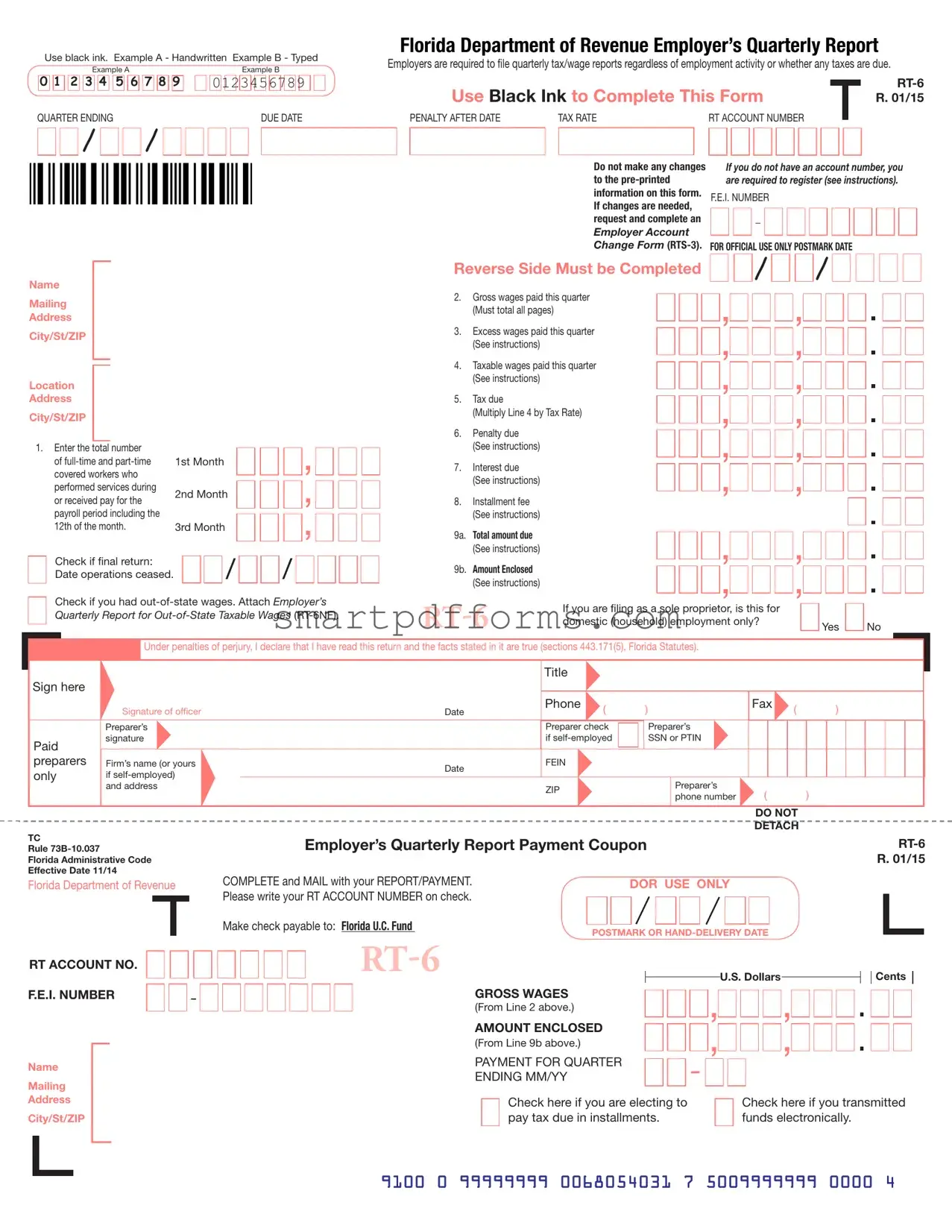

Blank Rt 6 PDF Template

Understanding the intricacies of the Florida Department of Revenue Employer’s Quarterly Report, commonly known as the RT-6 form, is essential for employers operating within the state. Required to be filled out and submitted quarterly, this form plays a pivotal role in tax and wage reporting for businesses. Employers must report details such as total gross wages paid, taxable wages, and the taxes due from those wages, using black ink to ensure the clarity and legibility of the information provided. Furthermore, the form outlines the need for declaring both full-time and part-time employees, with special sections dedicated to addressing excess wages paid within the quarter and other relevant calculations that affect the tax amount due. The RT-6 form also accommodates situations such as final returns, amendments due to out-of-state wages, and the potential penalties, interest, or installment fees applicable if deadlines are not met. Designed to streamline the process, the form includes a payment coupon and emphasizes the importance of using precise information to prevent discrepancies that could lead to audits or penalties under the perjury laws outlined in sections 443.171(5), Florida Statutes. With its structured format, the RT-6 form aids employers in maintaining compliance with state tax laws, ensuring they meet their reporting obligations accurately and efficiently.

Preview - Rt 6 Form

Use black ink. Example A - Handwritten Example B - Typed

|

Example A |

Example B |

|

0 1 |

2 3 4 |

5 6 7 8 9 |

0123456789 |

QUARTER ENDING |

DUE DATE |

/

/

/

Florida Department of Revenue Employer’s Quarterly Report

Employers are required to ile quarterly tax/wage reports regardless of employment activity or whether any taxes are due.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use Black Ink to Complete This Form |

|

|

|||||||||||||||||

|

|

R. 01/15 |

|||||||||||||||||

PENALTY AFTER DATE |

|

TAX RATE |

RT ACCOUNT NUMBER |

|

|

|

|||||||||||||

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do not make any changes If you do not have an account number, you

to the

information on this form. F.E.I. NUMBER If changes are needed,

request and complete an

Employer Account

Change Form

Name |

Mailing |

Address |

City/St/ZIP |

Location |

Address |

City/St/ZIP |

Reverse Side Must be Completed |

|

|

|

/ |

2.Gross wages paid this quarter (Must total all pages)

3.Excess wages paid this quarter (See instructions)

4.Taxable wages paid this quarter (See instructions)

5.Tax due

(Multiply Line 4 by Tax Rate)

/

1. Enter the total number |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

of |

1st Month |

|

|

|

|

|

|

|

|

|

|||||

|

covered workers who |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

performed services during |

2nd Month |

|

|

|

|

|

|

|

, |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

or received pay for the |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

payroll period including the |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

12th of the month. |

3rd Month |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if inal return: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date operations ceased. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if you had

6.Penalty due (See instructions)

7.Interest due (See instructions)

8.Installment fee (See instructions)

9a. Total amount due (See instructions)

9b. Amount Enclosed

(See instructions)

If you are iling as a sole proprietor, is this for domestic (household) employment only?

Yes

Yes  No

No

Under penalties of perjury, I declare that I have read this return and the facts stated in it are true (sections 443.171(5), Florida Statutes). |

|

|

|

||||

|

|

Title |

|

|

|

|

|

Sign here |

|

|

|

|

|

|

|

Signature of oficer |

Date |

Phone |

( |

) |

Fax |

( |

) |

|

|

||||||

|

Preparer’s |

|

Preparer check |

|

Preparer’s |

|

|

|

Paid |

signature |

|

if |

|

SSN or PTIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

preparers |

Firm’s name (or yours |

Date |

FEIN |

|

|

|

|

|

only |

if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

and address |

|

ZIP |

|

|

Preparer’s |

( |

) |

|

|

|

|

|

phone number |

|||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

DO NOT

DETACH

TC

Rule

Florida Administrative Code

Effective Date 11/14

Florida Department of Revenue

Employer’s Quarterly Report Payment Coupon |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

R. 01/15 |

||

COMPLETE and MAIL with your REPORT/PAYMENT. |

|

|

DOR USE ONLY |

|

|

|

||||||||

Please write your RT ACCOUNT NUMBER on check. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Make check payable to: Florida U.C. Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

POSTMARK OR |

|

|

|

|||||||||||

|

|

|

||||||||||||

|

|

|

|

|||||||||||

RT ACCOUNT NO.

F.E.I. NUMBER

GROSS WAGES

(From Line 2 above.)

U.S. Dollars

Cents

Name

Mailing Address

City/St/ZIP

AMOUNT ENCLOSED |

|

(From Line 9b above.) |

|

PAYMENT FOR QUARTER |

- |

ENDING MM/YY |

Check here if you are electing to pay tax due in installments.

Check here if you transmitted funds electronically.

9100 0 99999999 0068054031 7 5009999999 0000 4

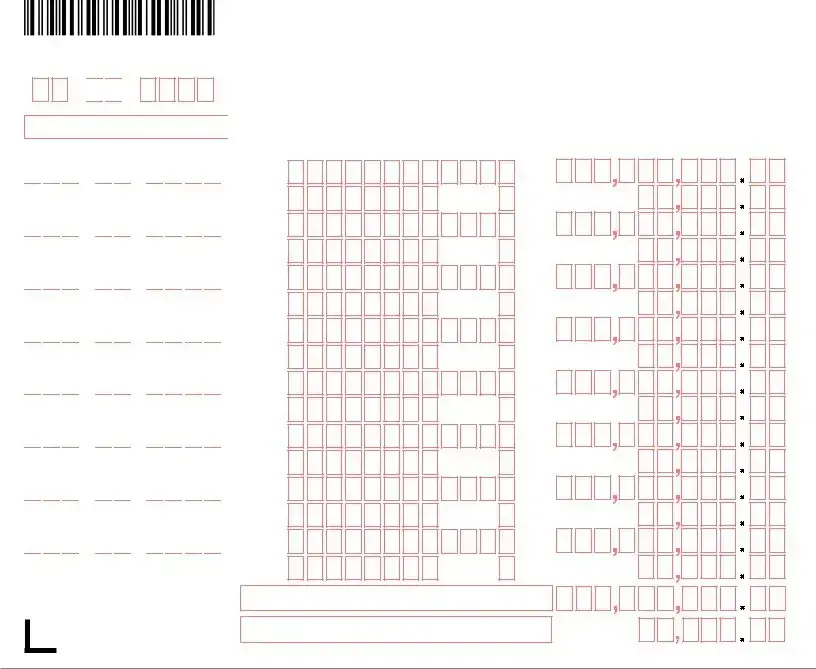

QUARTER ENDING

/

/

/

10. EMPLOYEE’S SOCIAL SECURITY NUMBER

|

|

|

|

|

Florida Department of Revenue Employer’s Quarterly Report |

|

|

|

||||||||||||||||

|

|

|

|

|

Employers are required to ile quarterly tax/wage reports regardless of employment activity or whether any taxes are due. |

|

|

R. 01/15 |

||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

Use Black Ink to Complete This Form |

|

|

|

|

|||||||||||||||

EMPLOYER’S NAME |

|

|

|

RT ACCOUNT NUMBER |

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

11. EMPLOYEE’S NAME (please print irst twelve characters of last name and irst |

|

12a. EMPLOYEE’S GROSS WAGES PAID THIS QUARTER |

|

|||||||||||||||||

|

|

|

|

eight characters of irst name in boxes) |

|

12b. EMPLOYEE’S TAXABLE WAGES PAID THIS QUARTER |

|

|||||||||||||||||

|

|

|

|

|

|

|

Only the irst $7,000 paid to each employee per calendar year is taxable. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Last

Name

First

Name

Last

Name

First

Name

Last

Name

First

Name

Last

Name

First

Name

Last

Name

First

Name

Last

Name

First

Name

Last

Name

First

Name

Last

Name

First

Name

Middle Initial

Middle Initial

Middle Initial

Middle Initial

Middle Initial

Middle Initial

Middle Initial

Middle Initial

12a.

12b.

12a.

12b.

12a.

12b.

12a.

12b.

12a.

12b.

12a.

12b.

12a.

12b.

12a.

12b.

13a. Total Gross Wages (add Lines 12a only). Total this page only. Include this and totals from additional pages in Line 2 on page 1.

13b. Total Taxable Wages (add Lines 12b only). Total this page only. Include this and totals from additional pages in Line 4 on page 1.

DO NOT

DETACH

Mail Reply To:

Reemployment Tax

Florida Department of Revenue

5050 W Tennessee St Bldg L

Tallahassee FL

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identiiers for the administration of Florida’s taxes. SSNs obtained for tax administration purposes are conidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized under state and federal law. Visit our website at www.mylorida.com/dor and select “Privacy Notice” for more information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

Please save your instructions!

Quarterly Report instructions

www.mylorida.com/dor

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The RT-6 form is used by employers to file quarterly tax/wage reports in Florida. |

| Submission Requirement | Employers are required to file this form regardless of employment activity or whether any taxes are due. |

| Completion Instruction | The form must be completed using black ink, and it accommodates both handwritten and typed entries. |

| Account Registration | If an employer does not have an account number, they are required to register and follow the instructions provided in the form. |

| Governing Law | This form is governed by the Florida Administrative Code, specifically Rule 73B-10.037, and sections 443.171(5), Florida Statutes. |

| Privacy Notice | Social security numbers collected on the form are used for tax administration purposes and are protected under sections 213.053 and 119.071, Florida Statutes. |

Instructions on Utilizing Rt 6

Filling out the RT-6 form properly is crucial for employers to report wages and pay taxes accurately. This step-by-step guide aims to simplify the process for you. Remember, correctly submitting this form will keep your business in compliance with the Florida Department of Revenue's requirements. Let’s walk through the process together, ensuring each section is completed accurately to avoid potential errors or delays.

- Begin by using black ink to fill out the form, whether you're handwriting or typing out the information. This ensures the form is legible and processed efficiently.

- Review the "QUARTER ENDING" and "DUE DATE" fields to ensure the pre-printed information is correct for the reporting period you are filing for.

- If you do not have an RT account number, you’ll need to register and obtain one before completing this form. If you have an RT account number, it should be pre-printed on the form. Do not make any changes to this.

- Enter your Federal Employer Identification Number (F.E.I. NUMBER) in the designated space.

- Fill in your business name, mailing address, and if different, your location address.

- On the reverse side, start with calculating and entering the total number of covered workers for each month of the quarter being reported.

- Check the appropriate box if filing your final return or if you have out-of-state wages, and attach the necessary documentation if you have out-of-state taxable wages.

- Input the gross wages paid this quarter, excess wages, taxable wages, and then calculate the tax due by multiplying the taxable wages by your tax rate.

- Fill in any applicable fields for penalties, interest due, installment fees, and total amount due. Make sure to also include the amount enclosed if you are making a payment with the form.

- If filing as a sole proprietor, indicate whether it is for domestic (household) employment only.

- Under the penalties of perjury section, an officer of the company must sign and date the form, providing their title, phone and fax numbers.

- The preparer, if applicable, should also sign and provide their details including SSN or PTIN, firm’s name, and contact information.

- On the Employee’s Quarterly Report section, list each employee's social security number, name, and both gross and taxable wages for the quarter.

- Calculate and enter the totals for both gross and taxable wages on the lines provided at the end of this section.

- Lastly, if you're making a payment, complete the Employer's Quarterly Report Payment Coupon by providing your RT account number, FEI number, gross wages from line 2 above, and the amount enclosed for this quarter.

Once the RT-6 form is filled out completely and accurately, review it one last time for any errors or omitted information. After ensuring everything is correct, mail the form to the provided address for the Florida Department of Revenue. It’s recommended to keep a copy of the completed form and any related documentation for your records. Adhering to due dates and filling out forms accurately helps maintain your business’s compliance and avoids potential penalties.

Obtain Answers on Rt 6

-

What is the RT-6 form used for?

The RT-6 form, officially recognized as the Employer’s Quarterly Report, is a document that employers in Florida must file every quarter. It reports wages paid to employees, taxable wages, and calculates the tax due. This report must be submitted to the Florida Department of Revenue, regardless of employment activity or whether taxes are due.

-

Who is required to file the RT-6 form?

All employers operating in Florida are required to file the RT-6 form every quarter. This applies whether or not they paid wages during the quarter or owe taxes. Employers without activity must still submit a report, indicating no wages paid or taxes due for the period.

-

How should the RT-6 form be completed?

The RT-6 form should be filled out using black ink. Employers may choose to handwrite or type their report; the form provides space for essential details such as the total number of employees, gross wages paid, taxable wages, and the resulting tax due. Accuracy is crucial to avoid errors or potential penalties.

-

What is the deadline for filing the RT-6 form?

The form is due on a quarterly basis, with specific due dates falling after the end of each quarter. Filing must be completed by these deadlines to avoid penalties and interest on late submissions. The exact due date can be found on the form itself, under the "Due Date" section.

-

Can I make changes to the pre-printed information on the RT-6 form?

No, any changes to the pre-printed information on the form are not allowed. If certain details have changed, such as the business address or ownership information, you must request and complete an Employer Account Change Form (RTS-3) to update your records with the Florida Department of Revenue.

-

What happens if I fail to file the RT-6 form?

Failure to file the RT-6 form can result in penalties, interest on owed taxes, and possible legal action. These consequences underline the importance of timely and accurate filing each quarter to stay compliant with state regulations.

-

Is it possible to file the RT-6 form electronically?

Yes, employers have the option to file the RT-6 form electronically. This method is often quicker and can help reduce errors in filing. The Florida Department of Revenue provides resources and guidelines on how to complete this process through their official website.

-

Where can I find more information or get help with the RT-6 form?

For more information or assistance with the RT-6 form, employers can visit the Florida Department of Revenue's official website. The site offers detailed instructions, FAQs, contact information for support, and additional resources to help employers successfully fulfill their quarterly reporting obligations.

Common mistakes

Filling out the Employer's Quarterly Report RT-6 form for the Florida Department of Revenue entails careful attention to detail. Missteps in this process can lead to errors that may complicate tax obligations or result in penalties. Here are ten common mistakes:

- Using an incorrect ink color: Completing the form in an ink color other than black can cause issues with machine readability, leading to processing delays or errors.

- Not sticking to the prescribed format for entries: Failing to follow the examples provided for handwritten or typed entries, such as the specific way numbers or characters must be entered, can result in incorrectly processed forms.

- Omitting the RT account number: This is a crucial identifier for your report. Leaving it blank or entering it incorrectly can misdirect your filings and payments.

- Altering pre-printed information: Attempting to correct pre-printed information on the form instead of using the outlined process (completing an Employer Account Change Form RTS-3 for corrections) can invalidate your submission.

- Error in reporting wages: Misreporting gross wages, excess wages, taxable wages, or any related figures can affect your tax obligations and result in underpayment or overpayment.

- Entering incorrect tax rate or calculating tax due incorrectly: Using the wrong tax rate or miscalculating the tax due disrupts the accuracy of your report, potentially leading to penalties.

- Forgetting to sign and date: A missing signature or date can render the form incomplete, as it serves as a certification under penalty of perjury that the information provided is accurate.

- Neglecting to complete the reverse side of the form: All necessary information must be provided, and omitting details requested on the back can lead to an incomplete submission.

- Incorrect reporting of employee information: Errors in listing employee social security numbers, names, and wages can have serious implications for both the employer and employee.

- Failing to check appropriate boxes: Overlooking to indicate if it's a final return, whether out-of-state wages were paid, or if electing to pay tax due in installments can lead to processing inaccuracies.

Each of these errors has the potential to disrupt the tax reporting and payment process, leading to unnecessary stress and possibly financial penalties. Careful attention to the requirements, details, and proper procedure when completing the RT-6 form is crucial for ensuring compliance and accuracy in tax reporting.

Documents used along the form

When managing employment taxes and related obligations, it’s essential to have all the required forms and documents at hand. The Rt 6 form is a cornerstone document for employers in Florida, who are required to file quarterly tax/wage reports. Alongside this form, there are several others that frequently come into play, aiding employers in fulfilling their reporting duties comprehensively.

- RTS-3, Employer Account Change Form: This document is vital for updating any changes in an employer’s account details. If there are changes needed that cannot be made on the Rt 6 form, the RTS-3 form allows employers to submit their updated information efficiently.

- RT-6NF, Employer's Quarterly Report for Out-of-State Taxable Wages: Employers who have paid wages for services performed outside Florida must complete this form. It supplements the main RT-6 form by accounting for any taxable wages not included due to geographical reasons.

- UCT-6, Florida Unemployment Tax Return: This form is used for reporting wages paid and calculating the unemployment tax due to the state. While similar to the RT-6, it focuses specifically on unemployment contributions.

- Form W-3, Transmittal of Wage and Tax Statements: After filing individual W-2 forms for employees, employers use Form W-3 to submit a summary of all W-2s to the Social Security Administration. This form plays a crucial role in ensuring employee wage and tax information is accurately reported on a federal level.

- Form DR-1, Florida Business Tax Application: Employers new to conducting business in Florida or those needing to register for unemployment tax must fill out the DR-1 form. It’s the starting point for establishing an employer’s tax responsibilities in the state.

Navigating through these forms ensures employers stay compliant with both state and federal regulations regarding employee wages and taxes. From updating account information to addressing out-of-state wages and summarizing annual tax reports, these documents collectively form the backbone of an employer's tax and wage reporting responsibilities. Understanding and utilizing these forms correctly can save time and prevent complications with tax authorities.

Similar forms

Form W-2 (Wage and Tax Statement): Similar to the RT-6 in that it requires employers to report wages, tips, and other compensation paid to employees, along with the employee's social security number and tax withheld. Both forms are critical for tax reporting purposes.

Form 941 (Employer’s Quarterly Federal Tax Return): Shares similarities with the RT-6 by requiring quarterly wage reporting and calculating taxes due. Both forms are necessary for employers to comply with federal and state tax obligations.

Form 940 (Employer's Annual Federal Unemployment (FUTA) Tax Return): Similar because it involves reporting wages paid to employees and calculating taxes owed for unemployment purposes. Both the RT-6 and Form 940 help fulfill unemployment tax reporting requirements.

Form I-9 (Employment Eligibility Verification): While primarily for verifying employee eligibility to work in the U.S., it indirectly relates to the RT-6 as both forms require accurate employee information for compliance with government regulations.

Form W-4 (Employee's Withholding Certificate): Though the W-4 is used to determine federal income tax withholding, it is similar to the RT-6 in that it deals with employee wage reporting and taxation issues from an employer's perspective.

State-specific New Hire Reporting Forms: Many states require employers to report new or rehired employees, somewhat akin to the RT-6’s requirement for reporting wages and employment status on a quarterly basis to the state department of revenue.

Schedule B (Form 941) (Report of Tax Liability for Semiweekly Schedule Depositors): This form is used by employers who deposit employment taxes on a semiweekly schedule, similar to the RT-6's role in reporting quarterly taxes, highlighting both forms' importance in tax responsibility and compliance.

Form UIA 1028 (Employer's Quarterly Wage/Tax Report): Used in certain states for reporting wages and paying state unemployment insurance taxes, this form has purposes akin to the RT-6, focusing on employer wage reporting and tax calculation on a quarterly basis.

Form WH-347 (Payroll Form for Federal Contracts): Required for contractors on federal projects to report wage payments to workers, it has commonalities with RT-6 in enforcing compliance with wage reporting regulations, albeit in a different context.

Form W-9 (Request for Taxpayer Identification Number and Certification): While primarily used to provide correct taxpayer identification information to entities that pay income, it shares a connective thread with the RT-6 in the broader context of accurate tax reporting and compliance.

Dos and Don'ts

When filling out the RT-6 form, a proper understanding of the dos and don'ts significantly streamlines the process, ensuring accuracy and compliance. Here are crucial pointers to guide you:

Dos:

- Use black ink to fill out the form, as it ensures the information is legible and capable of being scanned or photocopied without loss of quality.

- Ensure that all information is accurate, especially the pre-printed sections, which include sensitive data like the RT account number and F.E.I. number. Accuracy in reporting is crucial for tax and wage compliance.

- Attach the Employer’s Quarterly Report for Out-of-State Taxable Wages (RT-6NF) if you have out-of-state wages, as failure to report these may lead to inaccuracies in your taxable wages calculation.

- Review the entire form once completed to confirm that all entries are correct, including calculations for gross wages, taxable wages, and tax due. This final step minimizes errors and potential complications with your submission.

Don'ts:

- Alter any pre-printed information on the form. If there's a need for changes, such as in your business address or official contact details, request and complete an Employer Account Change Form (RTS-3) instead.

- Use any ink color other than black. While this might seem trivial, using other colors can lead to processing delays or difficulties in digitizing the document.

- Leave sections incomplete. Even if certain sections seem not to apply to your situation, review the instructions to ensure no requirement is overlooked. For sections that genuinely do not apply, follow the form's guidance on how to indicate this.

- Forget to sign and date the form. The signature certifies under penalty of perjury that the information provided is true and complete. An unsigned form is considered invalid and can lead to processing delays.

Adhering to these guidelines helps in the seamless processing of your RT-6 form, ensuring that your business remains in good standing with tax reporting requirements.

Misconceptions

It's a common misunderstanding that the RT-6 form can be filled out with any type of ink. In reality, the instructions specifically state that black ink must be used to complete the form. This ensures that the form is legible and can be processed efficiently by the Florida Department of Revenue.

Some people think the pre-printed information on the RT-6 form can be altered if it's incorrect. However, the form clearly instructs that no changes should be made to the pre-printed information. If there are errors or updates needed, one is required to request and complete an Employer Account Change Form (RTS-3).

There's a misconception that employers only need to file the RT-6 form if they owe taxes. In reality, employers are required to file quarterly tax/wage reports regardless of employment activity or whether any taxes are due. This ensures all employment activity is accurately reported to the state.

Many believe that if they are filing as a sole proprietor for domestic employment, they do not need to file the RT-6 form. This is not true. The form itself asks if you are filing as a sole proprietor for domestic employment, indicating that such employment situations also require reporting.

Another incorrect assumption is that digital submissions do not require a signature. Even though the form completion and submission process might be digital, the form clearly asks for a signature, asserting the truthfulness of the information provided under penalties of perjury.

It is mistakenly thought that the due date for the RT-6 form is flexible. In fact, there are specific quarterly due dates and penalties apply after these dates. Timely submission is essential to avoid penalties.

Some employers wrongly believe that only full-time employee wages need to be reported on the RT-6. However, the form requires reporting of both full-time and part-time covered workers who performed services or received pay during the payroll periods covered by the report.

A common misconception is that the RT-6 form and instructions are mailed out every quarter. Instructions for the RT-6 (RT-6N/RTS-3) are only mailed with new accounts or when changes occur, not routinely every quarter. Employers are responsible for accessing and understanding the most current form and instructions, which can be downloaded from the Florida Department of Revenue’s website.

Lastly, there is a misunderstanding about the confidentiality of information provided on the RT-6 form, particularly social security numbers. The form explicitly states that social security numbers, used as unique identifiers for tax administration purposes, are confidential under Florida law and not subject to unconditional release as public records.

Key takeaways

Understanding the complexities of the RT-6 form, or the Employer’s Quarterly Report, is crucial for Florida-based employers in ensuring compliance with state tax and employment laws. Here are five key takeaways for filling out and using the RT-6 form effectively:

- Use Black Ink: It is mandated that the RT-6 form be completed using black ink. This requirement ensures consistency and legibility, which is important for the Florida Department of Revenue to accurately process the forms. Employers have the option to fill out the form either by hand or type the information. Regardless of the method chosen, clarity and adherence to this guideline are necessary.

- Do Not Alter Pre-Printed Information: The RT-6 form contains pre-printed information that is unique to each employer, such as the RT account number and tax rate. It is critical that employers do not make changes to these sections. If any pre-printed information is incorrect, the employer is instructed to request an Employer Account Change Form (RTS-3) to make the necessary corrections. This procedure ensures that the employer's account details are accurately maintained for correct processing and record-keeping.

- Employer Identification Numbers: Providing both the Federal Employer Identification Number (F.E.I. NUMBER) and the RT Account Number is mandatory. These identifiers are crucial for the Florida Department of Revenue to correctly associate the quarterly tax/wage reports with the correct employer. This dual-identification system helps in preventing errors or mismatches in the state's unemployment tax collection efforts.

- Reporting Wages and Calculating Taxes Due: Employers must meticulously report the gross wages paid during the quarter, identify any excess wages, and calculate the taxable wages accordingly. The tax due is then determined by applying the tax rate to the taxable wages. These steps are critical in ensuring that employers contribute the correct amount to the state's unemployment fund, which is vital for the support of workers who are temporarily unemployed.

- Deadlines and Penalties: Filing the RT-6 form by the due date is crucial to avoid penalties. The form emphasizes the importance of timely submission by including sections for calculating penalty and interest due in case of late filings. Employers are encouraged to pay close attention to the quarter ending dates and due dates to ensure compliance and avoid unnecessary fines.

In summary, accurate and timely completion of the RT-6 form is essential for employers in Florida. It not only fulfills a legal obligation but also contributes to the state’s ability to support unemployed workers. Employers should carefully follow the form’s guidelines, from using black ink to timely reporting, to ensure their submissions are correct and compliant.

Popular PDF Forms

Tn Counter Offer - Enables revisiting previously agreed upon terms, offering a path to compromise and agreement in complex transactions.

Vehicle Inspection Forms - Highlight the importance of an organized and thorough fleet vehicle inspection, supporting safety, compliance, and operational readiness.

Employee Emergency Contact Form Template - An employee safety initiative in the form of a document to record essential emergency contact information and health specifics.