form, make sure to fill in the date when the notice is issued next to "This notice is dated the" line.

- Sign your name where it says "Name" under the signature space at the bottom of the form. Then, next to it, write your title or your role, if applicable. This could simply be "Borrower" if you're filling this out from your perspective.

- Lastly, provide the name of the lender in the line designated for it, ensuring it matches the name listed at the beginning of the document under the payment section.

After completing the Notice of Right to Cure Auto Loan Letter, review it thoroughly for any errors or omissions. Remember, this document is vital for maintaining your rights and avoiding further issues with your loan. Once completed, send it promptly to the address listed on the form, adhering to the specified deadline. Timely action can make a significant difference in resolving your loan default situation.

Obtain Answers on Notice Of Right To Cure Auto Loan Letter

What is a Notice of Right to Cure Auto Loan Letter?

A Notice of Right to Cure Auto Loan Letter is a formal communication from a lender to a borrower indicating that the borrower is in default on their auto loan. According to Nebraska Revised Statute § 45-1050 (Reissue 2010), it informs the borrower that they have defaulted on their loan for at least ten days. The letter outlines the borrower's right, under Neb. Rev. Stat. 45-1051 (1) (Reissue 2010), to rectify the default within twenty days from the date of the notice by making a specified payment. It includes the payment amount needed to cure the default and the lender's contact information.

What happens if I do not respond to the Notice of Right to Cure within the twenty-day period?

If you fail to address the default by making the required payment within the twenty-day period specified in the letter, the lender may proceed with further actions against you. This could include the cancellation of any credit insurance policies associated with the loan agreement and potentially moving forward with repossession of the vehicle. It's important to act promptly to avoid these consequences.

Can I make partial payments to cure my loan default?

The Notice of Right to Cure specifically requires the indicated payment amount to be made in full by a certain deadline to cure the loan default. Partial payments are not typically accepted as a means to cure the default under the terms outlined in the notice. To effectively address the situation, the full amount specified in the notice must be paid by the given deadline.

What should I do if I cannot afford to cure the loan default within the twenty-day period?

If you find yourself unable to make the full payment to cure the default, it's critical to communicate with your lender immediately. Lenders may be willing to discuss alternative arrangements or payment plans that can help you avoid further legal action or repossession. Don't wait until the deadline is near; contact your lender as soon as you receive the notice.

Is a Notice of Right to Cure Auto Loan Letter only applicable in Nebraska?

While the form mentioned references Nebraska Revised Statutes, the concept of a notice of right to cure is present in many jurisdictions across the United States, though specific laws and requirements may vary from state to state. It's important to consult local laws or a legal professional to understand how these notices are handled in your specific jurisdiction.

What should I do if I have questions about the Notice of Right to Cure Auto Loan Letter?

If you have any questions or need clarification about the Notice of Right to Cure Auto Loan Letter, it's advisable to contact the lender directly using the contact information provided in the notice. Prompt communication can help avoid misunderstandings and may provide an opportunity to discuss any concerns or negotiate alternative arrangements. Additionally, seeking advice from a legal professional can offer further guidance on how to proceed.

Common mistakes

Filling out the Notice of Right to Cure Auto Loan Letter form involves careful attention to detail. This document is critical for both the lender and borrower, as it outlines the steps necessary to address and resolve a loan default. Mistakes in this process can lead to misunderstandings, delays, and missed opportunities for rectification. Let's explore some common errors people make when completing this form.

- Not reading the instructions carefully: It is crucial to understand every aspect of the form, including statutory references and requirements. Skipping this step can lead to overlooking important details.

- Incomplete descriptions of the loan: Being vague or omitting details about the loan can create confusion. It's important to clearly identify the loan in question to avoid any ambiguity regarding what the notice pertains to.

- Incorrect payment amount: Entering the wrong amount to cure the default could either lead to further defaults or overpayments. It's essential to double-check the exact sum required to rectify the situation.

- Misidentifying the recipient: The notice needs to reach the right person to give them the opportunity to cure the default. Mislabeling or not specifying the recipient correctly can result in the notice not fulfilling its purpose.

- Failing to specify the deadline clearly: The form requires the borrower to make a payment by a specific date. Any ambiguity in this deadline can lead to disputes over whether the default has been cured in a timely manner.

- Leaving contact information incomplete: If the recipient has questions or needs clarification, they must know how to reach the sender. Omitting or inaccurately providing contact information hampers communication.

- Not addressing the potential cancellation of credit insurance: If credit insurance was obtained with the loan, the borrower must be informed about how defaulting affects this insurance. Overlooking this detail can lead to uninformed decisions.

- Forgetting to date and sign the form: An undated or unsigned form could be considered invalid. This final step is crucial for the document's legitimacy and enforceability.

When it comes to managing financial agreements, precision is key. Simple oversights in filling out forms like the Notice of Right to Cure Auto Loan Letter can easily compound, leading to further financial jeopardy. Attention to detail not only ensures compliance with the proper procedures but also fosters a clearer understanding between lenders and borrowers, which is essential for resolving defaults effectively.

Documents used along the form

When dealing with auto loans and the potential for default, there are several important documents besides the Notice of Right to Cure Auto Loan Letter that parties involved should be familiar with. These documents play critical roles throughout the loan lifecycle, from the initiation of a loan to addressing defaulting issues. Having a comprehensive understanding of these documents can help borrowers prepare better and potentially avoid financial pitfalls.

- Loan Agreement: This is the primary document that outlines the terms and conditions of the auto loan. It includes interest rates, repayment schedule, collateral details (if any), and the rights and responsibilities of both the borrower and the lender.

- Payment History Record: A document detailing each payment made by the borrower, including the date, amount, and any late fees incurred. It helps both parties track the progress of the loan repayment and identify any discrepancies.

- Late Payment Notice: A communication from the lender to the borrower notifying them of a missed payment and the potential consequences of such action. It often precedes more formal default notices.

- Loan Modification Agreement: If a borrower is facing financial hardship, this document outlines adjustments made to the original loan agreement to make the repayment terms more manageable. Modifications might include extending the loan term, reducing the interest rate, or changing the monthly payment amount.

- Repossession Notice: Should the borrower fail to cure the default, this notice informs them of the lender's intent to repossess the collateral vehicle as per the agreement's terms.

- Deficiency Balance Notice: After the repossession and sale of the collateral vehicle, if the proceeds from the sale do not cover the outstanding loan balance, this document notifies the borrower of the remaining amount they owe.

Understanding these documents, their purposes, and their implications can significantly impact a borrower's ability to successfully navigate through the auto loan process and address any issues that arise. Being well-informed can help borrowers take timely actions to rectify defaults and maintain their financial stability.

Similar forms

Notice of Default on Mortgage: This document bears similarity to the "Notice of Right to Cure Auto Loan Letter" in that it informs the borrower of a default on their mortgage payment obligations and provides them with a specified period to rectify the default before further legal action can be taken. Both documents serve as a formal reminder and offer a chance to avoid the escalation of the situation.

Payment Demand Letter: Similar in its intent to prompt action from the debtor, the Payment Demand Letter is used in various financial contexts to request overdue payments. While it may not pertain to a specific statute like the Nebraska Rev. Stat. sections mentioned in the auto loan letter, it similarly outlines the amount due and the consequences of nonpayment.

Past Due Invoice Notice: Often used in commercial transactions, this notice informs recipients that an invoice has not been paid by the due date. Like the auto loan letter, it emphasizes the need for prompt payment to avoid further consequences and maintains the business relationship by offering a final opportunity to settle the account.

Loan Modification Agreement Letter: This document is another form of communication between lender and borrower, where modifications to the original loan terms are proposed and agreed upon. Similar to the auto loan letter, it indicates a willingness to avoid foreclosure or repossession by adjusting the terms of the loan, focusing on curing a breach and maintaining the contract.

Credit Card Delinquency Letter: Credit card issuers often send out delinquency letters to cardholders who fail to make the minimum required payment on their accounts. These letters, like the "Notice of Right to Cure", inform the debtor of their default status and provide a specified timeframe for curing the default to prevent account closure or further penalties.

Foreclosure Notice: This legal notice is sent to a homeowner indicating that the process of foreclosure on their home has begun due to non-payment of the mortgage. It aligns with the auto loan cure letter by notifying the debtor of the legal action that will be taken should the default not be cured within a given period, thereby offering a window to prevent loss of property.

Dos and Don'ts

When dealing with the Notice Of Right To Cure Auto Loan Letter form, it's essential to navigate through the process with a clear understanding of what to do and what to avoid. The following guidelines are designed to assist you in filling out the form correctly, ensuring your rights are protected while adhering to legal procedures.

What You Should Do:- Read the entire form carefully before starting to fill it out. Ensure you understand every section and what is required of you.

- Use black ink for filling out the form to ensure legibility and to comply with standard legal document requirements.

- Fill out the form with accurate and up-to-date information. Double-check the details of the loan described to avoid any discrepancies.

- Review the form for errors. After completing it, carefully go through each section to correct any mistakes.

- Make the payment as instructed before the deadline to cure the default. Consider using a method that provides proof of payment, such as a check or online transfer where you get a receipt.

- Contact the lender promptly if you have any questions or need clarification on how to cure the default effectively.

- Keep a copy of the completed form and any correspondence related to curing the default. This documentation can be important if there are any disputes.

- Do not ignore the notice. Failing to respond can lead to further legal action and loss of rights concerning your loan.

- Do not utilize a pencil or any erasable pen, as changes can be seen as tampering or create issues with legibility.

- Do not leave any fields blank. If a section does not apply, write “N/A” to indicate that it's not applicable to your situation.

- Avoid making assumptions about what is required for curing the default. If anything is unclear, reach out to the lender for guidance.

- Do not delay in making the necessary payment to cure the default. Missing the deadline can result in additional penalties or action against you.

- Do not submit the form without retaining a copy for your records. It's crucial to have a personal record of all communications and actions taken.

Filling out the Notice Of Right To Cure Auto Loan Letter form attentively and correctly is an important step in managing your auto loan and safeguarding your financial health. Taking the right steps and avoiding common mistakes can help streamline the process, reduce stress, and ultimately resolve the situation in your favor.

Misconceptions

When dealing with auto loans and the potential of default, it's crucial to understand the rights and obligations both lenders and borrowers have. The Notice of Right to Cure Auto Loan Default is a formal communication from a lender to a borrower that highlights a default in the loan repayments. Unfortunately, there are several misconceptions about this process that can lead to confusion and stress for borrowers. Here are seven common misconceptions explained:

- Any Auto Loan Agreement Doesn't Need a Cure Notice. Many people mistakenly believe that lenders are not required to send a notice of right to cure before taking action against defaults. However, as per certain state laws, such as Neb. Rev. Stat. 45-1050, lenders are indeed required to notify borrowers, giving them an opportunity to rectify the default before further actions like repossession are initiated.

- Receiving a Notice Means Instant Repossession. Another common misconception is that once a notice of right to cure is received, repossession is immediate. In reality, the notice serves to provide the borrower with a final opportunity to cure the default—typically within 20 days from the notice date—thereby possibly avoiding repossession.

- Payment Amounts Are Non-Negotiable. Borrowers often assume the payment amount listed in the notice is fixed and non-negotiable. While the notice will specify an amount necessary to cure the default, borrowers have the right to discuss their situation with the lender. There may be room for negotiation based on the lender's policies and the borrower's circumstances.

- No Further Notice Required for Subsequent Defaults. A section of the notice warns that upon future defaults, the lender may not provide another notice before exercising their rights. This doesn't mean the lender will automatically move to repossession without any notice but that the future process may not involve the specific right to cure notice again.

- The Notice Is Only a Formality. Some view the notice as just a formal step without real significance. This view underestimates the importance of the notice, which legally protects the borrower's rights and provides a critical opportunity to address and resolve the loan default before more severe consequences occur.

- Cancellation of Credit Insurance Is Immediate. The notice includes a warning about the potential cancellation of credit insurance linked with the loan contract upon failure to cure the default. It is often misconstrued that this cancellation is immediate upon receipt of the notice. In fact, the cancellation will only be processed if the default is not rectified within the stipulated time frame.

- All States Require a Notice of Right to Cure. Many assume that all states have laws requiring lenders to send a notice of right to cure to borrowers before proceeding with repossession. The requirement is specific to certain states, like Nebraska per its statutes, and not a universal legal standard across the United States.

Understanding these facts about the Notice of Right to Cure Auto Loan Letter form and the misconceptions surrounding it can empower borrowers to better navigate potential loan default situations. It's essential for borrowers to fully comprehend their rights and the procedures involved to make informed decisions and take appropriate actions when faced with financial hardships.

Key takeaways

Filling out and using the Notice Of Right To Cure Auto Loan Letter form requires thoroughness and precision. Here are six key takeaways for anyone using this form:

- Understanding the Purpose: The notice serves to inform borrowers that they have defaulted on their auto loan but have a chance to remedy the situation within a specified period.

- Legal Requirements: This form complies with specific Nebraska statutes, indicating that the rules may vary by state. It's essential to ensure the form meets the legal requirements of the relevant jurisdiction.

- Details of the Default: The form requires detailed information about the loan default, including the specific terms and conditions that have not been met. Accuracy in filling out this section is crucial.

- Right to Cure: The form outlines the borrower's right to cure the default, including the exact amount due and the deadline for making the payment. Understanding the implications of this section can help avoid further legal action.

- Consequences of Non-Compliance: The notice clearly states the potential consequences of failing to cure the default, such as the cancellation of credit insurance (if applicable) and the possibility of not receiving future notices before rights enforcement actions are taken.

- Contact Information: It is mandatory to provide the lender’s contact information. This offers a clear avenue for communication, allowing borrowers to ask questions or express concerns regarding their situation.

It is essential for both lenders and borrowers to handle the Notice Of Right To Cure Auto Loan Letter form with attention to detail. Ensuring all the information is correct and understanding the available rights and obligations can help manage the default situation effectively, potentially avoiding more severe financial consequences.

Popular PDF Forms

Fs Form 1048 - FS Form 1522's instructions on where to mail completed forms include a reminder not to send legal documents or evidence to the forms management office.

How to Get Official College Transcripts - By requesting a transcript, former students of Bauder College can showcase their academic achievements to prospective employers.