Blank Nvar Rental Application PDF Template

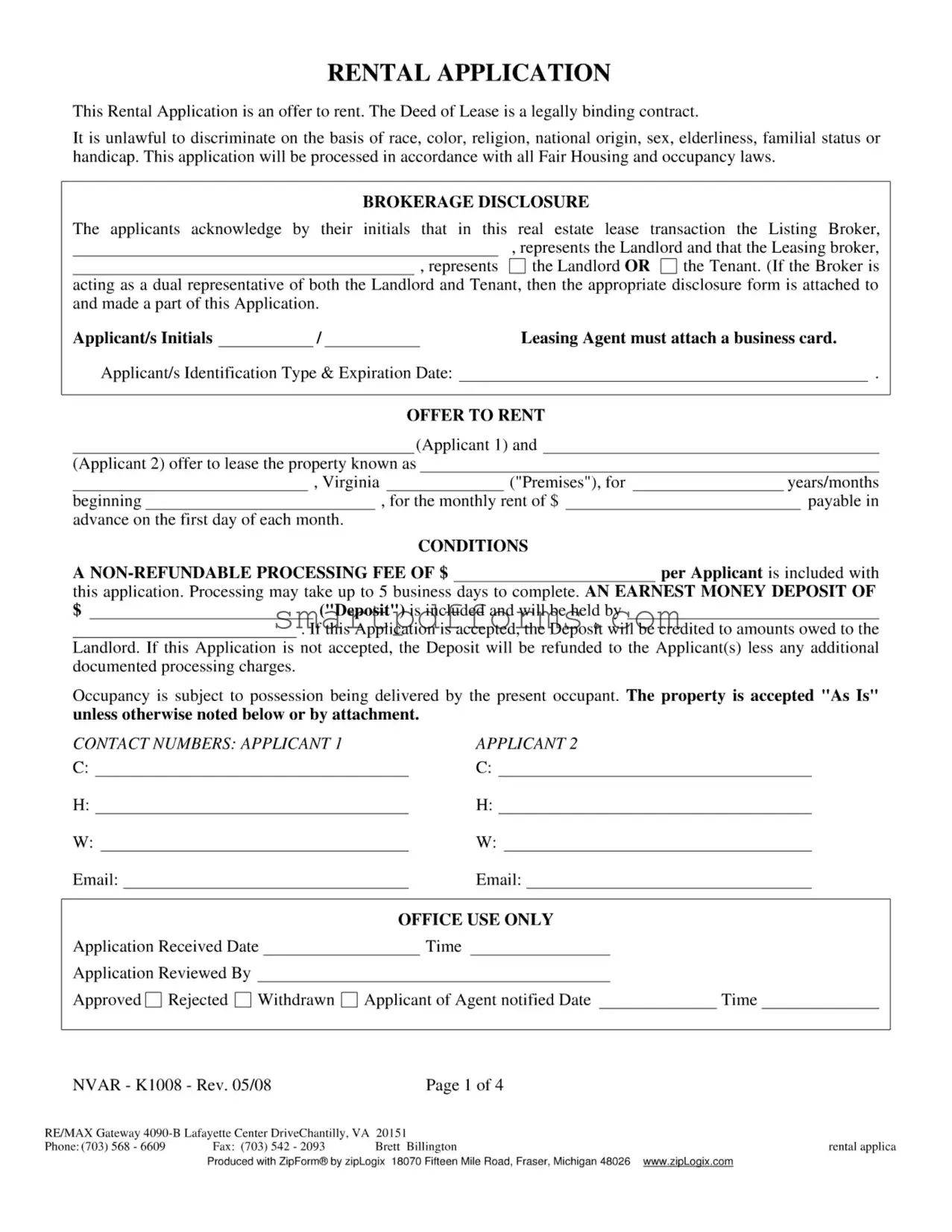

The Nvar Rental Application form serves as a gateway for potential tenants to express their interest in renting a property, laying the groundwork for a legally binding lease agreement. Crafted with care to comply with Fair Housing and occupancy laws, this document ensures that discrimination is not part of the rental process on the basis of race, color, religion, national origin, sex, elderliness, familial status, or handicap. As part of the application, applicants are informed about the brokerage disclosure, clarifying who represents the landlord and tenant, potentially including dual representation disclosures if applicable. This comprehensive application not only facilitates the offer to rent a specified property in Virginia but also outlines the conditions tied to the application process, such as non-refundable processing fees, an earnest money deposit, and the acceptance of the property "As Is." Moreover, it emphasizes the requirement for applicants to provide proof of income, obtain renter’s insurance, and assume responsibility for utility accounts and any associated move-in fees or deposits. Ensuring thoroughness, applicants must complete a detailed form that includes personal information, rental history, employment details, and additional income, accompanied by a segment addressing pet ownership and vehicle information. This meticulous approach is aimed at providing landlords with a comprehensive understanding of the applicant’s background, thereby facilitating an informed decision-making process.

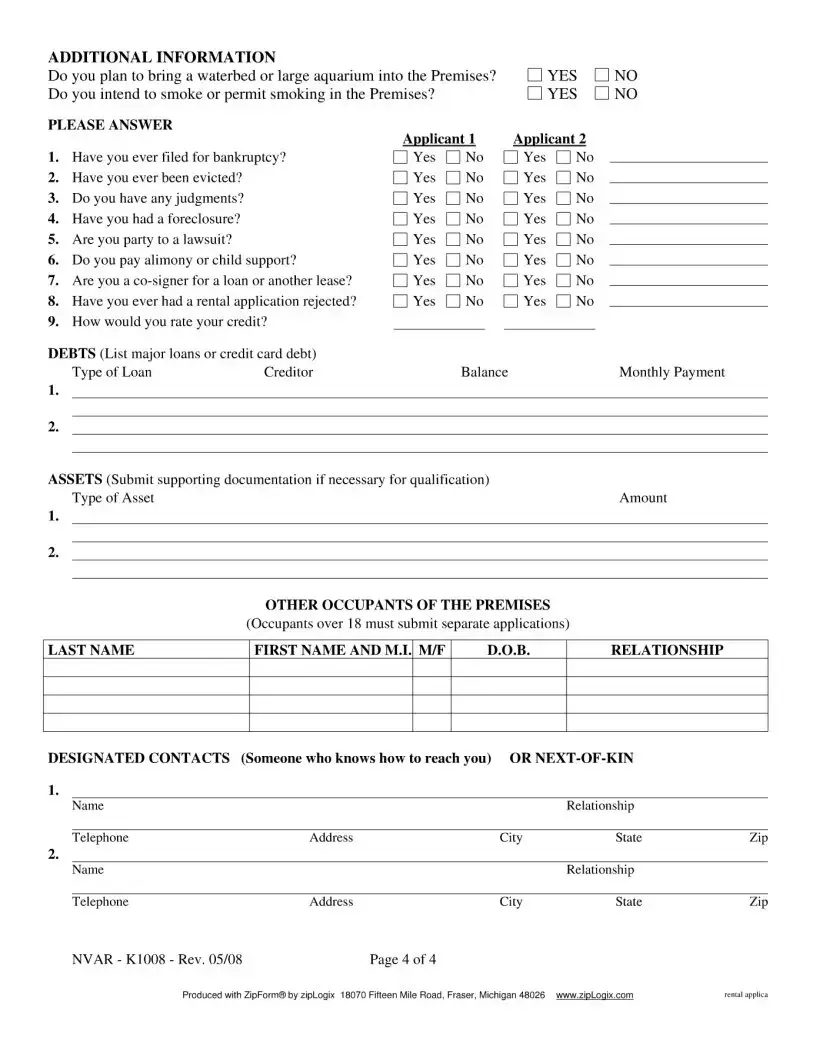

Preview - Nvar Rental Application Form

Form Data

| Fact Name | Detail |

|---|---|

| Form Purpose | The Nvar Rental Application form is designed to offer to rent a property, initiating a process that may lead to a legally binding Deed of Lease. |

| Non-Discrimination Clause | It specifies that discriminating on the basis of race, color, religion, national origin, sex, elderliness, familial status, or handicap is unlawful, aligning with Fair Housing and occupancy laws. |

| Brokerage Disclosure | Applicants must acknowledge the role of listing and leasing brokers in the real estate lease transaction, whether they represent the landlord, the tenant, or both as dual representatives. |

| Financial Terms | Includes stipulations about a non-refundable processing fee, an earnest money deposit, and outlines conditions for refund or credit of the deposit based on application acceptance. |

Instructions on Utilizing Nvar Rental Application

Filling out the NVAR Rental Application form is a crucial step in applying for a rental property in Virginia. This form helps landlords evaluate whether an applicant is a suitable candidate for their property. It requires detailed information about the applicants, including personal, employment, and previous rental history. It is important to fill out this form accurately and completely to help facilitate a smooth application process. Here are the steps to complete the application:

- Start by entering the full names of both applicant 1 and applicant 2 in the "OFFER TO RENT" section, along with the address of the property you wish to rent in Virginia.

- Fill in the proposed lease start date, the length of the lease, and the monthly rent amount.

- Under the "CONDITIONS" section, note the non-refundable processing fee per applicant and the earnest money deposit amount, including who will hold the deposit.

- Provide contact numbers and email addresses for both applicants in the designated "CONTACT NUMBERS" section.

- Initiate in the "BROKERAGE DISCLOSURE" section to acknowledge which party the broker represents.

- Enter the applicant/s identification type and expiration date.

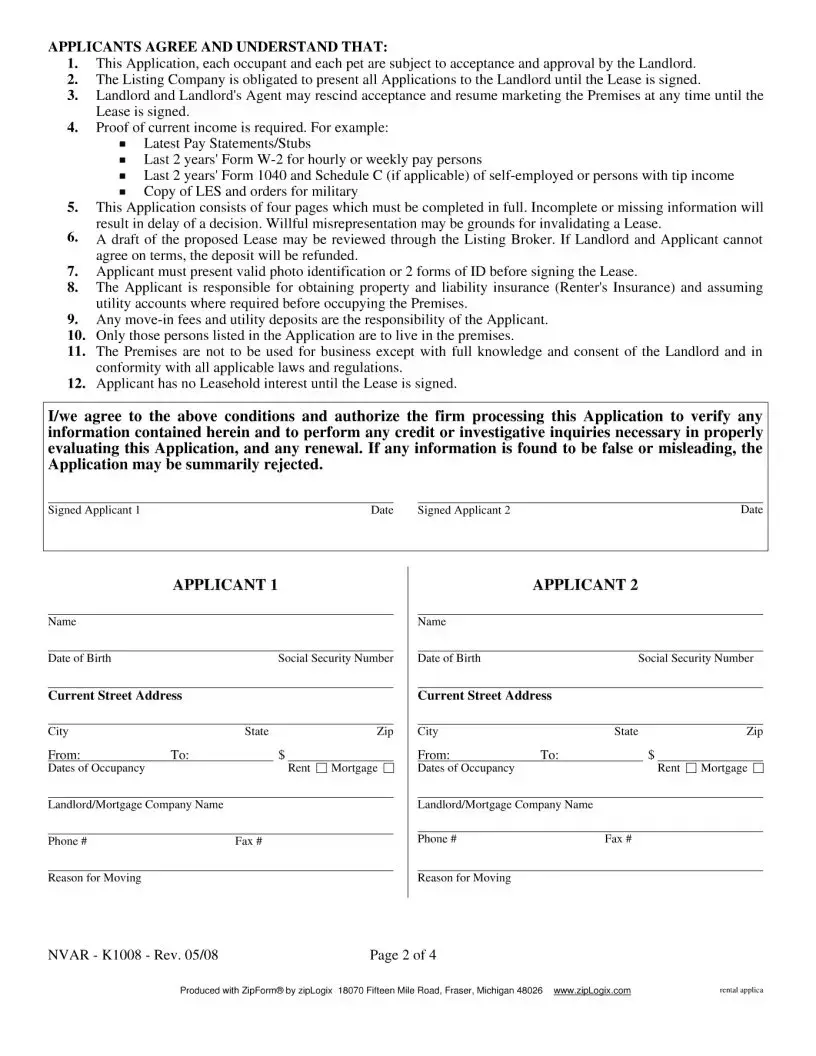

- In the section marked "APPLICANTS AGREE AND UNDERSTAND THAT," read through the statements carefully and proceed to list required documents such as proof of income.

- On the second page, fill in detailed personal information for both Applicant 1 and Applicant 2, including name, date of birth, current address, and social security number.

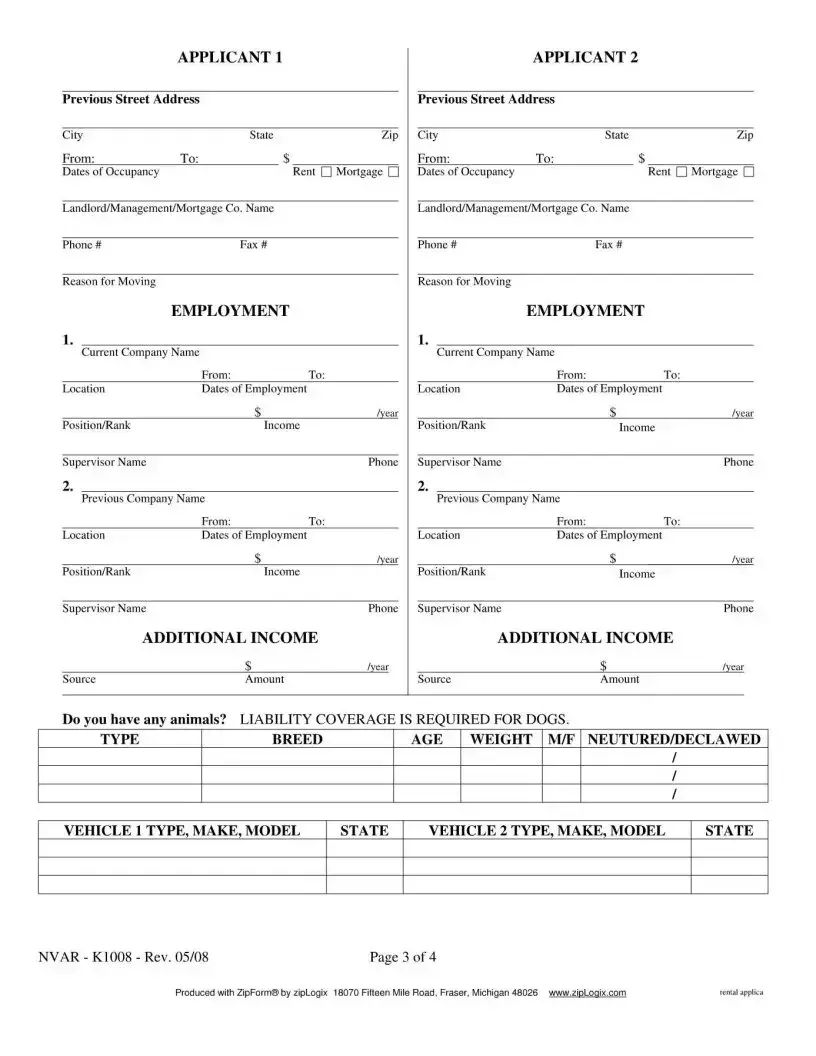

- Detail your rental or mortgage history for the current and previous addresses, including dates of occupancy, rent/mortgage amounts, landlord/mortgage company contact information, and the reason for moving.

- Provide employment history for both applicants, including current and previous company names, positions, supervisors, employment dates, and income details.

- If applicable, list any additional income sources along with annual amounts for both applicants.

- Answer questions about animals, ensuring to specify the type, breed, age, and weight, and mark if they are neutered/declawed.

- For the vehicles section, write down the type, make, model, and state for up to two vehicles per applicant.

- Both Applicant 1 and Applicant 2 should sign and date the application to agree to the conditions and authorize verification of the information provided.

After completing all sections of the application, review your entries for accuracy and completeness. Submitting an accurately completed form along with the necessary documents and fees can expedite the review process. The application will be processed, which might take up to 5 business days, and the decision (approved, rejected, or withdrawn) will be communicated to the applicant or their agent. Remember, filling out this application does not grant any leasehold interest until a lease contract is signed.

Obtain Answers on Nvar Rental Application

What is the purpose of the NVAR Rental Application form?

Who does the Listing Broker represent in the rental transaction?

What fees are associated with the NVAR Rental Application?

How long does it take to process the NVAR Rental Application?

What documentation is required with the application?

What happens if the NVAR Rental Application is incomplete?

Is renter's insurance required before occupying the premises?

Who can live in the premises according to the application?

Can the premises be used for business purposes?

What happens if false or misleading information is found on the application?

The NVAR Rental Application form serves as an offer to rent a property. It is the initial step in securing a lease agreement, which is a legally binding contract between the landlord and the tenant. The application ensures that the process adheres to Fair Housing and occupancy laws, preventing discrimination based on race, color, religion, national origin, sex, elderliness, familial status, or handicap.

By indicating their initials, applicants acknowledge that the Listing Broker represents the Landlord in the real estate lease transaction. If the Broker is acting as a dual representative for both the Landlord and Tenant, a specific disclosure form will be attached to this Application for transparency.

Applicants are required to pay a non-refundable processing fee per applicant. Additionally, an earnest money deposit is included with the application, which will be credited to amounts owed to the Landlord upon acceptance of the application or refunded (less any additional documented processing charges) if the application is not accepted.

The processing of the NVAR Rental Application may take up to 5 business days to complete. This timeframe allows the landlord or managing agent to review the application thoroughly and make an informed decision.

Applicants need to provide proof of current income, which could include the latest pay statements or stubs, the last two years' Form W-2 for hourly or weekly pay persons, the last two years' Form 1040 and Schedule C for self-employed individuals, or copy of LES and orders for military personnel.

Incomplete or missing information on the NVAR Rental Application can result in a delay of the decision. Willful misrepresentation of information may also be grounds for invalidating a future Lease agreement.

Yes, applicants are responsible for obtaining property and liability insurance (Renter’s Insurance) and assuming utility accounts where required before occupying the Premises. This is essential for protecting both the tenant's and landlord's interests.

Only those persons listed and approved in the NVAR Rental Application are permitted to live in the premises. This provision ensures all occupants are subject to the landlord's approval and comply with occupancy laws.

The premises cannot be used for business purposes without the full knowledge and consent of the Landlord and must be in conformity with all applicable laws and regulations. This is to ensure the property remains compliant with zoning laws and the lease agreement.

If any information on the NVAR Rental Application is found to be false or misleading, the application may be summarily rejected. This helps maintain the integrity of the leasing process and ensures fairness for all parties involved.

Common mistakes

-

Not fully completing all four pages of the application can lead people to make the mistake of submitting incomplete information. This not only delays the decision process but can also impact your application's credibility. Ensure every section is filled out comprehensively.

-

Failing to provide proof of current income as specified—like the latest pay statements, last 2 years' W-2 forms, or 1040 forms for self-employed individuals—can be a significant oversight. Documentation is crucial to verify your financial stability and ability to pay rent.

-

Omitting to initial the brokerage disclosure section can lead to misunderstandings about the roles and responsibilities of the involved parties. It's crucial to acknowledge whether the broker represents you, the landlord, or both, to ensure transparency in the leasing process.

-

Incorrectly listing the contact numbers and email addresses or leaving them blank may result in communication barriers between applicants and the leasing agent. It's important to provide accurate and working contact information for timely updates and inquiries.

-

Not specifying the details of pets, if any, including the type, breed, age, and whether they are neutered or declawed, can complicate the application process. Given that liability coverage is required for dogs, omitting these details can result in delays or denial of the application.

-

Signing the application without carefully reviewing the terms and authorizations at the end can lead to misunderstandings about the process of verifying information and conducting credit checks. It is crucial to agree to these conditions knowingly and authorize the necessary investigations.

Documents used along the form

When filling out the NVAR Rental Application form, both tenants and landlords find it beneficial to have additional forms and documents on hand to streamline the rental process. These materials not only facilitate a smoother transaction but also ensure compliance with legal and procedural requirements. Let's go through some of the key documents often used alongside the NVAR Rental Application form.

- Proof of Income Documents: These are essential for verifying the financial capability of the applicant. Common examples include recent pay stubs, tax returns, or bank statements, providing a clear picture of the applicant's earning and financial status.

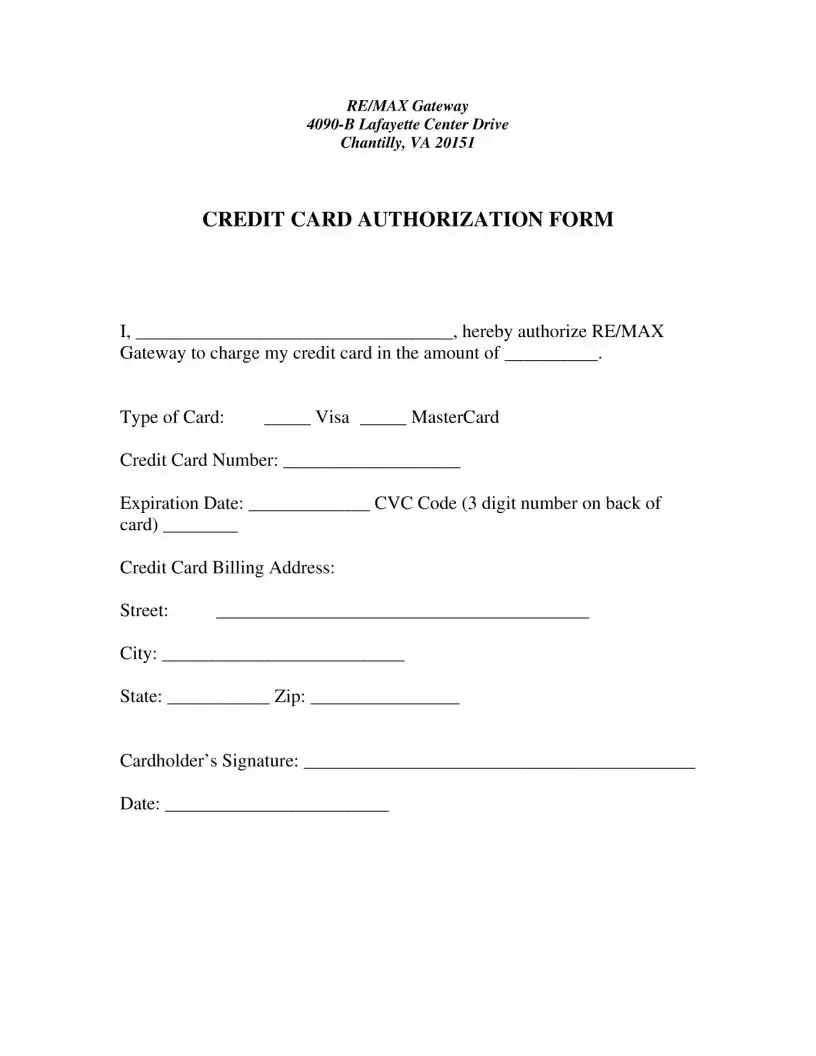

- Credit Report Authorization Form: This form grants the landlord permission to check the credit history of the applicant. It is a crucial step in assessing the financial reliability of the potential tenant.

- Rental History Verification: This document is used by the landlord to verify the rental background of the applicant with previous landlords. Questions may pertain to timely rent payments, property care, and reasons for departure.

- Employment Verification Form: Employers fill out this form to confirm the employment status, position, and salary of the applicant. It is another tool to assess financial stability.

- Co-Signer Agreement (if applicable): For applicants who might not meet the income or credit requirements on their own, a co-signer agreement with a financially stable co-signer can provide the necessary assurance to landlords.

- Pet Agreement (if applicable): If the applicant plans to have pets on the property, this agreement outlines the terms and conditions related to pet ownership, including number, type, and size of pets, alongside any pet deposit or additional fees.

- Move-In/Move-Out Checklist: This document is used at the beginning and end of the tenancy to inspect the rental property's condition. Both parties can note any damages or issues, providing a baseline that helps avoid future disputes over security deposits.

- Lead-Based Paint Disclosure: For properties built before 1978, federal law requires landlords to disclose information about lead-based paint hazards in the home. This form is filled out and signed by both parties to acknowledge the disclosure.

Each of these documents plays a vital role in the rental process, complementing the NVAR Rental Application form to ensure a thorough and legally compliant approach to leasing. Landlords and applicants alike benefit from the clarity and structure these forms provide, paving the way for a mutually beneficial tenant-landlord relationship.

Similar forms

The Residential Lease Agreement is analogous to the NVAR Rental Application form. They both create a legally binding relationship between the landlord and the tenant, specifying terms like the duration of the lease, monthly rent, and responsibilities of each party. The fundamental resemblance lies in these documents serving as preliminary steps towards establishing a rental agreement.

The Employment Verification Form shares similar features with the NVAR Rental Application, notably in terms of verifying an applicant's income. Both forms require detailed information about the applicant's employment, including the company name, position, and income, to ensure financial stability and the ability to pay rent.

A Credit Check Authorization Form is akin to the rental application in that it seeks permission to review an applicant's credit history. Both are essential in the screening process, the former directly, and the NVAR form indirectly by incorporating consent for such checks, as creditworthiness is a key factor in assessing a potential tenant's reliability.

The Pet Application Form is comparable because it also collects details on pets, similar to a section in the NVAR Rental Application. Both documents assess a tenant's request to have pets on the premises, reviewing breed, age, and weight, which impacts the landlord's decision regarding tenancy and potential additional deposits.

The Tenant Contact Information Form parallels the NVAR form in gathering essential contact details of the applicants, such as phone numbers and email addresses. This information facilitates communication between the landlord or property manager and the tenant, important for maintenance requests, lease renewals, and notices.

A Rental History Verification Form bears resemblance by requesting past rental information, including previous addresses, lengths of stay, and reasons for moving. This aspect of the NVAR form helps landlords verify reliability and adherence to previous lease terms, painting a picture of the applicant's tenant behavior.

The Cosigner Agreement is mirrored in aspects of the rental application that involve the financial responsibility of the lease. While the NVAR form does not directly serve as a cosigner agreement, it lays the groundwork by evaluating financial eligibility, potentially leading to discussions about a cosigner if financial criteria are not met independently by the applicants.

A Background Check Form has similarities in its purpose to vet potential tenants. Though not explicit in the NVAR Form, the submission and subsequent processing of the application imply consent to background checks, crucial for assessing the applicant's past behavior and legal issues.

The Move-In/Move-Out Checklist is reminiscent of the "Premises accepted 'As Is'" section in the NVAR form, albeit the checklist is more detailed. Both documents assess the condition of the property at the start (and end) of tenancy, important for security deposit deductions and maintenance obligations.

The Proof of Renters Insurance Form matches the NVAR application’s requirement for applicants to obtain renters insurance before occupancy. Both underscore the significance of liability coverage in protecting against damages to the rental unit or property within.

Dos and Don'ts

When completing the NVAR Rental Application form, there are important do's and don'ts to ensure your application is considered positively. Here’s a guide to help you navigate the process:

- Do provide truthful and complete information for every section of the application. Inaccurate or missing details can lead to delays or the rejection of your application.

- Don't overlook the requirement for identification. Before signing the lease, make sure you have valid photo identification or two forms of ID ready to present.

- Do attach the required documentation regarding your income. This could include your latest pay stubs, last 2 years' Form W-2, Form 1040 and Schedule C for self-employed individuals, or copy of LES and orders for military applicants.

- Don't assume the property is yours until the lease is signed. Remember, you have no leasehold interest in the property until all parties have signed the lease agreement.

- Do acknowledge the brokerage disclosure by initialing the section that clarifies whether the listing broker represents the landlord, tenant, or both.

- Don't bring pets without disclosing them on your application. Failure to do so can lead to issues down the line, especially since liability coverage is required for dogs.

- Do specify any additional occupants correctly on the application. Only those listed are permitted to live in the premises under the terms of the lease.

- Don't forget to budget for any move-in fees and utility deposits which are your responsibility. Additionally, ensure renter’s insurance and utility accounts are set up before moving in.

Misconceptions

There are several common misconceptions about the NVAR (Northern Virginia Association of Realtors) Rental Application form that potential tenants and even landlords may have. Understanding these misconceptions can help ensure a smoother application process for all parties involved. Here are eight misconceptions clarified:

The Rental Application is just a formality. In reality, the Rental Application is a crucial step in the leasing process. It collects vital information from applicants and serves as the basis for deciding whether to proceed with a lease. The information provided is used to perform background checks, credit checks, and verify rental history, making it far more than a mere formality.

Submitting an application means you are guaranteed the rental. Submitting an application does not guarantee approval. The landlord or management company will review all applications and make a decision based on various criteria, including credit history, rental history, income stability, and sometimes, the number of applications received for a particular property.

The application fee is refundable. The application clearly states that the processing fee is non-refundable. This fee covers the cost of processing the application, including credit and background checks. It is not a deposit that can be returned if the application is not accepted.

The earnest money deposit will not be returned if the application is rejected. Contrary to this belief, if the application is not accepted, the deposit will be refunded to the applicant(s) minus any documented additional processing charges. This deposit shows the applicant's seriousness and will be credited towards the amounts owed to the landlord upon acceptance.

Filling out the application partially is acceptable. An incomplete application can lead to delays or even rejection. The application must be completed in full, with all required information provided to allow for a thorough evaluation.

Misrepresentations on the application are not a big deal. Willful misrepresentation of information on the application can be grounds for invalidating an accepted lease. It's crucial to provide accurate and truthful information throughout the application.

The property can be used for any purpose once the lease is signed. The premises are not to be used for business purposes without the Landlord's full knowledge and consent and must comply with all applicable laws and regulations. Unauthorized use can result in lease violations.

Applicants are automatically covered by the landlord’s insurance. The applicant is responsible for obtaining renters insurance for personal property and liability, as outlined in the application. The landlord's insurance typically does not cover the tenant's personal belongings.

It's essential for applicants and landlords to carefully read and understand the NVAR Rental Application and the information provided within it to ensure a clear and smooth leasing process.

Key takeaways

Filling out and submitting the NVAR Rental Application is an essential step for potential tenants interested in leasing a property in Virginia. Understanding the key aspects of this application can provide a smooth pathway to securing your desired residence. Here are five critical takeaways to consider when dealing with the NVAR Rental Application form:

- The NVAR Rental Application initiates an offer to rent, essentially beginning the leasing process. This highlights the importance of being thorough and accurate with the information you provide, as it forms the foundation of your rental agreement.

- Discrimination is unlawful in the rental process. The application clearly states that it will be processed in compliance with all Fair Housing and occupancy laws. This assurance is pivotal for applicants, reinforcing a fair, discrimination-free environment.

- A non-refundable processing fee is standard with this application. Knowing the fee's non-refundable nature, applicants should be certain of their interest in the property before submitting the application. Timely processing, within five business days, ensures applicants will not be left waiting for a decision for an extended period.

- The application mandates disclosure of financial capabilities and background information, including current income proof and employment details. Ensuring accuracy and completeness in these sections can help avoid delays or rejections based on insufficient documentation or verification concerns.

- Fully understanding the section on pets, additional occupants, and the requirement for renter’s insurance and utility transfers is crucial. These elements of the agreement can significantly affect living conditions and responsibilities, making it vital to review them carefully before agreeing to the terms.

By adhering to these key points, applicants can navigate the NVAR Rental Application process more effectively, potentially leading to a successful leasing outcome. It is always recommended to review every section carefully and seek clarification if needed to ensure all terms and conditions are understood before submission.

Popular PDF Forms

Business License New Mexico - Geared towards simplifying the business registration process in Albuquerque, this form is your first stop to becoming a legal entity.

Vbs Full Form - Asking if family members are helping with the event strengthens community bonds and encourages a collaborative VBS experience.

Motion to Quash Service of Summons Form - A directive from the Fulton County Superior Court, specifying the process and timelines for defendants to respond to legal allegations made against them.