Blank Pennsylvania Pa 100 PDF Template

Embarking on the journey of understanding the Pennsylvania PA 100 form reveals a gateway essential for businesses within the state. This multifaceted form, serving as the Commonwealth of Pennsylvania's Enterprise Registration Form, demands attention from a broad spectrum of enterprises, ranging from fledgling startups setting their operations in motion to established entities seeking to update or expand their tax and service registrations. With sections meticulously designed to cater to an array of requirements - such as indicating the reason for registration, detailing enterprise information, and identifying the taxes and services applicable - the form stands as a cornerstone in ensuring compliance with Pennsylvania's Department of Revenue and Department of Labor & Industry's regulations. It delves into the specifics of business activities, scrutinizes sales information, examines employment details, and even navigates the choppy waters of bulk sale or transfer information, making it an indispensable tool for businesses striving to align with state laws and tax obligations. The form's comprehensive nature also extends to delineating corporation information and elucidating the preferred methods for reporting and payment, highlighting its crucial role in the seamless operation of businesses in Pennsylvania.

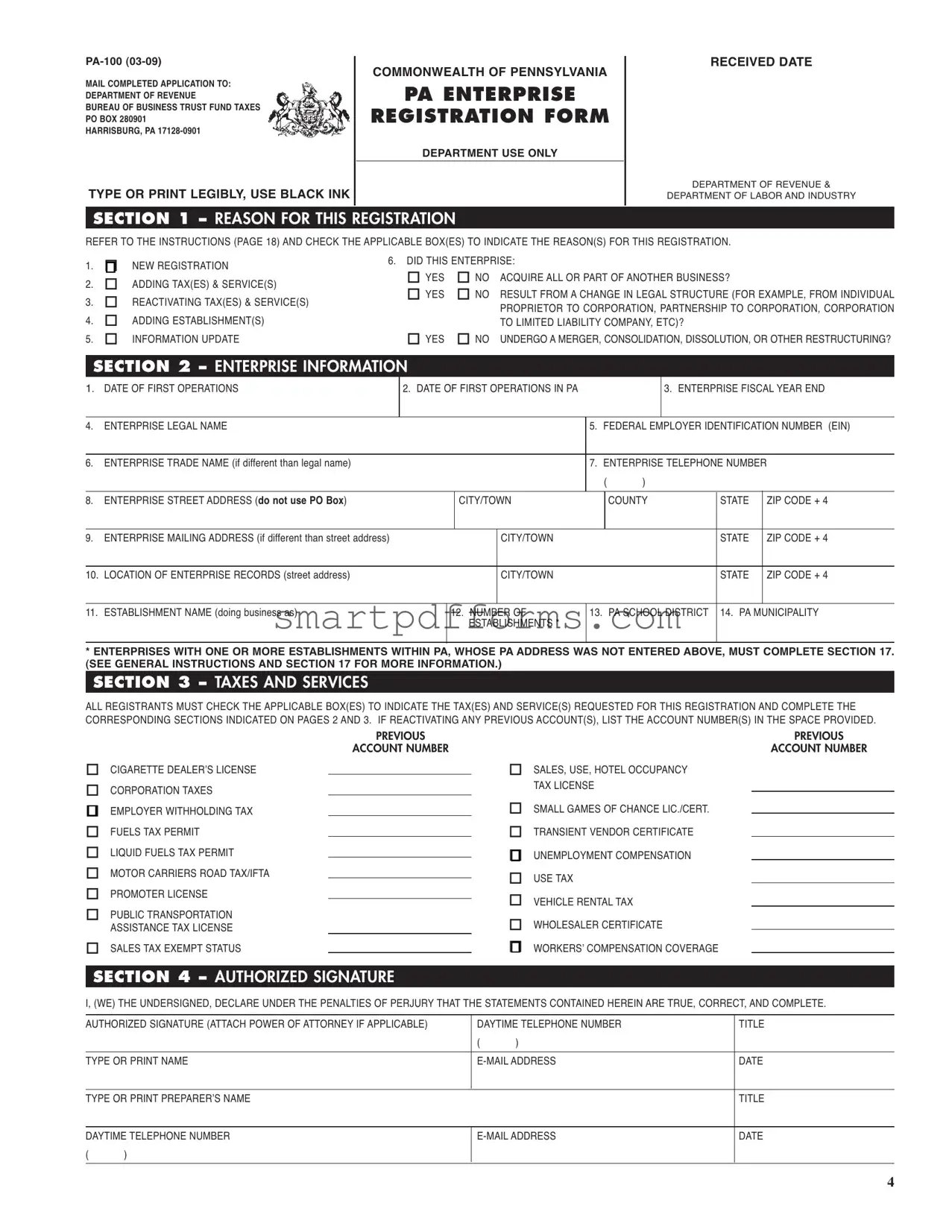

Preview - Pennsylvania Pa 100 Form

MAIL COMPLETED APPLICATION TO:

DEPARTMENT OF REVENUE

BUREAU OF BUSINESS TRUST FUND TAXES

PO BOX 280901

HARRISBURG, PA

TYPE OR PRINT LEGIBLY, USE BLACK INK

COMMONWEALTH OF PENNSYLVANIA

PA ENTERPRISE

REGISTRATION FORM

DEPARTMENT USE ONLY

RECEIVED DATE

DEPRTMENT OF REVENUE & DEPRTMENT OF LR D INDUSTRY

SECTION 1 – REASON FOR THIS REGISTRATION

REFER TO THE INSTRUCTIONS E D CHECK THE ICE BOXTO INDI |

CTE THE RENFOR THIS REGISTRTION. |

. |

NEW REGISTRTION |

|

. |

DING T& SERVICE |

|

. |

RETIVTING T& SERVICE |

|

4. DING ESTISHMENT

5. INFORMTION UPDTE

6. DID THIS ENTERPRISE: |

|

||

YES |

NO |

QUIRE L OR PRT OF OTHER BUSINESS? |

|

YES |

NO |

RESULT FROM CHGE IN LEG STRUCTURE OR EXE FROM INDIVIDU |

|

|

|

PROPRIETOR TO CORPORTION PRTNERSHIP TO CORPORTION COR |

PORTION |

|

|

TO LIMITED LILITY COMPYETC |

|

YES |

NO |

UNDERGO MERGER CONSOLIDTION DISSOLUTION OR OTHER REST |

RUCTURING? |

SECTION 2 – ENTERPRISE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

||

. |

DTE OF FIRST OPERTIONS |

|

. DTE OF FIRST OPERTIONS IN P |

. |

ENTERPRISE FISC YE END |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

ENTERPRISE LEG N |

|

|

|

|

|

|

5. FEDER EMPLOYER IDENTIFICTION NUMBER N |

|||||

|

|

|

|

|

|

|

|

|

|

|

|||

6. ENTERPRISE TRE Nf different than legal name |

|

|

|

|

|

. ENTERPRISE TELEPHONE NUMBER |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

ENTERPRISE STREETDRESS |

do ot use PO Box |

|

|

CITY/TOWN |

|

|

|

COUNTY |

|

STTE |

ZIP CODE + 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

. ENTERPRISE MLING DRESS f different than street address |

|

|

CITY/TO |

WN |

|

|

|

|

|

STTE |

ZIP CODE + 4 |

||

|

|

|

|

|

|

|

|

|

|

|

|

||

. LOCTION OF ENTERPRISE RECORDS reet address |

|

|

CITY/TOWN |

|

|

|

|

|

|

STTE |

ZIP CODE + 4 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. ESTISHMENT Noing business as |

|

|

. NUMBER OF |

|

. |

PSCHOOL DISTRICT |

4. P |

MUNICIPLITY |

|||||

|

|

|

|

|

ESTISHMENTS * |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*ENTERPRISES WITH ONE OR MORE ESTABLISHMENTS WITHIN PA, WHOSE PA ADDRESS WAS NOT ENTERED ABOVE, MUST COMPLETE SECTION 17 (SEE GENERAL INSTRUCTIONS AND SECTION 17 FOR MORE INFORMATION)

SECTION 3 – TAXES AND SERVICES

LL REGISTRTS MUST CHECK THE ICE BOXTO INDICTE THE TD SERVIC |

EREQUESTED FOR THIS REGISTRTION D CO |

MPLETE THE |

CORRESPONDING SECTIONS INDICTED ON PES D . IF RETIVT |

ING Y PREVIOUS COUNT LIST THE COUNT NUMBERIN THE SPE PROVID |

ED. |

|

PREVIOUS |

|

|

ACCOUNT NUMBER |

|

CIGETTE DEERʼS LICENSE |

|

|

CORPORTION T |

|

|

EMPLOYER WITHHOLDING TX |

|

|

FUELS TPERMIT |

|

|

LIQUID FUELS TPERMIT |

|

|

|

||

MOTOR CRIERS RO TIFT |

|

|

PROMOTER LICENSE |

|

|

|

||

PUBLIC TRSPORTTION |

|

|

|

||

STCE TLICENSE |

|

|

|

|

|

SES TEXEMPT STTUS |

|

|

SECTION 4 – AUTHORIZED SIGNATURE

PREVIOUS

ACCOUNT NUMBER

SES USE HOTEL OCCUPCY

TLICENSE

SML GOF CHCE LIC./CERT.

TRSIENT VENDOR CERTIFICTE

UNEMPLOYMENT COMPENSTION

USE TX

VEHICLE RENTTX

WHOLESER CERTIFICTE

WORKERSʼ COMPENSTION COVERE

I ETHE UNDERSIGNED DECLE UNDER THE PENTIES OF PERJURY THT TH |

E STTEMENTS CONTNED HEREIN E TRUE CORRECTD COM |

PLETE. |

||

|

|

|

|

|

THORIZED SIGNTURETTH POWER OFTTORNEY IF ICE |

DYTIME |

TELEPHONE NUMBER |

TITLE |

|

TYPE OR PRINT N

ELDRESS

DTE

TYPE OR PRINT PREPERʼS N

TITLE

DYTIME TELEPHONE NUMBER

ELDRESS

DTE

4

|

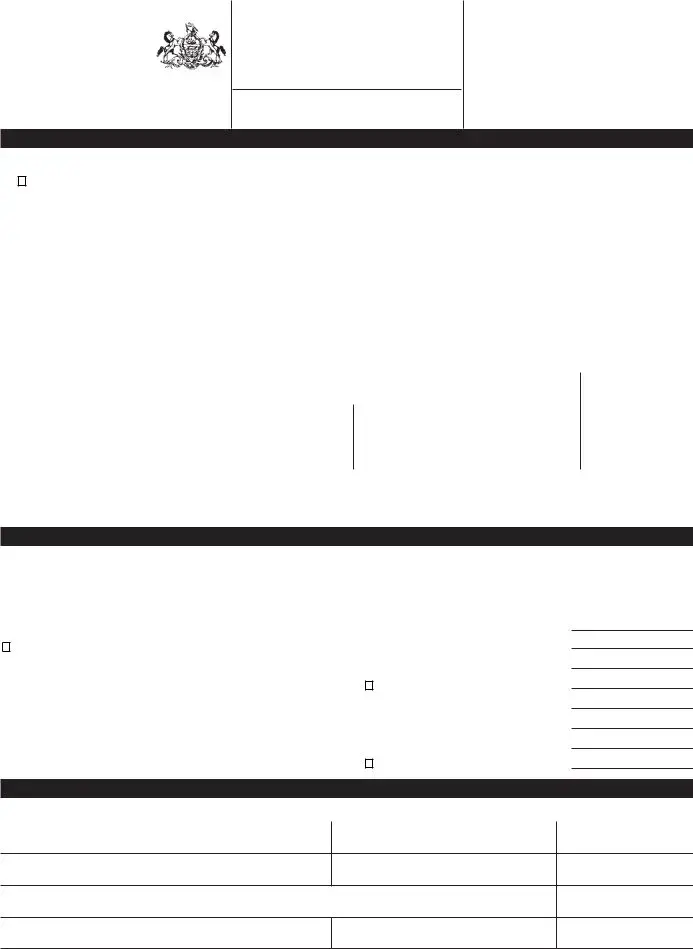

DEPRTMENT USE ONLY |

|

|

|

|

ENTERPRISE N |

|

|

SECTION 5 – BUSINESS STRUCTURE

CHECK THE OPRITE BOX FOR QUESTIONS & . IN DITION TO SEC |

TIONS THROUGH COMPLETE THE SECTIONINDICTED. |

. SOLE PROPRIETORSHIP NDIVIDU |

GENER PRTNERSHIP |

CITION |

|

CORPORTION c. |

LIMITED PRTNERSHIP |

BUSINESS TRUST |

|

GOVERNMENT c. |

LIMITED LILITY PRTNERSHIP |

ESTTE |

|

|

JOINT VENTURE PRTNERSHIP |

|

|

LIMITED LILITY COMPY

STTE WHERE CHTERED

RESTRICTED PROFESSION COMPY

STTE WHERE CHTERED

. |

PROFIT |

|

. |

YES |

NONOFIT |

IS THE ENTERPRISE ORGIZED FOR PROFIT OR NONOFIT? |

|

NO |

IS THE ENTERPRISE EXEMPT FROM TTION UNDER INTERN REVENUE CODE RCSEC |

TION 5 IF YES |

|

PROVIDE COPY OF THE ENTERPRISE'S EXEMPTION THORIZTION LETTER FROM T |

HE INTERN REVENUE SERVICE. |

SECTION 6 – OWNERS, PARTNERS, SHAREHOLDERS, OFFICERS, AND RESPONSIBLE PARTY INFORMATION

|

PROVIDE THE FOLLOWING FOR ALL INDIVIDUD/OR ENTERPRISE OWNERS PRTNERS SHEHOLDERS OFFICERS |

|

D RESPONSIBLE PRTIES. IF STOCK IS PUBLICLY |

|

||||||||||||||

|

TRED PROVIDE THE FOLLOWING FOR ANY SHAREHOLDER WITH AN EQUITY POSITION OF 5% OR MORE ADDITIONAL SPACE IS AVAILABLE IN SECTION 6A, PAGE 11 |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

N |

|

|

|

|

. SOCI SECURITY NUMBER |

. |

DTE OF BIRTH * |

4. FEDER EIN |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

OWNER |

OFFICER |

|

6. TITLE |

|

|

|

. EFFECTIVE DTE |

. |

PERCENTE OF |

. EFFECTI |

VE DTE OF |

|

|

||||

|

|

PRTNER |

SHEHOLDER |

|

|

|

|

|

OF TITLE |

|

OWNERSHIP |

|

OWNERSHIP |

|

|

|||

|

|

RESPONSIBLE PRTY |

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

. HOME DRESS reet |

|

|

|

|

CITY/TOWN |

|

|

COUNTY |

|

|

STTE |

ZIP CODE + 4 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

. THIS PERSON IS RESPONSIBLE TO REMIT/MNTN: |

SES T |

EMPLOYER WITHHOLDING TX |

MOTOR FUEL T |

|

|

|

||||||||||||

|

|

|

|

|

|

WORKERSʼ COMPENSTION COVERE |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

* DTE OF BIRTH REQUIRED ONLY IFYING FOR CIGETTE WHOL |

ESE DEERʼS LICENSE SML GOF CHCE DISTRIBUTOR LICENSE OR SML |

|

G |

|

|||||||||||||

|

OF CHCE MUFTURER CERTIFICTE. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

SECTION 7 – ESTABLISHMENT BUSINESS ACTIVITY INFORMATION |

|

|

|

|

|

|

|

|

|||||||||

|

REFER TO THE INSTRUCTIONS ON PAGES 20 & 21 TO COMPLETE THIS SECTION COMPLETE SECTION 17 FOR MULTIPLE ESTABLISHMENTS |

|

|

|||||||||||||||

. ENTER THE PERCENTE THT EH |

PABUSINESS ACTIVITY REPRESENTS OF THE TOTL RECEIPTS OR REVENUEST |

THIS ESTISHMENT. LIST |

PRODUCTS OR |

|

||||||||||||||

|

|

SERVICES CITED WITH EH BUSINESS TIVITY D THE PERCENTE REPRESENTING THE TO |

TL RECEIPTS OR REVENUES. |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PA BUSINESS ACTIVITY |

% |

|

PRODUCTS OR SERVICES |

% |

|

ADDITIONAL |

|

% |

|

|||||||

|

|

|

PRODUCTS OR SERVICES |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

mmodation & Food Services

riculture Forestry Fishing & Hunting

Entertainment & Recreation Services

Communications/Information

Construction st complete question

Domestics vate Households

Educational Services

Finance

Health Care Services

Insurance

Management Support & Remediation Services

Manufacturing

Mining Quarrying & Oil/Gas Extraction

Other Services

Professional Scientific & Technical Services

Public ministration

Real Estate

Retail Trade

Sanitary Service

Social stance Services

|

Transportation |

|

|

|

|

|

|

|

|

|

|

|

|

Utilities |

|

|

|

|

|

|

|

|

|

|

|

|

Warehousing |

|

|

|

|

|

|

|

|

|

|

|

|

Wholesale Trade |

|

|

|

|

|

|

|

|

|

|

|

|

TOTL |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

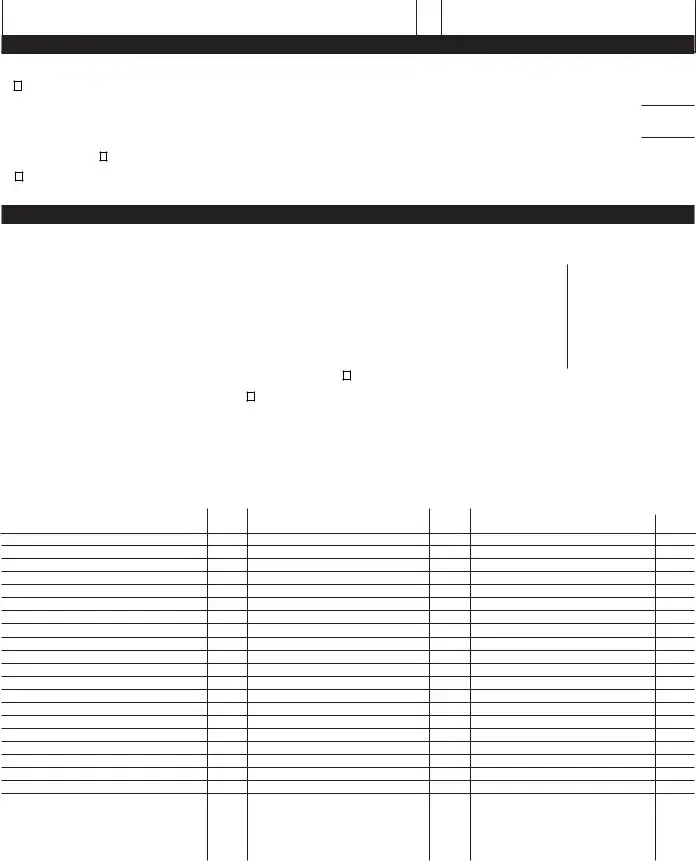

|

. ENTER THE PERCENTE THT |

THIS ESTABLISHMENTS RECEIPTS OR REVENUES REPRESENT OF THE TOTAL PARECEIPTS OR REVENUES OF THE ENTERPRISE. |

|

|

||||||||

|

______________%. SINGLE ESTBLISHMENT ENTERPRI SES ENTER %. MULTIPLE ESTISHMENT ENTERPRISES ENTER PERCENTE OF ENTERPRISE SEC |

TION |

||||||||||

|

. ESTISHMENTS ENGED IN CONSTRUCTION |

MUST ENTER THE PERCENTE OF CONSTRUCTION TIVITY THT IS NEW D/OR |

RENOVTIVE D THE PERCENT |

|||||||||

|

E OF CONSTRUCTION TIVITY THT IS RESIDENTID/OR COMMERCI |

|

. |

|

|

|

|

|

|

|||

|

|

|

___________________% NEW |

+ |

__________________% RENOVTIVE |

= |

% |

|

|

|

||

|

|

|

___________________% RESIDENTIL |

+ |

__________________% COMMERCIL |

= |

% |

|

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

4. YES NO |

DOES THIS ENTERPRISE WNT TO BECOME PENNSYLVNILOTTERY |

RETLER? |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

5

|

DEPRTMENT USE ONLY |

|

|

|

|

ENTERPRISE N |

|

|

SECTION 8 – ESTABLISHMENT SALES INFORMATION

. |

YES |

NO |

IS THIS ESTISHMENT SELLING TE PRODUCTS OR OFFERING TE SERVICES TO |

CONSUMERS FROM LOCTION |

|

|

|

|

IN PENNSYLVANIA? IF YES COMPLETE SECTION . |

|

|

. |

YES |

NO |

IS THIS ESTISHMENT SELLING CIGETTES |

IN PENNSYLVANIA? IF YES COMPLETE SECTIONS D . |

|

. LIST EH COUNTY |

IN PENNSYLVANIA WHERE THIS ESTISHMENT IS CONDUCTING TE SES TIVITYES |

|

||||

COUNTY |

|

|

COUNTY |

|

|

COUNTY |

COUNTY |

|

|

COUNTY |

|

|

COUNTY |

|

|

|

ATTACH ADDITIONAL 8 1/2 X 11 SHEETS IF NECESSARY. |

|

||

SECTION 9 – ESTABLISHMENT EMPLOYMENT INFORMATION

PART 1

.

YES

YES

. YES

. YES

NO |

DOES THIS ESTISHMENT EMPLOY INDIVIDUS WHO |

WORK IN PENNSYLVANIA? IF YES INDICTE: |

|||||

|

a. |

DTE WES FIRST |

PAID DD/YYYY |

. . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

||

|

|

|

|

|

|||

|

b. |

DTE WGES RESUMED FOLLOWING BREIN EMPLOYMENT |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

||||

|

|

|

|

|

|||

|

c. |

TOTL NUMBER OF EMPLOYEES |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . |

||||

|

|

|

|

|

|||

|

d. |

NUMBER OF EMPLOYEES PRIMILY WORKING IN NEW BUILDING OR INFRRUC |

TURE |

||||

|

|

|

|

|

|

|

|

e.NUMBER OF EMPLOYEES PRIMILY WORKING IN REMODELING CONSTRUCTION . . . . . . . . . . . . . . . . . . . . . .

f. ESTIMTED GROSS WGES PER QUTER |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . .$ |

. |

g.NOF WORKERSʼ COMPENSTION INSURCE COMPY

. |

POLICY NUMBER _________________________________E FFECTIVE STRT DTE __________________END DTE __ |

_________________ |

||||||

. |

GENCY NME _____________________________________ _________________DYTIME TELEPHONE NU MBER ______________________ |

|||||||

|

MLING DRESS |

_____________________________________CITY/TOWN ______________________STTE _____ZIP CODE + 4_ _______ |

||||||

. |

IF THIS ENTERPRISE DOES NOT HVE WORKERSʼ COMPENSTIONINSURCE CHECK |

ONE: |

|

|

||||

|

a. |

THIS ESTISHMENT EMPLOYSONLY EXCLUDED WORKERS . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|||

|

b. |

. . . . . . . . . . . . . .THIS ESTISHMENT HZERO EMPLOYEES |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|

|||

c.THIS ESTISHMENT RECEIVED OVTO SELFNSURE BY THE PBURE OF

|

|

WORKERSʼ COMPENSTION |

. . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|||||||

|

|

IF ITEM c. IS CHECKED PROVIDE PWORKERSʼ COMPENSTION BURE CODE |

|

|

|

||||||

NO |

DOES THIS ESTISHMENT EMPLOY PRESIDENTS WHO |

|

WORK OUTSIDE OF PENNSYLVANIA? |

|

|

||||||

|

IF YES INDICTE: |

|

|

|

|

|

|

|

|

|

|

|

a. |

DTE WES FIRST |

PAID DD/YYYY . . . |

. |

. . . . . . . . . . . . . . . . . . |

. |

. . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

b. |

. . . . . . . .DTE WGES RESUMED FOLLOWING BREIN EMPLOYMENT |

. . . . . . . . . . . . . . . . . |

|

|

|

|||||

|

c. |

ESTIMTED GROSS WGES PER QUTER. |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . .$ |

|

. |

|

||||

NO |

DOES THIS ESTISHMENT PY REMUNERTION FOR SERVICES TO PERSONS YOU DO |

NOT CONSIDER EMPLOYEES? |

|

|

|||||||

|

IF YES EXPLN THE SERVICES PERFORMED |

|

|

|

|

|

|

|

|

||

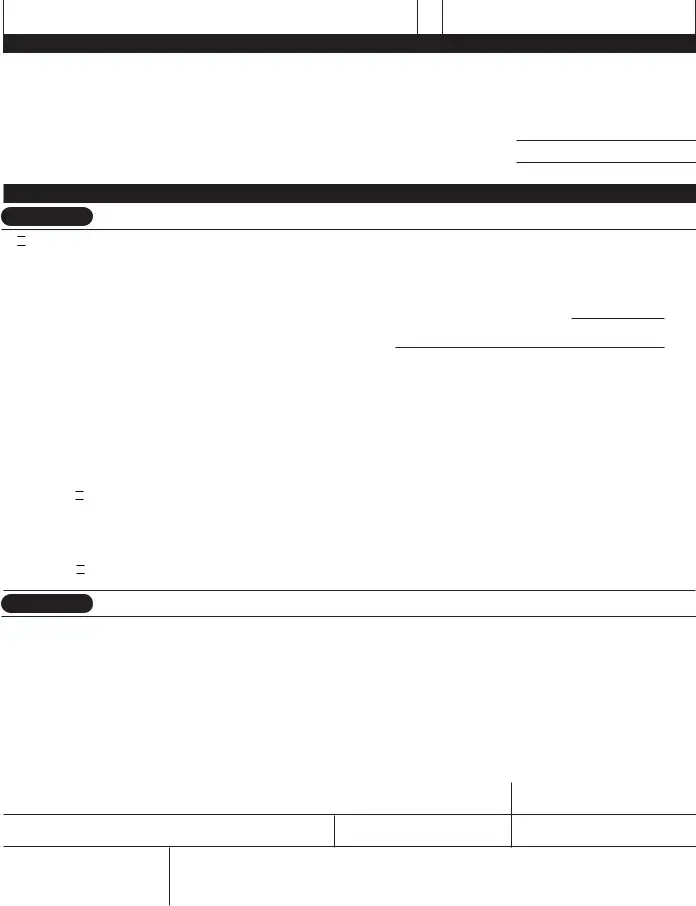

PART 2

. YES |

NO |

IS THIS REGISTRTION |

RESULT OF TE DISTRIBUTION FROM |

BENEFIT TRUST DEFERRED PYMENT OR RETIREMENT PL |

||||

|

|

FOR PRESIDENTS? |

|

|

|

|

|

|

|

|

IF YES INDICTE: |

a. |

DTE BENEFITS FIRST PAID DD/YYYY |

. . . . . . . . . . . |

|

|

|

|

|

|

b. ESTIMTED BENEFITS PID PER QUTER |

. . . . . . . . . . . . . . . . . . . . . .$ |

|

. |

|

|

|

|

|

|

|

|

|||

|

SECTION 10 – BULK SALE/TRANSFER INFORMATION |

|

|

|

|

|||

IF S WERE QUIRED IN BULK FROM MORE TH ONE ENTERPRISE PHOTOCOPY T |

HIS SECTION D PROVIDE THE FOLLOWING INFORMTION |

UT EH |

||||||

SELLER/TRSFEROR. |

|

|

|

|

|

|

||

. |

YES |

NO |

DID THE ENTERPRISE QUIRE 5% OR MORE OF |

ANY CLASS OF THE PA ASSETS OF OTHER ENTERPRISE? SEE THE CLOF S |

|

|

||

|

|

|

LISTED BELOW. |

|

|

|

|

|

. |

YES |

NO |

DID THE ENTERPRISE QUIRE 5% OR MORE OF THE |

TOTALASSETS OF OTHER ENTERPRISE? |

|

|

||

IF THE SWER TO EITHER QUESTION IS YES PROVIDE THE FOLLOWING INFO RMTION UT THE |

SELLER/TRANSFEROR |

|

|

|||||

|

|

|

|

|

|

|||

. SELLER/TRSFEROR N |

|

|

4. FEDER EIN |

|

|

|||

5. SELLER/TRSFEROR STREETDRESS

CITY/TOWN

STTE |

ZIP CODE + 4 |

|

|

6. DTE S QUIRED |

. S QUIRED: |

|

|

|

|

|

|

COUNTS RECEIVE |

EQUIPMENT |

INVENTORY |

ND/OR GOODWILL |

|

|

|

CONTRTS |

FIXTURES |

LE |

RE ESTTE |

|

|

|

CUSTOMERS/CLIENTS |

FURNITURE |

MHINERY |

OTHER |

|

|

|

|

|

|

|

|

|

IMPORTANT: IF, IN ADDITION TO ACQUIRING ASSETS IN BULK, THE ENTERPRISE ALSO ACQUIRED ALL OR PART OF A PREDECESSOR'S BUSINESS, SECTION 14 MUST BE COMPLETED.

IF THE ENTERPRISE IS ACQUIRING 51% OR MORE OF ANY CLASS OF PA ASSETS AND/OR 51% OF THE TOTAL ASSETS OF ANOTHER ENTERPRISE THE SELLER MUST OBTAIN A BULK SALE CLEARANCE CERTIFICATE. REFER TO INSTRUCTIONS ON PAGE 22.

6

|

DEPRTMENT USE ONLY |

|

|

|

|

ENTERPRISE N |

|

|

SECTION 11 – CORPORATION INFORMATION

. DTE OF INCORPORTION |

. |

STTE OF INCORPORTION |

. CERTIFIC |

TE OF THORITY DTE |

|

|

|

ONCORP. |

|

|

|

|

|

|

4. COUNTRY OF INCORPORTION

5. |

YES |

NO |

IS THIS CORPORTION'S STOCK PUBLICLY TRED? |

|

|

|

|

||

6. |

CHECK THE OPRITE BOX TO DESCRIBE THIS CORPORTION: |

|

|

|

|

|

|

||

|

CORPORTION: |

STOCK |

PROFESSION |

BK: |

STTE |

MUTU |

THRIFT: STTE |

INSURCE |

P |

|

|

NONOCK |

COOPERTIVE |

|

FEDER |

|

FEDER |

COMPNY: |

NON |

|

|

MEMENT |

STTUTORY CLOSE |

|

|

|

|

|

|

. S CORPORTION: |

FEDER |

INCORDCE WITHT NO.6 OF 6 CORPORTION WITH |

|

FEDER SUBHER S STTUS IS CONSIDERED PS COR |

|||||

|

|

|

PORTION. IN ORDER |

NOT TO BE T P S CORPORTION REV6 |

MUST BE FILED. THE FORM C BE CESSED T |

||||

|

|

|

WWWREVENUESTATEPAUS FORMS D PUBLICTIONS CORPORTION T |

|

|

||||

COMPLETING THIS FORM WILL NOT FULFILL THE REQUIREMENT TO REGISTER FOR CORPORATE TAXES REGISTERING CORPORATIONS MUST CONTACT THE PA DEPART- MENT OF STATE TO SECURE CORPORATE NAME CLEARANCE AND REGISTER FOR CORPORATION TAX PURPOSES CONTACT THE PA DEPARTMENT OF STATE AT (717) 787- 1057, OR VISIT wwwaoeforbusiessstateaus

SECTION 12 – REPORTING & PAYMENT METHODS

. THE DEPRTMENT OF REVENUE REQUIRES THTY ENTERPRISEMNG PYMENTS EQ |

U TO OR GRETER TH $ REMIT PYMENTS VI ONE |

OF THE FOL |

LOWING ELECTRONIC METHODS: ELECTRONIC FUNDS TRSFER T ELECTRO |

NIC TINFORMTION D DTEXCHGE SYSTEM IDES TELEFILE SYSTEM OR |

|

CREDIT CD. ENTERPRISE REGDLESS OF UNTIS ENCOURED TO REMIT |

TPYMENTS ELECTRONICLY. |

|

a. YES |

|

b. YES |

|

. YES |

NO |

DOES THIS ENTERPRISE MEET THE DEPRTMENT OF REVENUEʼS REQUIREMENTS FOR ELECT RONIC PYMENTS? |

|

NO |

DOES THIS ENTERPRISE WNT TO PRTICIPTE IN THE DEPRTMENT OF |

REVENUEʼS ELECTRONIC PROGR |

NO |

IF THIS ENTERPRISE IS NONOFIT ORGIZTION THT IS EXEMPT UN |

DER IRC 5 OR POLITIC SUBIVISIONS IS IT |

|

INTERESTED IN RECEIVING INFORMTION UT THE DEPRTMENT OF LR & |

INDUSTRYʼS OPTION OF FINCING UC COSTS |

|

UNDER THE REIMBURSEMENT METHOD IN LIEU OF THE CONTRIBUTORY METHOD? FOR MORE DETILS REFER TO SECTION |

|

|

INSTRUCTIONS. |

|

THE DEPRTMENT OF LR & INDUSTRY REQUIRES THTY ENTERPRISE WITH |

5 OR MORE WGE ENTRIES PER QUTERLY REPORTFILE THE W |

GE INFORMTION VI |

|||

MNETIC MEDIY MNETIC REPORTING FILE MUST BE SUBMITTED FOR COMPTI |

BILITY WITH THE DEPRTMENT OF LR & INDUSTRYʼS FORMT. CONTT |

THE M |

|||

NETIC MEDI REPORTING UNITT FOR MORE INFORMT |

ION. |

|

|

|

|

THE COMMONWETH STRONGLY RECOMMENDS THT ENTERPRISES USE ELECTRONIC FIL |

ING D PYMENT OPTIONS FOR CERTN PENNSYLVNI TD SERVICES. |

|

|||

INFORMTION UT INTERNET FILING OPTIONS C BE FOUND ON THE |

eIDES WEB SITET |

wwwetidesstateaus |

|

|

|

SECTION 13 – GOVERNMENT STRUCTURE

. IS THE ENTERPRISE |

|

|

|

|

GOVERNMENT BODY |

GOVERNMENT OWNED ENTERPRISE |

GOVERNMENT & PRIVTE SECTOR |

||

|

|

|

OWNED ENTERPRISE |

|

. IS THE GOVERNMENT: |

|

|

|

|

DOMESTIC/US |

FOREIGN/NONS |

MULTITION |

||

. IF DOMESTIC IS THE GOVERNMENT: |

|

|

|

|

FEDER |

LOC: |

COUNTY |

BOROUGH |

|

STTE GOVERNOR'S JURISDICTION |

|

CITY |

SCHOOL DISTRICT |

|

STTE NONOVERNOR'S JURISDICTION |

|

TOWN |

OTHER |

|

|

|

TOWNSHIP |

|

|

7

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The PA-100 form is used for new business registrations, updating information, or adding tax services in Pennsylvania. |

| Submission Address | Completed applications are mailed to the Department of Revenue, Bureau of Business Trust Fund Taxes, PO Box 280901, Harrisburg, PA 17128-0901. |

| Sections Covered | The form includes sections on enterprise information, tax responsibilities, authorized signatures, business activity, and specific compliance details. |

| Multiple Uses | It covers a range of tasks including new registration, tax service addition, information update, and changes in business structure. |

| Supporting Documentation | Applicants may need to provide additional documents, such as proof of exemption from taxation or workers' compensation insurance details. |

| Governing Laws | The PA-100 form is governed by Pennsylvania state laws related to business registration, tax filing, and employer responsibilities. |

Instructions on Utilizing Pennsylvania Pa 100

Filling out the Pennsylvania PA-100 form is a necessary step for registering your business for various tax responsibilities, licenses, and services in the state. This form is used not only for new businesses but also for those adding new taxes or services, updating information, or undergoing changes like mergers or structure adjustments. Here's a simple guide to help you complete the form accurately:

- Start by reading the form carefully to understand which sections are relevant to your business situation.

- In Section 1, select the reason for this registration by checking the appropriate box that describes your situation, such as new registration, adding tax/service, information update, etc.

- Proceed to Section 2 to provide detailed enterprise information. Fill in the date of first operations, the legal name of the enterprise, Federal Employer Identification Number (EIN), trade name if different from the legal name, enterprise street address, mailing address if different, location of enterprise records, name under which business is done, and contact details including the telephone number.

- In Section 3, check the box next to each tax or service for which you are registering. Complete the corresponding sections indicated on the form as applicable.

- Section 4 requires the authorized signature. The individual filling out the form declares that all statements contained therein are true and correct. Type or print the name of the signer, title, telephone number, and provide the signature and date.

- Fill in your business structure in Section 5. Check the appropriate box to indicate whether your enterprise is a sole proprietorship, partnership, corporation, etc., and complete additional sections as indicated.

- In Section 6, provide information about owners, partners, shareholders, officers, and responsible parties, including names, Social Security Numbers (SSN) or Federal EIN, date of birth, title, percentage of ownership, and contact details.

- Detail your business activities in Section 7. Here, describe the percentage that each PA business activity represents of the total receipts or revenues at this establishment.

- If applicable, complete Section 8 to provide establishment sales information, focusing on whether you're selling taxable products or services to consumers within Pennsylvania.

- Section 9 covers establishment employment information. Indicate whether you employ individuals who work in Pennsylvania and provide details such as wages and number of employees.

- For businesses acquired in bulk from another enterprise, complete Section 10 with bulk sale/transfer information.

- Corporations fill in Section 11 with specifics about incorporation and stock information.

- Address reporting and payment methods in Section 12. Indicate whether your business meets requirements for electronic payments and if you're interested in the Department of Revenue’s electronic program.

- Section 13 asks about government structure if applicable to your enterprise.

- Review the entire form for accuracy, then mail the completed application to the address provided at the top of the form.

Ensure all relevant sections are completed accurately to help streamline the processing of your PA-100 form. This will facilitate your business's proper registration for tax obligations and service needs in Pennsylvania.

Obtain Answers on Pennsylvania Pa 100

- What is the purpose of the Pennsylvania PA-100 form?

- Who needs to complete the PA-100 form?

- How can a business submit the PA-100 form?

- What information is required on the PA-100 form?

The PA-100 form serves as an enterprise registration application that facilitates various tax-related and service needs for businesses operating in Pennsylvania. Its primary aim is to register new enterprises for tax purposes, updating existing information, adding tax or service options, changing business structure, and indicating changes due to mergers or acquisitions. This comprehensive form is a crucial step for businesses to comply with the Commonwealth of Pennsylvania's tax and employment regulations.

Any business that plans to start operations in Pennsylvania, changes its legal structure, undergoes a merger or restructuring, or requires updating its current tax or service registrations must complete the PA-100 form. This includes businesses from a wide array of sectors, such as retail, manufacturing, and services, ensuring they meet state tax obligations and are registered for the appropriate employer and operational services. Also, if a business acquires assets or ownership from another entity, it may need to file this form to update its tax account details.

Businesses have the option to submit the PA-100 form either electronically or by mailing a printed copy. The electronic submission can be done through the official website provided by the Commonwealth of Pennsylvania, offering a streamlined process for entering and submitting the required information. For those preferring or required to submit a physical copy, the form can be mailed to the Department of Revenue, Bureau of Business Trust Fund Taxes, at the provided address. Using black ink and legible handwriting is strongly advised to ensure the form is processed correctly.

Completing the PA-100 form requires detailed information about the business, including its reason for registration, enterprise information (such as legal name, trade name, and contact details), tax and service information, and data on ownership and structure. Businesses must also provide specifics about their activities, sales, and employment in Pennsylvania. For corporations, additional details such as incorporation data and stock information are necessary. The form must be signed under penalties of perjury, declaring the accuracy and completeness of the submitted information.

Common mistakes

- Not using black ink or typing: The instructions specify that the form should be filled out legibly in black ink or typed. Ignoring this instruction can cause processing delays or even lead to the rejection of the form.

- Skipping sections relevant to your registration reason: Depending on the reason for registration, different sections of the form will need to be completed. Overlooking or not fully completing the sections relevant to your situation can lead to incomplete registration and future compliance issues.

- Incorrect selection of the reason for registration: The form starts by asking for the reason for registration. Choosing the wrong reason can lead to incorrect processing of your application, forcing you to start the process over again and possibly delaying your business operations.

- Leaving the enterprise information section incomplete: The enterprise information is vital for the Department of Revenue and Department of Labor & Industry to understand your business. Missing data in this section, such as the start date of operations or tax identification numbers, can prevent your form from being processed.

- Forgetting to check the required tax and service boxes in Section 3: It's important to accurately indicate which taxes and services apply to your enterprise. Failure to do so can result in non-compliance with state tax regulations, leading to penalties.

- Misunderstanding the business structure section: The business structure affects taxation and legal liability. Incorrectly identifying your business structure can have serious tax and legal implications.

- Not providing owner, partner, and responsible party information: Every business owner, partner, shareholder, officer, and responsible party must be listed with their correct information. This oversight can lead to personal liability issues.

- Overlooking the need for detailed employment information: If your business employs individuals in Pennsylvania, the Department needs detailed information about employment practices. Neglecting to provide this information, including the effective date of workers’ compensation coverage, can result in fines.

- Failure to obtain a bulk sale clearance certificate when necessary: If acquiring assets or a business in a bulk sale, failing to obtain the required clearance certificate can lead to being held responsible for the seller's unpaid taxes.

Filling out the Pennsylvania PA-100 form can sometimes be a daunting task. It is critical to approach this task with careful attention to detail to ensure accuracy and compliance. Below are nine common mistakes to avoid when completing this form:

By avoiding these common pitfalls, businesses can improve the accuracy and efficiency of their PA-100 form submission process, ensuring a smoother registration with state agencies.

Documents used along the form

When filing the Pennsylvania Enterprise Registration Form (PA-100), several other documents and forms are often used in conjunction to comply with state regulations and ensure a smooth registration process. Each form or document serves a distinct purpose, catering to various business and regulatory requirements.

- Articles of Incorporation: This document is vital for new corporations. It officially forms the corporation and includes key details such as the corporation's name, purpose, and information about shares and directors. This needs to be filed with the Pennsylvania Department of State before completing the PA-100 if registering a new corporation.

- Employer Identification Number (EIN) Confirmation Letter: Issued by the IRS, this document confirms a business's EIN, which is necessary for tax administration purposes. The EIN should be obtained prior to filling out the PA-100, as the number is required on the form.

- Sales, Use, and Hotel Occupancy Tax License: Although not a form that accompanies the PA-100, upon successful registration, businesses engaged in retail sales will receive this license. It allows them to collect state sales tax on taxable sales.

- Workers' Compensation Insurance Proof: For businesses with employees, proof of workers' compensation insurance must be maintained and available. This is not submitted with the PA-100 but is crucial for businesses to comply with Pennsylvania labor laws.

Completing and submitting the PA-100 form along with ensuring that all related documents and requirements are met helps ensure legal compliance and sets a strong foundation for business operations in Pennsylvania. Whether it's registering for taxes, obtaining the necessary licenses, or setting up for employees, each document plays a critical role in the business setup and operational process.

Similar forms

The Internal Revenue Service (IRS) SS-4 Form serves a purpose similar to the Pennsylvania PA-100 form as it is used for obtaining an Employer Identification Number (EIN). Both forms are essential for business operations, involving tax registration and identification at federal (IRS SS-4) and state (PA-100) levels.

The Uniform Business Office (UBO) Registry Application is analogous because it facilitates the registration of a business in a specific locale, much like the PA-100 form, which registers a business for various state taxes and services in Pennsylvania.

A Local Business License Application shares similarities with the PA-100 form, as both are crucial for legal operation within their respective jurisdictions. Local business licenses allow operation within a municipality, while PA-100 includes state tax registrations.

The New Jersey Business Registration Application (NJ-REG) is akin to the PA-100 form in that it is used by businesses to register for tax and employer purposes within New Jersey, fulfilling a similar role as PA-100 does for Pennsylvania businesses.

The California Seller's Permit Application is similar in function for businesses that intend to sell goods and collect sales tax within California, paralleling the PA-100 form's role in registering businesses for sales tax and other state-administered taxes in Pennsylvania.

Florida Business Tax Application (DR-1) is comparable as it is used for the registration of a business for tax purposes in Florida, serving a similar purpose as the PA-100 form does in the state of Pennsylvania for tax registrations.

The Illinois Business Registration Application (REG-1) shares similarities with the PA-100 form by serving as the primary document for registering a business with the Illinois Department of Revenue for taxation and employer purposes, akin to the registration processes outlined in PA-100 for Pennsylvania.

Dos and Don'ts

When filling out the Pennsylvania PA-100 form, a comprehensive approach towards providing accurate and detailed information can make the process smoother and ensure compliance with state requirements. Below are lists of dos and don'ts to consider during this process.

Things You Should Do

- Ensure all information is typed or printed legibly in black ink to prevent any misinterpretations or processing delays.

- Double-check the enterprise's details such as legal name, trade name, address, and contact information for accuracy to avoid any issues with the state's records.

- Refer to the instructions provided within the PA-100 form documentation to assist in accurately filling out the reason for registration and relevant taxes or services requested sections.

- Sign and date the form where required, as an authorized signature substantiates the form's completeness and the truthfulness of the information provided.

Things You Shouldn't Do

- Do not leave sections incomplete. If a section does not apply to your enterprise, fill it with "N/A" or "None" as appropriate, instead of leaving it blank.

- Avoid using PO Boxes for the enterprise's street address unless specifically allowed, as physical addresses are typically required for registration purposes.

- Do not forget to check whether your business structure or activities require filling out additional sections or supplying supplemental documentation.

- Resist the urge to skip the authorization of electronic payment methods section if applicable, as failing to comply with payment requirements can lead to penalties.

Misconceptions

When it comes to the Pennsylvania PA-100 form, misunderstandings are common, leading to confusion and errors in business registration processes. Here are ten misconceptions clarified:

- It's only for new businesses: The PA-100 form is not solely for new businesses. It is also required for existing businesses that need to update their information, add or reactivate a tax or service, or report changes in ownership or structure.

- Completing the PA-100 automatically registers a business for all taxes: While the PA-100 form is a comprehensive enterprise registration form, additional steps may be necessary for certain taxes or services not covered by this application.

- Personal information is not required: Contrary to what some might think, the PA-100 form does require detailed personal information for owners, partners, officers, and responsible parties, including Social Security Numbers and home addresses.

- Only physical Pennsylvania locations need to be listed: All establishments, including those located outside of Pennsylvania but conducting business within the state, must be listed on the PA-100 form.

- The form doesn’t apply to online businesses: Even if a business operates exclusively online but sells to Pennsylvania residents or otherwise conducts taxable activities within the state, it must complete the PA-100 form.

- A digital signature is enough: Although the world is moving towards digital solutions, a handwritten signature is still required on the PA-100 form to verify the information provided.

- There’s no need to update the PA-100 form after initial submission: Changes in business activities, ownership, contact details, or other pertinent information necessitate an update to your PA-100 registration.

- All sections of the PA-100 form must be completed: Not all sections of the PA-100 form apply to every business. Businesses should only complete sections relevant to their specific registration needs.

- Non-profit organizations don't need to file a PA-100: Non-profit organizations may still need to file a PA-100 form for certain taxable activities or if they have employees, even if they are exempt from some taxes.

- The PA-100 form can only be submitted by mail: While mailing is an option, the PA-100 form can also be completed and submitted online, offering a more convenient and faster processing option.

Understanding these points clearly helps businesses in Pennsylvania navigate the process of registering for taxes and services, ensuring compliance and avoiding potential issues.

Key takeaways

When completing the Pennsylvania Pa 100 form, there are several critical points to remember. This form is a gateway to establishing and operating your business within the state, ensuring compliance with tax and employment obligations. Here's a streamlined guide:

- Accuracy is crucial: Fill out the form legibly, using black ink. Ensure that all information provided is accurate and up to date to avoid delays or complications with your registration.

- Understand the purpose of registration: The PA-100 form is versatile and is used not just for new registrations, but also for updating information about an existing business, adding tax or service options, changing organizational structure, and more.

- Enterprise information: Detailed enterprise information is required, including operational details since the date of first operations in PA, legal name, trade name (if applicable), and contact information.

- Choose your taxes and services: Section 3 of the form requires you to check off the specific taxes and services relevant to your enterprise. Completing the corresponding sections as indicated is necessary to ensure proper registration for each tax and service.

- Sign the form: The form requires a sworn signature under penalty of perjury, attesting to the truthfulness and completeness of the information provided. This underscores the seriousness of the registration process.

- Business structure matters: Your enterprise’s structure affects tax responsibilities and liability. The form demands specifics about your business structure (e.g., sole proprietorship, partnership, corporation) and additional details pertinent to the chosen structure.

- Reporting employment information: If your business has employees, detailed employment information, including wage data and workers’ compensation coverage, is mandatory.

- Seeking assistance: If at any point the form becomes confusing, it’s advisable to consult with a professional. Missteps in the registration process can have legal and financial consequences.

Filling out the PA-100 form correctly is the first step toward establishing a legally compliant business in Pennsylvania. Paying close attention to detail and ensuring that all required sections are completed in full will save time and effort in the long run.

Popular PDF Forms

Fmla Leave - Securely gathers health-related details needed to approve FMLA leave, while maintaining privacy.

Tfn Australie - Is a key document for managing tax withholdings efficiently, ensuring compliance with Australian tax laws.