Blank Payslip Bcea4 PDF Template

In an effort to ensure that employees are fully aware of the terms of their remuneration, the Basic Conditions of Employment Act, 1997, underlines a crucial aspect through the introduction of the Payslip BCEA4 form. This form serves as an essential record, meticulously detailing an employee's earnings and deductions. Crafted with the intent to be furnished by employers, its primary aim is to compile comprehensive information regarding an individual's salary, inclusive of any payment in kind. Employers are mandated to deliver this form to their employees, ensuring it is accessible either at the workplace or a mutually agreed-upon location, and within timings that do not disrupt the employee's working hours. The focus on transparency extends to specifying the total value of remuneration, thus promoting a clear understanding between employer and employee. Although this form acts as a model and does not prescribe a specific format, it is emphasized that any alternative document must encompass equivalent details to meet regulatory compliance. By embodying such regulations, the BCEA4 form plays a pivotal role in fostering a transparent and informed work environment where every employee is duly informed about their earnings and deductions, therefore encapsulating a critical element of employment law.

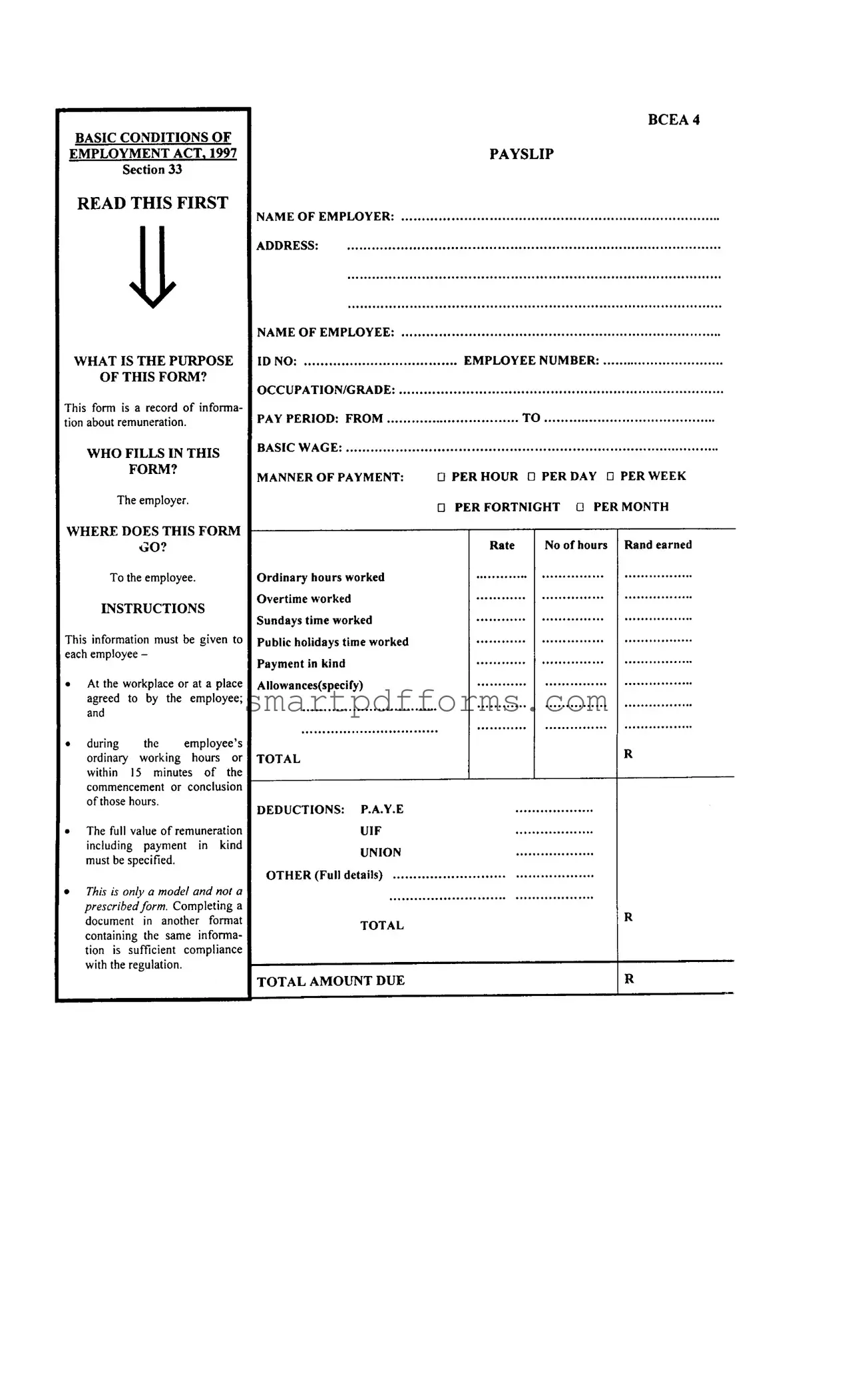

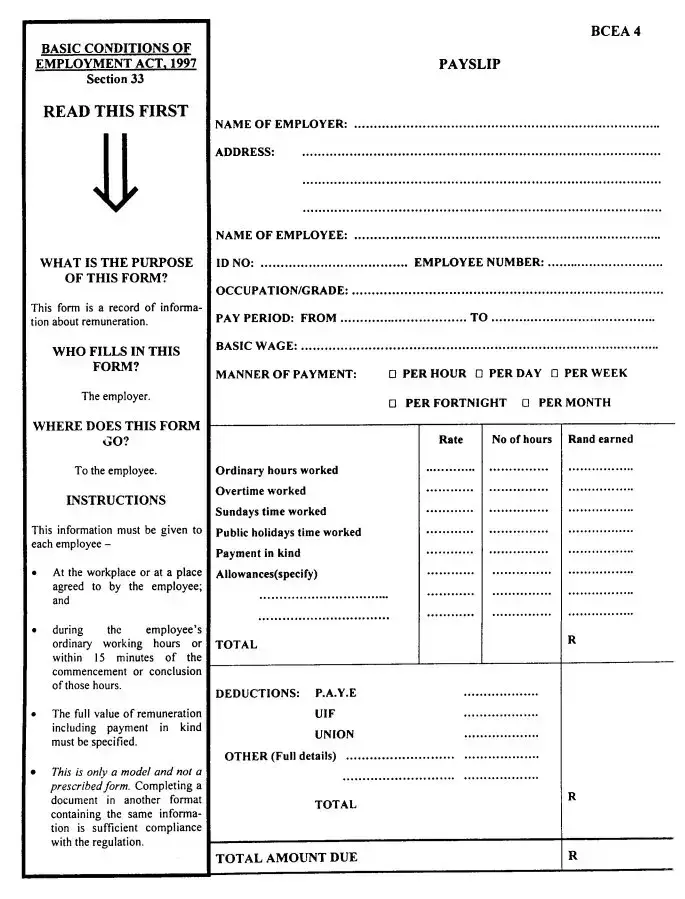

Preview - Payslip Bcea4 Form

Form Data

| Fact | Detail |

|---|---|

| Governing Legislation | BASIC CONDITIONS OF EMPLOYMENT ACT, 1997 Section 33 |

| Purpose of the Form | A record of information about remuneration. |

| Responsible for Filling | The employer. |

| Recipient of the Form | The employee. |

| Delivery Requirements | Must be given at the workplace or agreed place during or within 15 minutes of the employee's ordinary working hours; full value of remuneration, including payment in kind, must be specified. |

Instructions on Utilizing Payslip Bcea4

Before initiating the process of filling out the Payslip BCEA4 form, it's important to understand its function and the responsibility it entails. This form serves as a record of an employee's remuneration, including all earnings and deductions within a specific pay period. It is the employer's duty to properly fill out this form and provide it to the employee, ensuring clarity and compliance with the Basic Conditions of Employment Act, 1997, Section 33. The completed form must be handed over to the employee either at the workplace or another agreed-upon location, within their ordinary working hours or within 15 minutes of starting or ending their workday. Here are the detailed steps to correctly fill out the form:

- NAME OF EMPLOYER: Insert the full legal name of the business or individual employing the worker.

- ADDRESS: Provide the complete physical address of the employer's main office or place of business.

- NAME OF EMPLOYEE: Enter the full name of the employee receiving the payslip.

- ID NO: Fill in the employee's identification number as officially registered.

- EMPLOYEE NUMBER: If applicable, include the company-specific employee identification number.

- OCCUPATION/GRADE: Specify the employee's job title or grade within the company.

- PAY PERIOD: Clearly define the start and end dates of the pay period for which the payslip is being issued.

- BASIC WAGE: Document the employee's base salary or wage for the pay period, indicating the rate of pay(per hour, per day, per week, per fortnight, per month).

- Under MANNER OF PAYMENT, select the appropriate box that corresponds to how the employee is paid (hourly, daily, weekly, fortnightly, monthly).

- Rate No of hours Rand earned: Detail the pay rate, number of ordinary hours worked, and the total earnings for those hours.

- List any overtime worked, specifying hours and pay earned.

- Include hours worked on Sundays and public holidays along with respective earnings.

- Payment in kind: If applicable, describe any remuneration received in a form other than money.

- Allowances (specify): List any allowances provided to the employee, with clear descriptions.

- TOTAL DEDUCTIONS: Document all deductions made from the employee's earnings, such as PAYE, UIF, union fees, and any others, providing detailed amounts for each.

- TOTAL AMOUNT DUE: Calculate and present the final amount payable to the employee after all deductions.

After thoroughly completing the Payslip BCEA4 form, ensure it is reviewed for accuracy and compliance with the stated instructions. This document should then be promptly delivered to the employee, safeguarding both parties' interests and upholding the regulations set forth by the Basic Conditions of Employment Act.

Obtain Answers on Payslip Bcea4

-

What is the purpose of the Payslip Bcea4 form?

The Payslip Bcea4 form serves as a documented record of an employee's remuneration details. It is designed to capture comprehensive information about the payment an employee receives. This includes the full value of their salary, including any payment in kind, to ensure transparency between the employer and the employee regarding the latter's earnings.

-

Who is responsible for completing the Payslip Bcea4 form?

It is the employer's responsibility to fill out the Payslip Bcea4 form. The employer must ensure that all the details regarding the employee's remuneration, including basic wage, manner of payment, total deductions, and the total amount due, are accurately captured on this form. This responsibility underscores the employer's role in maintaining upfront communication about remuneration with their employees.

-

Where should the completed Payslip Bcea4 form be submitted?

Upon completion, the Payslip Bcea4 form should be given to the employee. Employers are instructed to deliver this form to employees either at the workplace or a location mutually agreed upon by both parties. The delivery of this form should also occur during the employee's ordinary working hours or within 15 minutes of starting or ending their shift. This ensures that employees receive their remuneration details promptly and without needing to go out of their way.

-

What instructions are provided for the completion and distribution of the Payslip Bcea4 form?

- Information on the payslip must include the full value of the employee's remuneration, accounting for any payment in kind.

- The form should be presented to the employee at their workplace or another agreed-upon location during their usual working hours or within 15 minutes of the start or end of their shift.

- The Payslip Bcea4 form is a model example and is not a prescribed format. Creating a document in another format that contains the same information is also considered compliance with the regulation.

These instructions aim to ensure that the process of documenting and communicating remuneration details is carried out effectively, promoting clarity and understanding between employers and employees.

Common mistakes

When completing the Payslip Bcea4 form, it's essential to pay careful attention to detail to ensure accuracy and compliance with the Basic Conditions of Employment Act, 1997. Avoiding common mistakes can prevent confusion and potential legal issues between employers and employees. Below are some of the frequent errors made while filling out this form:

- Not providing the complete name and address of the employer. This information is crucial for identifying the employer and ensuring the payslip is traceable to a legitimate source.

- Leaving out the employee's full name, ID number, or employee number. These details uniquely identify the employee within the organization, making the payslip personalized and official.

- Omitting the occupation or grade of the employee. This classification helps in understanding the employee's role and the corresponding pay scale.

- Incorrectly stating the pay period. It is vital to specify the accurate start and end date to avoid any disputes regarding the payment cycle.

- Failing to detail the method of payment (e.g., per hour, day, week, fortnight, month). Clarifying this ensures both parties are on the same page regarding how wage calculations are conducted.

- Not breaking down the earnings and deductions correctly. It's important to itemize ordinary hours worked, overtime, allowances, and any deductions such as PAYE, UIF, or union fees to provide transparency about the total amount due.

- Forgetting to include payment in kind, if applicable. This component must be specified to reflect the full value of remuneration received by the employee.

- Using vague descriptions or not specifying the nature of allowances and deductions. Detailed explanations help avoid misunderstandings about the employee's earnings and deductions.

Avoiding these mistakes ensures the Payslip Bcea4 form is filled out comprehensively and accurately, contributing to a transparent and smooth payroll process. Remember, this form serves not just as a record of payment but as a legal document that must reflect precise and truthful information about the employee's compensation.

Documents used along the form

Understanding the payslip and its accompanying documents is crucial for both employers and employees. The Payslip BCEA4 form, under the Basic Conditions of Employment Act, 1997 Section 33, is more than just a statement of wages. It's a compliance document that ensures transparency and fairness in the remuneration process. Alongside the BCEA4 form, several other documents often come into play to provide a more comprehensive overview of an employee's employment conditions and pay structure. Let's explore some of these important documents.

- Employment Contract: This fundamental document outlines the terms and conditions of employment between the employer and the employee. It includes details on job responsibilities, working hours, salary, benefits, and termination conditions. An employment contract lays the foundation for the employment relationship.

- Tax Declaration Forms: These forms are used by the employee to declare their tax deductions and personal exemptions. In the U.S., this may include the W-4 form for federal income tax withholding preferences. Accurate completion of tax declaration forms ensures that the correct tax amount is deducted from the employee's pay.

- Benefits Enrollment Forms: Employers offering health insurance, retirement plans, or other benefits require employees to complete enrollment forms. These documents capture choices and beneficiary information, which directly influence deductions and additions on the pay slip.

- Time Sheets: For employees paid hourly or those eligible for overtime pay, time sheets document the number of hours worked within a pay period. Time sheets support the accurate calculation of wages owed, including regular hours and overtime, as reflected in the payslip.

- Deduction Authorization Forms: When employees opt for payroll deductions for benefits, union dues, or other approved expenses, authorization forms must be completed. These forms give employers the legal right to deduct specific amounts from the employee’s paycheck.

These documents, when used in conjunction with the Payslip BCEA4 form, provide a transparent and detailed account of the employment terms, earnings, deductions, and contributions. For employees, this suite of documents empowers them with the knowledge and evidence of their employment and remuneration details, fostering a transparent workplace relationship. Employers, on the other hand, benefit from streamlined payroll processing and compliance with labor laws, ensuring a positive and compliant working environment.

Similar forms

W-2 Form: The W-2 form, commonly used in the United States, is similar to the Payslip BCEA4 form because both are centered around reporting an individual's earnings and deductions. Just like the Payslip BCEA4, the W-2 form documents the total earnings of an employee, including wages, salaries, and other compensation, along with the deductions for taxes and other withholdings.

Pay Stub: A pay stub, often provided with each paycheck, closely resembles the Payslip BCEA4 form in its function. It details the employee's gross pay, taxes, and other deductions, and net pay for a specific pay period. Both documents serve the purpose of informing employees about their compensation and deductions, though the format and specific content may vary.

Form 1099-MISC: The 1099-MISC form, used for reporting payments made to independent contractors in the U.S., shares similarities with the Payslip BCEA4 form in that both provide a record of earnings. However, the 1099-MISC does not typically show deductions for taxes or other withholdings, as these are the responsibility of the payee to calculate and report.

Employee Record of Earnings: An internal company document used to track an employee's earnings over time is akin to the Payslip BCEA4 form. It includes information on the employee's pay rate, hours worked, gross earnings, and deductions. Although not typically a formal legal document, it serves a similar purpose in providing detailed information on an employee's compensation.

Time Sheet: Time sheets, while primarily used to record the hours an employee works, share a common goal with the Payslip BCEA4 form - to calculate compensation based on hours worked. When time sheets are used to determine payments, they often include similar categories of information, such as regular hours, overtime, and sometimes even deductions, thereby acting as a foundational document for payroll processes.

Dos and Don'ts

When filling out the Payslip BCEA4 form, it’s essential to remember that accuracy and clarity are key. Below are things you should and shouldn’t do to ensure the form is filled out correctly.

Do:

- Verify all details: Double-check the employee's information, including their name, ID number, and employee number, to ensure accuracy.

- Include all forms of remuneration: Specify not only the basic wage but also payment in kind, allowances, and any overtime worked. The total remuneration must be clear.

- Detail deductions accurately: List all deductions, such as PAYE, UIF, and any union fees or others, with complete details.

- Provide the form timely: Make sure the payslip is given to the employee at the workplace or a mutually agreed location, within their ordinary working hours or within 15 minutes of the start or end of their shift.

- Use clear, precise language: Avoid vagueness to prevent misunderstandings about the employee's remuneration and deductions.

- Ensure compliance: Even if using another format, check that all information required by the BCEA4 form is included.

Don't:

- Omit any payment details: Failing to include any form of remuneration, including overtime or allowances, can lead to inaccuracies in the payslip.

- Forget to specify payment in kind: This is part of the total remuneration and must be specified separately.

- Leave out deduction details: Each deduction must be listed with full details to avoid confusion or errors in the total deduction amount.

- Delay distribution: Handing out payslips late can cause unnecessary stress or uncertainty for employees.

- Use complicated language: Keep the information straightforward to ensure that anyone reading the payslip can understand it.

- Assume one size fits all: Each employee's payslip might have unique elements. Customize as necessary to reflect their specific remuneration and deductions accurately.

Misconceptions

When it comes to understanding the Payslip Bcea4 form, associated with the Basic Conditions of Employment Act, 1997, there's quite a bit of confusion. Here are eight common misconceptions that need clearing up:

- It's a mandatory form. Many people believe that the Payslip Bcea4 form is a compulsory document that every employer must use. However, the truth is that it's a model. Employers can comply with the regulations by providing a document in another format, as long as it contains the same information.

- It's complicated to fill out. At first glance, the form might seem daunting. Yet, it's simply a record of remuneration details that the employer must provide to the employee. Once the sections are broken down, it's quite straightforward.

- It must be delivered in person. The document stipulates it should be given "at the workplace or at a place agreed to by the employee." This condition is often misunderstood as requiring personal delivery. In reality, it means there can be flexibility in how the information is provided to the employee, respecting their convenience.

- It includes unnecessary details. Every piece of information requested on the form—such as payment in kind and allowances—serves a purpose in ensuring full transparency about the employee's remuneration. These details are crucial for both the employer and employee to have a clear understanding of the compensation structure.

- It's only about the wages. While the basic wage or salary information is central to the Payslip Bcea4 form, it also encompasses other crucial details like hours worked (including overtime and public holidays) and deductions. This comprehensive overview is essential for fair labor practices.

- It can only be filled out by the employer. While the form states that it is the employer who fills in the form, this doesn't preclude the assistance of a payroll professional or HR department within the company. The key point is the employer's responsibility to ensure its accuracy and delivery.

- It has no flexibility in format. There’s a common belief that the form's layout is set in stone. In actuality, the flexibility in format is one of its strengths—as long as the necessary information is included, the specific layout can be adjusted to suit the employer's system.

- It is only relevant at tax time. While the Payslip Bcea4 form certainly plays a role during tax season, providing a record of income and deductions, its relevance extends year-round. It serves as an ongoing record of compensation, vital for both day-to-day and long-term financial planning for the employee.

Understanding these aspects of the Payslip Bcea4 can dispel fears and clarify its purpose. This form, or its informational equivalent, is a key piece of documentation in the South African employment landscape, helping to promote transparency and compliance with employment legislation.

Key takeaways

When managing the Payslip Bcea4 form, several key points must be kept in mind to ensure the process is done accurately and efficiently. These takeaways are crucial for both employers and employees to understand the significance of the document and its proper handling.

- The Payslip Bcea4 form serves as a comprehensive record of an employee’s remuneration, detailing earnings, deductions, and the final amount due to the employee.

- This form is the responsibility of the employer to fill out and provide to each employee. It acts as an essential document that confirms the financial details related to an employee’s salary.

- The form must be given to the employee either at the workplace or at a location agreed upon by the employee, ensuring easy access and transparency in the communication of financial information.

- Delivery of the form should be within the employee’s ordinary working hours or within 15 minutes before or after, allowing the employee to receive and review their payslip without it impacting their personal time or work commitments.

- It is important that the form includes the full value of the remuneration, including any payment in kind, to provide a clear and comprehensive overview of the employee’s earnings.

- While the Payslip Bcea4 is a model form, it’s important to note that any document containing the same information will fulfill the legal requirements. This flexibility allows employers to adapt as needed while still maintaining compliance.

- Key components of the form include details like the name of the employee, ID number, occupation/grade, pay period, basic wage, manner of payment, among other earnings and deductions, ensuring a thorough record of employment compensation.

- Deductions and total amount due must be clearly itemized, listing specifics such as PAYE (Pay As You Earn), UIF (Unemployment Insurance Fund contributions), union fees, and other relevant deductions, offering full disclosure of how the final pay is calculated.

Understanding these key aspects of the Payslip Bcea4 form helps in ensuring that the process of filling out and using the form is conducted correctly, promoting transparency and adherence to the Basic Conditions of Employment Act. Whether for the employer or the employee, familiarizing oneself with the requirements and details of the payslip ensures a smooth and compliant employment relationship.

Popular PDF Forms

Labor Laws for 16 Year Olds - Advises Maryland minors on the procedural aspects of applying for a work permit, including what documents to gather and where the application should be submitted.

Ky Cdl Self-certification Online - By mandating this form, Kentucky places a strong emphasis on the health and safety of commercial drivers, aiming to reduce road accidents and enhance public safety.