Blank Retail Installment Sale Contract PDF Template

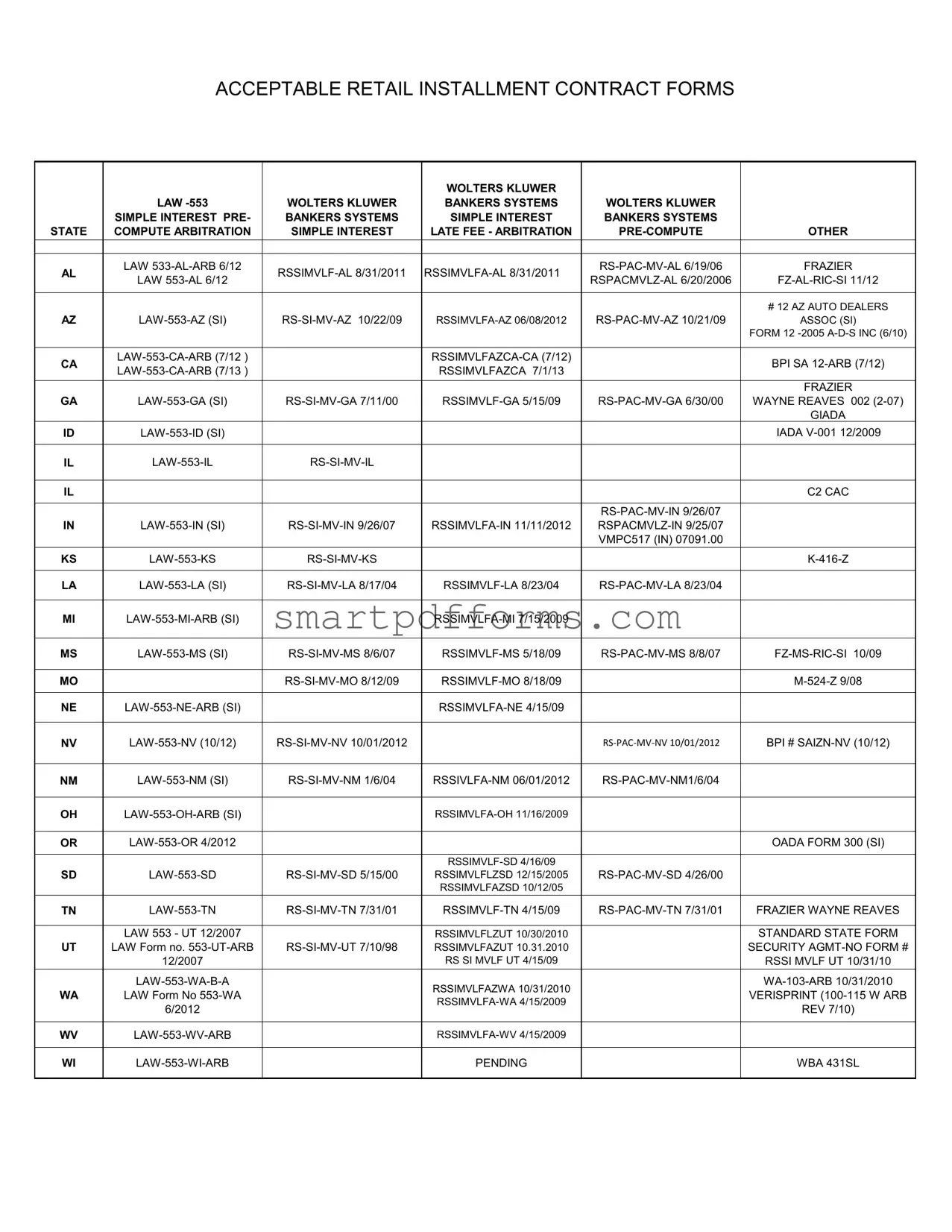

When individuals opt to purchase items through installment payments, the Retail Installment Sale Contract form becomes a significant document that outlines the terms between buyers and sellers. This form, utilized across various states, comes in numerous versions to comply with state-specific regulations, suggesting a complex landscape of legal requirements. Brands like Wolters Kluwer and Bankers Systems dominate this space, providing templates that include simple interest computations, arbitration clauses, and late fee policies. With modifications tailored for different jurisdictions—illustrated by the detailed list ranging from Alabama to Wisconsin—the diversity of forms includes provisions for arbitration in states like California, Michigan, and Ohio, signifying a legal framework designed to resolve disputes outside the court system. Each version, whether it specifies simple interest calculations, pre-compute agreements, or state-specific arbitration requirements, serves as a critical tool in ensuring transparent, fair dealings between parties, thereby highlighting the necessity for both buyers and sellers to thoroughly understand the implications of these contracts.

Preview - Retail Installment Sale Contract Form

ACCEPTABLE RETAIL INSTALLMENT CONTRACT FORMS

|

|

|

WOLTERS KLUWER |

|

|

|

|

LAW |

WOLTERS KLUWER |

BANKERS SYSTEMS |

WOLTERS KLUWER |

|

|

|

SIMPLE INTEREST PRE- |

BANKERS SYSTEMS |

SIMPLE INTEREST |

BANKERS SYSTEMS |

|

|

STATE |

COMPUTE ARBITRATION |

SIMPLE INTEREST |

LATE FEE - ARBITRATION |

OTHER |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AL |

LAW |

FRAZIER |

||||

LAW |

||||||

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

# 12 AZ AUTO DEALERS |

|

AZ |

ASSOC (SI) |

|||||

|

|

|

|

|

FORM 12 |

|

|

|

|

|

|

|

|

CA |

|

|

BPI SA |

|||

|

RSSIMVLFAZCA 7/1/13 |

|

||||

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

FRAZIER |

|

GA |

WAYNE REAVES 002 |

|||||

|

|

|

|

|

GIADA |

|

ID |

|

|

|

IADA |

||

|

|

|

|

|

|

|

IL |

|

|

|

|||

|

|

|

|

|

|

|

IL |

|

|

|

|

C2 CAC |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

IN |

|

|||||

|

|

|

|

VMPC517 (IN) 07091.00 |

|

|

|

|

|

|

|

|

|

KS |

|

|

||||

|

|

|

|

|

|

|

LA |

|

|||||

|

|

|

|

|

|

|

MI |

|

|

|

|||

|

|

|

|

|

|

|

MS |

||||||

|

|

|

|

|

|

|

MO |

|

|

||||

|

|

|

|

|

|

|

NE |

|

|

|

|||

|

|

|

|

|

|

|

NV |

|

BPI # |

||||

|

|

|

|

|

|

|

NM |

|

|||||

|

|

|

|

|

|

|

OH |

|

|

|

|||

|

|

|

|

|

|

|

OR |

|

|

|

OADA FORM 300 (SI) |

||

|

|

|

|

|

|

|

|

|

|

|

|

||

SD |

RSSIMVLFLZSD 12/15/2005 |

|

||||

|

|

|

RSSIMVLFAZSD 10/12/05 |

|

|

|

TN |

FRAZIER WAYNE REAVES |

|||||

|

|

|

|

|

|

|

|

LAW 553 - UT 12/2007 |

|

RSSIMVLFLZUT 10/30/2010 |

|

STANDARD STATE FORM |

|

UT |

LAW FORM NO. |

RSSIMVLFAZUT 10.31.2010 |

|

SECURITY |

||

|

12/2007 |

|

RS SI MVLF UT 4/15/09 |

|

RSSI MVLF UT 10/31/10 |

|

|

|

RSSIMVLFAZWA 10/31/2010 |

|

|||

WA |

LAW FORM NO |

|

|

VERISPRINT |

||

|

|

|||||

|

6/2012 |

|

|

REV 7/10) |

||

|

|

|

|

|||

|

|

|

|

|

|

|

WV |

|

|

|

|||

|

|

|

|

|

|

|

WI |

|

PENDING |

|

WBA 431SL |

||

|

|

|

|

|

|

Form Data

| Fact | Detail |

|---|---|

| Usage | Retail Installment Sale Contract forms are used for financing retail purchases, typically involving vehicles. |

| Variations | Forms vary by interest calculation methods: Simple Interest, Pre-Compute, and others. |

| Arbitration Clauses | Certain forms include arbitration clauses for dispute resolution. |

| Late Fees | Some contracts specify late fee arrangements. |

| State-Specific Forms | Forms are customized to meet the legal requirements of specific states. |

| Governing Laws | Contracts are governed by state laws where the contract is executed. |

| Availability Dates | Forms are updated periodically, with availability dates indicating the latest revisions. |

| Publishers | Wolters Kluwer and other legal document services publish these forms. |

| Specific Forms for Dealers | Auto dealers and industry associations have specific forms tailored to their needs. |

| Interest Types | Contracts differentiate between simple and pre-computed interest types. |

Instructions on Utilizing Retail Installment Sale Contract

Filling out a Retail Installment Sale Contract form is a key step in the process of a retail installment transaction, often involving the purchase of goods or services paid for over time. Understanding which form aligns with your specific needs—based on factors such as state laws, interest types, and whether arbitration is included—is crucial. This ensures compliance and protects all parties involved. The following steps will guide you through filling out this form accurately.

- Identify the correct form version for your state and specific requirements (e.g., simple interest, arbitration) from the list provided. Each state may have multiple forms depending on the transaction type.

- Once the appropriate form is identified, enter the full legal name of the buyer(s) and seller(s) involved in the transaction. This should match the identification and official documents.

- Describe the item or service being sold. Include model numbers, serial numbers, or any specifications that uniquely identify the item or service.

- Fill out the payment information section. This includes the total sale price, down payment, finance charges (if any), and the total amount financed.

- Clearly state the installment payment terms, including the amount of each payment, the frequency of payments (e.g., monthly), and the total number of payments to be made.

- Include information on any late fees, pre-payment penalties, or other charges that may apply outside of the regular payment terms.

- Detail the interest rate, if applicable, and how it is computed over the term of the contract.

- If the contract is subject to arbitration in the event of a dispute, make sure the arbitration agreement section is filled out in accordance with local laws and clearly understood by all parties.

- Both buyer(s) and seller(s) must sign and date the contract to acknowledge agreement to the terms outlined in the document.

- Retain a copy of the contract for all parties involved for record-keeping and reference in case of future disputes or questions.

Following these steps will help ensure that your Retail Installment Sale Contract is completed accurately and is legally binding. Always review your contract carefully before signing to make sure all information is correct and that you understand all terms and conditions.

Obtain Answers on Retail Installment Sale Contract

What is a Retail Installment Sale Contract?

A Retail Installment Sale Contract is a legal document that outlines the terms and conditions of a sale in which the buyer agrees to pay the seller for goods or services over time, rather than paying the full amount upfront. This type of contract is commonly used for high-value purchases such as automobiles.

Who uses the Retail Installment Sale Contract forms listed?

The forms mentioned are used by sellers and financial institutions across various states in the United States. They facilitate the documentation of retail sales where payment will be made in installments. Automotive dealerships are frequent users of these forms, especially when arranging financing for their customers.

Why are there different forms for different states?

Each state in the U.S. has its own laws and regulations governing consumer credit transactions. The different forms ensure compliance with the specific legal requirements and consumer protection statutes of each state. This variation addresses aspects like interest calculation methods, arbitration agreements, and late fees that might differ from one jurisdiction to another.

What does "SI" stand for in the form descriptions?

"SI" stands for Simple Interest, which is a method of calculating the finance charges on a loan based on the actual amount of the outstanding principal. Simple interest does not compound on interest, which can make it less expensive than other types of interest calculations over time.

What is the significance of the arbitration agreement mentioned in some forms?

Arbitration agreements within Retail Installment Sale Contracts specify that disputes between the seller and the buyer will be resolved through arbitration rather than through court litigation. This can potentially simplify dispute resolution and reduce legal expenses for both parties.

Can these forms be customized for specific transactions?

While these forms are designed to meet general requirements and ensure compliance with state laws, they often include provisions for customization to reflect the details of specific transactions. Details like the purchase price, interest rate, repayment schedule, and any additional fees can be tailored to suit individual agreements.

What happens if a buyer fails to make payments as agreed?

If a buyer does not make payments according to the terms of the Retail Installment Sale Contract, the seller may have the right to repossess the purchased item or pursue other legal remedies to recover the owed amount. The specific consequences and options available to the seller will be detailed in the contract.

Are late fees standardized across all contracts?

No, late fees are not standardized and can vary based on state regulations and the specifics of the sale agreement. Each Retail Installment Sale Contract form that mentions late fees will comply with the legal limits and conditions applicable in the state for which it is designed.

How do pre-compute contracts differ from simple interest contracts?

Pre-compute contracts calculate the total amount of interest and divide it evenly across all installment payments from the start of the loan. Unlike simple interest contracts, where interest is calculated on the outstanding principal, pre-compute agreements do not adjust the finance charges if the loan is paid off early.

What role do automotive dealers play in the process?

Automotive dealers often facilitate the creation and execution of Retail Installment Sale Contracts, acting as intermediaries between the buyer and the financing institution. They may help complete the necessary paperwork, calculate the financing terms, and guide each party through the process to ensure compliance and satisfaction on both sides.

Common mistakes

People often fill in the wrong form for their State, resulting in a submission that doesn't comply with state-specific regulations. For instance, using a form tailored for Arizona laws for a transaction in California. This mistake leads to unnecessary delays and confusion.

Signing the form without reading the fine print can lead to misunderstandings about the obligations. It's essential to understand all the terms, including interest rates, repayment schedule, and late fees, to avoid future disputes.

Incorrectly calculating the interest rates on simple interest contracts. Simple interest calculations can be tricky, and inaccuracies can significantly affect the total amount payable over the life of the contract.

Not specifying the late fee policy clearly. The contract should state when a payment is considered late and the fee amount. Leaving this section blank or inaccurately filled can lead to conflict.

Failing to complete the arbitration agreement section, if applicable. This part is crucial for outlining how disputes will be resolved outside the court system, providing a quicker and typically less expensive resolution method.

Omitting necessary identification details of the buyer or the seller, such as full legal names or addresses, leading to issues in enforcing the contract if disputes arise.

Skipping the description of the goods being sold. A detailed description, including make, model, and year for vehicles, ensures both parties are clear about what is being purchased.

Forgetting to add the date of the agreement, which is important for determining the start of the contract and for any time-bound provisions within it.

Not including or incorrectly filling in the pre-compute section, which affects how payments are allocated towards interest and principal, especially in states that require specific pre-computation methods for installment sales.

Misunderstanding state-specific requirements, such as the need for additional disclosures or specific language, leading to a contract that might not be legally enforceable.

Always double-check the requirements specific to your state before completing the contract to ensure compliance and avoid common mistakes.

Seek professional advice when in doubt, especially regarding interest calculations and legal disclosures, to ensure that all aspects of the contract are correct and legally binding.

Keep the client informed about every detail in the contract, ensuring they understand their rights and obligations, which helps in avoiding disputes and misunderstandings.

Documents used along the form

When entering into retail installment sales, several forms and documents are commonly utilized alongside the Retail Installment Sale Contract to ensure clarity, legality, and the protection of all parties involved. This assortment of forms includes essential agreements, disclosures, and statements documenting terms of sale, interest rates, arbitration agreements, and related financial conditions tailored to comply with both federal and state regulations.

- Truth in Lending Act (TILA) Disclosure: This document outlines the terms of credit, including the annual percentage rate (APR), finance charges, amount financed, total of payments, and payment schedule to inform the buyer comprehensively.

- Privacy Notice Form: It explains how the seller will use and protect the buyer’s personal information, ensuring compliance with privacy laws.

- Guaranty Agreement: If there are guarantors on the loan, this document outlines their responsibilities and obligations should the primary borrower fail to meet the loan requirements.

- Gap Insurance Waiver: This waiver is offered when the buyer decides against purchasing Gap insurance, which covers the difference between the actual cash value of the vehicle and the balance still owed on financing in the event of a total loss.

- Pre-Delivery Inspection (PDI) Form: This ensures that the buyer confirms the vehicle’s condition before taking delivery, noting any discrepancies for correction.

- Service Contract Agreement: If the buyer opts for a service contract (extended warranty), this agreement details the terms, coverage, exclusions, and duration of the contract.

- Arbitration Agreement: This document may be used to outline the process of resolving disputes between the buyer and seller outside of court, including any waiver of jury trials and possibly limiting class actions.

- Voluntary Repossession Agreement: In case the buyer foresees difficulties in continuing payment, this form outlines the terms under which they can voluntarily return the vehicle to avoid an involuntary repossession process.

- Odometer Disclosure Statement: Federal law requires that the seller provide this statement indicating the vehicle’s correct mileage at the time of sale to prevent odometer fraud.

These documents play a crucial role in supplementing the Retail Installment Sale Contract, each serving a unique purpose in ensuring comprehensive understanding, compliance with laws, and protection of the rights and interests of both parties involved in the transaction.

Similar forms

Lease Agreements: Just like retail installment sale contracts, lease agreements detail the terms and conditions under which a product can be used. However, the key difference lies in ownership. At the end of a lease term, the lessee often returns the property, whereas a retail installment sale results in the buyer owning the property once all payments are made.

Mortgage Loan Agreements: These also involve installment payments towards ownership, akin to retail installment sale contracts. The mortgage spells out the loan details for purchasing real estate, with the property serving as collateral. Both documents delineate payment schedules, interest rates, and the consequences of default.

Car Financing Contracts: Specifically structured for vehicle purchases, these contracts share similarities with retail installment sale contracts by setting up a payment plan for ownership transfer. They outline terms regarding the loan amount, interest rate, monthly payments, and late fees, just as retail installment contracts do for various goods.

Personal Loan Agreements: While personal loans can be versatile, when used for large purchases, the agreements resemble retail installment sale contracts. Both define the loan's terms, including repayment schedule, interest, and fees. However, personal loan agreements aren't necessarily tied to the purchase of specific goods.

Credit Card Agreements: These agreements govern the terms of credit use between a creditor and a borrower. Like retail installment sale contracts, they specify interest rates, payment schedules, and fees. The flexibility to make purchases and repay over time connects both document types, although credit cards offer revolving credit rather than installment payments for a specific item.

Payday Loan Agreements: Payday loans offer short-term borrowing, requiring a full payback usually within weeks. While they significantly differ in terms and duration, like retail installment sale contracts, they include finance charges and interest rates, presenting another way to finance purchases or expenses urgently.

Construction Loan Agreements: Used for financing new builds or renovations, these agreements share common ground with retail installment sale contracts through staged payments. Construction loans typically disburse funds in installments based on completed work phases, closely mirroring the installment payment structure for purchased goods.

Rent-to-Own Agreements: These agreements offer a path to ownership of goods through rental payments that may eventually lead to the renter becoming the owner. The structure mimics that of retail installment sale contracts by facilitating ownership via periodic payments, albeit initially as rent rather than loan repayments.

Student Loan Agreements: Designed for financing education, student loans necessitate repayment in installments, much like retail installment sales. They come with determined payment periods, interest rates, and sometimes a grace period, echoing the setup of buying goods on a payment plan, albeit for the specific purpose of funding education costs.

Dos and Don'ts

When completing a Retail Installment Sale Contract form, accuracy and attention to detail are paramount. Below are ten must-follow guidelines to ensure the process is done correctly and effectively:

Things You Should Do:

- Read through the entire form before beginning to fill it out to understand all the required information.

- Use a black or blue pen for clarity, unless the form specifies otherwise. Avoid using pencils as the information can easily be altered.

- Provide accurate information for all requested fields to ensure the validity of the contract.

- Review the specifics related to the interest rates, including any simple interest or arbitration clauses, to comprehend the financial implications fully.

- Check the state-specific requirements and versions of the form (e.g., California, Georgia, Michigan, etc.) to ensure compliance with local laws.

- Double-check all entered information for errors before submitting the form.

- If unsure about any section, seek clarification from a legal expert or the issuing authority to prevent mistakes.

- Keep a copy of the completed form for your records.

- Ensure that all parties involved in the contract sign and date the form where indicated.

- Submit the form to the appropriate entity or authority in a timely manner to avoid delays.

Things You Shouldn't Do:

- Do not leave any sections blank. If a section does not apply, mark it as “N/A” (not applicable).

- Avoid using correction fluid or tape. If you make a mistake, it's better to start over on a new form to ensure legibility.

- Do not guess on details or information. Verify all entries for accuracy.

- Refrain from signing the contract before all sections are completed satisfactorily.

- Do not ignore the fine print, such as arbitration agreements or late fee clauses, as these can have significant legal and financial implications.

- Avoid using non-official forms or outdated versions, as they may not be legally binding or accepted.

- Do not rush through filling out the form. Take your time to ensure all information is correct and complete.

- Refrain from altering any pre-printed information or terms on the form without proper authorization.

- Do not submit the form without retaining a copy for your personal records.

- Avoid delaying the submission of the completed form, as this may impact its legality or enforceability.

Misconceptions

When it comes to understanding retail installment sale contracts, there are several misconceptions that can mislead consumers and vendors alike. Let's demystify some of these common misunderstandings.

All Retail Installment Sale Contracts Are Essentially the Same: There's a belief that these contracts have a standard format that doesn't vary much between states or institutions. However, each contract might include unique terms depending on the local laws, the lender, and the type of purchase. Contracts listed, such as those by Wolters Kluwer, show variation tailored to specific states and regulations.

Interest Rates Are Negotiable After Signing: Many consumers think they can renegotiate the interest rates on their retail installment contracts post-signature. The interest rate is fixed upon signing the contract, reflecting the agreement terms at that moment. Changing this would require refinancing or modifying the contract under new terms.

Late Fees Are Standard Across All Contracts: Another misconception is that late fees are a standard flat rate in all contracts. Actually, late fees vary based on the agreement, the state laws, and the discretion of the lender. As indicated by differing terms like "SIMPLE INTEREST LATE FEE - ARBITRATION," contracts can have tailored late fee stipulations.

Pre-Computed and Simple Interest Contracts Are the Same: People often confuse these two types of contracts. A simple interest contract calculates interest based on the outstanding balance, while a pre-computed contract calculates total interest upfront. The distinction affects how payments are applied over the contract’s life.

Arbitration Clauses Are Optional: Many believe that arbitration clauses are optional and can be opted out of after signing. In reality, once a contract is signed, the arbitration clause becomes binding, unless the contract offers a specific opt-out period. Terms like "LAW-553-CA-ARB" highlight contracts with arbitration clauses specific to certain states.

A Retail Installment Contract Is Only for Automobile Purchases: While many retail installment contracts pertain to vehicles, this form of contract is not exclusive to them. They can be used for a variety of purchases, including furniture and electronics, as long as the sale involves installment payments over time.

Signing the Contract Commits You to the Purchase Regardless of Circumstance: It's a common belief that once signed, retail installment contracts bind the buyer to the purchase, no matter what. However, consumers may have recourse through state laws, cooling-off periods, or specific contract clauses allowing for cancellation under certain circumstances.

Understanding the nuances and specifics of retail installment sale contracts is crucial for both consumers and vendors to ensure that agreements are fair, transparent, and comply with applicable laws and regulations. It’s important to carefully review and comprehend each contract before signing to prevent future conflicts and misunderstandings.

Key takeaways

When dealing with the Retail Installment Sale Contract form, it's important to understand several key points that ensure its correct usage and completion. Here are four key takeaways to guide users:

- Choice of Form Depends on State Law: The form you use depends on the state where the transaction takes place. Different states have unique versions tailored to their specific legal requirements, such as arbitration clauses and simple interest calculations.

- Understanding Interest Calculation Methods Is Crucial: The contract forms list different interest calculation methods, like simple interest or pre-computed interest. Knowing which method applies to your transaction affects how interest is calculated over the life of the loan.

- Arbitration Clauses May Vary: Arbitration clauses are included in some of these contracts, which can impact how disputes are resolved. Some states have specific forms with arbitration clauses, indicating a need to understand how this might limit court action if a dispute arises.

- Attention to Forms' Validity Dates: Each form has a validity date or a date of last revision. This detail is crucial because it ensures that the document being used is up to date with current laws and regulations.

In summary, careful selection of the appropriate state-specific form, understanding the interest calculation method, awareness of arbitration clauses, and using an up-to-date form are vital steps in effectively filling out and using the Retail Installment Sale Contract form. These measures collectively safeguard against legal misunderstandings and enhance the transaction's smooth processing.

Popular PDF Forms

Ssa-521 - The form is designed for those who, upon reflection, believe their initial application disadvantages them.

Ca Jury Duty - There is a provision for updating contact details to ensure efficient communication between the court and the applicant.

Tractor Inspection - This pre-use tractor checklist form aids in upholding safety and efficiency on the farm, focusing on essential aspects like brake functionality, steering, and hoist operation checks.