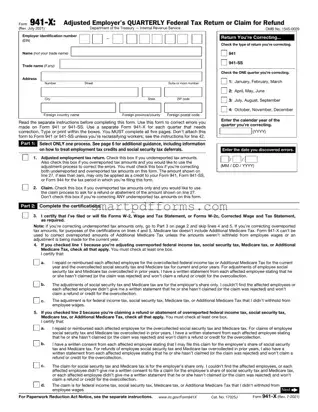

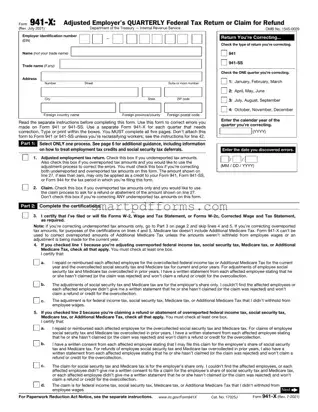

The IRS 941-X form serves as an essential correction document that employers use to amend previously filed Form 941 returns. This form is critical for accurate payroll tax reporting and ensuring compliance with federal tax obligations. For detailed guidance on...

The IRS 944 form is designed for small employers to report annual federal tax returns. This simplification means less paperwork and more focus on growing your business, making it an excellent option for those who qualify. To effortlessly navigate this...

The IRS Schedule 1 1040 or 1040-SR form is a document that taxpayers use to report certain types of income that aren't entered directly on the Form 1040 or 1040-SR. It's also where you can claim specific deductions that aren't...

The IRS Schedule 2 1040 or 1040-SR form is a document that individuals use to report additional taxes that may not be covered on the standard tax return forms. This includes but is not limited to, alternative minimum tax and...

The IRS Schedule D 1040 or 1040-SR form is a document used by taxpayers to report the capital gains or losses from the sale of assets. Whether it's stocks, real estate, or other investments, this form plays a crucial role...

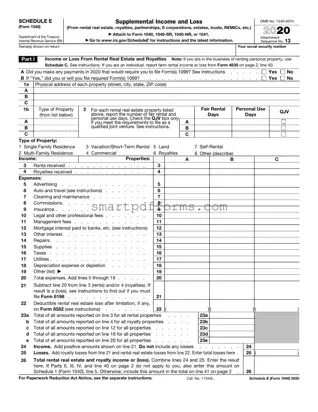

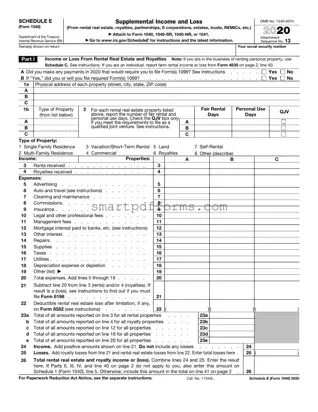

The IRS Schedule E (Form 1040) is a tax form used by taxpayers to report income and losses from rental real estate, royalties, partnerships, S corporations, trusts, and estates. It's a critical tool for individuals who have supplemental income or...

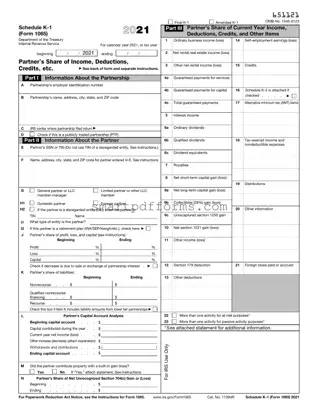

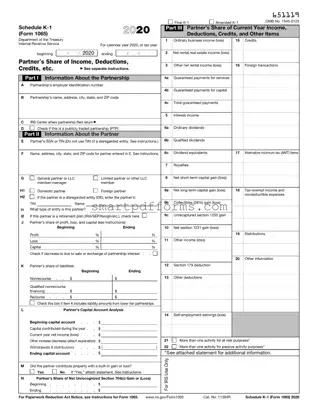

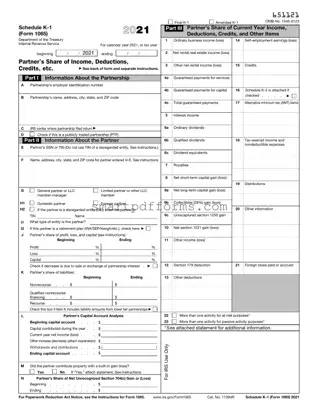

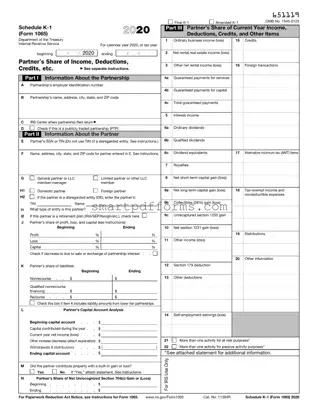

The IRS Schedule K-1 1065 form plays a crucial role for partnerships in the United States, detailing each partner's share of the business’s profits, losses, deductions, and credits. This document ensures transparency between the partnership and the IRS, as well...

The IRS Schedule K-1 1065 form is a document used by partnerships to report the income, deductions, and credits of each partner. It plays a crucial role in helping partners understand their share of the partnership's financial activity for the...

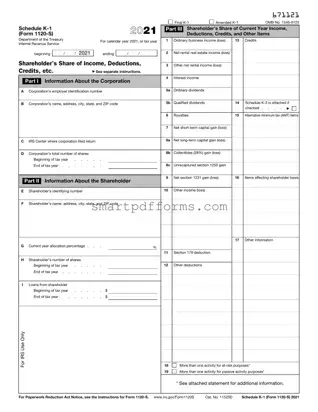

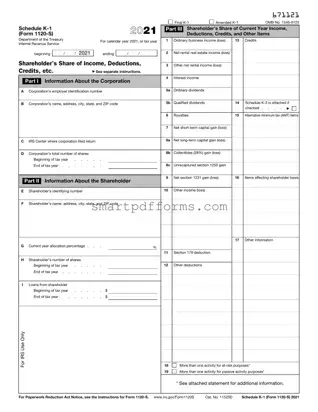

The IRS Schedule K-1 1120-S form is a document used by S corporations to report each shareholder's pro-rata share of net income, losses, deductions, and credits. This form helps shareholders understand their individual tax responsibilities related to the corporation's activities...

The IRS Schedule O (Form 990 or 990-EZ) is designed to provide the Internal Revenue Service with supplemental information about an organization's operations and responses to specific questions that are not covered in the primary forms. This form serves as...

The IRS Schedule SE (Form 1040) is designed for those who are self-employed to calculate the tax due on net earnings. It captures the essence of being your own boss by detailing how much Social Security and Medicare tax one...

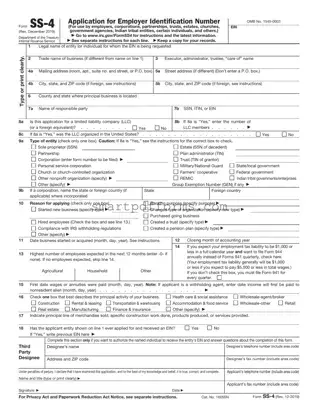

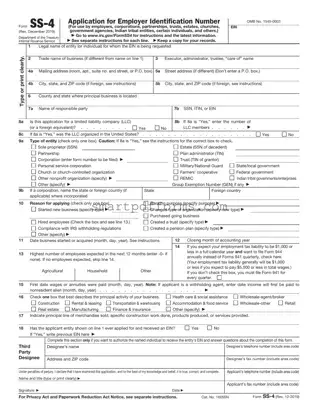

The IRS SS-4 form is an essential document used by businesses to apply for an Employer Identification Number (EIN), which is necessary for tax filing and reporting purposes. It serves as a business's identification in its dealings with the IRS...