Blank Proliant W2 Reprint Request PDF Template

Understanding the Proliant W2 Reprint Request form is vital for both employers and employees navigating the correction or replacement of a W-2 form due to errors or loss. This form serves the specific purpose of facilitating corrections in an employee’s Social Security Number or name if misspelled, and it provides a means to obtain a reprint of a lost W-2, crucial for accurate tax filing. However, it's critical to note the time sensitivity of this form; for changes in name or Social Security Number, it's usable only until February 28, after which the W-2C form becomes necessary. The form requires detailed information, including the company’s name and contact information, the correct and incorrect employee names and Social Security Numbers, the tax year in question, and the specific corrections needed. Additionally, the form offers various delivery methods for the reprinted W-2, which will be sent to the employer for distribution to the employee and highlights the associated costs for these services. The reprint, notably, doesn't have to be on an official W-2 form but will be marked as a "REISSUED STATEMENT," ensuring it's recognized for tax purposes. Completing this form accurately and understanding the instructions are essential steps for employers to ensure their employees have the necessary documents for tax filing, showcasing an understanding of the complexities involved in maintaining accurate employment records.

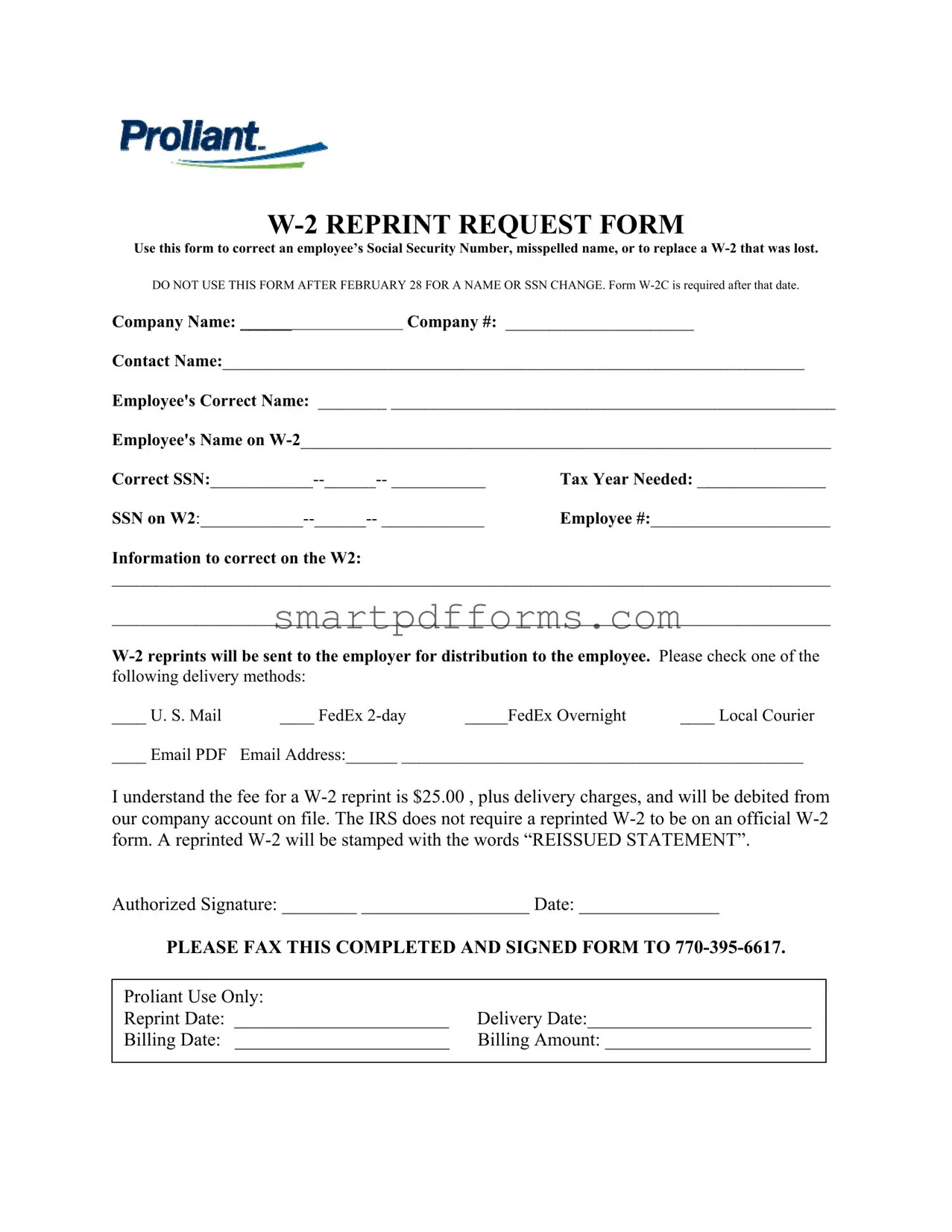

Preview - Proliant W2 Reprint Request Form

Use this form to correct an employee’s Social Security Number, misspelled name, or to replace a

DO NOT USE THIS FORM AFTER FEBRUARY 28 FOR A NAME OR SSN CHANGE. Form

Company Name: ______ Company #: ______________________

Contact Name:____________________________________________________________________

Employee's Correct Name: ________ ____________________________________________________

Employee's Name on

Correct |

Tax Year Needed: _______________ |

SSN on |

Employee #:_____________________ |

Information to correct on the W2:

____________________________________________________________________________________

____________________________________________________________________________________

____ U. S. Mail |

____ FedEx |

_____FedEx Overnight |

____ Local Courier |

____ Email PDF |

Email Address:______ _______________________________________________ |

||

I understand the fee for a

Authorized Signature: ________ __________________ Date: _______________

PLEASE FAX THIS COMPLETED AND SIGNED FORM TO

Proliant Use Only: |

|

Reprint Date: _______________________ |

Delivery Date:________________________ |

Billing Date: _______________________ |

Billing Amount: ______________________ |

|

|

Form Data

| Fact | Description |

|---|---|

| Usage Period | This form should not be used for name or Social Security Number changes after February 28. Form W-2C is required instead. |

| Correctable Information | It allows for the correction of an employee's Social Security Number, misspelled name, or the replacement of a lost W-2. |

| W-2 Distribution | Reprinted W-2s are sent to the employer for distribution to the employee. |

| Delivery Options | Options include U.S. Mail, FedEx (2-day or Overnight), Local Courier, or Email PDF. |

| Reprint Fee | A fee of $25.00, plus delivery charges, will be debited from the company account on file for a W-2 reprint. |

| IRS Requirements | The IRS does not require a reprinted W-2 to be on an official form; it will be stamped with “REISSUED STATEMENT”. |

| Submission Method | The completed and signed form must be faxed to 770-395-6617. |

| Authorized Signature | An authorized signature is required to validate the reprint request form. |

| Contact Details | The form requests the company name, number, and contact name for processing and billing. |

| Governing Laws | Not specified in form contents, but these requests usually adhere to federal IRS requirements and may also be influenced by state-specific employment laws where applicable. |

Instructions on Utilizing Proliant W2 Reprint Request

Filling out the Proliant W-2 Reprint Request form is a straightforward process when you've misplaced your original W-2 form or when corrections are needed for an employee's information. It is essential for ensuring accurate records for tax purposes. The form allows for the correction of Social Security numbers, misspelled names, or the replacement of a lost W-2. Keep in mind that for name or Social Security number changes after February 28, a W-2C form is required instead. Here's how to fill out the form:

- Start by entering the Company Name and Company # at the top of the form.

- Fill in the Contact Name with the person's name who is responsible for this request.

- Proceed to input the Employee's Correct Name as it should appear on the W-2.

- Next, write down the Employee's Name on W-2 as it is currently incorrect or how it appeared on the lost W-2.

- Enter the Correct Social Security Number (SSN) next, ensuring accuracy as this is crucial for tax records.

- Note the Tax Year Needed to specify for which year the reprint or correction is needed.

- State the incorrect SSN on W2, if applicable, for records.

- Provide the Employee # to help identify the employee within the company's system.

- Under Information to correct on the W2, list all corrections or note that it is a reprint request due to a lost W-2.

- Choose one of the delivery methods offered (U.S. Mail, FedEx 2-day, FedEx Overnight, Local Courier, or Email PDF) and provide the relevant delivery information, such as an email address if choosing Email PDF.

- Acknowledge the fee for a W-2 reprint, which is $25.00, plus delivery charges, by checking the box. This amount will be debited from the company account on file.

- Sign and date the form under Authorized Signature and Date, respectively, to validate the request.

- Finally, fax the completed and signed form to 770-395-6617 as directed.

After submitting the form, Proliant will process your request, and the reprint or corrected W-2 will be sent according to the chosen delivery method. It will be stamped with "REISSUED STATEMENT" to indicate that it's a reprint. Remember to double-check all information for accuracy before sending to avoid further corrections.

Obtain Answers on Proliant W2 Reprint Request

- What is the Proliant W2 Reprint Request form used for?

- Can I use this form to change my name or Social Security Number after February 28?

- How will the reprinted W-2 forms be delivered?

- Is there a fee associated with the W-2 reprint request?

- Do reprinted W-2 forms need to be on official W-2 paper?

- How can I submit the completed Proliant W2 Reprint Request form?

The Proliant W2 Reprint Request form is a critical document used by employers to correct an employee's Social Security Number (SSN), amend a misspelled name, or to request a replacement for a lost W-2 form. It is designed to ensure that employees receive accurate and timely W-2 forms, which are essential for filing their tax returns. However, it's important to note that this form should not be used after February 28 for a name or SSN change; in such cases, form W-2C is required.

No, you cannot use the Proliant W2 Reprint Request form for changes to your name or Social Security Number after February 28. If you need to make such changes after this date, the IRS requires a W-2C form to be filled out instead. The W-2C form is specifically designed for correcting information on previously issued W-2 forms.

The delivery of reprinted W-2 forms is flexible, offering several options to suit different needs. Once processed, the reprints will be sent directly to the employer by either U.S. Mail, FedEx 2-day, FedEx Overnight, local courier, or as an Email PDF, depending on the delivery method selected on the request form. This enables employers to then distribute the forms to their employees in a timely and convenient manner.

Yes, there is a $25.00 fee for the W-2 reprint service, which covers the cost of processing the request. Additionally, delivery charges may apply depending on the selected delivery method. These fees will be automatically debited from the company account on file with Proliant. It's vital for employers to be aware of and consent to these charges before submitting their request.

No, the IRS does not require a reprinted W-2 to be on an official W-2 form. However, to distinguish it from the original issuance, a reprinted W-2 will be stamped with the words "REISSUED STATEMENT." This ensures that the form is recognized as a legitimate reprint and not confused with the original document.

Once the Proliant W2 Reprint Request form has been completed and duly signed, it should be submitted by fax to 770-395-6617. This direct submission method is designed to make the process as efficient as possible, ensuring prompt processing and reducing the potential for delays in receipt of the reprinted W-2 forms.

Common mistakes

Filling out the Proliant W-2 Reprint Request form can be a straightforward task, but mistakes can easily occur if attention to detail is overlooked. To improve accuracy and ensure the process is smooth, here are some common mistakes people make:

- Submitting the form after the February 28 deadline for name or Social Security Number (SSN) changes, thereby requiring a Form W-2C instead.

- Failure to provide the correct company number, which can delay the request or result in it being sent to the wrong company.

- Incorrectly filling out either the employee's correct name or the name as it appears on the W-2, leading to confusion or incorrect reprints.

- Entering the SSN incorrectly on the request form, which is critical for matching the correct employee records.

- Omitting the tax year needed for the W-2 reprint, which is crucial for processing the correct document.

- Forgetting to specify the information needing correction on the W-2, if applicable, which could result in an incomplete correction process.

- Neglecting to choose a delivery method or providing an incorrect email for PDF delivery, thereby causing delays in receiving the reprinted W-2.

- Omitting the authorized signature and date, which are required to validate the request and authorize the fee and delivery charges to be debited.

In addition to these specific slip-ups, there are general practices that should be avoided:

- Not double-checking the form for accuracy before submission.

- Using outdated contact information that could lead to miscommunication.

- Assuming the form has been processed without receiving confirmation from Proliant or checking with the company contact for status updates.

By addressing these common errors and proceeding with careful attention to the instructions and details, the process of requesting a W-2 reprint can run more efficiently, reducing delays and ensuring that employees receive their necessary tax documents promptly and accurately.

Documents used along the form

When managing employee tax documents and information, employers often need more than just the Proliant W2 Reprint Request form. Various forms and documents complement the reprint request form, each serving a unique purpose in the broader context of employee tax reporting and compliance. Here's an overview of some commonly used forms and documents in conjunction with the Proliant W2 Reprint Request form to ensure a thorough and accurate process.

- Form W-2C: This form is essential for correcting information on a previously filed W-2 form. If changes are needed for the Social Security Number (SSN) or the employee's name after February 28th, Form W-2C becomes necessary.

- Form W-3: The Transmittal of Wage and Tax Statements form is used to submit the original W-2 forms to the Social Security Administration. It summarizes the information reported on all W-2 forms for a given employer.

- Form W-4: The Employee's Withholding Certificate allows employees to determine the amount of federal income tax to withhold from their pay. It might be relevant if employees need changes to their withholdings after correcting their W-2 information.

- Form 941: The Employer's Quarterly Federal Tax Return is used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks. It may need reviewing if discrepancies in W-2 forms are detected.

- Form SS-4: This Application for Employer Identification Number (EIN) form is used when a business needs to obtain an EIN. Occasionally, issues with W-2 forms might trace back to incorrect or missing EIN information.

- State-specific W-2 Reporting Forms: Many states require their version of the W-2 form or additional documents for state income tax reporting purposes. Employers must ensure these forms are consistent with federal W-2 forms.

- Direct Deposit Authorization Forms: While not directly related to tax reporting, these forms might be collected or updated in conjunction with W-2 information changes, especially if the changes affect payroll processing.

Together, these documents and forms contribute to a comprehensive approach to employee tax document management. Employers must understand each document's role and requirements to maintain compliance and ensure accurate income reporting. Correcting and reissuing W-2 forms is a critical component of this process, but it’s just one part of ensuring that both employer and employee tax information is complete and accurate.

Similar forms

Documents similar to the Proliant W2 Reprint Request form serve various functions, from correcting personal information to requesting specific employee documents. Each plays a vital role in ensuring accurate and timely management of employee records or requests within a company's HR processes.

Form W-2C (Corrected Wage and Tax Statement) - Just like the W-2 Reprint Request allows corrections to an employee's Social Security Number or name, the W-2C is used to correct information on a previously filed W-2 form. However, it's specifically for corrections after the deadline mentioned in the Reprint Request form and covers a broader range of corrections.

Form I-9 (Employment Eligibility Verification) - This form is another document focused on personal information, requiring accurate employee data, similar to the Proliant form which corrects names and SSNs. Though it serves a different purpose—verifying the eligibility of individuals to work in the United States—it parallels the need for accurate personal details.

Direct Deposit Authorization Form - This shares a similar concept with the W-2 Reprint Request in that they both involve an employee's financial dealings, though one is for correcting tax documents and the other is for setting up paycheck deposits. It also typically requires sensitive information like a Social Security Number.

Form 1099-MISC (Miscellaneous Income) - Similar to the W-2 form in its tax-related nature, the 1099-MISC is used for freelancers or independent contractors. It parallels the need for accuracy in personal and payment information to ensure compliance with tax laws.

Change of Address Form - While not tax-related, this form is significant for maintaining current records, akin to correcting an employee's name or SSN with the Reprint Request. The critical nature of keeping personal information up to date is a shared feature between these documents.

Employee Information Form - This form collects new employee data at the onset of employment, necessitating accurate personal and contact information like the Proliant form does for existing records. It ensures that fundamental employee details are correct from the start.

Request for Leave of Absence Form - Though it serves a different functional purpose, focusing on leave requests, it is similar in the sense that it also requires employee identification details. It underscores the need for accurate employee information in diverse HR processes.

Employee Feedback Form - This document, focused on gathering feedback from employees, requires proper identification of the personnel involved, similar to how the W-2 Reprint Request form identifies the employee needing corrections to their W-2. It stresses the importance of correctly identifying employees for administrative purposes.

In summary, these documents, though varied in function—from correcting employee information to processing tax documents and handling feedback—all emphasize the importance of accurate employee records and personal details. Similar to the Proliant W2 Reprint Request form, each plays a critical role in the smooth operation of HR and payroll processes within a company.

Dos and Don'ts

Filling out the Proliant W2 Reprint Request form is an important process that requires careful attention to detail. Here are ten things you should and shouldn't do to ensure the form is completed accurately and efficiently.

Things you should do:

- Verify the employee’s information (Social Security Number and name) for accuracy before submission.

- Ensure you are using the form before the February 28 deadline for a name or SSN change. After this date, Form W-2C is required.

- Include the correct company name and company number as registered.

- Choose the most appropriate delivery method that meets your needs, whether it's U.S. Mail, FedEx 2-day, FedEx Overnight, Local Courier, or Email PDF.

- Confirm the email address if you select Email PDF as your delivery method, ensuring it is accurate and accessible.

- Understand and accept the fee for a W-2 reprint, including delivery charges, that will be debited from the company account on file.

- Sign and date the form to provide the necessary authorization for the reprint request.

Things you shouldn't do:

- Don’t delay in submitting the form if you're close to the deadline to avoid any penalties or delays in processing.

- Avoid using incorrect information when specifying what needs to be corrected on the W2.

- Do not overlook the delivery method section; failing to choose one can result in processing delays.

- Refrain from sending incomplete forms; assure all required fields are filled out to prevent processing delays.

Misconceptions

When tackling the subject of W-2 forms and, in particular, the Proliant W2 Reprint Request form, it's essential to clear the air on several misconceptions that often swirl around the process. Misunderstandings can lead to unnecessary stress and complications, especially during the taxing tax season. Here are four widespread but inaccurate beliefs about the Proliant W2 Reprint Request form.

- Misconception #1: The Proliant W2 Reprint Request form can be used for any corrections at any time.

Many believe that this form serves as a one-stop solution for any corrections, regardless of the time of year. However, it's specifically designed to correct an employee's Social Security Number, misspelled name, or replace a lost W-2 before February 28. For changes to a name or SSN after this date, a different form, Form W-2C, is required.

- Misconception #2: You can request to have the W-2 reprint sent directly to the employee.

This is a common misbelief. The Proliant W2 Reprint Request form clearly states that reprints will be sent to the employer for distribution. This measure ensures the employer can maintain accurate records of all forms distributed to their employees.

- Misconception #3: The IRS requires a reprinted W-2 to be on an official form.

It's easy to think that strict IRS regulations would mandate a reprinted W-2 to be on an "official" form. However, this isn't the case. The IRS does not require this; a reprinted W-2, which will be stamped with "REISSUED STATEMENT," is perfectly valid for IRS purposes.

- Misconception #4: It’s free to get a W-2 reprint.

Another widespread myth is that requesting a reprint of a W-2 form is free of charge. In reality, there is a $25.00 fee, plus delivery charges, for each W-2 reprint request. This fee will be debited from the company's account on file, emphasizing the importance of keeping track of the original copies.

Understanding the specifics of the Proliant W2 Reprint Request form can save time and prevent frustration. Clarifying these misconceptions empowers both employers and employees to navigate tax season more smoothly, ensuring that everyone is on the same page and reducing the potential for errors or delays.

Key takeaways

Filling out and using the Proliant W2 Reprint Request form is an important process for correcting employee information or replacing lost W-2 forms. Here are five key takeaways to help you understand and navigate this form effectively:

- Correct Timing: It's crucial to use this form for corrections before the end of February. For changing an employee's name or Social Security Number (SSN) after February 28, a W-2C form is required instead.

- Accurate Information is Key: Ensure that the employee’s correct name, SSN, and the tax year needed are clearly and accurately filled in. Mistakes can delay the process or result in incorrect tax filings.

- Reprint Fees: There is a $25.00 fee for each W-2 reprint, in addition to delivery charges. These fees will be debited from the company's account on file, so confirm the account's readiness for this transaction.

- Delivery Options: You have several options for how the reprinted W-2 is delivered, including U.S. Mail, FedEx (2-day or overnight), local courier, or email PDF. Choose the option that best meets your urgency and security needs.

- Authorized Signature: An authorized signature is required to process the reprint request. This ensures that the request is legitimate and protects against unauthorized changes or requests.

By understanding these key points, you can ensure a smooth and efficient process for handling W-2 reprint requests, keeping your payroll records accurate and up to date.

Popular PDF Forms

Seller Credit Addendum - By detailing the escrow requirement for taxes and insurance, the addendum ensures that the property remains insured and tax-compliant.

Fire Alarm Frequency - A foundational tool in the management and documentation of fire alarm systems, ensuring proper installation and operation.

Hospital Release - Provides a structured format for detailing the recipient of the medical information, along with their contact details.