Blank Rd 3560 10 PDF Template

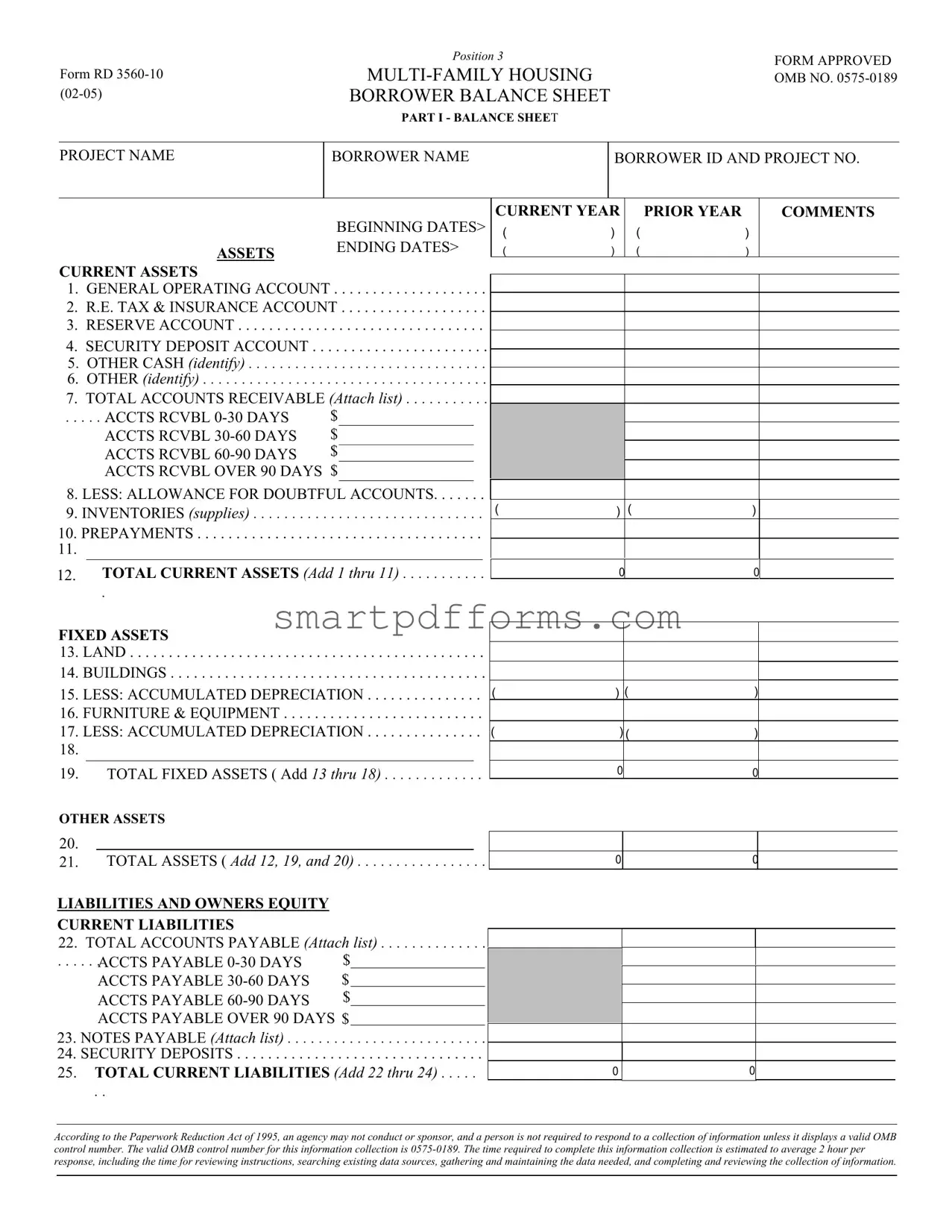

The Form RD 3560-10 is a critical documentation tool authorized under the auspices of the United States Department of Agriculture (USDA). This borrower balance sheet is designed for use within the multi-family housing sector, offering a structured means for borrowers to report their financial standings. The form encompasses a broad spectrum of financial data, ranging from current and fixed assets to current and long-term liabilities, culminating in the calculation of the owner's equity. It also includes sections for reporting on assets such as general operating accounts, real estate tax, insurance accounts, reserve accounts, and more, alongside liabilities that account for notes payable and accounts payable among others. Additionally, the form serves the purpose of ensuring compliance with legal and regulatory standards, as indicated by the mandatory certification by the borrower that the information provided is complete and accurate to the best of their knowledge, under the penalty of law as outlined in Section 1001 of Title 18, United States Code. The inclusion of a verification of review section further emphasizes the importance of accuracy and transparency in the reporting process. Mandated under the Paperwork Reduction Act of 1995, the form bears an OMB control number, underscoring its validity and the requirement for its use in specific informational collections within the USDA's programs, reflecting an estimated average completion time and underscoring its role in facilitating efficient and effective financial management and oversight in multi-family housing projects.

Preview - Rd 3560 10 Form

|

Position 3 |

FORM APPROVED |

|

||

Form RD |

OMB NO. |

|

BORROWER BALANCE SHEET |

|

|

|

PART I - BALANCE SHEET |

|

PROJECT NAME

BORROWER NAME

BORROWER ID AND PROJECT NO.

|

|

BEGINNING DATES> |

|

ASSETS |

ENDING DATES> |

|

|

|

CURRENT ASSETS |

|

|

1. |

GENERAL OPERATING ACCOUNT |

. . . . . . . . . . . . . . . . . . . . |

2. |

R.E. TAX & INSURANCE ACCOUNT |

|

3. |

RESERVE ACCOUNT |

. . . . . . . . . . . . . . . . . . . . |

4. SECURITY DEPOSIT ACCOUNT . . . . . . . . . . . . . . . . . . . . . . .

5. OTHER CASH (identify) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. OTHER (identify) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. TOTAL ACCOUNTS RECEIVABLE (Attach list) . . . . . . . . . . .

. . . . . ACCTS. . RCVBL |

$ |

ACCTS RCVBL |

$ |

ACCTS RCVBL |

$ |

ACCTS RCVBL OVER 90 DAYS $

8. LESS: ALLOWANCE FOR DOUBTFUL ACCOUNTS. . . . . . .

9. INVENTORIES (supplies) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. PREPAYMENTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

12. TOTAL CURRENT ASSETS (Add 1 thru 11) . . . . . . . . . . .

.

CURRENT YEAR |

PRIOR YEAR |

|

COMMENTS |

|

( |

) |

( |

) |

|

( |

) |

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

|

|

|

|

|

|

|

|

|

|

FIXED ASSETS

13. LAND . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. BUILDINGS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15. LESS: ACCUMULATED DEPRECIATION . . . . . . . . . . . . . . .

16. FURNITURE & EQUIPMENT . . . . . . . . . . . . . . . . . . . . . . . . . .

17. LESS: ACCUMULATED DEPRECIATION . . . . . . . . . . . . . . .

18.

19. TOTAL FIXED ASSETS ( Add 13 thru 18) . . . . . . . . . . . . .

(

(

) |

|

( |

) |

|

|

|

|||

|

|

|||

|

|

|||

) |

( |

) |

|

|

0 |

|

|

0 |

|

OTHER ASSETS

20.

21. TOTAL ASSETS ( Add 12, 19, and 20) . . . . . . . . . . . . . . . . .

LIABILITIES AND OWNERS EQUITY

CURRENT LIABILITIES

22. TOTAL ACCOUNTS PAYABLE (Attach list) . . . . . . . . . . . . . .

. . . . . .ACCTS PAYABLE |

$ |

ACCTS PAYABLE |

$ |

ACCTS PAYABLE |

$ |

ACCTS PAYABLE OVER 90 DAYS $

23. NOTES PAYABLE (Attach list) . . . . . . . . . . . . . . . . . . . . . . . . . .

24. SECURITY DEPOSITS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25. TOTAL CURRENT LIABILITIES (Add 22 thru 24) . . . . .

. .

0

0

0

0

According to the Paperwork Reduction Act of 1995, an agency may not conduct or sponsor, and a person is not required to respond to a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is

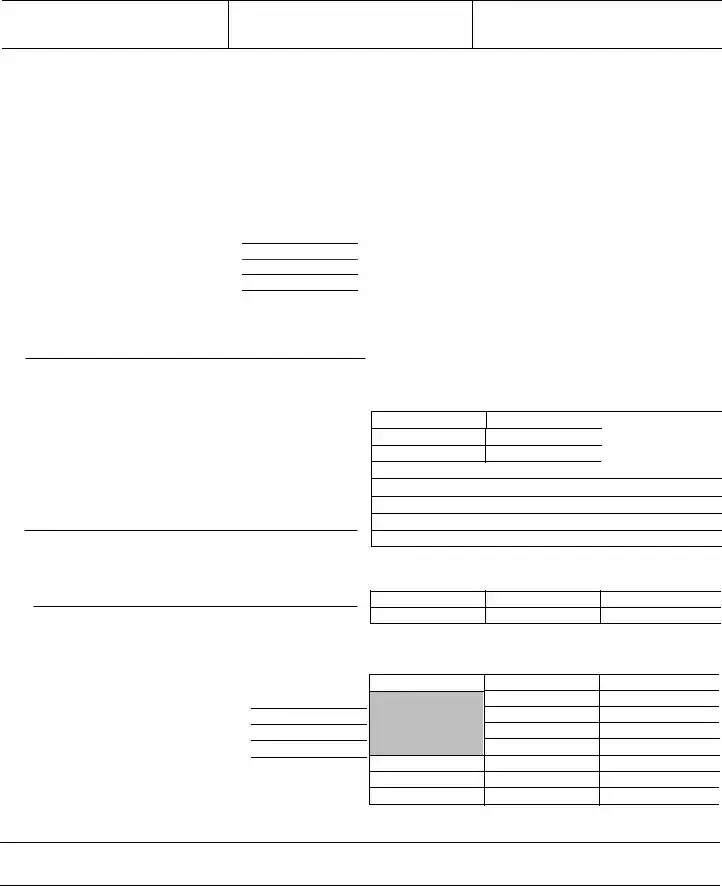

26.NOTES PAYABLE RURAL DEVELOPMENT

27.OTHER (Identify)

28.TOTAL

29.TOTAL LIABILITIES (Add 25 and 28) . . . . . . . . . . . . .

|

|

|

|

|

|

0 |

0 |

|

|

|

|

0 |

0 |

|

30. OWNER'S EQUITY (Net Worth) (21 minus 29) . . . . . . . . . . .

( |

0 ) |

( |

0) |

|

31.TOTAL LIABILITIES AND OWNER'S EQUITY (Add 29 and 30)

0

0

Warning: Section 1001 of Title 18, United States Code provides: ''Whoever, in any matter within the jurisdiction any ofdepartmentdepartment or agency of the United States knowingly and willfully falsifies, conceals or covers up by any trick,

scheme, or device a material fact, or makes any false, fictitious or fraudulent statements or representations, or makes or uses any false writing or document knowing the same to contain any false, fictitious or fraudulent statement or entry, shall be fined under this title or imprisoned not more than five years, or both.

I HAVE READ THE ABOVE WARNING STATEMENT AND I HEREBY CERTIFY THE FOREGOING INFORMATION IS COMPLETE AND ACCURATE TO THE BEST OF MY KNOWLEDGE.

(Date) |

(Signature of Borrower or Borrower' Representative) |

(Title)

PART II - VERIFICATION OF REVIEW

I/We have reviewed the borrower's records. The accompanying balance sheet, and statement of actual budget and income on Form RD

I/We certify that no identity of interest exists between me/us and any individual or organization doing business with the project or borrower.

(Date) |

(Signature) |

|

|

|

(Name and Title) |

|

|

|

(Address) |

In lieu of the above verification and signature, a review completed, dated and signed by a person or firm qualified by I license or certification is attached.

In lieu of the above verification and signature, a review completed, dated and signed by a person or firm qualified by I license or certification is attached.

Form Data

| Fact Name | Description |

|---|---|

| Form Identification | The document is titled as Form RD 3560-10, approved under OMB NO. 0575-0189. |

| Primary Purpose | It serves as a multi-family housing borrower balance sheet, detailing financial assets and liabilities. |

| Validity and Approval | According to the Paperwork Reduction Act of 1995, it is valid and authorized for use as it displays a correct OMB control number. |

| Completion Time Estimation | The estimated time to complete this form is an average of 2 hours, including preparation and review. |

| Legal Warning Included | Contains a warning under Section 1001 of Title 18, United States Code, about the penalties for falsification. |

Instructions on Utilizing Rd 3560 10

Filling out the RD 3560-10 form requires careful attention to detail and accuracy. This form is a balance sheet that borrowers of multi-family housing projects need to complete. Providing the financial snapshot of the project, it helps in assessing the financial health and managing the property effectively. To ensure the form is filled out correctly, follow the steps listed below. Don't rush; take your time to gather all necessary information before you start.

- Start with the Project Name, Borrower Name, Borrower ID, and Project No. at the top of the form. Make sure these details are accurate to avoid any confusion.

- Enter the Beginning Dates and Ending Dates to define the period the balance sheet covers.

- Under CURRENT ASSETS, fill in the respective fields for General Operating Account, R.E. Tax & Insurance Account, Reserve Account, Security Deposit Account, and any Other Cash or Other assets, clearly identifying any "Other" entries.

- For accounts receivable, list amounts under the appropriate age categories and subtract any Allowance for Doubtful Accounts to calculate the net receivables.

- Include the value of any Inventories (supplies) and Prepayments.

- Add up the values from steps 3 to 5 to get the Total Current Assets.

- Move to FIXED ASSETS section and enter values for Land, Buildings, and Furniture & Equipment. Subtract any Accumulated Depreciation where applicable.

- Tally up the Fixed Assets for a total figure.

- Under OTHER ASSETS, list any assets not covered elsewhere on the form and sum these with the totals of Current and Fixed Assets for the Total Assets.

- In the LIABILITIES AND OWNER'S EQUITY section, start with Current Liabilities, listing Accounts Payable and Notes Payable under their respective time frames and including Security Deposits.

- Add these figures to find the Total Current Liabilities.

- Under LONG-TERM LIABILITIES, list Notes Payable to Rural Development and any Other long-term liabilities, specifying their nature. Sum these for the Total Long-Term Liabilities.

- Add Total Current and Long-Term Liabilities for a combined Total Liabilities figure.

- Calculate the OWNER'S EQUITY (Net Worth) by subtracting Total Liabilities from Total Assets, then summing this with Total Liabilities for the Total Liabilities and Owner's Equity.

- Finally, read the warning statement carefully. Then, fill in the date, sign the form, and print the name and title of the borrower or borrower's representative.

- If applicable, complete PART II - VERIFICATION OF REVIEW, including the date, signature, name and title, and address. If an external review is attached, ensure it is accurately completed, dated, and signed by a qualified individual or firm.

Before submitting the RD 3560-10 form, double-check all the entries for accuracy and completeness. Any inaccuracies or omissions can lead to processing delays or questions about the property's financial status.

Obtain Answers on Rd 3560 10

- What is Form RD 3560-10?

Form RD 3560-10, also known as the Borrower Balance Sheet, is a document required by the United States Department of Agriculture (USDA) for Multi-Family Housing projects. It provides a financial snapshot of a borrower's assets, liabilities, and equity at specific beginning and ending dates. This form plays a crucial role in monitoring the financial health and compliance of housing projects financed under USDA's programs. It covers detailed information on current assets, fixed assets, other assets, liabilities, and owner's equity. The form also includes sections for verifications and certifications by the borrower or borrower's representative to affirm the accuracy of the provided information.

- Who needs to complete Form RD 3560-10?

Any borrower involved in a multi-family housing project financed or regulated by the USDA's Rural Development programs must complete Form RD 3560-10. This requirement applies to existing borrowers needing to report their financial status annually or as requested by USDA Rural Development, as well as applicants seeking funding for multi-family housing projects. The form serves as a critical tool for USDA to assess the financial viability and compliance of these projects.

- What information do I need to provide in Form RD 3560-10?

In Form RD 3560-10, you are required to detail the project’s current and fixed assets, including cash accounts, accounts receivable, inventories, and fixed assets such as land and buildings, along with accumulated depreciation. Liabilities need to be itemized as well, including accounts payable and notes payable, with current and long-term liabilities clearly distinguished. The form also requests information on the project’s owner's equity, presenting a comprehensive view of the financial standing of the borrower. Lastly, it includes sections for providing comments, listing any doubtful accounts, and a certification by the borrower or a representative that all information is accurate and complete.

- How often should Form RD 3560-10 be submitted to the USDA Rural Development?

Form RD 3560-10 is typically submitted annually; however, the exact frequency can vary based on the specific requirements set by USDA Rural Development for each project. It may also be requested on an as-needed basis to assess changes in the financial situation of a multi-family housing project or in response to specific concerns about a project’s financial health. Borrowers should stay in close communication with their USDA Rural Development representative to ensure they meet all submission timelines and requirements.

- Where can I find Form RD 3560-10 and its instructions?

Form RD 3560-10 and the accompanying instructions can be found on the official USDA Rural Development website. The form may also be available through local USDA Rural Development offices. Borrowers should ensure they are using the most current version of the form and follow all instructions carefully to ensure accurate and complete reporting. Assistance with completing the form can be sought from USDA representatives or financial advisors familiar with USDA Rural Development’s multi-family housing programs.

Common mistakes

Not providing complete and accurate information for all required fields, such as the borrower's name, borrower ID, and project number, can lead to processing delays. These details are crucial for linking the form to the correct borrower and project.

Failure to accurately report the beginning and ending dates for the current and prior year affects the form's temporal accuracy and relevance, potentially leading to incorrect financial assessments.

Omitting or inaccurately reporting current assets, including the general operating account, reserve accounts, and security deposit accounts, can distort the financial health portrayal of the project. It's important to clearly identify and accurately quantify each listed current asset.

Neglecting to attach a detailed list for total accounts receivable and not specifying the amounts receivable in the 0-30 days, 30-60 days, 60-90 days, and over 90 days categories can obscure potential cash flow issues.

Miscalculating or failing to adequately document allowances for doubtful accounts undermines the form’s credibility and may inflate the reported value of receivables.

Improper reporting of fixed assets, such as land, buildings, and equipment, including their accumulated depreciation, can significantly impact the financial statements’ balance. It is essential to correctly calculate and report these values to present a true reflection of asset value.

Incorrectly identifying or failing to specify other assets and liabilities potentially omits crucial information that might affect the overall financial analysis and subsequent decisions by reviewers or auditors. Every financial aspect needs clear and thorough documentation.

Submitting the form without the required signature and date at the bottom not only makes the submission invalid but also fails to comply with the legal attestation that the information provided is complete and accurate to the best of the submitter’s knowledge.

Completing the Form RD 3560-10 requires attention to detail and an accurate representation of the financial status of the multi-family housing project. Mistakes or omissions can lead to misunderstandings about the project's financial viability and potentially delay or jeopardize funding and support from relevant agencies.

Documents used along the form

Understanding the documents often used in conjunction with the RD 3560-10 form can significantly streamline the preparation process for borrowers or their representatives. The RD 3560-10 form, a crucial document for reporting a borrower's balance sheet in the context of multi-family housing projects, serves as a foundational piece in the financial reporting and compliance landscape. Alongside this form, there are several other documents crucial for comprehensive financial and compliance reporting in multifamily housing projects. These documents not only complement the RD 3560-10 but also cater to various aspects of financial management, compliance, and operational reporting.

- RD 1930-7 Form (Statement of Actual Budget and Income): This document is vital for comparing actual operations against the budgeted amounts. It showcases the financial performance over a specific period.

- Rental Assistance Application: This is used by tenants or borrowers to apply for rental assistance through programs that subsidize the rent for low-income individuals and families.

- Annual Financial Statement (AFS): An essential document that provides a comprehensive overview of the financial status of a project, including income, expenses, assets, and liabilities over the fiscal year.

- Tenant Certification Form: This document is used to certify the eligibility of tenants within multi-family housing projects, ensuring they meet specific income and other criteria.

- Management Plan: A detailed document outlining how a multi-family housing project is managed, including tenant selection, maintenance, budgeting, and compliance strategies.

- Maintenance Records: Records detailing the maintenance work conducted in the housing project, necessary for compliance and operational efficiency.

- Lease Agreements: Legal documents that outline the terms and conditions under which tenants occupy the housing units, including rent amounts, lease duration, and responsibilities of each party.

- Compliance Reports: Reports prepared to demonstrate adherence to various regulatory requirements, including those related to the environment, safety, and tenant rights.

Each document plays a specific role in ensuring the smooth operation and management of multi-family housing projects, while also ensuring compliance with regulations and providing clear, transparent financial reporting. Working with these documents in unison with the RD 3560-10 form allows for a comprehensive approach to managing and reporting on the health and compliance of housing projects. Whether for internal management or compliance with governmental regulations, understanding and properly utilizing these documents is essential for success in the multifamily housing sector.

Similar forms

Form 1040 (U.S. Individual Income Tax Return): Similar to the RD 3560-10 form, Form 1040 is required for financial disclosure by the federal government. Both forms require detailed financial information. Form 1040 focuses on individual income, deductions, and tax calculations, while RD 3560-10 focuses on the financial position of multifamily housing projects.

Form 1120 (U.S. Corporation Income Tax Return): This form, used by corporations to report their incomes, gains, losses, deductions, and credits to the IRS, is similar to RD 3560-10 in its requirement for detailed financial disclosure and its role in ensuring compliance with U.S. tax laws. Both forms help the government assess financial health and compliance.

HUD-1 Settlement Statement: Used in real estate transactions to itemize services and fees charged to the borrower and seller during closing. Like the RD 3560-10 form, it provides a detailed financial breakdown. However, HUD-1 focuses on individual transactions, while RD 3560-10 provides an overview of the borrower’s financial situation over a period.

Form 990 (Return of Organization Exempt From Income Tax): Required by the IRS from most tax-exempt organizations, Form 990 demands detailed financial information, similar to RD 3560-10. Both forms ensure accountability and transparency in financial reporting, albeit for different entities.

Balance Sheet Statements for Business Loans: When businesses apply for loans, banks require balance sheets that summarize the company's financial health, similar to the RD 3560-10, which acts as a balance sheet for multifamily housing projects. Both documents provide insight into assets and liabilities, facilitating financial decisions.

Form 1065 (U.S. Return of Partnership Income): This form is used by partnerships for tax reporting. Like RD 3560-10, Form 1065 requires a detailed account of financial status, including income, gains, losses, deductions, and credits. Both ensure transparent financial reporting to the government.

Dos and Don'ts

When filling out the Form RD 3560-10, it's crucial to approach this document with a detailed and attentive mindset. This form, required for Multi-Family Housing borrower's balance sheet submissions, demands accuracy and honest reporting in line with the Paperwork Reduction Act of 1995. Below are guidelines that can help ensure a smooth process:

Do's

- Review instructions carefully: Before starting, read the instructions to understand each section fully. This ensures all relevant data is compiled accurately.

- Gather necessary data in advance: Collect all required financial records and related documents before filling out the form to streamline the process.

- Use accurate and recent financial data: Ensure all financial information reflects the current state of affairs to provide an up-to-date picture of your financial position.

- Clarify entries where necessary: If an entry requires specific identification (such as "Other Cash" or "Other" under assets), provide clear and concise details.

- Sign and date the form: A form is not complete without the authorized signature, title of the signer, and date, affirming the accuracy and completeness of the information provided.

Don'ts

- Avoid guesswork: Estimations can lead to inaccuracies. Use actual figures from your financial records for every entry.

- Do not leave sections blank: If a section does not apply, it is better to enter "N/A" or "0" rather than leaving it empty, which can raise questions.

- Refrain from submitting outdated information: Using outdated financial data can misrepresent your financial situation, leading to potential issues down the line.

- Avoid inaccuracies in totaling: Double-check your math when adding totals. Errors in calculation can affect the entire balance sheet's accuracy.

- Do not forget to attach required lists: For sections that require additional lists (e.g., Accounts Payable, Notes Payable), failing to attach these can render the submission incomplete.

Approaching the Form RD 3560-10 with thoroughness and precision not only fulfills a legal requirement but also provides a clear and accurate snapshot of financial health, crucial for any Multi-Family Housing project's management and reporting duties.

Misconceptions

When it comes to understanding the purpose and requirements of the Form RD 3560-10, also known as the Multi-Family Housing Borrower Balance Sheet, several misconceptions commonly arise. These misunderstandings can lead to errors in completion, potential delays, and even compliance issues for borrowers. Below, we explore four prevalent misconceptions and clarify the essential truths about this crucial document.

- Only financial specialists can accurately complete the Form RD 3560-10. It's a common belief that a high level of financial expertise is required to fill out this form. While familiarity with financial statements is helpful, the form's primary aim is to gather a clear picture of the borrower's financial status concerning a specific project. The instructions provided with the form are designed to guide individuals through the process, regardless of their financial background. With diligent attention to detail and a comprehensive review of the project's financial records, borrowers or their representatives can accurately complete this form.

- The Form RD 3560-10 is only necessary for large projects. The size of the project is not the determining factor for whether the form needs to be completed. Any borrower involved in multi-family housing that is financed or overseen by Rural Development must submit this form. It serves as a universal tool to assess the financial health and risks of projects of varying sizes, ensuring the responsible management and use of federal funds.

- Information on the form is used for internal purposes only and doesn't affect funding. Another misconception is that the details provided on the form have no direct impact on the project's financial support from Rural Development. In reality, the information is crucial for evaluating the financial viability and management capacities of a project. It directly influences decisions related to funding, continued financial oversight, and the overall relationship between the borrower and Rural Development. Accurate and honest reporting is essential for maintaining trust and accessing ongoing or additional funding support.

- There is no legal consequence for inaccuracies or omissions on the Form RD 3560-10. The significance of the certification statement at the end of the form is often underestimated. It warns that knowingly providing false, fictitious, or fraudulent information may result in fines or imprisonment. This is not merely a formal caution; it underscores the legal responsibility of the borrower or their representative to ensure the completeness and accuracy of the information submitted. This legal framework is designed to protect federal funds and promote integrity in the management of publicly supported housing projects.

Correcting these misconceptions is crucial for ensuring that borrowers approach the Form RD 3560-10 with the seriousness and attention it requires. This process not only contributes to the efficient and effective use of federal housing funds but also supports the financial health and success of multi-family housing projects across the country.

Key takeaways

Filling out and using the RD 3560-10 form, also known as the Multi-Family Housing Borrower Balance Sheet, involves a series of steps and considerations to ensure accurate and compliant reporting to the United States Department of Agriculture (USDA). Here are key takeaways to help guide you through this process:

- The RD 3560-10 form is approved by the Office of Management and Budget (OMB) under the control number 0575-0189, indicating its legitimacy and requirement for certain USDA loan programs.

- This form is designed to present a snapshot of the borrower's financial position, requiring details on current and fixed assets, liabilities, and owners' equity at both the beginning and ending of the accounting period.

- Accuracy is crucial; the form starts with a warning under Section 1001 of Title 18, United States Code, against knowingly providing false information, which can lead to fines or imprisonment.

- It's essential to differentiate between current and fixed assets, where current assets include cash accounts and accounts receivable, and fixed assets comprise long-term investments like land and buildings.

- For liabilities, a distinction is made between current liabilities, due within a year, and long-term liabilities, which are due over a longer period.

- The form facilitates a comparison between the current and prior year's financials, allowing for an analysis of financial health over time.

- Details regarding accounts receivable and payable must be categorized by age, such as amounts due within 30 days, 30-60 days, etc., to assess the liquidity and payment timelines accurately.

- An allowance for doubtful accounts must be accounted for, reducing the reported value of accounts receivable by the amount estimated to be uncollectible.

- Completion of the form includes certification by the borrower or borrower's representative that the provided information is complete and accurate.

- Part II of the form requires verification of review, either by the borrower or an independent reviewer, ensuring that the balance sheet fairly represents the borrower's financial records and that there's no conflict of interest.

- Fulfilling the form's requirements, including attaching lists of accounts payable and receivable, notes payable, and clarifying any items under "Other" categories, is essential for a thorough and compliant submission.

Understanding and properly filling out the RD 3560-10 form is critical for borrowers within the USDA's Multi-Family Housing program to accurately represent their financial status and comply with federal requirements.

Popular PDF Forms

Proof of Income Bank Statement - A critical tool for self-employed individuals needing to report monthly financial details to the Iowa Department of Human Services.

Proof of Rent Payment Letter - A formal letter sent to tenants to remind them of overdue rent payments, indicating the amount due, the late fees as agreed in the agreement, and the total due amount including past arrears.