Blank Ri 79 9 PDF Template

Navigating the complexities of health benefits after retirement requires a solid understanding of available options and the necessary procedures to adjust one’s coverage as life circumstances change. The RI 79-9 form, issued by the United States Office of Personnel Management (OPM), serves a critical role for CSRS and FERS Annuitants, Survivor Annuitants, and Former Spouse Annuitants who need to either cancel or suspend their enrollment in the Federal Employees Health Benefits Program (FEHBP). The form caters to various situations, including transitioning to a family member’s FEHBP enrollment, enrollment in a Medicare Advantage health plan, opting for TRICARE or similar programs, and eligibility for Medicaid or state-sponsored medical assistance. Importantly, the Affordable Care Act's stipulation for individuals to maintain minimum essential coverage is a critical backdrop for understanding the implications of cancelling or suspending FEHBP enrollment. The document emphasizes the gravity of these decisions, especially due to the potential ineligibility to reenroll in FEHBP after cancellation. It obliges annuitants to validate their understanding of these consequences by signing the form, ensuring they are fully informed and have considered their options carefully. Through this structured approach, the RI 79-9 form elucidates the path for annuitants to tailor their health benefits in alignment with their current needs, yet underscores the significance of such decisions on their future eligibility and coverage.

Preview - Ri 79 9 Form

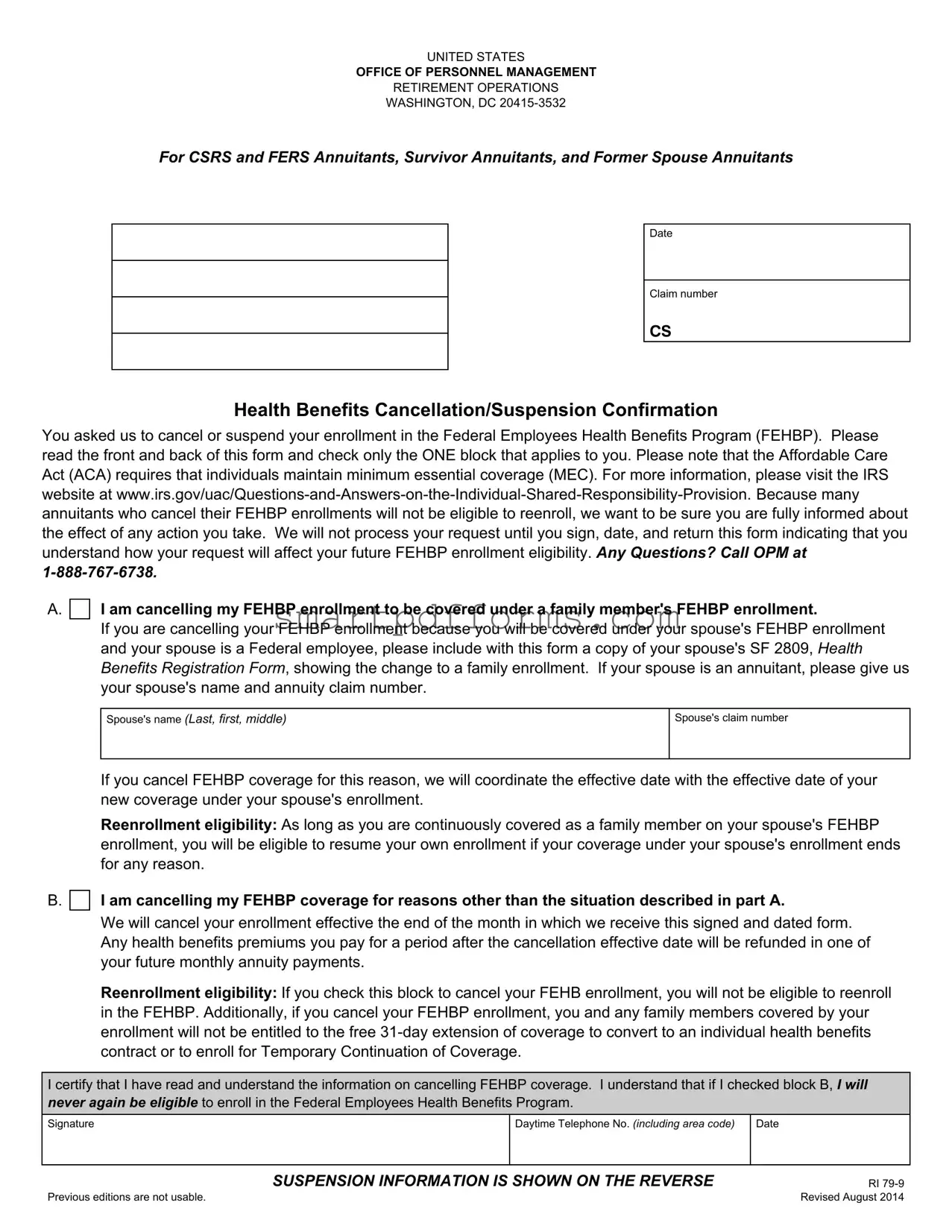

UNITED STATES

OFFICE OF PERSONNEL MANAGEMENT

RETIREMENT OPERATIONS

WASHINGTON, DC

For CSRS and FERS Annuitants, Survivor Annuitants, and Former Spouse Annuitants

Date

Claim number

CS

Health Benefits Cancellation/Suspension Confirmation

You asked us to cancel or suspend your enrollment in the Federal Employees Health Benefits Program (FEHBP). Please read the front and back of this form and check only the ONE block that applies to you. Please note that the Affordable Care Act (ACA) requires that individuals maintain minimum essential coverage (MEC). For more information, please visit the IRS website at

A.I am cancelling my FEHBP enrollment to be covered under a family member's FEHBP enrollment.

If you are cancelling your FEHBP enrollment because you will be covered under your spouse's FEHBP enrollment and your spouse is a Federal employee, please include with this form a copy of your spouse's SF 2809, Health Benefits Registration Form, showing the change to a family enrollment. If your spouse is an annuitant, please give us your spouse's name and annuity claim number.

Spouse's name (Last, first, middle)

Spouse's claim number

If you cancel FEHBP coverage for this reason, we will coordinate the effective date with the effective date of your new coverage under your spouse's enrollment.

Reenrollment eligibility: As long as you are continuously covered as a family member on your spouse's FEHBP enrollment, you will be eligible to resume your own enrollment if your coverage under your spouse's enrollment ends for any reason.

B.

I am cancelling my FEHBP coverage for reasons other than the situation described in part A.

I am cancelling my FEHBP coverage for reasons other than the situation described in part A.

We will cancel your enrollment effective the end of the month in which we receive this signed and dated form. Any health benefits premiums you pay for a period after the cancellation effective date will be refunded in one of your future monthly annuity payments.

Reenrollment eligibility: If you check this block to cancel your FEHB enrollment, you will not be eligible to reenroll in the FEHBP. Additionally, if you cancel your FEHBP enrollment, you and any family members covered by your enrollment will not be entitled to the free

I certify that I have read and understand the information on cancelling FEHBP coverage. I understand that if I checked block B, I will never again be eligible to enroll in the Federal Employees Health Benefits Program.

Signature

Daytime Telephone No. (including area code) |

Date |

|

|

SUSPENSION INFORMATION IS SHOWN ON THE REVERSE

Previous editions are not usable.

RI

C.

I am suspending my Federal Employees Health Benefits Program (FEHBP) enrollment because I am enrolled in a Medicare Advantage health plan. Please note: Medicare Parts A and B are not the same as a Medicare Advantage health plan. You CANNOT suspend your FEHBP enrollment if you are covered by Medicare Parts A and/or B only. Any

I am suspending my Federal Employees Health Benefits Program (FEHBP) enrollment because I am enrolled in a Medicare Advantage health plan. Please note: Medicare Parts A and B are not the same as a Medicare Advantage health plan. You CANNOT suspend your FEHBP enrollment if you are covered by Medicare Parts A and/or B only. Any

Questions: Call Medicare at

These Medicare Advantage health plans are Health Maintenance Organizations or

D.

I am suspending my FEHBP enrollment to use TRICARE, TRICARE for Life (enrollees over age 65 with Medicare Parts A and B), Peace Corps, or CHAMPVA. Please suspend my FEHBP enrollment effective

I am suspending my FEHBP enrollment to use TRICARE, TRICARE for Life (enrollees over age 65 with Medicare Parts A and B), Peace Corps, or CHAMPVA. Please suspend my FEHBP enrollment effective

_______________________________. (Carefully consider the effective date of your suspension. Once we process your request, we are not able to change the effective date.)

To suspend your FEHBP coverage for this reason, you must give us evidence of your eligibility for TRICARE, TRICARE for Life, Peace Corps, or CHAMPVA. Please send us a copy of your Uniformed Services Identification (I.D.) card and if over age 65, you must also send us a copy of your Medicare card showing enrollment in both Medicare Parts A and B (required for TRICARE for Life). To document your eligibility for CHAMPVA, please send us a copy of your CHAMPVA Authorization Card

E.

I am suspending my FEHBP enrollment because I am eligible for coverage under Medicaid or a similar

I am suspending my FEHBP enrollment because I am eligible for coverage under Medicaid or a similar

To suspend your FEHBP coverage for this reason, you must give us evidence of your eligibility for Medicaid or a similar

The following information applies to blocks C, D and E.

Reenrollment: You may voluntarily reenroll in the FEHBP during an annual open season. We will send you an open season package each year with instructions on how to reenroll. If you don't want to reenroll, disregard your open season material.

If you involuntarily lose your coverage under one of the programs mentioned above, you can reenroll in the FEHBP effective the day after your coverage ends. You must provide evidence of your involuntary loss of coverage. Your request to reenroll must be received at the Office of Personnel Management (OPM) within the period beginning 31 days before and ending 60 days after your coverage ends. Otherwise, you must wait until open season to reenroll.

I certify that I have read and understand the information on suspending FEHBP coverage. I have checked the block relating to my suspension, and I have enclosed the appropriate documentation.

Signature

Daytime Telephone No. (including area code)

Date

SAVE

CLEAR

Reverse of RI

Form Data

| Fact Name | Description |

|---|---|

| Form Identification | RI 79-9 |

| Title | Health Benefits Cancellation/Suspension Confirmation |

| Purpose | For CSRS and FERS Annuitants, Survivor Annuitants, and Former Spouse Annuitants to cancel or suspend their FEHBP enrollment. |

| Issuing Agency | United States Office of Personnel Management (OPM), Retirement Operations, Washington, DC. |

| Reenrollment Eligibility | Annuitants can reenroll in FEHBP during an annual open season or if they involuntarily lose coverage under another program, within specific time frames. |

| Affordable Care Act Compliance | The form reminds annuitants that under the ACA, individuals must maintain minimum essential coverage (MEC). |

| Suspension Reasons | FEHBP enrollment can be suspended for enrollment in Medicare Advantage, TRICARE, Peace Corps, CHAMPVA, or eligibility for Medicaid or similar state-sponsored programs. |

| Documentation Requirement | Proof of enrollment in another health plan is required to process suspension requests. |

| Contact Information for Queries | Includes contact numbers for OPM and Medicare for queries related to the cancellation or suspension of FEHBP coverage. |

Instructions on Utilizing Ri 79 9

Filling out the RI 79-9 form is an important step for those who need to adjust their enrollment in the Federal Employees Health Benefits Program (FEHBP) due to changes in their coverage needs. Whether you're planning to cancel or suspend your FEHBP enrollment, it's essential to follow the process diligently to ensure your healthcare coverage aligns with your current situation. Here's a simple guide on how to complete the form accurately.

- Locate the section on the form that best describes the reason for your cancellation or suspension request. There are multiple choices, including coverage under a family member's FEHBP enrollment, coverage by a Medicare Advantage health plan, TRICARE, CHAMPVA, Peace Corps, or Medicaid.

- If you're canceling your FEHBP enrollment to be covered under a family member's FEHBP enrollment (A), include the required documentation mentioned in the form instructions, such as a copy of your spouse's SF 2809 form or their annuity claim number.

- For those canceling for reasons other than being covered under a family member's FEHBP (B), no additional documentation is necessary. However, remember the implications regarding future reenrollment eligibility.

- If suspending FEHBP enrollment because you are enrolled in a Medicare Advantage health plan (C), provide documentation showing the effective date of your Medicare Advantage health plan enrollment.

- For suspension due to eligibility for TRICARE, TRICARE for Life, Peace Corps, or CHAMPVA (D), attach proof of your eligibility, such as your Uniformed Services Identification card, Medicare card for those over 65, or your CHAMPVA Authorization Card.

- If you are suspending your FEHBP enrollment due to eligibility for Medicaid or a similar state-sponsored program (E), send proof of your eligibility, like an enrollment card or a letter of eligibility.

- After selecting the reason for your action, sign and date the form to certify you understand the consequences of your decision regarding FEHBP coverage. Include your daytime telephone number.

- Double-check your form to ensure all information is accurate and you've included any necessary documentation based on your circumstances.

- Finally, send the completed and signed form, along with any required documentation, to the address provided by your benefits office or the Office of Personnel Management as directed.

By carefully following these steps, you'll make the adjustments to your FEHBP enrollment that best fit your current needs. Remember, it's crucial to understand the implications of your decision on future enrollment eligibility and coverage options.

Obtain Answers on Ri 79 9

What is the purpose of the RI 79-9 form?

The RI 79-9 form, issued by the United States Office of Personnel Management (OPM), serves as confirmation for annuitants, survivor annuitants, and former spouse annuitants who wish to cancel or suspend their enrollment in the Federal Employees Health Benefits Program (FEHBP). This form ensures that individuals are fully informed of the implications their actions may have on future eligibility to reenroll in FEHBP, in alignment with the requirements of the Affordable Care Act regarding minimum essential coverage.

Who needs to fill out the RI 79-9 form?

This form must be completed by CSRS and FERS annuitants, survivor annuitants, and former spouse annuitants who intend to cancel or suspend their FEHBP enrollment. It is crucial for anyone in these groups looking to adjust their health benefits coverage to use this form to communicate their decision officially to the OPM.

Can I cancel my FEHBP enrollment to be covered under a family member's plan?

Yes, if you are canceling your FEHBP enrollment to be covered under a family member's FEHBP enrollment, especially if your spouse is a Federal employee, you must attach a copy of your spouse's SF 2809 form. Continuous coverage under your spouse's plan qualifies you to resume your own enrollment if that coverage ends for any reason.

What happens if I cancel my FEHBP enrollment for reasons other than being covered by a family member’s plan?

If you cancel your FEHBP enrollment for reasons other than being covered under a family member’s FEHBP enrollment, your enrollment will be canceled at the end of the month in which the signed and dated form is received. Premiums paid for any period after the cancellation will be refunded. However, it's important to note that you will lose eligibility for reenrollment in FEHBP and you, along with any family members covered by your enrollment, will not be entitled to the free 31-day extension of coverage.

What are the requirements for suspending FEHBP coverage in favor of Medicare Advantage?

To suspend FEHBP coverage because you are enrolled in a Medicare Advantage health plan, documentation showing the effective date of your Medicare Advantage plan is necessary. Suspension is feasible provided the form and documentation are submitted within a specific timeframe around the start date of your Medicare Advantage plan coverage. Note that coverage by Medicare Parts A and B alone does not qualify for suspending FEHBP enrollment in this context.

How can FEHBP enrollment be suspended for TRICARE, TRICARE for Life, Peace Corps, or CHAMPVA users?

For suspension of FEHBP due to enrollment in TRICARE, TRICARE for Life, Peace Corps, or CHAMPVA, evidence of eligibility such as a Uniformed Services Identification (I.D.) card, or a CHAMPVA Authorization Card, is required. Specifying the effective date of suspension is also necessary, with the suspension process following a similar timeframe requirement as for Medicare Advantage plan suspension.

What about suspending FEHBP coverage due to Medicaid or similar state-sponsored program eligibility?

If you're suspending your FEHBP enrollment because you are eligible for Medicaid or a similar state-sponsored program, proof of your eligibility and the effective date of the program's coverage must be provided. The form and documentation must be submitted within a certain timeframe relative to your Medicaid coverage's start date, much like the other reasons for suspension.

What are the conditions for reenrolling in FEHBP after suspension?

After suspending FEHBP coverage, you may reenroll during an annual open season, or if you involuntarily lose coverage under the Medicare Advantage plan, TRICARE, TRICARE for Life, Peace Corps, CHAMPVA, Medicaid, or a similar state-sponsored program. Evidence of the involuntary loss of coverage and a timely request for reenrollment to OPM are required to reinitiate FEHBP coverage.

Common mistakes

When filling out the RI 79-9 form, individuals often make a range of mistakes that can delay or negatively impact the processing of their request regarding the Federal Employees Health Benefits Program (FEHBP). Understanding these common errors can help ensure the form is completed accurately and efficiently.

-

Not specifying the correct reason for the cancellation or suspension of FEHBP enrollment clearly in the designated section. Each reason has specific documentation requirements and different implications for future reenrollment eligibility.

-

Failing to include required documentation such as a family member’s SF 2809 form for those cancelling to be covered under a family member's FEHBP enrollment or eligibility proof for Medicare, TRICARE, Peace Corps, CHAMPVA, or Medicaid when suspending FEHBP coverage.

-

Incorrectly filling out the spouse’s or family member’s information when cancelling due to coverage under their FEHBP enrollment, including inaccuracy in the spouse’s name and claim number.

-

Omitting the signature and date, which is critical for processing the form. The form will not be processed without the requester’s signature and the date they signed it.

-

Ignoring the Affordable Care Act (ACA) advisory, not considering the ACA's requirement for maintaining minimum essential coverage (MEC) after cancelling FEHBP enrollment.

-

Choosing the wrong effective date for suspension, especially for those suspending enrollment to use TRICARE, TRICARE for Life, Peace Corps, or CHAMPVA. The effective date must be carefully considered and accurately filled out.

-

Not acknowledging the implications of checking block B for cancellation, which leads to losing eligibility to reenroll in FEHBP in the future.

-

Overlooking the open season reenrollment instructions and deadlines provided for those who have their FEHBP coverage suspended. Not paying attention to these details can result in missed opportunities to reenroll or delays.

By avoiding these common mistakes, individuals can ensure their RI 79-9 form is completed more accurately, facilitating a smoother transaction with the Office of Personnel Management regarding their FEHBP coverage.

Documents used along the form

When working with the RI 79-9 form, which involves the suspension or cancellation of enrollment in the Federal Employees Health Benefits Program (FEHBP) for different circumstances, individuals often need to provide additional documentation to support their requests. This is because specific situations, like enrolling in a different health plan or proving eligibility for another program, require verifiable evidence. The following documents are commonly associated with these requests and are imperative to ensure the process is completed accurately and effectively.

- SF 2809, Health Benefits Election Form: This document is used by Federal employees, retirees, and their eligible family members to enroll, change, or cancel their FEHBP coverage outside of an open season based on qualifying life events, such as marriage or the birth of a child. When cancelling FEHBP coverage to join a family member's FEHBP plan, this form, completed by the family member, must accompany the RI 79-9 form.

- Medicare Card: Essential for individuals who are suspending their FEHBP enrollment due to enrolling in Medicare Advantage, a copy of the Medicare card showing enrollment in both Parts A and B is required, particularly for those opting for TRICARE for Life. This evidence ensures that the suspension is justified under federal regulations.

- Uniformed Services ID Card: For those suspending their FEHBP enrollment to utilize TRICARE, TRICARE for Life, or similar military health benefits, a copy of the Uniformed Services ID is indispensable. This document serves as proof of eligibility for such healthcare services.

- CHAMPVA Authorization Card (A-card): To suspend FEHBP enrollment in favor of coverage under CHAMPVA, a healthcare program for the family members of veterans with disabilities or deceased, submission of the CHAMPVA Authorization Card confirms eligibility and entitlement to this alternative coverage.

- Medicaid or state program enrollment evidence: If suspending FEHBP coverage due to eligibility for Medicaid or similar state-sponsored medical assistance programs, documentation such as an enrollment card or a letter confirming eligibility is necessary. This serves as proof that the individual is entitled to and will receive healthcare coverage through these programs.

In handling these transitions or suspensions of coverage, the submission of the appropriate supplemental documentation is crucial. Each document proves the individual’s eligibility for alternative coverage or substantiates the reason for the change, facilitating a smoother transition and ensuring that all regulatory requirements are met. Accurate and prompt submission of these documents, along with the RI 79-9 form, ensures that federal employees, retirees, and their families can manage their health benefits effectively, maintaining coverage without unnecessary gaps or delays.

Similar forms

The SF 2809, Health Benefits Registration Form, is similar because it's used within the Federal Employees Health Benefits Program (FEHBP) for employees and annuitants to enroll in or change their health insurance coverage, similarly to how the RI 79-9 form is used by annuitants to cancel or suspend their FEHBP coverage.

The Medicare Advantage Plan enrollment documentation is comparable, as individuals use it to prove their enrollment in a Medicare Advantage Plan. This parallels the RI 79-9 requirement for documentation to suspend FEHBP enrollment for Medicare Advantage enrollment, demonstrating the official process to switch or adjust health coverage.

TRICARE or CHAMPVA documentation, such as the Uniformed Services Identification (I.D.) card or CHAMPVA Authorization Card, serves a similar purpose by verifying eligibility for health benefits. This is analogous to Part D of the RI 79-9 form, where individuals provide proof of eligibility for suspending FEHBP in favor of TRICARE, CHAMPVA, or similar programs.

Medicaid enrollment cards or eligibility letters are used to demonstrate eligibility for Medicaid, similar to how section E of the RI 79-9 form requires evidence of eligibility for Medicaid or state-sponsored programs to suspend FEHBP enrollment. Both forms facilitate a change in health coverage based on new eligibility.

The FEHB Program Handbook provides comprehensive information regarding enrollment, changes, and cancellation. This resource complements the RI 79-9 form by offering detailed guidance on managing FEHBP coverage, reinforcing the form's purpose in adjusting health benefits.

An Application for Immediate Retirement under Civil Service Retirement System (CSRS) or Federal Employees Retirement System (FERS) can indirectly relate to the RI 79-9 form. Although it serves a broader purpose in initiating retirement benefits, decisions made on this application can impact health benefits, which might necessitate the use of the RI 79-9 form to adjust FEHB coverage based on retirement status.

Temporary Continuation of Coverage (TCC) application forms also share similarities, as they are used by former employees, family members, and children to extend FEHB coverage after eligibility under the normal FEHB program ends. This intersects with RI 79-9's usage for suspending coverage, as both address changes in FEHB eligibility and coverage continuation.

The COBRA coverage election notice offers another parallel. Although it pertains to private sector and not federal employment, like the TCC application, it enables individuals who have lost their health benefits to continue their coverage temporarily. This concept aligns with the RI 79-9 form's role in managing transitions in health coverage.

Dos and Don'ts

Completing the RI 79-9 form, an essential document for those looking to change their enrollment status in the Federal Employees Health Benefits Program (FEHBP), requires attention to detail and an understanding of the process. Below are crucial dos and don'ts to consider when filling out this form.

What to Do:

- Review both sides of the form thoroughly to ensure you understand the ramifications of cancelling or suspending your FEHBP enrollment.

- Have all necessary documentation ready and attached before submission, such as a copy of your Medicare Advantage health plan documentation or evidence of eligibility for TRICARE, Peace Corps, CHAMPVA, or Medicaid.

- Check only one block that applies to your situation, ensuring clarity and preventing processing delays.

- Sign and date the form to validate your understanding and agreement with the terms of cancellation or suspension.

- Keep a copy of the completed form and any correspondence for your personal records.

- Contact OPM directly if you have any questions or concerns about completing the form or the impact on your benefits.

- Ensure you submit the form within the specified time frame to avoid lapses in coverage or other unintended consequences.

What Not to Do:

- Don’t skip reading the important notes and instructions, as they contain critical information about the effects of suspending or cancelling your coverage.

- Avoid delaying the submission of your form, especially if your coverage with another program like Medicare Advantage or TRICARE is about to begin.

- Don’t assume eligibility for reenrollment without verifying specific prerequisites; this could impact your health coverage options, especially in scenarios B and E.

- Don’t forget to provide contact information, including a daytime telephone number, enabling OPM to reach out to you if more information is needed.

- Avoid submitting the form without proper documentation for the cancellation or suspension reason selected; incomplete submissions lead to delays.

- Don’t overlook the instructions for reenrollment, as these are essential for understanding how and when you can reinstate your FEHBP coverage if desired.

- Don’t disregard the Affordable Care Act (ACA) requirements for maintaining minimum essential coverage (MEC), which the cancellation or suspension could impact.

By carefully following these guidelines, individuals can navigate the complexities of altering their FEHBP status with confidence, ensuring they make informed decisions about their health coverage.

Misconceptions

When discussing the RI 79-9 form associated with the Federal Employees Health Benefits Program (FEHBP), there are several misconceptions that need to be clarified to ensure that federal employees, annuitants, and their families make informed decisions regarding their health benefits. Understanding these misconceptions is crucial for managing health coverage effectively.

- Misconception 1: Cancelling or suspending FEHBP coverage means you can reenroll at any time. The truth is, once you cancel your FEHBP enrollment for reasons other than being covered under a family member's FEHBP, you cannot reenroll unless you meet certain criteria such as losing coverage under a Medicare Advantage plan, TRICARE, or similar programs, and even then, timing and specific conditions apply.

- Misconception 2: Suspension of FEHBP is only available to those who have Medicare Parts A and B. In reality, suspension options are broader; they are available for enrollees who join Medicare Advantage plans, not limited to those with Medicare Parts A and B, or other eligible programs like TRICARE for Life, Peace Corps, CHAMPVA, or Medicaid.

- Misconception 3: If you suspend your FEHBP coverage to use a Medicare Advantage plan, this decision is irreversible. However, you may reenroll in FEHBP during an open season or if you involuntarily lose your coverage with the Medicare Advantage plan, TRICARE, or a similar program, provided you furnish the required documentation and meet specific deadlines.

- Misconception 4: Cancelling FEHBP coverage for any reason has no consequences regarding the Affordable Care Act's (ACA) requirements. This misunderstanding might lead to penalties for not maintaining minimum essential coverage (MEC). It's important to ensure alternative coverage meets MEC requirements to avoid potential ACA penalties.

- Misconception 5: Enrolling in TRICARE for Life with Medicare Parts A and B automatically suspends FEHBP coverage. The process requires action from the enrollee, including submitting documentation for the suspension to be processed. Simply having TRICARE for Life and Medicare is not sufficient for automatic suspension.

- Misconception 6: You are entitled to a 31-day extension of your FEHBP coverage after cancelation, during which you can convert to an individual policy. This is not the case if you cancel your FEHBP enrollment; the 31-day extension and right to convert to an individual policy apply only upon loss of employment-related coverage, not for voluntary cancelation or suspension under these conditions.

Carefully evaluating these points and understanding the implications tied to the RI 79-9 form is essential for all federal employees, retirees, and their beneficiaries. This knowledge ensures that individuals can make decisions that best suit their health coverage needs while avoiding unintended lapses in coverage or eligibility issues.

Key takeaways

Filling out and utilizing the RI 79-9 form is a critical process for those involved in the Federal Employees Health Benefits Program (FEHBP), whether as annuitants, survivor annuitants, or former spouse annuitants. Understanding its purposes and requirements ensures that you make informed decisions regarding your health coverage. Here are four key takeaways about handling this form effectively:

- To cancel or suspend your FEHBP enrollment, it’s imperative to explicitly indicate the reason for doing so by checking the appropriate block on the RI 79-9 form. The rationale behind your decision could range from obtaining coverage under a family member's FEHBP enrollment to enrolling in Medicare Advantage, TRICARE, or similar programs. Each reason has its own set of requirements and implications on your future eligibility to reenroll in FEHBP.

- The Affordable Care Act (ACA) mandates that individuals maintain minimum essential coverage (MEC). Before proceeding with the cancellation or suspension of your FEHBP enrollment, consider how this action aligns with ACA requirements. Making an uninformed decision could not only impact your health coverage but also put you at odds with legal requirements.

- Documentation is key when requesting the suspension of your FEHBP enrollment. Whether you are shifting to a Medicare Advantage plan, TRICARE, or a similar health coverage program, providing proof of eligibility and the effective date of your new coverage is essential. The timely submission of this documentation (within 31 days before to 31 days after the effective date of your new enrollment) significantly influences the suspension process of your FEHBP coverage.

- Consider the long-term implications of your decision. Once you cancel your FEHBP enrollment for reasons other than being covered under a family member’s FEHBP plan, reenrollment is typically not an option. Conversely, suspending your FEHBP coverage for specific reasons such as Medicare Advantage enrollment allows for the possibility to reenroll during an annual open season or upon involuntary loss of the other coverage, provided you meet certain conditions.

Making informed decisions about your FEHBP coverage requires a comprehensive understanding of the RI 79-9 form. By closely reviewing the form and considering the above key points, individuals can navigate their health coverage options with greater confidence and clarity, ensuring their actions align with their personal circumstances and compliance obligations.