Blank Ny Anti Arson Application PDF Template

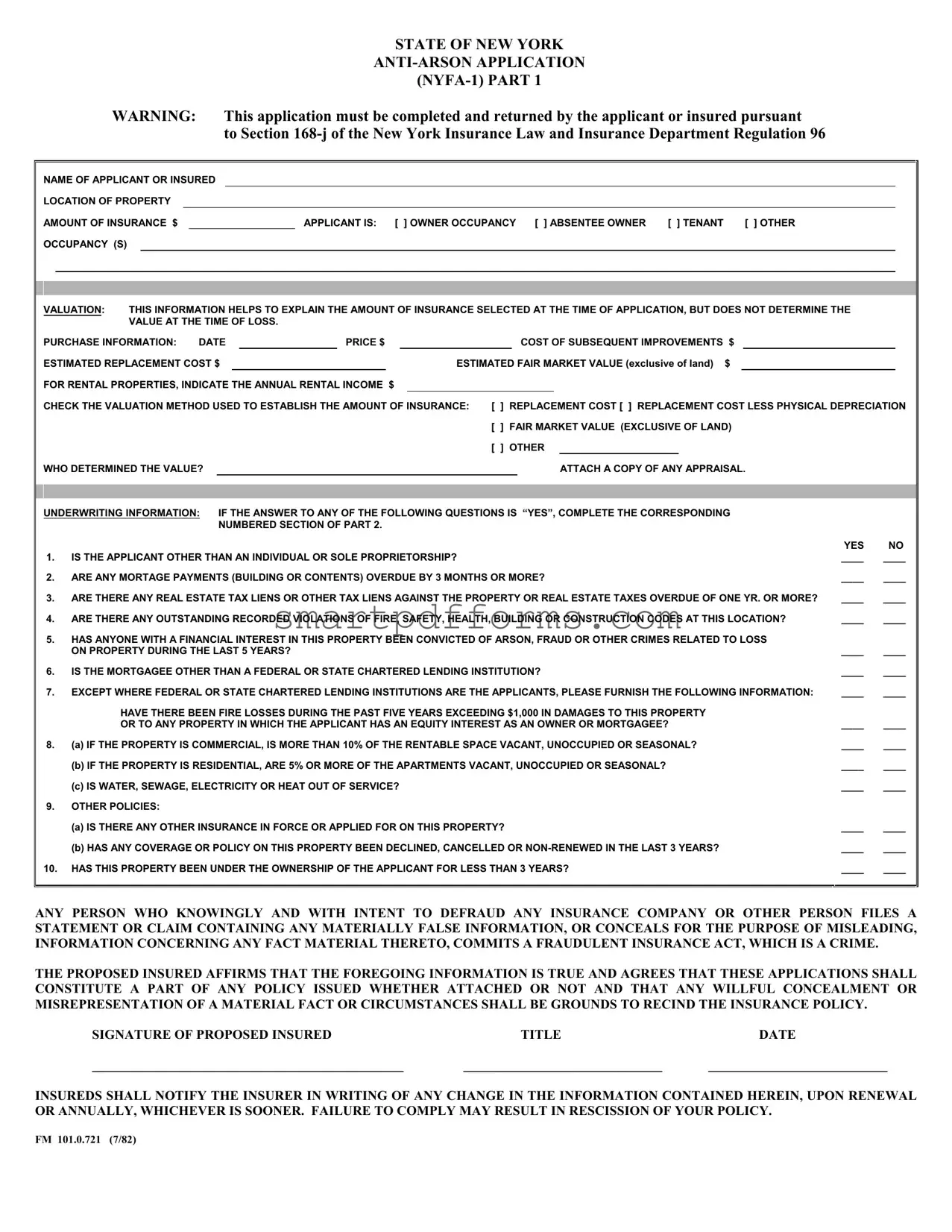

Insurance is a cornerstone of property ownership, providing a safety net against unforeseen damage or loss. In the State of New York, property insurance takes on an additional layer of significance with the implementation of the Anti-Arson Application (NYFA-1), a requirement set forth for applicants or insured parties under Section 168-j of the New York Insurance Law and Insurance Department Regulation 96. This comprehensive form serves as a critical tool in the fight against arson, requiring detailed information from the applicant or insured about the property in question, including the name of the applicant or insured, location, and the amount of insurance coverage sought. Applicants must disclose their relationship to the property, be it as an owner, tenant, absentee owner, or other, and provide a valuation of the property based on criteria such as purchase information, cost of subsequent improvements, estimated replacement cost, and estimated fair market value excluding land. The form goes further to probe underwriting information which could flag potential risks or concerns, touching on aspects like overdue mortgage payments, tax liens, code violations, past convictions related to property loss, and even details about the occupancy and vacancy rates of the property. Strict warnings against fraudulent information underscore the form's importance not just for insurance purposes but also as a preventative measure in property crimes. By completing this form, applicants affirm the truthfulness of their information, understanding that any willful concealment or misrepresentation of material facts can lead to the rescission of their policy, highlighting the seriousness with which New York State addresses the issue of arson and the protection of properties within its jurisdiction.

Preview - Ny Anti Arson Application Form

STATE OF NEW YORK

|

|

|

|

WARNING: |

This application must be completed and returned by the applicant or insured pursuant |

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

to Section |

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF APPLICANT OR INSURED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

LOCATION OF PROPERTY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

AMOUNT OF INSURANCE $ |

|

|

|

|

|

APPLICANT IS: |

[ ] OWNER OCCUPANCY [ ] ABSENTEE OWNER [ ] TENANT |

|

[ ] OTHER |

|

|

|

|

||||||||||||||

|

|

OCCUPANCY (S) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

VALUATION: |

|

THIS INFORMATION HELPS TO EXPLAIN THE AMOUNT OF INSURANCE SELECTED AT THE TIME OF APPLICATION, BUT DOES NOT DETERMINE THE |

|

|

|

||||||||||||||||||||||

|

|

|

|

|

VALUE AT THE TIME OF LOSS. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

PURCHASE INFORMATION: DATE |

|

|

PRICE $ |

|

|

|

|

COST OF SUBSEQUENT IMPROVEMENTS $ |

|

|

|

|

|

||||||||||||||

|

|

ESTIMATED REPLACEMENT COST $ |

|

|

|

|

|

|

ESTIMATED FAIR MARKET VALUE (EXCLUSIVE OF LAND) |

$ |

|

|

|

|

|

||||||||||||||

|

|

FOR RENTAL PROPERTIES, INDICATE THE ANNUAL RENTAL INCOME $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

CHECK THE VALUATION METHOD USED TO ESTABLISH THE AMOUNT OF INSURANCE: [ ] REPLACEMENT COST [ ] REPLACEMENT COST LESS PHYSICAL DEPRECIATION |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[ ] FAIR MARKET VALUE (EXCLUSIVE OF LAND) |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[ ] OTHER |

|

|

|

|

|

|

|

|

|||

|

|

WHO DETERMINED THE VALUE? |

|

|

|

|

|

|

|

|

|

|

|

|

|

ATTACH A COPY OF ANY APPRAISAL. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

UNDERWRITING INFORMATION: |

IF THE ANSWER TO ANY OF THE FOLLOWING QUESTIONS IS “YES”, COMPLETE THE CORRESPONDING |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

NUMBERED SECTION OF PART 2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

|

|

|

|

1. IS THE APPLICANT OTHER THAN AN INDIVIDUAL OR SOLE PROPRIETORSHIP? |

|

|

____ |

____ |

|

||||||||||||||||||||||

|

|

2. ARE ANY MORTAGE PAYMENTS (BUILDING OR CONTENTS) OVERDUE BY 3 MONTHS OR MORE? |

|

|

____ |

____ |

|

||||||||||||||||||||||

|

|

3. ARE THERE ANY REAL ESTATE TAX LIENS OR OTHER TAX LIENS AGAINST THE PROPERTY OR REAL ESTATE TAXES OVERDUE OF ONE YR. OR MORE? |

____ |

____ |

|

||||||||||||||||||||||||

|

|

4. ARE THERE ANY OUTSTANDING RECORDED VIOLATIONS OF FIRE, SAFETY, HEALTH, BUILDING OR CONSTRUCTION CODES AT THIS LOCATION? |

____ |

____ |

|

||||||||||||||||||||||||

5.HAS ANYONE WITH A FINANCIAL INTEREST IN THIS PROPERTY BEEN CONVICTED OF ARSON, FRAUD OR OTHER CRIMES RELATED TO LOSS

|

ON PROPERTY DURING THE LAST 5 YEARS? |

____ |

____ |

6. |

IS THE MORTGAGEE OTHER THAN A FEDERAL OR STATE CHARTERED LENDING INSTITUTION? |

____ |

____ |

7. |

EXCEPT WHERE FEDERAL OR STATE CHARTERED LENDING INSTITUTIONS ARE THE APPLICANTS, PLEASE FURNISH THE FOLLOWING INFORMATION: |

____ |

____ |

|

HAVE THERE BEEN FIRE LOSSES DURING THE PAST FIVE YEARS EXCEEDING $1,000 IN DAMAGES TO THIS PROPERTY |

|

|

|

OR TO ANY PROPERTY IN WHICH THE APPLICANT HAS AN EQUITY INTEREST AS AN OWNER OR MORTGAGEE? |

____ |

____ |

8. |

(A) IF THE PROPERTY IS COMMERCIAL, IS MORE THAN 10% OF THE RENTABLE SPACE VACANT, UNOCCUPIED OR SEASONAL? |

____ |

____ |

|

(B) IF THE PROPERTY IS RESIDENTIAL, ARE 5% OR MORE OF THE APARTMENTS VACANT, UNOCCUPIED OR SEASONAL? |

____ |

____ |

|

(C) IS WATER, SEWAGE, ELECTRICITY OR HEAT OUT OF SERVICE? |

____ |

____ |

9. |

OTHER POLICIES: |

|

|

|

(A) IS THERE ANY OTHER INSURANCE IN FORCE OR APPLIED FOR ON THIS PROPERTY? |

____ |

____ |

|

(B) HAS ANY COVERAGE OR POLICY ON THIS PROPERTY BEEN DECLINED, CANCELLED OR |

____ |

____ |

10. |

HAS THIS PROPERTY BEEN UNDER THE OWNERSHIP OF THE APPLICANT FOR LESS THAN 3 YEARS? |

____ |

____ |

|

|

|

|

ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD ANY INSURANCE COMPANY OR OTHER PERSON FILES A STATEMENT OR CLAIM CONTAINING ANY MATERIALLY FALSE INFORMATION, OR CONCEALS FOR THE PURPOSE OF MISLEADING, INFORMATION CONCERNING ANY FACT MATERIAL THERETO, COMMITS A FRAUDULENT INSURANCE ACT, WHICH IS A CRIME.

THE PROPOSED INSURED AFFIRMS THAT THE FOREGOING INFORMATION IS TRUE AND AGREES THAT THESE APPLICATIONS SHALL CONSTITUTE A PART OF ANY POLICY ISSUED WHETHER ATTACHED OR NOT AND THAT ANY WILLFUL CONCEALMENT OR MISREPRESENTATION OF A MATERIAL FACT OR CIRCUMSTANCES SHALL BE GROUNDS TO RECIND THE INSURANCE POLICY.

SIGNATURE OF PROPOSED INSURED |

TITLE |

DATE |

_______________________________________________ |

______________________________ |

___________________________ |

INSUREDS SHALL NOTIFY THE INSURER IN WRITING OF ANY CHANGE IN THE INFORMATION CONTAINED HEREIN, UPON RENEWAL OR ANNUALLY, WHICHEVER IS SOONER. FAILURE TO COMPLY MAY RESULT IN RESCISSION OF YOUR POLICY.

FM 101.0.721 (7/82)

STATE OF NEW YORK

OWNERSHIP INFORMATION: |

|

|

|

|

|

|

|

1. |

LIST THE NAMES AND ADDRESS OF: |

SHAREHOLDERS OF A CORPORATION |

PARTNERS, INCLUDING LIMITED PARTNERS |

TRUSTEES AND BENEFICIARIES |

|||

|

NOTE: LIST ONLY THOSE POSSESSING AN OWNERSHIP INTEREST OF 25% OR MORE, EXCEPT FOR CLOSE CORPORATION BENEFICIARIES WHERE ALL |

||||||

|

OWNERS SHOULD BE LISTED. |

|

|

|

|

||

|

|

NAME |

ADDRESS |

POSITION |

INTEREST % |

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

2. |

MORTGAGE PAYMENTS |

MORTGAGE _______________________________ |

DATE DUE_______________________ |

AMOUNT DUE ____________________________ |

|||

|

LIST ANY OTHER ENCUMBRANCES: |

|

|

|

|

|

|

3. |

UNPAID TAXES OR UNPAID LIENS: |

TYPE _________________________ |

DATE DUE_______________________ |

AMOUNT DUE ____________________________ |

|||

4. |

CODE VIOLATIONS: |

DATE _______________________________________ |

DESCRIBE ________________________________________________________________ |

||||

|

|

|

|

||||

5. |

CONVICTIONS: DATE ____________________________________________ |

DESCRIBE ________________________________________________________________ |

|||||

|

_________________________________________________________________ |

NAME OF PERSON _________________________________________________________ |

|||||

6.NAME(S) OF UNCHARTERED MORTGAGEES:

7. |

LOSSES: LOCATION |

_________________________________ |

DATE |

_____________ |

AMOUNT |

____________ |

DESCRIPTION _______________________ |

|

_______________________________________________________ |

_____________________ |

_______________________ |

______________________________________ |

|||

|

_______________________________________________________ |

_____________________ |

_______________________ |

______________________________________ |

|||

|

_______________________________________________________ |

_____________________ |

_______________________ |

______________________________________ |

|||

8.VACANCY AND/OR UNOCCUPANCY:

INDICATE SEASONAL PERIOD (IF ANY) WHEN BUILDING IS UNUSED:

FOR APARTMENT BUILDINGS, INDICATE: |

TOTAL UNITS __________________________ |

UNOCCUPIED UNITS |

_________________________________________ |

|||||||

FOR OTHER BUILDINGS INDICATE: |

VACANCY ___________________________________ |

% UNOCCUPANCY |

____________________________________________ |

|||||||

FOR ALL BUILDINGS INDICATE THE FOLLOWING: |

|

|

|

|

|

|

||||

REASON FOR VACANCY/UNOCCUPANCY: |

|

|

|

|

|

|

|

|||

ANTICIPATED DATE OF OCCUPANCY: |

|

|

|

|

|

|

|

|||

IF THE BUILDING IS VACANT OR UNOCCUPIED, INDICATE HOW IT IS PROTECTED FROM UNAUTHORIZED ENTRY |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

IS THERE A GOVERNMENTAL ORDER TO VACATE OR DESTROY THE BUILDING OR HAS THE BUILDING BEEN CLASSIFIED AS UNINHABITABLE |

|

|

||||||||

OR STRUCTURALLY UNSAFE? |

|

|

|

|

|

|

|

|

_____ |

_____ |

IF WATER, SEWAGE, ELECTRICITY OR HEAT IS OUT OF SERVICE, EXPLAIN CIRCUMSTANCES: __________________________________________ |

|

|

||||||||

|

|

|

|

|||||||

IS THERE UNREPAIRED DAMAGE OR HAVE ITEMS BEEN STRIPPED FROM THE BUILDING? IF YES, DESCRIBE: ___________________________ |

_____ |

_____ |

||||||||

|

|

|

|

|

|

|

||||

IS THE BUILDING FOR SALE? IF YES, DATE PUT UP FOR SALE: ____________________________ |

|

|

|

|

_____ |

_____ |

||||

9.OTHER POLICIES: INDICATE STATUS: (IN FORCE, APPLIED FOR, DECLINED, CANCELLED OR NONRENEWED)

STATUS |

DATE |

AMOUNT OF INSURANCE |

CARRIER |

POLICY# |

________________________________________ |

_______________________ |

___________________________________ |

__________________________________________________________________ |

________________ |

_______________________________________ |

______________________ |

___________________________________ |

__________________________________________________________________ |

________________ |

_______________________________________ |

______________________ |

___________________________________ |

__________________________________________________________________ |

________________ |

10.LIST ALL REAL ESTATE TRANSACTIONS DURING THE LAST 3 YEARS INVOLVING THIS PROPERTY.

DATE |

SELLING PRICE |

NAME OF SELLER |

AMOUNT OF MORTGAGE |

MORTGAGEE |

__________________________ |

_________________________________ |

_______________________________________________ |

________________________________________ |

________________________________ |

__________________________ |

_________________________________ |

_______________________________________________ |

________________________________________ |

________________________________ |

|

|

|

|

|

ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD ANY INSURANCE COMPANY OR OTHER PERSON FILES A STATEMENT OR CLAIM CONTAINING ANY MATERIALLY FALSE INFORMATION, OR CONCEALS FOR THE PURPOSE OF MISLEADING, INFORMATION CONCERNING ANY FACT MATERIAL THERETO, COMMITS A FRAUDULENT INSURANCE ACT, WHICH IS A CRIME.

THE PROPOSED INSURED AFFIRMS THAT THE FOREGOING INFORMATION IS TRUE AND AGREES THAT THESE APPLICATIONS SHALL CONSTITUTE A PART OF ANY POLICY ISSUED WHETHER ATTACHED OR NOT AND THAT ANY WILLFUL CONCEALMENT OR MISREPRESENTATION OF A MATERIAL FACT OR CIRCUMSTANCES SHALL BE GROUNDS TO RECIND THE INSURANCE POLICY.

SIGNATURE OF PROPOSED INSURED |

TITLE |

DATE |

_______________________________________________ |

______________________________ |

___________________________ |

Form Data

| Fact No. | Description |

|---|---|

| 1 | The New York Anti-Arson Application (NYFA-1) is mandated by Section 168-j of the New York Insurance Law and Insurance Department Regulation 96. |

| 2 | Applicants must disclose the valuation method used to establish the amount of insurance, which includes replacement cost, fair market value, among others. |

| 3 | Underwriting information requires disclosure of any overdue mortgage payments, tax liens, or violations of codes relevant to fire, safety, and construction. |

| 4 | The application asks if the property has been involved in any incidents of fire losses exceeding $1,000 or if any stakeholder has been convicted of arson or related crimes within the past five years. |

| 5 | Disclosure of occupancy details is required, including whether the property is commercially or residentially used, vacancy rates, and utility service statuses. |

| 6 | Applicants must report any other insurance policies in force, applied for, or recently cancelled or non-renewed in the past three years. |

| 7 | Fraudulent insurance acts are criminal offenses, and applicants are warned that providing false information or concealing material facts can lead to legal consequences. |

| 8 | The form requires applicants to affirm the truthfulness of the provided information and acknowledges that the application becomes part of any policy issued. |

Instructions on Utilizing Ny Anti Arson Application

Filling out the New York Anti-Arson Application form is a step-by-step process requiring attention to detail. It is designed to collect essential information to assess risk and determine insurance coverage needs. Carefully entering accurate information into this form is crucial, as it forms part of the contractual agreement between the applicant and the insurer. Misrepresentation or omission of material facts can have legal ramifications, including the potential for policy rescission. Follow these steps to ensure the form is completed accurately and thoroughly.

- Start by entering the name of the applicant or insured at the top of the form.

- Fill in the location of the property for which insurance is being sought.

- Specify the amount of insurance required in dollars.

- Indicate the applicant's relationship to the property (owner occupancy, absentee owner, tenant, or other occupancy) by checking the appropriate box.

- Under the Valuation section, provide information on the property's purchase date, purchase price, cost of subsequent improvements, estimated replacement cost, and estimated fair market value.

- For rental properties, state the annual rental income.

- Select the valuation method used to establish the amount of insurance by checking the appropriate box and specify who determined the property’s value. Attach any appraisal documents.

- Answer "Yes" or "No" to the questions in the Underwriting Information section. If you answer "Yes" to any question, you will need to complete the corresponding numbered section of Part 2.

- Ensure that the signature of the proposed insured is affixed at the bottom of Part 1 along with the title and date.

- If applicable, complete Part 2 by providing detailed information on ownership, mortgage payments, unpaid taxes or liens, code violations, convictions, unchartered mortgagees, previous fire losses, vacancy information, other insurance policies, and recent real estate transactions. This part requires specific details such as names, addresses, percentages of interest, dates, amounts due, descriptions of conditions or violations, and insurance policy details.

- Sign and date the bottom of Part 2, affirming the truthfulness of the provided information and agreeing to the terms stated in the form.

After completing these steps, review the form to ensure all information is accurate and no section has been overlooked. Any changes in the information provided must be reported to the insurer in writing, either upon renewal or annually, to avoid potential rescission of the policy. Submitting this form is a declaration of the accuracy of the information and an acceptance of the legal implications that come with it.

Obtain Answers on Ny Anti Arson Application

What is the purpose of the New York Anti-Arson Application (NYFA-1)?

The application is designed to collect detailed information about a property and its owners or occupants to assess the risk of arson. This helps insurance companies make informed decisions on providing coverage for properties in New York, ensuring that all parties are adequately protected against the financial losses that arson can cause.

Who needs to complete the New York Anti-Arson Application?

This form must be completed by the applicant or insured, according to Section 168-j of the New York Insurance Law and Insurance Department Regulation 96. It is typically required for property owners, tenants with certain responsibilities, or other parties with a financial interest in the property seeking insurance coverage.

What information is required on the application?

The form collects information on the applicant or insured, location and valuation of the property, occupancy details, and underwriting information, such as mortgage status, tax liens, code violations, and any history of arson or fraudulent activities associated with the property or individuals with a financial interest in it.

How does the valuation information affect my insurance coverage?

While the valuation information provided (including purchase price, costs of improvements, estimated replacement cost, and fair market value) helps explain the amount of insurance selected at the time of the application, it does not determine the value of the property at the time of loss. This information is used by the insurance company to assess the overall risk and establish the amount of coverage that can be offered.

What happens if I answer "Yes" to any questions in the Underwriting Information section?

If you answer "Yes" to any questions in the underwriting section, you must complete the corresponding numbered section of Part 2 of the form. This additional information is necessary for the insurance company to fully understand the risks associated with insuring your property.

What are the implications of failing to notify the insurer of changes?

Insureds must inform the insurer of any changes in the information provided on the application, either upon renewal or annually, whichever comes first. Failure to do so may lead to rescission of the policy, meaning the insurance coverage could be invalidated, leaving the property without protection.

What constitutes a fraudulent insurance act according to this application?

Committing a fraudulent insurance act includes knowingly and with intent to defraud, filing a statement or claim that contains materially false information or concealing information to mislead about any fact material thereto. Such actions are considered a crime and can lead to severe penalties, including the possibility of rescinding the insurance policy.

What is the significance of signing the Anti-Arson Application?

By signing the application, the proposed insured affirms that all the information provided is true and agrees that the applications will constitute a part of any policy issued, whether attached to the policy or not. Moreover, any willful concealment or misrepresentation of material facts or circumstances can be grounds to rescind the insurance policy, leading to a lack of coverage.

Common mistakes

Filling out the New York Anti-Arson Application form requires attention to detail to ensure accuracy and compliance. Common mistakes can lead to delays, inaccuracies, or potential denial of the insurance application. Below are eight mistakes frequently made when completing this form:

- Not specifying the type of applicant or insured status - It's essential to clearly indicate whether the applicant is the owner, an absentee owner, a tenant, or falls under another occupancy status.

- Incorrect valuation method selected - Applicants often mistakenly choose the wrong valuation method for establishing the amount of insurance. Each option (replacement cost, replacement cost less physical depreciation, fair market value exclusive of land, etc.) has specific criteria that must be met.

- Omission of purchase information and improvements - Failing to include detailed purchase information, cost of subsequent improvements, and estimated replacement cost can result in an inaccurate assessment of the property's value.

- Underreporting rental income - For rental properties, accurately indicating the annual rental income is crucial. Underreporting can affect the insurance terms.

- Incomplete underwriting information - Neglecting to answer all yes/no underwriting questions or failing to provide details in corresponding sections can lead to an incomplete application.

- Failure to attach a copy of the appraisal when required - When the value is determined by an appraisal, failing to attach a copy can halt the application process.

- Incorrectly listing ownership information - For Part 2, it's vital to accurately list the names, addresses, position, and interest percentage of relevant individuals or entities. Mistakes here can lead to questions about the property's ownership and financial interests.

- Not notifying of changes in information upon renewal or annually - Insureds must notify the insurer of any changes in the information provided on the form. Failing to do so may result in policy rescission.

Avoiding these common mistakes helps ensure the application process is smooth and efficient, reducing the likelihood of errors that could impact the approval of the anti-arson application.

Documents used along the form

When completing the New York Anti-Arson Application, various other forms and documents often complement the submission process to ensure a comprehensive assessment of the risk involved. These additional forms and documents help provide a full picture, allowing for a more accurate and detailed understanding of the property in question and its ownership.

- Property Appraisal Report: Validates the value of the property, including improvements and the land, used to determine the amount of insurance necessary.

- Fire Safety Inspection Report: Identifies any existing fire hazards and ensures compliance with local fire safety regulations.

- Building Code Violation Notices: Documents detailing any unaddressed code violations that could increase the risk of fire or other hazards.

- Proof of Ownership: Legal documents, such as a deed, that confirm the applicant's ownership of the property.

- Mortgage Statement: Shows current mortgage obligations, lender information, and ensures that payments are up-to-date, which is crucial for the ownership clause of the insurance policy.

- Tax Records: Confirm that all real estate taxes have been paid and there are no liens against the property that might affect the underwriting process.

- Lease Agreements: For properties with tenants, these agreements confirm the rental income asserted in the application and the responsibilities between landlords and tenants regarding the property maintenance and safety.

- Claims History: A record of past insurance claims related to the property, which helps insurers assess the risk of future claims.

- Electrical Inspection Reports: Assesses the state of the electrical system to identify any potential fire hazards due to outdated or improperly installed wiring.

- Plumbing Inspection Reports: Highlights issues with the plumbing system that could lead to water damage, indirectly impacting the risk of fire if electrical systems are affected.

Collectively, these documents support the information provided in the New York Anti-Arson Application by verifying details about the property's value, ownership, and structural condition, all of which are critical for accurately underwriting an insurance policy. Ensuring that these documents are accurate and up-to-date can significantly impact the processing and approval of the insurance application.

Similar forms

The New York Anti-Arson Application form bears similarity to a Home Insurance Application. Just like the anti-arson form requires detailed information about the property, ownership, and any past insurance claims or legal issues, a home insurance application also asks for comprehensive details about the property to be insured, including its use, condition, any existing mortgages or liens, and a history of previous insurance claims. These details help the insurer assess risk and determine policy terms.

Another document that shares characteristics with this form is a Commercial Property Insurance Application. This type of application, much like the anti-arson form, often includes questions about the occupancy and use of the building, such as the percentage of space that is occupied or vacant, the type of business conducted, and the presence of any features that may increase the risk of fire or other perils. Both documents are designed to gather enough information to properly evaluate the insurance risks.

A Loan Application for Real Estate also parallels the Anti-Arson Application in its requirement for detailed property information, including ownership details, the value of the property, and any liens or encumbrances against it. Both applications assess financial stability and risks, although for different purposes — one for lending and the other for insurance underwriting.

Last but not least, this form shares similarities with a Fire Safety Compliance Form that property owners might fill out for regulatory purposes. While the latter is more directly focused on compliance with fire safety codes and regulations, both forms include inquiries about fire safety violations, the condition of the property, and mitigating factors against fire risk. These sections aim to address concerns about the property's risk level from a fire prevention and safety standpoint.

Dos and Don'ts

Filling out the New York Anti-Arson Application form (NYFA-1) is a critical step in securing insurance for your property. This document is not just a formality—it's a vital piece of your insurance puzzle. To ensure a smooth process and prevent any hiccups, here are seven essential dos and don'ts to keep in mind:

- Do ensure all information provided is accurate and truthful. Remember, knowingly providing false information can be considered a fraudulent insurance act—a serious offense.

- Do review the form thoroughly before submitting. Ensure that every question is answered and that no section is left incomplete.

- Do attach a copy of any appraisal document if it was used to determine the value of the property. This supports your valuation claim and can be vital during the underwriting process.

- Do notify the insurer in writing of any changes in the information provided on the form, whether at renewal or annually, whichever comes first. Keeping your information updated is crucial for keeping your policy valid.

- Don't rush through the form without understanding the implications of your responses, especially in sections that inquire about past incidents or the operational status of building systems like water and electricity. Misrepresenting facts can lead to policy refusal or cancellation.

- Don't leave out any shareholders, partners, trustees, and beneficiaries who possess an ownership interest of 25% or more in the Ownership Information section of Part 2. For close corporation beneficiaries, listing all owners is mandatory.

- Don't hesitate to seek clarification on any item you find confusing or unclear. Consulting with a legal or insurance professional can provide clarity and prevent errors that might complicate your application process.

By adhering to these dos and don'ts, you're not just completing a formality. You're taking a responsible step towards safeguarding yourself and your investment. Remember, the New York Anti-Arson Application is a legal document, and respecting its significance ensures you're starting on the right foot with your insurance provider.

Misconceptions

There are several misconceptions about the New York Anti-Arson Application form (NYFA-1). This document is essential for understanding insurance requirements and legal responsibilities in New York. Below are seven common misconceptions and their clarifications.

Only for residential properties: It's a common belief that the NY Anti-Arson Application only applies to residential properties. However, the form is required for both residential and commercial properties. It's designed to gather detailed information to help prevent arson and ensure properties are appropriately insured.

Application is optional: Some people think that completing the NY Anti-Arson Application is optional. In reality, this form must be filled out and returned by the applicant or insured as mandated by Section 168-j of the New York Insurance Law and Insurance Department Regulation 96. Failure to submit the application can lead to insurance coverage issues.

Focuses only on arson: While the name suggests a focus on arson prevention, the application also gathers information on property valuation, mortgage details, tax liens, violations of fire, safety, health, building, or construction codes, and prior insurance claims. This comprehensive approach helps insurers assess the overall risk associated with a property.

Relevant only at the time of insurance policy issuance: Another misconception is that the information provided on this form is only relevant when the insurance policy is first issued. However, insured individuals are required to notify the insurer of any changes in the information provided on the application, either upon renewal or annually, whichever comes first. This ongoing relevance ensures that the insurance coverage remains appropriate and valid.

Only the property owner needs to complete it: It is often misunderstood that only the property owner needs to fill out the form. In truth, tenants, absentee owners, and others with financial interest in the property may also be required to complete portions of the application, depending on their involvement and interest in the property.

Information on the form does not affect insurance premiums: Some applicants may believe that the information provided on the NY Anti-Arson Application will not influence their insurance premiums. This is incorrect. The detailed information collected, including any history of arson, fire losses, and code violations, can significantly impact the cost of insurance premiums and the insurer's willingness to provide coverage.

Penalties for misinformation are lenient: Lastly, there's a misconception that penalties for providing false information on the application are insignificant or easily avoidable. The form clearly states that knowingly providing false information or concealing material facts is a criminal act, potentially leading to the rescission of the insurance policy and further legal consequences.

Understanding and addressing these misconceptions is crucial for applicants to ensure they comply with legal requirements, provide accurate information, and secure suitable insurance coverage for their property.

Key takeaways

Completing the New York Anti-Arson Application (NYFA-1) is a crucial process for those seeking insurance coverage for their property, ensuring compliance with state laws and regulations. Here are five key takeaways to guide applicants through this thorough and detailed form:

- Accuracy is paramount when filling out the form. Applicants are required to provide comprehensive data about the property, including ownership details, mortgage information, taxation, and any prior incidences of fire loss or damage. The provision of materially false information or the concealment of crucial facts is considered a fraud, which is a serious crime.

- Understanding the type of occupancy and accurately determining the valuation of the property are fundamental steps. The form distinguishes between various occupancies (e.g., owner occupancy, tenant) and valuation methods (e.g., replacement cost, market value) to ensure the amount of insurance selected is well-informed and justifiable.

- The need for thorough documentation cannot be overstated. Applicants are asked to attach copies of appraisals and detail any improvements made to the property, helping to justify the amount of insurance sought. This documentation aids in the establishment of a clear and transparent valuation basis for both the insured and the insurer.

- It is imperative to disclose any history of fire losses or damage exceeding $1,000, any criminal convictions related to arson, fraud, or property loss, and details about the ownership and mortgagee information. This comprehensive disclosure helps assess the risk and integrity associated with the application.

- The application mandates ongoing communication with the insurer regarding any changes to the provided information, be it upon renewal or annually. Failure to notify the insurer about significant changes can lead to policy rescission, highlighting the importance of maintaining an up-to-date and accurate dialogue with your insurance provider.

These steps underscore the importance of thoroughness, accuracy, and honesty in completing the New York Anti-Arson Application. By carefully adhering to these guidelines, applicants ensure they meet legal requirements and establish a foundation of trust with their insurer, ultimately securing the right coverage for their property.

Popular PDF Forms

What Do You Need to Set Up Direct Deposit - Keep a printed copy of the deposit slip for your records as it serves as proof of your transaction.

Benefeds Open Season - Detail the circumstances preventing on-time enrollment or changes to FEDVIP plans for consideration by BENEFEDS.

Key Control Log - An organizational tool for managing keys, detailing when they were issued and when returned.