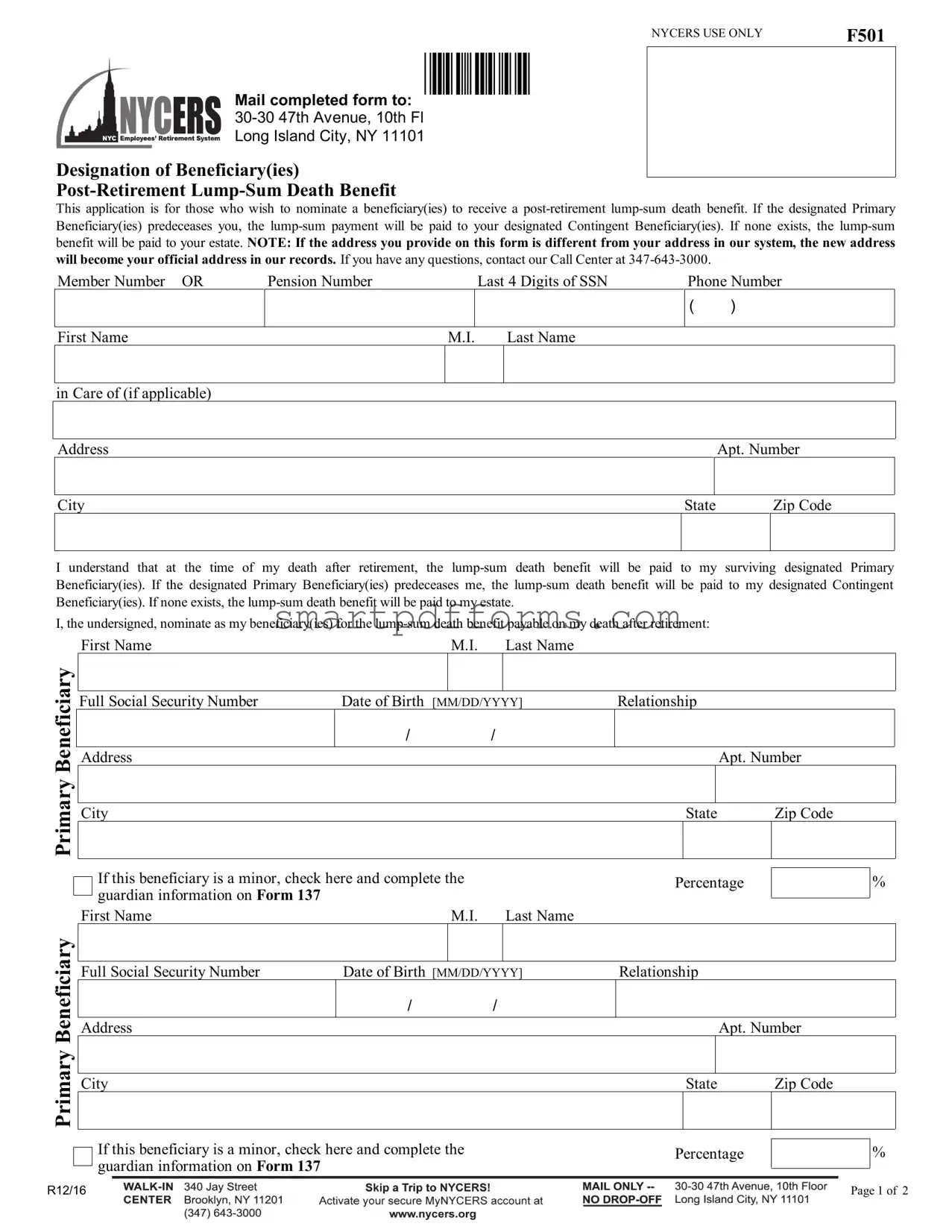

Blank Nycers F501 PDF Template

Ensuring the well-being of loved ones after retirement requires careful planning, especially regarding post-retirement benefits. The New York City Employees' Retirement System (NYCERS) offers a definitive way for members to secure a financial future for their beneficiaries through the F501 form, a crucial document for those looking to designate beneficiaries for a post-retirement lump-sum death benefit. This form allows members to nominate primary and contingent beneficiaries who will receive a specified sum in the event of the member's passing after retirement. Notably, if a primary beneficiary predeceases the member, the benefit then passes to the contingent beneficiary or beneficiaries designated on the form. In scenarios where no beneficiaries are named or survive the member, the lump-sum is directed to the member's estate, ensuring no loss of the intended financial support for next of kin or other designated parties. It is a straightforward yet essential form, mandating member’s thorough information such as last digits of the social security number, contact details, and clear designation of beneficiary proportions. The process is finalized with a signature, requiring notarization to ensure the form's enforceability and authenticity. With clear instructions and a provided contact number for assistance, NYCERS aims to make the nomination of post-retirement beneficiaries as seamless as possible, offering peace of mind to members about their loved ones’ future financial security.

Preview - Nycers F501 Form

NYCERS USE ONLY |

F501 |

Mail completed form to: *501*

Long Island City, NY 11101

Designation of Beneficiary(ies)

This application is for those who wish to nominate a beneficiary(ies) to receive a

Member Number OR |

Pension Number |

Last 4 Digits of SSN |

Phone Number |

First Name

( )

M.I. Last Name

in Care of (if applicable)

|

|

|

|

|

Address |

|

|

Apt. Number |

|

|

|

|

|

|

City |

State |

|

Zip Code |

|

|

|

|

|

|

I understand that at the time of my death after retirement, the

I, the undersigned, nominate as my beneficiary(ies) for the

First NameM.I. Last Name

Beneficiary |

|

Full Social Security Number |

Date of Birth |

|

|

|

|

|

[MM/DD/YYYY] |

||||||

|

|

||||||

|

|

|

/ |

|

|

/ |

|

|

|

Address |

|

|

|

|

|

Primary |

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If this beneficiary is a minor, check here and complete the |

|

|

|||

|

|

|

|

||||

|

|

guardian information on Form 137 |

|

|

|

|

|

|

|

First Name |

|

|

M.I. |

|

Last Name |

Beneficiary |

|

|

|

|

|

|

|

|

Full Social Security Number |

Date of Birth [MM/DD/YYYY] |

|||||

|

|

||||||

|

|

|

/ |

|

|

/ |

|

|

|

Address |

|

|

|

|

|

Primary |

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

If this beneficiary is a minor, check here and complete the guardian information on Form 137

Relationship

Apt. Number

|

State |

|

|

Zip Code |

||

|

||||||

|

|

|

|

|

% |

|

Percentage |

|

|

||||

|

|

|||||

|

|

|

|

|

|

|

Relationship

Apt. Number

|

State |

|

|

Zip Code |

||

|

||||||

|

|

|

|

|

% |

|

Percentage |

|

|

||||

|

|

|||||

|

|

|

|

|

|

|

R12/16 |

Page 1 of 2 |

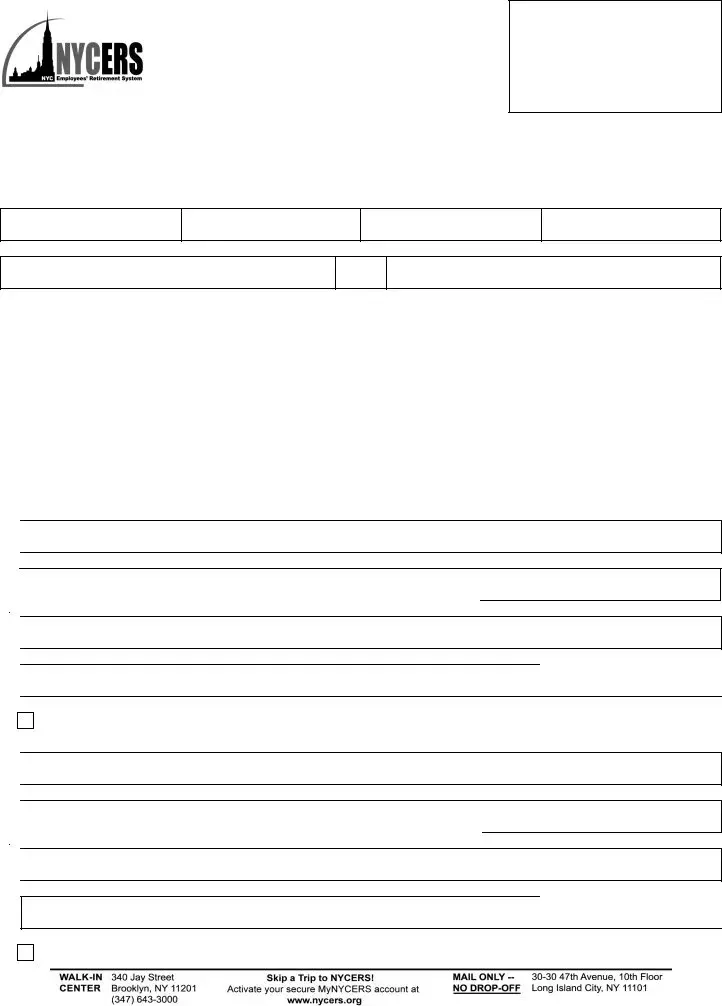

NYCERS USE ONLY |

F501 |

Mail completed form to:

Long Island City, NY 11101

Member Number OR |

Pension Number |

Last 4 Digits of SSN |

|

|

|

|

|

|

|

|

|

If the foregoing Primary beneficiary(ies) should predecease me, I hereby nominate the following as Contingent beneficiary(ies) for the above

Contingent Beneficiary

First Name |

|

|

M.I. |

|

Last Name |

Full Social Security Number |

Date of Birth |

|

|

|

|

[MM/DD/YYYY] |

|||||

Address |

/ |

|

|

/ |

|

|

|

|

|

|

|

City |

|

|

|

|

|

If this beneficiary is a minor, check here and complete the guardian information on Form 137

Relationship

Apt. Number

|

State |

|

|

Zip Code |

||

|

||||||

|

|

|

|

|

% |

|

Percentage |

|

|

||||

|

|

|||||

|

|

|

|

|

|

|

I am nominating my Estate as my beneficiary for my

Should I survive all designated beneficiaries, the

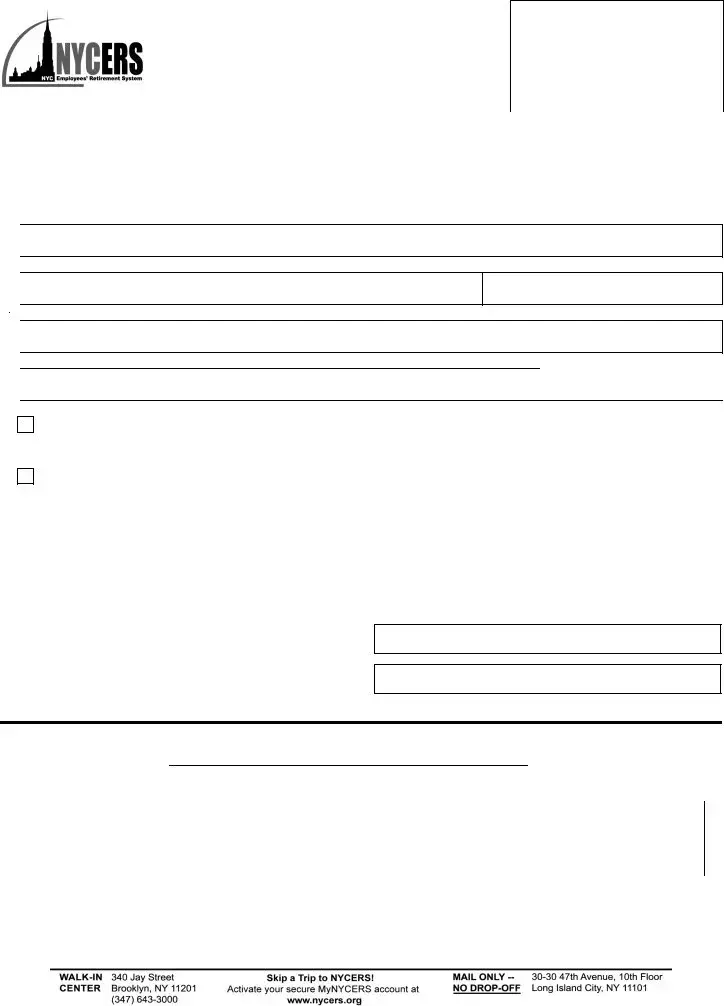

Signature of Member |

Date |

|

|

(Witnesses necessary only if mark is |

Witnessed by (1): |

|

|

used for signature) |

Witnessed by (2): |

|

|

This form must be acknowledged before a Notary Public or Commissioner of Deeds |

|

State of |

|

County of |

|

On this |

day of |

|

2 0 |

|

, personally appeared |

before me the above named, |

|

|

|

, to me known, and known to |

|||||

me to be the individual described in and who executed the foregoing instrument, and he or she acknowledged to me that he or she

executed the same, and that the statements contained therein are true. |

If you have an official seal, affix it |

||||

Signature of Notary Public or |

|

||||

|

|||||

Commissioner of Deeds |

|

||||

|

|

|

|

|

|

Official Title |

|

||||

|

|

|

|

|

|

Expiration Date of Commission |

|

||||

|

|

|

|

|

|

Sign this form and have it notarized, THIS PAGE

R12/16 |

Page 2 of 2 |

Form Data

| Fact | Detail |

|---|---|

| Form Purpose | The F501 form is used by individuals to designate beneficiaries for a post-retirement lump-sum death benefit. |

| Beneficiary Types | Designates both Primary and Contingent Beneficiaries. |

| Estate Clause | If no beneficiary exists, the lump-sum benefit is paid to the estate of the deceased. |

| Contact Information | Inquiries about the form can be directed to the Call Center at 347-643-3000. |

| Minor Beneficiaries | Allows designation of minors as beneficiaries with the completion of additional guardian information on Form 137. |

| Signature Requirement | The form must be signed by the member and notarized to be valid. |

| Governing Law | Governed by the laws of New York State. |

| Modification | Beneficiaries can be changed by submitting a new designation form to NYCERS. |

Instructions on Utilizing Nycers F501

The New York City Employees' Retirement System (NYCERS) F501 form plays a pivotal role for those individuals looking forward to designating their beneficiary(ies) to receive a post-retirement lump-sum death benefit. This decision requires thoughtful consideration as it ensures financial protection for the loved ones post the member's demise. The process of designating a beneficiary is straightforward but necessitates careful attention to detail to ensure the instructions are followed accurately. Below are the steps required for completing the NYCERS F501 form.

- Begin by entering your Member Number or Pension Number, along with the last 4 digits of your SSN, and your contact information, including phone number, full name, address (with apartment number if applicable), city, state, and zip code.

- Understand and acknowledge that the lump-sum death benefit will be paid to your nominated Primary Beneficiary(ies) upon your death by providing a signature at the designated section. If not available, the benefit will proceed to your nominated Contingent Beneficiary(ies) or, in their absence, to your estate.

- Nominate your Primary Beneficiary(ies) by filling out their full name(s), Social Security Number(s), date of birth, relationship to you, address, and the percentage of the benefit you wish to assign to them. If any beneficiary is a minor, mark the checkbox and complete the guardian information on Form 137.

- If you are nominating a Contingent Beneficiary(ies), should your Primary Beneficiary(ies) predecease you, fill out their details including full name(s), Social Security Number(s), date of birth, relationship, address, and the percentage of benefit designated to them. Remember to mark the checkbox and complete Form 137 if the Contingent Beneficiary is a minor.

- To designate your estate as the beneficiary, understand that you should not name any other beneficiary on the form and leave all other beneficiary sections blank.

- Print your name, sign and date the form in the presence of a witness if necessary. If a mark is used for a signature, witnesses are required.

- Ensure the form is notarized by presenting it to a Notary Public or Commissioner of Deeds for acknowledgment.

After you have completed and submitted the form, NYCERS will update your records to reflect your beneficiary(ies) choices. This action is crucial in ensuring that your intentions are clear and legally documented. It's a significant step towards safeguarding your beneficiaries' financial security, reinforcing the importance of meticulousness in accomplishing this task.

Obtain Answers on Nycers F501

What is the purpose of the NYCERS F501 form?

The NYCERS F501 form is specifically designed for members who wish to nominate one or more beneficiaries to receive a post-retirement lump-sum death benefit. This form allows a member to designate primary and contingent beneficiaries; the primary beneficiaries are the first in line to receive the benefit upon the member's death. If a primary beneficiary predeceases the member, the contingent beneficiary(ies) will receive the lump-sum payment. In cases where there are no surviving designated beneficiaries, the lump-sum death benefit will be paid to the member's estate.

How can I designate a minor as a beneficiary using the F501 form?

To designate a minor as a beneficiary on the F501 form, the member must indicate this by checking the appropriate box next to the beneficiary’s information. Additionally, the member is required to complete the guardian information on Form 137, which will ensure that the minor's interests are adequately protected and that there is a legally responsible party to manage the lump-sum death benefit on behalf of the minor until they reach the age of majority.

What happens if my primary beneficiary predeceases me?

If your designated primary beneficiary predeceases you, the post-retirement lump-sum death benefit will then be directed to your designated contingent beneficiary(ies), as indicated on your F501 form. It's essential to accurately designate both primary and contingent beneficiaries to ensure that your wishes regarding the distribution of your post-retirement lump-sum death benefit are honored. If there are no surviving designated beneficiaries, the benefit will be paid to your estate.

Is it necessary to notarize the F501 form, and how does one go about it?

Yes, after completing the F501 form, it is necessary to have your signature notarized. This process involves signing the form in the presence of a Notary Public or Commissioner of Deeds, who will then verify your identity and acknowledge that you have signed the form willingly and are the individual described within it. The notary or commissioner will then complete their section of the form, including their signature, official title, and the expiration date of their commission. This step is crucial in validating the form and ensuring that your beneficiary designations are legally recognized.

Common mistakes

When completing the NYCERS F501 form, which is crucial for nominating beneficiaries for the post-retirement lump-sum death benefit, individuals often overlook the importance of accuracy and completeness. This can lead to unnecessary complications and delays. Here are four common mistakes to be aware of:

Failing to provide detailed information for each beneficiary, including their full legal name, social security number, and date of birth. This data is essential for the New York City Employees' Retirement System (NYCERS) to accurately identify and communicate with beneficiaries.

Omitting the designation of a contingent beneficiary. In the event that the primary beneficiary predeceases the member, having a contingent beneficiary ensures that the lump-sum death benefit is disbursed according to the member's wishes without defaulting to the estate.

Incorrectly assuming that the form does not need to be notarized. The NYCERS F501 form must be acknowledged before a Notary Public or Commissioner of Deeds to be considered valid and executable.

Not updating the form after significant life events, such as marriage, divorce, or the birth of a child. It's crucial for members to review and, if necessary, update their beneficiary designations to reflect their current intentions.

Avoiding these common errors can significantly streamline the process of designating beneficiaries, ensuring that members' post-retirement benefits are distributed according to their expressed wishes.

Documents used along the form

When dealing with post-retirement planning and the designation of beneficiaries for lump-sum death benefits, the NYCERS F501 form plays a pivotal role. This form allows retirees to nominate their primary and contingent beneficiaries, ensuring that their wishes are honored in the event of their passing. Besides the F501 form, there are several other documents and forms that are often used in tandem to provide a comprehensive approach to post-retirement planning. These documents each serve distinct functions, from nominating a guardian for minor beneficiaries to updating personal contact information.

- Form 137 - Guardian for Minor Beneficiary Designation: This form is essential if a retiree chooses a minor as a beneficiary. It allows the member to designate a trusted guardian responsible for managing the benefits on behalf of the minor until they reach the age of majority.

- Form 190 - Affidavit for Lost Check: In situations where a retirement benefit or lump-sum death benefit check is lost, stolen, or destroyed, Form 190 is used to request a replacement check, ensuring beneficiaries can receive their due benefits without undue delays.

- Form 343 - Change of Address: It is crucial for retirees and beneficiaries to keep their contact information up to date with NYCERS. Form 343 allows for the easy update of mailing addresses, ensuring all correspondence and benefits reach the intended recipients efficiently.

- Form 354 - Direct Deposit Enrollment: To streamline the process of receiving retirement or death benefits, retirees and beneficiaries can use Form 354 to set up direct deposit, ensuring funds are deposited promptly and securely into their bank accounts.

- Form 766 - Application for the Payment of the Ordinary Death Benefit: In the event of a retiree's death, beneficiaries use this form to apply for the ordinary death benefit, providing necessary documentation and information to process the benefit.

- Form W-4P - Withholding Certificate for Pension or Annuity Payments: Beneficiaries receiving periodic payments may need to adjust their withholding for federal income tax purposes. Form W-4P allows them to specify the amount of tax to be withheld from each payment.

Each of these forms plays an essential role in the post-retirement planning process, ensuring that retirees can manage their affairs effectively and with peace of mind. By understanding how these documents complement the NYCERS F501 form, individuals can take proactive steps in securing their financial legacy and providing for their chosen beneficiaries.

Similar forms

The F502 form for Designation of Primary and Contingent Beneficiary for a Lump-Sum Payment Upon Death is similar to NYCERS F501 form because both forms allow a member to appoint beneficiaries to receive benefits after the member’s death. Both require detailed information about the beneficiaries and outline the payment procedures if the primary beneficiary predeceases the member.

The Last Will and Testament document shares similarities with the F501 form because it involves designating individuals or entities to receive assets upon the drafter's death. While the F501 is specific to a post-retirement lump-sum benefit, a will covers a broader range of assets but serves the similar purpose of passing on an individual's assets to chosen beneficiaries.

The Transfer on Death (TOD) Registration form for financial accounts is similar to the F501 form because it allows the account holder to designate beneficiaries to receive the account's assets after the holder's death, bypassing probate. Like the F501, the TOD form avoids the need for the assets to pass through the estate, offering a direct mechanism to transfer benefits to a named individual or individuals.

The Life Insurance Policy Beneficiary Designation form is closely related to the F501 form. In both instances, the individual specifies who will receive benefits upon their death. These forms are crucial for ensuring that benefits are distributed according to the individual’s wishes, rather than default legal procedures. Each requires the designation of primary and, often, contingent beneficiaries.

Dos and Don'ts

When filling out the NYCERS F501 form, there are key actions to take and to avoid ensuring the correct processing of your post-retirement lump-sum death benefit designation. Paying attention to these details can make a significant difference in how smoothly your intentions are carried out after your retirement.

Do:

- Ensure all information provided is accurate and current, including your full name, Member or Pension Number, and the last 4 digits of your Social Security Number.

- Clearly designate your primary and, if applicable, contingent beneficiaries by providing their full names, relationships, percentages (if splitting the benefit among multiple beneficiaries), and other required details.

- If a minor is named as a beneficiary, remember to check the appropriate box and fill out the guardian information on Form 137 to ensure the minor’s interests are properly managed.

- Sign the form and have it notarized to validate your designation. This is a critical step to ensure your form is legally acknowledged.

Don't:

- Leave any required fields blank. Incomplete forms may result in delays or the inability to process your beneficiary designation.

- Forget to update your beneficiary information if circumstances change. It is important to keep beneficiary designations current to reflect your current wishes.

- Attempt to designate your estate as a beneficiary on the form while also naming individual beneficiaries. If you wish to designate your estate, you must not fill out any other beneficiary sections.

- Fail to have the form witnessed or notarized as required, which could result in the designation not being accepted or recognized by NYCERS.

By following these guidelines, you can ensure that your post-retirement lump-sum death benefit designation is accurately recorded and reflects your wishes. It's also advisable to consult with a professional or NYCERS directly if you have any questions or need assistance with filling out the form.

Misconceptions

Many people have misconceptions about the NYCERS F501 form, which can lead to confusion or errors when designating beneficiaries for post-retirement lump-sum death benefits. It's essential to clear up these misunderstandings to ensure one's wishes are accurately fulfilled. Below are six common misconceptions about the F501 form and the truths behind them.

- Only family members can be beneficiaries: There's a belief that only relatives can be designated as beneficiaries. In truth, anyone can be nominated, including friends or organizations, as long as their information is correctly provided.

- Designation of a minor requires no additional steps: When nominating a minor as a beneficiary, it's often thought that no extra steps are needed. However, appointing a minor does require completing guardian information on Form 137 to ensure proper legal representation.

- Once submitted, the F501 form cannot be changed: Another common belief is that designations are final once the form is submitted. This is not the case; beneficiaries can be updated by submitting a new F501 form with NYCERS.

- The estate automatically receives the benefit if there are no living beneficiaries: While it's true that the estate will receive the benefit if there are no surviving designated beneficiaries, one can also specifically nominate their estate as a beneficiary on the F501 form.

- Filling out and submitting the form is all that's required: Simply completing and submitting the form isn't enough; it must also be notarized. This step is crucial to validating the document and the designations made within it.

- A primary beneficiary must be assigned a 100% share: It's often misunderstood that a primary beneficiary must receive the entire benefit. Shares can actually be distributed in any percentage to multiple beneficiaries, provided the total allocations equal 100%.

Understanding these key points can help ensure that your post-retirement wishes are honored precisely as you intend. Taking the time to accurately complete and update your F501 form with NYCERS is a significant step in securing your beneficiaries' future.

Key takeaways

Understanding the NYCERS Form F501, which pertains to the designation of beneficiary(ies) for a post-retirement lump-sum death benefit, is crucial for ensuring that one's final wishes regarding their pension benefits are respected and properly executed. Below are key takeaways about filling out and using this form.

- Designation of primary and contingent beneficiaries: The form allows you to designate primary and contingent beneficiaries for the receipt of a lump-sum death benefit after your retirement. It's important to accurately fill in the details of your designated beneficiaries, including their full names, social security numbers, addresses, and the percentage of the benefit they are to receive. The designation of a contingent beneficiary(ies) is particularly important in the event that the primary beneficiary predeceases the member.

- Minor beneficiaries: If any of the designated beneficiaries are minors, it is mandatory to check the appropriate box and complete additional guardian information on Form 137. This ensures that the benefits will be properly managed on behalf of the minor until they reach the age of majority.

- Designating an estate as a beneficiary: In some cases, a member may choose not to designate an individual or individuals as beneficiaries but instead nominate their estate to receive the lump-sum death benefit. If choosing this option, it's critical to leave all other sections of beneficiary designation blank to validate the selection of the estate as the sole beneficiary. This option is permissible but requires careful consideration of its implications for estate planning and administration.

- Notarization: Upon completing the form, the member's signature must be notarized. This step is vital for the form's acceptance and validity, emphasizing the importance of the document and the intentions expressed within it. The presence of witnesses may also be necessary if a mark is used instead of a signature, underscoring the importance of proper execution and witnessing of the form to ensure its legitimacy.

Attentive completion and understanding of the NYCERS F501 form is essential for members who wish to designate how their post-retirement lump-sum death benefit should be distributed. It safeguards the member's final wishes and provides clarity and direction for the distribution of benefits in accordance with those wishes.

Popular PDF Forms

Sample Ach Authorization Form - Details about fraud, identity compromise, and stolen checks as reasons for unauthorized transactions are explicitly mentioned.

Fl 320 - Attorneys or parties without attorneys can fill out the FL-320, providing essential case and personal information.

Are Irs Whistleblower Anonymous - By completing this form, individuals can assist in uncovering tax fraud that may otherwise remain hidden from authorities.