Blank Pa PDF Template

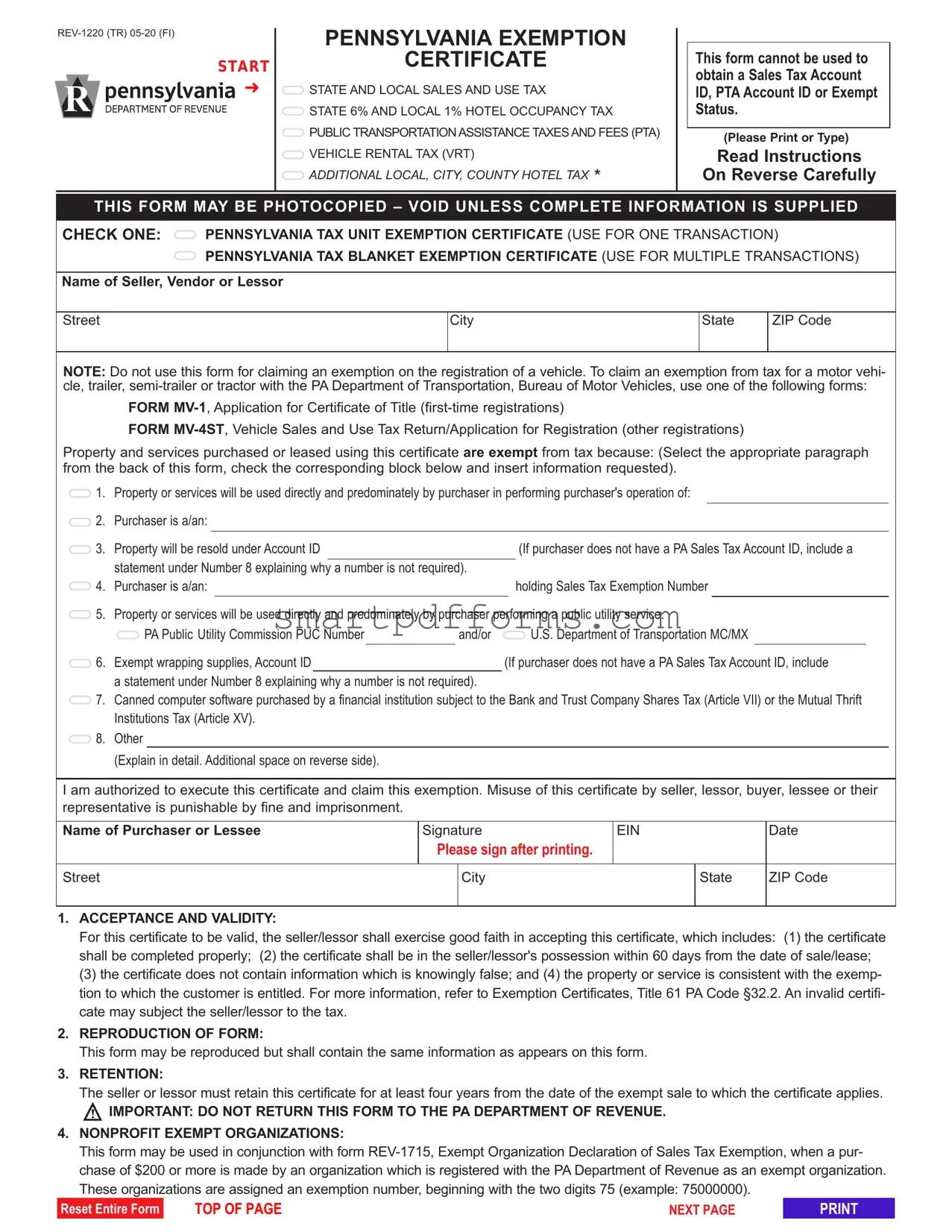

At the heart of Pennsylvania’s tax system lies the Pennsylvania Exemption Certificate (REV-1220), a key document designed to navigate the complexities of state and local taxes, including sales and use tax, hotel occupancy tax, and various other fees. This document plays a crucial role for businesses and organizations, allowing them to claim exemptions from certain taxes under specific conditions. The certificate, which comes in two forms—one for single transactions and another as a blanket certificate for multiple transactions—requires detailed information about the seller and purchaser, underscoring the importance of accuracy and completeness for legal and tax compliance. It cannot, however, be used for obtaining tax account IDs or exempt status but rather serves as a declaration for tax-exempt purchases or leases based on the nature of the use or the status of the buyer. Misuse of this certificate is subject to strict penalties, highlighting the need for integrity in its application. Moreover, the instructions on the reverse side of the form provide guidance on its proper use, including acceptance criteria, reproduction policies, and retention requirements, ensuring users understand the responsibilities and legal implications of declaring tax exemptions in Pennsylvania.

Preview - Pa Form

START

➜

➜

PENNSYLVANIA EXEMPTION

CERTIFICATE

STATE AND LOCAL SALES AND USE TAX

STATE AND LOCAL SALES AND USE TAX

STATE 6% AND LOCAL 1% HOTEL OCCUPANCY TAX

STATE 6% AND LOCAL 1% HOTEL OCCUPANCY TAX

PUBLIC TRANSPORTATION ASSISTANCE TAXES AND FEES (PTA)

PUBLIC TRANSPORTATION ASSISTANCE TAXES AND FEES (PTA)

VEHICLE RENTAL TAX (VRT)

VEHICLE RENTAL TAX (VRT)

ADDITIONAL LOCAL, CITY, COUNTY HOTEL TAX *

ADDITIONAL LOCAL, CITY, COUNTY HOTEL TAX *

This form cannot be used to obtain a Sales Tax Account ID, PTA Account ID or Exempt Status.

(Please Print or Type)

Read Instructions

On Reverse Carefully

THIS FORM MAY BE PHOTOCOPIED – VOID UNLESS COMPLETE INFORMATION IS SUPPLIED

CHECK ONE:  PENNSYLVANIA TAX UNIT EXEMPTION CERTIFICATE (USE FOR ONE TRANSACTION)

PENNSYLVANIA TAX UNIT EXEMPTION CERTIFICATE (USE FOR ONE TRANSACTION)  PENNSYLVANIA TAX BLANKET EXEMPTION CERTIFICATE (USE FOR MULTIPLE TRANSACTIONS)

PENNSYLVANIA TAX BLANKET EXEMPTION CERTIFICATE (USE FOR MULTIPLE TRANSACTIONS)

Name of Seller, Vendor or Lessor

Street

City

State

ZIP Code

NOTE: Do not use this form for claiming an exemption on the registration of a vehicle. To claim an exemption from tax for a motor vehi- cle, trailer,

FORM

FORM

Property and services purchased or leased using this certificate are exempt from tax because: (Select the appropriate paragraph from the back of this form, check the corresponding block below and insert information requested).

1. |

Property or services will be used directly and predominately by purchaser in performing purchaser's operation of: |

||||||||||||||

2. |

Purchaser is a/an: |

|

|

|

|

|

|

|

|

|

|||||

3. |

Property will be resold under Account ID |

|

|

|

(If purchaser does not have a PA Sales Tax Account ID, include a |

||||||||||

|

statement under Number 8 explaining why |

a number is not required). |

|

|

|

|

|

|

|

||||||

4. |

Purchaser is a/an: |

|

|

|

holding Sales Tax Exemption Number |

|

|||||||||

5. |

Property or services will be used directly and predominately by purchaser performing a public utility service. |

||||||||||||||

|

PA Public Utility Commission PUC Number |

|

and/or |

|

|

U.S. Department of Transportation MC/MX |

|

|

|||||||

6. |

Exempt wrapping supplies, Account ID |

|

(If purchaser does not have a PA Sales Tax Account ID, include |

||||||||||||

|

a statement under Number 8 explaining |

why a number is not required). |

|

|

|

|

|

|

|

||||||

7. |

Canned computer software purchased by a financial institution subject to the Bank and Trust Company Shares Tax (Article VII) or the Mutual Thrift |

||||||||||||||

|

Institutions Tax (Article XV). |

|

|

|

|

|

|

|

|

||||||

8. |

Other |

|

|

|

|

|

|

|

|

|

|||||

|

(Explain in detail. Additional space on reverse side). |

|

|

|

|

|

|

|

|

||||||

I am authorized to execute this certificate and claim this exemption. Misuse of this certificate by seller, lessor, buyer, lessee or their representative is punishable by fine and imprisonment.

Name of Purchaser or Lessee |

Signature |

EIN |

|

Date |

|

|

Please sign after printing. |

|

|

|

|

|

|

|

|

|

|

Street |

|

City |

|

State |

ZIP Code |

|

|

|

|

|

|

1.ACCEPTANCE AND VALIDITY:

For this certificate to be valid, the seller/lessor shall exercise good faith in accepting this certificate, which includes: (1) the certificate shall be completed properly; (2) the certificate shall be in the seller/lessor's possession within 60 days from the date of sale/lease;

(3) the certificate does not contain information which is knowingly false; and (4) the property or service is consistent with the exemp- tion to which the customer is entitled. For more information, refer to Exemption Certificates, Title 61 PA Code §32.2. An invalid certifi- cate may subject the seller/lessor to the tax.

2.REPRODUCTION OF FORM:

This form may be reproduced but shall contain the same information as appears on this form.

3.RETENTION:

The seller or lessor must retain this certificate for at least four years from the date of the exempt sale to which the certificate applies.

IMPORTANT: DO NOT RETURN THIS FORM TO THE PA DEPARTMENT OF REVENUE.

IMPORTANT: DO NOT RETURN THIS FORM TO THE PA DEPARTMENT OF REVENUE.

4.NONPROFIT EXEMPT ORGANIZATIONS:

This form may be used in conjunction with form

Reset Entire Form

TOP OF PAGE |

NEXT PAGE |

GENERAL INSTRUCTIONS

Those purchasers set forth below may use this form in connection with the claim for exemption for the following taxes:

a.State and local sales and use tax;

b.PTA rental fee or tax on leases of motor vehicles;

c.Hotel occupancy tax (state 6%, Philadelphia 1%, Allegheny 1%) if referenced with the symbol (●);

d.PTA fee on the purchase of tires if referenced with the symbol (+);

e.Vehicle rental tax (VRT).

EXEMPTION REASONS

1.) Property and/or services will be used directly and predominately by purchaser in performing purchaser's operation of:

A. Manufacturing |

B. Mining |

C. Dairying |

D. Processing |

E. Farming |

F. Shipbuilding |

G. Timbering |

This exemption is not valid for property or services used in: (a) constructing, repairing or remodeling of real property, other than real property used directly in exempt operations; or (b) maintenance, managerial, administrative, supervisory, sales, delivery, warehousing or other nonoperational activities. This exemp- tion is not valid for vehicles that are required to be registered under the Vehicle Code, as well as supplies and repair parts for such vehicles, the PTA tire fee, and certain taxable services.

2.) Purchaser is a/an:

+A. Instrumentality of the commonwealth (to include public schools and state universities).

+B. Political subdivision of the commonwealth (includes townships and boroughs).

+l C. Municipal authority created under the Municipality Authorities Acts.

+l D. Electric cooperative corporations created under the Electric Cooperative Law of 1990.

l E. Cooperative agricultural associations required to pay corporate net income tax under the Cooperative Agricultural Association Corporate Net Income Tax Act (exemption not valid for registered vehicles).

+l F. Credit unions organized under Federal Credit Union Act or Commonwealth Credit Union Act.

+l G. U.S. government, its agencies and instrumentalities.

l H. Federal employee on official business (exemption limited to hotel occupancy tax only. A copy of orders or statement from supervisor must be attached to this certificate).

I.School bus operator (This exemption certificate is limited to the purchase of parts, repairs or maintenance services upon vehicles licensed as school buses by the PA Department of Transportation).

J.Charter Schools and Community Colleges.

3.) Property and/or services will be resold or rented in the ordinary course of purchaser's business. If purchaser does not have a PA Sales Tax Account ID (8 digit number assigned by the department), complete Number 8 explaining why such number is not required. This exemption is valid for property or services to be resold: (1) in original form; or (2) as an ingredient or component of other property.

4.) Renewable Entities beginning |

Permanent Exemptions beginning with |

Special Exemptions: |

with “75”: |

the two numbers “75”: |

|

A. Religious Organization |

D. Volunteer Fire Company |

F. Direct Pay Permit Holder |

B. Nonprofit Educational Institution |

E. Relief Association |

G, Individual Holding Diplomatic ID |

C. Charitable Organization |

|

H. Keystone Opportunity Zone |

|

|

(beginning with two digit 72 account number) |

|

|

I. Tourist Promotion Agency |

Exemptions for exempt organizations are limited to purchases of tangible personal property or services for use and not for sale. Exempt organizations

5.) Property or services will be used directly and predominately by purchaser in the production, delivery or rendition of public utility services as defined by the PA Utility Code.

This exemption is not valid for property or services used for the following: (1) construction, improvement, repair or maintenance of real property, other than real property used directly in rendering the public utility services; or (2) managerial, administrative, supervisor, sales or other nonoperational activities; or (3) vehi- cles, as well as supplies and repair parts for such vehicles, unless the predominant use is for providing a common carrier service; or (4) tools and equipment used but not installed in maintenance of facilities or direct use equipment. Tools and equipment used to repair "direct use" property are exempt from tax.

6.) Vendor/seller purchasing wrapping supplies and nonreturnable containers used to wrap property which is sold to others.

7.) Canned computer software or services to canned computer software directly utilized in conducting the business of banking purchased by a financial institution subject to the Bank and Trust Company Shares Tax (Article VII) or the Mutual Thrift Institutions Tax (Article XV).

8.) Other (Attach a separate sheet of paper if more space is required).

*Employees or representatives of the Commonwealth traveling on Commonwealth duty are exempt from any taxes on hotel stays or room rentals imposed by local governments that are in addition to the 6% state tax and the 1% Philadelphia and Allegheny County hotel occupancy tax.

Reset Entire Form

RETURN TO PAGE 1 |

TOP OF PAGE |

Form Data

| Fact Name | Description |

| Form Identification | REV-1220 (TR) 05-20 (FI) |

| Purpose | Pennsylvania Exemption Certificate for state and local sales and use tax, and other specified taxes |

| Applicable Taxes | State and local sales and use tax, hotel occupancy tax, public transportation assistance taxes and fees, vehicle rental tax |

| Exemption Use | One transaction or multiple transactions |

| Governing Law | Title 61 PA Code §32.2 regarding Exemption Certificates |

| Validity Conditions | Certificate must be completed properly and in the seller/lessor's possession within 60 days from the sale/lease date |

| Reproduction of Form | Form may be reproduced but must contain the same information as the original |

| Retention Period | Seller or lessor must retain the certificate for at least four years from the date of the exempt sale |

| Restrictions | Not to be used for claiming exemption on the registration of vehicles |

Instructions on Utilizing Pa

Once the Pennsylvania Exemption Certificate (form REV-1220) is completed, it will play a crucial role in defining the tax liabilities for transactions within Pennsylvania. This documentation asserts exemption from sales, use, hotel occupancy, public transportation, and vehicle rental taxes under specific conditions. Proper compliance and detailed accuracy in filling out this certificate ensure that individuals or entities can rightfully claim exemptions, avoiding unwarranted tax burdens. The following steps guide you through the completion process efficiently.

- Decide between the Pennsylvania Tax Unit Exemption Certificate for a single transaction or the Pennsylvania Tax Blanket Exemption Certificate for multiple transactions. Check the appropriate box at the top of the form.

- Fill in the Name of Seller, Vendor or Lessor, alongside their Street, City, State, and ZIP Code in the designated fields.

- Identify the reason for exemption by selecting the corresponding paragraph from the instructions on the reverse side of the form. Check the appropriate block under the exemption reasons (1-8) and provide any requested information like Account IDs or explanations for absence of such IDs.

- If applicable, complete the section regarding Public Utility Commission (PUC) Number or U.S. Department of Transportation MC/MX Number for exemptions related to public utility services.

- For exemptions related to resales, input the Resale Account ID. If one is not available, prepare to give a detailed explanation under Number 8.

- Any exemptions falling under the "Other" category should be detailed in the space provided. If more space is required, attach an additional sheet of paper explaining the exemption in detail.

- Provide the Name of Purchaser or Lessee, their Signature, Employer Identification Number (EIN), and the Date of signature in the designated sections at the bottom of the form.

- Ensure the address information for the Purchaser or Lessee is completed, including Street, City, State, and ZIP Code.

- Revisit the entire form to confirm that all information is correct and complete. Incomplete forms are void and will not grant any tax exemptions.

- Finally, retain a copy of the completed form for your records as sellers or lessors will retain the original for at least four years from the date of the exempt sale.

Accurately filling out and retaining the Pennsylvania Exemption Certificate ensures that your transactions are compliant with state regulatory requirements, safeguarding against penalties. It’s crucial to reevaluate each transaction against the criteria for exemption to maintain compliance continuously.

Obtain Answers on Pa

What is the Pennsylvania Exemption Certificate (Pa form REV-1220)?

The Pennsylvania Exemption Certificate, identified by form number REV-1220, is a legal document that businesses use to claim exemption from Pennsylvania state and local sales and use taxes, as well as other specific taxes outlined in the form, including hotel occupancy and vehicle rental taxes. This certificate applies to purchases that qualify under specific exempt categories, such as those made for resale, or for direct use in certain operations like manufacturing or public utility services.

Who needs to fill out the Pa form REV-1220?

Businesses or individuals who make purchases that qualify for tax-exempt status in Pennsylvania need to complete the form. This includes entities performing operations that directly involve manufacturing, public utility services, or purchasing goods for resale. Additionally, nonprofit organizations making qualified purchases over $200 and entities with specific exemptions also need to utilize this form.

Can this form be used for vehicle purchases?

No, the REV-1220 form cannot be used to claim tax exemptions on the registration of vehicles with the Pennsylvania Department of Transportation. Instead, vehicles, trailers, semi-trailers, or tractors require other specific forms like the FORM MV-1 for first-time registrations or FORM MV-4ST for other registrations.

What are the requirements for a REV-1220 form to be considered valid?

A REV-1220 form is considered valid if it is properly completed, in the possession of the seller/lessor within 60 days from the date of sale/lease, contains truthful information, and the property or service is consistent with the customer's entitlement to the exemption. Sellers or lessors exercise good faith in accepting the certificate, ensuring it adheres to these stipulations.

How long must the seller or lessor retain the form?

The seller or lessor is required to keep the REV-1220 Certificate for at least four years from the date of the sale or lease related to the exempt purchase. This retention period helps in case of audits to confirm the validity of the tax exemptions claimed.

Can the REV-1220 form be copied?

Yes, the form may be photocopied. However, any reproduction must contain the same information as the original form. This flexibility allows businesses to efficiently manage multiple transactions qualifying for the exemption.

Common mistakes

Not providing complete information: Every field on the Pennsylvania Exemption Certificate form (REV-1220) must be filled out accurately. Many individuals make the mistake of leaving sections blank or providing incomplete details. This oversight can invalidate the certificate, making the transaction taxable. It's essential to supply all required information such as the name of the seller, vendor or lessor, and the street, city, state, ZIP code, and the specific exemption reason with all pertinent data.

Incorrect exemption reason: A common error is selecting the incorrect exemption reason or not providing enough detail about the exemption being claimed. The form outlines specific reasons for exemptions, including the use of purchased property or services directly and predominately by the purchaser in performing operations, or for resale under a PA Sales Tax Account ID. Ensuring the correct reason is chosen and thoroughly explained aids in the proper processing of the exemption.

Failing to sign the form: The form is considered void unless it is signed by the purchaser or lessee. The signature attests that the individual is authorized to claim the exemption and acknowledges the legal consequences of misuse. An unsigned form can lead to the rejection of the exemption claim, exposing both parties to potential fines and imprisonment for misuse.

Using the form for the wrong purpose: The REV-1220 form cannot be used for claiming exemptions on the registration of vehicles with the Pennsylvania Department of Transportation, Bureau of Motor Vehicles. Some individuals mistakenly use this form for vehicle registration purposes, instead of using FORM MV-1 for first-time registrations or FORM MV-4ST for other registrations. It's crucial to use the appropriate forms for specific exemption claims to avoid processing delays and potential legal issues.

Documents used along the form

When businesses and individuals in Pennsylvania engage in transactions that qualify for tax exemption under the state and local sales and use tax laws, several forms and documents are often used in conjunction with the Pennsylvania Exemption Certificate (REV-1220). This certificate serves as a crucial tool for documenting and claiming eligible exemptions from sales tax, hotel occupancy tax, and other specific taxes. Understanding the companion forms and documents can provide clarity and ensure compliance with Pennsylvania's tax regulations.

- FORM MV-1, Application for Certificate of Title: Used for the first-time registration of vehicles in Pennsylvania, indicating the necessity to claim exemption from sales tax for a motor vehicle, trailer, semi-trailer, or tractor.

- FORM MV-4ST, Vehicle Sales and Use Tax Return/Application for Registration: A required document for other vehicle registrations, it serves to claim tax exemption for vehicles not covered in the initial registration or for subsequent claims.

- REV-1715, Exempt Organization Declaration of Sales Tax Exemption: This form is specifically designed for nonprofit organizations making purchases over $200. It validates a nonprofit's tax-exempt status under Pennsylvania law, provided the organization is registered with the state.

- REV-72, Application for Sales Tax Exemption Certificate: Utilized by businesses and organizations qualifying for a permanent exemption status, REV-72 is the step preceding the use of a Pennsylvania Exemption Certificate for specific exempt purchases.

- REV-1832, PA Sales Tax Account ID and EIN Verification: While not a form for claiming exemption, REV-1832 is pivotal in verifying a purchaser’s Sales Tax Account ID and Employer Identification Number, often required when completing exempt transactions.

Utilizing these forms appropriately alongside the Pennsylvania Exemption Certificate facilitates smooth, compliant financial operations. Employers, organizations, and businesses should familiarize themselves with these documents to leverage tax benefits properly and adhere to state guidelines. It's advisable to consult with a tax professional or legal advisor to ensure the accurate application of these forms and understanding of Pennsylvania's tax exemption qualifications.

Similar forms

The Uniform Sales & Use Tax Exemption/Resale Certificate - Multijurisdiction has similarities with the PA form, particularly in its function to certify tax-exempt status for purchases that are intended for resale, or that qualify for a sales and use tax exemption across multiple states. Both documents require the purchaser to declare the exemption reason and provide identification, such as a tax ID number.

The Streamlined Sales and Use Tax Agreement Certificate of Exemption is similar to the PA form as it is also used for claiming tax-exempt purchases. Both forms include a section where purchasers must indicate the specific nature of their exemption based on predefined categories, like government agencies or charitable organizations.

The Resale Certificate for Non-Sales Tax States shares similarities with the PA form in its use by buyers to purchase goods tax-free that will be resold. The PA Exemption Certificate specifically notes that resold items are exempt, a characteristic common to general resale certificates.

A Vehicle Use Tax Exemption Certificate shares a particular connection with the PA form through the exclusion of certain transactions. The PA form explicitly states it is not to be used for claiming exemptions on motor vehicle registrations, directing users to specific vehicle-related forms instead.

The Exempt Organization Declaration of Sales Tax Exemption (REV-1715) is utilized similarly to the PA tax exemption forms by qualifying nonprofit entities for tax-exempt purchases. Both require the organization to cite their exempt status and provide a certification number, demonstrating how entities can utilize these documents to validate exemption claims.

Direct Pay Permit Applications also resemble the PA form in their purpose, allowing holders to directly purchase items or services tax-free for use in manufacturing or other qualifying activities, where tax is then paid on the finished product. The PA form facilitates similar tax-free transactions for eligible buyers, underlining their shared focus on business operational efficiencies.

The Farmers' Certificate for Wholesale Purchases and Sales Tax Exemptions parallels the PA form as it applies to specific purchases made by farmers for agricultural production. In the PA form, there are sectors (like farming) that qualify for tax exemptions on purchases used directly in their operations, emphasizing sector-specific tax relief measures.

Dos and Don'ts

When filling out the Pennsylvania Exemption Certificate (Form REV-1220), there are several dos and don'ts to keep in mind to ensure the process is completed accurately and efficiently. Following these guidelines will help in avoiding common mistakes and ensure the form is valid.

Things You Should Do:

- Read the instructions carefully. Before starting to fill out the form, take the time to read through the instructions provided on the reverse side to understand fully what is required for each section.

- Print or type clearly. Ensure all information is legible and filled out completely to prevent any misunderstandings or processing delays.

- Select the correct exemption reason. Choose the appropriate exemption reason from the list provided on the form and make sure to include any requested additional information related to the exemption claimed.

- Sign and date the form. The form must be signed and dated to be considered valid. This indicates that the information provided is accurate and that you are authorized to claim the exemption.

Things You Shouldn't Do:

- Don't leave sections incomplete. Failing to provide all the required information can lead to the form being considered invalid, which could result in the denial of the exemption.

- Don't use the form for incorrect purposes. This form is not to be used for claiming an exemption on the registration of a vehicle or to obtain a Sales Tax Account ID, PTA Account ID, or Exempt Status.

- Don't provide false information. Misuse of the form or providing knowingly false information is punishable by fine and imprisonment. Always ensure the information provided is accurate and truthful.

- Don't forget to keep a copy. After submitting the form, it's important to keep a copy for your records. The seller or lessor is required to keep the certificate for at least four years, but it’s wise for the buyer to retain a copy as well.

Misconceptions

Many people hold misconceptions about the Pennsylvania Exemption Certificate (Pa form), leading to confusion and mistakes in its usage. Here are four common misunderstandings clarified:

- The Pa form can be used for obtaining a Sales Tax Account ID, PTA Account ID, or Exempt Status. This is not accurate. The form explicitly states it cannot be used for these purposes. To obtain a Sales Tax Account ID or other types of exempt statuses, separate procedures and forms must be followed or completed.

- Any type of purchase is covered by the Pa form. This belief is incorrect. The form outlines specific types of exemptions, such as for manufacturing, public utility services, or purchases made by qualifying nonprofit organizations. It does not cover all imaginable purchases. For example, it cannot be used for claiming an exemption on the registration of a vehicle, which has its own designated forms.

- The certificate is automatically valid upon completion. Validity of the certificate requires more than just filling out the form. The seller or lessor must exercise good faith in accepting this certificate, which includes ensuring the form is properly completed, obtaining the certificate within 60 days from the date of sale or lease, and verifying that the information provided is accurate and consistent with the exemption claimed. An improperly completed certificate may not be deemed valid and can subject the seller/lessor to the tax liability.

- You can use the Pa form indefinitely once issued. While there is a blanket exemption certificate option for multiple transactions with the same seller, the form itself states specific conditions under which the exemptions apply. Moreover, the seller or lessor is required to retain the certificate for at least four years from the date of the exempt sale to which the certificate applies, implying that the applicability of the form has temporal limitations and record-keeping requirements.

To properly utilize the Pennsylvania Exemption Certificate, it is crucial to understand these misconceptions and adhere strictly to the guidelines and limitations set forth by the Pennsylvania Department of Revenue. Misuse of this certificate is subject to penalties, including fine and imprisonment, underscoring the importance of accurate and lawful application of exemptions.

Key takeaways

When dealing with the Pennsylvania (PA) Exemption Certificate, it's essential to keep a few key points in mind. These points ensure that the process of claiming tax exemptions is smooth and compliant with state laws.

- Reading the instructions carefully before beginning the form is crucial for accuracy and compliance.

- The choice between a Pennsylvania Tax Unit Exemption Certificate, used for a single transaction, and a Pennsylvania Tax Blanket Exemption Certificate, used for multiple transactions, depends on the specific needs of the purchaser or lessee.

- The form is not applicable for motor vehicle registrations including cars, trailers, semi-trailers, or tractors. Specific other forms must be used for claiming tax exemptions on these.

- For an exemption claim to be valid, the purchaser needs to specify the nature of the exemption based on the guided sections on the form, such as direct use in operations, resale, or public utility service, amongst others.

- The form allows for reproduction, but each copy must contain identical information to the original document provided.

- Sellers or lessors are required to retain the exemption certificate for at least four years following the date of the related exempt sale.

- Nonprofit organizations making purchases of $200 or more can use this form in conjunction with form REV-1715, assuming they hold a valid exemption number assigned by the PA Department of Revenue.

- It's critically important that the form is filled out with accurate information. Misuse or provision of false information can lead to penalties including fines and imprisonment.

- The certificate's acceptance and validity depend on the good faith of the seller/lessor, which involves the certificate being properly completed and consistent with the exemption claim of the purchaser.

This PA Exemption Certificate is a pivotal document for individuals and entities looking to claim tax exemptions on their purchases or leases within Pennsylvania, whether for single transactions or multiple. Ensuring that the form is correctly filled out and used in accordance with state guidelines will prevent any legal complications and secure the benefits intended by this exemption.

Popular PDF Forms

Perio Charting Template - Incorporates supervisor’s signature for validation of the periodontal examination and proposed treatment plan.

Va Form 21-10210 Example - Fiduciaries are obligated to disclose all monetary receipts and disbursements, including VA benefits, to the VA Fiduciary Hub.