Blank Po Box 7236 Sioux Falls Sd PDF Template

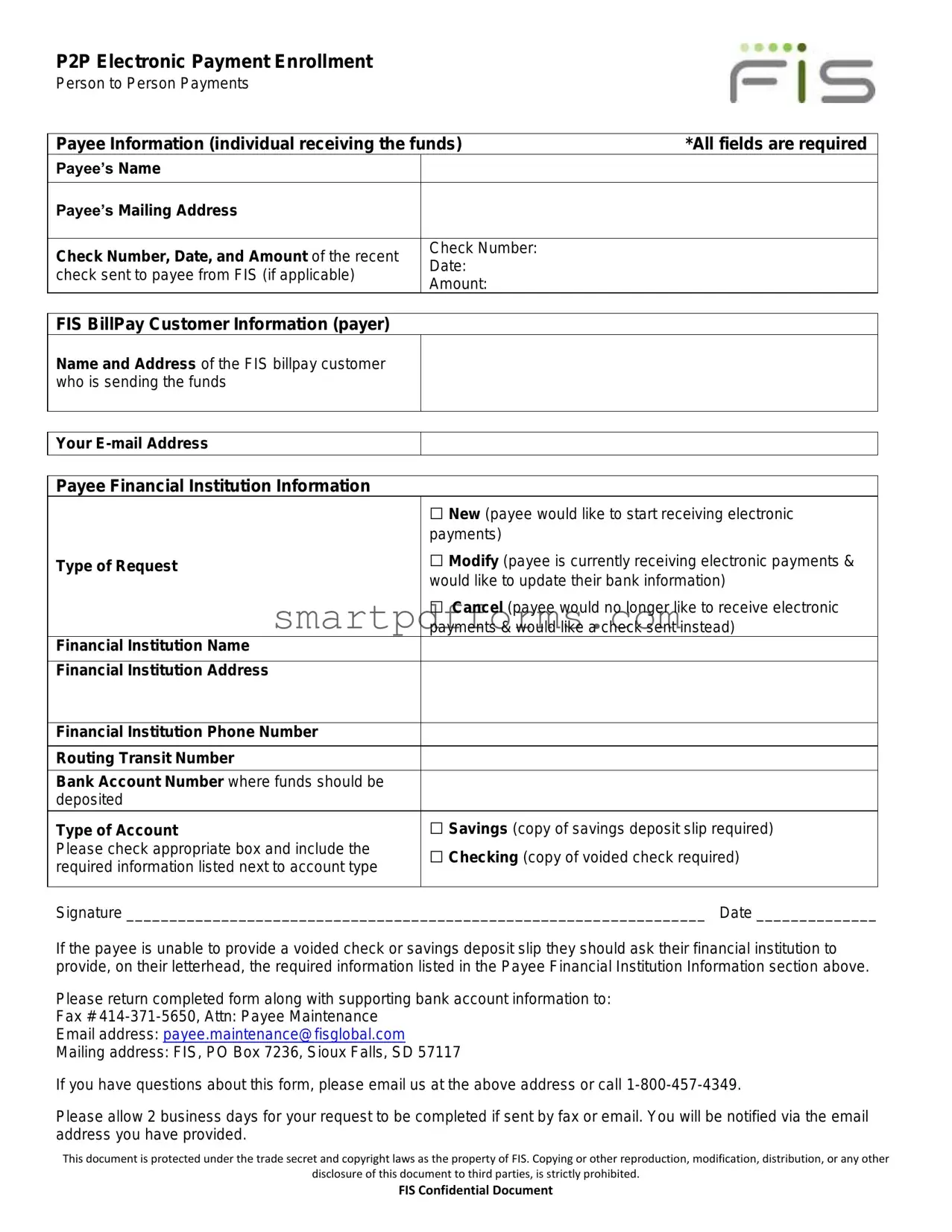

Understanding the intricacies of the Po Box 7236 Sioux Falls SD form is essential for individuals looking to engage in electronic payments, offering a structured way for payees and payers to manage fund transfers efficiently. This comprehensive form encompasses several critical sections, including Payee and FIS BillPay Customer Information, which are indispensable for the person receiving and the one sending the funds, respectively. Each field within these sections, marked as required, ensures that all necessary data, like names, addresses, and check details, are collected to facilitate a smooth transaction. Moreover, the form delicately handles the Payee Financial Institution Information, giving the payee the ability to opt for new electronic payments, modify existing bank information, or cancel electronic payments in favor of checks. It specifies the need for a copy of a voided check or savings deposit slip, ensuring accurate account and routing numbers are provided for the type of account chosen, whether it be savings or checking. The guidelines for submitting this form, through either fax or email, and the expected timeframe for the processing of requests, alongside the confidentiality notices, underscore the form's vital role in streamlining person-to-person payments while emphasizing the security and propriety of the process. Thus, this form stands as a cornerstone document for individuals navigating the nuances of electronic fund transfers within the FIS ecosystem.

Preview - Po Box 7236 Sioux Falls Sd Form

P2P Electronic Payment Enrollment

Person to Person Payments

Payee Information (individual receiving the funds) |

*All fields are required |

||

Payee’s Name |

|

|

|

|

|

|

|

Payee’s Mailing Address |

|

|

|

|

|

|

|

Check Number, Date, and Amount of the recent |

Check Number: |

|

|

Date: |

|

||

check sent to payee from FIS (if applicable) |

|

||

Amount: |

|

||

|

|

||

|

|

|

|

FIS BillPay Customer Information (payer) |

|

|

|

Name and Address of the FIS billpay customer |

|

|

|

who is sending the funds |

|

|

|

|

|

|

|

|

|

|

|

Your |

|

|

|

|

|

|

|

|

|

|

|

Payee Financial Institution Information |

|

|

|

|

□ New (payee would like to start receiving electronic |

||

|

payments) |

|

|

Type of Request |

□ Modify (payee is currently receiving electronic payments & |

||

|

would like to update their bank information) |

||

|

□ Cancel (payee would no longer like to receive electronic |

||

|

payments & would like a check sent instead) |

||

Financial Institution Name |

|

|

|

|

|

|

|

Financial Institution Address |

|

|

|

|

|

|

|

Financial Institution Phone Number |

|

|

|

|

|

|

|

Routing Transit Number |

|

|

|

|

|

|

|

Bank Account Number where funds should be |

|

|

|

deposited |

|

|

|

|

|

||

Type of Account |

□ Savings (copy of savings deposit slip required) |

||

Please check appropriate box and include the |

□ Checking (copy of voided check required) |

||

required information listed next to account type |

|||

|

|

||

|

|

|

|

Signature ___________________________________________________________________ Date ______________

If the payee is unable to provide a voided check or savings deposit slip they should ask their financial institution to provide, on their letterhead, the required information listed in the Payee Financial Institution Information section above.

Please return completed form along with supporting bank account information to:

Fax #

Email address: payee.maintenance@fisglobal.com

Mailing address: FIS, PO Box 7236, Sioux Falls, SD 57117

If you have questions about this form, please email us at the above address or call

Please allow 2 business days for your request to be completed if sent by fax or email. You will be notified via the email address you have provided.

This document is protected under the trade secret and copyright laws as the property of FIS. Copying or other reproduction, modification, distribution, or any other

disclosure of this document to third parties, is strictly prohibited.

FIS Confidential Document

Form Data

| Fact Name | Detail |

|---|---|

| Form Purpose | Enroll, update, or cancel Person to Person electronic payments. |

| Target Users | Individuals who want to send or receive funds electronically through FIS. |

| Required Fields for Payee | Name, Mailing Address, Check details if available (Number, Date, Amount). |

| Payee Financial Institution Requirements | Financial Institution Name and Address, Phone Number, Routing Transit Number, Bank Account Number, Type of Account. |

| Account Type Documentation | Voided check for checking accounts; savings deposit slip for savings accounts. |

| Form Submission Information | Fax number, Email, and Mailing address are provided for form submission. |

| Processing Time | Requests are completed within 2 business days if sent by fax or email. |

| Contact Information | Email and telephone number for inquiries are provided. |

| Confidentiality Notice | The document is protected under trade secret and copyright laws; unauthorized disclosure is prohibited. |

| Governing Law | Not specified directly within the form, but typically subject to laws of the state of South Dakota and federal laws. |

Instructions on Utilizing Po Box 7236 Sioux Falls Sd

When it comes to managing your finances, especially person-to-person payments, the details matter. The form for P.O. Box 7236 in Sioux Falls, SD, is designed to set up or alter how you receive electronic payments, a convenience that modern technology affords us. Whether you're initiating a new direct deposit, updating your current bank information, or ending electronic payments in favor of traditional checks, this form is your gateway. Carefully filling out this document ensures that your transactions are processed smoothly and securely, aligning with your financial management goals. Here's a clear, step-by-step guide to help you navigate the form accurately.

- Fill out the Payee Information section:

- Enter the Payee's Name as listed on their bank account.

- Provide the Payee’s Mailing Address accurately.

- If applicable, input the Check Number, Date, and Amount from the most recent check sent to the payee from FIS.

- Complete the FIS BillPay Customer Information:

- Write your Name and Address exactly as it appears on your FIS BillPay account.

- Provide your E-mail Address to receive notifications and communication.

- Specify the Type of Request by checking the appropriate box:

- New - for starting to receive electronic payments.

- Modify - for updating existing bank information.

- Cancel - to stop receiving electronic payments and receive checks instead.

- Enter Payee Financial Institution Information:

- Financial Institution Name.

- Complete Address of the Financial Institution.

- Phone Number of the Financial Institution.

- Routing Transit Number and Bank Account Number where the funds should be deposited.

- Indicate the Type of Account by checking either Savings or Checking. Remember to attach the required document: a copy of the savings deposit slip for savings, or a voided check for checking.

- Sign and Date the form:

- Provide your signature at the bottom of the form.

- Date the form next to your signature.

- Attach the required bank account information: If unable to provide a voided check or savings deposit slip, request your financial institution to provide the required information on their letterhead.

- Submit the form: Choose either to fax it to 414-371-5650, Attention: Payee Maintenance, email it to payee.maintenance@fisglobal.com, or mail it to FIS, PO Box 7236, Sioux Falls, SD 57117.

- Await confirmation: After submission, allow 2 business days for processing. You will be notified via the email address provided on the form regarding the status of your request.

This systematic approach to filling out the form for P.O. Box 7236 in Sioux Falls, SD, ensures that you cover all necessary details for processing your electronic payment preferences efficiently. With all the information correctly provided and the form submitted as instructed, your financial transactions will move smoothly, keeping you on track with your financial management ambitions.

Obtain Answers on Po Box 7236 Sioux Falls Sd

What is the purpose of the PO Box 7236 Sioux Falls SD form?

This form serves as an enrollment application for Person to Person (P2P) Electronic Payment. It is used by individuals who wish to receive or modify electronic payments directly to their bank account from another individual via FIS BillPay services. It covers essential information such as the payee’s details, recent transaction data, payer's information, and the required banking information for the electronic transfer of funds.

What must be included when submitting the form?

When submitting the form, it's vital to ensure that all fields are completed. This includes the payee's full name and mailing address, details about a recent check received from FIS (if applicable), and comprehensive FIS BillPay customer information. Additionally, the form requires information regarding the payee's financial institution, including the name and address of the bank, phone number, routing transit number, and bank account number. Depending on the type of account, either a copy of a voided check (for checking accounts) or a savings deposit slip (for savings accounts) must be included. If these are not available, a letter from the financial institution on its letterhead must be provided. Finally, a signature and date are necessary to validate the form.

How can the form be submitted?

The completed form, alongside the required bank account information, can be submitted through three methods: fax, email, or standard mail. The fax number provided is 414-371-5650, addressing to Payee Maintenance. Alternatively, emails should be directed to payee.maintenance@fisglobal.com, and mailed submissions should go to FIS, PO Box 7236, Sioux Falls, SD 57117.

What is the timeline for processing the form?

A completed form sent via fax or email should be processed within 2 business days. Remember, the processing begins from the moment FIS receives the form. Once the request has been completed, the individual who submitted the form will be notified via the email address provided. It's crucial to provide a valid and active email address to receive this confirmation promptly.

What if there is a need to change the electronic payment information after submission?

If there's a need to modify any banking or personal information after the submission, one can use the same form by selecting the 'Modify' option under the Type of Request section. This option allows individuals currently receiving electronic payments to update their bank details as needed. As with the initial submission, complete the revised information, and send it through one of the available submission methods. Always ensure the latest information is accurate to avoid any payment delays.

What are the implications of canceling electronic payments?

Selecting the 'Cancel' option on the form indicates that the individual no longer wishes to receive electronic payments. Instead, they prefer to have a check sent. When opting for cancellation, it's essential to provide updated mailing address details to ensure that any future payments are correctly directed. Cancellation will prevent electronic deposit of funds going forward and switch to a traditional check system for any payouts.

Common mistakes

Not including all required fields: The form specifies that all fields are required, yet it's common to overlook details such as the payee's full mailing address or the exact date and amount of the most recent check sent.

Incorrect financial institution details: Errors in entering the bank's name, address, or phone number can lead to misdirected funds or other transaction problems.

Routing and account number inaccuracies: Transposing numbers or failing to double-check these critical numbers can result in funds being sent to the wrong account.

Failing to specify the account type: Not checking whether the account is savings or checking can cause confusion, as each requires different verification documents.

Not providing the required verification document: Neglecting to include a copy of a voided check for checking accounts or a savings deposit slip for savings accounts, as specified.

Submitting incomplete or unclear photocopies: Often, the required documentation is submitted, but it is either incomplete or not legible, leading to processing delays.

Forgetting to sign or date the form: The form is considered invalid without the payee’s signature and the date of submission, yet this step is frequently missed.

Choosing the wrong type of request: Misidentifying the request as new, modify, or cancel can lead to unnecessary complications in processing the intended action.

Errors in contact information: Mistakes in the email address or failing to update contact information can prevent timely notification regarding the status of the transaction or request.

- Securely handling the form to protect sensitive financial information.

- Following up with the institution if notification of the request’s completion is not received within the specified timeframe.

- Consulting with their financial institution for any unclear requirements, especially if unable to provide a voided check or savings deposit slip.

When individuals fill out the Po Box 7236 Sioux Falls Sd form, commonly for enrollment in P2P Electronic Payment or modifications to existing arrangements, several common errors can significantly delay or derail the process. By understanding these pitfalls, individuals can ensure smoother transactions.

To avoid these issues, it's advisable to review all entered information for accuracy and completeness before submission. Providing incorrect or incomplete information not only delays processing but can also result in transactions failing, which could be problematic for both the sender and the receiver of funds.

Beyond these common errors, payees and payers should be vigilant about:

Documents used along the form

When you're dealing with financial forms, like the PO Box 7236 Sioux Falls SD form for P2P electronic payment enrollment, there are often other important documents you need to gather to make sure everything goes smoothly. These documents help in validating your information, ensuring that your payment setup or modification request is processed without a hitch. Here's a brief look at some of these additional forms and documents typically used in tandem.

- Voided Check: This is usually required when setting up electronic payments to confirm the bank account details. A voided check ensures that the account number and routing number provided are accurate for the account you wish to use for transactions.

- Bank Statement: Sometimes, you might be asked for a recent bank statement. This acts as a secondary verification of your bank account, showcasing your name, address, and financial institution's details, aligning them with the information provided on the P2P enrollment form.

- Authorization Agreement for Direct Deposits: This form is often necessary when you want to establish a new electronic payment setup. It grants permission to transfer funds electronically to or from your account. It usually requires your signature and sometimes that of a co-holder if the account is jointly held.

- Photo Identification: A copy of a valid government-issued photo ID (such as a driver's license or passport) might be required to further confirm your identity. This helps prevent fraud and ensures that the person setting up the electronic payment is indeed the account holder.

Collecting and submitting these forms together can streamline the process, making it faster and easier for all parties involved. Whether you're setting up a new payment method, modifying an existing one, or canceling service, having the right documents at your fingertips is key. Always check with your financial institution for the most accurate and up-to-date list of required documents to ensure your transaction is processed efficiently.

Similar forms

Direct Deposit Authorization Form: Similar to the PO Box 7236 Sioux Falls SD form, a Direct Deposit Authorization Form collects information to set up electronic payments directly into a bank account. It requires the account holder's name, bank account number, routing number, and type of account—savings or checking. Like the form mentioned, it also usually includes a section for the account holder's signature and date.

ACH Vendor/Merchant Payment Enrollment Form: This form is used by businesses to collect banking information from vendors or merchants to facilitate electronic payments for services or goods provided. It shares similarities with the PO Box 7236 form in that it gathers details about the payee's financial institution, including routing and account numbers, and also often specifies whether the account is savings or checking.

Electronic Funds Transfer (EFT) Authorization Form: An EFT Authorization Form is designed to authorize electronic transfers between bank accounts. It captures similar information as the PO Box 7236 form, such as the account holder's name, financial institution details, and type of account. Both forms typically require a signature to verify consent for the electronic transaction.

Payroll Direct Deposit Form: Employers use this form to collect information from employees for direct deposit of their salaries. The form shares common elements with the PO Box 7236 form, including required details like bank name, account number, routing number, and type of account. It also serves to gather consent for depositing funds electronically into the specified account.

Loan Disbursement Authorization Form: Similar to the PO Box 7236 form, a Loan Disbursement Authorization Form is used to arrange for the electronic transfer of loan amounts into a borrower's bank account. It requires the borrower’s banking information, including the type of account, and a signature for authorization, mirroring the data collection and consent aspects of the PO Box 7236 form.

Automatic Bill Payment Authorization Form: This form is used by individuals to authorize automatic debits from their bank account to pay recurring bills. Like the PO Box 7236 Sioux Falls SD form, it gathers payer’s bank details, account type, and includes a section for authorization. Both forms facilitate the electronic movement of funds but from different perspectives—payee setup versus payer setup.

Dos and Don'ts

When filling out the PO Box 7236 Sioux Falls SD form for P2P Electronic Payment Enrollment, there are crucial dos and don'ts that guide the process to ensure accuracy and confidentiality. Following these guidelines will facilitate a smooth submission process:

- Do ensure all required fields are completed. This includes the payee's name, mailing address, and all relevant financial institution information.

- Do double-check the financial institution's information, such as the routing transit number and bank account number, for accuracy to avoid misrouted payments.

- Do provide a voided check or savings deposit slip if selecting a checking or savings account for payment receipt, respectively. This documentation is crucial for verification.

- Do verify the type of request—New, Modify, or Cancel—to ensure proper handling of your electronic payment preferences.

- Do sign and date the form. A missing signature or date can invalidate your submission.

- Don't overlook the requirement for supporting bank account information. If a voided check or savings deposit slip is not available, request a document from your financial institution on their letterhead that provides the needed details.

- Don't send the form without checking for errors. Errors can delay the processing of your request.

- Don't forget to use the correct contact information for submission. Whether by fax, email, or mail, use the provided addresses and numbers to ensure your form reaches its destination.

- Don't hesitate to reach out for questions. Utilizing the contact information provided for queries can clarify any uncertainties and help avoid mistakes.

Adhering to these dos and don'ts when completing the PO Box 7236 Sioux Falls SD form is vital for a successful and secure electronic payment enrollment. Always take the time to review your information thoroughly and reach out for assistance if needed to ensure a smooth process.

Misconceptions

Understanding the nuances of financial documents and forms is crucial for the accurate processing of transactions and requests. Regarding the Po Box 7236 Sioux Falls SD form, which is used for enrolling in, modifying, or canceling Person to Person (P2P) electronic payments through FIS, there are several misconceptions that can lead to confusion or errors. Clarifying these misconceptions ensures that individuals and institutions can handle their financial transactions with confidence.

It's only for person-to-person payments: While the form primarily facilitates P2P payments, it also allows users to change how they receive payments from FIS, including starting electronic payments or switching back to checks.

All fields are optional: Contrary to what some might think, the form explicitly states that all fields are required. This ensures that FIS has all the necessary information to process the request accurately.

Any type of bank account document is acceptable: The form specifies that a copy of a voided check is required for checking accounts, and a savings deposit slip for savings accounts. Not any bank document will suffice.

Email and fax submissions take longer to process: The form actually notes that requests sent by fax or email should be completed within 2 business days, highlighting FIS's commitment to timely processing.

Electronic payments cannot be canceled: One of the options on the form is specifically to cancel receiving electronic payments and revert to checks, which means electronic payments are not irrevocable.

Financial institution information is not critical: This information is crucial for ensuring that payments are routed correctly and securely to the intended recipient's bank account.

The form can be shared freely: As indicated at the bottom of the form, it is a confidential document protected by trade secret and copyright laws. Unauthorized sharing or reproduction is strictly prohibited.

Assistance is limited: The form provides contact information for email and phone support, demonstrating FIS's commitment to assisting with any questions or concerns regarding the form.

By dispelling these misconceptions, individuals and institutions can navigate the complexities of financial transactions with greater ease and accuracy. Understanding the specific requirements and provisions of forms like the Po Box 7236 Sioux Falls SD form is key to ensuring smooth financial operations.

Key takeaways

Understanding the nuances of the Po Box 7236 Sioux Falls SD form is crucial for individuals wanting to navigate the process of person-to-person electronic payments with ease. This detailed guide highlights the essential takeaways to ensure a smooth transaction and compliance with the procedures set forth by FIS.

- All required fields must be filled out: It is mandatory to complete every section of the form. This includes the payee’s name, mailing address, and the specific details if there has been a recent check issued by FIS. Missing information could delay or complicate the process.

- Understanding the Type of Request options is critical when filling out the form. Whether it is to initiate a new setup for electronic payments, modify existing bank details, or cancel electronic payments in favor of checks, the appropriate box should be checked to reflect the payee’s current need accurately.

- For security and identification, the form requires a signature and date at the bottom. This acts as a confirmation of the request and authorizes FIS to make changes or initiate the process as outlined in the form.

- Documentation such as a voided check or a savings deposit slip is required, depending on the type of account where funds will be deposited. This is to ensure accuracy in bank account details to avoid any misdirected payments.

- If the payee cannot provide a voided check or savings deposit slip, they should request their financial institution to provide the necessary bank details on official letterhead. This alternative ensures that the process is not stalled and the information remains accurate.

- The timing for request completion is set at two business days if the form is sent via fax or email, highlighting the efficiency and promptness of the process. Payees and payers are advised to plan accordingly to ensure no interruption in payments.

- Confidentiality and protection of information are highly prioritized, as indicated by the document's status as an FIS Confidential Document. Unauthorized reproduction, modification, or distribution of the form to third parties is strictly prohibited, safeguarding all parties' interests involved in the transaction.

The importance of adhering to the requirements outlined in the Po Box 7236 Sioux Falls SD form cannot be overstated. By diligently following these guidelines, users can ensure that their person-to-person payment transactions are processed efficiently and securely, maintaining the integrity of their financial transactions with FIS.

Popular PDF Forms

Idaho Re 21 - Specifies conditions under which the buyer or seller may cancel the agreement based on the results of property inspections or failure to meet financing terms.

How Many Times Can You Take the Written Driving Test in California in One Day - The advice section allows eye specialists to provide specific recommendations regarding the patient’s ability to drive safely.

Printable Daily Planner - Plan your day like a pro, ensuring you have time allocated for all your tasks, meetings, and personal notes.