Blank Pa Payroll PDF Template

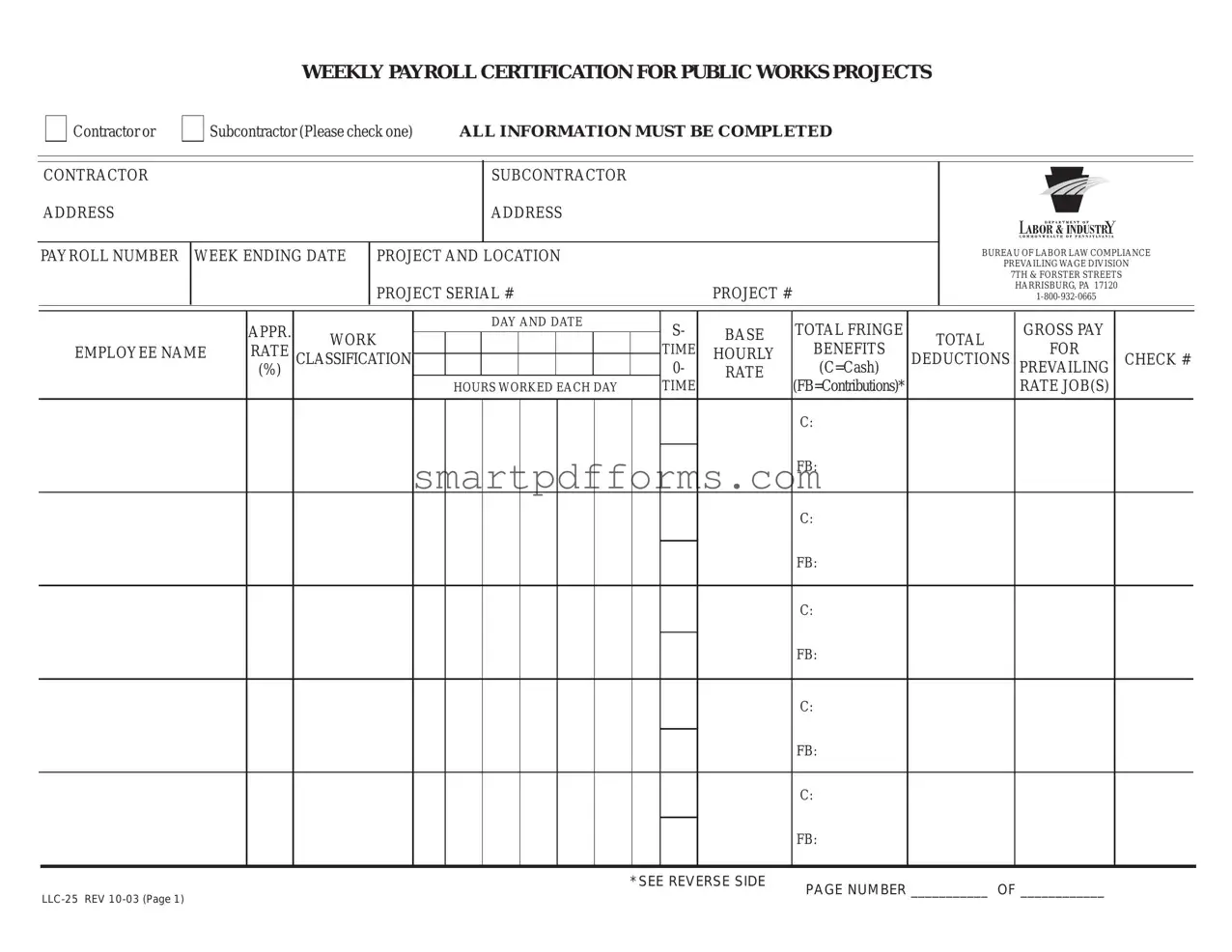

The Pennsylvania Payroll Form, known officially as the Weekly Payroll Certification for Public Works Projects, serves a vital role in maintaining compliance with the state's prevailing wage laws, ensuring that workers on public projects are compensated according to predetermined wage rates. Designed for use by both contractors and subcontractors, this comprehensive document demands detailed information, such as payroll number, week ending date, project location, employee names, classification, hourly rates including fringe benefits, and total gross pay, alongside deductions. Critical to the form is the notation of the contractor or subcontractor's commitment to adhering to prevailing wage requirements as stipulated in their respective contracts. Moreover, the form includes a certification section where the signatory attests to neither being debarred by the Secretary of Labor and Industry nor subcontracting to any debarred entity, under the penalties of the PA Prevailing Wage Act. This act intricately ties the completion and accuracy of this form to legal and financial responsibilities, enforcing the accountability of contractors and subcontractors in the fair compensation of their workforce on public works projects.

Preview - Pa Payroll Form

WEEKLY PAYROLL CERTIFICATION FOR PUBLIC WORKS PROJECTS

Contractor or

Subcontractor (Please check one) ALL INFORMATION MUST BE COMPLETED

CONTRACTOR |

SUBCONTRACTOR |

ADDRESS |

ADDRESS |

|

PAYROLL NUMBER WEEK ENDING DATE PROJECT AND LOCATION |

|

|

|

BUREAU OF LABOR LAW COMPLIANCE |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PREVAILING WAGE DIVISION |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7TH & FORSTER STREETS |

|

|

||

|

|

|

PROJECT SERIAL # |

|

PROJECT # |

|

|

|

HARRISBURG, PA 17120 |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APPR. |

WORK |

|

|

DAY AND DATE |

S- |

BASE |

TOTAL FRINGE |

TOTAL |

|

GROSS PAY |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

EMPLOYEE NAME |

RATE |

CLASSIFICATION |

|

|

|

|

|

|

|

TIME |

HOURLY |

BENEFITS |

DEDUCTIONS |

|

FOR |

|

CHECK # |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

(%) |

|

|

|

|

|

|

|

0- |

RATE |

(C=Cash) |

|

PREVAILING |

|

|

|||

|

|

|

|

|

HOURS WORKED EACH DAY |

TIME |

|

(FB=Contributions)* |

|

|

RATE JOB(S) |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

C: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FB: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FB: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FB: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FB: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FB: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*SEE REVERSE SIDE |

PAGE NUMBER ___________ OF ____________ |

|

THE NOTARIZATION MUST BE COMPLETED ON FIRST AND LAST SUBMISSIONS ONLY. ALL OTHER INFORMATION MUST BE COMPLETED WEEKLY.

*FRINGE BENEFITS EXPLANATION (FB): Bona fide benefits contribution, except those required by Federal or State Law (unemployment tax, workers’ compensation, income taxes, etc.)

Please specify the type of benefits provided and contributions per hour:

1)Medical or hospital care __________________________________________________________________________

2)Pension or retirement ____________________________________________________________________________

3)Life insurance _________________________________________________________________________________

4)Disability _____________________________________________________________________________________

5)Vacation, holiday _______________________________________________________________________________

6)Other (please specify) ___________________________________________________________________________

CERTIFIED STATEMENT OF COMPLIANCE

1.The undersigned, having executed a contract with _____________________________________________________

(AWARDING AGENCY, CONTRACTOR OR SUBCONTRACTOR)

______________________________ for the construction of the

(a)The prevailing wage requirements and the predetermined rates are included in the aforesaid contract.

(b)Correction of any infractions of the aforesaid conditions is the contractor’s or subcontractor’s responsibility.

(c)It is the contractor’s responsibility to include the Prevailing Wage requirements and the predetermined rates in any subcontract or lower tier subcontract for this project.

2.The undersigned certifies that:

(a)Neither he nor his firm, nor any firm, corporation or partnership in which he or his firm has an interest is debarred by the Secretary of Labor and Industry pursuant to Section 11(e) of the PA Prevailing Wage Act, Act of August 15, 1961, P.L. 987 as amended, 43 P.S.§

(b)No part of this contract has been or will be subcontracted to any subcontractor if such subcontractor or any firm, corporation or partnership in which such subcontractor has an interest is debarred pursuant to the aforementioned statute.

3.The undersigned certifies that:

(a)the legal name and the business address of the contractor or subcontractor are: _________________________

_________________________________________________________________________________________

(b) The undersigned is: |

a single proprietorship |

a corporation organized in the state of ______________ |

|

|

a partnership |

other organization (describe) ____________________________ |

|

(c)The name, title and address of the owner, partners or officers of the contractor/subcontractor are:

NAME

TITLE

ADDRESS

The willful falsification of any of the above statements may subject the contractor to civil or criminal prosecution, provided in the PA Prevailing Wage Act of August 15, 1961, P.L. 987, as amended, August 9, 1963, 43 P.S. § 165.1 through 165.17.

(DATE)

SEAL

(SIGNATURE)

(TITLE)

Taken, sworn and subscribed before me this _________ Day

of ___________________________________ A.D., ___________

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used for weekly payroll certification for public works projects in Pennsylvania. |

| User Demographic | Both contractors and subcontractors working on public works projects must complete it. |

| Content Requirements | All sections of the form must be filled out, including contractor or subcontractor information, project details, and employee wages and benefits. |

| Governing Laws | It is governed by the Pennsylvania Prevailing Wage Act of August 15, 1961, as amended. |

| Prevailing Wage Compliance | It requires acknowledgment of complying with prevailing wage requirements as per the contract. |

| Subcontracting Regulations | It assures that no part of the contract has been or will be subcontracted to a debarred subcontractor. |

| Legal Certification | The form includes a certified statement of compliance, requiring the signature of the contractor or subcontractor, affirming the truthfulness of the provided information. |

Instructions on Utilizing Pa Payroll

Filling out the PA Payroll Form for weekly payroll certification on public works projects is an essential task for contractors and subcontractors. This form ensures compliance with prevailing wage requirements by accurately documenting the work and wages of employees. The form must be filled out weekly, except for the notarization, which is only required on the first and last submissions. It's crucial to provide detailed and accurate information about the wages, hours, and benefits of each employee. Following these steps will help guide you through the process.

- Check the appropriate box at the top to indicate if you are a contractor or subcontractor.

- Fill in your business address in the space provided.

- Enter the payroll number assigned to your project.

- Specify the week ending date for the payroll period.

- Document the project and location, including the project serial number and project number.

- Contact the Bureau of Labor Law Compliance if you need assistance by using their provided address and phone number.

- For each employee, fill in their name, rate classification, the hourly rate, and the number of hours worked each day, separated into regular and overtime hours.

- Specify fringe benefits for each employee, marking whether they are cash (C) or contributions (FB) and listing the percentages or rates.

- On the reverse side of the form, clarify the types of fringe benefits provided, including contributions per hour for medical or hospital care, pension, life insurance, disability, vacation, or other benefits, with an explanation if "Other" is indicated.

- In the Certified Statement of Compliance section, fill in the name of the awarding agency, contractor, or subcontractor with whom you have executed a contract. Also, acknowledge the prevailing wage requirements and certify compliance regarding not being debarred.

- Complete the section regarding your legal name, business address, and organizational structure. Include names, titles, and addresses of owners, partners, or officers.

- Sign and date the form, ensuring the signature area is filled out properly. The notarization section should be completed on the first and last submissions.

Once the form is filled out, it should be reviewed for accuracy and completeness. Any missing or incorrect information can lead to delays or issues with compliance, so ensure all details are correct before submission. After review, submit the form as required for your project, keeping a copy for your records to ensure that all wage and hour regulations are met.

Obtain Answers on Pa Payroll

What is the purpose of the Pennsylvania Payroll Form for Public Works Projects?

The Pennsylvania Payroll Form (often referred to as the "Weekly Payroll Certification") is designed for contractors or subcontractors engaged in public works projects. It ensures that they comply with the prevailing wage requirements laid out by the Pennsylvania Department of Labor and Industry. By filling out this form weekly, contractors certify the wages paid to their employees, confirming adherence to the predetermined wage rates and fringe benefits for their work classification.

Who needs to fill out this form?

Both contractors and subcontractors working on public works projects in Pennsylvania must complete this form. It is mandatory for documenting the wages and fringe benefits of employees for each week they work on a project. Submission is required for the duration of the project to maintain compliance with state laws regarding prevailing wages.

What are fringe benefits, and why must they be documented?

Fringe benefits refer to non-wage benefits provided to employees, such as medical or hospital care, pension or retirement plans, life insurance, disability benefits, and paid vacations or holidays. These benefits contribute to the total prevailing wage rate and must be documented to ensure that the total compensation, not just the hourly wage, meets or exceeds the required prevailing wage for the work being performed. This documentation is crucial for maintaining transparent and fair labor practices on public works projects.

What information is required on the form?

Contractors must provide detailed information, including the company's and employees' names, the project’s details (location, serial number, etc.), payroll number, and the week-ending date. Additionally, for each employee, the form requires listing their classification, hours worked each day, hourly rate, fringe benefits, deductions, and gross pay. Fringe benefits should be specified in terms of contributions per hour for different types of benefits.

Is notarization required for each submission?

No, notarization of this form is mandatory only for the first and last submissions. However, accurate and complete information must be submitted weekly to ensure compliance with state regulations. The notary public will verify the authenticity of the information on these critical submissions, reinforcing the integrity of the compliance process.

What happens if a contractor or subcontractor provides false information?

Submitting false information on the Pennsylvania Payroll Form is a serious offense that can lead to civil or criminal prosecution under the Pennsylvania Prevailing Wage Act. Such actions undermine labor laws and harm employees by potentially depriving them of their lawful wages and benefits. Therefore, accuracy and honesty in reporting are paramount.

Can a debarred contractor or subcontractor submit a payroll form?

A contractor or subcontractor who is debarred by the Secretary of Labor and Industry may not engage in public works projects and, consequently, cannot submit payroll forms for such projects. The form includes a certification statement regarding debarment status to enforce this rule and ensure only eligible entities participate in these projects.

What are the responsibilities of a contractor regarding prevailing wage requirements?

A contractor is responsible for ensuring that they and any subcontractors they hire comply with the prevailing wage requirements. This includes including these wage rates in all subcontract agreements and correcting any infractions promptly. Contractors must also ensure that their subcontractors are not debarred and that they adhere to the state’s labor laws.

How should a contractor or subcontractor specify the type of organization they are?

On the form, the contractor or subcontractor must specify their business structure. This could be a single proprietorship, a corporation (including the state of organization), a partnership, or another type of organization. This information helps clarify the entity’s legal and financial structure for compliance and accountability purposes.

Common mistakes

Filling out the PA Payroll form, especially for public works projects, is a crucial task that ensures compliance with prevailing wage requirements. Mistakes can lead to financial penalties, project delays, and other legal issues. Here are seven common mistakes to avoid when completing the form:

-

Not checking the correct box for Contractor or Subcontractor at the top of the form. This distinction is critical for the Bureau of Labor Law Compliance to understand your role in the project.

-

Leaving information incomplete. Every field in the form, including addresses, payroll number, week ending date, project and location, must be filled out completely. Missing information can lead to processing delays or inaccuracies in records.

-

Incorrect project serial number and project number. This information is vital for tracking and verification purposes. Ensure these numbers match those provided by the Bureau of Labor Law Compliance.

-

Miscalculating hours worked or pay rates. Ensure that the hours worked each day are accurately recorded and that the rate of pay is calculated correctly, including separating the base rate from any fringe benefits.

-

Failure to accurately report fringe benefits. Fringe benefits should be clearly itemized and reported in the designated section. Benefits must be properly classified as either cash (C) or contributions (FB) and accurately calculated.

-

Omitting the certified statement of compliance on the first and last submissions. This statement is a legal certification of compliance with the prevailing wage requirements. Skipping this step can result in legal complications.

-

Incorrectly notarizing the document. The notarization must be completed correctly on the first and last submissions. Ensure that all details in the notarization section, including dates and signature, are accurately filled out and that the notary public has affixed their seal.

Avoiding these mistakes ensures that your submissions are accurate and compliant with the PA prevailing wage regulations. Attention to detail and thorough review before submission can prevent unnecessary delays and legal issues, ultimately contributing to a smoother project operation.

Documents used along the form

When managing payroll, especially for public works projects, it's not just about the Pa Payroll form. Understanding and utilizing a variety of forms and documents is crucial for compliance, accuracy, and efficiency. Below is a list of other essential forms and documents often used alongside the Pa Payroll form, each with its unique purpose and requirement.

- W-4 Form (Employee's Withholding Certificate): This IRS form is used by employers to determine the correct amount of federal income tax to withhold from an employee's paycheck. It's based on the employee's filing status, multiple jobs adjustments, amount of dependents, and other factors.

- I-9 Form (Employment Eligibility Verification): Employers use this form to verify the identity and legal authorization to work of their employees. It requires documentation that proves the employee's identity and eligibility to work in the United States.

- State-specific Withholding Form: Similar to the federal W-4, this form is used for state income tax withholding purposes, and requirements vary from state to state.

- Direct Deposit Authorization Form: This form is filled out by the employee to authorize direct deposit of their paycheck into their bank account, providing the employer with necessary account information.

- Local Earned Income Tax Residency Certification Form: Used to determine the appropriate local taxes to withhold from employees, this form is especially important in areas with varying local tax rates.

- New Hire Reporting Form: Employers are required to report new hires to a designated state agency, helping to track employment, assist in child support order enforcement, and detect unemployment benefits fraud.

- Workers' Compensation Insurance Forms: Various forms related to worker's compensation, including claim forms and proof of insurance coverage, are necessary for addressing workplace injuries or illnesses.

- Employee Handbook Acknowledgement Receipt: Though not always legally required, having employees acknowledge receipt and understanding of the company's employee handbook is a best practice for clarifying policies and procedures.

- Timekeeping Records: While not a single form, maintaining accurate records of hours worked is essential for compliance with labor laws, calculating payroll accurately, and serving as documentation in any disputes or audits.

- Year-End Tax Documents: These include Forms W-2 (Wage and Tax Statement) for employees and 1099-NEC for contractors, summarizing the income they received and taxes withheld throughout the tax year.

Together with the Pa Payroll form, these documents form a comprehensive framework for managing payroll responsibilities. Whether you’re a seasoned professional or new to payroll management, understanding how to correctly use and process these forms is key to ensuring that your payroll practices comply with all federal, state, and local regulations, safeguarding against any potential legal issues.

Similar forms

W-2 Form: The W-2 form is similar to the Pa Payroll form because both are used for reporting wages paid and taxes withheld. The Pa Payroll form details earnings and deductions for workers on public works projects, akin to how the W-2 form summarizes annual pay and taxes withheld for employees.

I-9 Form: Although the I-9 form is primarily used for verifying the identity and employment authorization of individuals, it shares a common purpose with the Pa Payroll form in ensuring compliance with employment laws. While the I-9 focuses on legal work status, the Pa Payroll form ensures adherence to prevailing wage requirements.

1099 Form: Similar to the Pa Payroll form, the 1099 form is used for reporting income but is specifically for independent contractors. Both forms are integral to tax reporting and compliance, with the Pa Payroll form focusing on employees in public works and the 1099 targeting freelancers and subcontractors.

State New Hire Reporting Form: This form, required by states to report new hires, parallels the Pa Payroll form in its role in employment documentation. Both forms serve to inform government agencies about employment activities; the Pa Payroll form does so by documenting weekly wages and compliance on public works projects.

Unemployment Insurance Filings: Similar to the Pa Payroll form, these filings are crucial for documenting wages and employment status to state agencies. Both contribute to the administration of unemployment benefits, with the Pa Payroll form additionally ensuring workers are paid according to prevailing wage laws.

Workers' Compensation Forms: These forms and the Pa Payroll form both play roles in protecting workers, albeit in different manners. Workers' compensation forms are used to report workplace injuries and manage claims, while the Pa Payroll form ensures that workers on public projects are paid properly, including fringe benefits.

Dos and Don'ts

When filling out the PA Payroll Form for Weekly Payroll Certification for Public Works Projects, it's important to adhere to certain dos and don'ts to ensure the form is completed accurately and meets legal requirements. Below is a list of things you should and shouldn't do:

- Do ensure that all the required information is accurately and completely filled out. Missing or incorrect information can lead to delays or legal complications.

- Do verify the classification of employees according to the work they performed, reflecting accurate classification rates and prevailing wage rates.

- Do clearly detail the hours worked each day for every employee listed, avoiding any ambiguity.

- Do accurately report fringe benefits contributed (marked as FB) and cash payments (marked as C), as these affect the total gross pay calculations.

- Don’t guess or estimate hours worked or rates of pay; use documented hours and approved wage rates to fill out the form.

- Don’t leave the certified statement of compliance section at the end of the form blank. This section is critical for the legal validation of the payroll information provided.

- Don’t ignore the requirement to specify the type of bona fide benefits provided, as detailed in the *FRINGE BENEFITS EXPLANATION section. This information is required for compliance with prevailing wage laws.

- Don’t submit the form without reviewing all the entered information for accuracy and completeness. Any errors or omissions can result in non-compliance with state regulations.

Adherence to these guidelines when filling out the PA Payroll Form is essential for ensuring compliance with prevailing wage requirements and for the smooth processing of the form.

Misconceptions

Understanding the Pennsylvania Payroll form for public works projects can sometimes feel overwhelming due to the intricate details and legal requirements involved. Here are ten common misconceptions about the PA Payroll form, unpacked to help clear up any confusion:

- All sections need to be completed for each submission: It's a common misconception that every section must be filled out for every submission. In reality, notarization is only required on the first and last submissions, simplifying the process.

- Only cash payments are reportable: Some believe that the form only requires reporting of cash payments. However, it also necessitates reporting fringe benefits contributions, highlighting a more comprehensive approach to remuneration.

- Subcontractors are not required to complete the form: There’s a false belief that only primary contractors need to worry about the form. Both contractors and subcontractors share this responsibility, ensuring transparency and compliance throughout the project hierarchy.

- Fringe benefits are optional: A common mistake is assuming fringe benefits are a bonus rather than a requirement. The form explicitly asks for details on bona fide benefits contributions, underscoring their importance.

- The form is only for internal use: It's wrongly assumed that the form is for the contractor's personal records. In truth, it's a pivotal document for ensuring compliance with the Bureau of Labor Law Compliance, thus it has broader implications.

- Prevailing wage rates do not need to be included: Another misconception is that prevailing wage rates can be omitted. These rates are crucial since they ensure that the workers are being paid fairly according to state guidelines.

- It’s only applicable to large projects: Some think that this form is only for big construction projects. However, it applies to all public works projects, large or small, reinforcing the state's commitment to worker rights.

- Electronic submissions are not accepted: The belief that paper is the only submission method is outdated. While the form itself emphasizes traditional submission methods, advancements in technology and communication mean electronic submissions could be facilitated by specific departments or through specific platforms, aligning with modern practices.

- Contract details are not necessary: The assumption that the contract details can be left out is false. The form requires specific details about the contract to ensure a clear connection between the project and its workforce.

- Debarment is not a focus of the form: Lastly, some underestimate the importance of the debarment section. This part of the form is crucial for maintaining high standards of conduct among contractors and subcontractors, serving as a certification of their eligibility to participate in public works projects.

Clarifying these misconceptions helps in understanding the PA Payroll form's purpose and how it fosters a transparent and fair work environment for public works projects. Navigating its requirements with a clearer perspective ensures compliance and furthers the protection of workers’ rights.

Key takeaways

Filling out the Pennsylvania (PA) Payroll form correctly is crucial for contractors or subcontractors working on public works projects. This ensures compliance with prevailing wage requirements and proper documentation of work performed. Here are the key takeaways:

- Check the appropriate box to indicate whether you are a contractor or a subcontractor at the beginning of the form to clarify your role in the project.

- Complete all requested information without leaving any sections blank, including addresses, payroll number, and week ending date to avoid processing delays.

- Include detailed information about the project, such as project and location, Bureau of Labor Law Compliance, and project serial numbers, for accurate tracking and compliance.

- For each employee, you must list their name, rate classification, daily hours worked, hourly rate, total gross pay, and detailed breakdowns of any fringe benefits and deductions.

- Fringe benefits must be clearly explained and itemized per hour, excluding those required by federal or state law. Specify the type of benefits provided, such as medical care, pensions, or vacation.

- The certified statement of compliance section should be completed carefully, acknowledging the prevailing wage requirements, the responsibility for correcting infractions, and ensuring subcontractors are not debarred from the project.

- Accurately provide the legal name and business address of the contractor or subcontractor, along with organizational information and the names, titles, and addresses of owners, partners, or officers.

- The form requires a signature and title of the signatory, along with notarization on the first and last submissions, guaranteeing the authenticity and compliance of the provided information.

- Understanding and correctly reporting the prevailing hours worked, rates, and fringe benefits are essential to comply with the PA Prevailing Wage Act and avoid potential legal issues.

- Lastly, be aware that willful falsification of any information on the form may subject the contractor or subcontractor to civil or criminal prosecution under the PA Prevailing Wage Act.

By adhering to these guidelines, contractors and subcontractors can ensure their payroll documentation for public works projects in Pennsylvania is accurate, compliant, and properly maintained.

Popular PDF Forms

Form 9611 - Designed to ensure compliance with federal regulations regarding family and medical leave.

How to Apply for Worker Compensation - The DWC 041 form is instrumental in navigating the complexities of the workers' compensation system for both employees and employers.

Heirship Affidavit Meaning - A tool for next of kin to officially receive a deceased's estate under foreign and state laws.