Blank Nzcs 224 PDF Template

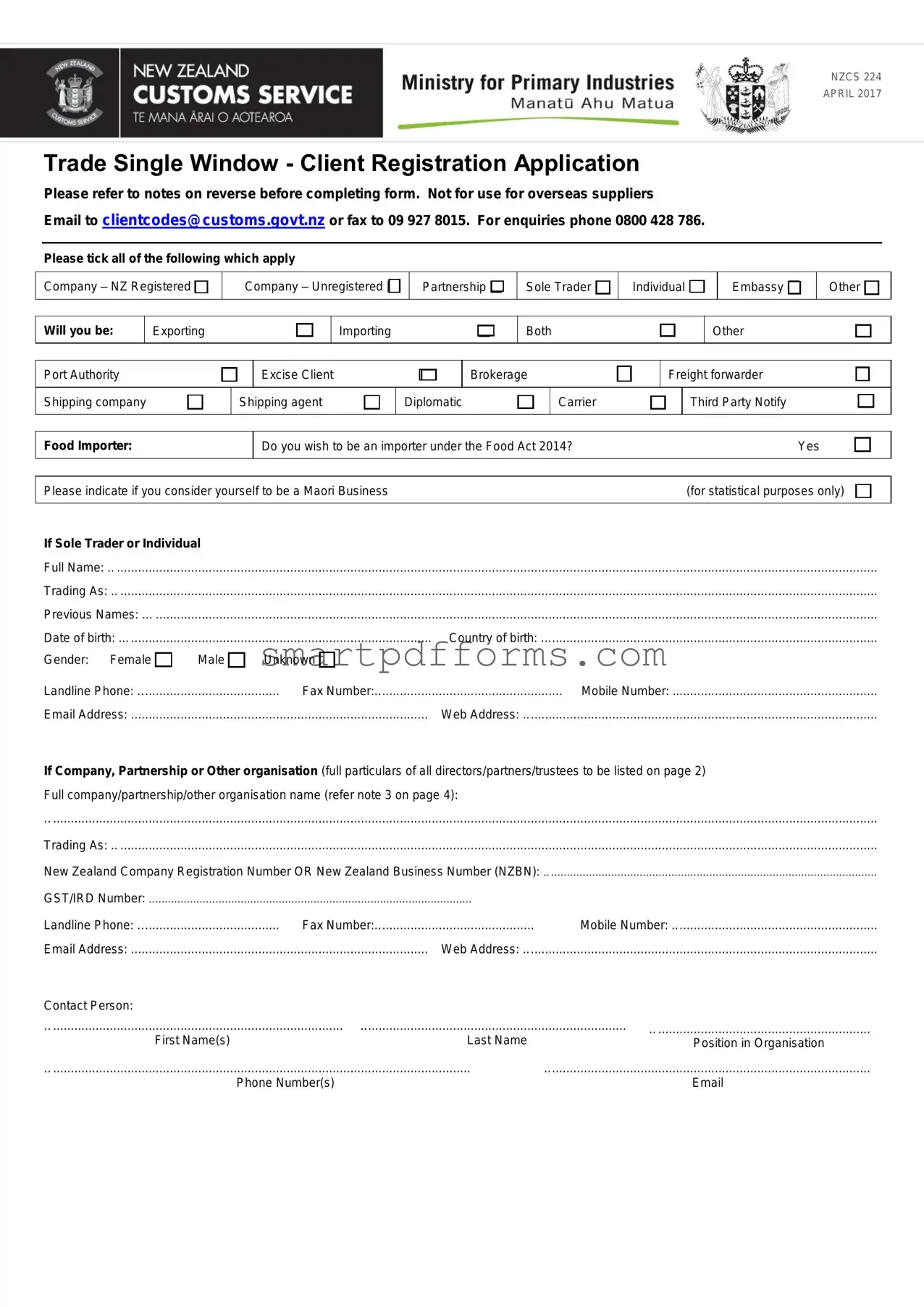

In a world increasingly guided by the complexities of international trade laws and regulations, understanding the nuances of specific documents such as the NZCS 224 form, published in April 2017, becomes crucial for entities engaging with New Zealand's trading system. This form, serving as a Client Registration Application within the Trade Single Window framework, epitomizes the meticulous procedures entities must navigate to partake in the import and export dynamics of the country. From companies, both registered and unregistered in New Zealand, to partnerships, sole traders, diplomatic entities, and more, the NZCS 224 form accommodates a broad spectrum of applicants seeking to formalize their trade operations. Its requirement for detailed information, ranging from organizational details and contact information to specifics about the nature of the trade activities (importing, exporting, or both), highlights the New Zealand Customs Service's commitment to maintaining a secure and efficient trade environment. Crucially, the form also touches on compliance with the Food Act 2014 for food importers, and it opens a window into the intersection of trade with biosecurity and public health considerations. The optional designation of set TSW broker access further signifies the tailored control entities have over their trade dealings, underscoring the form's role not just as a bureaucratic necessity but as a foundational tool for engaging in New Zealand's trade ecosystem effectively and responsibly.

Preview - Nzcs 224 Form

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NZCS 224 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APRIL 2017 |

|

|

Trade Single Window - Client Registration Application |

|

|

|

|

|

||||||||||||||

|

Please refer to notes on reverse before completing form. Not for use for overseas suppliers |

|

|

|

|

|

||||||||||||||

|

Email to clientcodes@customs.govt.nz or fax to 09 927 8015. For enquiries phone 0800 428 786. |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please tick all of the following which apply |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company – NZ Registered |

|

Company – Unregistered |

|

Partnership |

Sole Trader |

Individual |

|

|

Embassy |

Other |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Will you be: |

|

Exporting |

|

|

|

Importing |

|

|

|

Both |

|

|

|

|

Other |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Port Authority |

|

|

|

Excise Client |

|

|

Brokerage |

|

Freight forwarder |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Shipping company |

|

|

Shipping agent |

Diplomatic |

|

Carrier |

|

|

|

Third Party Notify |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Food Importer:

Do you wish to be an importer under the Food Act 2014? |

Yes |

Please indicate if you consider yourself to be a Maori Business |

(for statistical purposes only) |

|||

|

|

|

||

If Sole Trader or Individual |

|

|

||

Full Name: |

|

|

||

Trading As: |

.. ...................................................................................................................................................................................................................... |

|

|

|

Previous Names: |

|

|

||

Date of birth: |

Country of birth: |

|||

Gender: |

Female |

Male |

Unknown |

|

Landline Phone: |

Fax Number: |

Mobile Number: |

||

Email Address: |

Web Address: |

|||

If Company, Partnership or Other organisation (full particulars of all directors/partners/trustees to be listed on page 2) Full company/partnership/other organisation name (refer note 3 on page 4):

.. .........................................................................................................................................................................................................................................

Trading As: |

|

|

|

New Zealand Company Registration Number OR New Zealand Business Number (NZBN): |

.. ....................................................................................................... |

||

GST/IRD Number: |

|

|

|

Landline Phone: |

Fax Number: |

Mobile Number: |

|

Email Address: |

Web Address: |

|

|

Contact Person: |

|

|

|

.. .................................................................................. |

........................................................................... |

.. ............................................................ |

|

First Name(s) |

Last Name |

|

Position in Organisation |

.. ...................................................................................................................... |

............................................................................................ |

||

|

Phone Number(s) |

|

|

NZCS 224 | APRIL 2017

Physical Address: |

|

Street Number: |

|

Unit Number: |

Floor Level: |

Property Name: |

Property Type: |

Street Name: |

Street Type: |

Suburb : |

Town/City: |

State: |

Country: |

Postcode: |

|

Postal Address (if not same as above): |

|

Street Number: |

|

Unit Number: |

Floor Level: |

Property Name: |

Property Type: |

PO Box: |

Private Bag: |

Street Name: |

Street Type: |

Suburb : |

Town/City: |

State: |

Country: |

Postcode: |

|

|

|

|

Full particulars of all directors/partners/trustees (refer note 3 on page 4) |

|

|

||

1 |

.. ...................................................... |

.. ............................ |

.............................................. .. .............................. |

|

First Name(s) |

Last Name |

Date of Birth |

Identification Type |

Number |

2 |

.. ...................................................... |

.. ............................ |

.............................................. .. .............................. |

|

First Name(s) |

Last Name |

Date of Birth |

Identification Type |

Number |

3 |

.. ...................................................... |

.. ............................ |

.............................................. .. .............................. |

|

First Name(s) |

Last Name |

Date of Birth |

Identification Type |

Number |

4 |

.. ...................................................... |

.. ............................ |

.............................................. .. .............................. |

|

First Name(s) |

Last Name |

Date of Birth |

Identification Type |

Number |

Billing Address (if not same as above): |

|

|

|

|

Street Number: |

|

|

|

|

Unit Number: |

Floor Level: |

|

||

Property Name: |

Property Type: |

|

||

PO Box: |

Private Bag: |

|

||

Street Name: |

Street Type: |

|

||

Suburb : |

Town/City: |

|

||

State: |

Country: |

|

||

Postcode: |

|

|

|

|

Payment Account Details (if applicable) |

|

|

|

|

Ministry for Primary Industries account number: ...……………………………………………

P2 of 4

NZCS 224 | APRIL 2017

Lodgement Notifications

To receive TSW notifications for lodgements - select ONE of the following notification methods:

Do not notify

B2B Messaging

Add name(s) to be notified: ...……………………………………………

Email: ...……………………………………………………………………..

If TSW notification preferences requested - select any/all of the following WCO lodgement types:

Import

Export

OCR

CRE

ICR

ANA

Excise

AND

For the lodgement type requested - select any/all of the following lodgement status:

Cancelled

Cleared

Directions given

Error

Declaration Required

Written Off

OPTIONAL: Set TSW Brokerage Access |

|

|

|

Please indicate if you wish to restrict the use of your code to nominated Brokers only? |

Yes |

No |

|

If yes: |

|

|

|

Brokerage Code (if known): |

Brokerage Name: .. |

............................................................................. |

|

Brokerage Code (if known): |

Brokerage Name: .. |

............................................................................. |

|

Brokerage Code (if known): |

Brokerage Name: .. |

............................................................................. |

|

(attach a supplementary list if more than three brokers) |

|

|

Optional: Please advise Customs Broker |

..................................................... |

of the code at email: |

|

|

|

DECLARATION (refer Note 4 below) |

|

|

I |

(position) |

of |

declare that the information provided is true and correct. |

|

|

Signature: |

Date: |

|

Date: .....................................

Processing Officer: ... ..................................................

Client Code: ... .......................................................

P3 of 4

NZCS 224 | APRIL 2017

IMPORTANT INFORMATION

NOTES:

1.You must tick ALL boxes that apply.

2.Private individuals must supply clearly legible photo ID – preferably a copy of your passport or drivers licence.

3(a). For registered companies: A copy of your company’s Certificate of Incorporation must be attached. Provide your trading name - if different from registered company name. All directors must be listed – add a supplementary page if required. Clearly legible photo ID is required for each name listed – a copy of the passport biography details page or drivers licence is preferred.

3(b) For Partnerships and sole traders: A trading name must be specified, along with full names of all sole traders/partners. Photo ID (as described above) is required for all sole traders/partners.

3(c). For other organisations (such as schools, sports clubs, registered trusts, charities or similar): All trustees, the principal, or other relevant person(s) of responsibility must be listed. Photo ID (as described above) is required for all listed persons. For New Zealand registered trusts, societies and charities, a copy of your certificate must be supplied. For schools, sports clubs and similar, a letterhead of the organisation must be supplied.

4.The application must be completed and signed by an authorised person of the entity concerned (for example an officer of the organisation or a Customs broker) or the importer/exporter of the goods.

5.Incomplete applications will be rejected and returned for completion.

6.Please note you are required to keep business records in New Zealand pursuant to section 95 of the Customs and Excise Act 1996.

7Applications can be lodged electronically to email clientcodes@customs.govt.nz or, if you do not have access to email, faxed to 09 927 8015.

Note that fax copies of ID’s are often illegible and therefore may be rejected, so email is the recommended method of submission.

8.For enquiries phone 0800 428 786.

The information on the client registration application form (and any subsequent customs entries) may be supplied to Statistics New Zealand for use in official statistics.

The personal information on this form will be used as part of the assessment of the client registration application in accordance with the Customs and Excise Act 1996 and for

The New Zealand Customs Service and the Ministry for Primary Industries may collect and use information for border management and

For Food Importers

This information is being collected for the purpose of listing importers of food for sale and for

All information provided to the Ministry for Primary Industries for the purposes of listing importers of food for sale is official information and subject to the Official Information Act 1982. If a request is made under that Act for information you have provided in this application, the Ministry for Primary Industries will consider any such request taking into account its obligation under the Official Information Act 1982 and any other applicable legislation.

Set TSW broker access –

This is an optional field that allows you to nominate a specific brokerage or group of brokers who can use your client registration code to make lodgements through TSW. If no selection is made, then any brokerage will be able to make lodgements on your behalf.

P4 of 4

Form Data

| Fact Name | Description |

|---|---|

| Form Identifier | NZCS 224 |

| Form Version Date | April 2017 |

| Title | Trade Single Window - Client Registration Application |

| Submission Information | Email to clientcodes@customs.govt.nz or fax to 09 927 8015 |

| Enquiry Contact | For enquiries phone 0800 428 786 |

| Application Scope | For companies, partnerships, sole traders, individuals, and several other entity types engaging in importing/exporting |

| Special Sections for Specific Entities | Includes sections for food importers under the Food Act 2014 and options for Maori Business declaration |

| Privacy and Data Use | Information provided may be used for official statistics, border management, and risk management in accordance to Customs and Excise Act 1996 and other laws |

| Optional Brokerage Access | Applicants can restrict their code use to nominated brokers only |

| Declaration Requirement | The form must be completed and signed by an authorized entity representative |

| Governing Laws | Customs and Excise Act 1996, Biosecurity Act 1993, Food Act 2014 |

Instructions on Utilizing Nzcs 224

Filling out the NZCS 224 form is a critical step for businesses and individuals planning to engage in trade activities through New Zealand's borders. This form is designed to set up a client registration application within the Trade Single Window (TSW) system, facilitating a smoother process for importing or exporting goods. Here are the step-by-step instructions to accurately complete this form:

- Start by specifying the nature of your entity: Tick the appropriate box(es) that describe your entity (e.g., Company – NZ Registered, Sole Trader, Individual, etc.).

- Indicate the trade activities you will be involved in: Exporting, Importing, Both, or Other specific activities.

- If applicable, answer the question regarding food importing under the Food Act 2014 and whether you consider yourself a Maori Business for statistical purposes.

- For Sole Traders or Individuals, provide your full name, trading as (if applicable), previous names, date of birth, country of birth, gender, contact information (landline phone, fax number, mobile number, email address, and web address).

- If you are registering a Company, Partnership or Other organization, fill in the full name of the company/partnership, trading name if different, NZ Company Registration Number OR NZ Business Number (NZBN), GST/IRD Number, and contact information including the contact person’s name and position in the organization.

- Enter the Physical Address and Postal Address details accurately. If the postal address is the same as the physical address, you do not need to repeat the information.

- Provide full particulars of all directors/partners/trustees including their first name(s), last name, date of birth, identification type, and number.

- If the Billing Address differs from the addresses given, fill in the specific details.

- List the Ministry for Primary Industries account number if it's applicable to your trade operations.

- Specify your preferences for receiving TSW notifications for lodgements. Choose your preferred method of notification and specify the required details.

- Under Lodgement Notifications, select the types of lodgements and the status updates you wish to be notified about.

- For users wishing to set TSW Brokerage Access, indicate whether you want to restrict your code to nominated brokers only and provide the necessary brokerage details.

- Complete the Declaration section by providing the position of the person filling out the form, their signature, and the date.

After carefully reviewing the form to ensure all provided information is accurate and complete, submit the form via email to clientcodes@customs.govt.nz or fax it to the provided number if email is not an option. Remember, an accurately filled form ensures a quicker and smoother registration process, facilitating your trade activities through New Zealand's borders.

Obtain Answers on Nzcs 224

What is the NZCS 224 form?

The NZCS 224 form is a Client Registration Application used for the Trade Single Window system. It is designed for businesses or individuals in New Zealand who are involved in importing, exporting, or both. The form enables entities to register with New Zealand Customs Service, allowing them to conduct trade activities efficiently. The form asks for detailed information about the business or individual, including type of operation (e.g., company, sole trader, partnership), contact details, and specific preferences regarding the handling of their trade documentation.

Who needs to fill out the NZCS 224 form?

Any entity, be it a registered company, unregistered partnership, sole trader, individual, or any other organization engaging in import or export activities in New Zealand, needs to complete the NZCS 224 form. This also includes entities like embassies, port authorities, excise clients, brokerages, freight forwarders, shipping companies, and shipping agents, among others. If you wish to import or export goods, registering through this form is a necessary step to ensure compliance with New Zealand Customs Service requirements.

How can I submit the NZCS 224 form?

- Email: The form can be submitted electronically via email to clientcodes@customs.govt.nz. This method is preferred to avoid legibility issues with faxed documents.

- Fax: If email is not an option, the form can be faxed to 09 927 8015. However, note that faxed copies of identification documents often turn out illegible and may cause the submission to be rejected.

It's important to ensure that all parts of the form are completed accurately and submitted along with any required supportive documents to avoid delays or rejections.

What information do I need to provide on the NZCS 224 form?

All applicants are required to provide detailed information, including, but not limited to, the type of entity (e.g., registered company, sole trader), full names and particulars of directors or partners, trading name, New Zealand Company Registration Number or NZBN (if applicable), GST/IRD Number, contact details, and physical and postal addresses. Entities will also need to specify their role in the import/export process and whether they act as importers under the Food Act 2014. Proof of identification and additional documentation, such as a company’s Certificate of Incorporation or a certificate for trusts, societies, and charities, may be required.

Is there any specific documentation required to accompany the NZCS 224 form?

Yes. Depending on the type of applicant, specific documents are required:

- For registered companies: A Certificate of Incorporation and clearly legible photo IDs for all listed company directors are needed.

- For partnerships and sole traders: A specified trading name and photo IDs for all partners or the sole trader are required.

- For other organizations (e.g., schools, clubs, trusts): Listings of all responsible persons with their photo IDs and any relevant certificates (e.g., for trusts, charities) or a letterhead for non-registered entities.

All photo IDs should preferably be a copy of the passport’s biography details page or a driver's license to ensure clarity and legibility.

Common mistakes

- Failing to tick all boxes that apply to their situation, leading to incomplete application information.

- Not providing a clearly legible photo ID, which is especially crucial for private individuals. Acceptable forms include a passport or driver’s license copy.

- Omitting the trading name when it differs from the registered company name or not specifying it for partnerships and sole traders.

- Forgetting to attach a copy of the company’s Certificate of Incorporation for registered companies, which is a mandatory requirement.

- Leaving out full particulars of all directors/partners/trustees, which is essential information for the registration process.

- Submitting the form without the necessary photo ID for each person listed as a director, partner, or trustee. A passport biography details page or driver's licence is preferred.

- Not including a letterhead for non-commercial organisations like schools or sports clubs, which is required for identification purposes.

- Failing to complete and sign the form by an authorised person of the concerned entity or the importer/exporter of the goods.

- Electing to fax the document when a legible email submission is possible, risking the rejection of illegible ID copies.

- Incorrectly setting the TSW brokerage access by not specifying or improperly specifying the brokerage code or name, potentially leading to unauthorized submissions.

Here are 10 common mistakes people make when filling out the NZCS 224 form:

Correcting these mistakes ensures a smoother application process and avoids unnecessary delays or rejections.

Documents used along the form

When engaging with the NZCS 224 form, which is used for client registration in the Trade Single Window (TSW) system, various other forms and documents are often used to ensure comprehensive compliance and registration. These documents support different aspects of the import/export process, legal compliance, and business verification in New Zealand.

- Certificate of Incorporation: This document is crucial for registered companies. It verifies the legal existence of a company and provides essential details about its incorporation. When submitting the NZCS 224 form, a copy of this certificate helps authenticate the company’s status and eligibility for certain customs and trade operations.

- New Zealand Business Number (NZBN): This unique identifier for each business operating in New Zealand simplifies interaction with government agencies and other businesses. Mentioning the NZBN in the registration process assists in the swift identification and verification of business entities.

- Photo Identification: For private individuals, sole traders, directors, partners, and trustees involved in the registration process, providing a clear copy of photo identification (preferably a passport or driver's license) is required. This ensures the authenticity of the persons involved and aids in compliance with identity verification standards.

- Proof of Trading Name (if applicable): Businesses operating under a name different from their legally registered name need to provide evidence of their trading name. This could be in the form of a branding document or a business registration stating the trade name. It is essential for ensuring that customs documentation and operations align with public business identifiers.

- Letter of Authorization: Especially relevant for third-party registrations or when a customs broker is submitting documents on behalf of a client, a letter of authorization formalizes the relationship and grants legal permission for the broker to act on the business’s or individual’s behalf. This document outlines the scope and limitations of the broker’s authority regarding customs and trade matters.

Each document serves a specific purpose in fortifying the registration and compliance framework for businesses and individuals navigating New Zealand’s trade regulations. Together, they form a comprehensive dossier that supports the efficient and lawful conduct of import and export activities within the country.

Similar forms

The NZCS 224 form is a detailed registration application for clients interacting with the Trade Single Window (TSW) system, primarily used in New Zealand for customs and import/export activities. It's designed to capture a comprehensive range of information about companies, partnerships, sole traders, and various other entities engaging in trade, ensuring compliance and facilitating smoother operations within New Zealand's border control systems. There are similar forms and documents used in other contexts, both within New Zealand and internationally, that share similarities in purpose and content:

- IRS Form W-9 (Request for Taxpayer Identification Number and Certification) - Similar to the NZCS 224, the W-9 form is used in the United States for business and certain financial transactions. It gathers taxpayer identification information to ensure proper tax reporting and withholding.

- Customs Declaration Form - Customs Declaration forms, used globally, share similarities with the NZCS 224 by collecting information on goods being imported or exported, albeit they are generally used for individual shipments rather than client registration.

- UCC-1 Financing Statement - Used in the U.S. to secure interests in commercial transactions, this form requires detailed information about the parties involved, similar to the organizational details requested in the NZCS 224.

- Business Registration Forms - Similar to sections of the NZCS 224 that deal with detailed organizational information, business registration forms globally collect company details, director/partnership information, and business activities for official registration purposes.

- Import License Application Forms - These forms, required for certain goods in many countries, often gather detailed information about the importing entity, its business status, and the types of goods being imported, reflecting the NZCS 224's focus on compliance and regulatory oversight.

- ACORD 125 (Commercial Insurance Application) - The ACORD 125 form collects detailed information about businesses seeking commercial insurance, including contact details, business descriptions, and prior history, mirroring the detail-oriented nature of the NZCS 224.

- Shipper's Export Declaration (SED) - Required for international shipments from various countries, the SED gathers exporter and consignee information, as well as details about the shipped goods, similar to the NZCS 224's role in facilitating international trade.

- DOT Hazardous Material Registration Form - For businesses in the U.S. that transport hazardous materials, this form collects in-depth business and operational information to ensure public safety and compliance, akin to the regulatory alignment of the NZCS 224.

- Food Facility Registration (FDA) - In the U.S., facilities that manufacture, process, pack, or hold food for consumption must register with the FDA, providing detailed business information, similar to food importer sections of the NZCS 224.

These documents, while various in their specific applications and jurisdiction, share the common theme of collecting detailed organizational, operational, and compliance-related information to facilitate business operations within regulatory frameworks. The NZCS 224 form is a vital part of New Zealand's trade infrastructure, ensuring that those engaged in trade are properly registered and compliant with national and international standards.

Dos and Don'ts

Filling out the NZCS 224 form accurately is vital for anyone looking to engage in trade activities, such as exporting or importing goods, through New Zealand's Trade Single Window (TSW) system. Understanding the dos and don'ts of completing this form can streamline your registration process and ensure compliance. Below is a list compiled to guide you through this essential process efficiently.

- Do thoroughly read the instructions and notes provided on the reverse side of the form before starting. These notes contain crucial information that can help prevent mistakes.

- Do check all applicable boxes that relate to your business activity, whether you're an exporter, importer, or both. Accurately identifying your role ensures you receive the correct classification and facilitates smoother transactions.

- Do provide complete and accurate information for the contact person, including full name, position in the organisation, and contact details. This individual will be the main point of contact for any enquiries or issues, so their details must be current and correct.

- Do ensure that all required fields related to personal or business identification are filled in, including full legal names, date of birth for individuals, and company registration number or NZBN for businesses.

- Do attach all necessary documentation such as photo ID, certificate of incorporation for companies, or any other documents as specified in the form's notes. These documents are essential for verifying the information provided.

- Don't leave sections incomplete. If a section does not apply to you, indicate this appropriately rather than skipping it. Incomplete applications can lead to delays or outright rejection.

- Don't submit illegible copies of IDs or documents. If emailing, ensure scans are clear and legible. Unclear documentation can cause unnecessary hold-ups in the processing of your application.

- Don't forget to sign the declaration at the end of the form. A signature is required to validate the information provided, and failing to sign can render the application invalid.

- Don't hesitate to use the recommended methods of submission, such as email, especially for sending copies of IDs, to prevent legibility issues that can arise from faxed documents.

By following these guidelines, individuals and businesses can improve the likelihood of a hassle-free processing of their NZCS 224 form. It is important to approach this process with attention to detail and ensure that all provided information is accurate and up to date. An accurately completed application not only facilitates smoother transactions but also contributes to the efficiency of New Zealand's trading operations and compliance with local regulations.

Misconceptions

When it comes to the NZCS 224 form, there are several common misconceptions that can lead to confusion. Understanding these misconceptions is vital for anyone looking to accurately complete and submit this form for client registration in the Trade Single Window system. Here are ten such misunderstandings and the clarifications to help guide you through the process:

It's only for New Zealand-based companies: This is not true. The form is also for international entities engaging in trade with New Zealand, including exporters, importers, and shipping companies.

Personal identification isn’t necessary: Contrary to this belief, clear and legible photo ID is required for private individuals, and specifics are necessary for all directors, partners, or trustees listed in the form.

Email submission is not preferred: Actually, submitting the form via email is recommended over faxing, as fax copies of ID can often be illegible and may lead to rejection.

The form doesn't need to be signed: This is incorrect. The form must be completed and signed by an authorised person of the entity concerned or the importer/exporter of the goods.

All sections are mandatory: While it's important to provide comprehensive information, not all sections will apply to every applicant. Ticking all boxes that apply to your situation is crucial.

Only for importing or exporting goods: The form is not just for importing or exporting goods; it also caters to other roles such as brokerage, shipping agents, and third-party notifications.

Listing as a food importer is optional: If your business involves importing food for sale under the Food Act 2014, indicating this on the form is necessary for border-related risk management purposes.

No need to report changes after initial registration: It's essential to keep your registration information up to date, including any changes to your business details or roles.

The form is too complicated for individual traders: While the form is comprehensive, following the instructions and providing the required information for individual traders or sole proprietors is straightforward.

It's a one-time requirement: Completing the form is not a one-off task. Businesses need to ensure they maintain compliance with any updates and regulations by submitting updated information as necessary.

Understanding these misconceptions and their clarifications can simplify the process of completing and submitting the NZCS 224 form, making it a smoother experience for all parties involved in trade activities with New Zealand.

Key takeaways

Understanding the NZCS 224 form is crucial for businesses and individuals involved in importing, exporting, or both in New Zealand. Here are key takeaways to ensure the process is as smooth as possible:

- The NZCS 224 form is specifically designed for the Trade Single Window - Client Registration Application, which is central for businesses and individuals engaging in trade activities.

- It is important to identify accurately whether you are a sole trader, partnership, company (either NZ registered or unregistered), individual, embassy, or fall under another category. This helps in providing the relevant information required for each category.

- Applicants must specify their activity: whether it’s exporting, importing, both, or involving in other port authority or shipping activities. This will determine the kind of information and documents needed for the registration.

- For food importers, indicating your intention to import under the Food Act 2014 is asked explicitly to adhere to specific requirements and regulations.

- There’s an option to identify as a Māori business for statistical purposes, which implies a commitment to recognizing the unique cultural aspects of trade practices among Māori businesses.

- Provision of contact and personal details such as full names, trading names, contact numbers, and email addresses is mandatory. These details facilitate effective communication and any necessary follow-up.

- The form necessitates the submission of physical and postal addresses, which must include detailed information like street numbers, unit numbers, and postcodes to ensure accurate records and correspondence.

- A crucial element of the form is the declaration by an authorized individual that the information provided is true and correct. This underscores the importance of accuracy in the application process.

- The application form also contains significant notes, including the necessity to attach various documents such as a copy of the company’s Certificate of Incorporation, photo IDs for all directors/partners/trustees, and information concerning billing and payment accounts if applicable.

Submitting the NZCS 224 form is a step toward ensuring compliance with New Zealand customs regulations and facilitates smoother trade operations. It’s recommended to review the form carefully, provide accurate information, and attach all necessary documents to avoid any delays or complications in the registration process.

Popular PDF Forms

Landlord Letter Statement From Non-relative Landlord - A document where landlords officially state the rental situation of a property, including tenant information and occupancy.

Sowp Document Checklist - Must be filled out and submitted by those aiming to gain temporary worker status.

Renew Cosmetology License Ca - Remember to sign the certification section of your renewal form, confirming the truthfulness of your supplied information.