Blank Prenuptial Agreement PDF Template

Before taking the significant step of marriage, couples often consider the future in all its aspects, including the financial. This is where a Prenuptial Agreement comes into play, serving as a practical measure to protect individual assets, clarify financial rights, and manage debt issues that might arise during the marriage. Tailored to fit the unique needs of each couple, these agreements set clear expectations and provide a sense of security for both parties. By detailing how financial matters and property will be handled in the event of divorce or one partner's death, a Prenuptial Agreement aims to prevent potential disputes and ensure a fair division of assets. Given its importance, understanding all facets of this agreement, from its basic composition to the conditions under which it can be enforced or challenged, becomes invaluable. This careful planning tool is not about anticipating failure but rather about bringing clarity and fairness to the financial aspects of a marriage, making it a wise consideration for couples looking to protect their future.

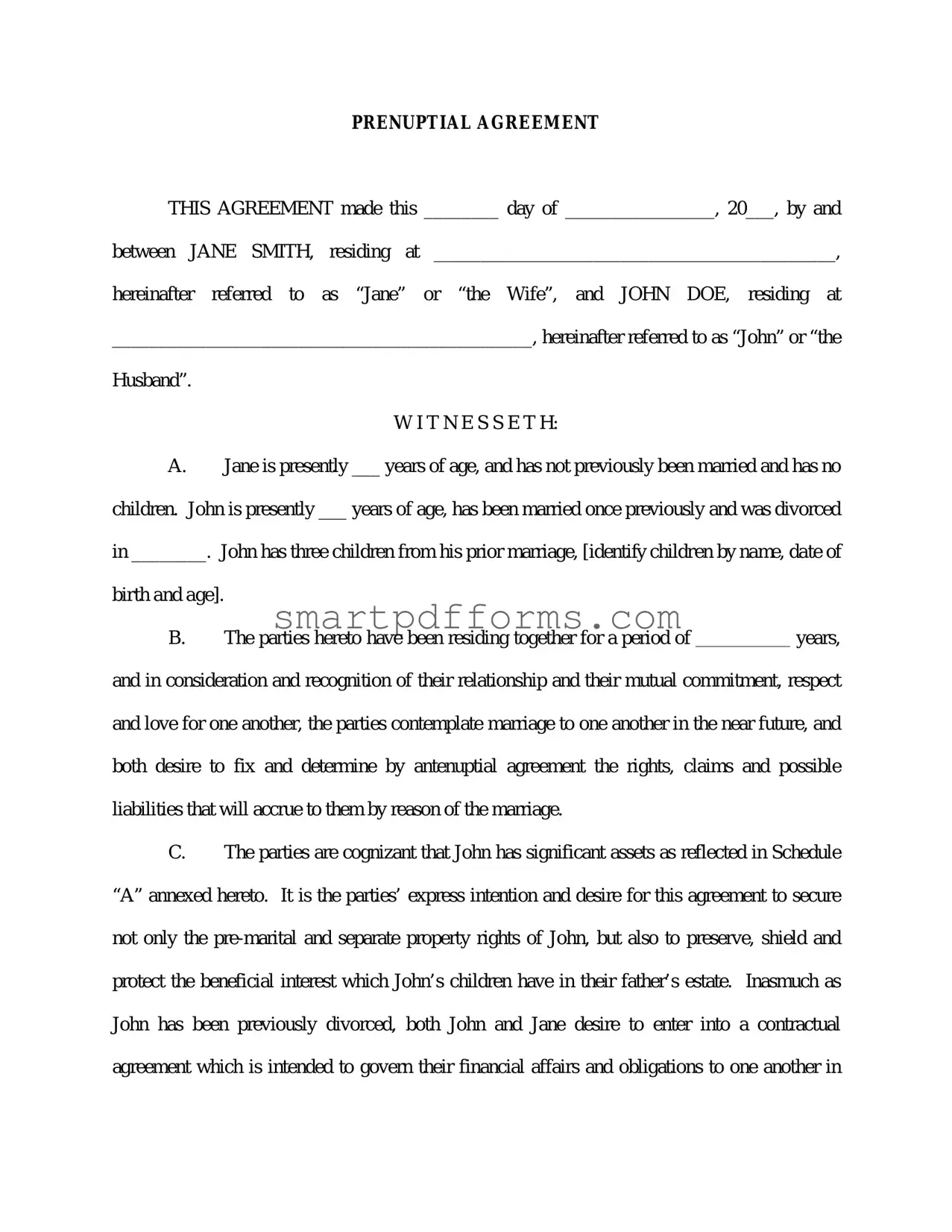

Preview - Prenuptial Agreement Form

PRENUPTIAL AGREEMENT

THIS AGREEMENT made this ________ day of ________________, 20___, by and

between JANE SMITH, residing at ___________________________________________,

hereinafter referred to as “Jane” or “the Wife”, and JOHN DOE, residing at

_____________________________________________, hereinafter referred to as “John” or “the

Husband”.

W I T N E S S E T H:

A.Jane is presently ___ years of age, and has not previously been married and has no children. John is presently ___ years of age, has been married once previously and was divorced in ________. John has three children from his prior marriage, [identify children by name, date of birth and age].

B. The parties hereto have been residing together for a period ofyears,

and in consideration and recognition of their relationship and their mutual commitment, respect and love for one another, the parties contemplate marriage to one another in the near future, and both desire to fix and determine by antenuptial agreement the rights, claims and possible liabilities that will accrue to them by reason of the marriage.

C.The parties are cognizant that John has significant assets as reflected in Schedule “A” annexed hereto. It is the parties’ express intention and desire for this agreement to secure not only the

the event of a dissolution of their marital relationship, said agreement being a deliberate and calculated attempt by John and Jane to avoid a painful and costly litigation process.

D.The parties are over the age of eighteen and are fully competent to enter into this Agreement, each being of a sufficiently mature and sound mind to understand fully the contemplated promises contained in this Agreement.

E.Except as expressly provided in this agreement to the contrary, each party desires

that all property owned by him or her at the date of the parties̓ marriage together with any appreciation or increase thereon shall be free from any claim of the other that may arise by reason of their contemplated marriage, and that in the event of a termination event as hereinafter set forth, all such property shall be his or her respective separate property and shall not be subject to any equitable distribution or community property laws in the event that the parties establish a domicile or residence in a state that has adopted either of such systems.

F.The parties specifically intend and desire to enter into an agreement, under Section 236B, subdivision 3, of the New York Domestic Relations Law, that fully provides for the ownership and distribution of their marital property and for certain other rights and obligations arising from the marital relationship, which they further intend shall control and be determinative in all respects for the present and in the event of the dissolution of the marriage.

G.The parties further intend that this Agreement is made in consideration of and is conditioned upon the parties entering into a valid marriage with each other, and this Agreement shall become effective only upon the parties entering into a valid marriage with each other.

H.The parties further specifically intend and desire that this prenuptial agreement and the terms and provisions hereinafter set forth shall control and be binding upon them in the

event of divorce or a “Termination Event.” For purposes of this Agreement, a “Termination Event” shall be defined as set forth in Article 1 of this agreement.

NOW, THEREFORE, in consideration of the mutual covenants, promises and agreements hereinafter set forth, the parties do fully and voluntarily agree as follows:

ARTICLE I. |

TERMINATION EVENT |

As used in this Agreement, “Termination Event” shall refer to any one of the following

events:

1.The commencement by either party against the other party of an action or proceeding for divorce, separation, annulment or dissolution of the parties’ marriage;

2.The sending of a written notice by one party to the other party, by certified mail, return receipt requested, stating that the marriage between the parties is no longer viable and that the receipt of said letter shall constitute a Termination Event; or

3.The parties cease residing together and/or remain in a state of marital separation, for a period of sixty (60) days or more, and do not thereafter reconcile.

ARTICLE II. GENERAL PROPERTY WAIVERS

1.Except as otherwise specifically provided in this agreement, neither party shall by virtue of the marriage have or acquire any right, title or claim in or to the other party's real or personal property or estate upon the other party's death, or in the event of the dissolution of the impending marriage.

2.By the execution of the within Agreement, each party specifically waives any right that each now has or may ever have pursuant to the following provisions of New York’s Domestic Relations Law, and accepts the terms of the within Agreement in lieu thereof:

(a)Section 236 B(4) as to compulsory financial disclosure, except as may be required if the issue of child support is extant;

(b)Section 236 B(5) regarding disposition of marital property and declaration of

separate property;

(c)Section 236 B(6) as to maintenance;

(d)Section 236 B(8) regarding specific relief in matrimonial actions; and

(e)Section 237 with regard to counsel fees and expenses, except as provided in Article XV of this agreement.

ARTICLE III. |

ESTATE WAIVERS |

1.Except as otherwise provided in the within agreement, neither party shall by virtue of the marriage have or acquire any right, title or claim in or to the other party's real or personal property upon the other party's death. In the event of the death of either party, that party's estate shall descend to, or vest in his or her heirs at law, distributees, legatees or devisees and in such a manner as may be prescribed by his or her Last Will and Testament or Codicil thereto, or in default thereof, by the statutory law then in force, as though no marriage between the parties had ever taken place. The waivers set forth herein shall include, but shall not be limited to the following:

(a)RIGHT OF ELECTION: The right to elect to take against any present or future Last Will and Testament or Codicil of the other party pursuant to Estates, Powers and Trusts Law [of New York] (EPTL) §

(b)RIGHT TO TAKE: The right to take his or her intestate share of the other party's estate pursuant to Article 5 of the EPTL, and by law amendatory thereof, or supplemental or similar thereto.

(c)RIGHT TO ACT: The right, if any, to act as administrator or administratrix of the other party's estate pursuant to Article 5 of EPTL, and by law amendatory thereof, or supplemental or similar thereto.

(d)RIGHT TO CLAIM: The right to claim or assert a claim for the declaration of marital property and the distribution thereof pursuant to the Domestic Relations Law of the State of New York, and any law amendatory thereof, or supplemental or similar thereto; except as specifically set forth in the within agreement.

(e)RIGHT TO ASSERT: The right to assert a claim for maintenance and/or support pursuant to the Domestic Relations Law of the State of New York, and any law amendatory thereof, or supplemental or similar thereto; except as specifically set forth in the within agreement.

2.Nothing herein contained shall be deemed to constitute a waiver by either party of any bequest that the other party may choose to make to him or her by Will or Codicil dated subsequent to the execution of this agreement.

ARTICLE IV. |

SEPARATE PROPERTY WAIVERS |

1.All property owned individually by either of the parties at the time of their marriage, whether real, personal or mixed, wheresoever situated, and whether vested, contingent or inchoate, together with the appreciation, rents, issues, enhanced earning capacity, and profits thereof, whether passive or active, or due in part or in whole to the direct or indirect

contributions of the other party, and the proceeds of the sale thereof or mergers and acquisitions thereto, and the investments and reinvestments thereof and the appreciation, rents, issues, enhanced earning capacity, and profits of such investments and reinvestments along with any liabilities in connection thereto and together with all property, real, personal or mixed, which the parties may acquire in their individual names hereafter or during their marriage, from any source whatever, hereby is declared to be and shall remain the separate property, (as defined by Section 236, Part B, of the Domestic Relations Law) of the respective party now owning, or hereafter acquiring such property, free and clear of any rights, interests, claims or demands of the other. Each party hereby covenants and agrees to make no claim or demand on the separate property of the other, or on the heirs, executors, or administrators of the other in the event of his or her death, with respect to such separate property of the other, except as otherwise expressly provided herein.

2.Without in any way limiting the definition of separate property as set forth in paragraph numbered “1” of this Article, separate property shall include the following:

(i)John shall retain as his sole and separate property all of the assets set forth in Schedule “A” annexed hereto;

(ii)Jane shall retain as her sole and separate property all of the assets set forth in Schedule “B” annexed hereto;

(iii)all property derived from personal services, skills, efforts and employment, whether performed before or during the marriage or after the occurrence of a Termination Event, (e.g., including but not limited to wages, bonuses, royalties, commissions, deferred compensation plans, retirement plans, profit sharing plans, employer provided savings accounts, stock warrants,

stock options, incentive awards, and any other form of compensation or asset provided as a result of his or her employment); and

(iv)all articles and accessories of attire, jewelry, personal effects, and sports equipment acquired by way of purchase, gift (whether

3.Inheritance and

1. Any funds or property inherited by either party shall remain the sole and separate property of the party so inheriting such funds or property; and

2. Any

ARTICLE V. THE MARITAL RESIDENCE

1.The parties acknowledge that John is the owner of a house located at

______________________________________, New York. The parties acknowledge that John is the sole owner of this property and that Jane has made no contribution or investment therein. It is the intention of the parties to reside in this house after they are married.

2.During the course of the marriage while they reside in the said home, John shall be responsible for payment of the carrying charges (mortgage/home equity loan payment, if any, real estate taxes, homeowner’s insurance, utilities, etc.) for the residence.

3.It is agreed and understood between the parties that upon the occurrence of a Termination Event, John may give Jane ninety (90) days written notice of his desire for Jane to

vacate the said residence, and Jane agrees that she shall, within

4.Simultaneous with Jane’s vacatur from the marital residence pursuant to this Article, John shall pay to Jane, as a rental allowance for a residence, a

5.The provisions of this Article shall apply to any subsequent or successor residence of the parties that is owned in the name of John only.

6.It is specifically agreed that all items of furniture, furnishings, household goods and appliances, books, works of art and other miscellaneous items of personal property presently located at _____________________________________, New York, shall belong to John, with the exception of the personal effects belonging to Jane, which shall remain her separate property.

ARTICLE VI:

1.All property and accounts hereafter acquired in the name of each party shall remain the separate and distinct property of the party acquiring such property or accounts. However, all property and accounts acquired or maintained by the parties jointly and in the joint names of the parties shall be considered for purposes of this agreement the joint property of the parties. Such jointly held property shall be subject to the following:

a. Upon the occurrence of a Termination Event, the jointly held property shall be divided equally between the parties, as follows:

(i)the joint property shall be valued as near as practicable to the time of

the Termination Event;

(ii)if an item of joint property lends itself to a distribution in kind, to the extent possible, the property shall be distributed equally in kind;

(iii)if the item of joint property does not lend itself to distribution in kind, the parties shall attempt to resolve between themselves a method of distributing such property so that all such property is distributed equally. If, within ninety (90) days following the occurrence of a Termination Event, the parties are unable to agree upon a method of distributing such property, the property shall be sold and the proceeds shall be divided equally with each party receiving

b.Upon the death of a party during marriage, the surviving spouse shall be entitled to the full interest in the jointly held property, i.e., such jointly held property shall be deemed to be held as joint tenants with the right of survivorship.

2.

a.In the event of a Termination Event, and in the event that Jane and John shall

b.If it is the nature of the

c. If it is the nature of the

d. If it is the nature of the

e. If it is the nature of the

ARTICLE VII: WAIVER OF INTEREST IN QUALIFIED PLAN

1.Any individual retirement account, pension, retirement, death benefit, stock bonus, annuity or

Form Data

| Fact # | Detail |

|---|---|

| 1 | Prenuptial agreements are legal documents signed before marriage to outline the division of assets and financial responsibilities in the event of a divorce. |

| 2 | These agreements can protect premarital assets, support estate planning, and reduce conflicts during divorce proceedings. |

| 3 | For a prenuptial agreement to be considered valid, both parties must enter into it voluntarily, with full and fair disclosure of all assets and liabilities. |

| 4 | Each party should have independent legal counsel, or at least the opportunity to seek such counsel, to ensure that the agreement is equitable and understandable. |

| 5 | State laws vary regarding the enforcement of prenuptial agreements, with some states adopting the Uniform Premarital Agreement Act (UPAA) to standardize rules. |

| 6 | Prenuptial agreements cannot dictate terms regarding child support, custody, or visitation rights as these are subject to court discretion based on the child's best interests. |

| 7 | If deemed unfair or if either party did not have proper legal representation during its drafting, courts can invalidate part or all of a prenuptial agreement upon review. |

Instructions on Utilizing Prenuptial Agreement

Filling out a Prenuptial Agreement form is a significant step for couples planning to get married. This document helps both partners discuss and decide on the financial aspects of their marriage, protecting their interests. The process might seem overwhelming, but it can be tackled with care and attention. The guidelines provided here aim to simplify this process, ensuring that all necessary information is accurately captured. Follow these steps to complete your Prenuptial Agreement form effectively.

- Gather Financial Documents: Both partners should compile their financial documents, including bank statements, investments, property deeds, and any other assets or liabilities. This step ensures that the agreement reflects the complete financial picture.

- Review State Laws: Each state has specific laws regarding prenuptial agreements. Familiarize yourself with these to ensure your agreement is valid and enforceable in your state.

- Discuss Agreement Details: Openly discuss what you both want to include in the agreement. This discussion should cover how you'll manage finances during the marriage, how assets will be handled in case of separation, and any other concerns about your future finances.

- Fill Out the Form: Begin by entering both partners' full names and addresses. Specify the date the marriage is expected to take place.

- Detail Assets and Liabilities: Using the information from your financial documents, list each partner's assets and liabilities. Be as specific as possible, including account numbers, properties' addresses, and outstanding debt amounts.

- Outline Terms: Clearly describe how assets and liabilities will be managed during the marriage, how property will be distributed in the event of separation or divorce, and any arrangements regarding alimony or support.

- Signatures: After reviewing the agreement together and ensuring it reflects your mutual understanding and intentions, both partners sign the document. It's highly recommended to have the signatures notarized to add an extra layer of authenticity.

- Witnesses and Notarization: If your state requires witnesses, have them sign the agreement too. Then, proceed to notarize the document, if necessary, to make it legally binding.

- Seek Legal Advice: Before finalizing the agreement, consider seeking legal advice. A lawyer can ensure that the agreement meets all legal requirements and fully protects your rights.

Completing a Prenuptial Agreement form is a forward-thinking step for any couple. It sets a foundation for open financial communication and lays out clear expectations for the future. By following these steps, you'll be well on your way to creating an agreement that aligns with your shared values and goals.

Obtain Answers on Prenuptial Agreement

-

What is a Prenuptial Agreement?

A Prenuptial Agreement, often abbreviated as a prenup, is a legal document that a couple signs before getting married. This agreement outlines how assets and financial matters will be handled during the marriage and in the event of a divorce. Key areas often covered include division of property, debt liability, and potentially spousal support. The main goal is to provide clarity and protect both parties' interests.

-

Who needs a Prenuptial Agreement?

While commonly associated with individuals who have substantial assets, a Prenuptial Agreement can benefit almost any couple. It may be particularly important if you own a business, expect to receive an inheritance, have children from a previous relationship, or have debts. It serves to protect what you bring into the marriage and can also define financial responsibilities during the marriage.

-

Is a Prenuptial Agreement legally enforceable?

Yes, a Prenuptial Agreement is legally enforceable if it meets all requirements under state law where it is executed. This typically includes full disclosure of assets by both parties, ensuring the agreement is not signed under duress, and confirming that the terms are not unconscionably unfair. It's essential for both parties to have separate legal counsel or at least have the opportunity to seek it before signing to ensure its enforceability.

-

Can a Prenuptial Agreement be modified or revoked?

Indeed, a Prenuptial Agreement can be modified or revoked, but this must be done with the consent of both parties. Any changes or the decision to revoke must be documented in writing, signed, and sometimes even notarized, depending on your state’s laws. It's wise to consult with a legal professional to ensure that any modifications or the revocation process is properly executed.

-

Does a Prenuptial Agreement cover child support or custody?

No, a Prenuptial Agreement does not cover child support or custody issues. The court always has the final say in matters concerning children to ensure that the best interests of the child are met. A Prenuptial Agreement focuses primarily on financial aspects and the division of property and cannot dictate terms for child support or custody arrangements.

-

How does one prepare a Prenuptial Agreement?

Preparing a Prenuptial Agreement involves several steps. Firstly, both parties should fully disclose their assets and debts. Open communication about your financial situation and expectations is crucial. Then, it's wise to draft the agreement with legal assistance to ensure that it's comprehensive and adheres to state law requirements. Once the agreement is drafted, both parties should review it with their separate attorneys before signing. Finally, the agreement should be signed well before the wedding to avoid any claims of duress. Documenting and understanding your state's specific requirements is essential for creating a valid agreement.

Common mistakes

-

Not fully disclosing their assets and debts. Both parties must provide a complete and truthful account of their financial situation. Hiding or omitting assets can not only make the agreement invalid but also lead to future legal disputes.

-

Forgoing independent legal advice. Each party should have their own attorney review the agreement. This ensures that both individuals fully understand the terms and the implications of the agreement.

-

Failing to consider future changes in circumstances. Life events such as the birth of children, career changes, or inheritances should be accounted for to some extent in the agreement.

-

Not allotting adequate time for review. Rushing to sign a prenuptial agreement without proper consideration can lead to oversights and regret. Both parties should take their time to review the document thoroughly.

-

Using ambiguous or unclear language. The terms within the agreement should be clear and specific to avoid misinterpretation and future disputes.

-

Assuming a prenuptial agreement only concerns financial matters. Although finances are a primary concern, the agreement can also address issues like property rights, spousal support, and the division of responsibilities.

-

Using a standard form without customization. A generic template may not cover the unique aspects of the couple's relationship or financial situation. Tailoring the agreement to fit specific needs is crucial.

-

Forgetting to update the agreement. As circumstances change, the agreement should be reviewed and possibly amended to reflect these changes. Regular updates help keep the document relevant and enforceable.

-

Not considering the enforceability of the agreement. Certain provisions may not be enforceable in court. It’s important to ensure that the agreement complies with state laws and court requirements.

Documents used along the form

A prenuptial agreement form is a critical document for couples who are planning to marry, serving to protect individual assets, manage financial responsibilities, and establish property rights before entering into marriage. To bolster the efficacy and comprehensiveness of a prenuptial agreement, several other forms and documents are often utilized alongside it. These supplementary documents ensure that the agreement is well-supported, clear, and enforceable, covering a range of considerations from financial documentation to estate planning.

- Financial Statements: These are comprehensive accounts of each party's financial situation, including assets, liabilities, income, and expenses. They provide a clear snapshot of the financial standing of both individuals.

- Will: A will outlines a person's wishes regarding how their estate and assets should be handled after their death. Including a will can delineate how assets described in the prenuptial agreement are to be distributed.

- Life Insurance Policies: These documents identify the policyholder, the coverage amount, and the beneficiaries. They can be important in ensuring that financial obligations outlined in the prenuptial agreement are met even after one party's death.

- Business Ownership Documents: If either party owns a business, these documents prove ownership and outline the business's valuation. They play a crucial role in the fair division of assets and liabilities.

- Trust Documents: Trusts are arrangements where assets are held by one party for the benefit of another. Trust documents can specify what happens to these assets upon certain conditions, such as marriage or death.

- Real Estate Deeds: A deed is a legal document that proves ownership of property. Including real estate deeds ensures that any property owned by either party is accounted for and addressed in the prenuptial agreement.

- Investment Records: These records show the ownership of stocks, bonds, mutual funds, and other investments, critical for assessing each party's financial status and contributions.

- Debt Documentation: Documents outlining any debts owed by either party, such as loans or credit card statements, are vital for a fair assessment of liabilities.

- Postnuptial Agreement: Though it is finalized after marriage, a postnup can complement a prenuptial agreement by updating or amending terms based on changes in the couple’s situation or assets.

Utilizing these documents alongside a prenuptial agreement form contributes to a thorough and legally sound preparation for marriage. Each document has its specific role in painting a complete picture of the financial and legal circumstances surrounding the union, safeguarding both parties' interests and ensuring clarity and fairness in the agreement. Together, they form a robust framework that supports the initial intentions of the prenuptial agreement, allowing couples to enter into marriage with security and peace of mind.

Similar forms

Postnuptial Agreement: Similar to a prenuptial agreement, a postnuptial agreement also outlines the division of assets and liabilities. However, it is drafted and signed after the couple has already married, not before.

Will: A will is a legal document configuring the distribution of assets after an individual's death. It's similar to a prenuptial agreement in that it specifies how assets should be allocated, though its context and application are for post-death rather than divorce or separation.

Trust: Trusts manage the distribution of assets, often used to avoid probate or to manage an estate on behalf of beneficiaries under certain conditions. Like prenuptial agreements, trusts can dictate conditions under which assets are distributed.

Partnership Agreement: Used in business, this agreement delineates the responsibilities, profit distributions, and other operational rules among partners. It shares the prenuptial agreement's preventive nature, aiming to mitigate disputes by clearly defining terms beforehand.

Separation Agreement: A legal document agreed upon by a couple deciding to live apart, detailing the division of their assets and arrangements for any children involved. It parallels prenuptial agreements by outlining asset division, though it is utilized at the end of or during a pause in the relationship.

Co-habitation Agreement: This agreement is between individuals who live together but are not married. It covers aspects similar to a prenup, such as asset division and financial responsibilities, establishing clear expectations without a marital commitment.

Buy-Sell Agreement: Found in business, especially among co-owners, this outlines what happens if an owner wants out, dies, or is forced to leave the business. Its similarity to a prenuptial agreement lies in the preventive planning for potential future changes in the relationship.

Power of Attorney: This legal document allows an individual to appoint someone else to make decisions on their behalf, possibly including the management of assets. The comparison to a prenuptial agreement comes from the concept of preparing for future scenarios where one's usual ability to manage their affairs is compromised.

Living Will: A living will specifies an individual's preferences for medical treatment in situations where they're unable to communicate. It's akin to a prenuptial agreement in forecasting and making arrangements for potential future circumstances.

Property Settlement Agreement: Specifically drafted during divorce proceedings, this agreement outlines the division of assets and debts between spouses. It's closely related to a prenuptial agreement, with the critical difference being that it's created at the relationship's dissolution, rather than its outset.

Dos and Don'ts

When you're filling out a Prenuptial Agreement form, the process can seem straightforward. However, there are certain do's and don'ts that can make a big difference in protecting your interests. Here's a guide to help you navigate through it efficiently:

Do's:Be transparent about your finances. This includes disclosing all your assets, debts, and income. Honesty at this stage lays a strong foundation for mutual trust and understanding.

Seek independent legal advice. To ensure that the agreement is fair and that you fully understand its implications, both partners should have their own lawyers.

Think about the future. Life changes, such as having children or changes in career, should be considered when creating the agreement.

Keep the language clear and understandable. Avoid using legalese that can make the document confusing. Plain language helps both parties know exactly what they're agreeing to.

Update the agreement as necessary. As life circumstances change, it’s important to revisit and possibly revise the agreement to reflect these changes.

Make sure the agreement is signed well before the wedding. This eliminates any speculation that either party was coerced into signing under pressure.

Don’t hide any assets. This can invalidate the agreement entirely and can lead to legal repercussions down the line.

Avoid making unfair provisions. If the agreement is too one-sided, there’s a chance it won’t hold up in court.

Don’t forget to consider laws specific to your state. Pre-nuptial agreements are subject to state laws, and what’s acceptable in one state may not be in another.

Avoid rushing the process. Giving yourselves ample time to draft, review, and understand the agreement ensures that it accurately reflects your wishes.

Don’t use a generic template without customization. While templates can be a good starting point, every couple’s situation is unique and your agreement should reflect that.

Never pressure the other person into signing. Coercion can invalidate the agreement, plus it’s not a good way to start a marriage.

Misconceptions

Prenuptial agreements, often simplified as "prenups," come with a variety of misconceptions. Understanding the truth behind these legal documents is crucial for any couple considering their options before entering into marriage.

Only wealthy people need prenups. A common misconception is that prenuptial agreements are only for those with a significant amount of assets. However, these agreements can benefit couples of all financial backgrounds by protecting individual assets, clarifying financial rights, and managing debt responsibilities.

Prenups are planning for divorce. While it's true that prenups outline the division of property and financial obligations in the event of a divorce, they are not an indication that a couple expects to split. Instead, think of them as a financial planning tool that can provide peace of mind.

You can include child custody and support details. Many believe that prenuptial agreements can dictate child custody and support arrangements. Legal standards aimed at protecting children's best interests govern these decisions, so they cannot be predetermined in a prenup.

Prenups are only valid if you get divorced. The truth is, these agreements can also come into play during a marriage under certain conditions, such as bankruptcy, and not just in the event of a divorce or separation.

If it's signed, it's set in stone. Not necessarily. Courts can and do set aside prenuptial agreements if they're found to be unfair, signed under duress, or if full disclosure wasn't provided by both parties. It's critical that both individuals understand the agreement fully and enter into it voluntarily.

Everything is split 50/50 in states with community property laws, so prenups aren't needed. Although it's true that community property laws stipulate an equal division of assets acquired during the marriage, prenuptial agreements can specify a different distribution of assets that both parties agree to, providing personalized solutions for unique situations.

You can't change a prenup after you're married. Actually, as circumstances change, couples can amend their prenuptial agreement through a postnuptial agreement, which is a similar document agreed upon after marriage. This flexibility allows couples to adapt to new financial situations or changes in their relationship.

Prenups are too expensive and not worth the cost. The upfront cost of a prenuptial agreement might seem high, but considering the protection it provides and the potential for saving on legal fees in the event of divorce, it's often seen as a wise investment in the long-term financial health of both partners.

Key takeaways

Filling out a Prenuptial Agreement form is a significant step for couples planning to marry, serving to protect their financial interests and outline the handling of financial matters in the event of a separation or divorce. Here are key takeaways to ensure the process is handled thoughtfully and effectively:

- Understand the Purpose: A Prenuptial Agreement isn’t a prediction or expectation of failure but a practical tool for protecting assets and interests. It allows for a clear understanding and agreement on financial matters from the beginning.

- Communicate Openly: Open and honest communication about finances is crucial before drafting a Prenuptial Agreement. Both parties should fully disclose their assets, liabilities, and expectations.

- Consider Future Changes: Life circumstances change. A good Prenuptial Agreement should account for potential future changes, such as inheritance, changes in income, or the birth of children.

- Seek Independent Legal Advice: Both parties should seek independent legal advice from attorneys who specialize in family law. This ensures that each individual’s rights and interests are well-represented and understood.

- Do Not Rush: Allow ample time to discuss, draft, and review the Prenuptial Agreement. Rushing through its preparation can lead to misunderstandings or oversights. Ideally, this discussion should start several months before the wedding.

- Be Fair and Reasonable: Courts can set aside Prenuptial Agreements that are deemed unfair or one-sided. Ensure the terms are reasonable and equitable for both parties.

- Keep it Updated: Review and update the agreement as your marriage evolves and as your financial situations change. Amendments should be made with the consent of both parties.

- Understand It’s Not Only About Divorce: While often associated with divorce, a Prenuptial Agreement also handles estate planning and financial responsibilities during the marriage.

- Ensure Proper Formalities: For a Prenuptial Agreement to be legally binding, it must be in writing, signed by both parties, and executed properly according to state laws. Witnesses or a notary public may also be required.

- Consider State Laws: Since laws vary by state, it’s important to understand how your state views Prenuptial Agreements. Some states follow community property rules while others are equitable distribution states.

Thoughtfully considering these aspects can help couples create a Prenuptial Agreement that supports their marriage with a foundation of transparency, fairness, and mutual respect. Remember, this legal document is about protecting both individuals and their future together.

Popular PDF Forms

Ga Firearm Bill of Sale - Designed by legal professionals, this form aids in the transparent and lawful exchange of firearms, safeguarding both parties' interests.

Pa100 Form - The PA-100 form helps new employers register for the state's unemployment compensation system.