Blank Rc65 E Canada PDF Template

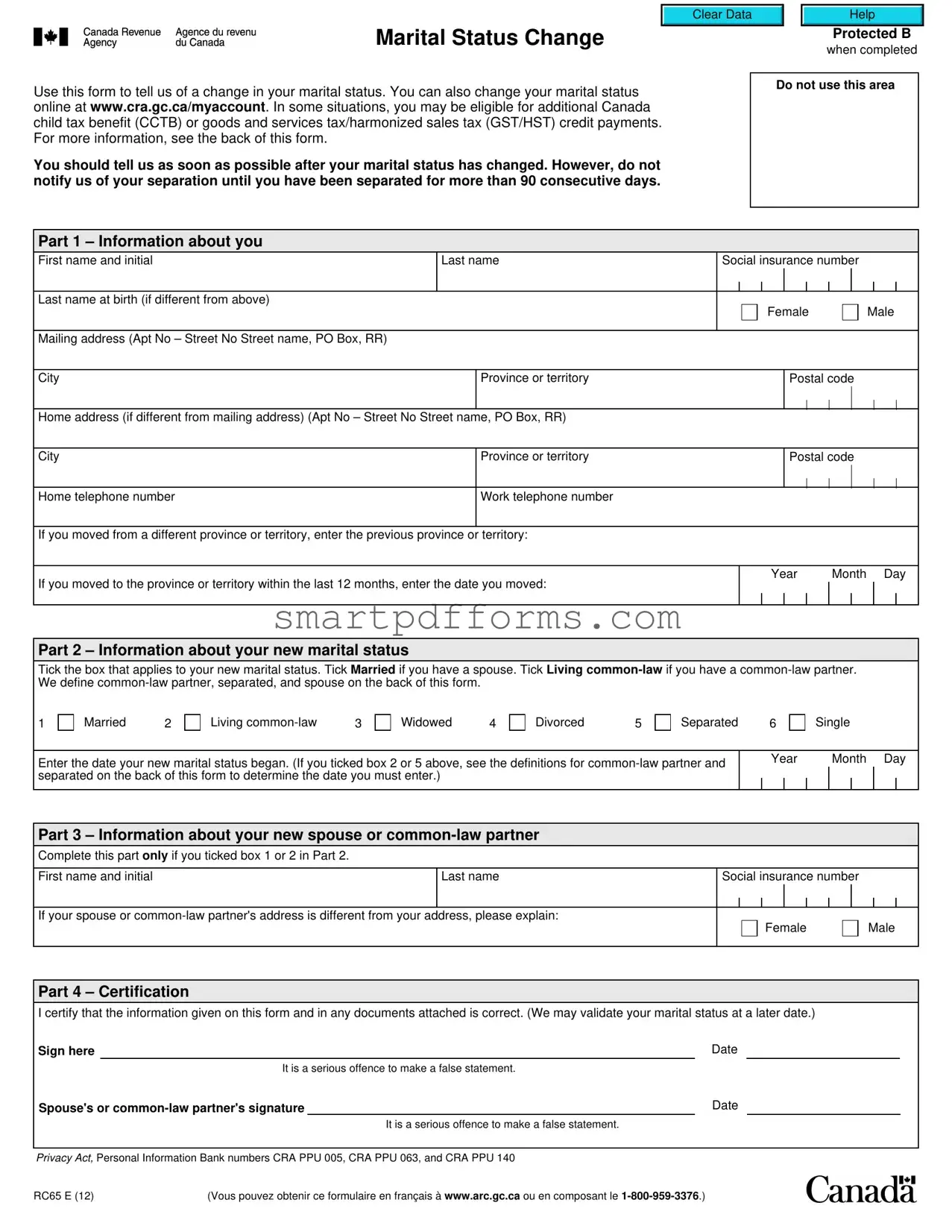

Keeping the Canadian Revenue Agency (CRA) informed about changes in marital status is crucial for ensuring the correct calculation of benefits and credits, such as the Canada child tax benefit (CCTB) and the Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit. The RC65 E Canada form serves this exact purpose, enabling individuals to report a change in marital status efficiently. It is important to submit this form promptly after a change has occurred to facilitate timely adjustments in benefit entitlements. Notably, the form advises against reporting a separation until after 90 consecutive days have passed to affirm the permanence of the situation. Alongside submitting this form, individuals can make the update online for added convenience. The form requires detailed personal information, including social insurance numbers and addresses, ensuring the CRA can accurately process the change. Additionally, it includes sections to specify the new marital status and, if applicable, provide information about a new spouse or common-law partner. The necessity for precise and truthful information is underscored by a certification section, highlighting the legal ramifications of false statements. This form not only streamlines the process for individuals navigating through significant life changes but also ensures that the CRA can administer tax laws and benefit programs accurately and fairly.

Preview - Rc65 E Canada Form

Marital Status Change

Use this form to tell us of a change in your marital status. You can also change your marital status online at www.cra.gc.ca/myaccount. In some situations, you may be eligible for additional Canada child tax benefit (CCTB) or goods and services tax/harmonized sales tax (GST/HST) credit payments. For more information, see the back of this form.

You should tell us as soon as possible after your marital status has changed. However, do not notify us of your separation until you have been separated for more than 90 consecutive days.

Clear Data |

|

Help |

|

|

|

Protected B

when completed

Do not use this area

Part 1 – Information about you |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

First name and initial |

|

|

|

|

|

|

Last name |

|

|

|

|

|

Social insurance number |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last name at birth (if different from above) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Female |

|

|

|

|

|

Male |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Mailing address (Apt No – Street No Street name, PO Box, RR) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

City |

|

|

|

|

|

|

|

|

|

|

Province or territory |

|

|

|

|

|

|

|

|

|

|

Postal code |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Home address (if different from mailing address) (Apt No – Street No Street name, PO Box, RR) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

City |

|

|

|

|

|

|

|

|

|

|

Province or territory |

|

|

|

|

|

|

|

|

|

|

Postal code |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home telephone number |

|

|

|

|

|

|

|

Work telephone number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

If you moved from a different province or territory, enter the previous province or territory: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

If you moved to the province or territory within the last 12 months, enter the date you moved: |

|

|

|

|

|

|

|

|

Year |

|

Month |

|

Day |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Part 2 – Information about your new marital status |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Tick the box that applies to your new marital status. Tick Married if you have a spouse. Tick Living |

|

|

|

|

|

|||||||||||||||||||||||||||||

We define |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

1 |

Married |

2 |

Living |

3 |

Widowed |

4 |

Divorced |

5 |

Separated |

6 |

|

|

|

Single |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Enter the date your new marital status began. (If you ticked box 2 or 5 above, see the definitions for |

|

|

|

Year |

|

Month |

|

Day |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

separated on the back of this form to determine the date you must enter.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Part 3 – Information about your new spouse or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Complete this part only if you ticked box 1 or 2 in Part 2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

First name and initial |

|

|

|

|

|

|

Last name |

|

|

|

|

|

Social insurance number |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If your spouse or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Female |

|

|

|

|

|

Male |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Part 4 – Certification |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

I certify that the information given on this form and in any documents attached is correct. (We may validate your marital status at a later date.) |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

Sign here |

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

It is a serious offence to make a false statement. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Spouse's or |

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

It is a serious offence to make a false statement. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Privacy Act, Personal Information Bank numbers CRA PPU 005, CRA PPU 063, and CRA PPU 140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

RC65 E (12) |

|

(Vous pouvez obtenir ce formulaire en français à www.arc.gc.ca ou en composant le |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Canada child tax benefit (CCTB)

Has your marital status changed?

When we get notification of your change in marital status, we will recalculate your CCTB taking into consideration your new marital status, your new adjusted family net income, and your province or territory of residence. Your CCTB will be adjusted the month following the month that your marital status changed.

Note

If you have become separated, do not notify us until you have been separated for at least 90 days.

Are you now married or living

If you or your new spouse or

To continue getting the CCTB, you and your spouse or

Are you now separated, widowed, or divorced?

We will recalculate your benefit based on the number of children under 18 years of age you have in your care and your adjusted net income.

If a child for whom you were getting benefits no longer lives with you on a

For more information about the CCTB, go to www.cra.gc.ca/cctb or see Booklet T4114, Canada Child Benefits.

Goods and services tax/harmonized sales tax (GST/HST) credit

Are you now married or living

You or your spouse or

Are you now separated, widowed, or divorced?

If you did not apply for the GST/HST credit on your last income tax

and benefit return, you can apply now by including a letter with this form stating that you would like to apply for the GST/HST credit.

When applicable, we will recalculate your credit and send you a GST/HST credit notice showing your revised calculation.

For more information about the GST/HST credit, go to www.cra.gc.ca/gsthstcredit or see Booklet RC4210, GST/HST Credit.

Do you share custody of a child?

If you share custody of a child, see Booklet T4114, Canada Child Benefits, follow the "Shared custody" link at www.cra.gc.ca/cctb or call

Has your direct deposit information changed?

You can have your payments deposited directly into your account at a financial institution in Canada. To get this service or change your banking information, go to www.cra.gc.ca/myaccount

or attach a completed Form

Definitions

a)has been living with you in a conjugal relationship for at least 12 continuous months;

b)is the parent of your child by birth or adoption; or

Clear Data |

|

Help |

|

|

|

c)has custody and control of your child (or had custody and control immediately before the child turned 19 years of age) and your child is wholly dependent on that person for support.

In addition, an individual immediately becomes your

Reference to "12 continuous months" in this definition includes any period that you were separated for less than 90 days because of a breakdown in the relationship.

Separated – You are separated when you start living separate and apart from your spouse or

Once you have been separated for 90 days (because of a breakdown in the relationship), the effective day of your separated status is the day you started living separate and apart.

Spouse – This applies only to a person to whom you are legally married.

For more information

For more information, go to www.cra.gc.ca/benefits or call

To get our forms and publications, go to www.cra.gc.ca/forms or call

Where do you send this form?

Send this completed form (or your letter) to the tax centre that serves your area. Use the chart below to find out the address.

If your tax services office is |

Send your correspondence |

|

located in: |

to the following address: |

|

|

|

|

|

Surrey Tax Centre |

|

British Columbia, Regina, or Yukon |

9755 King George Boulevard |

|

|

Surrey BC V3T 5E1 |

|

|

|

|

Alberta, London, Manitoba, |

Winnipeg Tax Centre |

|

Northwest Territories, Saskatoon, |

PO Box 14005, Station Main |

|

Thunder Bay, or Windsor |

Winnipeg MB R3C 0E3 |

|

|

|

|

Barrie, Sudbury (the area |

Sudbury Tax Centre |

|

of Sudbury/Nickel Belt only), |

||

1050 Notre Dame Avenue |

||

Toronto Centre, Toronto East, |

||

Sudbury ON P3A 5C1 |

||

Toronto North, or Toronto West |

||

|

||

|

|

|

Laval, Montréal, Nunavut, Ottawa, |

||

PO Box 3000, Station Main |

||

or Sudbury (other than the |

||

Sudbury/Nickel Belt area) |

||

|

||

|

|

|

Chicoutimi, |

Jonquière Tax Centre |

|

Outaouais, Québec, Rimouski, or |

PO Box 1900, Station LCD |

|

Jonquière QC G7S 5J1 |

||

|

|

|

Kingston, New Brunswick, |

St. John's Tax Centre |

|

Newfoundland and Labrador, |

||

PO Box 12071, Station A |

||

Nova Scotia, Peterborough, |

||

St. John's NL A1B 3Z1 |

||

or St. Catharines |

||

|

||

|

|

|

Belleville, Hamilton, Kitchener/ |

Summerside Tax Centre |

|

102 – 275 Pope Road |

||

Waterloo, or Prince Edward Island |

||

Summerside PE C1N 5Z7 |

||

|

||

|

|

Form Data

| Fact | Description |

|---|---|

| Form Purpose | This form is used to notify the Canadian Revenue Agency (CRA) of a change in marital status. |

| Online Option | Marital status changes can also be reported online at the CRA's official website. |

| Eligibility for Benefits | Changing your marital status may make you eligible for additional Canada child tax benefit (CCTB) or goods and services tax/harmonized sales tax (GST/HST) credit payments. |

| Notification Timeline | It's important to inform the CRA as soon as possible after a change in marital status, but separations should only be reported after being separated for more than 90 days. |

Instructions on Utilizing Rc65 E Canada

It's crucial to inform the Canada Revenue Agency (CRA) about any changes in marital status as it can impact the calculation of certain benefits, such as the Canada Child Tax Benefit (CCTB) or the Goods and Services Tax/Harmonized Sales Tax (GST/HST) credits. The RC65 E form, specifically designed for this purpose, allows individuals to update their marital status efficiently. Whether you've gotten married, entered into a common-law partnership, separated, divorced, or widowed, promptly updating your status ensures you receive the correct benefit amount. Here's a straightforward guide to completing the RC65 E form.

- Start with Part 1 – Information about you. Fill in your first name, initial, and last name. Include your Social Insurance Number (SIN) and your last name at birth if it's different.

- Indicate your gender by ticking the appropriate box.

- Provide your mailing address in full, including apartment number, street number, street name, PO Box, or RR number, city, province or territory, and postal code.

- If your home address differs from your mailing address, include that information as well.

- Enter your home and work telephone numbers.

- If you've moved from a different province or territory within the last 12 months, specify the previous province or territory and the exact date of the move.

- In Part 2 – Information about your new marital status, tick the box that corresponds to your new marital status. Also, enter the date when this status began. If you're reporting living common-law or separation, refer to the definitions on the back of the form to determine the correct date.

- If applicable, complete Part 3 – Information about your new spouse or common-law partner. This includes their first name, initial, last name, and Social Insurance Number. If they live at a different address, provide an explanation.

- The final step before submitting the form involves the Part 4 – Certification. Sign the form to certify that all the information provided is correct and accurate to the best of your knowledge. Your spouse or common-law partner should also sign if applicable.

- Review the form thoroughly to ensure all provided information is accurate and complete. This helps prevent any delays in processing your updated marital status.

Once completed, send the RC65 E form to the tax center that serves your area. You can find the appropriate address by consulting the list provided with the form. Remember, keeping your marital status updated with the CRA is essential for receiving the correct benefits and credit amounts. Prompt notification after a change in marital status helps ensure that your financial matters are in order.

Obtain Answers on Rc65 E Canada

What is the purpose of the RC65 E form in Canada?

The RC65 E form is used to inform the Canada Revenue Agency (CRA) about a change in marital status. This notification is crucial for the recalibration of benefit entitlements such as the Canada Child Tax Benefit (CCTB) or the Goods and Services Tax/Harmonized Sales Tax (GST/HST) credits, which are calculated based on family composition and net income. Individuals can also update their marital status online through the CRA's official website.

When should I inform the CRA about a change in marital status?

It's important to notify the CRA as soon as possible after your marital status changes. However, in the case of a separation, the CRA requests that you wait until you have been separated for more than 90 consecutive days before notifying them.

How does a change in marital status affect the Canada Child Tax Benefit (CCTB)?

Upon notification of a change in marital status, the CRA recalculates the CCTB based on the new family composition, adjusted family net income, and province or territory of residence. This adjustment occurs the month after the marital status change. For separated individuals, notification should be delayed until after a 90-day separation period.

What impact does marital status have on the Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit?

Marital status changes result in a recalculation of the GST/HST credit to reflect the new family net income. Married or common-law partners will receive a joint recalculation, while those who are separated, widowed, or divorced may need to apply for a recalculation if they haven't done so on their last tax return.

Can I change my direct deposit information for benefits through the RC65 E form?

Yes, you can update your direct deposit information for receiving benefit payments by accessing your account online at the CRA website or by attaching a completed Form T1-DD(1), Direct Deposit Request – Individuals, to the RC65 E form.

What definitions should I be aware of when completing the RC65 E form?

- Common-law partner: This refers to a person you are not married to but with whom you have a conjugal relationship for at least 12 continuous months, or who is the parent of your child by birth or adoption, or who has custody and control of your child.

- Separated: This means you have been living apart from your spouse or common-law partner for at least 90 days due to a breakdown in the relationship.

- Spouse: This applies only to a person to whom you are legally married.

How does a new marital status affect children’s benefits?

If you have children and your marital status changes, the CRA will move the children to the account of the parent who is primarily responsible for their care and upbringing. In cases where parents are of the same sex, one parent will receive the benefits for all children.

What should I do if I share custody of a child?

For shared custody situations, refer to the CRA's booklet T4114, Canada Child Benefits, or visit the CRA website for guidance. Shared custody arrangements have specific criteria and documentation requirements for benefits distribution.

Where do I send the completed RC65 E form?

The completed form should be sent to the tax centre that serves your area. The correct mailing address can be determined by consulting a chart available on the CRA website, which organizes addresses by the taxpayer's location.

Common mistakes

Filling out the RC65 E Canada form, which is utilized for reporting changes in marital status, might seem straightforward. However, mistakes can occur, impacting eligibility for certain benefits like the Canada Child Tax Benefit (CCTB) or Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit. Being aware of common errors can help ensure the process is completed smoothly. Here are four common mistakes:

- Incorrect Information about Marital Status: It's crucial to accurately report your current marital status, especially noting the official dates of any changes. Misreporting whether you're married, living common-law, widowed, divorced, separated, or single can affect your benefits greatly.

- Forgetting to Update Personal Details: Promptly updating your address and personal details is essential. Failing to do so might result in delays or lost correspondence from the Canada Revenue Agency (CRA).

- Not Waiting the 90 Days After Separation: The form explicitly instructs not to report a separation until after 90 consecutive days have passed. This period is significant for the CRA to determine your eligibility for adjusted benefits.

- Overlooking the Certification Section: Both you and, if applicable, your current or former spouse or common-law partner must sign the form. Missing signatures can invalidate your submission, potentially delaying any adjustments to your benefits.

Avoiding these mistakes helps ensure that your martial status is accurately reflected in the eyes of the CRA, allowing for proper assessment and adjustment of applicable tax benefits. Always review your form closely before submission and consult the provided definitions and instructions on the form to clarify any uncertainties.

Documents used along the form

When it comes to navigating the changes in your life, especially those that affect your marital status, understanding the documents and forms that may accompany such transitions is crucial. The RC65 E Canada form, used to inform about a change in marital status, is often just the first step in a series of necessary bureaucratic adjustments. Below, we outline five other forms and documents frequently involved in this process, shedding light on each of their purposes to ensure you are well-prepared.

- Form T1-DD(1), Direct Deposit Request – Individuals: This form is for individuals who wish to start or change direct deposit information with the Canada Revenue Agency (CRA). It is particularly useful if you anticipate changes in where you would like your benefit payments to be deposited, such as the Canada Child Tax Benefit (CCTB) or GST/HST credit following a change in marital status.

- Booklet T4114, Canada Child Benefits: This booklet provides comprehensive information on child benefits available in Canada, including eligibility, how to apply, and how marital status affects these benefits. It's an essential read for parents navigating the process of a marital status change, offering guidance on how to ensure that child benefits are correctly allocated and continue to be received without interruption.

- RC4210, GST/HST Credit: This publication offers detailed information on the GST/HST credit, including eligibility criteria, how to apply, and how changes in your family situation, like a change in marital status, can impact your credit amount. Understanding these nuances ensures that you receive the correct credit amount post-marital status change.

- Income Tax and Benefit Return: Your annual income tax return is critical after a change in marital status. It must reflect your new marital situation, as the CRA uses this information to determine your eligibility and calculate the correct amount for certain benefits and credits, including those related to children and GST/HST.

- Letter of Explanation: In some cases, especially when applying for the GST/HST credit after a change in marital status without having applied on your last tax return, including a letter with the RC65 form stating that you wish to apply for the GST/HST credit can be necessary. It serves as a formal request to adjust your file accordingly.

Transitioning through changes in marital status can be complex, but understanding the purpose and the need for each accompanying document can streamline the process, ensuring that all benefits and credits you're entitled to are adjusted and received correctly. Familiarizing yourself with these forms and documents, alongside the RC65 E Canada form, can significantly lessen the bureaucratic burden during these times of change.

Similar forms

The Form 1040 used in the United States for filing individual income tax returns is similar to the RC65 E Canada form in providing information to the tax authorities about changes in personal information that may affect tax calculations. Both forms require taxpayers to update their status to ensure accurate tax benefits and credits.

Change of Address Form (Form AR-11) used by the U.S. Citizenship and Immigration Services mirrors the RC65 E form in the aspect of notifying a government agency about a change in personal information, specifically the change in address, to ensure proper delivery of mail and services.

The Form W-4, an Employee's Withholding Certificate in the U.S., shares similarities with the RC65 E form as both involve significant life changes that could affect one's financial responsibilities to the government, especially regarding taxes and benefits associated with marital status.

Direct Deposit Enrollment Form (Form SF-1199A) for the U.S. government payments has parallels with the RC65 E, particularly in parts where updated banking information for direct deposit of benefits is necessary, ensuring correct and timely financial transactions.

The Application for Child Benefit form, similar to aspects of RC65 E, is used in various jurisdictions to inform tax authorities about changes in family size or structure, which could affect the receipt of child-related benefits and credits.

Updating Personal Information Form used by many organizations requires individuals to notify changes similar to marital status changes in the RC65 E form, ensuring that records reflect current circumstances for accurate service provision.

The Forms for GST/HST Credit Application found in some countries require updates to personal and financial circumstances, echoing the purpose of the RC65 E in updating marital status for benefit calculation concerning Goods and Services Tax or Harmonized Sales Tax credits.

Custody Declaration Form used in family law has elements that resonate with the section of the RC65 E dealing with changes in custody due to marital status changes, impacting benefits like the Canada Child Tax Benefit and necessitating accurate reporting to reflect care responsibilities.

Dos and Don'ts

When completing the RC65 E Canada form to notify about a change in marital status, it is crucial to approach the task with accuracy and attentiveness. Below are several guidelines to follow, including both do's and don'ts, to ensure the process is smooth and the information provided is correct.

Do:- Review the definitions: Before ticking any boxes, make sure to read the definitions provided on the form for terms like "common-law partner" and "separated". This ensures the selected status accurately reflects your situation.

- Report accurate dates: When inputting the date your marital status changed, double-check the accuracy. This date is crucial for the correct processing of your form.

- Provide detailed contact information: Ensure all contact details are current and complete, including mailing and home addresses, even if they are the same. Accurate contact information is essential for any necessary follow-up.

- Sign the form: Your signature is mandatory to validate the form. Also, if applicable, have your spouse or common-law partner sign the form to certify the correctness of the information if it pertains to both parties.

- Update direct deposit information: If your banking details have changed, remember to update this information to avoid any delays in receiving potential benefits.

- Include all necessary documents: If additional documentation is required to support your change in marital status, make sure everything is attached before submission.

- Notify before 90 days of separation: If your marital status change is due to a separation, wait until you have been separated for more than 90 consecutive days before submitting the form.

- Forget to check your marital status option: Only one box should be ticked to indicate your new marital status. Ensure it's correctly marked to avoid processing delays.

- Use unclear handwriting: Fill out the form in clear, legible handwriting or, if possible, type the information. This prevents misunderstandings or incorrect data entry.

- Leave sections incomplete: If a section applies to you, make sure to fill it out completely. Incomplete forms may result in processing issues.

- Omit the year of marital status change: Including just the month and day without the year can lead to inaccurate recording of your marital status change.

- Send to the wrong tax center: Make sure to send your completed form to the appropriate tax center based on your location. The correct address ensures your form is processed without unnecessary delay.

Misconceptions

The RC65 E form, used in Canada for reporting a change in marital status to the Canada Revenue Agency (CRA), is surrounded by various misconceptions. Clarifying these misunderstandings can help individuals navigate their tax and benefit situations more effectively. Below are 10 common misconceptions and the truths behind them:

- Online reporting is the only option: While changing your marital status online through the CRA's My Account is an option, you can also use the RC65 E form to report changes in marital status by mail.

- Immediate notification is necessary: It's advised to inform the CRA as soon as possible after a change in marital status. However, in the case of separation, you should wait until after 90 consecutive days of being separated before notifying.

- Changes in marital status don't affect child benefits: A change in marital status can indeed affect the Canada Child Tax Benefit (CCTB) and the Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit payments, as these are recalculated based on your new marital status and adjusted family net income.

- All fields must be completed: You only need to complete parts of the form that apply to your specific situation. For example, Part 3 is only necessary if you are now married or living common-law.

- Any separation requires notification: You should not notify the CRA of a separation until after you have been separated for more than 90 consecutive days. Temporary separations do not need to be reported.

- A common-law partner is recognized immediately: For tax purposes, a common-law partnership is recognized only after you have lived together in a conjugal relationship for at least 12 continuous months, except under certain conditions like having a child together.

- Only females can receive the CCTB for children living with them: Typically, the CCTB is moved to the female parent's account if she has custody. However, the male parent may receive it if he is primarily responsible. Same-sex couples are also eligible, with one partner receiving the benefit for all children.

- Notification of marital status change affects the current tax year only: Updating your marital status can affect calculations for the CCTB and GST/HST credits not just in the current year, but in subsequent years as well, depending on your adjusted family net income and province or territory of residence.

- Signature of both partners is always required: The form requires the signature of the person reporting the change in marital status and, if applicable, the signature of the spouse or common-law partner when certain information is provided or documentation is attached.

- Privacy concerns over information sharing: The information provided on the RC65 E form is protected under the Privacy Act. The Canada Revenue Agency is committed to safeguarding personal information and uses it solely for the purpose of recalculating benefits.

Understanding these facts about the RC65 E form and the implications of changing your marital status can ensure that you are in a better position to manage your finances and access the benefits you are entitled to.

Key takeaways

When encountering a change in marital status, the RC65 E Canada form serves as a critical document for informing the Canada Revenue Agency (CRA). Here are key takeaways to help navigate this process smoothly and ensure you're well-informed:

- Timely Reporting is Crucial: Notify the CRA as soon as possible following any change in your marital status to avoid delays in adjusting your benefits.

- Waiting Period for Separation: In cases of separation, ensure that at least 90 consecutive days have passed before reporting the change to accurately reflect your status.

- Online Option Available: For convenience, changes to marital status can also be made online through the CRA’s My Account service.

- Impact on Benefits: Changes in marital status can affect eligibility and calculations for Canada Child Tax Benefit (CCTB) and GST/HST credits, making it essential to update your information.

- Documentation is Key: Complete all sections relevant to your new marital status accurately to ensure correct assessment and benefit calculation.

- Direct Deposit Updates: If your banking information has changed, you can update your direct deposit details through My Account or by attaching the necessary form.

- Definitions Matter: Understand the terms used on the form such as “common-law partner” and “separated” to accurately represent your situation.

- Signatures are Mandatory: Ensure both you and your partner (if applicable) sign the form to validate the information provided.

- Respecting Privacy: The CRA takes your privacy seriously. Information provided through this form is protected under privacy acts.

Properly completing and submitting the RC65 E Canada form is not only a legal requirement but also helps ensure that you receive the correct benefits based on your current situation. If you have questions or need assistance, visiting the CRA website or contacting them directly can provide additional guidance tailored to your needs.

Popular PDF Forms

Drop Ball Test Certification - This legal certificate confirms that the designated eyewear items have been tested for their ability to resist impact, ensuring compliance with safety regulations.

Court Affidavit - Guidelines are provided to help applicants understand what information is required and how to complete the form properly.

Dr2395 - The DR 2395 form accommodates various fuel types, anticipating the diverse energy sources used by Colorado vehicles.