Blank Real Estate Tax Deduction PDF Template

In recognition of the complexities and potential benefits tied to tax preparation for real estate professionals, Daszkal Bolton LLP has put together a comprehensive Realtors’ Tax Deduction Worksheet. This initiative follows the considerable interest generated by a previous article on tax tips specifically aimed at realtors. The purpose of this worksheet is to simplify the process of organizing tax deductible business expenses, ensuring that realtors can efficiently claim what is rightfully theirs according to tax laws. To qualify as deductible, an expense must be deemed "ordinary and necessary" and directly linked to the conduct of a real estate business. It is crucial for realtors to note that expenses reimbursed or expected to be reimbursed cannot be included. This detailed worksheet spans various categories of potential deductions, including advertising, office supplies, professional fees, out-of-town travel expenses, continuing education costs, and vehicle-related expenditures, among others. Furthermore, it provides spaces for noting down expenses not explicitly listed but relevant to the operation of a real estate business. Jeff Bolton, CPA, at Daszkal Bolton LLP, is available to offer advice or answer any questions regarding specific real estate tax issues, ensuring realtors have the necessary support to maximize their deductions.

Preview - Real Estate Tax Deduction Form

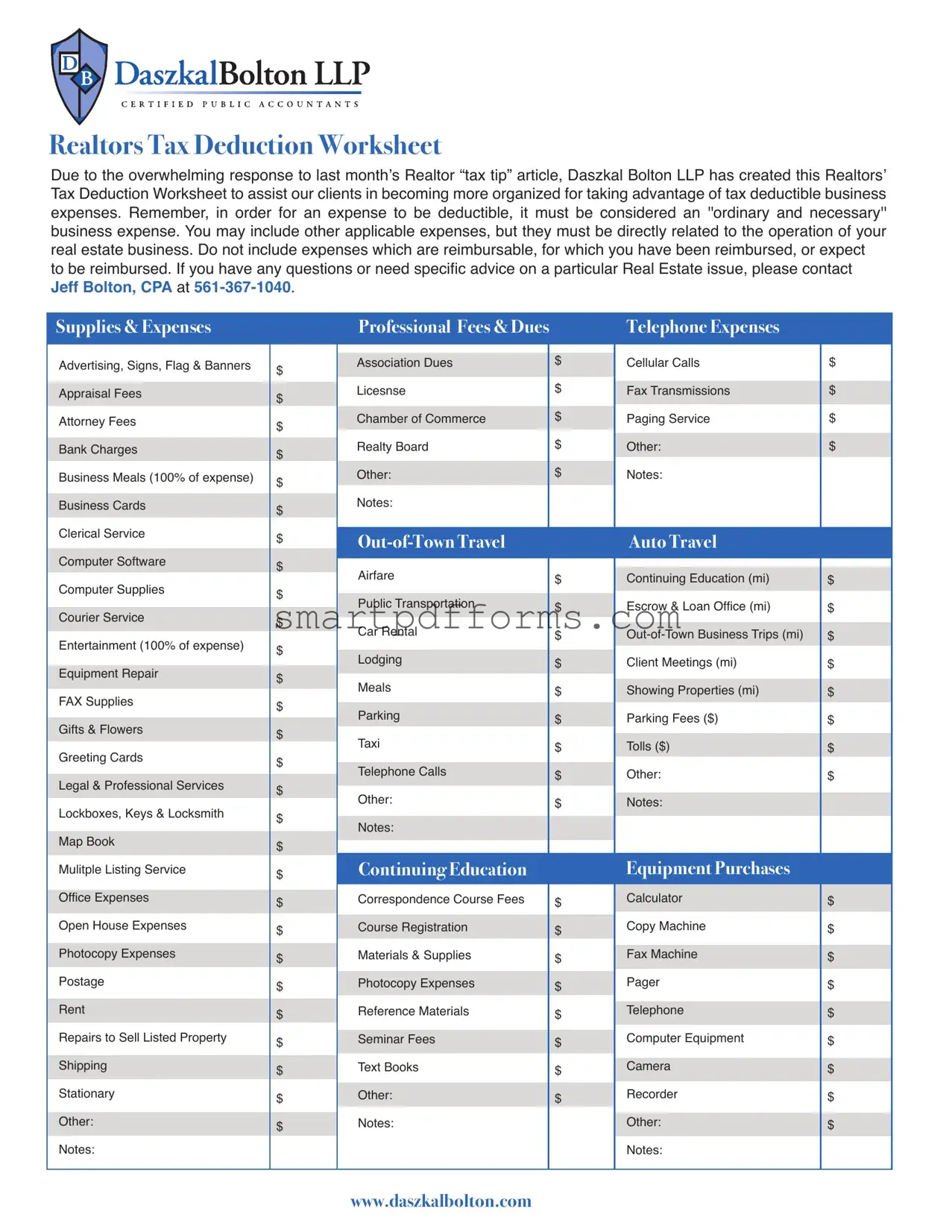

Realtors Tax Deduction Worksheet

Due to the overwhelming response to last month’s Realtor “tax tip” article, Daszkal Bolton LLP has created this Realtors’ Tax Deduction Worksheet to assist our clients in becoming more organized for taking advantage of tax deductible business expenses. Remember, in order for an expense to be deductible, it must be considered an ''ordinary and necessary'' business expense. You may include other applicable expenses, but they must be directly related to the operation of your real estate business. Do not include expenses which are reimbursable, for which you have been reimbursed, or expect to be reimbursed. If you have any questions or need specific advice on a particular Real Estate issue, please contact JEFF BOLTON, CPA at

Supplies & Expenses

Advertising, Signs, Flag & Banners Appraisal Fees

Attorney Fees

Bank Charges

Business Meals (100% of expense) Business Cards

Clerical Service

Computer Software

Computer Supplies Courier Service Entertainment (100% of expense) Equipment Repair

FAX Supplies

Gifts & Flowers

Greeting Cards

Legal & Professional Services

Lockboxes, Keys & Locksmith

Map Book

Mulitple Listing Service

Office Expenses

Open House Expenses

Photocopy Expenses

Postage

Rent

Repairs to Sell Listed Property

Shipping

Stationary

Other:

Notes:

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Professional Fees & Dues

Association Dues |

$ |

|

|

Licesnse |

$ |

|

|

Chamber of Commerce |

$ |

Realty Board |

$ |

|

|

Other: |

$ |

Notes: |

|

|

|

|

|

Airfare |

$ |

|

|

|

|

Public Transportation |

$ |

|

|

Car Rental |

$ |

|

|

|

|

Lodging |

$ |

|

|

Meals |

$ |

|

|

|

|

Parking |

$ |

Taxi |

$ |

|

|

|

|

Telephone Calls |

$ |

|

|

Other: |

$ |

|

|

|

|

Notes: |

|

|

|

|

|

Continuing Education |

|

Correspondence Course Fees |

$ |

|

|

|

|

Course Registration |

$ |

Materials & Supplies |

$ |

|

|

|

|

Photocopy Expenses |

$ |

|

|

Reference Materials |

$ |

|

|

|

|

Seminar Fees |

$ |

|

|

Text Books |

$ |

|

|

|

|

Other: |

$ |

Notes: |

|

|

|

Telephone Expenses

Cellular Calls

Fax Transmissions

Paging Service

Other:

Notes:

Auto Travel

Continuing Education (mi)

Escrow & Loan Office (mi)

Client Meetings (mi)

Showing Properties (mi)

Parking Fees ($)

Tolls ($)

Other:

Notes:

Equipment Purchases

Calculator

Copy Machine

Fax Machine

Pager

Telephone

Computer Equipment

Camera

Recorder

Other:

Notes:

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

www.daszkalbolton.com

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The worksheet is designed for Realtors to organize tax-deductible business expenses. |

| 2 | Expenses must be "ordinary and necessary" to qualify as deductible. |

| 3 | Reimbursable expenses, or expenses expected to be reimbursed, should not be included. |

| 4 | The worksheet was created in response to a previous article's popularity, highlighting demand for tax tips among Realtors. |

| 5 | Jeff Bolton, CPA, is available for specific Real Estate issue advice, with contact information provided. |

| 6 | Categories for deductions include supplies and expenses, professional fees and dues, out-of-town travel, continuing education, telephone expenses, auto travel, and equipment purchases. |

| 7 | Business meals and entertainment expenses can be deducted at 100% of their cost within this worksheet's guidelines. |

| 8 | For Realtors, specific items like lockboxes, keys, and multiple listing service expenses are recognized as deductible. |

Instructions on Utilizing Real Estate Tax Deduction

When it comes to taxes, being organized can save you a lot of time and effort, especially for real estate professionals looking to maximize deductions. The Real Estate Tax Deduction form is designed to help you track and claim permissible business expenses over the tax year. These deductions must qualify as "ordinary and necessary" to your real estate activities. It's important to document each expense accurately and consistently, ensuring you don't include costs that have been reimbursed or are reimbursable. Below are the steps to fill out this essential form correctly.

- Begin by reviewing the entire worksheet to understand the types of expenses it covers.

- Under the "Supplies & Expenses" section, input the amount spent on each listed item over the tax year. This includes advertising costs, signage, appraisal fees, attorney fees, bank charges, business meals, and more. Ensure you only report expenses directly tied to your business operations.

- For business meals and entertainment expenses, you can claim 100% of these costs. Make sure these expenses comply with the tax rules as ordinary and necessary business expenses.

- Move on to "Professional Fees & Dues," where you will report any association dues, licensing fees, and memberships to professional bodies like the Chamber of Commerce or realty boards.

- In the "Out-of-Town Travel" section, document all costs associated with business travel, including airfare, car rentals, accommodations, meals, and other related expenses.

- Under "Continuing Education," include fees related to courses, seminars, textbooks, and any materials that contribute to your professional development within real estate.

- Report your total telephone expenses, including cellular calls, fax transmissions, and any paging services used for business purposes.

- For "Auto Travel," accurately log miles traveled for continuing education, escrow and loan office visits, client meetings, and property showings. Additionally, record any parking fees and tolls.

- In the "Equipment Purchases" section, itemize any equipment bought during the tax year that was necessary for your business, such as computers, phones, cameras, or any specialized tools.

- Review your entered information for accuracy and completeness. Ensure you haven’t included reimbursable expenses or those expected to be reimbursed.

- For any additional notes or unique expenses not explicitly mentioned but directly related to the operation of your real estate business, utilize the "Notes" spaces provided in each section.

- Consult with a tax professional if you have specific questions or need advice on particular deductions. Remember, JEFF BOLTON, CPA, is available for consultation.

After completing the worksheet, take a moment to double-check each section. Accuracy is key to maximizing your deductions while staying compliant with tax laws. Keep all related receipts and documents throughout the year to support your deductions if ever required by tax authorities. With everything in order, you’re now better prepared to manage your real estate business’s financial obligations effectively.

Obtain Answers on Real Estate Tax Deduction

What is the Real Estate Tax Deduction form?

Who can use this form?

What kinds of expenses can be included on the form?

- Advertising costs

- Professional service fees (e.g., attorney, CPA)

- Office expenses and supplies

- Transportation costs related to business

- Continuing education costs

- Equipment purchases directly necessary for your business

Can business meals and entertainment expenses be deducted?

Are there any expenses that cannot be included?

What if an expense seems relevant but is not listed on the form?

How do I know if an expense is "ordinary and necessary"?

What should I do if I have questions or need advice on a particular expense?

Where can I find more information or get the form?

This form helps realtors organize their deductible business expenses. Deductible means that an expense can reduce your taxable income, thus potentially lowering your taxes. Expenses must be "ordinary and necessary" for your real estate business to be considered deductible.

Any realtor looking to organize and maximize their tax deductions related to their real estate business activities can use this form. It's crucial, however, to ensure that the expenses are directly related to your business operations.

Yes, 100% of business meals and entertainment expenses that are ordinary and necessary for your real estate business can be included. This is a change from previous years when the deduction was limited.

Yes, any expenses that are reimbursable, or for which you have already been reimbursed, cannot be included. Only out-of-pocket costs that are solely for your business should be accounted for on this form.

If you have an expense that is not explicitly listed but is ordinary, necessary, and directly related to your real estate business, you should include it. There's a section labeled "Other" for such expenses. Do keep notes or records explaining the nature and business purpose of these expenses.

An "ordinary" expense is common and accepted in your trade or business, while a "necessary" expense is helpful and appropriate for your business. Generally, if other realtors commonly incur the expense and it's helpful for your operations, it likely qualifies.

For specific questions or advice related to real estate tax deductions, consider contacting a Certified Public Accountant (CPA) or a tax professional who is familiar with real estate business operations. The form mentions contacting Jeff Bolton, CPA, as a contact for advice.

You can visit the website provided at the bottom of the form, www.daszkalbolton.com, for more information or to obtain the Realtors' Tax Deduction Worksheet. It's also recommended to consult with a tax professional for detailed guidance tailored to your specific situations.

Common mistakes

When filling out the Real Estate Tax Deduction form, it's essential to approach with care and precision to fully leverage tax advantages without making errors that could lead to an audit or the disallowance of legitimate deductions. Missteps in this process not only jeopardize one's financial position but also waste the time and effort invested in meticulous record-keeping throughout the year. Below are nine common mistakes people often make on this critical form:

- Overlooking Ordinary and Necessary Expenses: Individuals sometimes fail to claim deductions for expenses that are legitimately ordinary and necessary for the operation of their real estate business. This includes not recognizing smaller items that, cumulatively, can significantly impact the tax liability.

- Including Non-Deductible Expenses: Conversely, some might attempt to include expenses that are not directly related to the business’s operations or are reimbursable. This includes personal expenses or those which have been, or will be, reimbursed.

- Misclassifying Personal and Business Expenses: Another common error is the incorrect classification of expenses, especially when a clear line between personal and business use is not defined, such as with vehicle use or home office expenses.

- Incorrectly Reporting Travel Expenses: Travel expenses must be accurately accounted for and directly related to the business. Misinterpreting what constitutes a deductible travel expense can lead to claiming non-qualifying deductions.

- Improper Documentation of Meals and Entertainment: The IRS applies strict guidelines to the deduction of meals and entertainment expenses. Claiming 100% of such costs without understanding the limitations or failing to keep detailed records are typical pitfalls.

- Failing to Separate Equipment Purchases: Large purchases such as computers, cameras, or other significant equipment must be accurately reported and, in some cases, depreciated over time rather than fully deducted in the year of purchase.

- Errors in Calculating Auto Travel Expenses: Deductions for mileage and other automobile expenses require diligent record-keeping. Oftentimes, individuals inaccurately estimate or improperly document these deductions.

- Omitting or Incorrectly Reporting Professional Fees & Dues: Memberships, professional licenses, and association dues are deductible expenses often missed or inaccurately reported by individuals on their tax forms.

- Miscalculating Home Office Deductions: For those who work from a home office, accurately calculating and justifying the space used exclusively for business is crucial. Overestimating this space can lead to deductions that do not comply with IRS rules.

To navigate the complexities of real estate tax deductions successfully, individuals are encouraged to maintain comprehensive and accurate records throughout the year, understand the tax code's nuances as it applies to their business, and seek professional advice when in doubt. This diligence ensures that every qualifying expense is captured, and non-eligible costs are excluded, thereby maximizing the potential tax benefits while adhering to legal requirements.

Documents used along the form

When preparing for tax time, especially for those in the real estate sector, having the right documents and forms at hand is crucial. The Realtors' Tax Deduction Worksheet is a vital tool, aiding professionals in organizing deductible business expenses effectively. However, this worksheet is just a piece of the puzzle. Several other forms and documents often accompany it, each serving its purpose in ensuring a comprehensive approach to managing real estate-related taxes.

- Form 1040, U.S. Individual Income Tax Return: This is the primary form used by individuals to file their annual income tax returns with the IRS. It includes all taxable income and allows taxpayers to claim deductions, including those related to real estate.

- Schedule E (Form 1040), Supplemental Income and Loss: Specifically important for real estate professionals, this form is used to report income and losses from rental real estate, as well as royalties, partnerships, S corporations, estates, and trusts.

- Form 1098, Mortgage Interest Statement: This document is sent by mortgage lenders to borrowers showing the amount of mortgage interest paid during the year. It is essential for homeowners looking to deduct mortgage interest on their tax returns.

- Schedule A (Form 1040), Itemized Deductions: Taxpayers use Schedule A to itemize deductions instead of taking the standard deduction. Property taxes and certain other real estate-related expenses are deducted here.

- Form 4562, Depreciation and Amortization: Real estate professionals use this form to claim deductions for the depreciation of property, among other things. It's crucial for reporting the depreciation of assets held in a real estate business.

- Form 8829, Expenses for Business Use of Your Home: For realtors working partly or entirely from a home office, this form helps calculate the deduction for business use of a home, which includes a portion of rent, utilities, mortgage interest, insurance, and repairs.

Though the process might seem daunting, each of these documents plays a role in ensuring real estate professionals can claim every possible deduction, ultimately saving money and reducing their tax burden. Accurate and organized record-keeping across these documents not only simplifies tax preparation but also maximizes potential deductions. Remember, consulting with a tax professional can provide personalized advice tailored to individual circumstances, ensuring compliance and optimization of tax benefits.

Similar forms

Mortgage Interest Deduction Form: This form is similar because it also allows taxpayers to reduce taxable income based on specified payments related to home ownership, much like how the Real Estate Tax Deduction form caters to business-related real estate expenses.

Self-Employment Tax Deduction Form: Self-employed individuals use this form to deduct business expenses, closely aligning with the purpose of the Realtors’ Tax Deduction Worksheet, which targets real estate professionals' business deductions.

Home Office Deduction Form: This document is akin to the Real Estate Tax Deduction form by giving individuals who work from home the opportunity to deduct a part of their home expenses, paralleling how realtors can deduct home office costs if it's a primary place of business.

Vehicle Expense Deduction Form: Similar to the Auto Travel section of the Realtors’ Tax Deduction Worksheet, this form allows the deduction of expenses related to business use of a vehicle, contributing to reducing taxable income.

Business Travel Expenses Deduction Form: It shares similarities by allowing deductions for travel expenses incurred for business, matching the Out-of-Town Travel section, which details similar deductible expenses for real estate professionals.

Depreciation Deduction Form: This form enables taxpayers to deduct the cost of property over time, similar to how real estate professionals can deduct expenses for Equipment Purchases, acknowledging the long-term use of assets in conducting business.

Charitable Donations Deduction Form: Though focused on charitable giving, it parallels the Real Estate Tax Deduction form by allowing deductions that reduce taxable income, reflecting how various expenses directly related to business operations are handled.

Education Expenses Deduction Form: This form is related through its provision for deducting education costs pertaining to one's profession, much like the Continuing Education section that aids realtors in acquiring necessary skills and knowledge for their trade.

Medical Expenses Deduction Form: While primarily for personal medical costs, it mirrors the Realtors’ Tax Deduction Worksheet in concept, demonstrating how taxpayers can deduct specific expenses to lower their taxable income, albeit in different categories.

Dos and Don'ts

When it comes to maximizing the benefits from Real Estate Tax Deductions, organized and informed preparation is key. Understanding what actions to take—and which pitfalls to avoid—can make a significant difference in your tax savings. Here are six things you should do, as well as six things you shouldn't do, when filling out the Real Estate Tax Deduction form.

Do:

- Verify that all expenses are "ordinary and necessary" and directly related to your real estate business operation.

- Keep meticulous records of all expenses and deductions to provide evidence in case of an audit.

- Include all non-reimbursable expenses, ensuring they are not expected to be reimbursed in the future.

- Consult with a tax professional, such as Jeff Bolton, CPA, for personalized advice tailored to your unique situation.

- Review the complete list of deductible expenses regularly to ensure you're not missing out on any potential deductions.

- Stay informed about changes in tax laws that could affect your deductions and tax liabilities.

Don't:

- Attempt to deduct expenses that are reimbursable or have been reimbursed already.

- Overlook the necessity to categorize expenses accurately according to the form's sections, such as Supplies & Expenses, Professional Fees & Dues, and so on.

- Forget to include all applicable notes or additional expenses in the 'Other' sections, ensuring nothing is left out.

- Assume all business-related expenses are deductible without confirming they meet the IRS criteria of "ordinary and necessary."

- Delay organizing your receipts and documentation, which can lead to missed deductions or errors in reporting.

- Ignore the potential need for professional tax advice to navigate complex scenarios, potentially leading to missed opportunities for deductions.

By adhering to these do's and don'ts, real estate professionals can better navigate the intricacies of tax deductions, ensuring they maximize their returns while staying compliant with tax laws. Remember, the landscape of tax deductions is ever-evolving, and keeping abreast of these changes is essential for optimizing your financial strategy.

Misconceptions

When it comes to managing your finances as a realtor, it's essential to understand the real estate tax deduction process thoroughly. However, numerous misconceptions can lead to missed opportunities or errors in filing. Here are seven common misconceptions about the Real Estate Tax Deduction form, debunked to help you navigate this complex area with greater confidence.

Only large expenses are deductible: Many realtors assume that only significant expenses can be deducted, overlooking smaller costs that can add up. Items like business cards, postage, and even smaller supplies and expenses listed on the Real Estate Tax Deduction Worksheet are all deductible, as they are ordinary and necessary for conducting business.

Home office expenses are always deductible: While many real estate professionals work from home, not all home office expenses automatically qualify for deductions. The space must be used regularly and exclusively for business, and expenses can be apportioned based on the home office's size relative to the entire home.

Entertainment expenses are 100% deductible: According to the worksheet, entertainment expenses are marked as 100% deductible. However, it's crucial to note that this might not always align with IRS guidelines, which have specific rules about what qualifies as a deductible entertainment expense.

Personal auto use is fully deductible: While the worksheet includes auto travel for various business purposes, it's a misconception that all auto-related expenses are deductible. Only the business portion of auto use, calculated either through actual expenses or the standard mileage rate, qualifies for deductions.

All gifts to clients or associates are deductible: The worksheet mentions gifts and flowers, but there's a limit to how much you can deduct for gifts to clients or business associates in a given tax year. Understanding these limits can ensure you're maximizing your deductions without overstepping IRS rules.

Meals with clients are always 100% deductible: While the worksheet appears to allow a 100% deduction for business meals, it's important to differentiate between meals provided during entertainment, which may not be fully deductible, and meals strictly for business discussions. The IRS has precise regulations about deducting business meals.

Every expense needs a receipt for deduction: Proper documentation is crucial for substantiating deductions, but not every expense requires a physical receipt. For example, mileage for showing properties or traveling to client meetings can be documented through logs rather than receipts. However, keeping comprehensive records is always wise.

As you prepare your taxes and seek to maximize your deductions, remember that understanding the nuances of the Real Estate Tax Deduction form and IRS guidelines can lead to more effective and compliant tax strategies. For specific scenarios or questions, consulting with a CPA like JEFF BOLTON or another tax professional is advisable to ensure that you are making the most of your real estate business deductions.

Key takeaways

Understanding how to properly fill out and utilize the Real Estate Tax Deduction form can significantly benefit real estate professionals in managing their taxes more effectively. The following key takeaways are essential for anyone preparing to use this form:

- Expenses must be "ordinary and necessary" business expenses to be deductible. This means they are common, accepted in the field of real estate, and helpful and appropriate for your business.

- Only expenses directly related to the operation of your real estate business should be included. This ensures clarity and compliance with tax regulations, focusing on expenses that support your business's purpose.

- Avoid listing reimbursable expenses, or those for which you have been or expect to be reimbursed. Including these can lead to inaccuracies in your tax reporting and potential issues with tax authorities.

- Various categories such as advertising, professional fees, equipment purchases, and travel expenses are outlined to help organize and itemize deductions accurately. This organization aids in making the most of deductible expenses.

- Special attention should be given to categorizing expenses properly under supplies and expenses, professional fees and dues, out-of-town travel, continuing education, telephone expenses, auto travel, and equipment purchases. Correct categorization ensures that deductions are maximized and correctly reported.

- 100% of business meals and entertainment expenses are noted as deductible, highlighting the importance of tracking these expenses separately due to their full deductibility under certain conditions.

- Keep detailed records and receipts for all listed expenses. This documentation is critical for justifying deductions should the IRS request more information or in case of an audit.

- If you need specific advice or have questions about particular items related to real estate tax issues, contacting a certified professional, such as JEFF BOLTON, CPA, is recommended for personalized guidance.

By following these guidelines and organizing expenses meticulously, real estate professionals can leverage the Real Estate Tax Deduction Worksheet to streamline their tax preparation and ensure that they are taking advantage of all relevant deductions to minimize their taxable income effectively.

Popular PDF Forms

Ms Harvest Permit - Procedure for requesting harvest permits, with steps for new applications or renewals.

Da Form 7801 Example - Integral to ensuring the readiness and operational capability of military units.

Abf Freight Bol - Establishes a clear line of responsibility and protocol for shipping, handling, and delivery services provided by ABF Freight.