Blank Rpd 41083 PDF Template

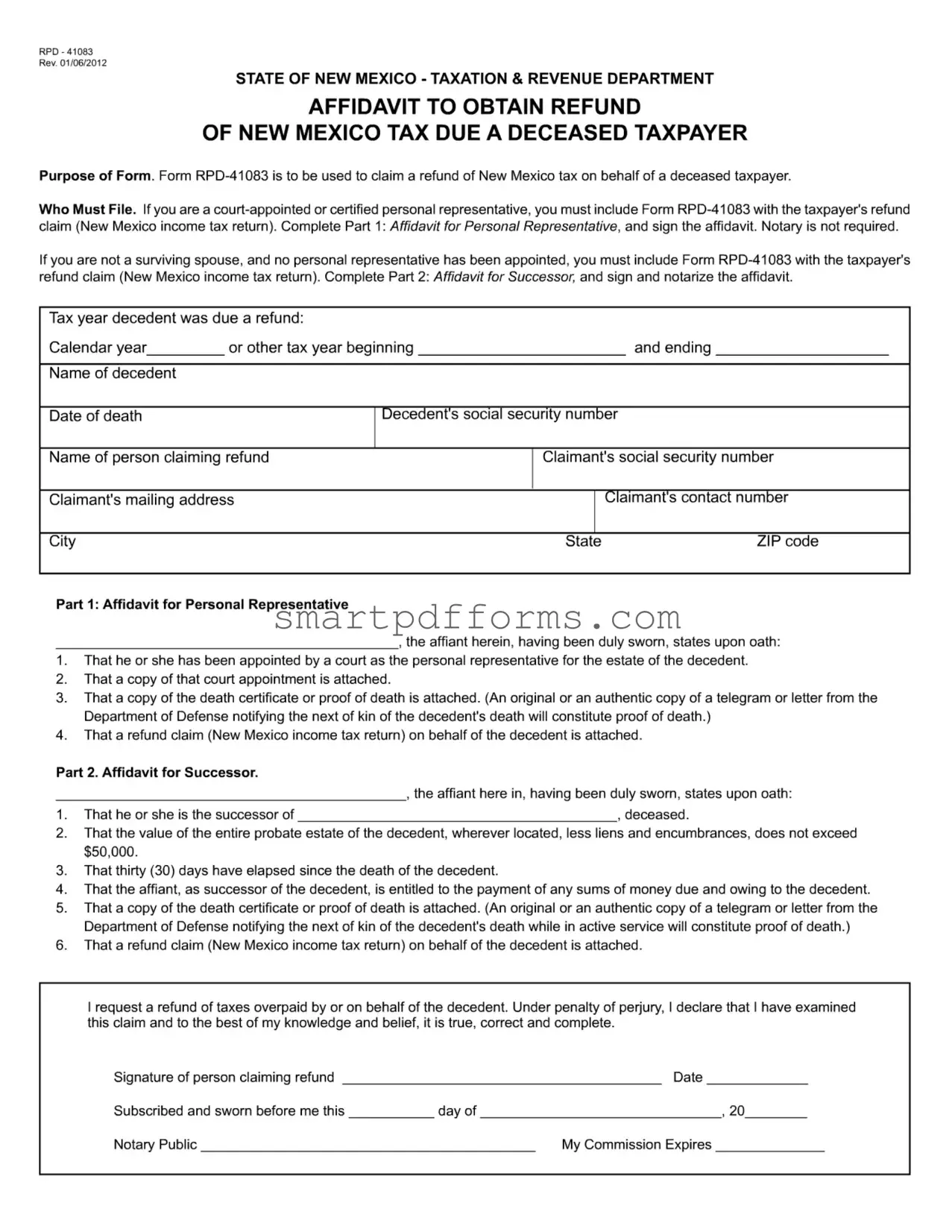

In the wake of a loved one's passing, handling financial affairs sensitively and efficiently becomes a paramount concern for many families and individuals. The State of New Mexico offers a structured way to address one such financial matter through the RPD-41083 form, an affidavit designed specifically for obtaining a tax refund due to a deceased taxpayer. This particular form serves a dual purpose, catering to both court-appointed or certified personal representatives and successors (in cases where no personal representative has been named and the claimant isn't a surviving spouse). The document contains detailed sections that allow individuals to declare their entitlement to the refund, backed by necessary attachments such as a copy of the death certificate or proof of death and, importantly, the deceased's tax return claiming the refund. Notably, while personal representatives can complete their affidavit without the need for notarization, successors must have their affidavits notarized to validate their claims. This careful process ensures that the New Mexico Taxation and Revenue Department handles each refund with the utmost respect and diligence, providing a clear path for those left behind to claim what was duly owed to the decedent, thereby helping to close one of the many fiscal chapters in the aftermath of a loss.

Preview - Rpd 41083 Form

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The Form RPD-41083 is specifically designed for the purpose of claiming a refund of New Mexico tax due to a deceased taxpayer. |

| 2 | Court-appointed or certified personal representatives are required to file Form RPD-41083 alongside the deceased taxpayer's New Mexico income tax return. |

| 3 | For a successor (not a surviving spouse) to file, the form must be completed with a notarization for the affidavit to be valid. |

| 4 | Proof of death is required to be attached with Form RPD-41083, which can be a death certificate or an authentic copy of notification from the Department of Defense for those lost in active service. |

| 5 | Governing laws for Form RPD-41083 include the Uniform Probate Code, specifically Section 1-21(42), relating to the definition of a successor. |

| 6 | Surviving spouses filing an original or amended joint return with the decedent or trustees managing the decedent's affairs are not required to file Form RPD-41083. |

| 7 | All claimants must declare under penalty of perjury that the information provided in the claim is true, correct, and complete to the best of their knowledge and belief. |

Instructions on Utilizing Rpd 41083

Navigating the aftermath of a loved one's passing can be challenging, especially when it involves settling financial matters. The RPD-41083 form serves an essential purpose in this process, allowing individuals to claim a refund of New Mexico tax due a deceased taxpayer. Depending on your relationship to the deceased and whether a personal representative has been appointed, the steps to complete this form can vary. Below is a straightforward guide to help you through each section of the form, ensuring that you fulfill all necessary requirements to submit a claim properly.

- Determine your eligibility:

- If you are a court-appointed or certified personal representative of the deceased's estate, you'll complete Part 1 of the form.

- If you are filling as a successor (and are not the surviving spouse filing a joint return), and no personal representative has been appointed, you'll need to complete Part 2.

- For Part 1: Affidavit for Personal Representative:

- Enter the tax year for which the decedent was due a refund, the decedent's name, the date of death, your name, and your mailing address, including city, state, and ZIP code.

- Provide the decedent's and your social security numbers, along with your contact number.

- Assert your appointment by the court, attach a copy of the court appointment, the decedent's death certificate (or proof of death), and the New Mexico income tax return as a refund claim on behalf of the decedent.

- For Part 2: Affidavit for Successor:

- Enter similar information as Part 1 regarding the decedent, yourself (the claimant), and the tax refund details.

- Confirm you are the decedent's successor, state that the probate estate's value does not exceed $50,000, and 30 days have passed since the decedent's death.

- Declare entitlement to any sums due to the decedent, attach a death certificate (or proof of death) and the tax refund claim, then sign and date the affidavit in the presence of a notary.

- Regardless of filling out Part 1 or Part 2, attach all required documents specified in the respective part.

- Sign and date the form. Note that Part 2 requires notarization.

- Mail the completed form, along with the New Mexico Personal Income Tax Return and all attachments, to the address provided: New Mexico Taxation and Revenue Department, P.O. Box 25122, Santa Fe, New Mexico 87504-5122.

Having carefully followed the instructions and ensured all requested documentation is attached, you can expect the New Mexico Taxation and Revenue Department to process your claim. It is important to remember that this step towards finalizing the decedent's affairs is a sensitive and necessary procedure to rightfully transfer or refund the decedent's assets. Patience and attention to detail throughout this process will help ensure that the task is completed accurately and respectfully.

Obtain Answers on Rpd 41083

-

What is the purpose of Form RPD-41083?

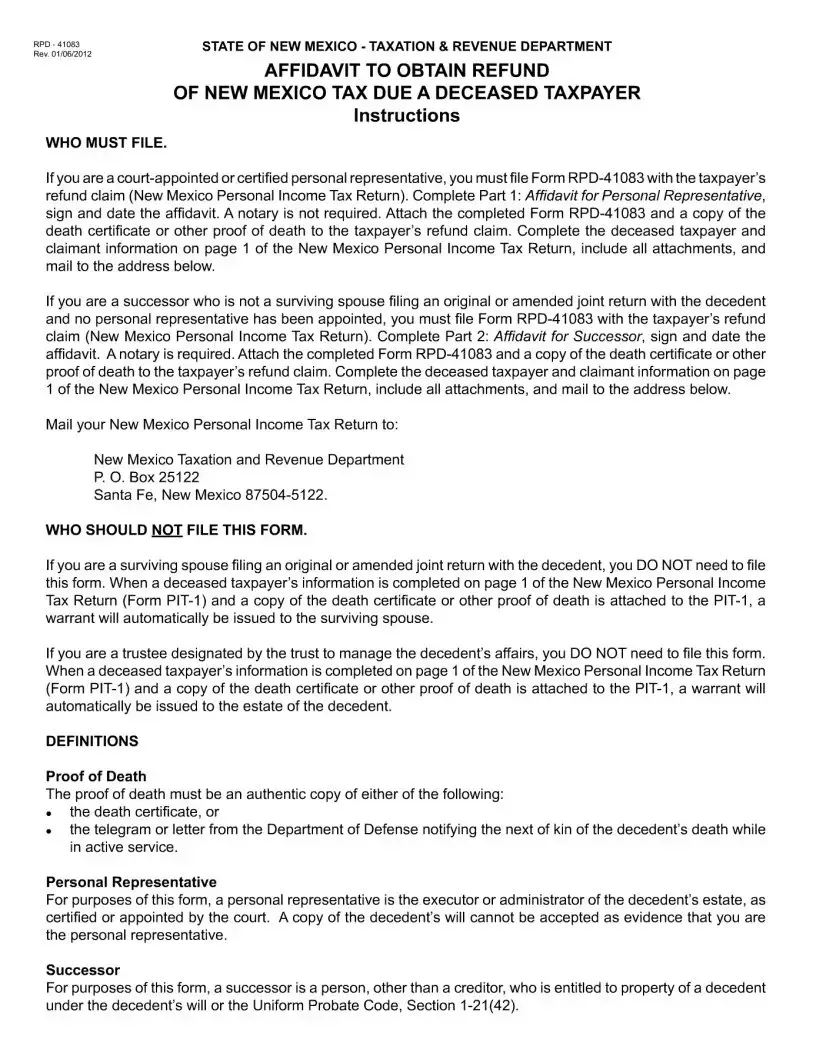

Form RPD-41083 is designed for use in claiming a refund of New Mexico tax that is due to a deceased taxpayer. This form enables either a court-appointed or certified personal representative, or a successor when no personal representative has been appointed, to file for a tax refund on behalf of the deceased.

-

Who must file Form RPD-41083?

There are two groups of people who are required to file Form RPD-41083:

- A court-appointed or certified personal representative filing the deceased taxpayer's New Mexico income tax return must complete Part 1 of the form.

- If there is no surviving spouse and no personal representative has been appointed, a successor may file using Part 2 of the form. This requires notarization.

-

Is notarization necessary for filing Form RPD-41083?

Notarization is not required for a court-appointed or certified personal representative completing Part 1 of the form. However, for successors filing under Part 2, notarization of the form is indeed required.

-

Who should not file Form RPD-41083?

You do not need to file Form RPD-41083 if you are:

- A surviving spouse filing an original or amended joint return with the decedent.

- A trustee designated by the trust to manage the decedent’s affairs.

In these cases, the process for issuing a refund is automatically initiated upon the filing of the standard New Mexico Personal Income Tax Return with the required documentation.

-

What documentation must be attached to the Form RPD-41083?

Regardless of the part being completed, it is necessary to attach a copy of the death certificate or proof of death to the form. Additionally, for Part 1 filers, a copy of the court appointment must be included, while Part 2 filers need to ensure that a claim for the refund (New Mexico income tax return) is also attached.

-

Where should Form RPD-41083 be mailed?

The completed Form RPD-41083, along with the deceased taxpayer's New Mexico Personal Income Tax Return and all required attachments, should be mailed to:

New Mexico Taxation and Revenue Department

P.O. Box 25122

Santa Fe, New Mexico 87504-5122 -

What constitutes proof of death?

Proof of death can be an authentic copy of the death certificate or a telegram or letter from the Department of Defense notifying the next of kin of the decedent's death while in active service. These documents are needed to substantiate the claim for a refund due to the deceased taxpayer.

Common mistakes

Not attaching the necessary documentation: One common mistake when filling out the RPD-41083 form is the failure to attach either a copy of the court appointment (for personal representatives) or a notarized affidavit (for successors), as well as the death certificate or proof of death and the New Mexico income tax return. These documents are essential for processing the refund claim.

Incorrectly completing the claimant information: Individuals often make errors in the claimant's section, such as providing incorrect social security numbers or mailing addresses. This information must match what is on file for both the claimant and the deceased taxpayer to avoid processing delays.

Filing the form when it is not required: A common mistake is filing the RPD-41083 form when it is not necessary. For example, surviving spouses filing an original or amended joint return with the decedent do not need to file this form. Similarly, trustees managing the decedent's affairs through a trust are not required to file.

Not checking for eligibility: Another mistake is not ensuring eligibility before filing. The form specifies that only court-appointed or certified personal representatives or successors (if no personal representative is appointed and the claimant is not a surviving spouse) are eligible to file. People outside these categories who submit the form will have their refund claim rejected.

Failing to sign and date the affidavit: The affidavit section of the form requires a signature and date to swear the truthfulness of the information provided. Sometimes individuals forget to sign, date, or both, which invalidates the submission until corrected and resubmitted.

Documents used along the form

When processing requests for refunds of New Mexico tax due a deceased taxpayer using Form RPD-41083, certain documents are often necessary to accompany the form to ensure a smooth and accurate submission. These documents play critical roles in verifying the claim and the claimant's entitlement to the refund. Here is a list of other forms and documents that are commonly used alongside Form RPD-41083:

- Death Certificate: An official government document that proves the death of the taxpayer. It is vital for confirming the deceased's information and is required for both personal representatives and successors.

- Court Appointment Letter: This letter demonstrates that an individual has been legally appointed by a court as the personal representative of the deceased's estate. It is necessary for those claiming refunds as the personal representative.

- Proof of Identity: A government-issued ID, such as a driver's license or passport of the claimant, may be required to verify the identity of the person filing the claim.

- New Mexico Personal Income Tax Return (Form PIT-1): The decedent’s income tax return for the relevant tax year. This form shows the original tax calculations and supports the claim for a refund.

- Letter from the Department of Defense: For military personnel, an original or an authentic copy of a letter or telegram from the Department of Defense notifying the next of kin of the decedent’s death serves as proof of death and is necessary when the death certificate is not immediately available.

- Notarized Affidavit for Successor: Required when a successor who is not a surviving spouse is filing the claim. The affidavit must be signed in the presence of a notary public to verify its authenticity.

- Document Proving Relationship to Decedent: This may include marriage certificates, birth certificates, or other legal documents that establish the claimant’s relationship to the deceased, especially in situations where the claimant is a successor or is requesting a refund based on relationship to the decedent.

Understanding and gathering these documents is a crucial step before filing Form RPD-41083. Each document serves as a piece of the puzzle in validating the claim and ensuring that the refund is rightfully and efficiently processed. Individuals are advised to review the requirements carefully and ensure all necessary documentation is complete and accurate for submission.

Similar forms

IRS Form 1310 (Statement of Person Claiming Refund Due a Deceased Taxpayer): Just like the RPD-41083, IRS Form 1310 is used to claim a refund on behalf of a deceased taxpayer. Both forms require information about the decedent and the claimant, and documentation proving the claimant's right to the refund. Whereas RPD-41083 is specific to New Mexico, Form 1310 is used for federal tax purposes.

Form 706 (United States Estate (and Generation-Skipping Transfer) Tax Return): Although used for a different purpose, Form 706 shares similarities with RPD-41083 as they both deal with the financial affairs of deceased persons. Form 706 is required for reporting the estate of a decedent and might be needed to finalize state tax obligations, as RPD-41083 is used for claiming a refund of New Mexico taxes for a deceased taxpayer.

Form 1041 (U.S. Income Tax Return for Estates and Trusts): This form is akin to RPD-41083 in that they both concern the tax responsibilities of decedents' estates. Form 1041 is necessary when an estate generates more than $600 in annual gross income, whereas RPD-41083 specifically addresses the refund of tax overpayments by or on behalf of a deceased taxpayer in New Mexico.

Affidavit for Collection of Personal Property of the Decedent: Many states have a version of this document that serves a function similar to Part 2 of the RPD-41083. It allows the transfer of assets without formal probate when an estate falls below a certain value threshold. Like Part 2 of the RPD-41083, these affidavits often require the successor to swear that the estate’s value is below a specific amount and that they have a legal right to the assets.

Dos and Don'ts

When submitting the RPD-41083 form to claim a refund of New Mexico tax due a deceased taxpayer, it is crucial to follow certain guidelines to ensure the process is completed accurately and efficiently. Below are five actions you should take, followed by five actions you should avoid.

Do:

- Verify your eligibility: Confirm whether you are a court-appointed or certified personal representative, or if no personal representative has been appointed, ensure you are the successor before filling out the form.

- Complete the form accurately: Fill out every required field in the form carefully, making sure the information provided is accurate and matches the documentation you will submit.

- Attach necessary documents: Depending on your status (personal representative or successor), attach a copy of the court appointment, the death certificate, or proof of death as required.

- Include the tax refund claim: Ensure that the refund claim (New Mexico income tax return) on behalf of the decedent is attached to your form.

- Sign and date the form: Ensure the form is signed and dated. Remember, a notary is required for successors, but not for personal representatives.

Don't:

- Avoid incomplete forms: Do not submit the form without filling out all the necessary sections. Incomplete forms may result in delays or denial of the refund claim.

- Don’t forget attachments: Failing to attach the required documents, such as the decedent’s death certificate or proof of death, and the court appointment (if applicable), can cause your claim to be rejected.

- Avoid incorrect information: Do not provide incorrect information regarding the decedent or the claimant. This could lead to issues in processing the refund or potential legal repercussions.

- Don’t ignore notarization requirements: If you are filing as a successor, do not forget to have the affidavit notarized, as it is a mandatory step in the process.

- Do not delay: Avoid waiting too long to file the claim. Ensure you are aware of any deadlines or time frames for filing the refund claim to avoid any potential forfeiture of the refund.

Misconceptions

- Misconception 1: A notary is required for all sections of Form RPD-41083.

- Misconception 2: The form can only be used to claim New Mexico income tax refunds.

- Misconception 3: Only surviving spouses can file for a refund using this form if they are filing a joint return.

- Misconception 4: Trustees managing the decedent’s affairs are required to file Form RPD-41083.

This is incorrect. The requirement for notarization depends on who is filing the form. For court-appointed or certified personal representatives completing Part 1, a notary is not required. However, for those who are not surviving spouses and have not been appointed as personal representatives, thus completing Part 2 as successors, notarization of the affidavit is mandatory. This distinction ensures that the document is legally binding, particularly when a formal court appointment has not been made.

Despite the focus on income tax, Form RPD-41083 is intended to facilitate the refund of any New Mexico tax that is due to a deceased taxpayer. This broad applicability is important for claimants seeking refunds of any nature on behalf of the deceased, making the form a crucial tool beyond just income tax matters.

This is not accurate. While surviving spouses filing an original or amended joint return do not need to use this form, it overlooks the provision that successors — individuals other than creditors who are entitled to the decedent's property by will or law — can utilize Form RPD-41083 if no personal representative has been appointed. This flexibility helps ensure that rightful claimants have access to funds due to the estate, regardless of their marital status to the decedent.

This misunderstanding fails to recognize that trustees designated by a trust to manage the decedent's affairs are not required to file this form. Such individuals are differentiated from personally appointed representatives or successors and have a separate process for claiming tax refunds due to the decedent, primarily through the management of the estate's affairs directly through trust mechanisms.

Key takeaways

Form RPD-41083 is designed to help claim a refund of New Mexico tax for a deceased taxpayer, ensuring those entitled can properly request what is due.

It is essential for court-appointed or certified personal representatives of the deceased's estate to fill out and include Form RPD-41083 when submitting the New Mexico income tax return on behalf of the decedent.

For those who do not have a court-appointed personal representative and are not a surviving spouse, the process still requires completion of Form RPD-41083, specifically Part 2: Affidavit for Successor, which also must be notarized.

To file for a refund, various documents are necessary: the completed form (depending on the filer’s status), a copy of the death certificate or other acceptable proof of death, and the decedent's New Mexico income tax return.

The state has clear definitions of who should and should not file this form. For example, surviving spouses filing a joint return or trustees managing the decedent's affairs under a trust might not need to file Form RPD-41083.

Proof of death can be provided through an authentic death certificate or a telegram or letter from the Department of Defense, especially relevant for those who passed away while in active service.

The personal representative aspect is crucial, with the form specifying it refers to executors or administrators certified or appointed by the court, highlighting the formality required in proving one’s authority to claim on behalf of the decedent.

Successor, as defined for the form’s purpose, covers individuals entitled to the decedent's property under a will or the Uniform Probate Code, essentially broadening who may be eligible to file for a refund, provided they meet the criteria.

Popular PDF Forms

What Is a Test Requisition - The form includes a space to record the laboratory location and the staff member who received the requisition, keeping a proper chain of documentation.

Dd 603 1 - Completion of the DD Form 603-1 is a proactive measure taken by service members to avoid legal issues and ensure the smooth transport of war souvenirs.

B1-1 Form - It represents an essential step in the work permit processing chain, linking legal knowledge with the practical aspects of employing minors in California.