Blank Proof Of Funds Letter Sample PDF Template

Navigating the financial aspects of major transactions, such as buying property or business acquisitions, often requires solid proof of financial stability. A Proof of Funds (POF) letter serves as this assurance, signifying that individuals or companies possess the necessary financial resources for the transaction. The POF letter is not merely a formality; it's a pivotal document that can smooth the path towards closing deals by providing sellers or parties on the other end with confidence in the buyer's financial capabilities. An exemplary Proof of Funds Letter includes critical elements such as the bank’s letterhead, the date, and comprehensive bank and contact details, ensuring authenticity and reliability. It specifies the principal buyer's name and their affiliation, whether as the owner or partner of a company, and outlines the financial relationship with the bank—be it cash deposits or lines of credit, expressed in clear, unambiguous figures. The letter underscores the buyer's value to the bank, leveraging the institution’s credibility to vouch for the buyer's fiscal health. Ending with the banker's contact information, it opens a direct line for verification, further instilling trust among all parties involved. This document is more than just a form; it's a foundational brick in constructing financial trust in transactions, underscoring the importance of accuracy, clarity, and thoroughness in its preparation.

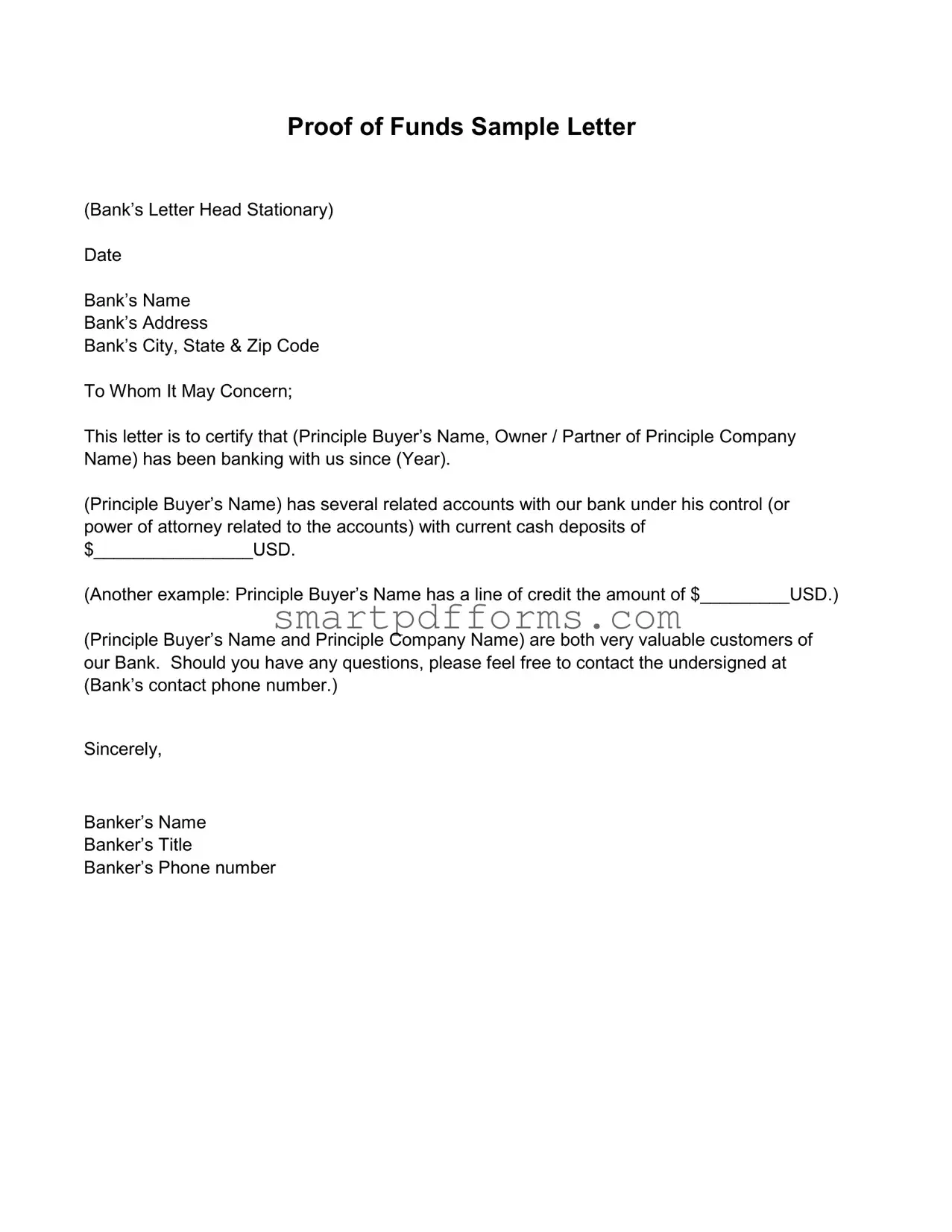

Preview - Proof Of Funds Letter Sample Form

Proof of Funds Sample Letter

(Bank’s Letter Head Stationary)

Date

Bank’s Name

Bank’s Address

Bank’s City, State & Zip Code

To Whom It May Concern;

This letter is to certify that (Principle Buyer’s Name, Owner / Partner of Principle Company Name) has been banking with us since (Year).

(Principle Buyer’s Name) has several related accounts with our bank under his control (or power of attorney related to the accounts) with current cash deposits of $________________USD.

(Another example: Principle Buyer’s Name has a line of credit the amount of $_________USD.)

(Principle Buyer’s Name and Principle Company Name) are both very valuable customers of

our Bank. Should you have any questions, please feel free to contact the undersigned at (Bank’s contact phone number.)

Sincerely,

Banker’s Name

Banker’s Title

Banker’s Phone number

Form Data

| Fact | Description |

|---|---|

| 1. Document Type | Proof of Funds Sample Letter |

| 2. Required Information | The letter must include the bank's name, address, the principal buyer's name, the company name, banking relationship duration, and details of accounts or lines of credit. |

| 3. Purpose | To certify the financial capability of the principal buyer. |

| 4. Stationery | Must be on the bank’s letterhead stationary. |

| 5. Key Figures | It should state the current cash deposits or line of credit in USD. |

| 6. Authentication | Includes banker’s name, title, and contact phone number for verification. |

| 7. Governing Law | While the form itself does not specify state-specific laws, the interpretation and requirements may vary by state. Therefore, it's advisable to be aware of any local regulations that might affect the validity or presentation of the proof of funds letter. |

Instructions on Utilizing Proof Of Funds Letter Sample

Filling out a Proof of Funds Letter requires precision and attention to detail. This letter serves as a formal indication that a person or a company has the financial capability to complete a transaction. It's often used in real estate dealings, business acquisitions, or any scenario where proving financial stability is necessary. Following a specific sequence of steps can help ensure that the information presented is both accurate and reliable.

- Start by adding the Bank's Letterhead Stationary at the top of the document. This typically includes the bank's name, logo, and contact information.

- Enter the Date when the letter is being issued.

- Fill in the Bank's Name, Address, City, State, and Zip Code in the designated spots right at the beginning of the letter.

- Begin the body of the letter with the phrase "To Whom It May Concern;" to ensure that the letter is formally addressed to all relevant parties.

- Insert the Principle Buyer’s Name and the Principle Company Name (if applicable) where indicated. This identifies who the proof of funds letter is concerning.

- Specify the Year the principle buyer has been banking with the bank. This information provides a sense of the length of the banking relationship.

- Detail the current cash deposits or line of credit available under the buyer’s name (as applicable) by adding the correct amounts in the spaces provided. This is crucial for showcasing the financial capability.

- Reiterate the value the bank places on the relationship with the principle buyer and company by completing the sentence provided emphasizing their importance to the bank.

- Include the Banker’s Name, Title, and Phone Number at the bottom. This contact information is important for follow-up or verification purposes.

Once completed, this proof of funds letter should provide a credible testament to the financial stability of the individual or entity named within. It is important to review the letter for accuracy and ensure that all information is current and truthful. The letter can then be submitted to the relevant parties as part of the financial verification process in their specific transaction.

Obtain Answers on Proof Of Funds Letter Sample

-

What is a Proof of Funds (POF) Letter?

A Proof of Funds letter is a document issued by a bank or financial institution confirming that an individual or entity has sufficient funds available to complete a transaction. This letter typically shows the account holder's name, balance in a specific account, and the date of the account statement. It is often required in large transactions, such as real estate purchases, to demonstrate the buyer’s financial capability.

-

Why is a Proof of Funds Letter necessary?

This letter serves as verification from a credible financial institution that the buyer has enough liquid assets to fulfill the purchase. It provides the seller with the confidence that the buyer can complete the transaction without financial hitches. In many cases, it is a prerequisite for sellers to even engage in negotiations or accept offers.

-

What information is typically included in a Proof of Funds Letter?

- Date of issue and bank’s contact information

- Account holder's name

- Statement declaring the availability of funds

- Balance of the accounts in question

- Banks official signature and contact information for follow-up

-

How can one obtain a Proof of Funds Letter from their bank?

Contact your bank or financial institution directly to request a Proof of Funds Letter. You may need to speak with your account manager or visit the bank in person. Generally, you must provide identification and specify the required information, such as the accounts to be verified. Each bank's process might vary, and some may charge a fee for this service.

-

Is there a cost associated with getting a Proof of Funds Letter?

Some banks might charge a nominal fee to prepare a Proof of Funds Letter, while others may offer this service for free, especially to long-standing or high-value customers. It is advisable to check with your bank about any applicable fees beforehand.

-

What is the validity period of a Proof of Funds Letter?

Proof of Funds Letters do not have a standardized validity period; it largely depends on the requirements of the transaction or the requestor. However, given that financial situations can change rapidly, sellers or counterparties often require a letter that is no more than 30-60 days old.

-

Can a Proof of Funds Letter be issued for international transactions?

Yes, banks can issue Proof of Funds Letters for international transactions. It's imperative, however, to inform the bank that the letter will be used internationally, so they can ensure that it meets the required standards and formats of the receiving party or country.

-

Are Proof of Funds Letters legally binding?

While a Proof of Funds Letter itself does not bind the account holder to proceed with the transaction, it serves as a formal attestation by the bank of the account holder's current financial status. Legal implications may arise if the letter is fraudulently obtained or used for deceitful purposes.

-

How is a Proof of Funds Letter different from a pre-approval letter for a loan?

A Proof of Funds Letter confirms that an individual or entity has sufficient liquid assets available, whereas a pre-approval letter indicates that a lender is willing to loan a specified amount of money under certain conditions. The former demonstrates available wealth, while the latter shows borrowing capacity.

Common mistakes

Filling out a Proof of Funds Letter can be straightforward, but common mistakes often occur. Avoiding these can help ensure your document is effective and accurately represents your financial standing. Here are five of the most common errors:

Incorrect Information: Using incorrect details for the bank's name, address, or the principal buyer's name and account information can invalidate the letter.

Not Using Bank Letterhead: The legitimacy of a Proof of Funds Letter greatly depends on it being on the bank's official letterhead, something often overlooked.

Omission of Key Details: Leaving out crucial information, such as the specific amount of funds or failing to mention both cash deposits and lines of credit, could lead to misunderstandings or a lack of trust from the party requesting the proof.

Failure to Sign: An unsigned letter may be perceived as incomplete or not fully authorized by the bank, making it important to ensure that the banker's signature is included.

Lack of Current Date: Not dating the letter or using an outdated date can question the present accuracy of the stated funds.

Avoiding these mistakes is crucial for the confidence and clarity a Proof of Funds Letter is meant to provide. Here are additional tips to make your document even more effective:

Verify all the information with your bank before submitting the letter to ensure accuracy.

Ensure the document is tailored to the specific requirements of the entity requesting proof of funds, as they may vary.

Keep the letter concise and to the point, only including necessary details to prove your financial capability.

Maintain a professional tone throughout the letter to reflect the seriousness and formality of the financial declaration.

By paying attention to these commonly made mistakes and following the additional advice, you can efficiently demonstrate your financial readiness and reliability with a Proof of Funds Letter.

Documents used along the form

When preparing to demonstrate financial credibility, a Proof of Funds Letter is a crucial document. This letter confirms the availability of funds for transactions such as purchasing real estate or securing a business deal. Alongside this letter, several other documents are often required to comprehensively support financial dealings or applications.

- Bank Statements: These provide a detailed record of transactions within a specific period, offering a snapshot of the account holder's financial stability and activity.

- Credit Report: A credit report is critical for assessing the creditworthiness of an individual or an entity. It outlines the credit history, including loans, repayment timelines, and any defaults or delays in payments.

- Asset Appraisals: In transactions involving significant assets, an official appraisal report can verify the value of these assets. This is particularly relevant in dealings that require collateral.

- Business Financial Statements: For transactions involving businesses, financial statements such as balance sheets, income statements, and cash flow statements offer insight into the health and performance of the business.

Together with a Proof of Funds Letter, these documents create a comprehensive profile of financial health and capabilities. Each plays a distinct role in ensuring the parties involved in a transaction have a clear and accurate understanding of the financial landscape. This suite of documentation is essential for proceeding with confidence in any substantive financial engagement.

Similar forms

Bank Reference Letter: Similar to a proof of funds letter, a bank reference letter also comes from a bank and serves as a testament to a person's financial responsibility and reliability. However, instead of confirming specific funds or credit lines available, it generally attests to the good standing and character of the account holder over a period of time.

Credit Verification Letter: This document is used to verify the creditworthiness of an individual or entity, similar to how a proof of funds letter verifies available cash or credit resources. However, a credit verification letter focuses more on credit history and payment reliability rather than current account balances.

Loan Pre-Approval Letter: A loan pre-approval letter, issued by lenders, shows the amount a buyer is approved to borrow. It's similar to a proof of funds letter in that both provide assurance to sellers that the buyer has financial means. The key difference is that one confirms existing funds, while the other confirms potential borrowing capacity.

Income Verification Letter: Employers issue income verification letters to confirm an employee's current income and employment status. Though distinct, it serves a similar purpose to a proof of funds letter by providing evidence of financial stability, yet through income rather than bank account balances.

Escrow Account Letter: An escrow account letter demonstrates that funds have been secured in a third-party account for a specific transaction, offering a level of assurance similar to a proof of funds letter. While the proof of funds shows general financial capability, an escrow letter indicates funds have already been earmarked for a particular use.

Bank Guarantees: A bank guarantee offers a more secure form of transaction assurance compared to a proof of funds letter. It ensures that the financial institution will cover costs if the client fails to fulfill a contractual agreement, indicating more than just available funds but also backing for transaction completion.

Investment Statement: Similar to a proof of funds letter, an investment statement shows the current value of an individual's or entity's investment accounts. While it serves to demonstrate financial resources, it reflects market-based assets, which may include stocks and bonds, rather than cash deposits or lines of credit.

Mortgage Statement: A mortgage statement provides details about the balance, payments, and other information regarding a mortgage, showcasing a person's financial commitments and capacity. Though it primarily records debt rather than assets, it similarly gives insight into an individual's financial state.

Asset Verification Letter: This type of letter confirms the assets owned by an individual or entity, which could include cash, investments, property, and other valuable goods. While it covers a broader range of assets than a proof of funds letter, both documents serve to establish financial credibility.

Dos and Don'ts

When completing the Proof of Funds Letter form, it is essential to provide accurate and clear information. This documentation serves as a testimonial to a buyer's financial capability. To ensure this process is handled effectively, there are several dos and don'ts to consider:

- Do ensure the letterhead of the bank is used for this letter. It lends credibility to the document.

- Do fill in the principal buyer's name and the principle company's name accurately to avoid any confusion or misrepresentation.

- Do verify the amounts stated in the letter, whether it's cash deposits or a line of credit, to reflect the current standing accurately.

- Do include the bank’s contact information, including the contact number of the person who can verify the letter’s claims.

- Do have the letter signed by an authorized bank official to confirm its authenticity.

- Do not leave out the signature and title of the bank's representative; this is crucial for verification purposes.

- Do not fabricate or exaggerate the financial details. The truth will likely emerge and could jeopardize the transaction and your credibility.

- Do not use informal language or incorrect formatting. This is a formal document and should be treated as such.

- Do not forget to include the date on the letter. The currency of the information is essential for the proof of funds to be valid.

Misconceptions

When dealing with real estate transactions, letters verifying the availability of funds, known as Proof of Funds (POF) letters, become indispensable. However, there are several common misconceptions about these documents that need clarification to ensure both parties involved—buyers and sellers—are on the same page.

Misconception 1: POF Letters Guarantee Payment

A common misunderstanding is that a Proof of Funds Letter guarantees payment to the seller. While a POF letter does indicate that the buyer has access to a certain amount of money, it doesn’t guarantee that these funds will be used for the purchase. The letter serves as verification of the buyer's financial capability at the time of issuing the letter. Market fluctuations or unexpected changes in the buyer’s financial situation can affect the availability of these funds later on.

Misconception 2: POF Letters Must Disclose Detailed Financial Information

Another misconception is that Proof of Funds letters must include detailed financial information, such as account numbers or exhaustive lists of assets. In reality, POF letters need only to show that the buyer has enough available funds to complete the transaction. They do not need to detail how these funds are distributed across accounts or the specific assets the buyer possesses. This misunderstanding can lead to unnecessary invasion of privacy and resistance from buyers hesitant to disclose sensitive financial information.

Misconception 3: Only Banks Can Issue POF Letters

It’s often thought that only banks can issue valid Proof of Funds letters. While banks are a common and credible source, other financial institutions like credit unions or investment firms can also issue POF letters. The key aspect is the institution’s credibility and the verifiability of the information provided, not solely the institution's nature. This broadens the horizon for buyers who may have their funds in various types of financial establishments.

Misconception 4: POF Letters are Legally Binding

A significant misconception is that a POF letter constitutes a legally binding commitment by the bank or financial institution to ensure the buyer's purchase of property. In reality, a POF letter is a snapshot of a buyer's financial capability at a given moment and does not bind the financial institution to fund the purchase if the buyer defaults or encounters financial difficulties down the line. The letter assures the seller of the buyer’s current financial health and readiness to proceed but not much beyond that.

In summary, understanding the nuances and limitations of Proof of Funds letters is crucial for both buyers and sellers in real estate transactions. By dispelling these misconceptions, all parties can manage their expectations and responsibilities, ensuring smoother, more informed negotiations and transactions.

Key takeaways

When filling out and using the Proof of Funds Letter Sample form, understanding the significance and the correct way to approach this document is crucial for individuals and businesses. Here are four key takeaways to guide you through the process:

- Use Official Bank Letterhead: It's imperative to ensure that the Proof of Funds Letter is printed on the bank's official letterhead. This includes the bank’s name, address, city, state, and zip code at the top of the document. The inclusion of these official details lends credibility to the letter and verifies the authenticity of the bank's communication.

- Details of the Account Holder: The letter must clearly identify the principle buyer by full name and, if applicable, the name of the principle company. It should also mention the duration of the account holder's relationship with the bank. Including these specifics confirms the account holder's identity and their long-standing relationship with the financial institution.

- Financial Information: Critical to the letter’s purpose is the disclosure of current cash deposits or a line of credit available to the principle buyer, stated in USD. This financial information must be accurate and reflect the account holder's current financial standing. This not only demonstrates financial credibility but also reassures the recipient of the letter about the account holder’s financial health and stability.

- Contact Information for Verification: The letter should conclude with the name, title, and contact phone number of the bank representative. This allows the recipient of the letter to verify the information if necessary. Providing a direct contact for inquiries shows transparency and facilitates trust between all parties involved.

Adhering to these guidelines when filling out and presenting a Proof of Funds Letter ensures that the document achieves its intended purpose effectively. Whether used for business transactions, investment purposes, or real estate dealings, a well-prepared Proof of Funds Letter is a powerful tool in demonstrating financial capability.

Popular PDF Forms

Will My Insurance Go Up If Someone Hits Me Geico - Provide a detailed summary of the accident on the form, ensuring key details including the GEICO insured and the claim number are mentioned.

Colorado Department of Real Estate - Provides a practical solution for sellers needing short-term housing immediately after sale.