Blank Ptax 401 PDF Template

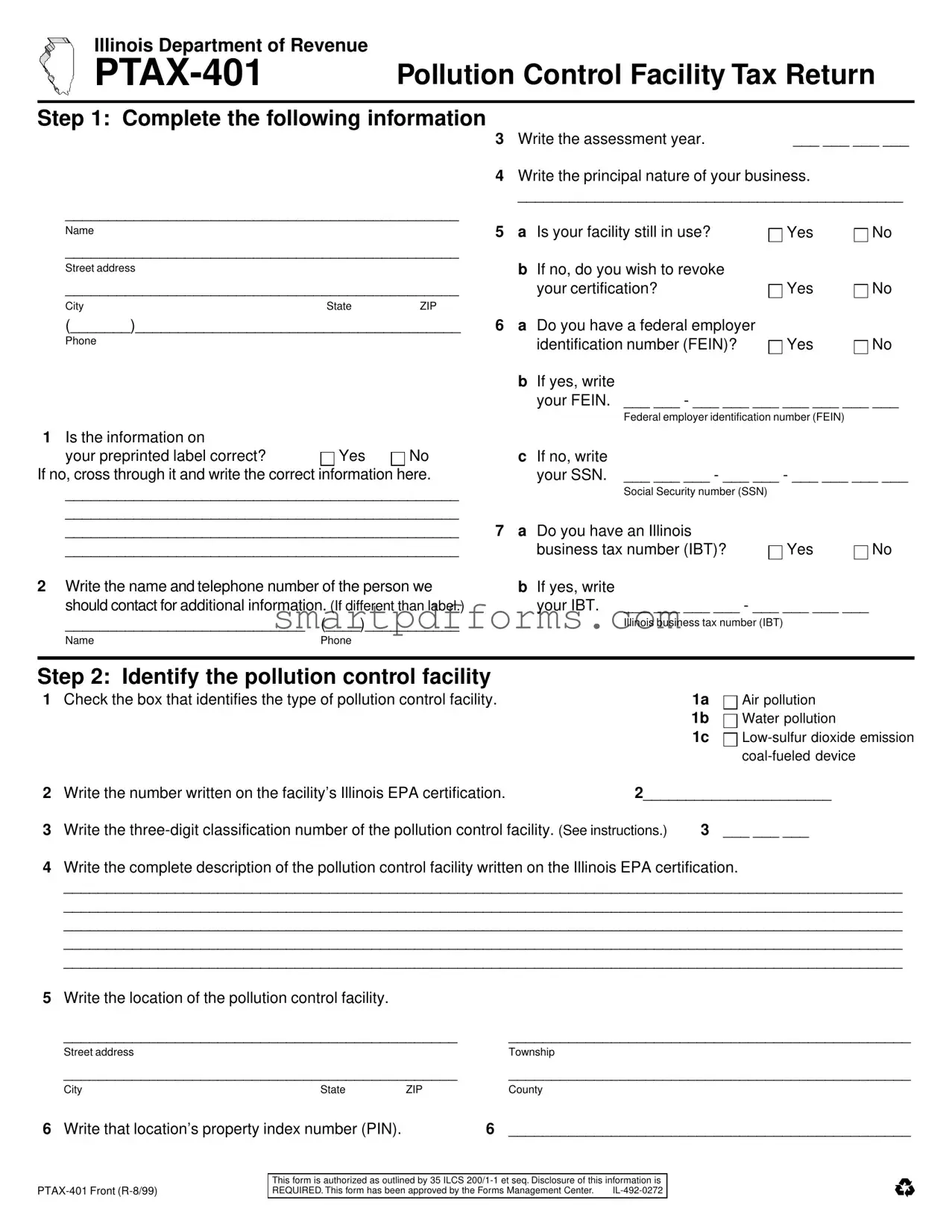

In the realm of environmental responsibility and compliance, the Illinois Department of Revenue PTAX-401 Pollution Control Facility Tax Return emerges as a crucial document for facility owners. This form is a testament to Illinois’s legislative commitment to pollution control and environmental protection. It serves as a detailed reporting tool for the assessment year, requiring comprehensive information about pollution control facilities, including their nature, usage status, and pertinent identification numbers such as the Federal Employer Identification Number (FEIN) and the Illinois Business Tax Number (IBT). Additionally, it delves into the specifics of the pollution control facility, such as its type—be it for air, water, or low-sulfur dioxide emission control—the facility’s Illinois EPA certification details, and the precise location and classification of the pollution control infrastructure. The form further guides the submission process through a step-by-step procedure on completing assessment information, which includes the original and net costs involved, the facility’s operational impacts, and any changes or improvements made. Such meticulous documentation underscores the dual benefits of ensuring that facilities operate within the environmental standards set forth by Illinois law and supporting transparent tax assessment for pollution control facilities. This process not only helps owners keep track of their facility's compliance and financial obligations but also reinforces the importance of responsible environmental practices in the state.

Preview - Ptax 401 Form

Illinois Department of Revenue |

|

|

|

|

|

|

|

Pollution Control Facility Tax Return |

|||||

Step 1: Complete the following information |

|

|

|

|

||

|

|

|

3 |

Write the assessment year. |

___ ___ ___ ___ |

|

|

|

|

4 Write the principal nature of your business. |

|

||

|

|

|

|

_____________________________________________ |

||

______________________________________________ |

|

|

|

|

||

Name |

|

|

5 |

a Is your facility still in use? |

Yes |

No |

______________________________________________ |

|

|

|

|

||

Street address |

|

|

|

b If no, do you wish to revoke |

|

|

______________________________________________ |

|

your certification? |

Yes |

No |

||

City |

State |

ZIP |

|

|

|

|

(_______)______________________________________ |

6 |

a Do you have a federal employer |

|

|

||

Phone |

|

|

|

identification number (FEIN)? |

Yes |

No |

|

|

|

|

|||

|

|

|

|

|

b If yes, write |

|

|

|

|

|

|

|

|

|

your FEIN. |

___ ___ - ___ ___ ___ ___ ___ ___ ___ |

|||

|

|

|

|

|

|

Federal employer identification number (FEIN) |

|

||

1 |

Is the information on |

|

|

|

|

|

|

|

|

|

your preprinted label correct? |

Yes |

No |

|

c If no, write |

|

|

|

|

If no, cross through it and write the correct information here. |

|

your SSN. |

___ ___ ___ - ___ ___ - ___ ___ ___ ___ |

||||||

|

______________________________________________ |

|

|

Social Security number (SSN) |

|

||||

|

______________________________________________ |

|

|

|

|

|

|

||

|

______________________________________________ |

7 |

a Do you have an Illinois |

|

|

||||

|

______________________________________________ |

|

business tax number (IBT)? |

Yes |

No |

||||

2 |

Write the name and telephone number of the person we |

|

b If yes, write |

|

|

|

|

||

|

should contact for additional information. (If different than label.) |

|

your IBT. |

___ ___ ___ ___ - ___ ___ ___ ___ |

|

||||

|

____________________________ (____)___________ |

|

|

Illinois business tax number (IBT) |

|

||||

|

Name |

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Step 2: Identify the pollution control facility |

|

|

|

|

|

|

|||

1 Check the box that identifies the type of pollution control facility. |

|

|

1a |

Air pollution |

|

||||

|

|

|

|

|

|

|

1b |

Water pollution |

|

|

|

|

|

|

|

|

1c |

||

|

|

|

|

|

|

|

|

|

|

2 Write the number written on the facility’s Illinois EPA certification. |

|

2______________________ |

|

||||||

3 |

Write the |

3 ___ ___ ___ |

|

||||||

4Write the complete description of the pollution control facility written on the Illinois EPA certification.

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

5Write the location of the pollution control facility.

______________________________________________ |

_______________________________________________ |

||

Street address |

|

|

Township |

______________________________________________ |

_______________________________________________ |

||

City |

State |

ZIP |

County |

6 Write that location’s property index number (PIN). |

|

6 _______________________________________________ |

|

This form is authorized as outlined by 35 ILCS

REQUIRED. This form has been approved by the Forms Management Center. |

Step 3: Complete the assessment information

1 |

Write the month and year that the facility was placed into use. |

1 |

___ ___ /___ ___ ___ ___ |

|

|

|

|

Month |

Year |

2 |

Write the estimated remaining useful life of the facility. (See instructions.) |

2 |

________________ years |

|

3 |

Write the original cost of the certified portion of the facility as of the date placed into use. |

3 |

$ ____________________ |

|

4If any portion of the facility was assessed as personal property before January 1, 1979,

write the original cost of the certified portion of the facility as of January 1, 1978. |

4 |

$ ____________________ |

5 Subtract Line 4 from Line 3. |

5 |

$ ____________________ |

6Write the total original cost of all additions and improvements made to the certified portion

of the facility from the date placed into use through January 1 of this assessment year. |

6 |

$ ____________________ |

7 Add Lines 5 and 6. |

7 |

$ ____________________ |

8Write the total original cost of all certified portions of the facility that have been retired

|

or removed from use through January 1 of this assessment year. |

8 |

$ |

____________________ |

9 |

Subtract Line 8 from Line 7. |

9 |

$ |

____________________ |

10 |

Write the net earnings attributable to the certified portion of the facility. |

10 |

$ |

____________________ |

11 Does the operation of the facility produce a byproduct that can be commercially sold? |

11 |

If you answered yes, please explain: _________________________________________ |

|

12Does the operation of the facility result in increased production or reduced production cost? 12 If you answered yes, please explain: _________________________________________

Yes

Yes

No

No

Step 4: Complete the following information

1Have there been any changes in the use of the facility within the previous assessment year? 1 If you answered yes, please explain: _________________________________________

2a Have there been any additions or improvements made to the certified portion

of the facility within the previous assessment year? |

2a |

If you answered yes, complete the following. |

|

b Write the original cost of the addition or improvement. |

2b |

c Write the date placed into use. |

2c |

d Check the classification of the addition or improvement. |

2d |

Describe the addition or improvement: _____________________________________ |

|

3a Has any part of the certified portion of the facility been retired or removed from use

within the previous assessment year? |

3a |

If you answered yes, complete the following. |

|

b Write the original cost of the retired or removed portion. |

3b |

c Write the date retired or removed from use. |

3c |

YesNo

YesNo

$___________________

___ ___/___ ___ ___ ___

Month Year

Real Personal

YesNo

$___________________

___ ___/___ ___ ___ ___

Month Year

Step 5: Sign below

I state that, to the best of my knowledge, the information contained in this return is true, correct, and complete.

___________________________________________/____/____ ___________________________________________________

Pollution control facility owner’s or authorized representative’s signature |

Date |

Print the pollution control facility owner’s or authorized representative’s name and title |

|

|

|

Mail this return to:

Local Government Services Bureau, Illinois Department of Revenue, P.O. Box 19033, Springfield, IL

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form PTAX-401 | This form is used for the tax return of pollution control facilities in Illinois. |

| Governing Law | Illinois Compiled Statutes (35 ILCS 200/1-1 et seq.) authorize this form. The statutes govern the assessment and taxation of pollution control facilities within the state. |

| Disclosure Requirement | Disclosure of the information requested by PTAX-401 is mandatory, indicating the serious nature of the form's contents and the requirements for compliance. |

| Form Approval | The form has been officially approved by the Forms Management Center, ensuring it meets the necessary requirements for information collection and processing. |

| Assessment Information | Owners of pollution control facilities must provide comprehensive details, including the facility's operational status, certification numbers, description, location, and financial data related to its cost and earnings attributable. |

| Submission Address | Completed forms should be mailed to the Local Government Services Bureau, Illinois Department of Revenue, indicating the specific department responsible for processing these returns. |

Instructions on Utilizing Ptax 401

After completing the PTAX-401 form, crucial for reporting specifics about pollution control facilities, it’s essential to understand what happens next. The form collects detailed information used by the Illinois Department of Revenue to assess and manage pollution control efforts across the state. Thoroughly and accurately filling out each section is paramount to ensure compliance and support environmental protection initiatives. What follows is a step-by-step guide to assist in filling out the form correctly.

- Step 1: Complete the following information

- Write the assessment year in the space provided.

- Clearly indicate the principal nature of your business.

- If applicable, state whether your facility is still in use and if you wish to revoke your certification should the facility no longer be operative.

- Check if the preprinted label information is correct. If not, provide the correct details including your Social Security Number (SSN) or Federal Employer Identification Number (FEIN), and correct any other preprinted information as necessary.

- Indicate if you have an Illinois Business Tax number (IBT) and write it down if applicable.

- Provide the name and telephone number of the person to contact for additional information.

- Step 2: Identify the pollution control facility

- Select the type of pollution control facility (Air pollution, Water pollution, Low-sulfur dioxide emission coal-fueled device).

- Write the number found on the facility’s Illinois EPA certification.

- Input the three-digit classification number of the pollution control facility.

- Furnish a complete description of the pollution control facility as detailed on the Illinois EPA certification.

- Provide the street address, city, state, ZIP code, township, and county of the pollution control facility.

- Enter the property index number (PIN) of that location.

- Step 3: Complete the assessment information

- Specify the month and year that the facility was placed into use.

- Estimate the remaining useful life of the facility in years.

- Record the original cost of the certified portion of the facility as of the date placed into use, alongside any pre-January 1, 1979 assessments, if applicable.

- Subtract any pre-1979 assessed cost from the original cost and add the total cost of all additions and improvements made since the facility's integration.

- Document any portions of the facility that have been retired or removed from use and adjust the total original cost accordingly.

- Write the net earnings attributable to the certified portion of the facility.

- Indicate if the operation of the facility results in a commercially sellable byproduct or affects production rates or costs, and provide explanations where necessary.

- Step 4: Complete the following information

- Report on any changes in the use of the facility within the previous assessment year and describe any additions, improvements, or portions retired or removed from use.

- Step 5: Sign below

- Ensure that the Pollution control facility owner or an authorized representative signs and dates the form, attesting to the accuracy and completeness of the information provided.

Upon form completion, review all entered information for accuracy before mailing to the Local Government Services Bureau, Illinois Department of Revenue. This careful attention to detail will contribute positively to the management and assessment of pollution control facilities in Illinois, thereby supporting environmental protection efforts.

Obtain Answers on Ptax 401

When dealing with the intricacies of environmental responsibilities and tax obligations, the PTAX-401 form is a crucial document for businesses operating pollution control facilities in Illinois. Understanding this form is essential for compliance and benefit maximization. Here are some frequently asked questions:

- What is the purpose of the PTAX-401 form?

The PTAX-401 form serves as a Pollution Control Facility Tax Return in Illinois. Its primary purpose is for facilities that manage pollution—such as air or water purification systems—to report their operational details to the Illinois Department of Revenue. This reporting is vital for both regulatory compliance and for facilities to possibly qualify for tax incentives related to pollution control.

- Who needs to file the PTAX-401 form?

Any business or entity operating a pollution control facility within Illinois should complete and file the PTAX-401. Specifically, if your facility includes systems for air and water pollution control, low-sulfur dioxide emission, or other designated pollution management technologies, and is certified by the Illinois Environmental Protection Agency (EPA), you are required to file this form. It applies whether you are directly managing pollution from your operations or providing pollution control services to others.

- What information is required on the PTAX-401 form?

- Assessment year and principal nature of your business.

- Whether your facility is still in use and if you wish to revoke your certification, if applicable.

- Your federal employer identification number (FEIN) or social security number (SSN), if the preprinted label is incorrect.

- Details about your pollution control facility, including the type of facility, EPA certification number, and a detailed description as per the EPA certification.

- A comprehensive assessment of the facility's cost, including original, additions, improvements, retired portions, and the net earnings attributable to the certified portion of the facility.

- Any changes in the use of the facility, additions or improvements made, parts retired or removed from use within the previous assessment year, and more.

This thorough collection of information ensures that the Illinois Department of Revenue can accurately assess the eligibility and extent of any tax incentives for pollution control.

- Where and when should the PTAX-401 form be filed?

The completed PTAX-401 form must be mailed to the Local Government Services Bureau, Illinois Department of Revenue. As for the filing deadline, it is crucial to refer to the latest guidance from the Illinois Department of Revenue since deadlines may vary. Typically, it aligns with other state tax obligations, ensuring that businesses can manage their responsibilities in a streamlined manner. Staying up to date with the specific due dates is critical to avoid penalties for late submission.

Understanding and accurately completing the PTAX-401 form is essential for businesses in Illinois that invest in controlling pollution. Not only does this compliance support environmental objectives, but it can also provide tax benefits, underscoring the intersection of economic and ecological interests in the state's policies.

Common mistakes

When filling out the PTAX-401 form for the Illinois Department of Revenue, individuals often make a range of mistakes. Avoiding these errors is crucial for accurately reporting the pollution control facility tax return. Here are six common errors:

- Incorrect identification of the principal nature of the business in Step 1, section 4. As this impacts the classification and potential benefits, ensuring accurate and complete description is critical.

- Failing to accurately write the assessment year in Step 1, section 3. The assessment year is pivotal for the tax return's relevance, and incorrect dates can lead to processing delays or inaccuracies.

- Omitting or incorrectly stating the Pollution Control Facility information, including the type of facility (Step 2, question 1) and the Illinois EPA certification number (Step 2, question 2). This information is paramount in classifying the facility for tax purposes.

- In Step 3, not accurately calculating or reporting financial information, such as the original cost of the facility, additions, improvements, and net earnings. Accurate financial reporting is essential for fair assessment and tax computation.

- Overlooking the questions regarding changes in the use of the facility, additions, improvements, or retirement of portions of the facility in the previous assessment year (Step 4). These details significantly affect the assessment and tax obligations.

- Neglecting to check the accuracy of pre-printed labels or the completeness of the contact information (Step 1, sections 1 and 2). Accurate contact information and correct labels ensure smooth communication and processing.

Here are additional pointers to avoid in the form:

- Ensure that all sections of the form are completed to avoid any processing delays.

- Review financial statements and records closely to report accurate numbers in the assessment information section.

- Confirm that the facility's classification matches the activity for correct tax benefits and obligations.

- Double-check whether any sections that do not apply are clearly marked as such to prevent unnecessary queries.

- Before submission, verify all dates and numerical entries for accuracy.

- Ensure that the person completing the form signs and dates it to certify its accuracy.

Documents used along the form

When it comes to managing and filing the PTAX-401 form, understanding the context and the other forms that may accompany it is crucial for individuals and businesses in Illinois. The PTAX-401, for example, is specifically designed for pollution control facilities, outlining the assessment information pertinent to these properties. Alongside this form, several other documents can play a critical role in ensuring compliance and maximizing benefits under the law. Below is a list of some key forms and documents often used in conjunction with the PTAX-401 form, each serving a distinct but complementary purpose.

- Schedule A - Property Record Card: This document provides detailed property information, including descriptions and assessments, which is crucial for accurate PTAX-401 filings.

- Form IL-1023-C - Composite Return: Required for entities electing to file composite returns. It helps aggregate the tax liabilities for multiple properties, including pollution control facilities.

- Form PTAX-300-R - Application for Certificate of Error: In case of errors in property assessment that impact PTAX-401 filings, this form is used to officially request corrections.

- EPA Certification Documentation: Official documents from the Illinois Environmental Protection Agency certifying the pollution control facility, which is a prerequisite for the PTAX-401.

- Form IL-4562 - Special Depreciation: This is utilized to calculate and declare special depreciation for pollution control facilities, affecting the assessment data on the PTAX-401.

- Proof of Ownership Documents: Key to establishing the legal ownership of the property in question. This could include deeds or titles, directly affecting PTAX-401 filings.

- Lease Agreements: For leased properties being declared on the PTAX-401, the lease agreement specifics are crucial for correct filing.

- Financial Statements: These documents provide a broader look at the financial situation of the entity owning the pollution control facility, occasionally required for comprehensive assessment.

- Form PTAX-340 - Non-Homestead Property Tax Exemption Application: For properties eligible for exemptions other than pollution control, this form is integral to comprehensive tax strategy.

- Zoning Certifications: Documents that verify the zoning status of the property, which can influence its eligibility and assessment as a pollution control facility on the PTAX-401 form.

Navigating the complexities of tax and regulatory compliance for pollution control facilities in Illinois can be a daunting task. Having a thorough understanding of not only the PTAX-401 form but also the supplementary documents and forms that support it, can significantly simplify this process. The interplay between these documents ensures a comprehensive approach to managing pollution control facility assessments and maximizing the related benefits. By carefully compiling and reviewing these forms, businesses and individuals can ensure they meet all legal requirements and position themselves favorably in terms of tax liability and environmental compliance.

Similar forms

The W-9 Form, Request for Taxpayer Identification Number and Certification, is similar to the PTAX-401 form as it also requires the filer to provide their Federal Employer Identification Number (FEIN) or Social Security Number (SSN) for tax reporting purposes. Both forms are crucial for ensuring that businesses or individuals are properly identified for tax-related activities.

The Schedule C (Form 1040), Profit or Loss from Business, shares similarities with the PTAX-401 form since both involve reporting information related to the operation of a business. The PTAX-401 form focuses on pollution control facilities specifically, while Schedule C is broader, covering profit and losses from a business as a whole. Each form helps the government assess the economic activities and tax liabilities of businesses.

Form 4562, Depreciation and Amortization, is akin to the PTAX-401 form in how it requires the reporting of the original cost and the estimated useful life of property, which in the case of the PTAX-401, is specifically pollution control facilities. These details are essential for calculating depreciation or amortization deductions, as well as for determining tax liabilities related to property improvements and investments.

The Form 8824, Like-Kind Exchanges, and the PTAX-401 form both deal with specific asset details, though for different purposes. The PTAX-401 focuses on pollution control facilities, requiring information about facility certification and costs, whereas Form 8824 involves reporting exchanges of business or investment properties not immediately taxable. Both forms require detailed descriptions of properties to ensure compliance with tax regulations.

Finally, the Form 1120, U.S. Corporation Income Tax Return, shares a connection with the PTAX-401 form in its requirement for detailed financial information from entities for tax purposes. While Form 1120 is a comprehensive tax document for corporations, the PTAX-401 targets businesses with pollution control facilities, specifically documenting costs and operational details relevant to tax assessment of those facilities.

Dos and Don'ts

Correctly filling out the PTAX-401 form, a vital document for reporting details related to pollution control facilities in Illinois, demands attention to detail and an understanding of state requirements. Below are essential dos and don'ts to ensure accuracy and compliance during the process:

Dos:Ensure all preprinted label information is current and accurate. If not, make necessary corrections directly on the form.

Clearly write the assessment year, emphasizing the specific period the return covers.

Indicate the principal nature of your business, providing clarity about the facility's primary function and industry.

Answer truthfully regarding the facility's operational status and any intentions to revoke certification if it's no longer in use.

Provide accurate identification numbers, including the Federal Employer Identification Number (FEIN) and Illinois Business Tax number (IBT), as these are crucial for tax identification purposes.

Identify the pollution control facility type correctly (air, water, low-sulfur dioxide emission) to ensure precise classification and applicable benefits or regulations.

Document the total original cost and any additions or improvements with accuracy, as this impacts the facility's valuation and tax obligations.

Consider the facility's production byproducts and operational impacts on production costs or volumes, which can affect the comprehensive assessment of the facility's benefits.

Update any changes made to the facility within the previous assessment year, including additions, improvements, or parts that were retired or removed from use.

Sign and date the form, verifying the truthfulness and completeness of the information provided, to affirm your compliance and responsibility.

Do not leave fields blank that are applicable to your facility; incomplete forms may result in processing delays or outright rejection.

Avoid guessing or estimating figures. Ensure all numerical entries, especially costs and dates, are accurate and verifiable.

Do not ignore the requirement to explain any changes in the use of the facility, additions, or improvements made during the assessment period; detail is critical.

Refrain from submitting the form without reviewing all the information for accuracy and completeness to prevent errors that could affect your tax liability.

Do not forget to include contact information for the person responsible for additional information, ensuring a clear point of contact for any follow-up required.

Avoid using outdated forms or information; always refer to the latest instructions and requirements from the Illinois Department of Revenue.

Do not overlook the declaration section at the end of the form; it must be signed by the pollution control facility owner or authorized representative.

Avoid informal explanations or descriptions; use precise, formal language that clearly conveys the required information.

Do not provide false or misleading information, as this could lead to legal consequences, including penalties or fines.

Refrain from mailing the form to an incorrect address; always verify the current mailing address for the Local Government Services Bureau.

Misconceptions

Filing a PTAX-401 form, which pertains to the valuation and taxation of pollution control facilities in Illinois, can be complicated. Many misconceptions surround this form and its requirements. Understanding these misconceptions is crucial for accurate and compliant filing.

- Misconception 1: All businesses must file the PTAX-401 form annually. The PTAX-401 is specifically designed for entities that own pollution control facilities. If your business doesn't own or operate such a facility, this form isn't necessary for you.

- Misconception 2: The form is only for facilities that deal with air pollution. In truth, the PTAX-401 covers a range of pollution control facilities, including air, water, and low-sulfur dioxide emission coal-fueled devices, among others. It's important to identify your facility type correctly on the form.

- Misconception 3: There's no need to update the form if there are no changes since last year. Even if there have been no changes to your facility or its operation, you must still complete and submit the form for the current assessment year to confirm this status.

- Misconception 4: You only need to report the initial cost of your facility. The form requires reporting not only the original cost but also all additions, improvements, retirements, or removals associated with the certified portion of the facility. This ensures accurate valuation and taxation.

- Misconception 5: The form doesn't account for the revenue generated by byproducts. If the operation of your pollution control facility produces a byproduct that can be commercially sold, this must be reported. It affects the economic valuation of the facility.

- Misconception 6: Personal information, such as the Social Security Number (SSN), is always required. You'll only need to provide your SSN if you do not have a Federal Employer Identification Number (FEIN). For most businesses, the FEIN is sufficient for identification purposes.

Understanding these key points clarifies the filing process, ensuring that businesses comply with relevant regulations while accurately representing their operations. If you're uncertain about any requirements, seeking guidance from a professional familiar with Illinois tax law can be immensely helpful.

Key takeaways

Filling out the PTAX-401 form, a Pollution Control Facility Tax Return for Illinois, requires careful attention to detail and accurate data about your pollution control facility. Here are some key takeaways to help guide you through the process:

- Know the Assessment Year: Clearly indicate the assessment year for which the tax return is being filed to ensure that your form is processed for the correct period.

- Describe Your Business and Facility Accurately: Provide a detailed description of the principal nature of your business and the pollution control facility, including its street address, to help the Department of Revenue understand your operations.

- FEIN and IBT Numbers: If you have a Federal Employer Identification Number (FEIN) or an Illinois Business Tax number (IBT), ensure you fill these in accurately. These identifiers are crucial for tax purposes.

- Type of Pollution Control Facility: Clearly check the box that identifies whether your facility is for air pollution, water pollution, or is a low-sulfur dioxide emission coal-fueled device. This classification affects how your facility is assessed.

- Illinois EPA Certification Details: Include the number on your facility’s Illinois EPA certification, the three-digit classification number, and a complete description as per the certification. This information corroborates your facility's legitimacy and classification.

- Original Cost and Additions: Report the original cost of the certified portion of your facility, costs of any additions or improvements, and any portions retired or removed from use. Accurate financial information ensures correct tax assessment.

- Net Earnings and Byproducts: Disclose the net earnings attributable to the certified portion of the facility and if its operation produces any commercially sold byproducts, as this can affect assessment outcomes.

- Changes Within the Assessment Year: Notify of any changes in the use of the facility, as well as any additions, improvements, or retired portions within the previous assessment year. This keeps your facility’s assessment current and accurate.

Finally, the owner or authorized representative must sign and date the form, attesting to the accuracy of the information provided. Remember, each detail helps the Illinois Department of Revenue properly assess and tax your pollution control facility. Ensuring completeness and accuracy in every section of the PTAX-401 can help avoid processing delays and potential discrepancies.

Popular PDF Forms

Bol Pdf - Environmental and safety regulations can be enforced through the information provided in this document, ensuring goods are transported responsibly.

Lease Violation Letter - An official lease infraction notice, emphasizing the violation committed by the tenant and the course of action for rectification.

Lead Generation Agreement Template - Delineates the agent's right to decline new lead costs and the process for doing so.