The Iris Worker Timesheet form serves as a crucial document for employees working under the IRIS (Include, Respect, I Self-Direct) program, outlining the hours worked for each service provided within a specified pay period. It details requirements for accurately recording...

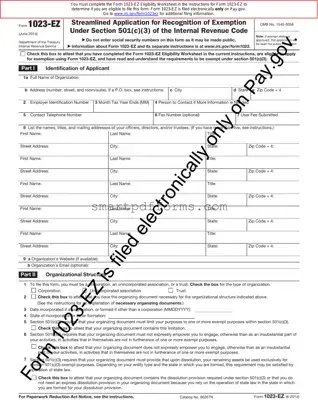

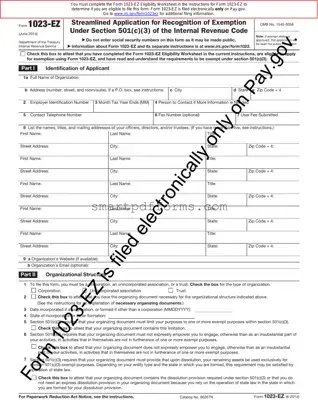

The IRS 1023-EZ form serves as a streamlined application for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. Designed for smaller charities, it simplifies the process of obtaining federal tax exemption, making it accessible to organizations that meet...

The IRS 1024 form is used by organizations seeking tax-exempt status under sections other than 501(c)(3) of the Internal Revenue Code. It's a critical step for entities that aim to operate without the burden of income taxes, allowing them to...

The IRS 1040-V form is a payment voucher used by taxpayers to submit their federal income tax payments. This essential document ensures that payments are processed accurately and linked to the taxpayer's account. To simplify the process of paying your...

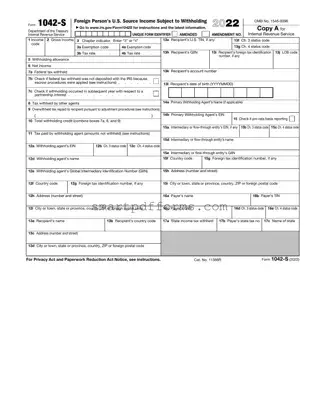

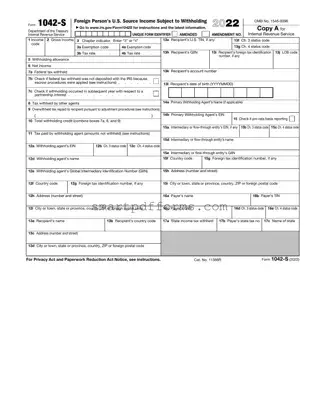

The IRS 1042-S form serves as a crucial document for reporting income paid to a foreign person within the United States, including payments, withholdings, and covering a diverse range of income types. It plays a vital role in ensuring compliance...

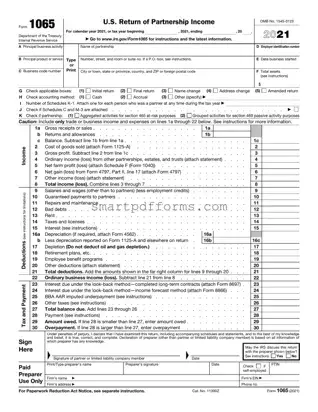

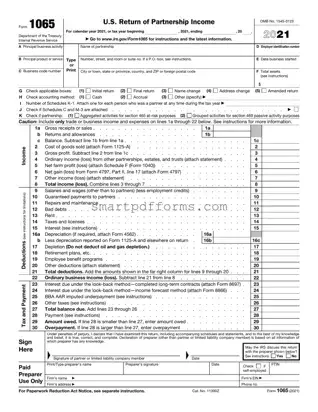

The IRS 1065 form is a crucial document for partnerships in the United States, serving as their annual income tax return. It is the means by which partnerships report their financial information to the Internal Revenue Service, including income, gains,...

The IRS 1098 form is a document that reports certain types of payments or contributions made throughout the year, often linked to mortgage interest, student loan interest, or tuition payments. This form plays a crucial role for individuals, allowing them...

The IRS 1098 form, commonly known as the Mortgage Interest Statement, is a document that lenders use to report the amount of interest and related expenses paid on a mortgage during the tax year. This form is crucial for homeowners...

The IRS Form 1098-T is an important document for anyone who has incurred education expenses. It is provided by educational institutions to both the student and the IRS to report payments received, scholarships, or grants awarded during the tax year....

The IRS 1099-A form is a document used in the United States to report the acquisition or abandonment of secured property. This form is vital for both the lender and the borrower, as it details the information needed for tax...

The IRS 1099-B form is a document that brokerages and mutual fund companies must fill out for their clients, reporting sales of stocks, bonds, and other securities within the year. This essential document helps taxpayers report capital gains and losses...

The IRS 1099-INT form is a document that financial institutions use to report interest income paid to individuals. It serves as a crucial piece of documentation for taxpayers to report their interest income on their tax returns, ensuring accurate tax...