Blank Rental Property Expenses PDF Template

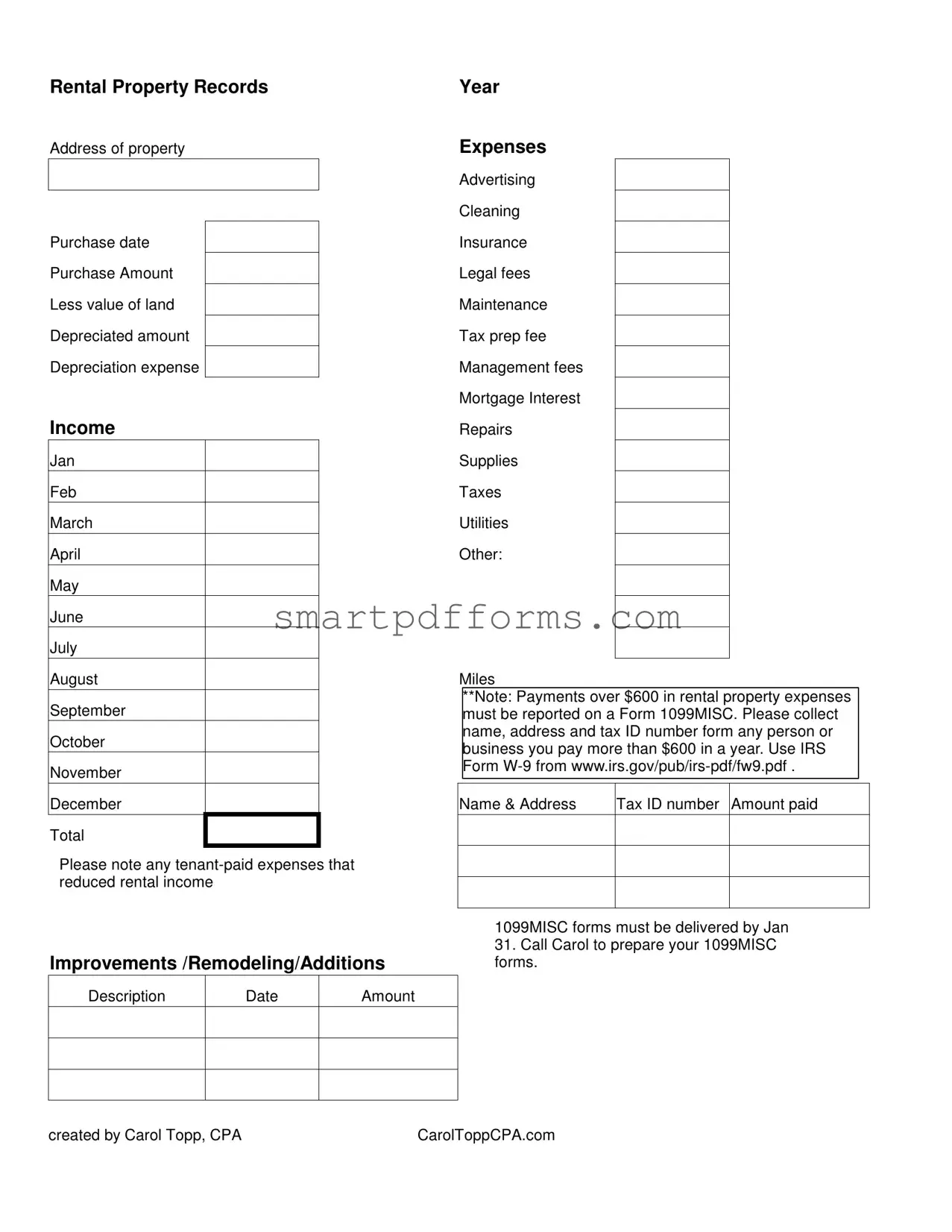

Navigating the financial aspects of managing a rental property can often feel overwhelming for property owners. Keeping meticulous records of expenses is crucial, not only for tax purposes but also for the effective management and profitability of the property. The Rental Property Expenses form serves as a comprehensive tool, tailored specifically for this purpose. It diligently outlines various expenses associated with property management, providing sections for recording detailed information including the address of the property, purchase details, depreciation, and income received monthly. Additionally, it underscores the importance of noting tenant-paid expenses that effectively reduce rental income. The form further delves into annual expenses ranging from advertising and insurance to repairs and utilities, ensuring no detail is overlooked. Particularly notable is the reminder for property owners to issue Form 1099MISC for any payment over $600 made in a year to service providers, requiring the collection of their name, address, and tax ID number. Created by Carol Topp, CPA, this form not only aids in organizing financial information but also in preparing for tax season, illustrating the interconnection between meticulous record-keeping and successful rental property management.

Preview - Rental Property Expenses Form

Rental Property Records

Address of property

Purchase date

Purchase Amount

Less value of land

Depreciated amount

Depreciation expense

Income

Jan

Feb

March

April

May

June

July

August

September

October

November

December

Total

Please note any

Improvements /Remodeling/Additions

Description |

Date |

Amount |

|

|

|

|

|

|

|

|

|

Year

Expenses

Advertising

Cleaning

Insurance

Legal fees

Maintenance

Tax prep fee

Management fees

Mortgage Interest

Repairs

Supplies

Taxes

Utilities

Other:

Miles

**Note: Payments over $600 in rental property expenses must be reported on a Form 1099MISC. Please collect name, address and tax ID number form any person or business you pay more than $600 in a year. Use IRS Form

Name & Address |

Tax ID number |

Amount paid |

|

|

|

1099MISC forms must be delivered by Jan

31.Call Carol to prepare your 1099MISC forms.

created by Carol Topp, CPA |

CarolToppCPA.com |

Form Data

| Fact Name | Fact Detail |

|---|---|

| Property Information Required | Address of property, Purchase date, Purchase Amount, Less value of land, Depreciated amount, Depreciation expense |

| Rental Income Tracking | Monthly income from January to December needs to be documented along with the total. |

| Tenant-Paid Expenses | Note any tenant-paid expenses that reduced rental income. |

| Improvements and Remodeling | Description, Date, and Amount of any improvements or remodeling/additions must be recorded. |

| Yearly Expenses | Record expenses such as Advertising, Cleaning, Insurance, Legal fees, Maintenance, Tax prep fee, Management fees, Mortgage Interest, Repairs, Supplies, Taxes, Utilities, and any Other expenses. |

| Form 1099MISC requirements | Payments over $600 in rental property expenses must be reported on a Form 1099MISC. A W-9 form is required from any person or business paid more than $600 in a year. |

| IRS Form W-9 Collection | Collect name, address, and tax ID number from individuals or businesses paid over $600 using IRS Form W-9 available at www.irs.gov/pub/irs-pdf/fw9.pdf. |

| 1099MISC Form Submission Deadline | 1099MISC forms must be delivered by January 31. |

| Creator | The form was created by Carol Topp, CPA, with a contact web address of CarolToppCPA.com |

Instructions on Utilizing Rental Property Expenses

Filling out the Rental Property Expenses form is an important step for property owners to keep track of their financials throughout the tax year. This form helps you itemize the expenses associated with your rental property, making it easier to manage your budget, prepare for tax season, and understand your property's financial performance. Whether you're new to property management or a seasoned professional, completing this form accurately can save you time and help you make informed decisions about your property. Here are step-by-step instructions to guide you through filling out the form.

- Start with the Rental Property Records section. Enter the Address of the property.

- Fill in the Purchase date and Purchase Amount of the property.

- Under Less value of land, deduct the value of the land from the purchase amount to focus on the depreciatable value of the building.

- Enter the Depreciated amount to track how much value the property has lost over time.

- For the Depreciation expense, jot down the portion of the property's value depreciated over the current tax year.

- In the Income section, meticulously record the monthly income from January through December, then calculate the Total.

- Note any tenant-paid expenses that reduced rental income in the provided space.

- Under Improvements/Remodeling/Additions, list each project with its description, date, and amount. This helps track significant investments in the property.

- Proceed to Year Expenses and detail all operational costs incurred, including Advertising, Cleaning, Insurance, Legal fees, among others listed.

- For each category, such as Maintenance, Tax prep fee, Management fees, etc., record the annual expense total.

- In the Mortgage Interest and Repairs sections, ensure accurate figures are entered as they significantly impact financial statements and tax deductions.

- Do not forget to include any Supplies, Taxes, Utilities, and expenses under Other, specifying what they are.

- Log any Miles driven for rental property purposes, as this can be deductible.

- If you paid over $600 in rental property expenses to any person or business, collect their Name & Address, Tax ID number, and Amount paid. Use IRS Form W-9 to gather this information.

- Remember, you must deliver 1099MISC forms by January 31. Contact Carol as instructed to prepare your 1099MISC forms.

Completing the Rental Property Expenses form with careful attention to each detail will not only organize your financial records but also ensure compliance with tax regulations. It's a straightforward document designed to make life easier for property owners, facilitating better management and understanding of the expenses involved in rental property operations. Be sure to check the IRS website for the latest forms and guidelines to stay updated.

Obtain Answers on Rental Property Expenses

What is the purpose of the Rental Property Expenses form?

The Rental Property Expenses form is designed to help property owners keep meticulous records of all expenses and income associated with their rental property. This includes tracking the depreciation of the property, monthly rental income, tenant-paid expenses that reduce rental income, and specific costs related to maintenance, improvements, and operations of the property throughout the financial year.

How should I record the purchase details of my rental property on this form?

You should record the purchase details by listing the address of the property, the date of purchase, the purchase amount, the value of the land (which is subtracted to find the depreciable amount), and the depreciated amount. This process lays the foundation for calculating your annual depreciation expense, instrumental for your tax reporting and financial analysis.

What expenses should I track monthly on this form?

Monthly tracking should include all income received from January to December, along with any tenant-paid expenses that reduced the rental income. This comprehensive monthly record-keeping allows for a clear overview of the property's profitability and can help in identifying trends or months with higher expenses or lower income.

How do I record improvements or additions to my rental property?

For improvements, remodeling, or additions, you should note the description of the work done, the completion date, and the total amount spent. These expenses are distinct from regular maintenance and may not be fully deductible in the year they are made, so accurate record-keeping is essential for proper tax treatment.

What are “Year Expenses,” and how do I document them?

"Year Expenses" refer to the operational costs incurred in maintaining the rental property. These include advertising, cleaning, insurance, legal fees, maintenance, tax preparation fees, management fees, mortgage interest, repairs, supplies, taxes, utilities, and any other specified costs. Each expense should be documented with its description, date, and amount, providing a detailed account of all expenditures throughout the year.

Why is there a note about payments over $600?

This note emphasizes the requirement to report any payment over $600 for rental property expenses to the IRS on a Form 1099MISC. It is crucial to collect the name, address, and tax ID number from any person or business paid more than $600 in a year, as this information is necessary for completing the form. It ensures compliance with tax laws regarding the reporting of payments.

What is IRS Form W-9, and where can I find it?

IRS Form W-9 is used to collect correct taxpayer identification numbers (TIN) and certification from individuals or entities that are paid for services. For property owners, this form serves as a way to gather necessary information from contractors or service providers paid more than $600 in a year. It is available for download at the IRS website: www.irs.gov/pub/irs-pdf/fw9.pdf.

Who is Carol, and how can she assist me with my 1099MISC forms?

Carol is a CPA (Certified Public Accountant) who has created the Rental Property Expenses form to assist property owners with their financial tracking and tax preparation. She offers her services for the preparation of 1099MISC forms, ensuring that property owners comply with tax reporting requirements for payments over $600. Property owners can contact Carol for professional assistance, ensuring accurate and timely submission of their tax documents.

Common mistakes

-

Frequently, individuals incorrectly combine the purchase amount of the property with the value of the land, failing to subtract the land value to determine the depreciated amount. This results in an inaccurate calculation of depreciation expenses.

-

Another common mistake is not systematically recording income and expenses for each month. Property owners often overlook documenting minor expenses or income, which can lead to discrepancies in the Total annual calculation.

-

Some property owners inadvertently omit tenant-paid expenses that decreased rental income from their records. This oversight can lead to an overestimation of reported income.

-

When documenting Improvements/Remodeling/Additions, it's common to see inaccuracies due to not specifying the exact date and amount. Each entry must have both to ensure proper record-keeping for tax purposes.

-

Failure to properly distinguish between repairs and improvements is another mistake. This distinction is crucial since repairs are deductible in the year they are completed, while improvements need to be depreciated over time.

-

Property owners sometimes neglect to collect the necessary information, such as name, address, and tax ID number, for anyone paid more than $600 in a year. This information is essential for submitting the Form 1099MISC.

-

Lastly, there's often a delay in preparing and delivering the 1099MISC forms by the January 31 deadline. Late submission can result in penalties and fines from the IRS.

-

Ensuring the separation of the purchase amount from the land value for accurate depreciation expenses calculation is vital.

-

Maintaining meticulous monthly records of income and expenses prevents calculation errors in the annual totals.

-

Documenting tenant-paid expenses accurately is necessary to avoid overstating income.

-

Specifying the date and amount for each improvement or addition ensures compliance with tax requirements.

-

Distinguishing between repairs and improvements allows for proper tax treatment of each expense.

-

Gathering name, address, and tax ID number for payments over $600 is important for 1099MISC submission.

-

Timely preparation and delivery of 1099MISC forms by the January deadline are crucial to avoid IRS penalties and fines.

Documents used along the form

Landlords and real estate investors often find themselves juggling a myriad of paperwork and documents, especially during tax season. The Rental Property Expenses form is a crucial document for tracking income and expenses associated with rental properties, ensuring accurate tax filings and financial analysis. However, to maintain comprehensive records and comply with legal requirements, several other forms and documents must accompany this form. Below is a list of these essential documents and a brief description of each to help landlords stay organized and informed.

- Rental Application: This document is filled out by prospective tenants and collects personal information, employment history, and references to help landlords screen and select tenants.

- Lease Agreement: A legally binding contract between the landlord and the tenant, outlining the terms and conditions of the rental arrangement, including rent amount, lease duration, and policies.

- Move-In and Move-Out Checklists: These checklists itemize the condition of the property at the start and end of a lease, helping to identify any damages or changes that occurred during the tenancy.

- Rent Receipts: Proof of payment provided to tenants by landlords for rent and other possible payments, vital for record-keeping and dispute resolution.

- Property Management Agreement: For landlords who hire property managers, this document outlines the terms of the property manager's services, fees, and responsibilities.

- Form W-9: Request for Taxpayer Identification Number and Certification, used to collect information from contractors or service providers who are paid more than $600 in a fiscal year, as noted on the Rental Property Expenses form.

- Form 1099-MISC: Used to report payments made to contractors or service providers (as reported on Form W-9), necessary for income tax reporting purposes.

- Ledger of Security Deposits: Records keeping track of all security deposits held, their status, and any deductions made for repairs or unpaid rent, crucial for transparency and legal compliance.

- Expense Receipts: All receipts for repairs, maintenance, improvements, and other expenses related to the property should be kept to support entries on the Rental Property Expenses form.

- Insurance Policies: Documentation of insurance policies for the property, including liability, property damage, and in some cases, renter's insurance, providing a safety net against various risks.

Together, these documents form a comprehensive record-keeping framework that not only supports the effective management of rental properties but also ensures compliance with tax laws and legal obligations. By staying organized and keeping thorough records, landlords can navigate the complexities of property management with greater ease and accuracy.

Similar forms

Income and Expense Statement: This document, often used by businesses, is similar to the Rental Property Expenses form because it tracks income and expenses over a specific period. It details revenue sources, much like the rental income section, and categorizes expenses (e.g., advertising, maintenance) to determine net income, offering a clear financial overview of business activities.

Property Management Agreement: Property management agreements outline the responsibilities and fees associated with the management of a rental property. They often include sections on maintenance, financial reporting, and expenses similar to those listed in the Rental Property Expenses form, such as advertising, legal fees, and repairs. This shows the scope of services and corresponding costs related to property management.

IRS Schedule E (Form 1040): Schedule E is used by property owners to report rental income and expenses on their income tax return. It covers similar categories of expenses as the Rental Property Expenses form, including mortgage interest, repairs, taxes, and insurance. Schedule E also requires information about income, which echoes the form’s tracking of monthly rental income and improvements.

Mortgage Statement: Mortgage statements, provided by lenders, detail the principal and interest payments on a mortgage. While its primary focus is on the mortgage aspect, similar to the mortgage interest section of the Rental Property Expenses form, it contributes to understanding the financial obligations associated with rental property ownership.

Real Estate Investment Analysis: This detailed document evaluates the profitability and financial performance of a real estate investment. It examines income (like rental income), expenses, cash flow, and capital appreciation, paralleling the comprehensive financial recording and depreciation aspects of the Rental Property Expenses form. This analysis helps investors make informed decisions based on various financial factors, mirroring the aim of maintaining an organized record of expenses and income.

Dos and Don'ts

When managing the finances related to your rental property, it is important to maintain accurate records. Below are guidelines to assist you in correctly filling out a Rental Property Expenses form. Following these guidelines will help ensure that you are well-prepared for tax season and that your financial records accurately reflect the state of your property investments.

Things You Should Do

Ensure all monetary figures are accurate and up-to-date to prevent any discrepancies in your financial statements.

Include detailed descriptions for improvements, remodeling, or additions to clearly distinguish these expenses from ordinary repairs.

Document every expense paid out in any given month, using the provided fields from January through December, to ensure comprehensive reporting.

Keep track of any tenant-paid expenses that lowered your rental income, as these need to be accurately reflected in your records.

Collect the name, address, and Tax ID number using an IRS Form W-9 for any individual or business paid over $600 in a year. This information is crucial for the preparation of Form 1099MISC.

Things You Shouldn't Do

Do not estimate or round-off expenses. Always use exact figures to ensure the accuracy of your financial records.

Avoid the inclusion of personal expenses. Ensure only expenses related to the rental property are documented to maintain clear and legal financial records.

Refrain from delay in updating the form. Timely entries prevent the backlog of information and reduce the risk of forgetting or misplacing receipts.

Do not neglect to provide detailed descriptions and the relevant dates for significant expenditures on improvements or additions. This information is crucial for determining the proper tax treatment of these expenses.

Never disregard the importance of delivering 1099MISC forms by the January 31st deadline. Late submissions may result in penalties.

By adhering to these guidelines, you will be able to manage your Rental Property Expenses efficiently, ensuring accurate and compliant financial reporting. Should you need assistance or have any queries regarding the form or any specifics related to your property expenses, please do not hesitate to reach out to a professional for guidance.

Misconceptions

Understanding the nuances of managing rental property finances includes navigating common misconceptions about the Rental Property Expenses Form. It's essential to address these misunderstandings to ensure accurate reporting and compliance.

Rental Income is the Only Figure that Matters: Many believe that only rental income needs to be reported, overlooking the importance of documenting all expenses. Accurate recording of expenses such as maintenance, repairs, and management fees is crucial for tax purposes and to identify the property’s true profitability.

Improvements and Repairs are Interchangeable: It's a common misconception that money spent on the property can be lumped together. However, improvements (which increase the property's value or extend its life) must be depreciated over several years, whereas repairs (which maintain the property's current condition) can be deducted in the year they are made.

Personal Use Expenses can be Included: Some property owners mistakenly believe that expenses incurred during personal use of the property can be deducted. Only expenses related to the rental activity are deductible.

Depreciation is Optional: Depreciation is often overlooked or considered optional, but it's a mandatory expense that reflects the property’s wear and tear over time. This deduction can significantly impact your rental property’s taxable income.

Any Payment to Vendors Requires a 1099MISC: While it’s necessary to report payments over $600 for rental property expenses on a Form 1099MISC, this applies only when the services rendered are directly related to your rental activity. Not all payments to vendors require a 1099MISC.

All Rental Expenses are Deducted in the Same Year: Some expenses, particularly major improvements, are not fully deductible in the year they are paid. These costs must be depreciated over their useful life, which spreads the deduction over several years.

All Management Fees are the Same: Misunderstanding often arises regarding management fees. Not all money paid to a property manager or management company falls under this category. Only fees directly related to the day-to-day management of the property are deductible.

Clearing up these misconceptions is critical for correctly reporting your financial activity and optimizing your investment's return. An informed approach to documenting your rental property expenses will help ensure your filings are both accurate and compliant with tax regulations.

Key takeaways

Understanding the Rental Property Expenses form is crucial for property owners who must accurately report their expenses and income for tax purposes. Here are key takeaways to ensure compliance and maximize your benefits:

- Comprehensive Expense Tracking: The form provides categories for various expenses including advertising, insurance, maintenance, and utilities, among others. Accurately tracking these expenses throughout the year is essential for deducing the real cost of property management and maximizing deductions on your tax returns.

- Depreciation Details: It's important to note the purchase amount and subtract the land value to find the depreciated amount. This allows property owners to calculate depreciation expenses, which can significantly impact the reported profit or loss of the rental property.

- Income Recording: Keeping a meticulous record of rental income monthly provides a clear overview of cash flow. Additionally, noting any tenant-paid expenses that reduced rental income is crucial for accurate income reporting.

- Diligence with 1099MISC Forms: Payments over $600 to service providers or contractors require reporting on Form 1099MISC. Ensure to collect name, address, and Tax ID number using the IRS Form W-9 for anyone you pay more than $600 in a fiscal year. These forms must be issued by January 31 to comply with tax regulations.

Effectively managing and documenting rental property expenses and income not only aids in financial tracking but also ensures compliance with tax laws. Utilizing a detailed form like the Rental Property Expenses form can significantly simplify this process, providing a clear framework for property owners to follow.

Popular PDF Forms

Hit a Thon Pledge Sheet - Participate in fostering young talent by pledging a donation for each foot your chosen player hits.

Pa Tint Exemption Form - Understanding the criteria for exemption is critical for applicants, emphasizing the form’s role in legal and health-related accommodations.