Blank Ny Restraining Notice PDF Template

The New York Restraining Notice form serves as a critical tool within the state's legal framework, particularly in the context of enforcing money judgments. This form, officially titled "Information Subpoena with Restraining Notice," is aimed at individuals or entities (garnishees) holding assets belonging to a debtor or having an obligation to the debtor. Once a judgment is made in favor of a creditor, this form mandates the garnishee to withhold any sale, assignment, transfer, or interference with any assets or debts related to the debtor, thereby ensuring the creditor's ability to collect. The form encompasses various components including a certification that it complies with specific sections of the Civil Practice Law and Rules and the General Business Law, a detailed notice to the judgment debtor, provisions about exempt assets, and the implications of non-compliance, which may lead to sanctions for contempt of court. Such comprehensive scope underscores the form’s significance in securing creditors' rights while also detailing the obligations and potential liabilities of garnishees and the protections available to debtors, including exemptions for certain types of income or assets from being used to satisfy judgments.

Preview - Ny Restraining Notice Form

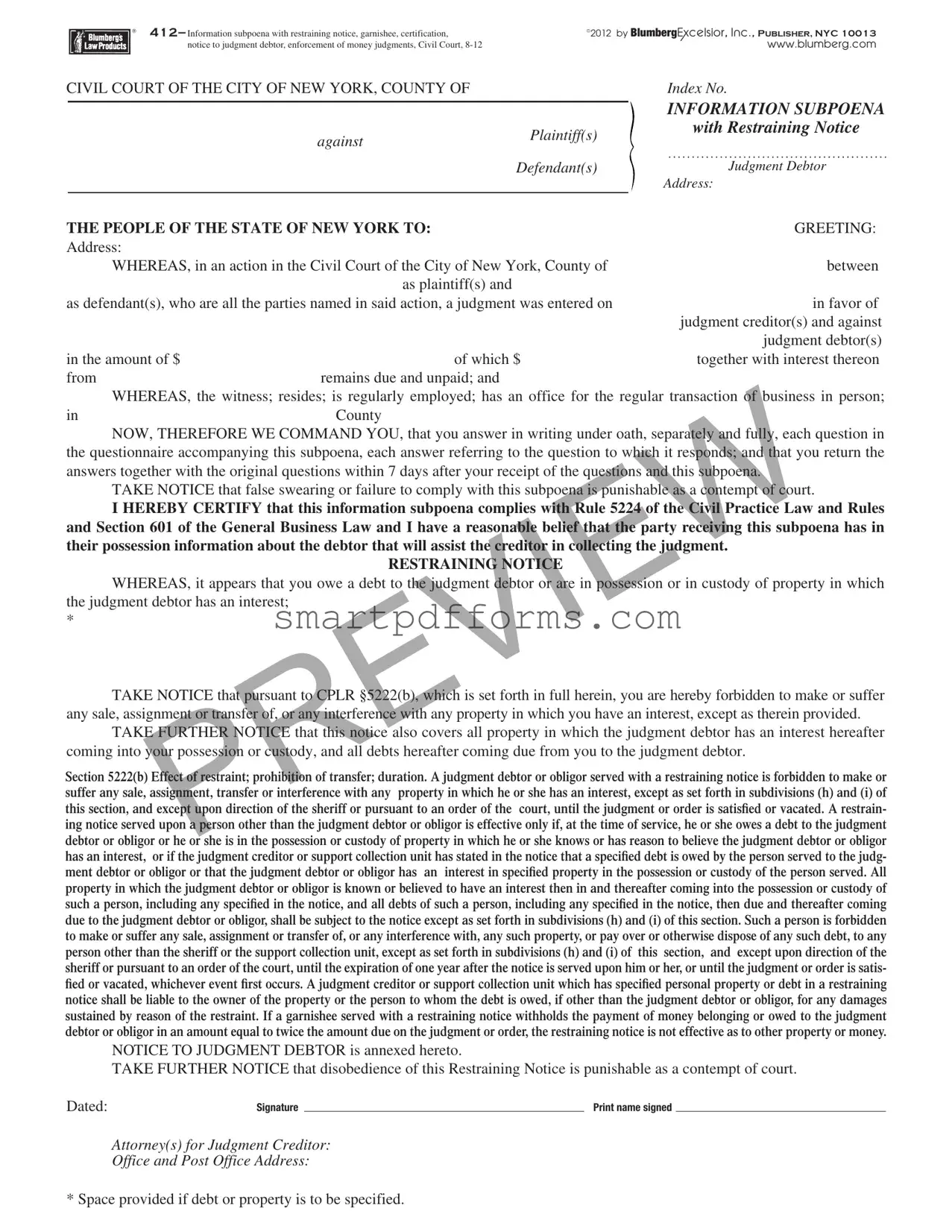

412– Information subpoena with restraining notice, garnishee, certification, |

©2012 by BlumbergExcelsior, Inc., PUBLISHER, NYC 10013 |

|

notice to judgment debtor, enforcement of money judgments, Civil Court, |

|

www.blumberg.com |

CIVIL COURT OF THE CITY OF NEW YORK, COUNTY OF |

|

Index No. |

|

|

INFORMATION SUBPOENA |

|

|

|

against |

Plaintiff(s) |

with Restraining Notice |

|

||

|

|

|

|

Defendant(s) |

Judgment Debtor |

|

|

Address: |

|

|

|

THE PEOPLE OF THE STATE OF NEW YORK TO: |

GREETING: |

|

Address: |

|

|

WHEREAS, in an action in the Civil Court of the City of New York, County of |

between |

|

|

as plaintiff(s) and |

|

as defendant(s), who are all the parties named in said action, a judgment was entered on |

in favor of |

|

|

|

judgment creditor(s) and against |

|

|

judgment debtor(s) |

in the amount of $ |

of which $ |

together with interest thereon |

from |

remains due and unpaid; and |

|

WHEREAS, the witness; resides; is regularly employed; has an office for the regular transaction of business in person; |

||

in |

County |

|

NOW, THEREFORE WE COMMAND YOU, that you answer in writing under oath, separately and fully, each question in the questionnaire accompanying this subpoena, each answer referring to the question to which it responds; and that you return the answers together with the original questions within 7 days after your receipt of the questions and this subpoena.

TAKE NOTICE that false swearing or failure to comply with this subpoena is punishable as a contempt of court.

I HEREBY CERTIFY that this information subpoena complies with Rule 5224 of the Civil Practice Law and Rules and Section 601 of the General Business Law and I have a reasonable belief that the party receiving this subpoena has in their possession information about the debtor that will assist the creditor in collecting the judgment.

RESTRAINING NOTICE

WHEREAS, it appears that you owe a debt to the judgment debtor or are in possession or in custody of property in which the judgment debtor has an interest;

*

TAKE NOTICE that pursuant to CPLR §5222(b), which is set forth in full herein, you are hereby forbidden to make or suffer any sale, assignment or transfer of, or any interference with any property in which you have an interest, except as therein provided.

TAKE FURTHER NOTICE that this notice also covers all property in which the judgment debtor has an interest hereafter coming into your possession or custody, and all debts hereafter coming due from you to the judgment debtor.

Section 5222(b) Effect of restraint; prohibition of transfer; duration. A judgment debtor or obligor served with a restraining notice is forbidden to make or suffer any sale, assignment, transfer or interference with any property in which he or she has an interest, except as set forth in subdivisions (h) and (i) of this section, and except upon direction of the sheriff or pursuant to an order of the court, until the judgment or order is satisfied or vacated. A restrain- ing notice served upon a person other than the judgment debtor or obligor is effective only if, at the time of service, he or she owes a debt to the judgment debtor or obligor or he or she is in the possession or custody of property in which he or she knows or has reason to believe the judgment debtor or obligor has an interest, or if the judgment creditor or support collection unit has stated in the notice that a specified debt is owed by the person served to the judg- ment debtor or obligor or that the judgment debtor or obligor has an interest in specified property in the possession or custody of the person served. All property in which the judgment debtor or obligor is known or believed to have an interest then in and thereafter coming into the possession or custody of such a person, including any specified in the notice, and all debts of such a person, including any specified in the notice, then due and thereafter coming due to the judgment debtor or obligor, shall be subject to the notice except as set forth in subdivisions (h) and (i) of this section. Such a person is forbidden to make or suffer any sale, assignment or transfer of, or any interference with, any such property, or pay over or otherwise dispose of any such debt, to any person other than the sheriff or the support collection unit, except as set forth in subdivisions (h) and (i) of this section, and except upon direction of the sheriff or pursuant to an order of the court, until the expiration of one year after the notice is served upon him or her, or until the judgment or order is satis- fied or vacated, whichever event first occurs. A judgment creditor or support collection unit which has specified personal property or debt in a restraining notice shall be liable to the owner of the property or the person to whom the debt is owed, if other than the judgment debtor or obligor, for any damages sustained by reason of the restraint. If a garnishee served with a restraining notice withholds the payment of money belonging or owed to the judgment debtor or obligor in an amount equal to twice the amount due on the judgment or order, the restraining notice is not effective as to other property or money.

NOTICE TO JUDGMENT DEBTOR is annexed hereto.

TAKE FURTHER NOTICE that disobedience of this Restraining Notice is punishable as a contempt of court.

Dated: |

Signature |

|

Print name signed |

Attorney(s) for Judgment Creditor:

Office and Post Office Address:

* Space provided if debt or property is to be specified.

©2009 BY BlumbergExcelsior, Inc., PUBLISHER, NYC 10013 |

|

|

www.blumberg.com |

NOTICE TO JUDGMENT DEBTOR OR OBLIGOR

Money or property belonging to you may have been taken or held in order to satisfy a judgment or order which has been entered against you. Read this carefully.

YOU MAY BE ABLE TO GET YOUR MONEY BACK

State and federal laws prevent certain money or property from being taken to satisfy judgments or orders. Such money or property is said to be “exempt”. The following is a partial list of money which may be exempt:

1.Supplemental security income (SSI);

2.Social security;

3.Public assistance (welfare);

4.Spousal support, maintenance (alimony) or child support;

5.Unemployment benefits;

6.Disability benefits;

7.Workers’ compensation benefits;

8.Public or private pensions;

9.Veterans benefits;

10.Ninety percent of your wages or salary earned in the last sixty days;

11.

12.Railroad retirement; and

13.Black lung benefits.

If you think that any of your money that has been taken or held is exempt, you must act promptly because the money may be applied to the judgment or order. If you claim that any of your money that has been taken or held is exempt, you may contact the person sending this notice.

Also, YOU MAY CONSULT AN ATTORNEY, INCLUDING ANY FREE/LEGAL SERVICES ORGANIZATION IF YOU QUALIFY. You can also go to court without an attorney to get your money back. Bring this notice with you when you go. You are allowed to try to prove to a judge that your money is exempt from collection under New York CPLRsections 5222(a), 5239 and 5240. If you do not have a lawyer, the clerk of the court may give you forms to help you prove your account contains exempt money that the creditor cannot collect. The law (New York CPLR Art. 4 and sections 5239 and 5240) provides a procedure for determination of a claim to an exemption.

STATE OF NEW YORK, COUNTY OF |

ss.: |

The undersigned, being duly sworn, deposes and says; deponent |

|

is not a party herein, is over 18 years of age and resides at |

|

|

|

That on |

at |

M., at |

|

deponent served the within subponea on |

|

|

(judgment debtor) (witness) therein named. |

INDIVIDUAL

1.

CORPORATION

2.

SUITABLE AGE PERSON

3.

AFFIXING TO DOOR, ETC.

4.

MAILING TO

RESIDENCE

USE WITH 3 OR 4

5A.

MAILING TO

BUSINESS

USE WITH 3 OR 4

5B.

DESCRIPTION

USE WITH

1,2,OR 3

by delivering a true copy to said person personally; deponent knew the person so served to be the (judgment debtor) (witness) therein.

acorporation, by delivering thereat a true copy to

personally, deponent knew said corporation so served to be the corporation described in said subponea as said (judgment debtor) (witness) and knew

said individual to be |

thereof. |

|

|

by delivering thereat a true copy to |

|

a person of suitable |

|

age and discretion. Said premises is (judgment debtor's) |

within the state. |

||

by affixing a true copy to the door of said premises, which is (judgment debtor's) |

actual place of |

usual place of |

|

Within 20 days of such delivery or affixing, deponent enclosed a copy of same in a postpaid envelope properly addressed to (judgment debtor) (witness) at (judgment debtor's) (witness') last known residence, and deposited said envelope in an official depository under the exclusive care and custody of the U.S. Postal Service within New York State.

Within 20 days of such delivery or affixing, deponent enclosed a copy of same in a first class postpaid envelope properly addressed to (judgment debtor) (witness) at (judgment debtor's) (witness') actual place of business, at

in an official depository under the exclusive care and custody of the U.S. Postal Service within New York State. The envelope bore the legend "Personal and Confidential" and did not indicate on the outside thereof, by return address or otherwise, that the communication was from an attorney or concerned an action against the (judgment debtor) (witness).

Male |

White Skin |

Black Hair |

White Hair |

Under 5' |

Under 100 Lbs. |

|

Female |

Black Skin |

Brown Hair |

Balding |

|||

|

Yellow Skin |

Blonde Hair |

Mustache |

|||

|

Brown Skin |

Gray Hair |

Beard |

|||

|

Red Skin |

Red Hair |

Glasses |

Over 65 Yrs. |

Over 6' |

Over 200 Lbs. |

Other identifying features:

That the copy so delivered was accompanied by a copy and original questions, and a prepaid, addressed return envelope, and that at the same time the authorized fee of 50 cents was paid (or tendered) to said witness.

Sworn to before me on

Print name beneath signature

LICENSE NO.:__________________________

Index No. |

Civil Court of the City of New York |

COUNTY OF |

|

|

|

|

|

|

Information Subpoena

LAW OFFICES OF

Plaintiff

against

Attorney(s) for

Office and Post Office Address

Defendant

Form Data

| Fact | Detail |

|---|---|

| Form Type | Information Subpoena with Restraining Notice |

| Publisher | BlumbergExcelsior, Inc., NYC 10013 |

| Governing Law | Civil Practice Law and Rules (CPLR) §5222(b), Section 601 of the General Business Law |

| Jurisdiction | Civil Court of the City of New York, County of [Specific County] |

| Purpose | To restrain a judgment debtor or person in possession of judgment debtor's property or owing a debt to the debtor from disposing of the property or paying the debt except as directed |

| Compliance Requirement | Recipient must answer under oath each question in the questionnaire accompanying this subpoena and return answers within 7 days |

Instructions on Utilizing Ny Restraining Notice

Once a judgment has been made in your favor in a court of law, the challenge shifts to collecting the awarded amount from the judgment debtor. In New York, one effective tool at your disposal is the use of a Restraining Notice. This legal document forbids the judgment debtor from making any transactions that could dissipate their assets, ensuring that the judgment creditor (you) has a fair chance at securing what is owed. Filling out the Restraining Notice correctly is paramount to its effectiveness and legality. Below are detailed steps to complete the form without error, ensuring your efforts to collect are on solid ground.

- Start by entering the Index No. assigned to your case in the designated space at the top right of the form.

- In the section titled "INFORMATION SUBPOENA," fill in the county where the action took place next to "CIVIL COURT OF THE CITY OF NEW YORK, COUNTY OF."

- Identify yourself as the "Plaintiff" by writing your full name and address in the provided space. Do the same for the "Defendant(s) / Judgment Debtor" in their respective field.

- Complete the "WHEREAS" statements by entering the necessary details about the judgment, such as the date the judgment was entered, the total amount awarded, the amount that remains unpaid, and any accrued interest. Ensure that these details accurately reflect the judgment as recorded by the court.

- Address the "THE PEOPLE OF THE STATE OF NEW YORK TO:" part by entering the judgment debtor's name and address again, reaffirming whom this notice is directed at.

- In the "GREETING" section, reiterate the names of the parties involved in the judgment as listed earlier in the form.

- For the actual "RESTRAINING NOTICE" segment, review the pre-printed text to confirm it applies to your situation, considering whether the judgment debtor has any assets or debts in possession that need to be restrained. If specific assets or debts are to be mentioned, use the space provided* in the document.

- Fill in the current date next to "Dated:" towards the bottom of the notice.

- Sign your name next to "Signature" and print your name below that to certify that you are issuing this Restraining Notice in accordance with New York's Civil Practice Law and Rules.

- Provide your attorney's information including their name, office, and post office address in the section titled "Attorney(s) for Judgment Creditor." If you are not represented by an attorney, you may need to enter your own information again in this section.

- Examine the "Notice to judgment debtors" to ensure it is attached and contains accurate information regarding the rights of the judgment debtor, especially concerning exempt property or money.

Upon completion, this filled form, along with any required accompanying questionnaires or documents, should be served to the judgment debtor or third parties as applicable, following New York's rules on the service of legal documents. This action places a legal obligation upon the recipient to refrain from dissipating their assets until your judgment is satisfied, giving you a legally enforceable right to collect what is owed.

Obtain Answers on Ny Restraining Notice

- What is a Restraining Notice in New York?

- When can a Restraining Notice be used?

- Who can issue a Restraining Notice?

- What information must be included in a Restraining Notice?

- How is a Restraining Notice served?

- What actions are prohibited by a Restraining Notice?

- Is there a time limit on a Restraining Notice?

- What if the Restraining Notice is violated?

- Can any money or property be exempt from a Restraining Notice?

- What should a judgment debtor do if they believe their assets are exempt?

A Restraining Notice in New York is a legal document issued by a creditor, or their attorney, to prevent a debtor from disposing, transferring, or interfering with their property. It is a method used to secure assets until a judgment can be satisfied or vacated. This notice can be served on the judgment debtor or on a third party who may owe a debt to, or is holding property of, the judgment debtor.

It can be used after a judgment has been entered against a debtor in a court of law. The creditor, holding a valid judgment, may issue a Restraining Notice to secure assets and prevent them from being hidden or spent before the judgment can be collected.

Either the judgment creditor themselves or their attorney can issue a Restraining Notice. It requires a certification that the notice complies with specific rules laid down in the Civil Practice Law and Rules.

The notice must include the name of the court where the judgment was entered, the names of both the creditor and the debtor, the amount of the judgment, and a command to refrain from disposing of any property that may satisfy the judgment. Specific legal language outlined in CPLR §5222(b) must also be included.

It can be served personally or through mailing to the last known address of the individual or entity upon whom it is to be served. The process for service must comply with New York's Civil Practice Law and Rules.

The notice prohibits the sale, assignment, transfer, or interference with any property in which the judgment debtor has an interest. This holds true for property presently held or that may come into possession in the future, as well as debts owed to the debtor.

Yes, a Restraining Notice is effective for one year from the date it is served, or until the judgment is satisfied or vacated, whichever occurs first.

Disobedience of a Restraining Notice is punishable as a contempt of court, which can entail various penalties, including fines or imprisonment.

Yes, state and federal laws protect certain types of money and property from being taken to satisfy judgments. Examples include social security income, unemployment benefits, and certain personal property. The NOTICE TO JUDGMENT DEBTOR OR OBLIGOR section provides a detailed list of exempt assets.

The debtor should promptly contact the creditor or the creditor's attorney if they believe their money or property being restrained is exempt. They may also seek legal advice or directly approach the court to claim the exemption and possibly recover the restrained assets.

Common mistakes

Filling out a New York Restraining Notice form is crucial for the enforcement of money judgments. However, several mistakes can occur in this process, potentially undermining the effectiveness of the legal action. Let's explore six common errors people make when completing this form.

Not verifying the accuracy of all parties' information: It's essential to ensure that the names and addresses of the plaintiff(s), defendant(s), and judgment debtor are correctly listed, matching the court records exactly.

Overlooking the details of the judgment: The form requires the exact amount of the judgment, including interest, to be specified. Failing to accurately report these amounts can lead to confusion or disputes down the line.

Incorrectly identifying the nature of the debtor’s assets: The notice must accurately reflect whether assets are in possession or if there is an owed debt. Misidentification can invalidate attempts to restrain assets.

Failure to comply with service requirements: Proper service of the restraining notice to all relevant parties, including the judgment debtor and garnishee, is mandatory. Neglecting proper service procedures can render the notice ineffective.

Not specifying exempt property or debts: The form allows the identification of certain debts or properties. Not clearly specifying these can lead to the unnecessary restraint of exempt assets, leading to potential legal challenges.

Forgetting to sign and date the notice: A restraining notice must be signed and dated by the attorney for the judgment creditor or by the judgment creditor themselves if acting pro se. An unsigned or undated notice is not legally enforceable.

Additionally, bear in mind that compliance with specific legal requirements, such as those mandated by Rule 5224 of the Civil Practice Law and Rules, is crucial. Mistakes in following these protocols can significantly delay or impede the judgment enforcement process.

Ensure all details match court records exactly.

Review and confirm the judgment amount and interest are accurate.

Identify and describe debtor's assets correctly.

Follow all required procedures for proper service.

Specify any exempt property or debts clearly.

Remember to sign and date the notice.

Avoiding these mistakes can help in the smooth execution of a restraining notice, thereby facilitating the effective collection of a judgment.

Documents used along the form

When dealing with the enforcement of money judgments in New York, the NY Restraining Notice form plays a pivotal role. However, navigating through the legal process requires more than just one form. Siqnificantly, parties involved often need to utilize additional legal forms and documents to effectively manage or respond to the situation. Below are some of the documents commonly used alongside the NY Restraining Notice form, each serving its unique function in the broader context of judgment enforcement.

- Information Subpoena: This document is a legal tool used to discover assets or information from the judgment debtor or third parties that might possess information about the debtor's assets. It requires the recipient to answer questions regarding the debtor's properties, employment, and financial institutions under oath, aiding in the judgment enforcement process.

- Property Execution Form: Following the identification of assets, this form is used to instruct a sheriff or marshal to seize certain assets belonging to the judgment debtor. It is an essential step in converting judgment into actual recovered funds or property.

- Income Execution Form: Specifically designed for garnishing wages, this form is sent to the debtor's employer, mandating the withholding of a portion of the judgment debtor's earnings towards satisfaction of the judgment. It is a common and effective method of judgment enforcement.

- Exemption Claim Form: This form allows a judgment debtor to claim certain statutory exemptions against garnishment or asset seizure. Considering that state and federal laws protect specific types of income and assets from being used to satisfy judgments, this document is critical for debtors seeking to protect their rights.

- Third-Party Subpoena: If a third party is suspected of holding assets belonging to the judgment debtor, this subpoena compels the disclosure of such information. It can be directed towards banks, employers, or any entity that might hold assets or owe debts to the judgment debtor.

Together, these forms create a framework that creditors can navigate to enforce judgments effectively. Understanding the function and appropriate use of each document is crucial for both creditors seeking to collect on judgments and debtors aiming to navigate or contest these actions. While the NY Restraining Notice form initiates the process by legally preventing the debtor from dissipating assets, the subsequent documents facilitate the actual recovery of funds, offering a blend of investigative and actionable steps towards judgment satisfaction.

Similar forms

The Writ of Garnishment is similar to the NY Restraining Notice in that both are legal tools used to secure debts by allowing creditors to claim assets or funds from a third party, known as the garnishee, who holds them on behalf of the debtor. This process involves legally notifying and compelling the garnishee to transfer the debtor's assets or funds to satisfy a debt.

Bank Levy forms resemble the restraining notice as they authorize a creditor to seize assets from a debtor’s bank account under court order. Once the bank receives the levy, it must freeze the debtor's account and transfer the funds to the creditor, similar to how property or money is restrained from transfer or disposal upon receiving a restraining notice.

A Property Lien can be compared to a restraining notice because both create a legal claim against an asset due to an unpaid debt. While a lien doesn't immediately transfer ownership, it needs to be cleared for the asset to be sold or refinanced, paralleling the restraining notice's way of forbidding sale, assignment, or transfer of property.

The Judgment Lien Certificate shares similarities with the restraining notice due to its role in enforcing money judgments by attaching a lien to the property of a debtor. This document signals to the court and the public that the creditor has a right to the debtor's property, akin to the restraining notice's capability to bind property and restrict transactions concerning the debtor's assets.

Order of Attachment is akin to the restraining notice as both are prejudgment remedies that safeguard a creditor's interest in a debtor's property. By preventing the debtor from dissipating or concealing assets, the order of attachment secures property that can later be used to satisfy a judgment, a purpose shared with the restraining notice's restrictions on property dealings.

Notice to Judgment Debtor included within the restraining notice shares its goal of informing the debtor about the actions being taken against them and their rights, specifically in regard to exempt property. Both documents serve to notify and potentially recover assets from a debtor, with the Notice to Judgment Debtor focusing on exempt assets that cannot be taken to satisfy the judgment.

Dos and Don'ts

Filling out the New York Restraining Notice form meticulously is essential for ensuring that it is legally valid and effective. To assist individuals in this process, here’s a guide on what to do and what to avoid:

Do:- Review the form thoroughly before starting to fill it out. Understanding every section will help in providing accurate and complete information.

- Provide precise details about the judgment debtor and creditor, including full names and addresses. Accuracy is critical in legal documents.

- Answer each question in the accompanying questionnaire carefully, making sure that your responses are truthful and to the point.

- Include the correct judgment amount owed, as well as any interest that has accrued, to ensure the restraining notice reflects the total debt accurately.

- Read and understand the legal implications of the restraining notice, especially the prohibitions and obligations it imposes on the garnishee.

- Make sure the form is signed and dated by the appropriate authority, which is usually the attorney for the judgment creditor.

- Provide the correct contact information for the attorney or judgment creditor, including the office and post office address.

- Ensure the form complies with Rule 5224 of the Civil Practice Law and Rules and Section 601 of the General Business Law.

- Review the notice to judgment debtor or obligor section to ensure it accurately explains their rights, especially regarding exempt income or assets.

- Deliver or serve the form correctly as per New York’s legal requirements to ensure it is enforceable.

- Leave any sections blank unless they are explicitly not applicable. Incomplete forms may be considered invalid.

- Guess or estimate figures such as the judgment amount; always use exact numbers to avoid disputes or legal challenges.

- Ignore the guidelines on how to serve the restraining notice to the garnishee or judgment debtor.

- Overlook the necessity of including the questionnaire with the subpoena, as failure to do so may render the restraining notice ineffective.

- Delay in returning the answers to the questionnaire within the specified time frame, which is typically 7 days after receipt.

- Fail to include the warning about the consequences of false swearing or noncompliance with the restraining notice.

- Forget to specify if certain debts or property are involved, as the restraining notice can be more effective if it details specific assets.

- Misrepresent any information, as this can lead to legal penalties, including being held in contempt of court.

- Fail to check compliance with relevant sections of the law, as legal challenges can arise from noncompliance.

- Disregard the requirement to send a copy of the restraining notice to the judgment debtor, as doing so violates their rights.

Misconceptions

When it comes to the New York Restraining Notice form, several misconceptions can lead to confusion and potential misuse. It is essential to dispel these myths for both creditors and debtors to understand their rights and obligations.

Myth 1: A Restraining Notice Completely Freezes All of a Debtor’s Assets

While the Restraining Notice is a powerful tool, it does not freeze all assets of the debtor. Instead, it prevents the debtor from disposing of or transferring assets that the debtor directly controls or assets owed to the debtor by the served party.Myth 2: Only Banks Receive Restraining Notices

While banks are common recipients due to holding debtor's accounts, any third party who owes the debtor money or holds their property can be served a Restraining Notice.Myth 3: The Notice Immediately Leads to Asset Transfer to the Creditor

Issuing a Restraining Notice does not directly transfer debtor’s assets to the creditor. It is a preliminary step to secure assets until a court determines their disposition or a settlement is reached.Myth 4: A Debtor Can Ignore a Restraining Notice Without Repercussion

Ignoring or violating a Restraining Notice can lead to penalties, including being held in contempt of court. It is essential for a debtor to comply with the terms of the notice.Myth 5: All of a Debtor's Property Can Be Reached

Some properties are exempt from being restrained, such as certain types of retirement accounts, social security benefits, and items deemed necessary for reasonable living standards.Myth 6: Restraining Notices Are Effective Indefinitely

A Restraining Notice is not permanent. It expires one year after its issuance or once the judgment is satisfied or vacated, whichever occurs first.Myth 7: A Restraining Notice Is the Same as a Garnishment

While both involve third parties, a garnishment is a specific legal process for withholding a debtor's money for the payment of a debt, usually from wages, unlike a blanket restriction on asset transfer.Myth 8: Creditors Can Issue Restraining Notices at Will

Creditors must have a valid judgment to issue a Restraining Notice. They cannot arbitrarily impose such notices without a court's decision confirming a debt is owed.Myth 9: Only Attorneys Can Issue Restraining Notices

While often facilitated by attorneys to ensure legality, technically, any judgment creditor can issue a Restraining Notice as long as they comply with the relevant legal requirements.Myth 10: Restraining Notices Can Be Used for Non-Monetary Judgments

Restraining Notices are specific to monetary judgments. They are an aid in the collection of a debt, and cannot be applied in cases of non-monetary judgments, like injunctions or custodial orders.

Understanding these misconceptions and the actual implications of a Restraining Notice can help both creditors and debtors navigate their legal options more effectively, ensuring that rights are maintained and legal duties are fulfilled.

Key takeaways

Understanding the New York Restraining Notice form is critical for anyone involved in the enforcement of money judgments. Here are key takeaways to guide you through filling out and using this form effectively:

- The form serves as a legal directive to restrain a debtor's assets, preventing the sale, assignment, or transfer of property or money that the debtor owns or is owed.

- It is essential to accurately complete the form, ensuring all parties' details are correct, including names and addresses, to avoid any delays or legal issues.

- The form must be served properly to the debtor or the person in possession of the debtor's assets. Incorrect service could invalidate the restraining notice.

- Recipients of the restraining notice are required to answer a questionnaire under oath, which assists the creditor in identifying assets for judgment recovery. This questionnaire must be returned within seven days after receipt.

- There are serious consequences for not complying with the restraining notice, including possible contempt of court penalties for both the debtor and the entity holding the debtor's assets.

- The restraining notice is effective for a year after service or until the judgment or order is satisfied or vacated, whichever happens first.

- Judgment debtors have rights, including exemptions that protect certain types of income and assets from being taken to satisfy judgments. It's important for debtors to be aware of these exemptions which can include social security, unemployment benefits, and child support, among others.

Always seek expert legal advice when dealing with restraining notices and the collection of judgments to ensure compliance with the law and to protect your rights throughout the process.

Popular PDF Forms

Form I-765 - Form I-765 includes sections for personal information, work eligibility, and legal declarations.

Free Driver Qualification File Forms - Verification of a driver's previous employment and driving records over the last three years to ensure compliance with regulations.

Ford Credit Application Pdf - Financial sections request detailed income information for evaluating creditworthiness and repayment capability.