Blank Rc145 E PDF Template

The RC145 E form stands as a pivotal document for businesses interacting with the Canada Revenue Agency (CRA), facilitating the closure or cancellation of various business number (BN) program accounts. This form provides a structured pathway for companies to streamline the process of discontinuing their association with specific CRA program accounts, leveraging options such as online platforms like My Business Account and Represent a Client for enhanced accessibility. It covers a broad spectrum of accounts including GST/HST (RT program account), payroll deductions (RP program account), corporation income tax (RC program account), and information returns (RZ program account), each with its respective procedural requirements and stipulations for cancellation. Crucially, the form also outlines scenarios where its usage is inappropriate, such as for selected listed financial institutions which are directed towards a different procedure. Apart from the logistical steps of filing the form, it emphasizes the necessity for authorized signatories, ensuring that submissions are legitimate and accurately reflective of the business’s intent. The document further educates on the consequences of account closure, such as the handling of property for GST/HST purposes, signifying its comprehensive role in not only guiding businesses through the closure process but also in detailing subsequent obligations. Consequently, the RC145 E form emerges as an essential tool for businesses navigating the intricacies of concluding their engagements with specific CRA program accounts.

Preview - Rc145 E Form

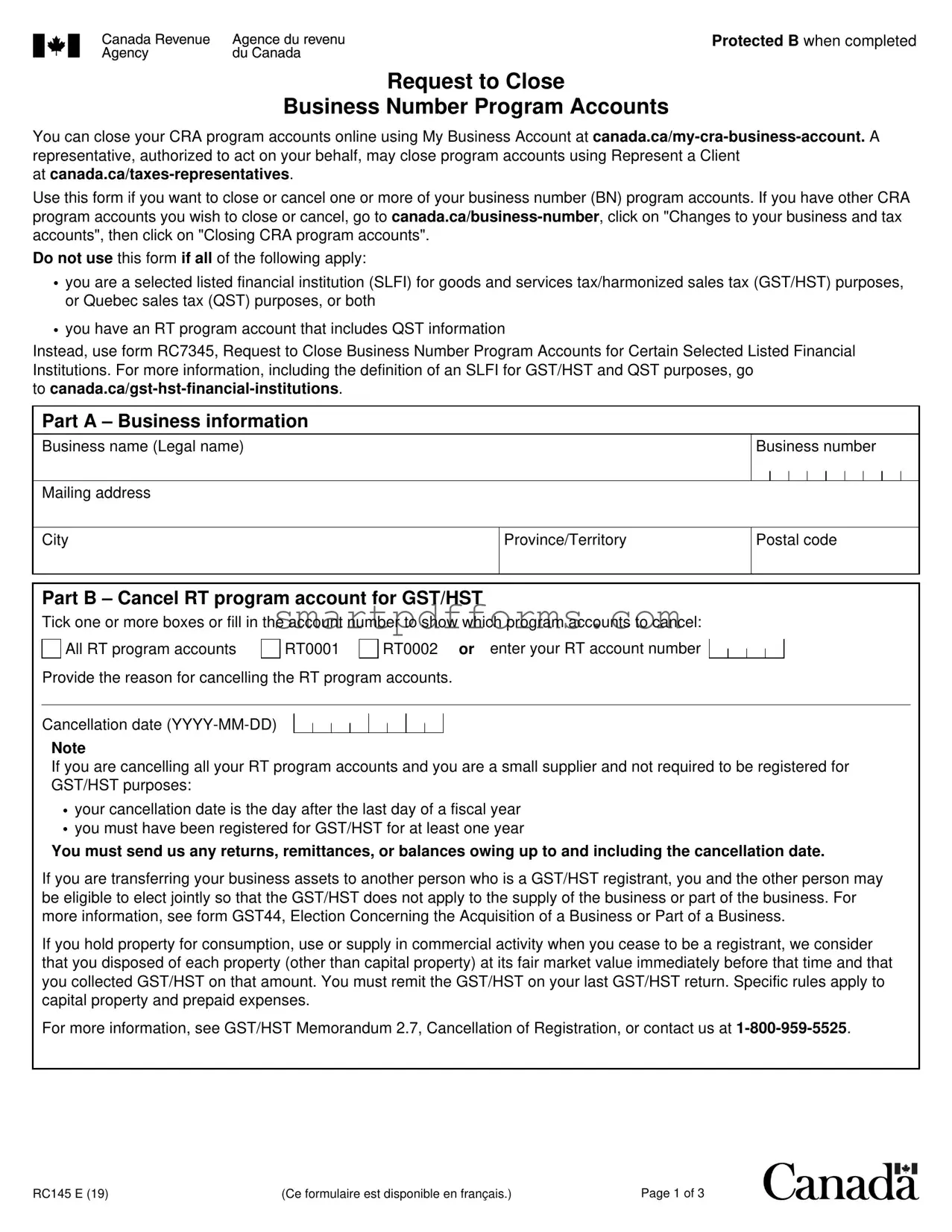

Protected B when completed

Request to Close

Business Number Program Accounts

You can close your CRA program accounts online using My Business Account at

at

Use this form if you want to close or cancel one or more of your business number (BN) program accounts. If you have other CRA program accounts you wish to close or cancel, go to

Do not use this form if all of the following apply:

•you are a selected listed financial institution (SLFI) for goods and services tax/harmonized sales tax (GST/HST) purposes, or Quebec sales tax (QST) purposes, or both

•you have an RT program account that includes QST information

Instead, use form RC7345, Request to Close Business Number Program Accounts for Certain Selected Listed Financial Institutions. For more information, including the definition of an SLFI for GST/HST and QST purposes, go

to

Part A – Business information

Business name (Legal name)

Business number

Mailing address

City

Province/Territory

Postal code

Part B – Cancel RT program account for GST/HST

Tick one or more boxes or fill in the account number to show which program accounts to cancel:

All RT program accounts

RT0001

RT0002 or enter your RT account number

Provide the reason for cancelling the RT program accounts.

Cancellation date

Note

If you are cancelling all your RT program accounts and you are a small supplier and not required to be registered for GST/HST purposes:

•your cancellation date is the day after the last day of a fiscal year

•you must have been registered for GST/HST for at least one year

You must send us any returns, remittances, or balances owing up to and including the cancellation date.

If you are transferring your business assets to another person who is a GST/HST registrant, you and the other person may be eligible to elect jointly so that the GST/HST does not apply to the supply of the business or part of the business. For more information, see form GST44, Election Concerning the Acquisition of a Business or Part of a Business.

If you hold property for consumption, use or supply in commercial activity when you cease to be a registrant, we consider that you disposed of each property (other than capital property) at its fair market value immediately before that time and that you collected GST/HST on that amount. You must remit the GST/HST on your last GST/HST return. Specific rules apply to capital property and prepaid expenses.

For more information, see GST/HST Memorandum 2.7, Cancellation of Registration, or contact us at

RC145 E (19) |

(Ce formulaire est disponible en français.) |

Page 1 of 3 |

Protected B when completed

Part C – Close RP program account for payroll deductions

Tick one or more boxes or fill in the account number to show which program accounts to close:

All RP program accounts

RP0001

RP0002 or enter your RP account number

If the reason you no longer need your RP account is the same as Part B, tick this box.

Otherwise, specify the reason.

Closing date

Note

You must remit any money deducted or withheld at source within seven days. You must send us the necessary T4 slips and T4 Summary within 30 days of the day your business ends.

Part D – Close RC program account for corporation income tax

When you close or dissolve your corporation, there are different ways to close your RC corporate income tax program account depending on the incorporating authority.

•If your business was incorporated federally or with a province that uses a federal business number with a Canada Revenue Agency (CRA) program account, and you asked the incorporating authority to close your corporation, the CRA automatically closes your corporate income tax (RC) program when the incorporating authority informs us that your corporation has been closed. You do not need to call or complete this form. For a list of provinces that include a federal business number with the CRA, go to

•If your business was incorporated with a province that is not partnered with the CRA, you must send us a copy of the instrument confirming the dissolution (for example, the certificate of dissolution or the letters patent of dissolution) with this form. Together, they act as your request to close your corporation income tax account.

Do not use this form for a corporation that has amalgamated or that plans to amalgamate. If you need information about amalgamating and closing an account, call us at

Note

You must always file a corporation income tax return up to the date of dissolution or closure.

Part E – Close RZ program account for an information return

Tick one or more boxes or fill in the account number to show which program accounts to close:

All RZ program accounts

RZ0001

RZ0002 or enter your RZ account number

If the reason you no longer need your RZ account is the same as Part B, tick this box.

Otherwise, specify the reason.

Closing date

Page 2 of 3

Protected B when completed

Part F – Certification

You must have signing authority for the business in order to sign this form. Forms that cannot be processed will be returned to the individual or business. We may contact you to confirm the information you have given.

The individual signing this form is (tick one box only):

an owner

a corporate officer

an authorized representative

a partner of a partnership

an officer of a

an individual with delegated authority

a corporate director

atrustee

alegal representative

This form will not be processed if your name does not match the one in our records. To avoid processing delays, verify that we have complete and valid information on file for you before signing this form.

First name |

|

Last name |

Title |

|

Telephone number |

By signing and dating this form, you authorize the CRA to cancel or close one or more program accounts in Part B, C, D and E.

I certify that the information given on this form is correct and complete.

Signature ► |

|

Date |

Once filled in, send this form to the Prince Edward Island Tax Centre or the Sudbury Tax Centre within six months of the date it was signed or it will not be processed. The tax centres are listed at

Personal information (including the SIN) is collected for the purposes of the administration or enforcement of the Income Tax Act, Excise Tax Act, and related programs and activities including administering tax, benefits, audit, compliance, and collection. The information collected may be used or disclosed for purposes of other federal acts that provide for the imposition and collection of a tax or duty. It may also be disclosed to other federal, provincial, territorial or foreign government institutions to the extent authorized by law. Failure to provide this information may result in interest payable, penalties or other actions. Under the Privacy Act, individuals have the right to access their personal information, request correction, or file a complaint to the Privacy Commissioner of Canada regarding the handling of the individual's personal information. Refer to Personal Information Bank CRA PPU 223 on Info Source at

Page 3 of 3

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The RC145 E form is used by businesses to request the closure of one or more of their Canada Revenue Agency (CRA) business number program accounts. |

| Online Closure Options | Businesses can close their CRA program accounts online through My Business Account or a representative can do it via Represent a Client. |

| Exclusion Criteria | The form is not to be used by selected listed financial institutions for GST/HST purposes or those with an RT program account containing QST information. |

| Part A - Business Information | Collects basic details about the business such as legal name, business number, and mailing address. |

| Part B - Cancel RT Program Account for GST/HST | Allows cancellation of all or specific RT program accounts for GST/HST with reasons and specifies the process for handling remaining obligations. |

| Requirements upon Cancellation | Businesses must submit any final returns, remittances, or balances owing up to and including the cancellation date. |

| Transfer of Business Assets | Details the process for transferring business assets to another GST/HST registrant without incurring GST/HST on the supply. |

| Part C - Close RP Program Account for Payroll Deductions | Requests the closure of RP program accounts for payroll deductions and specifies associated obligations and deadlines. |

| Part D - Close RC Program Account for Corporation Income Tax | Explains the procedure for closing RC corporate income tax program accounts based on the authority of incorporation. |

Instructions on Utilizing Rc145 E

Upon deciding to close one or more of your business number (BN) program accounts, the RC145 E form is a necessary document to complete accurately and submit. This task requires diligence to ensure that each step is correctly fulfilled, adhering to the guidelines provided by the Canada Revenue Agency (CRA). Before progressing with the form's completion, ensure that your business does not fall under the specified exemptions, including being a selected listed financial institution or having RT program accounts that include QST information. Here's a step-by-step guide to navigate through the form efficiently.

- Begin by inputting the legal name of your business in the "Business name" field, followed by the business number in the designated space.

- Fill in your business's mailing address, including city, province or territory, and postal code in the "Part A – Business information" section.

- In "Part B – Cancel RT program account for GST/HST," tick the relevant box(es) or enter your RT account number to indicate which program accounts you intend to cancel. Specify the reason for cancellation and provide the cancellation date in the format YYYY-MM-DD.

- For "Part C – Close RP program account for payroll deductions," again, select the applicable box(es) or input your RP account number if you wish to close these accounts. If the reason for closing is the same as Part B, tick the corresponding box; otherwise, provide a different reason. Mention the closing date in the format YYYY-MM-DD.

- In "Part D – Close RC program account for corporation income tax," ensure whether your corporation's dissolution follows the process outlined for businesses incorporated federally or with a province using a federal business number. If your business is incorporated with a province not partnered with the CRA, attach a copy of the dissolution instrument along with this form.

- If intending to close any RZ program accounts, in "Part E – Close RZ program account for an information return," select the boxes that correspond to your intention or enter the specific RZ account number. Provide the reason if it differs from previously mentioned reasons, along with the closing date formatted as YYYY-MM-DD.

- For "Part F – Certification," indicate your relationship to the business by ticking the appropriate box. Verify that your name matches the records to prevent processing delays. Enter your first and last name, title, and telephone number.

- By signing and dating the form, you authorize the CRA to proceed with canceling or closing the specified program accounts. Ensure that the signature and date (YYYY-MM-DD) are clear.

- Finally, mail the completed form to either the Prince Edward Island Tax Centre or the Sudbury Tax Centre, as dictated by the instructions, within six months from the date it was signed to ensure it's processed.

Accurately completing and submitting form RC145 E is crucial for the seamless closure of your BN program accounts. This step is vital for maintaining compliance and ensuring that your business's records with the CRA are up-to-date. It is advisable to consult the guidance provided by the CRA or seek professional advice if you encounter any uncertainties during the process.

Obtain Answers on Rc145 E

-

What is the purpose of the RC145 E form?

The RC145 E form is designed for businesses that need to close or cancel one or more of their Business Number (BN) program accounts with the Canada Revenue Agency (CRA). These accounts can include those for GST/HST (RT program accounts), payroll deductions (RP program accounts), corporation income tax (RC program account), and information returns (RZ program account). The form serves as a formal request to terminate these accounts.

-

When should you not use the RC145 E form?

You should avoid using this form if your business is a selected listed financial institution (SLFI) for GST/HST or Quebec sales tax (QST) purposes or both. Additionally, if you possess an RT program account that includes QST information, this form is not applicable. In such cases, the RC7345 form is more appropriate. The RC145 E form is specifically for businesses not falling under these categories.

-

How can you submit the RC145 E form?

Businesses looking to close their CRA program accounts traditionally would mail the completed RC145 E form to the appropriate tax centre. Currently, the form can also be submitted through My Business Account for online convenience. Representatives authorized to act on behalf of the business can utilize the Represent a Client service to submit the form online as well.

-

What information is needed to complete the RC145 E form?

To effectively fill out the RC145 E form, you will need your business name, business number, mailing address, and information specific to each CRA program account you wish to close. This includes ticking boxes or filling in account numbers for RT, RP, RC, and RZ program accounts and specifying the reason and date for each account's closure.

-

What are the certification requirements for the RC145 E form?

The individual signing the RC145 E form must have signing authority for the business. This could be an owner, corporate officer, authorized representative, partner, officer of a non-profit organization, individual with delegated authority, corporate director, trustee, or legal representative. It's crucial to ensure that the signer's name matches the one in CRA's records to avoid processing delays.

-

What should you do after submitting the RC145 E form?

After submitting the form, it's essential to remain diligent in completing any necessary returns, remittances, or balances owing up to and including the cancellation date for each program account. If you have transferred business assets to another GST/HST registrant, ensure to check if you're eligible for any elections that could affect your GST/HST obligations. Finally, always confirm with CRA to ensure the closures have been processed correctly.

Common mistakes

When completing the RC145 E form, "Request to Close Business Number Program Accounts," individuals often make several mistakes that can lead to processing delays or even the rejection of their request. By understanding these common errors, you can ensure that the form is filled out correctly and efficiently, thereby facilitating a smoother process in closing your CRA program accounts.

Not using the appropriate form: Individuals sometimes use the RC145 E form when it's not applicable to their situation. For instance, if you are a selected listed financial institution (SLFI) for GST/HST or QST purposes, or if you have an RT program account that includes QST information, a different form (RC7345) should be used. Always verify that the RC145 E form is the correct document for your specific circumstances.

Incomplete business information: Part A of the form requires detailed business information, including the legal name, business number, mailing address, city, province/territory, and postal code. Failing to provide complete and accurate information in this section can result in the CRA being unable to process the form. It's crucial to double-check that all data entered matches the records held by the CRA.

Incorrect cancellation or closing dates: Sections B through E ask for cancellation or closing dates for different types of accounts (RT, RP, RC, and RZ). A common mistake is providing a date that does not conform to the requirements (e.g., not using the day after the last day of a fiscal year for RT program accounts if you are a small supplier not required to be registered for GST/HST purposes). Understanding the specific date requirements for each account type and complying with them is essential.

Failure to sign or misidentification of the signer: Part F of the form requires the signature of an individual with signing authority for the business, as well as their title, and contact information. A common oversight is the submission of the form without a signature or with the name of an individual who does not match the CRA's records for individuals authorized to act on behalf of the business. Ensuring that the signer is correctly identified and authorized, and that their name matches the CRA's records, is important for the form to be processed.

By avoiding these common mistakes, businesses can ensure a smoother and more efficient process in closing their CRA program accounts. Attention to detail and a thorough review of the form before submission can prevent unnecessary delays.

Documents used along the form

When closing or canceling business program accounts with the Canada Revenue Agency (CRA), utilizing the RC145 E form, several additional documents often become necessary to ensure a comprehensive approach to wrapping up fiscal responsibilities. These documents either complement the closure process by offering detailed information required by the CRA or serve to fulfill related obligations that arise from account closures. Below is a list of documents often used in tandem with the RC145 E form, described briefly for your understanding.

- Articles of Dissolution: This document is crucial for corporations officially dissolving their entity. It marks the legal end of a corporation's existence and is usually required when closing RC program accounts for corporate income tax.

- GST44 Election Concerning the Acquisition of a Business or Part of a Business: This form is used when a business is transferring its assets to another GST/HST registrant. It allows the supply of the business, or part of it, without the application of GST/HST.

- T4 Slips and T4 Summary: Essential for businesses closing their RP program accounts for payroll deductions, these documents report the final remuneration paid to employees, including all deductions made.

- Certificate of Dissolution or Letters Patent of Dissolution: Similar to the Articles of Dissolution, these documents formally recognize the dissolution of corporations not federally incorporated but based in provinces not partnered with the CRA for business account closures.

- GST/HST Memorandum 2.7, Cancellation of Registration: Offers detailed guidance on the rules for GST/HST cancellation of registration, relevant for businesses needing to understand their GST/HST obligations upon account cancellation.

- Financial Statements: While not a specific CRA form, comprehensive final financial statements are often necessary to ensure all fiscal responsibilities are met and properly documented during the closure process.

- RC7345, Request to Close Business Number Program Accounts for Certain Selected Listed Financial Institutions: This is a specialized form used in place of the RC145 E form for selected listed financial institutions that need to close their accounts.

- Copies of Tax Returns Up to Closure: Businesses are required to ensure all relevant tax returns are filed up to the date of dissolution, closure, or cancellation of their accounts, indicating financial activities until the end of their operations.

Understanding and gathering these documents is a critical step that accompanies the use of the RC145 E form, aiding businesses in fulfilling their final tax obligations to the Canada Revenue Agency. This process, while seemingly complex, is essential for the orderly conclusion of business operations and helps prevent future legal or financial complications arising from unresolved tax matters.

Similar forms

The RC7345, Request to Close Business Number Program Accounts for Certain Selected Listed Financial Institutions, is akin to the RC145 form due to its purpose of facilitating the closure of program accounts. However, the RC7345 is specifically designed for selected listed financial institutions that are involved with goods and services tax/harmonized sales tax (GST/HST) or Quebec sales tax (QST), indicating its specialized use case compared to the broader application of the RC145.

The GST44, Election Concerning the Acquisition of a Business or Part of a Business, shares similarities with the RC145 in that both deal with changes in business status concerning GST/HST. While the RC145 is used to close accounts, the GST44 is utilized during the acquisition of a business or a part of it, potentially affecting the GST/HST registration status or obligations of the business involved.

Forms related to the T4 Summary and T4 Slips submission process are somewhat parallel to the RC145, particularly in the context of closing RP program accounts for payroll deductions. When a business decides to close its RP account using the RC145, it must also ensure compliance with payroll reporting obligations by submitting necessary T4 slips and summaries, highlighting a procedural link between these documents.

Documentation required for the dissolution of a corporation, such as the certificate of dissolution or letters patent of dissolution, interacts closely with the RC145’s Part D, which is aimed at closing RC program accounts for corporation income tax. While the RC145 facilitates the request to close these accounts, the dissolution certificates serve as necessary legal documentation to confirm the termination or closing of the corporation itself, making them complementary in the dissolution process.

Dos and Don'ts

When completing the RC145 E form, a Request to Close Business Number Program Accounts with the Canada Revenue Agency (CRA), there are several important dos and don'ts to keep in mind to ensure that the process goes smoothly and effectively. Below are seven key points:

- Do ensure that you have the authority to close the account. Only individuals with signing authority, such as an owner, a corporate officer, or an authorized representative, can legally sign off on the form.

- Don't use this form if your business is a selected listed financial institution (SLFI) for GST/HST or QST purposes. In such cases, a different form, RC7345, is required.

- Do accurately complete all required sections, including Business Information (Part A), and the specific program account sections (Parts B, C, D, and E) that you wish to close.

- Don't leave out any relevant financial information. If you are closing a GST/HST account (RT), payroll deductions account (RP), corporation income tax account (RC), or an information return account (RZ), you must provide all necessary details, including the reason for account closure and the closure date.

- Do check that all provided information matches the records held by the CRA. This includes your business number, legal name, mailing address, and the name of the individual with signing authority.

- Don't forget to submit any outstanding returns, remittances, or balances owing prior to the account closure. These obligations do not cease until the closure date you've provided on the form.

- Do send the completed form to the appropriate tax center within six months of signing and dating it to ensure timely processing. The addresses for the Prince Edward Island Tax Centre and the Sudbury Tax Centre are provided on the form.

By following these dos and don'ts, you can more effectively manage the closure of CRA program accounts, ensuring compliance with the necessary regulations and minimizing potential complications. Remember, accurate and complete information is key to a smooth process.

Misconceptions

When it comes to understanding the RC145 E form for closing business number program accounts, several misconceptions can lead to confusion. Let's clear up some of these misunderstandings:

- Online Closure is the Only Option: Many believe that the only way to close CRA program accounts is online through My Business Account or Represent a Client. The RC145 E form provides an alternative for those who prefer or need to submit their request on paper.

- Applies to All Business Structures: Some think this form is suitable for all types of businesses. However, selected listed financial institutions, due to their specific GST/HST and QST requirements, must use a different form, the RC7345.

- One Form Closes All Accounts: There's a misconception that submitting an RC145 E form will close all accounts associated with a business number. In reality, you need to specify each program account (e.g., GST/HST, payroll deductions) you wish to close.

- No Obligations After Form Submission: Some assume once the form is submitted, there are no further obligations. But, businesses must send any remaining returns, remittances, or balances owing up to the cancellation date.

- Immediate Processing and Account Closure: The belief that accounts are closed immediately upon submission is incorrect. Processing takes time, and businesses should wait for confirmation from the CRA.

- Can Be Used for Amalgamations or Acquisitions: The RC145 E form is not intended for corporations that are amalgamating or being acquired. There are specific processes for these situations.

- All Businesses Must Use the Form to Dissolve: If your corporation was incorporated federally or in a province with a CRA partnership, the corporate income tax account closes automatically when the incorporating authority notifies the CRA. No form is required in these cases.

- No Need to File a Final Tax Return: Regardless of closing accounts with this form, corporations must file a return up to the date of dissolution.

- Personal Information Is Unprotected: Some worry about the safety of their information. The form clearly states that personal information is protected under the Privacy Act, collected solely for administrative purposes, and can lead to legal action if not provided.

- Signature Requirements Are Flexible: There's a false belief that anyone can sign the form. Only individuals with signing authority, such as owners, corporate officers, or authorized representatives, can sign the RC145 E form, ensuring security and proper authorization.

Understanding these aspects of the RC145 E form can help ensure a smooth process when closing your CRA program accounts.

Key takeaways

When it comes to handling the intricacies of the RC145 E form, businesses have a structured path to follow for closing their CRA program accounts. This document is essential if you're looking to shut down one or several business number (BN) program accounts, ensuring all fiscal responsibilities are tidily concluded.

Online Options: Before diving into paper forms, businesses and their representatives can utilize digital avenues to close CRA program accounts. The CRA's My Business Account and Represent a Client platforms offer streamlined, user-friendly ways to accomplish this task.

Businesses that are specified as selected listed financial institutions (SLFIs) for GST/HST and/or QST purposes have a different route. The RC145 E form is not suitable for them; instead, they need to use form RC7345 for their specific requirements.

Requirement for Specific Business Information: The form requests detailed business information, which is a reminder of the need for accurate and up-to-date data when interacting with regulatory bodies.

Cancelling RT program accounts for GST/HST necessitates not just indicating which accounts to close but also providing reasons for the cancellations alongside the specific closure dates.

For those businesses deemed small suppliers and thereby not required to register for GST/HST, the cancellation date aligns with fiscal year-end schedules — a detail that showcases the CRA's consideration for business operational structures.

Final GST/HST Remittances: If assets are held for commercial activities upon deregistration, businesses must account for GST/HST on these at fair market value, underlining the importance of understanding tax obligations during closure processes.

For payroll deductions (RP program accounts), the form underscores the necessity to remit deductions and submit T4 slips and summaries within specified timeframes, stressing punctuality in fulfilling end-of-business tax obligations.

Closing corporate income tax accounts (RC program) varies by the business's incorporating authority, illustrating the interconnectedness of various regulatory and administrative bodies in business operations.

The form's certification part emphasizes the importance of having the proper authority to submit such requests. This calls attention to organizational governance and the need for clarity on who can make legally binding decisions for a business.

Timeliness and Accuracy: Finally, the RC145 E form highlights the critical nature of timely submission—within six months of signing—and the necessity of accuracy in the provided information to avoid processing delays and potential complications.

In conclusion, the careful closure of CRA program accounts through the RC145 E form is an integral step for businesses ending operations. It reflects a broader responsibility to comply with Canadian tax laws and regulations, ensuring all financial obligations are met accordingly.

Popular PDF Forms

Free Pet Sitting Contract - Offers a detailed account of pet sitting requirements including feeding, medication, and exercise routines.

Can You Get Married at Any Registry Office - A way for couples to document their marriage when no official ceremony has taken place, through a mutual declaration of their commitment and shared details.

How Long Does It Take the Dmv to Get Notice of a Seizure? - Sections dedicated to specific conditions like vision impairments, seizures, and diabetes ensure a comprehensive medical review.