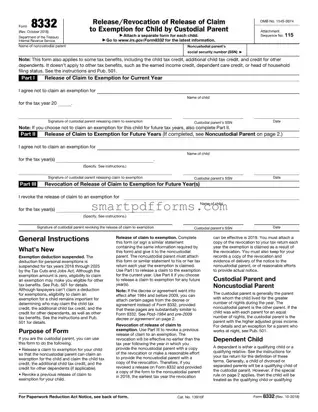

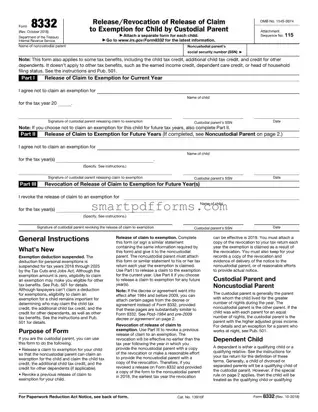

The IRS Form 8332 is a document that allows divorced or separated parents to transfer the tax benefit of claiming a child as a dependent to the other parent. This may include eligibility for the child tax credit and other...

The IRS 8582 form, known as the "Passive Activity Loss Limitations" form, is a document used by taxpayers to report losses from passive activities that may be limited. This form plays a critical role in how individuals can deduct losses...

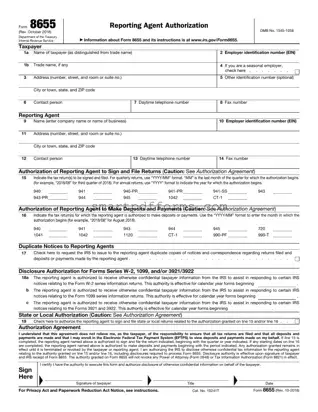

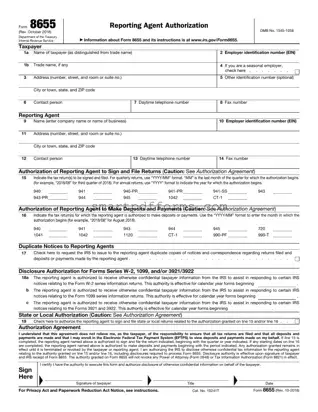

The IRS 8655 form, also known as the Reporting Agent Authorization Form, is a crucial document for businesses that opt to have a third party file taxes and make payments on their behalf. It legally allows the designated agent to...

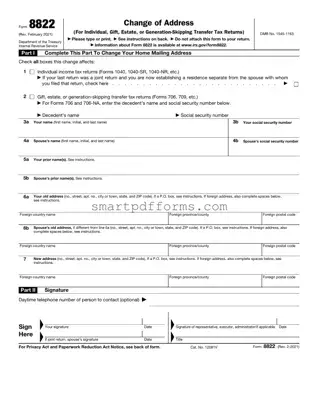

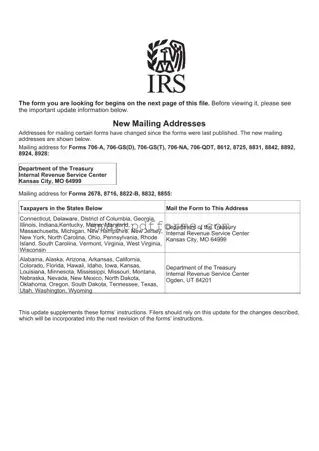

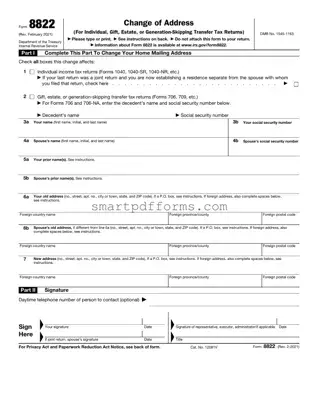

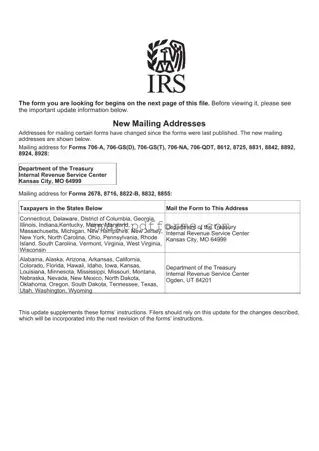

The IRS Form 8822 is a crucial document for notifying the Internal Revenue Service of a change in address. Accurate and timely submission of this form ensures that individuals receive important tax documents and information without delay. For a smooth...

The IRS 8829 form is a document used by taxpayers who operate a business from their home, allowing them to calculate and claim deductions for business use of their home on their tax returns. This form walks you through determining...

The IRS Form 8832 is crucial for businesses that intend to change their tax classification. Often referred to as the Entity Classification Election form, it allows a company to be taxed as a corporation, partnership, or as part of the...

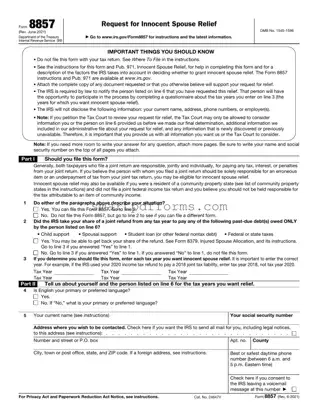

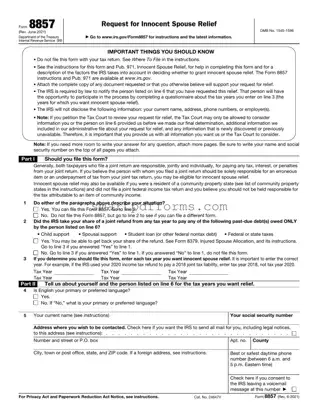

The IRS Form 8857, commonly known as the Request for Innocent Spouse Relief, serves as a lifeline for individuals seeking relief from joint tax liabilities under specific circumstances. It allows those who find themselves unfairly burdened by tax debts, incurred...

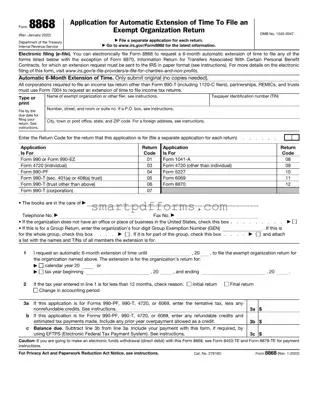

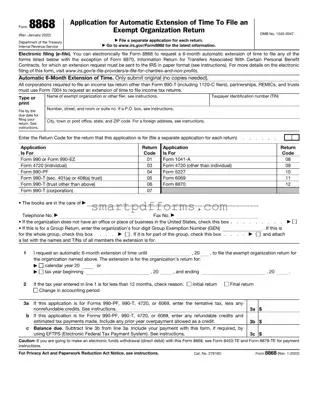

The IRS 8868 form is an application used by tax-exempt organizations to request an extension of time to file their return. This form is crucial for organizations that need additional time to gather information or ensure accuracy in their tax...

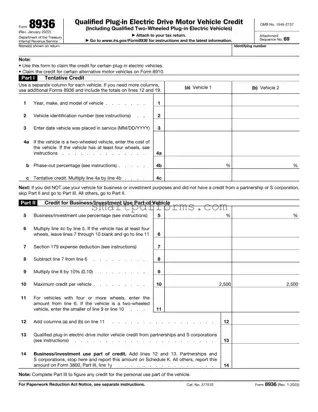

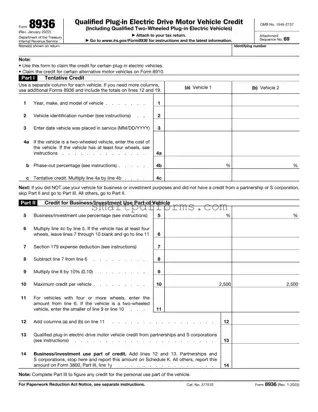

The IRS 8936 form is a document designed to allow individuals and businesses to claim a federal income tax credit for purchasing a qualified plug-in electric drive motor vehicle, including cars and motorcycles. This incentive encourages the adoption of electric...

The IRS 911 form is an essential document for taxpayers seeking immediate and specialized assistance with tax issues that haven't been resolved through normal channels. It serves as a request for the Taxpayer Advocate Service to step in, offering help...

The IRS 940 form is a critical document utilized by employers to report their annual Federal Unemployment Tax Act (FUTA) taxes. This form plays a pivotal role in ensuring the proper funding of state workforce agencies, assisting with unemployment costs....

The IRS 941 form is a crucial document used by employers to report quarterly federal tax returns. This form includes wages paid, tips your employees have reported, and the federal income, Social Security, and Medicare taxes withheld from employees' paychecks....