Blank Official Registration PDF Template

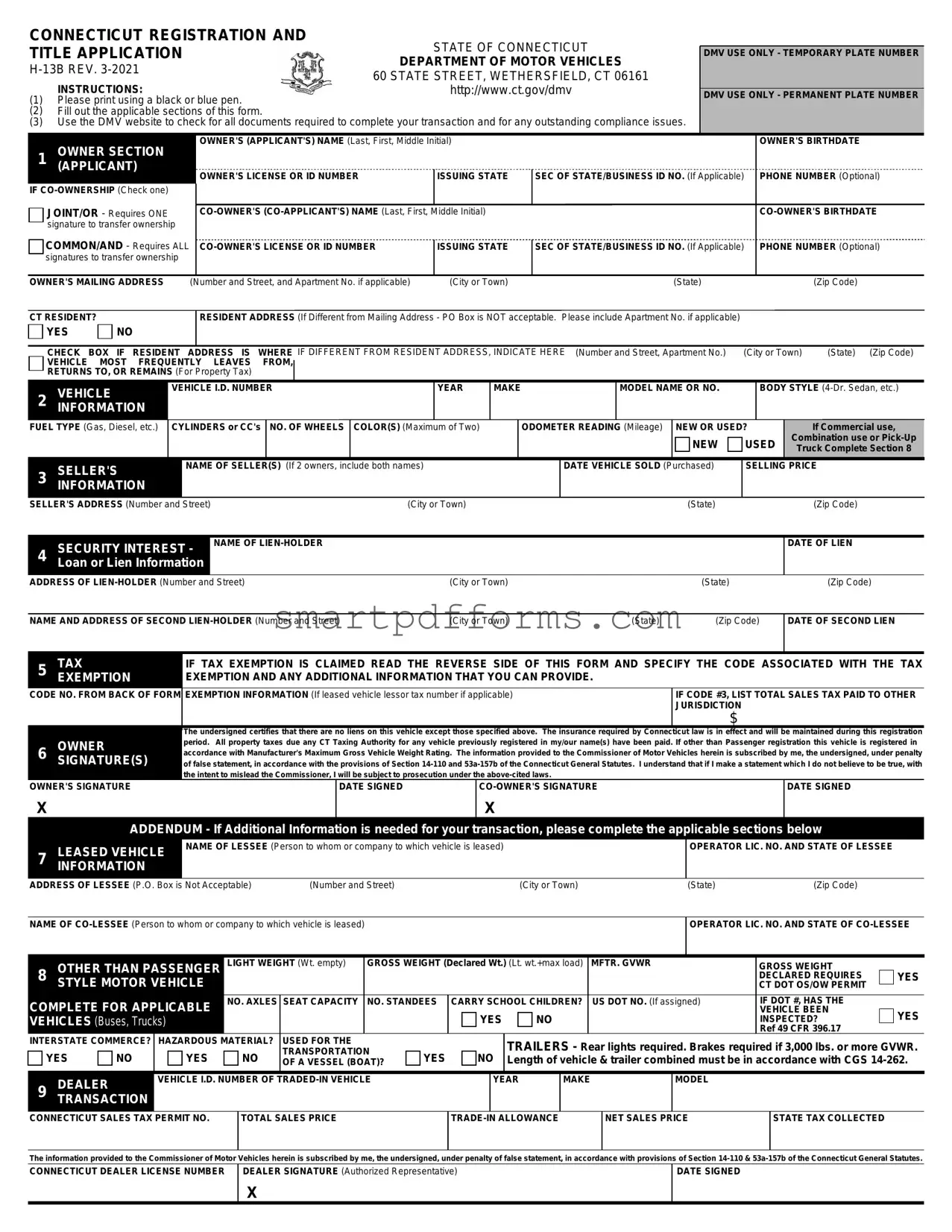

The process of vehicle registration and titling in Connecticut, as outlined by the "CONNECTICUT REGISTRATION AND TITLE APPLICATION H-13B REV. 3-2021" from the STATE OF CONNECTICUT DEPARTMENT OF MOTOR VEHICLES, presents several detailed requirements and instructions to ensure compliance with state laws. This application serves not only as a formal request for vehicle registration and titling but also encompasses a broad spectrum of ownership scenarios such as joint or common co-ownership, indicating specific documentation needed for completing the transaction. It accommodates various vehicle types, including commercial use vehicles and leased vehicles, by requesting detailed information about the vehicle, seller, and lien-holder if applicable. Furthermore, it outlines the tax exemptions available under certain conditions, further complicated by detailed instructions for claiming an exemption, thus underscoring the necessity of understanding the requisites for different transactions. The form also stipulates the need for accurate and truthful information under penalty of law, emphasizing the legal responsibility of the applicant(s) in providing correct details and ensuring compliance with Connecticut vehicle tax laws, insurance requirements, and property tax obligations. Sales and use tax instructions provide clarity on computation and exceptions, aiding residents in navigating the financial aspects of vehicle registration. The form acts as a comprehensive guide for Connecticut residents seeking to navigate the complexities of vehicle registration, ensuring all required steps are clearly communicated and adhered to for a successful application process.

Preview - Official Registration Form

CONNECTICUT REGISTRATION AND

TITLE APPLICATION |

STATE OF CONNECTICUT |

|

DEPARTMENT OF MOTOR VEHICLES |

||

60 STATE STREET, WETHERSFIELD, CT 06161 |

||

INSTRUCTIONS: |

||

http://www.ct.gov/dmv |

(1)Please print using a black or blue pen.

(2)Fill out the applicable sections of this form.

(3)Use the DMV website to check for all documents required to complete your transaction and for any outstanding compliance issues.

DMV USE ONLY - TEMPORARY PLATE NUMBER

DMV USE ONLY - PERMANENT PLATE NUMBER

OWNER SECTION

1(APPLICANT)

IF

JOINT/OR - Requires ONE signature to transfer ownership

COMMON/AND - Requires ALL signatures to transfer ownership

COMMON/AND - Requires ALL signatures to transfer ownership

OWNER'S (APPLICANT'S) NAME (Last, First, Middle Initial)

OWNER'S LICENSE OR ID NUMBER |

|

ISSUING STATE |

|

|

|

|

ISSUING STATE |

|

|

||

|

|

|

SEC OF STATE/BUSINESS ID NO. (If Applicable)

SEC OF STATE/BUSINESS ID NO. (If Applicable)

OWNER'S BIRTHDATE

PHONE NUMBER (Optional)

PHONE NUMBER (Optional)

OWNER'S MAILING ADDRESS |

(Number and Street, and Apartment No. if applicable) |

(City or Town) |

(State) |

(Zip Code) |

CT RESIDENT?

YES

NO

RESIDENT ADDRESS (If Different from Mailing Address - PO Box is NOT acceptable. Please include Apartment No. if applicable)

CHECK BOX IF RESIDENT ADDRESS IS WHERE IF DIFFERENT FROM RESIDENT ADDRESS, INDICATE HERE (Number and Street, Apartment No.) (City or Town) |

(State) (Zip Code) |

||

VEHICLE MOST FREQUENTLY LEAVES FROM, |

|

|

|

|

|

||

RETURNS TO, OR REMAINS (For Property Tax) |

|

|

|

2 INFORMATIONVEHICLE |

VEHICLE I.D. NUMBER |

|

YEAR

MAKE

MODEL NAME OR NO.

BODY STYLE

FUEL TYPE (Gas, Diesel, etc.)

CYLINDERS or CC's NO. OF WHEELS COLOR(S) (Maximum of Two)

ODOMETER READING (Mileage)

NEW OR USED?

NEW |

USED |

If Commercial use,

Combination use or

3SELLER'SINFORMATION

NAME OF SELLER(S) (If 2 owners, include both names)

DATE VEHICLE SOLD (Purchased)

SELLING PRICE

SELLER'S ADDRESS (Number and Street) |

(City or Town) |

(State) |

(Zip Code) |

SECURITY INTEREST - NAME OF

4Loan or Lien Information

DATE OF LIEN

ADDRESS OF |

(City or Town) |

|

(State) |

(Zip Code) |

|

|

|

|

|

NAME AND ADDRESS OF SECOND |

(City or Town) |

(State) |

(Zip Code) |

DATE OF SECOND LIEN |

|

|

|

|

|

5 |

TAX |

IF TAX EXEMPTION IS CLAIMED READ THE REVERSE SIDE OF THIS FORM AND SPECIFY THE CODE ASSOCIATED WITH THE TAX |

||

EXEMPTION |

EXEMPTION AND ANY ADDITIONAL INFORMATION THAT YOU CAN PROVIDE. |

|

||

CODE NO. FROM BACK OF FORM EXEMPTION INFORMATION (If leased vehicle lessor tax number if applicable) |

IF CODE #3, LIST TOTAL SALES TAX PAID TO OTHER |

|||

|

|

|

JURISDICTION |

|

|

|

|

$ |

|

|

|

The undersigned certifies that there are no liens on this vehicle except those specified above. The insurance required by Connecticut law is in effect and will be maintained during this registration |

||

6 |

OWNER |

period. All property taxes due any CT Taxing Authority for any vehicle previously registered in my/our name(s) have been paid. If other than Passenger registration this vehicle is registered in |

||

accordance with Manufacturer's Maximum Gross Vehicle Weight Rating. The information provided to the Commissioner of Motor Vehicles herein is subscribed by me, the undersigned, under penalty |

||||

SIGNATURE(S) |

||||

of false statement, in accordance with the provisions of Section |

||||

the intent to mislead the Commissioner, I will be subject to prosecution under the

OWNER'S SIGNATURE

X

DATE SIGNED

X

DATE SIGNED

ADDENDUM - If Additional Information is needed for your transaction, please complete the applicable sections below

LEASED VEHICLE NAME OF LESSEE (Person to whom or company to which vehicle is leased)

7INFORMATION

OPERATOR LIC. NO. AND STATE OF LESSEE

ADDRESS OF LESSEE (P.O. Box is Not Acceptable) |

(Number and Street) |

(City or Town) |

(State) |

(Zip Code) |

NAME OF

OPERATOR LIC. NO. AND STATE OF

8 |

OTHER THAN PASSENGER |

LIGHT WEIGHT (Wt. empty) |

GROSS WEIGHT (Declared Wt.) (Lt. wt.+max load) |

|

MFTR. GVWR |

GROSS WEIGHT |

|

||||||||||||

STYLE MOTOR VEHICLE |

|

|

|

|

|

|

|

|

|

|

|

|

|

DECLARED REQUIRES |

YES |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

CT DOT OS/OW PERMIT |

||||||

COMPLETE FOR APPLICABLE |

NO. AXLES |

SEAT CAPACITY |

NO. STANDEES |

CARRY SCHOOL CHILDREN? |

|

US DOT NO. (If assigned) |

IF DOT #, HAS THE |

|

|||||||||||

|

|

|

|

|

YES |

NO |

|

|

|

|

|

VEHICLE BEEN |

YES |

||||||

VEHICLES (Buses, Trucks) |

|

|

|

|

|

|

|

|

|

|

INSPECTED? |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ref 49 CFR 396.17 |

|

|

INTERSTATE COMMERCE? |

HAZARDOUS MATERIAL? |

USED FOR THE |

|

|

|

|

TRAILERS - Rear lights required. Brakes required if 3,000 lbs. or more GVWR. |

||||||||||||

YES |

NO |

YES |

|

NO |

TRANSPORTATION |

YES |

NO |

||||||||||||

|

OF A VESSEL (BOAT)? |

Length of vehicle & trailer combined must be in accordance with CGS |

|||||||||||||||||

9 |

TRANSACTIONDEALER |

VEHICLE I.D. NUMBER OF |

|

|

YEAR |

MAKE |

|

|

MODEL |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONNECTICUT SALES TAX PERMIT NO. |

|

TOTAL SALES PRICE |

|

|

|

|

|

NET SALES PRICE |

|

STATE TAX COLLECTED |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The information provided to the Commissioner of Motor Vehicles herein is subscribed by me, the undersigned, under penalty of false statement, in accordance with provisions of Section

CONNECTICUT DEALER LICENSE NUMBER |

DEALER SIGNATURE (Authorized Representative) |

DATE SIGNED |

|

X |

|

SALES TAX INSTRUCTIONS

A)SALES OR USE TAX COMPUTATION - The sales or use tax is based on the invoiced purchase price for vehicles purchased from a licensed dealer. If the vehicle is purchased from a private individual, not from a licensed dealer, the sales or use tax is based on the current month's issue of the N.A.D.A. Official Used Car Guide, Eastern Edition or the Bill of Sale, whichever is greater.

B)SALES TAX PAID IN ANOTHER STATE - In order to obtain credit for sales/use tax paid to another jurisdiction, you must present proof of payment in the form of an official receipt or dealer's invoice.

C)BARTER, TRADE, SWAP - When two individuals trade vehicles, each must pay sales/use tax on the value of the vehicle received based on the current month's issue of the N.A.D.A. Official Used Car Guide, Eastern Edition.

D)CHECKS - Please make your check payable to "DMV". The total for all DMV fees also will include the sales tax.

E)REFUNDS - Claims for sales or use tax refunds must be submitted to the Department of Revenue Services. Use

SPECIAL INSTRUCTIONS FOR THOSE CLAIMING EXEMPTION FROM CONNECTICUT SALES OR USE TAX

Specify the applicable code (1, 2, 3, 4, or 5) as described below in the space on the front in SECTION 5 labeled TAX EXEMPTION. Include additional information as required below for the applicable code in the area labeled EXEMPTION INFORMATION.

Code 1:

Code 2:

Code 3:

Code 4:

Code 5:

Transfer between immediate family members (Only MOTHER, FATHER, SPOUSE (wife, husband, civil union), DAUGHTER, SON, SISTER or BROTHER qualify as "immediate family members"). Specify code "1" and in the area labeled EXEMPTION INFORMATION, write which of the

Sale to a Connecticut exempt organization or to a governmental agency. Specify code "2" and write the Connecticut Tax Exemption Number beginning with "E" in the area labeled EXEMPTION INFORMATION or attach a copy of the organization's Internal Revenue Code Section 501(c)(3) or 501(c)(13) exemption letter issued by the IRS.

Sales or Use Tax was paid to another jurisdiction. An official receipt or dealer's invoice must be presented identifying the amount of sales tax paid. Specify code "3" and, in the area labeled EXEMPTION INFORMATION, write the amount of tax paid and the jurisdiction to which this tax was paid.

Vehicles purchased while residing outside of Connecticut.

Other reasons. Specify code "5" and write the applicable letter from the list below in the area labeled EXEMPTION INFORMATION.

5A) GIFT - If vehicle was received as a gift, provide a copy of form

5B) VEHICLE PURCHASED BY A LESSOR EXCLUSIVELY FOR LEASE OR RENTAL - Provide the Connecticut Tax Registration Number of the lessor/purchaser.

5C) SALE BY A FEDERAL AGENCY, FEDERAL CREDIT UNION OR AMERICAN RED CROSS - Vehicle must have been obtained from a Federal Agency, a Federal Credit Union or the American Red Cross.

5D) CORPORATE ORGANIZATION, REORGANIZATION OR LIQUIDATION - Acquiring a vehicle in connection with the organization, reorganization or liquidation of an incorporated business provided (a) the last taxable sale, transfer or use of the motor vehicle was subjected to Connecticut sales or use tax, (b) the transferee is the incorporated business or a stockholder thereof.

5E) PARTNERSHIP OR LLC ORGANIZATION OR TERMINATION - Acquiring a vehicle in connection with the organization or termination of a partnership or LLC provided (a) the last taxable sale, transfer or use of the motor vehicle was subjected to Connecticut sales or use tax, and (b) the purchaser is the partnership or limited liability company, as the case may be, or a partner or member, thereof, as the case may be.

5F) HIGH MPG PASSENGER MOTOR VEHICLES - Section

5G) COMMERCIAL TRUCKS, TRUCK TRACTORS, TRACTORS AND SEMITRAILERS AND VEHICLES USED IN COMBINATION THEREWITH - Section

Section

For further information about sales and use taxes, see the DRS website (www.ct.gov/drs) or call DRS during business hours, Monday through Friday:

•

•

TTY, TDD, and Text Telephone users only may transmit inquiries anytime by calling

Form Data

| Fact Name | Description |

|---|---|

| Form Identification | Connecticut Registration and Title Application, Form H-13B, Revision March 2021 |

| Issuing Agency | State of Connecticut Department of Motor Vehicles |

| Application Requirements | Must be completed using a black or blue pen, filling out all applicable sections, and referencing the DMV website for document requirements and compliance issues |

| Co-Ownership Options | Joint (OR) requires one signature for transfer of ownership; Common (AND) requires all signatures for transfer of ownership |

| Vehicle Information | Includes vehicle identification number, year, make, model, body style, fuel type, cylinders or CC's, number of wheels, color(s), odometer reading, and status (new or used) |

| Sales and Use Tax Exemption | Provides codes for specific exemptions including family transfers, sales to exempt organizations, sales or use tax paid to another jurisdiction, purchases while residing outside Connecticut, among others |

| Governing Law | Statutes underpinning the form include Section 14-110 and 53a-157b of the Connecticut General Statutes |

Instructions on Utilizing Official Registration

Filling out the official registration form is a critical step for vehicle owners in Connecticut who need to register and title their vehicle with the Department of Motor Vehicles (DMV). The form requires accurate and detailed information about the vehicle and its owners. Below are the steps needed to ensure the form is completed accurately, assisting in a smooth transaction with the DMV. It's important to gather all necessary documents and review the DMV's requirements before you start filling out the form to avoid any delays or issues during the process.

- Use a black or blue pen to fill out the form to ensure clarity and legibility.

- Thoroughly review the form, focusing on the sections that apply directly to your transaction. Not every section may be applicable, so it's important to identify which parts of the form you need to complete.

- Begin by entering the personal information of the vehicle owner(s) in the OWNER SECTION, including name(s), license or ID number(s), issuing state, birthdates, and contact information. If there is co-ownership, indicate whether it's JOINT/OR or COMMON/AND and ensure all required signatures will be obtained.

- For the vehicle information section, accurately fill in the vehicle's identification number, year, make, model, body style, fuel type, number of cylinders or CCs, number of wheels, color(s), odometer reading, and specify if it's new or used.

- In the SELLER'S INFORMATION section, provide the name of the seller or sellers, the date the vehicle was sold, the selling price, and the seller's address.

- Complete the loan or lien information section if applicable, including the date of lien, name, and address of the lien-holder(s).

- If claiming a tax exemption, refer to the instructions on the back of the form and specify the exemption code and provide any additional information required in SECTION 5.

- Read and understand the certification statement at the bottom of the form. The owner(s) must sign and date, indicating that the information provided is accurate and that the required insurance is in place and will be maintained.

- If the vehicle is leased or requires additional information not covered in the main sections of the form, complete the ADDENDUM section as necessary.

- Before submitting the form, use the DMV website to check for documents required to complete your transaction and resolve any outstanding compliance issues. Gather all necessary documents to accompany your registration form.

Once the form is completely filled out and all additional documents are prepared, review everything carefully to ensure accuracy. Submitting a form with errors or omissions can lead to delays. Once you are certain all information is correct and complete, submit the form and documents as directed by the Connecticut DMV. Be prepared to pay any applicable fees during the submission process. Following these steps methodically will help ensure a smoother process for registering and titling your vehicle in Connecticut.

Obtain Answers on Official Registration

-

What pens can I use to fill out the Connecticut Registration and Title Application form?

You are required to fill out the form using a black or blue pen. This ensures that the information is clearly legible and can be scanned or copied without issues.

-

Where can I find additional information on documents needed to complete my registration?

All necessary documents and any outstanding compliance issues can be checked on the official DMV website. It's important to gather all documents prior to submitting your application to avoid any delays in the processing of your registration.

-

What is the difference between the 'JOINT/OR' and 'COMMON/AND' co-ownership options?

Choosing 'JOINT/OR' means that only one signature is required to transfer ownership of the vehicle, making it easier to sell or make changes to the registration. On the other hand, 'COMMON/AND' requires all owners to sign for such transactions, offering a higher level of control over the vehicle's ownership.

-

How can I claim an exemption from the sales or use tax?

To claim an exemption, you will need to specify the applicable code (1 through 5) on the front section labeled TAX EXEMPTION of the form. Additionally, you must include any required information for the exemption you are claiming in the area labeled EXEMPTION INFORMATION.

- Exemptions range from vehicle transfers between immediate family members to vehicles purchased out-of-state.

-

Can I get a refund on sales or use tax if I overpaid?

Yes, if you believe you've overpaid on sales or use tax, claims must be submitted to the Department of Revenue Services using form CERT-106 for vehicles purchased from private sellers, or directed to their Refunds-RCA Audit Group for all other claims. Supporting documents must be included with your refund request.

Common mistakes

Filling out the Official Registration form requires attention to detail. Unfortunately, mistakes can happen. Here are five common errors that people tend to make:

- Not using a black or blue pen as instructed, which can lead to processing delays or even having to resubmit the form.

- Skipping sections that are applicable to their situation, possibly causing incomplete registration or title transfer.

- Failing to check the DMV website for required documents, leading to incomplete submissions and potential rejections.

- Incorrectly ticking the box for co-ownership status, which can complicate or invalidate the transfer of ownership.

- Overlooking to sign and date the form, which is essential for the form to be processed.

Each of these mistakes can delay or impact the successful submission of the registration application. Careful review and adherence to the instructions can help ensure a smooth process.

Documents used along the form

When completing the Official Registration Form, various other forms and documents might be needed to ensure a seamless process. These documents cater to specific requirements or scenarios that might arise during vehicle registration and titling. Understanding each of these documents and their purpose can make the registration process more efficient and less stressful.

- Bill of Sale: This legal document provides evidence of the purchase, detailing the sale of the vehicle. It includes information such as the sale price, the date of the transaction, and the names and addresses of the buyer and seller.

- Proof of Insurance: Before a vehicle can be registered, proof of insurance must be submitted. This document verifies that the vehicle meets the state's minimum insurance requirements.

- Title Certificate: This document proves ownership of the vehicle. If the vehicle was previously owned, the title must be transferred to the new owner’s name.

- Emissions Test Report: Some states require a passed emissions test for vehicle registration. This report confirms the vehicle meets the state’s environmental standards.

- Safety Inspection Certificate: Similar to emissions testing, a safety inspection certificate may be required, ensuring the vehicle is safe to operate on public roads.

- Odometer Disclosure Statement: This form records the vehicle's mileage at the time of sale. It's crucial for preventing odometer fraud and ensuring the buyer is aware of the vehicle's condition.

- Power of Attorney: If someone is signing documents on behalf of the vehicle owner, a power of attorney may be needed. This grants the representative legal authority to make decisions regarding the vehicle’s registration and titling.

- Lien Release: If the vehicle was financed and the loan has been paid off, a lien release from the lender is necessary. This document removes the lender's legal right to the vehicle, transferring full ownership to the lienholder.

- Exemption Forms: Depending on circumstances like military service or disability, exemption forms can be filed to waive certain fees or requirements during the registration process.

Gathering the right documents ahead of time is crucial to ensure the vehicle registration process is handled efficiently and correctly. Each of these documents plays a key role in different aspects of vehicle registration and titling. Whether it’s establishing legal ownership through a Title Certificate, validating a vehicle’s roadworthiness with inspection certificates, or proving liability coverage with Proof of Insurance, being well-prepared can help navigate the process smoothly.

Similar forms

The Vehicle Title Application is similar because it also collects detailed information about the vehicle and its ownership history, similar to the Connecticut Registration and Title Application's requirement for seller and co-owner details.

The Driver's License Application Form shares similarities by requiring personal identification information, such as name, birthdate, and address, which is the same data needed for the owner's section in the official registration form.

The Voter Registration Form can be likened to it because both forms require confirmation of the applicant's address and, sometimes, an identification number to ensure eligibility and validity of the application.

A Loan Application Form for auto financing is similar as it gathers details about the vehicle, including make, model, and VIN, information that's also crucial for the registration form's vehicle identification section.

The Insurance Application Form for vehicle insurance has parallels, notably the requirement for vehicle information, owner's information, and if applicable, lienholder information to ensure proper coverage.

Business Registration Forms align with the official registration form in terms of requiring identification numbers (like the SEC of State/Business ID No.) and details about the entity's (or individual's) address and contact information.

The Permit Application for Oversize/Overweight Vehicles is akin to the special section for commercial use vehicles, requiring detailed specifications of the vehicle, including weight, which affects registration and permitted use.

Income Tax Return Forms are somewhat similar because they may require the disclosure of ownership of assets, such as vehicles, and include tax exemption information that affects the owner's financial responsibilities.

Boat Registration Forms compare by requiring the owner's information, boat (or vehicle) identification information, and use type, just like the section for trailers or other special vehicle types in the official registration form.

The Change of Address Form for state DMV parallels the part of the vehicle registration form where the owner must provide current mailing and resident addresses, ensuring all correspondence and legal documents are properly directed.

Dos and Don'ts

When filling out the Connecticut Registration and Title Application (H-13B form), it's crucial to follow the instructions carefully to ensure the process is completed correctly. Below are lists of things you should do and shouldn't do to help guide you through this process.

Do:

- Use a black or blue pen for clarity and legibility. This ensures that the information is easily readable and that the form can be scanned or photocopied without issues.

- Fill out all applicable sections of the form. Only provide information relevant to your situation, ensuring the DMV has all the necessary details.

- Refer to the DMV website for a list of required documents. This ensures you have all the paperwork needed for your transaction before you visit the DMV.

- Check for any outstanding compliance issues on the DMV website. This helps avoid delays in processing your application.

- Include all necessary signatures. Depending on the type of ownership (joint or common), ensure the correct parties sign the form.

- Provide accurate and truthful information to avoid penalties for false statements.

Don't:

- Use colors other than black or blue pen as it may result in processing delays or the need to fill out the form again.

- Leave sections blank that are applicable to your situation. Incomplete forms may cause delays or rejection of your application.

- Forget to check for required documents specific to your transaction type, as missing paperwork can lead to delays.

- Ignore compliance issues or unresolved matters with the DMV. Addressing these beforehand speeds up the process.

- Omit necessary signatures, which could invalidate the form or require you to resubmit.

- Provide false or misleading information, which is illegal and can lead to prosecution under Connecticut law.

Following these guidelines will help ensure a smoother process when submitting your Connecticut Registration and Title Application.

Misconceptions

Many people find the process of completing the Connecticut Registration and Title Application form (H-13B) daunting due to various misconceptions about its requirements and implications. Here’s a look at nine common misconceptions and the facts that clarify them.

- Misconception 1: Any pen color is acceptable for filling out the form.

- Misconception 2: All sections of the form must be filled out by every applicant.

- Misconception 3: The DMV does not provide instructions or assistance for completing the form.

- Misconception 4: A post office box is an acceptable address for residency verification.

- Misconception 5: Vehicle sales tax exemptions are rarely granted.

- Misconception 6: The signature section is only a formality and bears no legal weight.

- Misconception 7: Commercial use vehicles do not require additional paperwork.

- Misconception 8: Leased vehicles are registered the same way as owned vehicles.

- Misconception 9: The form does not need to be updated if you move within Connecticut after registration.

Fact: The form explicitly requests the use of a black or blue pen. This is to ensure the legibility and official processing of the document.

Fact: Applicants only need to complete sections applicable to their transaction. This guidance helps streamline the process and avoid unnecessary information submission.

Fact: Detailed instructions and a checklist for required documents are available on the DMV website, offering valuable support to applicants.

Fact: P.O. boxes are not accepted for the residential address section. A physical address is required to establish Connecticut residency eligibility and for taxation purposes.

Fact: Several exemptions are achievable under specified conditions, such as transfers between immediate family members, sales to exempt organizations, or sales where the tax was already paid in another jurisdiction.

Fact: Signing the form under penalty of false statement subjects signatories to legal accountability, emphasizing the importance of providing accurate information.

Fact: Specific sections on the form are dedicated to commercial, combination, or pickup truck registrations, indicating different requirements for these vehicle types.

Fact: Leased vehicles have a separate section on the form that requires information about the lessee and lessor, reflecting the different legal considerations for leased assets.

Fact: Connecticut law requires residents to update their address with the DMV to accurately reflect residency for tax assessment and voting districts, among other legal obligations.

Understanding these aspects of the Connecticut Registration and Title Application can simplify the registration process and ensure compliance with state requirements. Always refer to the most current form and the DMV website for accurate and up-to-date information.

Key takeaways

Filling out the Official Registration and Title Application in Connecticut involves several key steps that must be followed closely to ensure the process is done correctly. Here are some essential takeaways everyone should know:

- Use the correct ink: It is mandatory to fill out the form using a black or blue pen. This helps in making the document legible and ensures that all the information recorded is clear and durable over time.

- Complete the relevant sections: Not every section of the form may apply to your specific circumstances. Ensure that you carefully fill out the sections that are relevant to your vehicle transaction to avoid any processing delays.

- Prepare necessary documents: Before submission, check the DMV website for a list of the required documents to accompany your registration form. This step is crucial in ensuring that your application is complete.

- Understand co-ownership options: If the vehicle has more than one owner, you need to specify the type of co-ownership – JOINT/OR which requires one signature or COMMON/AND which requires all owners to sign, affecting how ownership can be transferred in the future.

- Accurately report vehicle information: Provide detailed information about the vehicle including the VIN, year, make, model, body style, fuel type, color(s), and odometer reading. Accuracy here is vital for the vehicle’s identification and registration.

- Record seller and lien information: If the vehicle is being purchased or has a lien against it, the seller’s details and any lien-holder information must be thoroughly documented.

- Tax exemption details: If claiming any tax exemption, specify the exemption code and provide necessary additional information as required on the form. This can significantly affect the taxation related to your vehicle.

- Understand the importance of the signature: Signing the form is a declaration that all the information provided is accurate and true, under penalty of false statement. All owners listed must sign the form if it’s a COMMON/AND ownership.

- Leased vehicles: If the application is for a leased vehicle, additional sections relating to lease information must be completed.

- Special conditions for registration: For vehicles like commercial trucks or those claiming sales tax exemptions, additional information and documentation could be required. Review these sections carefully if they apply to your vehicle.

- Check for sales tax requirements: Depending on the nature of the purchase, you may be required to compute and include sales tax with your application. Consult the instructions on the form or the DMV website for guidance.

Understanding these key aspects of the Connecticut Registration and Title Application will assist in making the registration process as smooth as possible. Always refer to the most current forms and instructions available on the DMV website to ensure compliance with the latest requirements.

Popular PDF Forms

22-6553d-1 - Details the consequences, including fines or imprisonment, for willful false statements concerning VA benefits.

Change Name on Marriage Certificate California - The VS 24 C form is essential for amending information on vital records, demanding clear printing in black ink and the avoidance of erasures or photocopies.