Blank Repo Order PDF Template

In the often complex and sensitive realm of vehicle repossession, the Repo Order form stands as a critical document designed to streamline the process for all parties involved. It meticulously outlines the necessary information, starting with the company's name and address, and extending to intricate details about the legal owner, account number, and the debtor. The form also delves into specifics regarding the vehicle in question, including its year, make, model, VIN, and license tag number, ensuring there's no ambiguity about the asset being reclaimed. Crucially, the form authorizes Action Auto Recovery - RA 641 and their designated recovery agent to engage with various entities, from impound facilities to police departments, to facilitate the vehicle's release and repossession. It contains a robust ‘Hold Harmless’ clause that protects involved parties from potential claims or damages arising during the repossession process. Additionally, the form's adaptability is highlighted in instructions that permit its reuse for separate hold harmless agreements with both police and tow yards, significantly reducing administrative burdens. Instructions for completing, signing, and submitting the form, along with contact details for further assistance, encapsulate the document's user-centric design, making it an invaluable tool for legal owners embarking on the vehicle repossession journey.

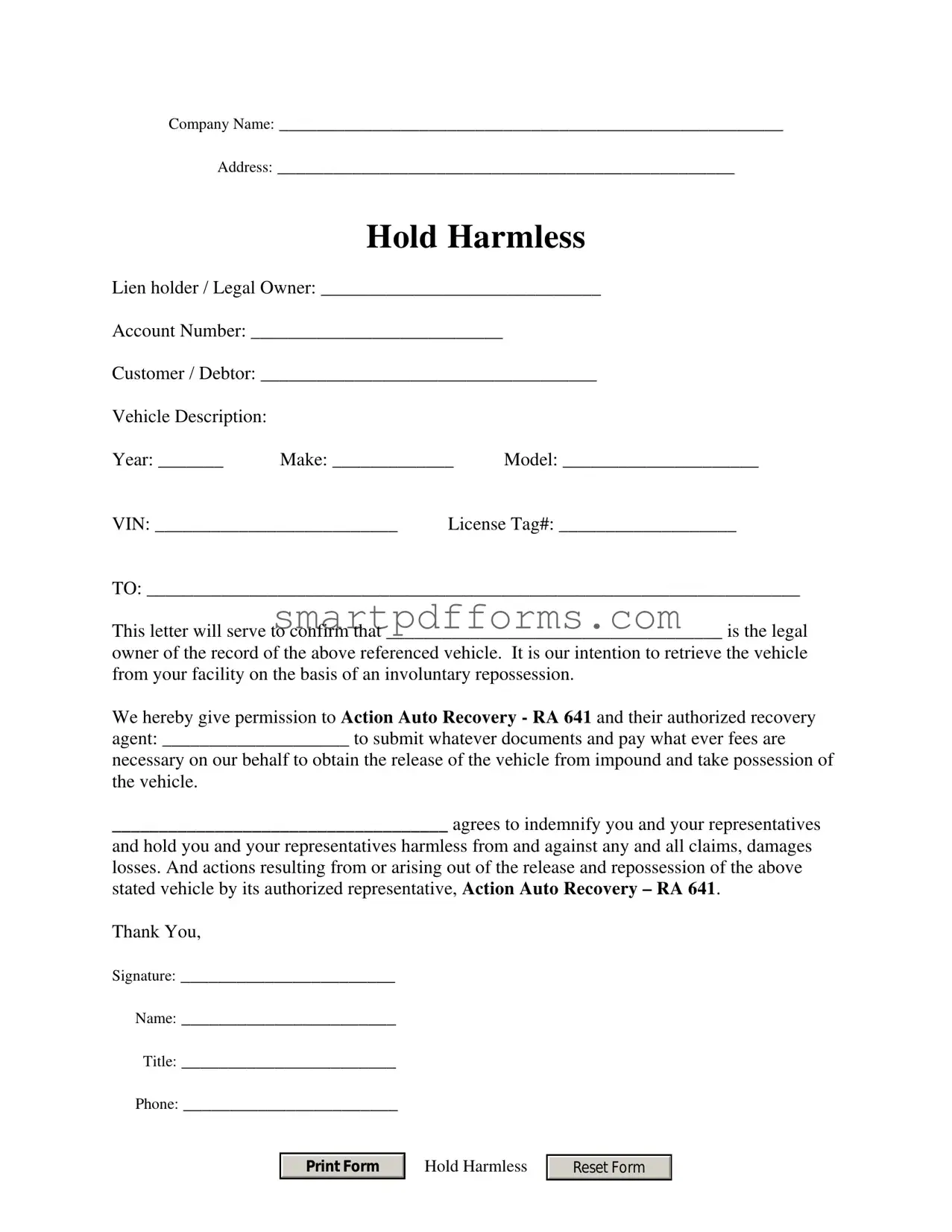

Preview - Repo Order Form

Company Name: ______________________________________________________

Address: _________________________________________________

Hold Harmless

Lien holder / Legal Owner: ______________________________

Account Number: ___________________________

Customer / Debtor: ____________________________________

Vehicle Description:

Year: _______ |

Make: _____________ |

Model: _____________________ |

|

VIN: __________________________ |

License Tag#: ___________________ |

||

TO: ______________________________________________________________________

This letter will serve to confirm that ____________________________________ is the legal

owner of the record of the above referenced vehicle. It is our intention to retrieve the vehicle from your facility on the basis of an involuntary repossession.

We hereby give permission to Action Auto Recovery - RA 641 and their authorized recovery agent: ____________________ to submit whatever documents and pay what ever fees are

necessary on our behalf to obtain the release of the vehicle from impound and take possession of the vehicle.

____________________________________ agrees to indemnify you and your representatives

and hold you and your representatives harmless from and against any and all claims, damages losses. And actions resulting from or arising out of the release and repossession of the above stated vehicle by its authorized representative, Action Auto Recovery – RA 641.

Thank You,

Signature: _______________________

Name: _______________________

Title: _______________________

Phone: _______________________

Print Form

Hold Harmless

Reset Form

Most Impound vehicles require two Hold Harmless. One for the impounding police agency (police department) and one for the impounding agency (tow yard): ___

Once you complete the form above to the tow yard and print, just scroll up and change the “To:” filed to the police department and print. This will help from re- typing the entire form all over again.

There are two fields you can not enter on the form online. The first field is the name of our repossessor and your signature. Make sure you sign the form and we will enter the name of the recovery agent once we receive the completed forms.

Make sure you Sign both forms and fax them to us along with: the copy of the Title and Contract.

Our Fax number is (562)

If you have any questions please contact our Impound Dept at: (800)

Thank you,

Action Auto Recovery – RA 641

Southern California’s Repossession & Skip Tracing Experts – Since 1967

Serving all of Los Angeles, Orange, Riverside and San Diego Counties Daily

Hold Harmless

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used for the involuntary repossession of a vehicle, allowing the legal owner to retrieve the vehicle from an impound facility. |

| Key Components | The form includes sections for company information, vehicle description, and authorization for Action Auto Recovery - RA 641 to act on the legal owner's behalf. |

| Hold Harmless Agreement | The form contains a hold harmless agreement, protecting the releasing party from claims arising from the repossession. |

| Vehicle Information Required | Details such as year, make, model, VIN, and license tag number must be provided to accurately identify the vehicle. |

| Signature Requirement | The legal owner or a representative must sign the form, authorizing the action and agreement. |

| Additional Documents | The completed form must be accompanied by a copy of the vehicle's title and contract. |

| Contact Information | Contact details for Action Auto Recovery and instructions for further assistance are included. |

| Recovery Agent | The name of the authorized recovery agent is to be filled in by Action Auto Recovery upon receiving the signed forms. |

| Multiple Hold Harmless Agreements | Most impounded vehicles require two Hold Harmless agreements—one for the police department and another for the tow yard. |

| Governing Laws | The form's use and enforcement are subject to the laws governing the state in which the repossession occurs; specific laws vary by state. |

Instructions on Utilizing Repo Order

Filling out the Repo Order form requires careful attention to detail to ensure that all information is accurately reported. This form is essential for the process of reclaiming a vehicle through involuntary repossession. It serves to inform and obtain permission from the impounding facility and to indemnify the involved parties against possible claims or damages arising from the repossession process. Once the form is completed, it should be accompanied by pertinent documents and sent to the specified contact details for further action. Here are the steps to fill out the Repo Order form:

- Input the Company Name in the space provided at the top of the form.

- Enter the Address of your company below its name.

- Specify the Hold Harmless Lien holder / Legal Owner in the designated field to identify the entity legally entitled to authorize the repossession.

- Fill in the Account Number associated with the vehicle for identification purposes.

- Provide the Customer / Debtor's details, ensuring the information matches the vehicle's registration documents.

- Under Vehicle Description, list the Year, Make, Model, VIN (Vehicle Identification Number), and License Tag# to accurately identify the vehicle in question.

- In the section addressed "TO:", write the name of the impounding facility or agency.

- Confirm that the named party is the legal owner of the vehicle in the paragraph that follows and express your intention to retrieve the vehicle on the basis of an involuntary repossession.

- Authorize Action Auto Recovery - RA 641 and their designated recovery agent to act on your behalf by entering the name of the authorized recovery agent in the space provided. Note: The name of the recovery agent will be filled in by the company receiving the completed forms.

- Agree to indemnify and hold harmless the impounding facility, police department, and their representatives by completing the statement of indemnification.

- Sign the form where indicated. Since the form cannot capture a digital signature online, ensure a physical signature is affixed to the document before submission.

- Fill in your Name, Title, and Phone Number at the bottom of the form to provide contact information.

- For impounded vehicles requiring two Hold Harmless agreements, repeat the process and change the "To:" field to the police department for the second form, then print both forms.

After filling out the Repo Order form and any necessary Hold Harmless agreements, remember to sign both documents. Fax them alongside a copy of the Title and Contract to (562) 633-9768. If any issues arise or further clarification is needed during this process, contact the Impound Department at (800) 421-5528 ext: 221. This step is critical in ensuring the seamless repossession of the vehicle and mitigating any potential legal challenges.

Obtain Answers on Repo Order

Here are some common questions and answers related to the Repo Order form process:

- What is a Repo Order form, and why do I need to fill it out?

A Repo Order form is a document that authorizes a repossession company to retrieve a vehicle on behalf of the lienholder or legal owner of the vehicle. You need to fill it out to provide formal permission and instructions to the repossession agency, ensuring that the vehicle can be legally and efficiently recovered from its current location, such as an impound lot.

- Whom should I list as the "Hold Harmless Lien holder / Legal Owner" on the form?

The "Hold Harmless Lien holder / Legal Owner" should be the name of the entity that holds the lien on the vehicle or is legally recognized as its owner. This could be a bank, financing company, or other institution that provided funding for the vehicle's purchase. They are granted indemnity by the repossession process under the terms outlined in the form.

- Why are two Hold Harmless agreements required, and to whom should they be sent?

Two Hold Harmless agreements are necessary because the vehicle recovery process often involves two distinct entities: the police department, which may have ordered the tow and impound of the vehicle, and the impounding agency or tow yard, which physically holds the vehicle. Each entity requires its own Hold Harmless agreement to protect themselves legally when releasing the vehicle. The completed forms should be sent to the respective parties as indicated on the Repo Order form, ensuring both are informed and agree to the repossession under the stated conditions.

- How do I complete and submit the Repo Order form correctly?

- Fill out all the fields with the accurate and relevant information regarding the company, vehicle, and legal owner.

- Ensure you manually sign the form, as electronic signatures might not be accepted by all entities. The name of the repossession agent authorized by Action Auto Recovery - RA 641 will be filled out by the company after receiving the forms.

- Print two copies of the form, changing the "To:" field from the tow yard to the police department as necessary.

- Send both signed forms, along with copies of the vehicle's Title and Contract, via fax to Action Auto Recovery - RA 641 at the provided fax number.

To correctly complete and submit the Repo Order form:

If you encounter any issues or have further questions, contacting the Impound Department directly through the provided phone number is recommended for the most accurate and immediate assistance.

Common mistakes

When filling out a Repo Order form, it's essential to avoid making mistakes that might delay or complicate the repossession process. Here are eight common errors people often make:

Failing to provide the complete company name can lead to confusion about who is requesting the repossession, resulting in unnecessary delays.

Leaving the address field blank or incomplete. It's crucial for ensuring all correspondence and documentation reach the correct location promptly.

Not specifying the Hold Harmless Lien holder / Legal Owner clearly. This information is vital to establish the legal right to repossess the vehicle.

Omitting the account number can slow down the process, as it's typically used to identify the contract or loan associated with the vehicle.

Incorrectly filling out the customer/debtor details. Accurate information here ensures the correct identification of the party from whom the vehicle is being repossessed.

Incomplete or inaccurate vehicle description, including year, make, model, VIN, and license tag#. Precise details are critical for legally identifying and locating the vehicle.

Forgetting to change the “To:” field when printing multiple forms for different agencies. This might cause confusion and lead to the paperwork not being processed correctly.

Not manually signing the form or including the necessary additional documents (like the copy of the Title and Contract) when faxing. Electronic submissions lack a physical signature, which is a legal requirement for these forms.

Additionally, individuals often overlook the instruction to provide two Hold Harmless agreements - one for the police department and another for the tow yard. This oversight can lead to legal complications.

Ensure every field is accurately completed to avoid any misunderstandings or legal issues.

Double-check vehicle details against official documents to prevent errors.

Remember to sign both the Repo Order form and the Hold Harmless agreements before submission.

Always maintain a copy of the completed and signed form along with any correspondence for your records.

Documents used along the form

When preparing for the repossession of a vehicle, it's crucial to have all necessary documentation in order to complete the process smoothly and legally. The Repo Order form is a key document in this process, but it doesn't stand alone. There are other forms and documents that often accompany the Repo Order form to ensure all legal and procedural bases are covered. Understanding each of these documents can make the repossession process more straightforward and minimize potential complications.

- Permission for Repossession Letter: This document serves as an official authorization from the lien holder to the repossession agency, granting them the right to locate and repossess the vehicle. It typically includes the vehicle's details, account information, and a statement authorizing the repossession under specific terms.

- Vehicle Condition Report: Completed after the repossession, this report documents the condition of the vehicle at the time it was recovered. Detailed notes and photographs may be included to record any existing damage or issues. This is essential for protecting both the repossession agency and the lien holder against claims of damage caused during the repo process.

- Personal Property Inventory Form: If personal belongings are found in the repossessed vehicle, this form catalogs those items. It ensures that all personal property is accounted for and returned to the rightful owner, thereby reducing the risk of liability for lost or damaged property.

- Notice of Intent to Sell Property: After repossession, this document is sent to the debtor, informing them that the vehicle will be sold, usually at public auction, if they do not redeem it within a certain period. It specifies the amount required to redeem the vehicle and the timeframe for action. This notice is important for providing the debtor with a fair opportunity to reclaim the vehicle and for fulfilling legal requirements before the sale.

Each of these documents plays a vital role in the vehicle repossession process. Together with the Repo Order form, they form a comprehensive toolkit that guides the legal and efficient recovery of a vehicle. By ensuring that each step of the process is properly documented, lien holders and repossession agencies can protect themselves against legal challenges and disputes. Moreover, this documentation can help in fostering transparency and fairness in the otherwise stressful ordeal of vehicle repossession.

Similar forms

A Subpoena Form is similar to a Repossession Order in its authoritative request for action or information. Both forms serve as legal tools that compel the recipient to comply with specified actions—either to produce documents, give testimony, or, in the case of repossession, surrender property. The major distinction lies in their application areas within legal proceedings or enforcement actions.

Eviction Notice Forms share parallels with Repo Orders in that they both notify the recipient of an impending action due to a breach of agreement. An eviction notice is issued when tenants violate rental agreements, whereas a Repo Order is used for reclaiming property due to payment default. Both documents mark the initiation of a process to recover property and detail the reason for the action.

A Power of Attorney (POA) Document is similar in the aspect of delegated authority. Just as a POA grants an individual the authorization to act on behalf of another in financial or legal matters, a Repo Order authorizes a recovery agent to act on behalf of a lienholder to repossess an asset. Both documents specify the extent of the authority granted to the representative.

Mortgage Foreclosure Notices are akin to Repo Orders as they both signify the start of action to reclaim a secured asset due to non-payment. While foreclosure notices relate to real property like homes, Repo Orders concern personal property, such as vehicles. Each form notifies the borrower of the intent to recover the asset and provides details about the claim.

Writs of Replevin closely resemble Repo Orders in the sense that both seek the recovery of property. A Writ of Replevin is a court order that requires the return of wrongfully held property to its rightful owner, very much like how a Repo Order seeks to retrieve financed property due to contract violations. Both involve legal authorization and a process for reclaiming assets.

A Garnishment Order can be compared to a Repossession Order in terms of enforcing financial recoveries. Garnishment Orders instruct a third party to withhold funds from a debtor for payment of a debt, whereas Repo Orders direct the retrieval of tangible assets as a means of satisfying a debt. Both are legal mechanisms for creditors to enforce debts.

Notice of Default is used in the financing and mortgage industry, similar to how a Repo Order functions in asset repossession. Both documents serve as formal notices that a party has not met their contractual obligations, leading to potential legal action or asset recovery. The primary difference is the nature of the consequence—financial versus physical recovery.

A Seizure Warrant is analogous to a Repo Order because it is an official directive that permits the taking of property. Issued by a court, a seizure warrant allows for the confiscation of property involved in a crime, whereas a Repo Order permits the repossession of property due to contractual breaches. Both entail authorized parties taking possession of property under specified legal circumstances.

Dos and Don'ts

When filling out a Repo Order form, it's important to follow specific guidelines to ensure the process is handled efficiently and legally. Below are lists of things you should and shouldn't do when completing this form.

Things You Should Do

Verify all the information provided, including the company name, address, and legal owner details, to ensure accuracy.

Include a clear description of the vehicle, ensuring the year, make, model, VIN, and license tag number are correct.

Ensure the form is signed and dated to confirm the authorization of the repossession and the accuracy of the information provided.

For impounded vehicles, remember to change the "To:" field and print the form twice, once for the impounding police department and once for the impounding agency (tow yard), to streamline the process.

Contact the provided number for the Impound Department if you have questions or need further assistance with the form.

Things You Shouldn't Do

Do not leave any fields blank, as incomplete forms can delay the repossession process.

Avoid submitting the form without the signature of the authorizing individual, as unsigned forms are invalid.

Do not guess vehicle details; incorrect information can lead to the wrongful repossession of another person's vehicle.

Refrain from submitting the form without confirming the need for two Hold Harmless forms, as both the police department and tow yard may require separate forms.

Do not ignore the instructions to fax additional documents, such as the title and contract, along with the signed forms, as these are essential for the repossession process.

By following these guidelines, individuals can ensure a smoother, more compliant approach to vehicle repossession, minimizing potential legal issues and streamlining the retrieval process.

Misconceptions

There are several misconceptions about the Repo Order form that can lead to confusion or misuse of the form. Understanding these misconceptions can help ensure that the process of vehicle repossession is handled correctly and efficiently.

- Misconception 1: The Repo Order form grants immediate rights to repossess a vehicle.

This is not accurate. The form is an instrumental part of initiating the repossession process, but it does not in itself grant immediate authority to repossess the vehicle. Legal processes and further documentation may be required depending on state laws and specific circumstances.

- Misconception 2: Only one Hold Harmless is required for the repossession process.

Contrary to what some may believe, most impounded vehicles require two Hold Harmless agreements - one for the impounding police agency and one for the impounding agency (tow yard). This ensures that all parties involved are protected from liability during the repossession process.

- Misconception 3: Digital signatures are accepted on the Repo Order form.

The form explicitly requires a handwritten signature. Despite the digital age we live in, this requirement underscores the importance of the physical signature in this legal process, ensuring authenticity and accountability.

- Misconception 4: All information can be filled out online on the Repo Order form.

There are specific fields, notably the name of the repossessor and the signature of the person authorizing the repossession, that cannot be entered online. This limitation requires manual completion of the form to ensure all needed information is accurately provided and verified.

- Misconception 5: The Repo Order form is the only document needed to retrieve an impounded vehicle.

Aside from the Repo Order form, other documents such as the title and contract are also required. These documents serve as proof of ownership and contractual agreement for repossession, reinforcing the legal basis for the vehicle’s retrieval.

- Misconception 6: The process is the same irrespective of the state.

The repo order form suggests a generalized process, but it's important to note that laws and requirements can vary significantly from one state to another. Compliance with local laws and regulations is crucial in the repossession process to avoid legal complications.

In conclusion, navigating the complexities of the Repo Order form and the repossession process requires a clear understanding of what the form does and does not do. By addressing these misconceptions, individuals and organizations can better prepare for the legal and procedural requirements of vehicle repossession.

Key takeaways

Navigating through the process of filling out and using a Repo Order form can be intricate. Here are key takeaways to ensure accuracy and compliance:

- Complete Company Information: The form requires detailed information about the company initiating the repossession, including the company name and address. This identifies the legal entity responsible for the action.

- Identify the Legal Owner: It is crucial to specify the hold harmless lien holder or legal owner's name and account number. This confirms the party entitled to reclaim the vehicle.

- Provide Detailed Vehicle Description: A comprehensive description of the vehicle, including year, make, model, VIN (Vehicle Identification Number), and license tag number, must be provided. This ensures the correct vehicle is repossessed.

- Authorization for Action Auto Recovery: The form expressly authorizes Action Auto Recovery - RA 641 and its authorized recovery agent to retrieve the vehicle from impound. It involves submitting necessary documents and paying impound fees on behalf of the legal owner.

- Hold Harmless Agreement: The legal owner agrees to indemnify and hold harmless the impound facility and its representatives from claims or damages arising from the vehicle's release and repossession.

- Signature and Contact Information: The form requires a signature, printed name, title, and phone number of the person authorizing the repossession. This serves as a formal agreement to the terms outlined in the document.

- Requirement for Two Hold Harmless Forms: Most impounded vehicles need two hold harmless forms – one for the police department and another for the tow yard. This double assurance protects all parties involved from potential legal issues.

- Additional Documents and Communication: The repossession process requires submitting additional documents, such as a copy of the title and contract. Also, it's important to sign both forms and fax them along with the required documents to the provided fax number. For any questions, a specified contact number is provided to reach the Impound Department.

By thoroughly understanding and meticulously completing the Repo Order form, legal owners can facilitate a smoother and legally compliant process for vehicle repossession.

Popular PDF Forms

Usda Aphis 7001 - Specific instructions are laid out for completing each section accurately.

Tax Returns - Useful for individuals with earnings from multiple states or occupations that require detailed income reporting.

Eddm Usps Pricing - Every section from mailer information to postage details is methodically designed for efficiency and clarity in the EDDM Retail® process.