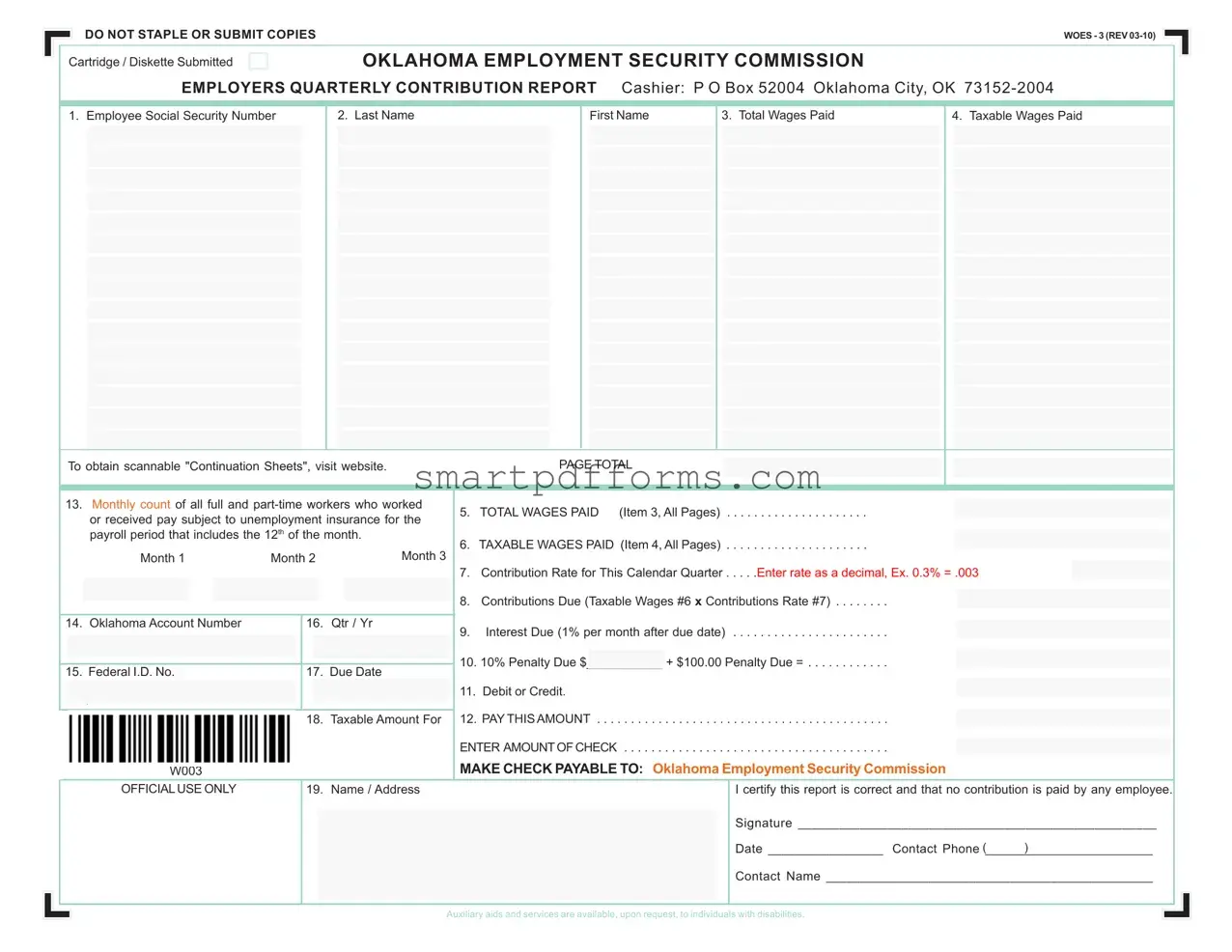

Blank Oklahoma Quarterly Contribution Report PDF Template

In the heart of Oklahoma's employment and tax reporting landscape lies the critical, yet often overlooked, Oklahoma Quarterly Contribution Report form. This document serves as a bridge between employers and the Oklahoma Employment Security Commission, enabling a structured reporting of wages and contributions for unemployment insurance. Employers are required to meticulously report employee details such as social security numbers and names, alongside the total and taxable wages paid within a quarter. This information not only aids in the accurate calculation of contributions due but also affects the monthly count of all workers, highlighting both full and part-time employees who have earned income during specific payroll periods. Moreover, the form details such as the employer's account number, federal identification, and crucial deadlines emphasize the personalized and time-sensitive nature of this reporting. With contributions calculated as a percentage of taxable wages, and inclusion of penalties for late submissions, the document underscores the financial implications for businesses. The responsibility entrusted to employers is clear, as the certification signature at the bottom of the form asserts the accuracy of the reported figures and assures compliance with state regulations. Offering accessibility, the form notes the availability of auxiliary aids and services for individuals with disabilities, demonstrating a commitment to inclusiveness. Navigating through the Oklahoma Quarterly Contribution Report form requires a keen attention to detail and an understanding of its impact on the financial and regulatory obligations of Oklahoma employers.

Preview - Oklahoma Quarterly Contribution Report Form

DO NOT STAPLE OR SUBMIT COPIES |

WOES - 3 (REV |

Cartridge / Diskette Submitted |

OKLAHOMA EMPLOYMENT SECURITY COMMISSION |

EMPLOYERS QUARTERLY CONTRIBUTION REPORT Cashier: P O Box 52004 Oklahoma City, OK

1. Employee Social Security Number |

|

2. Last Name |

|

First Name |

3. Total Wages Paid |

4. Taxable Wages Paid |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To obtain scannable "Continuation Sheets", visit website. |

|

|

PAGE TOTAL |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

13. Monthly count of all full and |

5. |

TOTAL WAGES PAID (Item 3, All Pages) |

|

|

|

|

|

||||||

|

|

|

|

|

|||||||||

|

or received pay subject to unemployment insurance for the |

. . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

||||||

|

payroll period that includes the 12th of the month. |

Month 3 |

6. |

TAXABLE WAGES PAID (Item 4, All Pages) |

|

|

|

|

|

||||

|

|

|

|

|

|||||||||

|

Month 1 |

|

Month 2 |

. . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||||

|

|

7. |

Contribution Rate for This Calendar Quarter |

. . . . .Enter rate as a decimal, Ex. 0.3% = .003 |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

. . . . . . . .8. Contributions Due (Taxable Wages #6 x Contributions Rate #7) |

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

14. Oklahoma Account Number |

16. |

Qtr / Yr |

9. Interest Due (1% per month after due date) |

|

|

|

|

|

|

15. Federal I.D. No. |

17. |

Due Date |

10. 10% Penalty Due $___________ + $100.00 Penalty Due = |

|

|

|

|||

|

|

|

11. Debit or Credit. |

|

|

18. |

Taxable Amount For |

12. PAY THISAMOUNT |

|

|

|

|

ENTER AMOUNTOF CHECK |

|

W003 |

|

|

MAKE CHECK PAYABLE TO: Oklahoma Employment Security Commission |

|

OFFICIALUSE ONLY |

19. |

Name / Address |

I certify this report is correct and that no contribution is paid by any employee. |

|

|

|

|

Signature ____________________________________________________ |

|

|

|

|

Date _________________ Contact Phone ( |

) |

|

|

|

Contact Name ________________________________________________ |

|

Auxiliary aids and services are available, upon request, to individuals with disabilities.

Form Data

| Fact Name | Detail |

|---|---|

| Form Identification | The form is known as the Oklahoma Quarterly Contribution Report form, identified by its code WOES - 3 (REV 03-10). |

| Primary Purpose | Its main purpose is for employers to report employee wages and calculate contributions to the Oklahoma Employment Security Commission. |

| Required Information | Essential information includes Employee Social Security Number, name, total and taxable wages paid, and the monthly count of all full and part-time workers. |

| Calculation of Contributions | Employers are required to enter their contribution rate for the quarter as a decimal to calculate contributions due on taxable wages. |

| Penalties and Interest | Interest is due at 1% per month after the due date, and there's a 10% penalty plus a $100.00 penalty for late submissions. |

| Governing Law | The form is governed by the rules and regulations established by the Oklahoma Employment Security Commission under state law, pertaining to unemployment insurance contributions. |

Instructions on Utilizing Oklahoma Quarterly Contribution Report

Completing the Oklahoma Quarterly Contribution Report is a required process for businesses reporting employee wages and calculating unemployment insurance contributions. This task ensures compliance with state laws and supports the unemployment insurance system. Below, you'll find straightforward steps to accurately fill out the form.

- Locate the Oklahoma Employment Security Commission's address at the top of the form and remember that this is where the completed form must be sent.

- Enter the Social Security Number for each employee in the designated area.

- Fill in the employee's last name and first name next to their Social Security Number.

- Record the Total Wages Paid to each employee during the quarter in the specified section.

- Document the Taxable Wages Paid for each employee. This figure may differ from the total wages if some earnings are exempt from unemployment insurance contributions.

- To detail additional employees, if necessary, obtain scannable "Continuation Sheets" from the mentioned website.

- At the end of the form, calculate the PAGE TOTAL for items 3 (Total Wages Paid) and 4 (Taxable Wages Paid).

- In the summary section, enter the TOTAL WAGES PAID from all pages.

- Similarly, note the TAXABLE WAGES PAID from all pages in the designated area.

- Fill out the monthly count of all full and part-time workers for the specified months in the given sections.

- Input the Contribution Rate for the calendar quarter as a decimal in the provided space.

- Calculate the Contributions Due by multiplying the taxable wages by the contribution rate and enter this amount.

- If applicable, add any Interest Due and 10% Penalty Due in their respective sections.

- Indicate any Debit or Credit in the specified area.

- Fill in the Oklahoma Account Number, Federal I.D. No., and the quarter and year in their respective sections.

- Note the Due Date for the report submission.

- Under the PAY THIS AMOUNT section, write the total amount of the check you are to make payable to the Oklahoma Employment Security Commission.

- Provide the business name and address, the signature of the certifying official, date of certification, contact phone, and contact name at the bottom of the form.

Once completed, review the form for accuracy and completeness. Errors or omissions can delay processing or result in penalties. Mail the form to the Oklahoma Employment Security Commission at the address provided on the form. Remember, accurately reporting this information is crucial for maintaining compliance with state regulations and supporting the state’s unemployment insurance program.

Obtain Answers on Oklahoma Quarterly Contribution Report

What is the Oklahoma Quarterly Contribution Report?

The Oklahoma Quarterly Contribution Report is a required document for employers filed with the Oklahoma Employment Security Commission. This report records an employee's social security number, name, total wages paid, and taxable wages paid within a quarter. It is used to calculate contributions due for unemployment insurance and must be submitted quarterly.

How can I obtain scannable "Continuation Sheets" for my report?

Scannable "Continuation Sheets" can be obtained by visiting the official website of the Oklahoma Employment Security Commission. These sheets are necessary for employers who need to report on multiple employees and ensure accurate processing of the reports.

Which wages should be reported as "Taxable Wages" on the form?

"Taxable Wages" refer to the portion of an employee's wages that are subject to unemployment insurance contributions. Not all wages may be taxable according to Oklahoma state guidelines, so it's important to distinguish between total wages paid and those that are taxable under state law.

How is the "Contribution Rate for This Calendar Quarter" determined?

The "Contribution Rate for This Calendar Quarter" is determined by the Oklahoma Employment Security Commission and reflects the percentage of taxable wages an employer must contribute. It varies by employer based on factors such as the employer's industry and experience with unemployment claims. This rate should be entered as a decimal on the report, for example, 0.3% would be entered as .003.

When is the due date for submitting the Oklahoma Quarterly Contribution Report?

The due date for submitting the Oklahoma Quarterly Contribution Report is specified in the report instructions and typically falls on the last day of the month following the end of a quarter. Late submissions may result in interest and penalties.

What penalties and interest might be applied for late submissions?

For reports submitted after the due date, an interest charge of 1% per month is applied to the amount due. Additionally, there is a 10% penalty on the contributions due plus a $100.00 fixed penalty. These fees ensure timely and accurate submission of employment data.

How should payment for the Oklahoma Quarterly Contribution Report be made?

Payment for the Oklahoma Quarterly Contribution Report should be made by check payable to the Oklahoma Employment Security Commission. It is crucial to enter the amount of the check accurately on the report and include the employer's Oklahoma Account Number to ensure that the payment is correctly applied to their account.

All employers are encouraged to provide accurate information and submit their reports on time to avoid penalties. Additionally, auxiliary aids and services are available upon request for individuals with disabilities.

Common mistakes

When filling out the Oklahoma Quarterly Contribution Report form, it's important to ensure accuracy and completeness to avoid errors that could lead to penalties or processing delays. Below are eight common mistakes people make:

Not entering the Employee Social Security Number accurately. This is a crucial step for the identification of employees.

Failing to correctly list the employee's Last Name First Name in the specified order can lead to issues in record-keeping and identification.

Omitting or inaccurately reporting Total Wages Paid. This figure must include all forms of compensation within the quarter.

Incorrect calculation of Taxable Wages Paid. This requires careful attention to ensure only wages subject to unemployment insurance are accounted for.

Misunderstanding the Contribution Rate for This Calendar Quarter and entering it incorrectly. It must be entered as a decimal, not a percentage.

Errors in calculating Contributions Due. This mistake is often the result of incorrect taxable wages or contribution rate.

Forgetting to include Interest Due and Penalties if the report is submitted after the due date.

Incorrect or missing employer information, such as the Oklahoma Account Number or Federal I.D. No., which is essential for properly crediting the payment.

To avoid these errors, a thorough review of the entire form before submission is recommended. Additionally, utilizing the available resources like scannable "Continuation Sheets" can simplify the process of reporting multiple employees.

Documents used along the form

When working with the Oklahoma Quarterly Contribution Report, several supplementary forms and documents are frequently utilized to ensure thorough and accurate reporting. These aid in the comprehensive coverage of required information for unemployment insurance and payroll tax obligations. The forms typically complement the data submitted on the main contribution report, providing additional details or clarifying the information needed by the Oklahoma Employment Security Commission.

- Form OES-4: This is the Employer's Quarterly Adjustment Report. It is used for correcting or adjusting previously submitted quarterly contribution reports. Employers may need to amend the wages paid, the number of employees, or other details that were incorrectly reported in an earlier quarter.

- Form OES-1: Known as the Employer's First Report of Injury or Illness, this document is critical for reporting any workplace injuries or illnesses. While it is not directly related to contributions, maintaining accurate records of workplace incidents can impact an employer's contribution rate due to changes in claim history.

- UC-5A: The Employer’s Quarterly Wage Report is a detailed listing of individual employee wages, which supports the total wages reported. This document ensures that each employee's earnings are accurately captured for unemployment insurance purposes.

- Payment Voucher: Accompanies the Oklahoma Quarterly Contribution Report for employers choosing to make their contributions via check or money order. This document ensures that payments are properly credited to the correct employer account.

- Form OES-3 Continuation Sheet: For employers with extensive employee rosters, continuation sheets provide the additional space needed to list all employees and their earnings. These sheets are an extension of the main contribution report form, allowing for comprehensive employee wage reporting.

In addition to these forms, employers may also encounter requests for additional documentation or reports specific to their circumstances. For instance, new businesses or employers with changes to their company structure might need to submit supplementary information. Regardless, the primary goal is to maintain accurate, up-to-date records that reflect the employment and compensation status of all employees, supporting the integrity of the unemployment insurance system.

Similar forms

IRS Form 941 (Employer's Quarterly Federal Tax Return): This form, similar to the Oklahoma Quarterly Contribution Report, is required by the IRS for employers to report federal withholdings from employee wages, including social security and Medicare taxes, which mirrors how state-level contributions are reported to Oklahoma Employment Security Commission.

State Unemployment Tax Act (SUTA) Reports: Much like the Oklahoma report focuses on unemployment insurance contributions, other states have their own versions of SUTA reporting forms. These forms also collect employee wages and calculate contributions owed to the state's unemployment insurance program.

IRS Form W-2 (Wage and Tax Statement): Though used annually, the W-2 form shares similarities with the Oklahoma Quarterly Contribution Report by requiring employers to disclose the wages paid to employees and the taxes withheld, providing a yearly summary that complements the quarterly detail of state contributions.

IRS Form W-3 (Transmittal of Wage and Tax Statements): The Form W-3, which accompanies Form W-2 submissions to the IRS, consolidates the total of wages paid and taxes withheld from all employees for the year, acting as a federal counterpart to the state-level aggregate reporting seen in Oklahoma's quarterly filings.

Form UC-2 (Unemployment Insurance Contribution Report): Used in certain states, this form captures information similar to Oklahoma's quarterly contribution report, detailing total and taxable wages for each employee, to calculate the business's unemployment insurance contributions.

Form 940 (Employer's Annual Federal Unemployment (FUTA) Tax Return): Although annual, Form 940 is akin to the Oklahoma report in its purpose to tally up unemployment tax liabilities based on employee wages, but on a federal level, covering FUTA taxes.

Payroll Summary Reports: Common in business operations, these internal payroll summary reports list aggregate employee earnings and deductions for a given period, serving as the groundwork for completing the Oklahoma Quarterly Contribution Report and similar forms.

Form 1099-MISC (Miscellaneous Income): While targeting different types of payments, Form 1099-MISC encompasses the reporting of payments not typically subject to automatic withholdings, similar to how the Oklahoma form tracks wages that are subject to unemployment contributions.

Local Municipal Business Taxes: Various localities require quarterly or annual reporting of wages for tax purposes, paralleling the Oklahoma report's collection of wage data to ensure appropriate municipal tax contributions are made.

Dos and Don'ts

When completing the Oklahoma Quarterly Contribution Report form, there are several key actions to ensure accuracy and compliance. Below are five recommended practices along with five common mistakes to avoid.

Recommended Practices:- Double-check employee information: Accurately enter each employee's Social Security Number and full name to avoid processing delays or errors.

- Report exact wages: Include the total wages paid and taxable wages accurately for each employee to ensure correct contribution calculations.

- Use the correct contribution rate: Enter your contribution rate as a decimal based on the rate provided for the current calendar quarter to calculate your contributions due correctly.

- Calculate contributions meticulously: Use the formula provided on the form (Taxable Wages #6 x Contributions Rate #7) to calculate contributions due accurately and avoid underpayment or overpayment.

- Sign and date the form: Ensure the form is signed and dated before submission. This certifies the accuracy of the information and complies with official requirements.

- Do not staple documents: Avoid stapling any documents or the form itself, as this can cause issues with processing and scanning.

- Avoid submitting copies: Original forms are required for processing. Copies may not be accepted and could delay processing times.

- Do not leave mandatory fields blank: Ensure all required fields, including employee information, wages, contribution rate, and employer details, are thoroughly completed to prevent the form from being returned.

- Avoid miscalculating contributions: Incorrect contribution calculations can lead to either underpayment, which may result in penalties, or overpayment, which could complicate your financial records.

- Do not be late: Submit the form by the due date to avoid interest and penalties. Being aware of submission deadlines is crucial for maintaining compliance and avoiding additional fees.

Misconceptions

When it comes to filing the Oklahoma Quarterly Contribution Report, there are several misconceptions that can lead to confusion. Understanding these misconceptions can help ensure that the process is as smooth as possible.

- Misconception 1: Employee Social Security Numbers are optional.

This is incorrect. Providing an employee's Social Security Number is mandatory for the accurate processing of the report.

- Misconception 2: It's acceptable to staple documents when submitting the report.

The instructions clearly state not to staple documents in order to prevent damage to the paperwork and ensure that all information is accessible for processing.

- Misconception 3: You can submit copies of the form.

Submitters are instructed not to submit copies of the form; original forms are required to ensure accuracy and legibility.

- Misconception 4: The form is only for reporting wages paid to full-time workers.

The form actually requires information on both full and part-time workers who worked or received pay subject to unemployment insurance for the specified period.

- Misconception 5: Taxable and total wages are the same.

Total wages paid is an overall figure, while taxable wages are those wages subject to unemployment insurance contributions and may differ from the total wages paid.

- Misconception 6: The contribution rate is flexible.

Each employer is assigned a specific contribution rate that must be entered as a decimal on the form. This rate is not up for interpretation.

- Misconception 7: Penalties are negotiable.

The form specifies clear penalties for late submissions, including a 1% interest per month and a 10% penalty plus a $100 penalty. These penalties are firm and are applied as stated.

- Misconception 8: The Oklahoma Account Number is the same as the Federal I.D. Number.

These are two distinct numbers. The Oklahoma Account Number is specifically for state reporting purposes, while the Federal I.D. Number is used for federal tax matters.

- Misconception 9: Contributions can be paid by the employee.

It is the responsibility of the employer to pay these contributions. The certification statement on the report confirms that no contribution is paid by any employee.

Clearing up these misconceptions not only helps in complying with the filing requirements but also ensures that contributions are reported accurately, benefiting both employers and employees in Oklahoma.

Key takeaways

Filling out the Oklahoma Quarterly Contribution Report is a crucial task for employers to ensure compliance with state employment security laws. This document plays a significant role in the administration of unemployment insurance contributions. Here are five key takeaways to consider when preparing this form:

- Accuracy in Employee Information: It's paramount to provide accurate employee information, including social security numbers, and full names. This ensures that records are correctly matched and maintained for unemployment insurance purposes.

- Understanding Wage Reporting: Employers must report total wages paid and taxable wages paid during the quarter. It's important to distinguish between the two, as taxable wages are used to calculate contributions due.

- Contribution Rate Application: The contribution rate given for the calendar quarter should be entered as a decimal. This rate is applied to the taxable wages to determine the amount of contributions due. Correct application of this rate is essential for accurate reporting.

- Payment Timelines and Penalties: The report highlights the importance of meeting due dates to avoid interest and penalties. A 1% interest rate applies per month after the due date, in addition to a 10% penalty and a $100.00 fixed fine for late payments.

- Completion and Certification: Employers must certify the accuracy of the report by signing it. This certification confirms that all information provided is correct to the best of the employer's knowledge and that no contributions are made from employee wages.

Utilizing the available auxiliary aids and services can assist individuals with disabilities in accurately completing this form. Employers can visit the specific website provided to obtain "Continuation Sheets" for more detailed or extensive reporting. Remember, making payments to the Oklahoma Employment Security Commission must be done carefully, with checks payable explicitly to the name provided, ensuring that contributions support the state's unemployment insurance program effectively.

Popular PDF Forms

B13a - It serves as an official record of export for businesses, containing details like HS codes and item descriptions.

City of Plantation Building Department Forms - This document helps maintain the aesthetic and structural standards of the community, contributing to the overall well-being and safety of its residents.