Blank Real Estate Agent Profit PDF Template

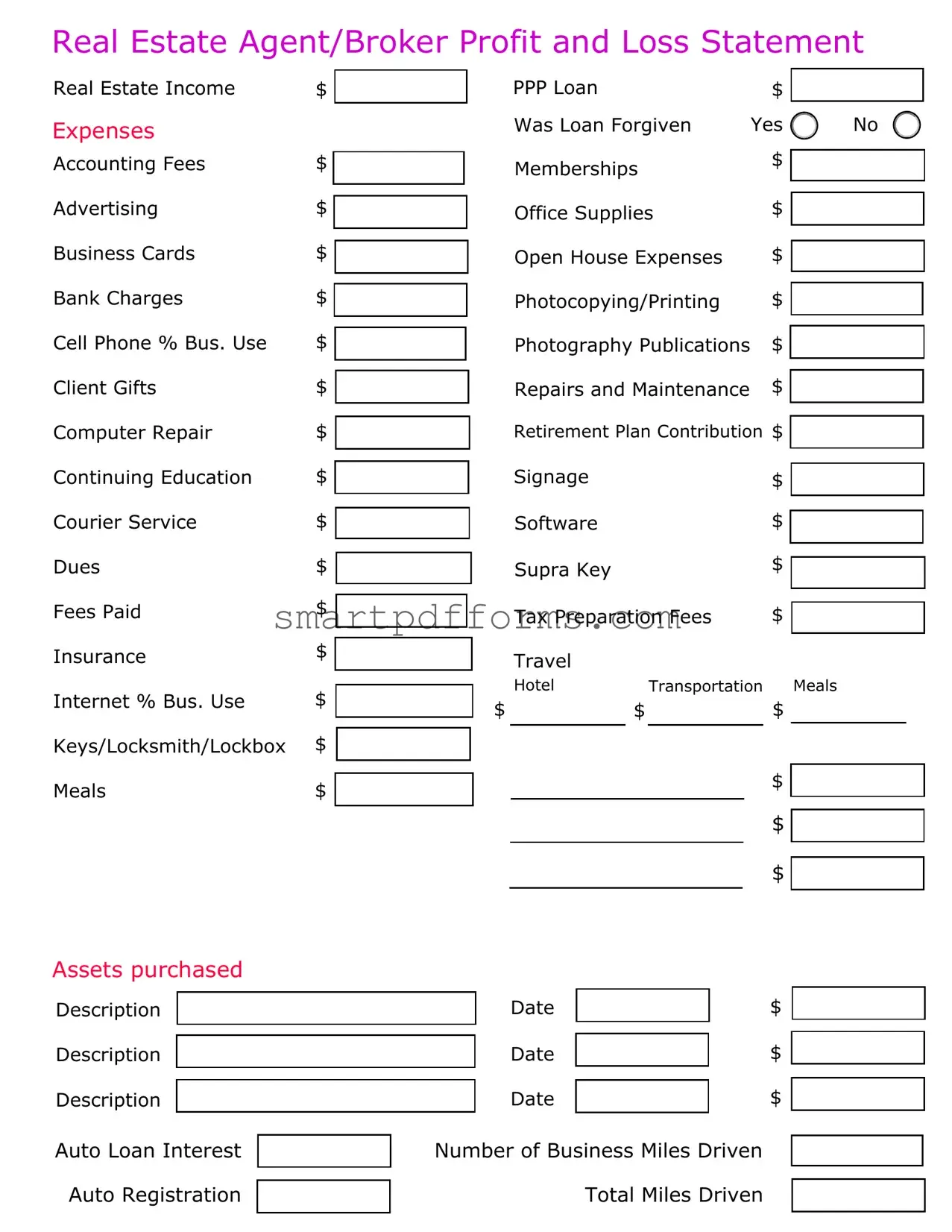

Understanding the financial intricacies involved in real estate transactions is paramount for agents and brokers, who navigate through a diverse array of earnings and expenditures. At the heart of financial management for these professionals is the Real Estate Agent/Broker Profit and Loss Statement. This comprehensive document sheds light on real estate income while detailing an exhaustive list of expenses—from accounting fees and advertising costs to more nuanced outlays like meal expenditures and PPP loans, outlining whether such loans have been forgiven. Furthermore, it dives into the operational aspects by enumerating various operational expenses like office supplies, open house expenses, and even digital necessities such as internet usage dedicated to business. Additionally, it addresses personal expenditures linked to the profession, including auto loan interest and registration, encapsulated by a detailed account of business versus total miles driven. Highlighting assets purchased adds another layer, emphasizing the investment nature of real estate operations. This form, thus, serves as a crucial tool for agents and brokers, not only aiding in the meticulous tracking of income and outgoings but also in planning and forecasting for sustainable business growth.

Preview - Real Estate Agent Profit Form

Real Estate Agent/Broker Profit and Loss Statement

Real Estate Income $

Expenses

Accounting Fees |

$ |

Advertising |

$ |

Business Cards |

$ |

Bank Charges |

$ |

Cell Phone % Bus. Use |

$ |

Client Gifts |

$ |

Computer Repair |

$ |

Continuing Education |

$ |

Courier Service |

$ |

Dues |

$ |

Fees Paid |

$ |

Insurance |

$ |

Internet % Bus. Use |

$ |

Keys/Locksmith/Lockbox |

$ |

Meals |

$ |

PPP Loan |

|

$ |

|

|

Was Loan Forgiven |

Yes |

No |

||

Memberships |

|

$ |

|

|

|

|

|||

|

|

|

|

|

Office Supplies |

$ |

|

|

|

|

|

|||

Open House Expenses |

$ |

|

|

|

|

|

|||

Photocopying/Printing |

$ |

|

|

|

|

|

|||

Photography Publications |

$ |

|

|

|

|

|

|||

Repairs and Maintenance |

$ |

|

|

|

|

|

|||

|

|

|||

Retirement Plan Contribution $ |

|

|||

Signage |

|

$ |

|

|

|

|

|

||

|

|

|

||

Software |

|

$ |

|

|

|

|

|

||

|

|

|

||

Supra Key |

|

$ |

|

|

|

|

|

||

|

|

|

||

|

|

|

|

|

Tax Preparation Fees |

$ |

|

|

|

|

|

|||

|

|

|||

Travel |

|

|

|

|

|

|

|

|

|

Hotel |

Transportation |

Meals |

||

$$$

$

$

$

Assets purchased

Description

Description

Description

Auto Loan Interest

Auto Registration

Date |

|

$ |

|

|

|

Date |

|

$ |

|

|

|

Date |

|

$ |

Number of Business Miles Driven

Total Miles Driven

Form Data

| Fact Name | Description |

|---|---|

| Income and Expenses Reporting | The Real Estate Agent/Broker Profit and Loss Statement details both the income earned and the expenses incurred over a specific period, highlighting financial performance and operational costs. |

| Tax Deductible Expenses | Several listed expenses such as advertising, continuing education, client gifts, and car expenses (like auto loan interest and auto registration) might be tax-deductible, subject to IRS rules and the specific circumstances of the business. |

| PPP Loan Reporting | It necessitates the disclosure of whether any received PPP (Paycheck Protection Program) loan was forgiven, impacting the net profit or loss and potential tax liabilities. |

| Governing Laws | Although the form is standardized, real estate agents and brokers must comply with state-specific laws and IRS regulations concerning income reporting, deductions, and taxation. |

Instructions on Utilizing Real Estate Agent Profit

Ready to get a clear view of your earnings and expenditures as a real estate agent or broker? The Real Estate Agent Profit form is designed to help you do just that, breaking down income and expenses into an accessible format. Gathering your financial information beforehand will make the process smoother. Here's a straightforward guide to filling out the form to ensure you cover all necessary details.

- Start by entering your total Real Estate Income in the designated space. This includes all earnings from sales, rentals, or any other real estate activities.

- Next, fill in your Expenses. This part requires attention to detail:

- Include Accounting Fees and Advertising costs.

- Record the amount spent on Business Cards, Bank Charges, and the percentage of Cell Phone use for business.

- Enter expenses for Client Gifts, Computer Repair, and Continuing Education.

- Document costs for Courier Service, Dues, Fees Paid, and Insurance.

- Fill in the percentage of Internet used for business, expenses for Keys/Locksmith/Lockbox, and Meals with clients or for business purposes.

- If you've received a PPP Loan, mark whether it was forgiven with a "Yes" or "No".

- Add amounts for Memberships, Office Supplies, Open House Expenses, and Photocopying/Printing.

- Include costs for Photography, Publications, Repairs and Maintenance, and your Retirement Plan Contribution.

- Lastly, input expenses for Signage, Software, Supra Key, Tax Preparation Fees, and Travel (Hotel, Transportation, Meals).

- Move on to documenting Assets Purchased:

- Describe each asset, including vehicles, office equipment, or others relevant to your business.

- Enter the purchase Date and Amount for each.

- For vehicle-related expenditures, include Auto Loan Interest, Auto Registration, the Number of Business Miles Driven, and the Total Miles Driven.

After completing all sections, review your entries for accuracy. This form offers a comprehensive overview of your professional financial status, serving as a valuable tool for planning and tax preparation. Ensure you've accurately reported all figures to make the most of this assessment.

Obtain Answers on Real Estate Agent Profit

What is the Real Estate Agent Profit and Loss Statement?

The Real Estate Agent Profit and Loss Statement is a detailed document that tracks the income and expenses of a real estate agent or broker over a certain period. This statement helps agents understand their financial performance by highlighting how much they have earned (income) and how much they have spent (expenses) in their real estate activities.Why is it important for a real estate agent or broker to maintain a Profit and Loss Statement?

Maintaining a Profit and Loss Statement is crucial for real estate agents because it gives them a clear picture of their financial health. It helps agents to track their financial progress, identify trends in income and expenses, and make informed decisions about budgeting and financial planning. It also simplifies the process of filing taxes and can support loan applications by providing proof of income and expenses.What types of income should be included in the Real Estate Income section?

In the Real Estate Income section, agents should include all earnings generated from their real estate activities. This includes commissions from buying, selling, or renting properties, referral fees, or any other income directly related to their role as a real estate agent or broker.What types of expenses are listed in the expenses section?

The expenses section includes various costs associated with running a real estate business. These expenses cover advertising, business cards, bank charges, cell phone usage for business, client gifts, computer repair, continuing education, courier services, dues, fees, insurance, internet usage for business, keys/locksmith/lockbox costs, meals, memberships, office supplies, open house expenses, photocopying/printing, photography, publications, repairs and maintenance, retirement plan contribution, signage, software, Supra key, tax preparation fees, travel, hotels, transportation, meals, and more. Additionally, loan interest, auto registration, and assets purchased for the business may also be recorded.How should a real estate agent document the PPP Loan information?

For those who received a PPP (Paycheck Protection Program) Loan, it's essential to document whether the loan was forgiven in the relevant section of the Profit and Loss Statement. Indicate by checking "Yes" or "No," as this has important implications for your financial reporting and potential tax obligations.What is the purpose of tracking mileage in the Profit and Loss Statement?

Tracking the number of business miles driven is important for tax deduction purposes. The IRS allows real estate agents to deduct vehicle expenses related to their business, and maintaining accurate records of business mileage is necessary to calculate and justify these deductions.How does the assets purchased section work?

In the assets purchased section, real estate agents should list significant purchases made for their business. This could include vehicles, computers, or office equipment. For each item, agents should document a description of the asset, the purchase date, and the purchase amount. This information is vital for accounting purposes and tax planning, especially regarding depreciation calculations and deductions.Can the Real Estate Agent Profit and Loss Statement be used for tax preparation?

Yes, the Real Estate Agent Profit and Loss Statement can be an invaluable tool during tax season. By providing a comprehensive breakdown of income and expenses, it simplifies the process of reporting taxable income and claiming allowable deductions. Real estate agents are encouraged to share this statement with their tax preparers to ensure accuracy in their tax filings.How often should a real estate agent update their Profit and Loss Statement?

It's advisable for real estate agents to update their Profit and Loss Statement regularly, ideally on a monthly basis. This consistent update schedule allows agents to keep close tabs on their financial performance, identifying trends, managing expenses more effectively, and making timely adjustments to their business strategy. Quarterly reviews are also beneficial, especially for planning purposes and aligning financial goals.

Common mistakes

Filling out the Real Estate Agent/Broker Profit and Loss Statement might seem straightforward, yet several common mistakes can significantly affect the accuracy of the financial information reported. Awareness and correction of these errors are paramount for an accurate representation of a real estate agent or broker's financial stance. Let's look at four of these common blunders.

Not accurately categorizing expenses: Often, individuals fail to correctly categorize their expenses. For example, mixing up personal and business expenses, such as cell phone usage or internet costs, if not accurately split based on actual business use, can lead to an incorrect financial portrayal. It's crucial to allocate expenses precisely to the right category to ensure the profit and loss statement reflects the real financial health of the business.

Forgetting to record smaller expenses: Small expenditures, such as business cards, client gifts, or even coffee for an open house, can seem insignificant on their own. However, cumulatively, they can amount to a substantial sum over time. Neglecting these minor expenses can lead to an overestimated profit. Diligent tracking and recording of every expenditure, no matter how small, are vital for accuracy.

Omitting to document the use percentage for shared expenses: Certain costs, like internet and cell phone bills, are often utilized for both personal and business purposes. A mistake commonly made is not specifying what percentage of these costs should be attributed to business use. This oversight can either inflate or deflate the business expense claims, leading to potential issues with tax liabilities or not taking full advantage of lawful deductions.

Misreporting auto-related expenses: Auto expenses, specifically when a vehicle is used for both personal and business activities, require careful documentation. The number of business miles driven versus total miles driven must be accurately recorded, alongside auto loan interest and auto registration fees, to claim the correct amount. Errors in this area can result in missed deductions or challenges if audited.

Being diligent in avoiding these common mistakes on the Real Estate Agent/Broker Profit and Loss Statement not only ensures compliance with tax regulations but also offers a clear view of financial progress, aiding in strategic business decision-making. By allocating a bit of additional time and attention to accurately complete this form, real estate professionals can safeguard their financial integrity and position themselves for sustained success.

Documents used along the form

When managing real estate transactions, a Real Estate Agent Profit form is crucial for tracking income and expenses. However, other documents play vital roles in ensuring smooth operations and legal compliance for agents. These documents range from initial agreements to finalizing the sale, each serving a specific purpose throughout the real estate process.

- Listing Agreement: This contract between a property owner and a real estate agent authorizes the agent to sell the property. It details the rights and obligations of both parties, including the agent's commission.

- Buyer Representation Agreement: This document formalizes the relationship between a buyer and a real estate agent, outlining the agent's duties to the buyer and the terms of compensation.

- Property Disclosure Statement: Sellers use this form to disclose the condition of the property, including any known defects or problems, to inform potential buyers.

- Offer to Purchase Real Estate Form: This is a proposed agreement from a buyer to a seller to buy real estate on certain terms. It becomes binding if the seller accepts it.

- Home Inspection Report: This report is generated by a professional home inspector after evaluating a property. It provides a detailed account of the property's condition, highlighting areas needing repair or maintenance.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document itemizes all financial transactions made as part of the real estate deal, including payments to and from the buyer, seller, and other parties.

- Title Search Report: Before finalizing a real estate transaction, a title search is performed to ensure the property is free of liens or claims. It ensures the seller has a clear title to transfer to the buyer.

- Lease Agreement: If a property is intended for rental use, this agreement outlines the terms under which a tenant agrees to rent a property from the landlord, specifying details such as rent amount, deposit, and lease duration.

Each of these documents addresses different aspects of real estate transactions, from listing to sale, promoting transparency, clarity, and protection for all parties involved. By understanding and effectively using these forms alongside the Real Estate Agent Profit form, agents can ensure a well-organized, efficient, and legally compliant practice.

Similar forms

Profit and Loss Statement (General Business): Just like the Real Estate Agent/Broker Profit and Loss Statement, this documents a company's revenues, costs, and expenses to illustrate a business's financial performance over a specific time period. Both include categories such as income, expenses, and possible loans.

Independent Contractor Financial Statement: Similar to the Profit and Loss Statement for real estate agents, this document captures the financial transactions for individuals who work on a contract basis, detailing income, expenses, and business-related purchases.

Small Business Monthly Expense Report: This report shares common elements with the real estate profit form by itemizing monthly expenditures such as office supplies, advertising, and travel costs, helping small business owners track their operational costs.

Self-Employment Ledger: This ledger functions similarly to the Real Estate Agent Profit and Loss Statement by providing a record of income and expenses for self-employed individuals, which is essential for tax preparation and financial planning.

Tax Deduction Tracker for Self-Employed: This tracker resembles the real estate form by listing expenses that can be deducted from income to lower the taxable income, including business use of home, vehicle expenses, and office supplies.

Annual Financial Report: While broader in scope, this report is akin to the real estate profit form in its purpose to summarize the yearly financial activities, including income, expenses, and asset purchases, of an organization or individual.

Business Budget Planner: Similar in functionality, this planner helps businesses and individuals forecast and manage their finances by detailing expected income, planned expenses, and investments, akin to the budgeting aspect within the real estate profit form.

Dos and Don'ts

Filling out the Real Estate Agent/Broker Profit and Loss Statement is a crucial task that requires accuracy and attention to detail. The aim is to provide a clear view of your financial performance over a specific period. Here are essential dos and don'ts to help ensure the process is completed effectively:

- Do double-check all figures for accuracy. Inaccuracies can lead to financial discrepancies, affecting the overall analysis of your business performance.

- Do keep receipts and documentation for all listed expenses. These are vital for verification purposes and can be crucial if your return is ever audited.

- Do list all sources of income clearly, ensuring that every dollar earned is accounted for. This includes not only direct sales but also any ancillary income related to your real estate activities.

- Do deduct all applicable expenses. Many real estate agents overlook deductions that could significantly impact their net profit, such as home office expenses or mileage.

- Do indicate clearly whether the PPP Loan was forgiven in the relevant section. This detail is critical for accurate financial reporting and tax implications.

- Don't estimate expenses or income. Use actual figures to ensure the statement accurately reflects your financial situation. Estimates can lead to significant issues down the line.

- Don't forget to report personal usage percentages for items like your cell phone or internet if they're not used exclusively for business. This is important for complying with tax regulations and for the accuracy of your expense reporting.

By following these guidelines, real estate agents and brokers can create a precise and comprehensive Profit and Loss Statement. This document not only aids in financial planning and tax preparation but also helps in assessing the business's health and areas for improvement.

Misconceptions

When it comes to understanding the Real Estate Agent Profit form, several misconceptions can cloud the judgment of agents and brokers alike. Here, we are going to debunk four common misunderstandings:

- The form is just about income and expenses. While the Real Estate Agent Profit form does detail income and expenses comprehensively, categorizing them under various heads like advertising, client gifts, and insurance, it offers more. The form also requests information related to assets purchased, auto loan interest, and auto registration, rendering a comprehensive overview of an agent's financial health beyond merely income and expenses.

- Personal expenses are irrelevant to this form. It's a common fallacy. While the form primarily focuses on business-related transactions, personal expenses that directly impact business operations, such as the percentage of cell phone and internet use, are essential. These details help in delineating the business use percentage of these utilities, which directly feeds into business expense calculations and profit analysis.

- All loans are treated equally in the profit form. This misunderstanding could lead to inaccurate reporting. The form distinguishes between various types of loans, most notably through the inclusion of the PPP (Paycheck Protection Program) Loan section which further probes whether the loan was forgiven. Differentiating between loans, especially in such detail, aids in obtaining accurate financial portraits and facilitating appropriate fiscal planning and reporting.

- It's a static document only for year-end review. Contrary to this belief, the Real Estate Agent Profit form is a dynamic document beneficial throughout the fiscal year. It not only aids in year-end financial reviews but also serves as a crucial tool for real-time financial tracking and planning. Frequent updates to the form can provide real estate professionals with ongoing insights into their financial performance, enabling more informed decision-making regarding budgeting, investments, and expense management.

In summation, the Real Estate Agent Profit form is a nuanced document that, when understood and utilized correctly, offers far-reaching benefits for financial tracking, planning, and reporting. Dispelling common misconceptions allows real estate professionals to make the most of this important resource, thereby enabling better business decisions and fostering financial health.

Key takeaways

When completing and utilizing the Real Estate Agent Profit Form, agents and brokers can gain valuable insights into their financial performance. To ensure accuracy and comprehensive understanding, consider the following key takeaways:

- Detail Income and Expenses: The form requires a thorough listing of income sources and business expenses. This includes not just obvious costs like advertising and client gifts, but also less considered expenses such as accounting fees, continuing education, and internet use. Precise tracking and reporting are vital for an accurate financial overview.

- Keep Adequate Records: To accurately fill out the form, maintaining detailed records of all transactions, including receipts and invoices, is essential. This documentation is not only necessary for filling out the form but also vital in case of an audit.

- PPP Loan Reporting: If you have received a PPP loan, the form requires you to indicate whether this loan was forgiven. This information is crucial as it impacts the net profit and taxable income calculations.

- Auto Expenses and Mileage: The form specifically asks for details regarding auto expenses, including auto loan interest and auto registration. It also requires the recording of business vs. total miles driven, emphasizing the importance of tracking business use of personal vehicles for accurate deductions.

- Asset Tracking: Accurately reporting assets purchased, with descriptions and dates, allows for proper depreciation calculations and ensures that the value of these assets is correctly factored into the profit and loss statement. This section underscores the importance of recording significant purchases and understanding their impact on financial statements.

By closely adhering to these key points, real estate professionals can ensure that their Real Estate Agent Profit Form accurately reflects their business's financial health, thereby enabling better financial planning and management.

Popular PDF Forms

156-r - A comprehensive form including data on unit identification, training periods, and preparation details.

Motion for Emergency Custody Ohio - Includes vital information on presenting evidence and testimony at the custody hearing, emphasizing preparation and factual representation.