Blank P 1 PDF Template

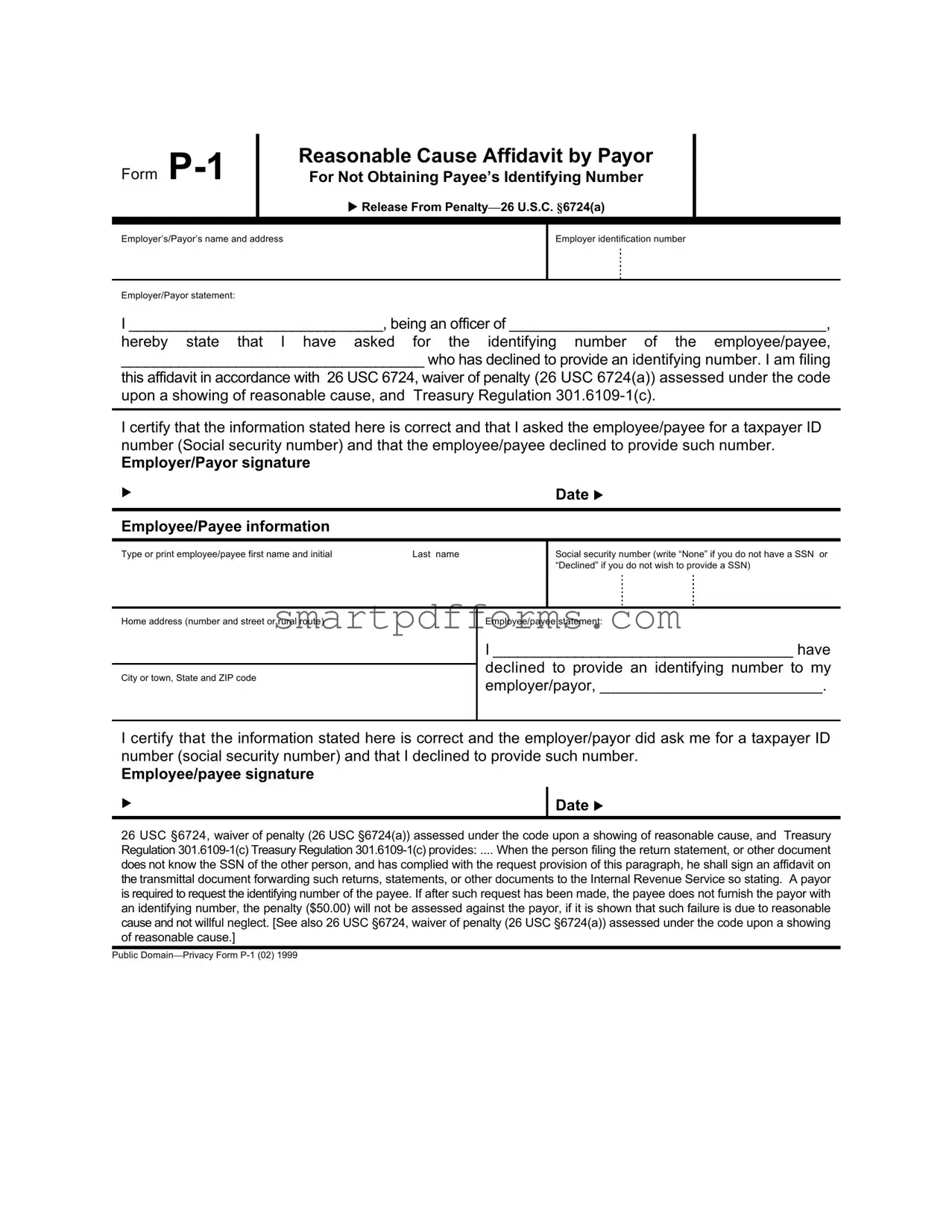

In the intricate dance of compliance and responsibility that characterizes the relationship between employers and their employees, the Form P-1 stands as a key procedural document. This form, formally known as the Reasonable Cause Affidavit by Payor For Not Obtaining Payee’s Identifying Number, serves a critical role in the realm of tax documentation and penalty avoidance as enshrined under 26 U.S.C. §6724(a). It is meticulously designed to document instances where an employee, referred to here as the payee, fails to provide their employer (the payor) with a necessary identifying number, typically a Social Security Number (SSN). In completing this form, the employer attests to having made a diligent effort to obtain this identification as mandated by Treasury Regulation 301.6109-1(c), and asserts that the failure to secure such information constitutes a reasonable cause, thereby seeking exemption from potential penalties. With sections dedicated to both the employer's and the employee's statements, and the requirement for signatures from both parties, the form not only underscores the importance of due diligence in tax-related documentation but also highlights the shared responsibility in adhering to regulatory requirements. In doing so, it acts not just as a safeguard against penalties but also as a testament to the complexities inherent in employer-employee dynamics concerning tax information sharing.

Preview - P 1 Form

Form

Reasonable Cause Affidavit by Payor

For Not Obtaining Payee’s Identifying Number

uRelease From

Employer’s/Payor’s name and address

Employer identification number

Employer/Payor statement:

I _______________________________, being an officer of _____________________________________,

hereby state that I have asked for the identifying number of the employee/payee,

_____________________________________ who has declined to provide an identifying number. I am filing

this affidavit in accordance with 26 USC 6724, waiver of penalty (26 USC 6724(a)) assessed under the code upon a showing of reasonable cause, and Treasury Regulation

I certify that the information stated here is correct and that I asked the employee/payee for a taxpayer ID number (Social security number) and that the employee/payee declined to provide such number.

Employer/Payor signature

u |

Date u |

|

Employee/Payee information

Type or print employee/payee first name and initial |

Last name |

Social security number (write “None” if you do not have a SSN or “Declined” if you do not wish to provide a SSN)

Home address (number and street or rural route)

City or town, State and ZIP code

Employee/payee statement:

I ____________________________________ have

declined to provide an identifying number to my employer/payor, __________________________.

I certify that the information stated here is correct and the employer/payor did ask me for a taxpayer ID number (social security number) and that I declined to provide such number.

Employee/payee signature

u

Date u

26 USC §6724, waiver of penalty (26 USC §6724(a)) assessed under the code upon a showing of reasonable cause, and Treasury Regulation

does not know the SSN of the other person, and has complied with the request provision of this paragraph, he shall sign an affidavit on the transmittal document forwarding such returns, statements, or other documents to the Internal Revenue Service so stating. A payor is required to request the identifying number of the payee. If after such request has been made, the payee does not furnish the payor with an identifying number, the penalty ($50.00) will not be assessed against the payor, if it is shown that such failure is due to reasonable cause and not willful neglect. [See also 26 USC §6724, waiver of penalty (26 USC §6724(a)) assessed under the code upon a showing of reasonable cause.]

Public

Form Data

| Fact Name | Description |

|---|---|

| Form Title | Reasonable Cause Affidavit by Payor For Not Obtaining Payee’s Identifying Number |

| Primary Purpose | Release From Penalty under 26 U.S.C. §6724(a) |

| Governing Law | 26 U.S.C. §6724 and Treasury Regulation 301.6109-1(c) |

| Requirement for Payor | The payor is required to request an identifying number from the payee. |

| Penalty Waiver Condition | If the payee declines to provide an identifying number, the payor may be exempt from a penalty with proof of reasonable cause. |

| Penalty Amount Avoided | $50.00 per instance |

| Affidavit Requirements | Statement by payor confirming request for identifying number was declined by payee. |

| Additional Statement | Payee must confirm they declined to provide their identifying number. |

| Form Issue Date | 1999 |

| Document Status | Public Domain—Privacy |

Instructions on Utilizing P 1

Before undertaking the task of filling out Form P-1, it is important for individuals to familiarize themselves with the requirements and purpose of this document. Form P-1, known as the Reasonable Cause Affidavit by Payor for Not Obtaining Payee's Identifying Number, is a crucial document intended to provide a waiver from penalties under specific provisions of the United States Tax Code, particularly 26 U.S.C. §6724(a). This form facilitates a statement by the payor, usually an employer, regarding their attempt to obtain an identifying number from the payee, usually an employee, and the payee's refusal to provide such information. Completing this form accurately is essential for ensuring compliance with tax regulations and avoiding potential penalties. The following steps are designed to guide you through the process of accurately filling out the form.

- Start by entering the name and address of the employer or payor at the designated spot on the form.

- Fill in the employer identification number in the space provided.

- In the employer/payor statement section, the officer of the company must print their name, followed by the name of the company they represent.

- Identify the employee or payee by filling in their name in the blank space provided within the statement.

- After the statement, sign the employer/payor signature line, and ensure to fill in the date next to it.

- Move to the Employee/Payee Information section and type or clearly print the employee's first name, initial, and last name.

- If applicable, write "None" in the space for the Social Security Number (SSN) if the employee does not have one, or "Declined" if the employee has refused to provide it.

- Enter the employee's home address, including the city or town, state, and ZIP code in the spaces provided.

- In the employee/payee statement section, the employee needs to print their name and the name of the employer/payor, reflecting the refusal to provide the identifying number.

- The employee/payee must sign and date the form in their respective sections to certify the accuracy of the information provided.

Upon completion of these steps, it is essential to review the form for accuracy before submitting it to the appropriate authorities. This review process ensures that all information provided is accurate and truthful, thereby fulfilling the requirement set forth under Treasury Regulation 301.6109-1(c) and helping to avoid potential penalties. It's a demonstration of compliance with tax regulations, emphasizing the responsibility of both employers and employees in maintaining proper documentation within the framework of the U.S. tax system.

Obtain Answers on P 1

-

What is Form P-1?

Form P-1, named Reasonable Cause Affidavit by Payor For Not Obtaining Payee’s Identifying Number, is a document used by employers or payors to declare that they have made efforts to obtain an identifying number from an employee or payee, who has declined to provide it. This form helps employers or payors avoid penalties under 26 U.S.C. §6724(a) by demonstrating a reasonable cause for not obtaining the required information.

-

Why might an employer need to complete Form P-1?

An employer might need to complete Form P-1 if an employee or payee refuses to provide their taxpayer identification number (TIN), such as a Social Security Number (SSN). This form shows the Internal Revenue Service (IRS) that the employer has taken the necessary steps to request the information, thereby helping them to avoid a penalty for failing to report the TIN on tax documents.

-

What are the consequences of not filing Form P-1?

If an employer does not file Form P-1 when an employee or payee declines to provide a TIN, the employer may face a penalty. This penalty is designed to encourage compliance with the IRS's requirements to collect and report identifying numbers for all payees. By filing Form P-1, an employer demonstrates due diligence, potentially leading to a waiver of this penalty.

-

How does an employer file Form P-1?

To file Form P-1, an employer or payor must complete the form, providing their name and address, employer identification number, a statement about the request for the employee's or payee's TIN, and signatures from both the employer or payor and the employee or payee who declined to provide their TIN. This form should then be submitted to the IRS as part of the employer's tax documentation.

-

What information is required on Form P-1?

Form P-1 requires the employer’s or payor’s name and address, employer identification number (EIN), a statement from the employer or officer of the company affirming that they requested the TIN from the employee or payee, and that the request was declined. Moreover, it requires the type or print name and address of the employee or payee, and signatures and dates from both parties involved.

-

Can an employee be penalized for not providing their TIN?

-

Yes, an employee or payee who fails to provide their TIN to an employer may face consequences, such as being subject to backup withholding. However, this form primarily concerns the employer's responsibility and attempts to comply with IRS requirements, rather than direct penalties to the employee for non-compliance.

-

-

Are there exceptions that allow for the non-provision of a TIN?

There are certain circumstances under which an individual may not be able to provide a TIN, such as if they are waiting for an SSN or EIN to be issued. In these cases, communication and documented attempts to comply can help mitigate penalties until the number can be provided.

-

How does one show "reasonable cause" on Form P-1?

On Form P-1, the employer or payor shows reasonable cause by detailing their efforts to obtain the TIN from the payee and the payee’s refusal to provide it, alongside their declaration and signature. This demonstrates to the IRS that the failure to provide the TIN was not due to willful neglect on part of the employer.

Common mistakes

Filling out Form P-1, the Reasonable Cause Affidavit for Not Obtaining a Payee's Identifying Number, is a critical process that employers or payors must navigate with attention to detail to ensure compliance with the IRS requirements and to avoid penalties. However, there are common pitfalls encountered in this process. Recognizing these mistakes can help individuals accurately complete the form and fulfill their obligations under the law.

Not Providing Detailed Information: One of the most significant errors is the lack of detailed information in the employer/payor and employee/payee statements. Both parties must clearly and accurately state the request for the identifying number and the refusal to provide it. Leaving out specifics or not clearly articulating the sequence of events can lead to the form being dismissed or not properly processed.

Incorrectly Identifying the Employee or Payee: Failing to provide the correct name and social security number (or indicating "None" or "Declined" appropriately) of the employee/payee is a common mistake. This information must match other documents and records to ensure the IRS can accurately assess the situation and grant the waiver request.

Overlooking the Certification Requirement: Both the employer/payor and the employee/payee must certify that the information provided is correct. Skipping this step or not properly signing the affidavit can invalidate the document, as certification is a legal affirmation of the accuracy of the provided information.

Misunderstanding the Reasonable Cause Requirement: Sometimes, there is a misconception about what constitutes 'reasonable cause' for not obtaining an identifying number. It's important to understand that reasonable cause is not merely a lack of information but also involves demonstrating that a concerted effort was made to obtain the required information and the refusal of the employee or payee to provide it.

Failure to Submit in a Timely Fashion: Finally, submitting the form after the deadline can lead to penalties despite the payor having a valid reason for not obtaining the identifying number. Timeliness is key in these situations, and understanding the deadlines and processing times is crucial to avoid unnecessary penalties.

To avoid these mistakes, it is advisable to carefully review the form's instructions, double-check all entered information for accuracy, and ensure that all necessary sections are completed fully and correctly. Where there is doubt or confusion, seeking clarification or professional assistance may prevent errors and ensure compliance with IRS regulations.

Documents used along the form

Form P-1, known as the Reasonable Cause Affidavit for Not Obtaining Payee's Identifying Number, is a critical document for employers or payors who have made a genuine attempt to secure an employee's or payee's identifying number without success. This form serves as a proactive step to waive a potential penalty under specific sections of the United States Code. When used appropriately, it illustrates due diligence on the part of the employer or payor. There are several other forms and documents that may be necessary to support or be accompanied by Form P-1 for various financial, employment, and tax-related processes. Below is a list and brief description of some of these additional forms and documents.

- Form W-9, Request for Taxpayer Identification Number and Certification: Employers use this form to request the taxpayer identification number (TIN) of a U.S. person (including a resident alien), to help ensure the information provided on an information return is accurate.

- Form W-4, Employee's Withholding Certificate: This form is completed by employees to let employers know how much tax to withhold from their paycheck.

- Form 1099-MISC, Miscellaneous Income: Employers use this document to report payments made in the course of a trade or business to a person who's not an employee or to an incorporated business.

- Form I-9, Employment Eligibility Verification: Employers use this form to verify the identity and employment authorization of individuals hired for employment in the United States.

- Form SS-4, Application for Employer Identification Number: This form is used by businesses to apply for an employer identification number (EIN), which is used for tax purposes.

- Form 941, Employer's Quarterly Federal Tax Return: Employers must file this form to report income taxes, social security tax, or Medicare tax withheld from employee's paychecks.

- Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return: Employers use this form to report and pay the federal unemployment tax.

- Form W-2, Wage and Tax Statement: Employers must provide this form to employees and the Social Security Administration to report wages, tips, and other compensation.

- Letter of Reasonable Cause: While not a standard IRS form, a personalized explanation or letter may be required to detail the specific reasons beyond an employer's control that led to the inability to obtain the necessary identifying information.

- State-Specific New Hire Reporting Forms: Employers may need to complete these forms to comply with state regulations regarding the reporting of new or rehired employees.

While the Reasonable Cause Affidavit (Form P-1) stands out for its specific purpose relating to non-compliance penalties, each of the documents listed plays an important role in the broader spectrum of employment and tax regulation compliance. Ensuring that these forms are accurately completed and properly filed is essential for both legal compliance and the smooth operation of payroll and tax reporting processes. Familiarizing oneself with these documents and their respective requirements can help employers navigate the complexities of financial and employment-related responsibilities.

Similar forms

The Form P-1 Reasonable Cause Affidavit by Payor For Not Obtaining Payee’s Identifying Number stands as a procedural document in the compliance landscape, particularly in the domain of tax reporting and penalty avoidance. This form, instrumental for payors in demonstrating diligence and reasonable cause when a payee's identifying number is not furnished, bears similarities with several other documents within the tax and regulatory compliance sphere. The essence of these documents revolves around providing structured pathways for entities to comply with regulations, prevent penalties, or remediate lapses in procedural compliance. Below is a list of documents similar to Form P-1 and the nature of their similarities:

- Form W-9, Request for Taxpayer Identification Number and Certification: Similar to Form P-1, Form W-9 is used to request the taxpayer identification number (TIN) of a payee or other parties. However, it is more commonly associated with the initial gathering of TINs rather than the remediation after a party has declined to provide their TIN.

- Form 1099-MISC, Miscellaneous Income: This form, which requires the payor to report payments made to payees within a year, parallels Form P-1’s context of payor-payee interaction. The necessity for a payee's identifying number on Form 1099-MISC underscores the relevance of Form P-1 for situations where such information is not available.

- Form 8962, Premium Tax Credit: Although its primary purpose is to facilitate the reconciliation of advance payments of the premium tax credit and to claim this tax credit on the taxpayer's return, Form 8962 is similar to Form P-1 in its basis in tax law compliance and its interaction with provisions under the Internal Revenue Code.

- Form 2848, Power of Attorney and Declaration of Representative: This form, used to authorize an individual to represent another person before the IRS, aligns with Form P-1 in terms of procedural compliance and formal documentation of roles and responsibilities in the context of tax administration.

- Form 4506-T, Request for Transcript of Tax Return: Like Form P-1, Form 4506-T is an official request form used in the domain of tax compliance, specifically for obtaining past tax return information. Both forms play roles in procedural compliance and documentation.

- Form 843, Claim for Refund and Request for Abatement: Form 843 is used to request a refund or ask for an abatement of certain taxes, penalties, and other amounts. The similarity with Form P-1 lies in its purpose to relieve the taxpayer from penalties under specific circumstances, predicated on demonstrating reasonable cause.

- Form 8850, Pre-Screening Notice and Certification Request for the Work Opportunity Credit: Both forms serve a compliance function within the tax code, with Form 8850 focusing on the eligibility for a tax credit related to hiring from certain groups. The parallel to Form P-1 exists in the need to document certain information and circumstances for compliance and benefit purposes.

In essence, these documents, while serving varied specific purposes within the tax code and compliance landscape, share the underlying principle with Form P-1: facilitating adherence to regulations, demonstrating compliance, and potentially avoiding penalties through structured documentation and adherence to procedural mandates.

Dos and Don'ts

When completing the Form P-1, it is important to be thorough and precise to ensure compliance and to potentially avoid penalties. Here are some critical dos and don'ts to keep in mind:

- Do read the entire form carefully before beginning to fill it out. Understanding each section will help prevent errors.

- Do provide accurate information for the employer/payor's name and address, ensuring it matches official documents.

- Do include the employer identification number (EIN) as this is critical for identification and processing.

- Do ensure that the employer/payor statement is signed by an authorized officer of the company, as it validates the affidavit.

- Do type or print the employee/payee’s information clearly, including the name, address, and social security number (if available).

- Don't leave any fields blank. If a section does not apply, indicate with “N/A” (not applicable) or “None” if the social security number is not available.

- Don't forget to have the employee/payee sign their portion of the form, as their signature is required to confirm their refusal to provide an identifying number.

- Don't disregard the importance of dating both the employer/payor and the employee/payee sections. Accurate dates are crucial for record-keeping and deadlines.

- Don't submit the form without reviewing it for completeness and accuracy to avoid the potential for delays or the assessment of penalties.

Following these recommendations can help ensure that the Form P-1 is completed correctly and efficiently, aiding in compliance with IRS regulations and potentially averting penalties.

Misconceptions

There are several misconceptions about the Form P-1, known as the Reasonable Cause Affidavit by Payor for Not Obtaining Payee’s Identifying Number. Understanding these misconceptions is crucial for employers and payors to navigate their responsibilities correctly. Here is a list of ten common misunderstandings:

- Form P-1 is optional: Many people mistakenly believe that the P-1 form is optional. However, it's a required document for employers or payors who have not been able to obtain a payee's identifying number despite reasonable efforts.

- Any reason is acceptable for not obtaining a taxpayer ID: This is incorrect. The form is specifically designed for situations where the payee refuses to provide their identifying number, and the employer/payor must demonstrate reasonable cause for this failure.

- The form protects against all penalties: The P-1 form offers relief from the specific $50 penalty for failing to obtain a payee's identifying number, but it does not protect against other related penalties or issues stemming from noncompliance with other tax laws.

- The form is complicated to fill out: In reality, the P-1 form is straightforward. It requires basic information about the employer/payor, the payee, and a statement of reasonable cause for not obtaining the taxpayer ID number.

- Submitting Form P-1 automatically waives the penalty: Merely submitting the form does not guarantee the waiver of the penalty. The IRS assesses whether the failure was due to reasonable cause and not willful neglect on a case-by-case basis.

- Only large employers need to worry about Form P-1: Regardless of size, any employer or payor who faces an issue obtaining a payee’s identifying number may need to file a P-1 form. The requirement is based on a specific situation, not the size of the business.

- The employee/payee must fill out the form: Although the form requires information regarding the employee/payee, it is the employer’s or payor's responsibility to complete and file the form. The employee/payee must simply provide a statement and signature acknowledging their refusal to give their identifying number.

- Form P-1 can be filed at any time: It's best to file the form as soon as it becomes clear that the payee will not provide their identifying number and certainly by the time of tax filing. Delays can complicate matters or affect the acceptance of the reasonable cause claim.

- Digital submissions are acceptable: The IRS has specific guidelines on how forms should be submitted, and while electronic filing is growing in use for many forms, one should verify the current filing options for Form P-1 to ensure compliance.

- The form is only for employees: The title "payee" covers a broad range of recipients beyond traditional employees, including contractors and other entities to which payments are made. It’s important to understand the form applies to any payee from whom an identifying number is required but not obtained.

Clarifying these misconceptions ensures that employers and payors are better equipped to handle situations involving the refusal or inability of a payee to provide a necessary taxpayer identification number, avoiding unnecessary penalties by adhering to the guidelines set forth by the IRS.

Key takeaways

Filling out the P-1 form correctly is crucial for both employers/payors and employees/payees in order to comply with federal regulations and avoid possible penalties. The key takeaways from this document are outlined below to ensure clarity and compliance with the process.

- Employer Responsibility: It is the employer's or payor’s duty to request the identifying number, typically a social security number (SSN), of the employee or payee.

- Employee/Payee Declaration: If an employee or payee declines to provide their SSN, they must affirm this decision by signing the P-1 form, thereby officially declining to provide the necessary identifier.

- Reasonable Cause Affidavit: The P-1 form serves as an affidavit for the employer/payor to assert that they have requested the required identification and the request has been declined. This affidavit helps demonstrate a reasonable cause for not obtaining the number, aiming to protect the employer/payor from penalties.

- Penalty Waiver: Under Title 26 of the U.S. Code, Section 6724(a), a penalty usually applied for not obtaining the payee's identifying number can be waived if the employer/payor shows that the failure is due to reasonable cause rather than willful neglect.

- Required Information: The form requires detailed information including the employer’s/payor’s name and address, the employer identification number, and both the employer/payor and employee/payee's statements and signatures.

- Signing Requirement: Both the employer/payor and the employee/payee must sign the form, certifying that the content and declarations made within are correct.

- Regulatory Compliance: Filling out and submitting the P-1 form helps ensure compliance with Treasury Regulation 301.6109-1(c), which outlines the requirements for affidavit submission when a payee’s SSN is not provided.

- Submission Guidelines: Upon completion, the form along with any applicable returns, statements, or other documents should be forwarded to the Internal Revenue Service (IRS) as stipulated by federal guidelines.

Adherence to these guidelines when filling out the P-1 form is essential for employers/payors to fulfill their legal obligations and for employees/payees to responsibly manage their identifying information.

Popular PDF Forms

Eeoc Form - A formal request to the EEOC to stop action on a previously filed discrimination charge.

Connecticut 7B - Gain insight into the critical nature of the Connecticut 7B form for ensuring every worker on your project is protected under workers' compensation insurance.

Miss Punch Application - Facilitates the orderly management of employee time records by providing a structured format for reporting and correcting missed clock-in or clock-out times.