The IRS 1099-MISC form is an important document used to report various types of income other than wages, salaries, and tips. It's essential for individuals and businesses to understand its purpose to accurately report miscellaneous income such as rental income,...

The IRS 1099-R form is a document that reports distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and similar financial vehicles. Essentially, this form is how the government keeps track of any money you've withdrawn from these...

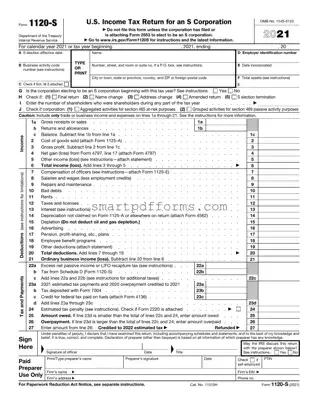

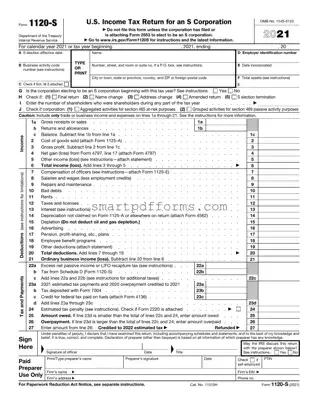

The IRS 1120-S form is a tax document specifically designed for S corporations to report their income, gains, losses, deductions, credits, and other pertinent financial information. This form allows such entities to pass corporate income, credits, and deductions to their...

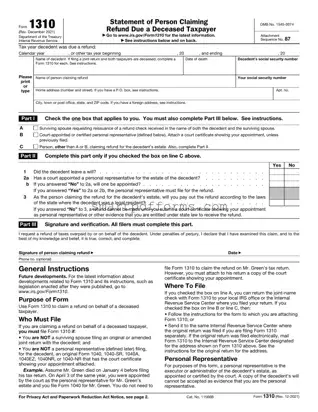

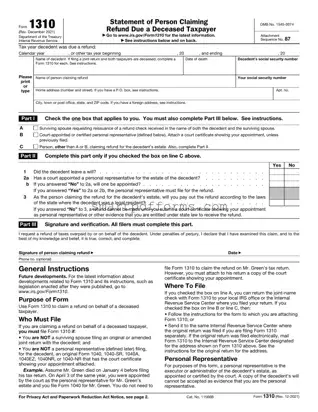

The IRS 1310 form is a crucial document used by individuals to claim a federal tax refund on behalf of a deceased taxpayer. It is the official way to ensure that the refund reaches the rightful heir or estate. For...

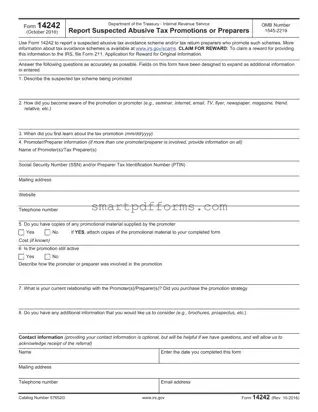

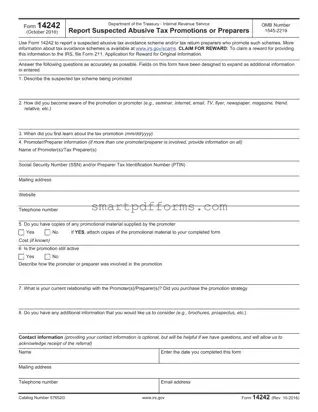

The IRS Form 14242 is a document designed for reporting suspected abusive tax avoidance schemes and the tax return preparers who promote them. This form plays a crucial role in the Internal Revenue Service's efforts to combat tax fraud by...

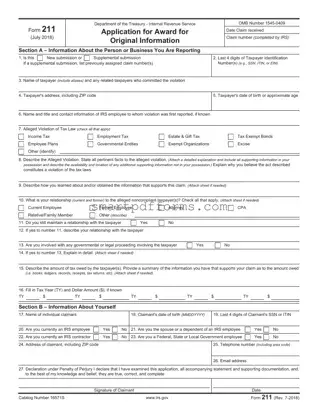

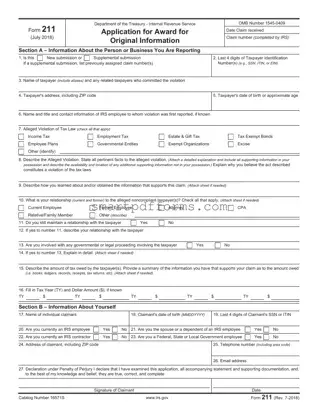

The IRS 211 form is an official document used by individuals to report information to the Internal Revenue Service regarding suspected tax fraud or noncompliance. This form serves as a confidential way for whistleblowers to alert the IRS about potential...

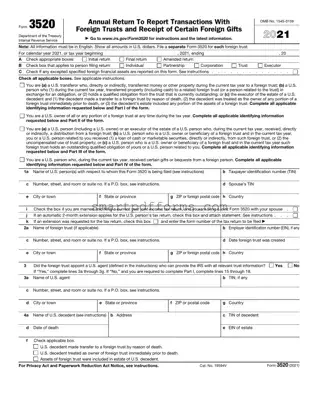

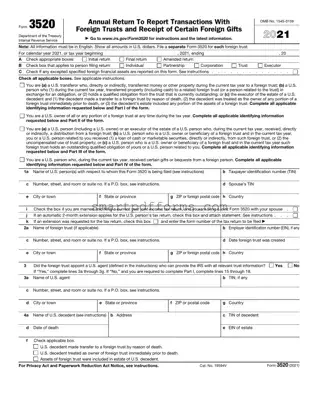

The IRS 3520 form is a crucial document for individuals who engage in transactions with foreign trusts or receive large gifts or bequests from foreign individuals. It serves as a means to report these transactions to the Internal Revenue Service...

The IRS 3800 form, known as the General Business Credit form, is a tool for businesses to aggregate their credits from a variety of sources into one comprehensive tax credit. It's designed to streamline the process of claiming different tax...

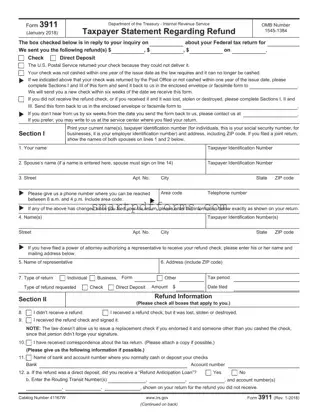

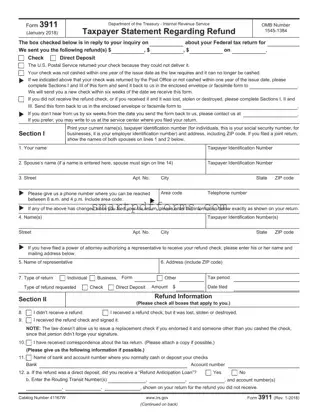

The IRS Form 3911, Taxpayer Statement Regarding Refund, is a document that taxpayers use to initiate a trace of a missing, stolen, or lost refund check. It serves as a formal request for the Internal Revenue Service to investigate the...

The IRS 3921 form serves as a document for individuals who exercise an incentive stock option (ISO) pursuant to section 422(b). It provides essential details such as the exercise date and the fair market value of the stock. For those...

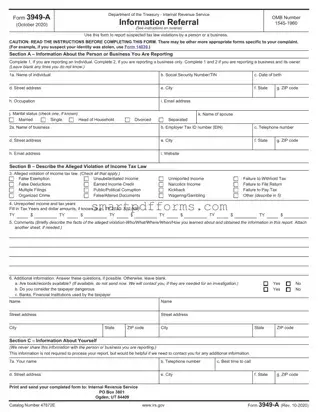

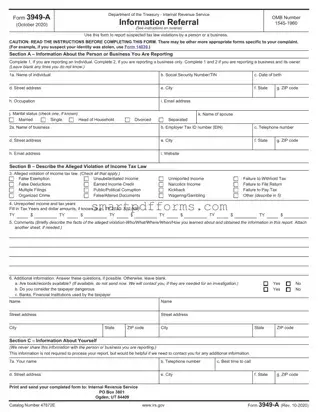

The IRS 3949-A form is a document used to report suspected tax fraud or evasion to the Internal Revenue Service. It plays a crucial role in maintaining the integrity of the federal tax system by providing a means for individuals...

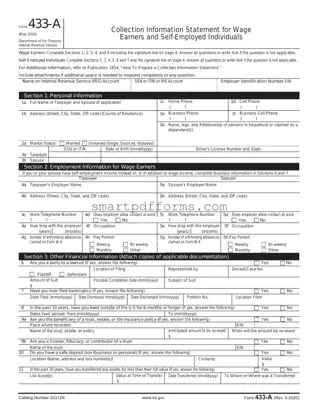

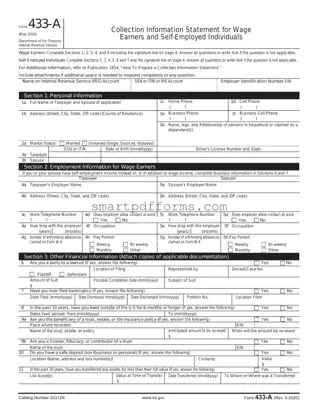

The IRS 433-A form, also known as the Collection Information Statement for Wage Earners and Self-Employed Individuals, is a document used by the IRS to collect financial information. This form helps the IRS determine how an individual can settle their...