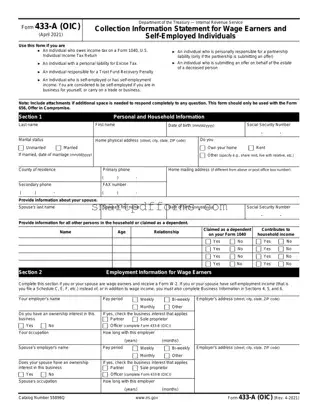

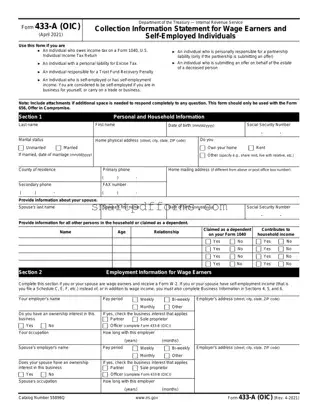

The IRS 433-A (OIC) form is a document used by individuals to apply for an Offer in Compromise with the Internal Revenue Service, allowing them to settle their tax debt for less than the full amount owed. This form gathers...

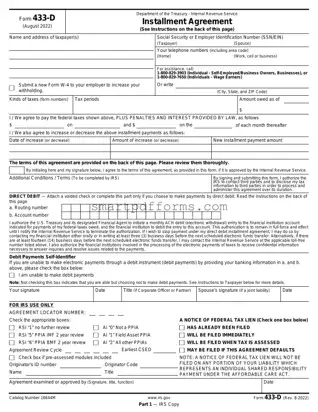

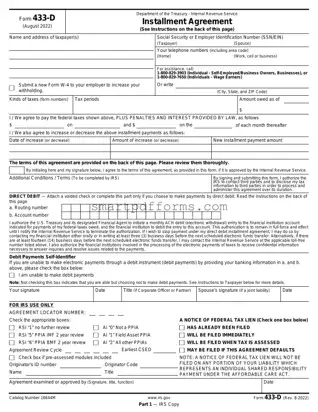

The IRS 433-D form is an agreement that allows individuals to pay off their tax debt through an installment plan. This form is used when the amount owed cannot be paid in full immediately, providing a structured way to clear...

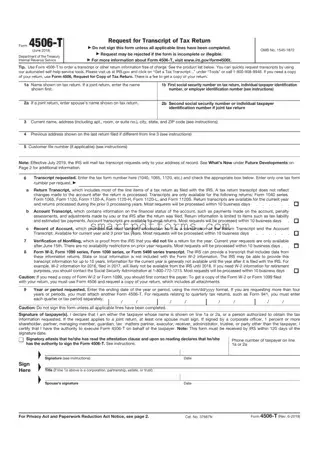

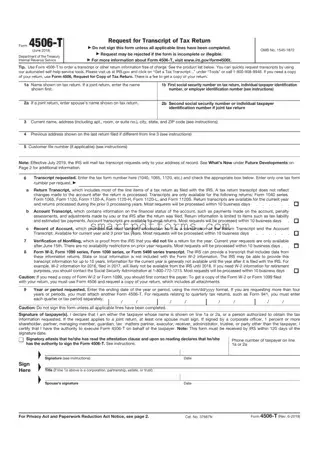

The IRS 4506-T form serves as a request for tax return information. It allows individuals and entities to authorize the disclosure of their tax details to third parties, ensuring a smoother verification process for loans, housing, and other financial applications....

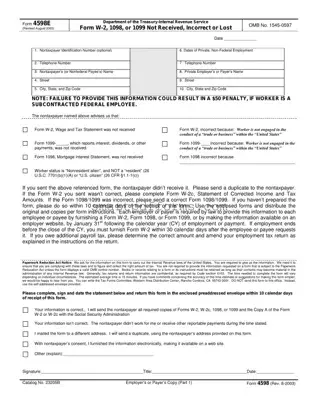

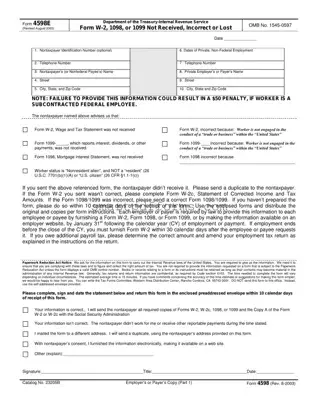

The IRS Form 4598E is a crucial document used when individuals do not receive, misplace, or are issued incorrect Forms W-2, 1098, or 1099, which are essential for tax reporting and compliance. It serves as a notification to the IRS...

The IRS Form 4681, officially known as Publication 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals), is a critical document for understanding how the IRS treats various forms of debt cancellation and loss through events like foreclosures and repossessions....

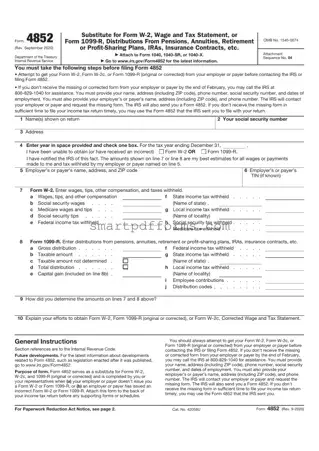

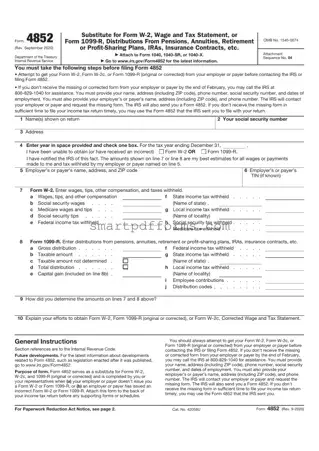

The IRS Form 4852 serves as a substitute for Forms W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., when the original documents have not been received by the...

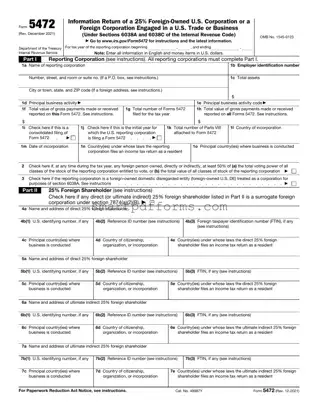

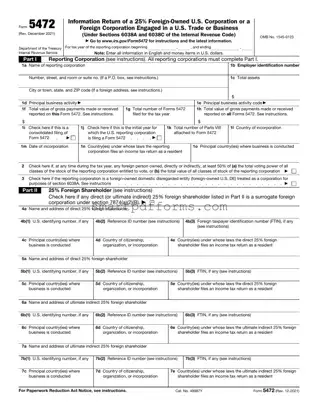

The IRS 5472 form is a tax document required for reporting transactions between a United States corporation and a foreign or domestic related party. It serves as a critical tool for the IRS in identifying and preventing tax evasion through...

The IRS 656-B form, officially known as the Offer in Compromise booklet, serves as a guide for individuals seeking to settle tax debts for less than the full amount they owe. This document comprehensively outlines the process, eligibility criteria, and...

The IRS 7004 form is an application used by businesses to request an automatic extension of time to file certain business income tax, information, and other returns. It allows businesses extra time to gather all necessary information and properly prepare...

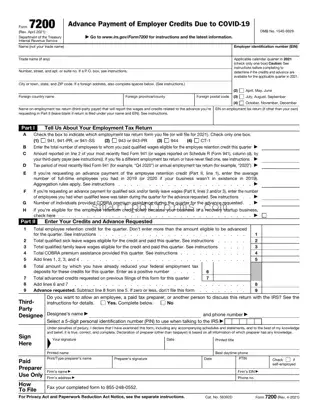

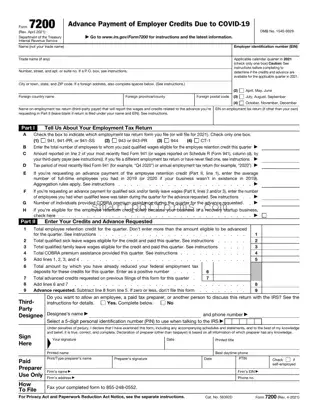

The IRS Form 7200, in essence, allows employers to request an advance payment of employer credits due to COVID-19. This form, pivotal during unprecedented times, is designed to boost liquidity for businesses navigating through the financial challenges posed by the...

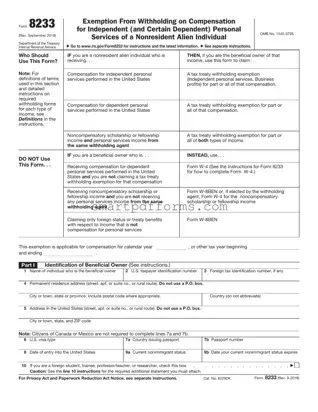

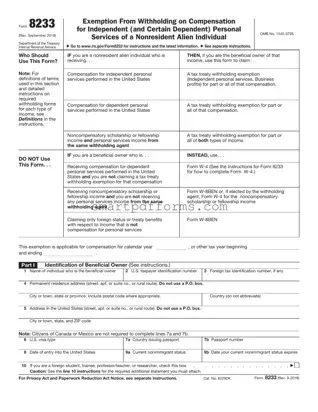

The IRS 8233 form is designed for non-resident aliens to claim exemption from withholding on compensation for independent personal services and certain other income. This form allows individuals who meet specific criteria to reduce or eliminate the amount of taxes...

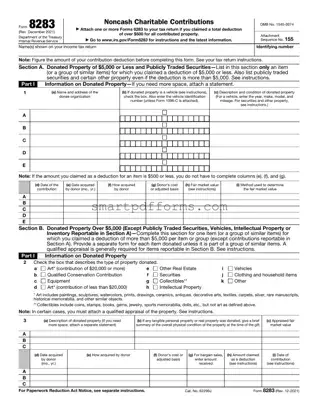

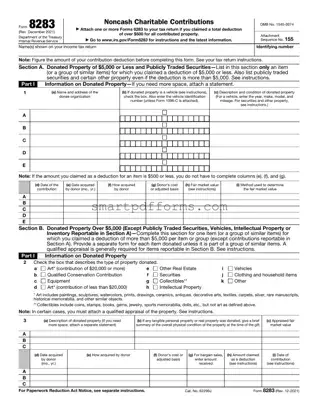

The IRS 8283 form is a document used by individuals to report information about non-cash charitable contributions they have made. This form plays a crucial role in ensuring that taxpayers receive the proper deductions for their generous donations, aligning their...