Blank Rt 8A PDF Template

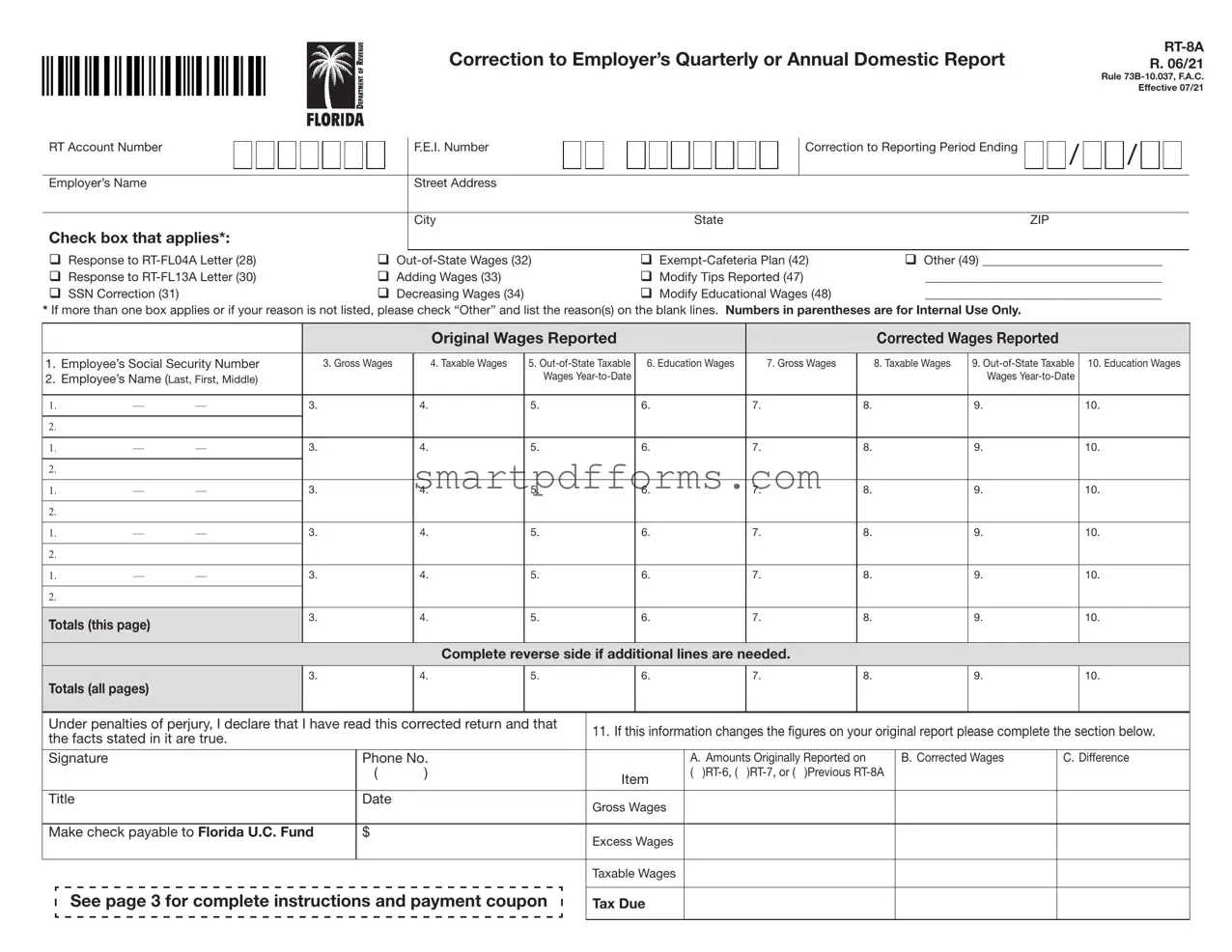

Employers often face challenges when reporting wages and tax information, sometimes necessitating corrections to previously submitted reports. The RT-8A form serves as a tool for these corrections, specifically for Employer’s Quarterly or Annual Domestic Reports in the state of Florida. Designed to address discrepancies or changes in employee wage reports, including Social Security number corrections, wage adjustments, and alterations in exempt status or other categories, the form is integral for ensuring accurate accounting and compliance with state regulations. Effective as of July 2021, following Rule 73B-10.037, F.A.C., the form allows for detailed adjustments to be made, including the need to respond to specific letters from the Florida Department of Revenue, adjust previously reported wages, or correct taxable wages for out-of-state or educational purposes. Employers are also required to detail original versus corrected wages, thereby showcasing the direct changes being reported. This process not only aids in maintaining accurate employment records but also ensures that both the state and the employer can reconcile any differences that may affect tax liabilities or refunds due. Additionally, the instructions provided with the form guide employers through the necessary steps to complete and submit corrections, whether they are being made to quarterly or annual reports, with specific sections dedicated to explaining the payment procedure in cases where discrepancies result in additional taxes due or credits owed. Through the RT-8A form and its comprehensive instructions, employers can navigate the complexities of wage reporting and correction with greater ease and precision.

Preview - Rt 8A Form

Correction to Employer’s Quarterly or Annual Domestic Report

R. 06/21

Rule

RT Account Number |

F.E.I. Number |

|

Correction to Reporting Period Ending |

Employer’s Name |

Street Address |

|

|

|

City |

State |

ZIP |

Check box that applies*: |

|

|

|

q Response to |

q |

q |

q Other (49) _____________________________ |

q Response to |

q Adding Wages (33) |

q Modify Tips Reported (47) |

______________________________________ |

q SSN Correction (31) |

q Decreasing Wages (34) |

q Modify Educational Wages (48) |

______________________________________ |

*If more than one box applies or if your reason is not listed, please check “Other” and list the reason(s) on the blank lines. Numbers in parentheses are for Internal Use Only.

|

|

|

|

Original Wages Reported |

|

|

Corrected Wages Reported |

|

||

|

|

|

|

|

|

|

|

|

||

1. Employee’s Social Security Number |

3. Gross Wages |

4. Taxable Wages |

5. |

6. Education Wages |

7. Gross Wages |

8. Taxable Wages |

9. |

10. Education Wages |

||

2. Employee’s Name (Last, First, Middle) |

|

|

Wages |

|

|

|

Wages |

|

||

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals (this page) |

|

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Complete reverse side if additional lines are needed.

Totals (all pages)

3.

4.

5.

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

Under penalties of perjury, I declare that I have read this corrected return and that |

11. If this information changes the figures on your original report please complete the section below. |

|||||

the facts stated in it are true. |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

Phone No. |

|

A. Amounts Originally Reported on |

B. Corrected Wages |

C. Difference |

|

|

( |

) |

Item |

( |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

Date |

|

Gross Wages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Make check payable to Florida U.C. Fund |

$ |

|

Excess Wages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable Wages |

|

|

|

See page 3 for complete instructions and payment coupon |

|

|

|

|

||

Tax Due |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

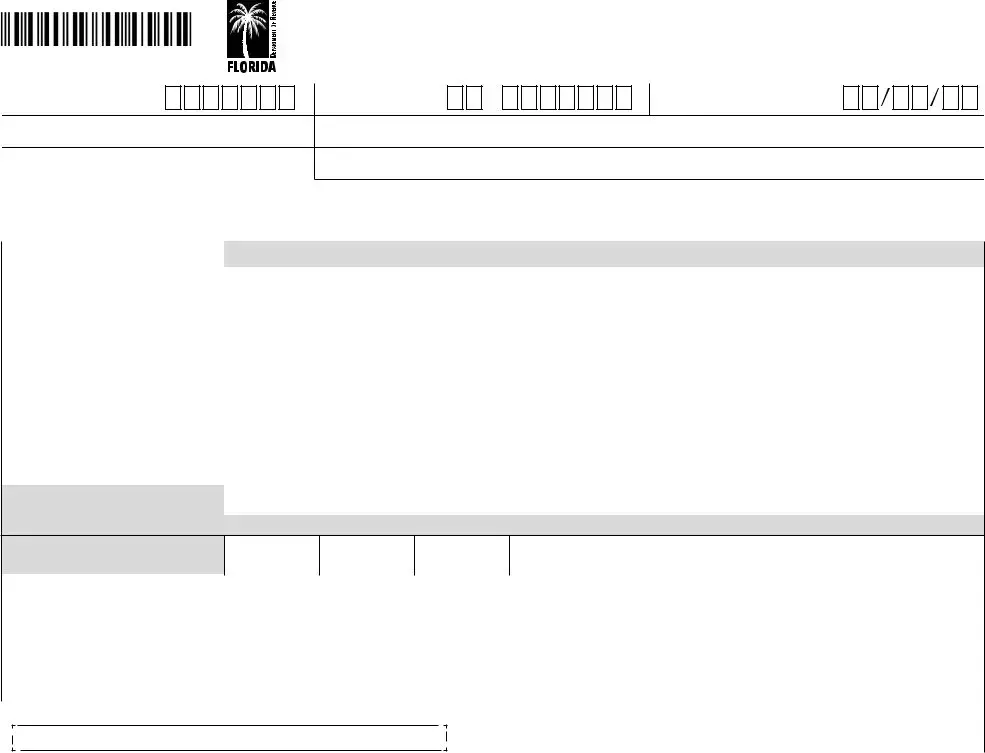

R. 06/21 |

|

|

|

|

|

|

|

|

|

|

Page 2 |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Original Wages Reported |

|

|

Corrected Wages Reported |

|

||

|

|

|

|

|

|

|

|

|

||

1. Employee’s Social Security Number |

3. Gross Wages |

4. Taxable Wages |

5. |

6. Education Wages |

7. Gross Wages |

8. Taxable Wages |

9. |

10. Education Wages |

||

2. Employee’s Name (Last, First, Middle) |

|

|

Wages |

|

|

|

Wages |

|

||

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

— |

— |

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals (this page) |

|

3. |

4. |

5. |

6. |

7. |

8. |

9. |

10. |

|

Totals from this page should be included in

Totals (all pages) on page 1.

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the administration of Florida’s taxes. SSNs obtained for tax administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized under state and federal law. Visit our Internet site at floridarevenue.com/privacy for more information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

Correction to Employer’s Quarterly or Annual Domestic Report Instructions

R.06/21 Page 3

This form

•Employer’s Quarterly Report

•Quarterly Report for

•Annual Report for Employers of Domestic Employees Only

•Employer’s Quarterly Report for Employees Contracted to Governmental or Nonprofit Educational Institutions(Form

Annual filers will need to complete one

Corrections to an Employer’s Quarterly Report may be made online by using the Department’s File and Pay webpage. If you are required to file and pay reemployment tax electronically, you are also required to correct your prior returns electronically and should not submit this form.

Please complete the information at the top of page 1 and check the box that states your reason(s) for making the correction. If more than one box applies or if your reason is not listed, please check “Other” and list the reason(s) on the blank lines.

Items 1 and 2 – Enter the social security number (SSN) and name as reported on the original report,

Correcting employee SSN or name – If you are correcting the employee SSN or name:

•include the exact information from the original report,

•indicate on the next line that this is a “SSN change” or “name change”, and

•list the corrected information on the line below.

Item 3 – Enter the employee Gross Wages as reported on the original

Item 4 – Enter the employee Taxable Wages as reported on the original

Item 5 – Enter the employee

Item 6 – Enter the employee Education Wages as entered on the original

Item 7 – Enter the employee corrected Gross Wages as it should be on the

Item 8 – Enter the employee corrected Taxable Wages as it should be on the

Item 9 – Enter the employee corrected

Item 10 – Enter the employee corrected Education Wages as it should be on the

Item 11 –

Column A - Amounts Originally Reported on

Column B - Corrected Amounts for

gross wages, excess wages, taxable wages, and tax due as it should be recorded for the reporting quarter being corrected.

Column C - Difference, is the net change to the total gross wages, excess wages, taxable wages, and tax due between the corrected amount (Column B) and what was originally reported (Column A). The column will also indicate either the amount of the credit or the amount of additional tax due.

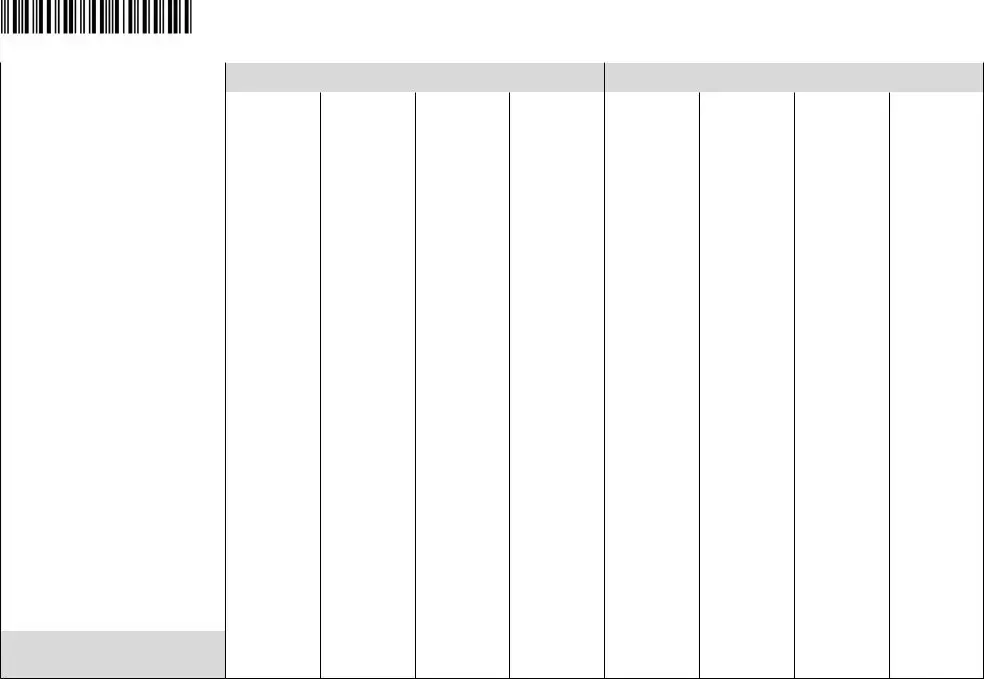

Payment Coupon Completion Instructions –

Complete the payment coupon even if you do not owe any additional tax.

Write the

Enter the federal employer identification number in the “F.E.I. Number” box. Enter the employer’s legal entity name and mailing address in the space provided.

Enter the additional tax due in the “Amount Enclosed” field. If the individual wage corrections result in a credit, any applicable refund will be sent to you.

Enter the

Month |

|

|

Year |

|

|

March 31 |

= |

03 |

2018 |

= |

18 |

June 30 |

= |

06 |

2017 |

= |

17 |

September 30 |

= |

09 |

2016 |

= |

16 |

December 31 |

= |

12 |

2015 |

= |

15 |

|

|

|

|

|

|

Make check payable to Florida U.C. Fund.

Mail the original completed form and coupon along with any remittance due to:

Florida Department of Revenue 5050 W Tennessee Street Tallahassee FL

Need Assistance? To speak with a Department of Revenue representative, call Taxpayer Services, Monday through Friday, excluding holidays, at

IMPORTANT

Complete pages 1 and 2 for corrections to the Employer’s Quarterly or Annual Domestic Report. Return completed form and coupon, even if you don’t owe any additional tax, to the Department.

|

DO NOT |

|

DETACH |

Correction to Employer’s Quarterly or Annual Domestic Report |

|

Payment Coupon |

R. 06/21 |

Florida Department of Revenue COMPLETE and MAIL with your REPORT/PAYMENT. Please write ACCOUNT NUMBER on your check.

Be sure to SIGN YOUR CHECK.

Make check payable to: Florida U.C. Fund

DOR USE ONLY

POSTMARK OR HAND DELIVERY DATE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCOUNT NO. |

|

|

|

|

|

1234567 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

F.E.I. NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1 |

2 |

|

|

3 |

|

4 |

|

5 |

|

6 |

|

7 |

|

8 |

|

9 |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

Mailing Address 1 |

|||||||||||||||||||||||||||||||

Mailing Address 2 |

||||||||||||||||||||||||||||||||

Address |

||||||||||||||||||||||||||||||||

City/St/ZIP |

Mailing Address 3 |

|||||||||||||||||||||||||||||||

|

Mailing Address 4 |

|||||||||||||||||||||||||||||||

|

Mailing Address 5 |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

91002 |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

US Dollars |

|

|

|

|

|

|

|

Cents |

|

|||||

AMOUNT ENCLOSED |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYMENT FOR QUARTER |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Q |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

ENDING MM/YY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you transmitted |

|

||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

funds electronically. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

0 99999999 0068054049 2 5009999999 0000 4

Form Data

| Fact Name | Description |

|---|---|

| Form Identifier | RT-8A |

| Revision Date | R. 06/21 |

| Governing Rule | Rule 73B-10.037, F.A.C. |

| Effective Date | 07/21 |

| Purpose | Correction to Employer’s Quarterly or Annual Domestic Report |

| Key Features | Allows for correction of reporting errors like Employee’s Social Security Number, Gross Wages, Taxable Wages, Out-of-State Taxable Wages, and Education Wages. |

Instructions on Utilizing Rt 8A

Filling out government forms can sometimes feel like navigating through a maze without a map. The Rt 8A form is specifically designed for employers needing to correct previously submitted quarterly or annual domestic reports. It's crucial for maintaining accurate employment records and ensuring compliance with state tax regulations. This step-by-step guide aims to simplify the process, ensuring you fill out the form correctly and efficiently.

- Start by entering the RT Account Number and F.E.I. Number at the top of the form.

- Identify the Correction to Reporting Period Ending by indicating the specific year and quarter you are correcting.

- Write down the Employer’s Name and complete address (Street Address, City, State, ZIP).

- Check the box that corresponds to the reason for the correction. Options include Response to RT-FL04A Letter (28), Out-of-State Wages (32), and others. If your reason doesn't match any listed categories, check Other (49) and specify your reason on the provided line.

- For each employee, fill in the original and corrected data for:

- Employee’s Social Security Number

- Employee’s Name (Last, First, Middle)

- Gross Wages, Taxable Wages, Out-of-State Taxable, and Education Wages for both the originally reported and corrected amounts.

- Under the section titled "If this information changes the figures on your original report", fill in the columns A, B, and C to show the Amounts Originally Reported, the Corrected Wages, and the Difference, respectively.

- Ensure the Totals for both the original and corrected wages are clearly indicated for each category.

- Complete the Signature section at the end of the form, including Signature, Title, Date, and Phone Number. This attests to the accuracy of the information provided under penalty of perjury.

- If you owe additional tax or are due a credit, fill out the Payment Coupon section as directed, including your account number, the amount enclosed, and the quarter ending for which the corrections are being reported.

- Last but not least, mail the completed form alongside any payment due to the address provided, ensuring all sections are thoroughly reviewed for accuracy to prevent future corrections.

By following these steps, you'll have navigated the Rt 8A form successfully. This not only helps ensure compliance with state regulations but also assists in maintaining the integrity of your employment records. Remember, accuracy and thoroughness are key when it comes to any form of regulatory compliance.

Obtain Answers on Rt 8A

What is the purpose of the RT-8A form?

The RT-8A form is designed for employers to correct errors made in previously submitted reports related to their domestic employment. These reports include the Employer’s Quarterly Report (RT-6), Quarterly Report for Out-of-State Taxable Wages (RT-6NF), Annual Report for Employers of Domestic Employees Only (RT-7), and the Employer’s Quarterly Report for Employees Contracted to Governmental or Nonprofit Educational Institutions (Form RT-6EW). Whether an employer needs to adjust wages reported, correct an employee's social security number, or modify taxable wages, the RT-8A form is the tool to ensure accurate reporting and compliance with Florida’s tax administration requirements.

Can I file the RT-8A form online?

Yes, corrections to an Employer’s Quarterly Report can be made online using the Department of Revenue’s File and Pay webpage. This online service provides a convenient way for employers to make necessary adjustments to previously submitted tax reports. However, it's important to note that if you are required to file and pay reemployment tax electronically, you are also required to correct your prior returns electronically. In such cases, submitting the RT-8A form in paper format would not be acceptable.

How do I complete the RT-8A form?

To complete the RT-8A form, carefully fill out the information at the top of page 1, including your RT account number and employer identification number. Then, check the box that correctly identifies your reason for making the correction. If your situation doesn't fit any of the prelisted reasons, select “Other” and specify your reason(s). You will need to enter the original and corrected amounts for wages reported, specifying details such as the employee’s social security number, name, gross wages, taxable wages, and any out-of-state taxable wages or education wages. Lastly, if the corrections alter the amounts reported on your original tax report, fill out the section comparing the originally reported amounts to the corrected figures, which will help determine if additional tax is due or if a credit is applicable.

What should I do if I owe additional tax after filing an RT-8A form?

If, after submitting an RT-8A form, you find that additional tax is due based on the corrections made, you must complete the accompanying payment coupon. This coupon requires your RT account number, federal employer identification number, the amount of additional tax due, and your business’s mailing address. Make sure the check is made payable to the Florida U.C. Fund and mail it along with the original completed RT-8A form to the Florida Department of Revenue's specified address. If you have calculated and determined that a credit is applicable, any owed refund will be processed and sent to you.

Common mistakes

Not checking the correct box for the reason for correction or leaving the reason for correction field blank. It is critical to specify why a correction is being made to ensure the form is processed correctly and promptly.

Failing to accurately complete the "Original Wages Reported" section. Precise figures from the original report are necessary to calculate the differences and make the appropriate corrections.

Incorrectly reporting corrected wages without verifying the amounts against payroll records. This can lead to discrepancies that may require additional corrections.

Omitting Social Security numbers or providing incorrect Social Security numbers for employees. Accurate identification is crucial for tax purposes and for employee wage records.

Miswriting employee names or not correcting them as they were initially reported. Consistency in reporting helps in maintaining accurate records.

Not listing all applicable corrections when multiple errors exist in the original report. Each error must be corrected to ensure comprehensive compliance.

Leaving the totals for both "this page" and "all pages" blank or inaccurate. These totals are essential for reconciling the corrected report with the original submission.

Forgetting to sign the form or not including the correct date. A signature and date certify that the information provided is accurate and truthful.

In addition to these completion errors, it is equally important to ensure the form is submitted to the correct address and accompanied by any necessary payment or documentation. This helps avoid delays in processing and ensures that corrections are applied in a timely manner.

Documents used along the form

When handling employment and payroll corrections, it's common to come across various forms and documents, each serving a unique purpose in ensuring compliance and accuracy in reporting. Among these, the RT-8A form is notably utilized for making adjustments to an employer's quarterly or annual domestic report. This form is essential for correcting previously submitted information related to wages, taxes, and employee details. However, it's often not the only document an employer might need to file to ensure their records with the authorities are accurate and up-to-date. Here's a look at five other forms and documents frequently used in conjunction with the RT-8A form.

- RT-6: This is the Employer’s Quarterly Report form. Employers use it to report wages paid to employees, calculate and report taxes due to the state. It's crucial for maintaining accurate employment records and compliance with tax obligations.

- RT-6NF: The Quarterly Report for Out-of-State Taxable Wages is designed for reporting wages for employees who work outside of Florida. This form allows businesses to comply with reporting requirements when they have employees working in other states.

- RT-7: This form is known as the Annual Report for Employers of Domestic Employees Only. Employers who hire domestic workers (such as in-house nannies, gardeners, and maids) use this form for annual reporting, further emphasizing its role in specialized employment situations.

- RT-6EW: The Employer’s Quarterly Report for Employees Contracted to Governmental or Nonprofit Educational Institutions is used for employers who have employees contracted to work with educational institutions. It's specific to workers providing services under educational contracts.

- Response to RT-FL04A or RT-FL13A Letter: These letters from the Department of Revenue might request additional information or clarification regarding previously filed reports. Employers must respond appropriately, often needing to file corrected forms like the RT-8A to address any issues raised.

Together, these documents form a comprehensive toolkit for employers to manage and correct their payroll and tax reporting. Accuracy in filling out and submitting these forms cannot be overstated, as it ensures compliance with state regulations, avoids potential penalties, and maintains a clear record of employee compensation and taxation. Employers navigating these requirements may seek guidance from various resources, including online portals, professional advisors, and official channels, to ensure that their submissions accurately reflect their payroll practices and adhere to legal standards.

Similar forms

The Employer's Quarterly Report (RT-6) is similar to the RT-8A form in that it requires employers to report wages paid, taxable wages, and taxes due for their employees on a quarterly basis. Both forms are integral to maintaining accurate employment tax records and ensuring compliance with Florida's reemployment tax laws.

Quarterly Report for Out-of-State Taxable Wages (RT-6NF) shares similarities with the RT-8A in that it is specifically designed for reporting wages paid to employees who work out of state. Like the RT-8A, it ensures that employers correctly report and adjust any discrepancies in wages that could affect tax liabilities.

The Annual Report for Employers of Domestic Employees Only (RT-7) is akin to the RT-8A in terms of its target audience—employers of domestic workers. Both reports require detailed wage reporting and allow for corrections to previously filed wage data, ensuring accurate annual reconciliation of employment taxes.

Employer’s Quarterly Report for Employees Contracted to Governmental or Nonprofit Educational Institutions (RT-6EW) is similar to the RT-8A as it caters to a specific employer group. Both forms necessitate detailed reporting and correction of wages and taxes, tailored to the unique employment scenarios in educational institutions.

The W-2 Form, issued annually, shares a conceptual purpose with the RT-8A form. While the W-2 summarizes an employee's annual wages and taxes withheld, the RT-8A allows employers to correct inaccuracies in quarterly or annual reports, ensuring the information matches that of related W-2s.

940 Form (Employer’s Annual Federal Unemployment (FUTA) Tax Return) is akin to the RT-8A as both involve annual reporting responsibilities of employers regarding employment taxes. While the RT-8A is state-specific, the 940 caters to federal unemployment contributions, yet both allow for corrections ensuring accurate tax reporting.

The 941 Form (Employer’s Quarterly Federal Tax Return) parallels the RT-8A in frequency and purpose, focusing on the federal level. This form requires detailed reporting of wages, tips, and other compensation, similar to the RT-8A’s function of ensuring accurate wage reporting and tax calculation on a quarterly basis.

Dos and Don'ts

When dealing with the RT-8A form, which is essential for correcting employer's quarterly or annual domestic reports, accuracy and compliance with guidelines are critical. Here are some dos and don'ts to keep in mind:

Dos:- Review all previously submitted information. Before making corrections, thoroughly check the details you provided on the original RT-6, RT-7, or previous RT-8A reports. This ensures that the changes you are about to make are accurate and necessary.

- Be clear and precise about the changes. Whether it’s a social security number, gross wages, or any other detail that needs correction, ensure that the information is correct and clearly presented. Clarity prevents further errors and potential issues.

- Check the appropriate box for your correction reason. Clearly indicate why you are submitting the RT-8A form. If your specific reason isn’t listed, use the “Other” box and provide a detailed explanation.

- Sign and date the form. An unsigned form could be considered incomplete. Your signature and the date confirm that you have reviewed the corrections and attest to their accuracy.

- Don’t rush through the form. Take your time to fill out each section accurately. Mistakes can lead to delays or the need to resubmit the form, compounding any issues.

- Don’t overlook the instructions. The RT-8A form comes with specific instructions for completion. Ignoring these can lead to errors in your submission.

- Don’t use correction fluid or tape. If you make a mistake, it’s better to start fresh with a new form. Corrections made with fluid or tape can cause processing delays.

- Don’t forget to include all necessary documentation. Any changes to wages, for example, may require additional documentation. Omitting this can result in further inquiries and slow down the correction process.

Adhering to these guidelines will help ensure that your RT-8A form is filled out correctly and processed efficiently, leading to a smoother correction of your employer's quarterly or annual domestic report.

Misconceptions

Employers often face confusion when dealing with the RT-8A form, a document used for correcting previously submitted quarterly or annual domestic reports in Florida. Below are six common misconceptions about the RT-8A form, which, when clarified, can assist employers in properly fulfilling their reporting obligations.

The RT-8A form can only correct recent reports: One common misconception is that corrections using the RT-8A form are limited to recent reporting periods. In reality, this form can be used to amend reports from prior quarters or years as long as the employer identifies the specific periods needing correction.

Electronic filing isn't an option for RT-8A submissions: Many employers mistakenly believe that the RT-8A form must be submitted in paper form. However, corrections to an Employer’s Quarterly Report can be made online through the Department of Revenue’s File and Pay webpage, offering convenience and efficiency in the correction process.

All sections of the RT-8A must be completed for any correction: It's a common mistake to think that every section of the RT-8A needs to be filled out when making corrections. In fact, employers only need to complete the sections relevant to the specific errors they are correcting, whether they relate to wages, social security numbers, or other details.

The RT-8A form is for state tax adjustments only: Another misconception is that the RT-8A is exclusively used for adjusting state taxes. While it's true that the form does adjust figures that could affect state tax liabilities, its primary objective is to correct reported wages and other information critical for the accurate calculation of unemployment compensation contributions.

Corrections made with the RT-8A form will not affect previous tax liabilities: Employers sometimes incorrectly assume that corrections made on the RT-8A have no impact on previously calculated taxes. In contrast, depending on the nature of the correction, changes submitted via the RT-8A can result in additional taxes due or credits owed to the employer.

Submitting an RT-8A form for correction is optional: Finally, there's a belief that submitting corrections through the RT-8A form is at the employer's discretion. In reality, ensuring accurate reporting is a legal requirement, and employers must correct any inaccuracies found in previously submitted reports to remain compliant with Florida’s employment laws.

In summary, understanding the purpose, usage, and requirements of the RT-8A form is essential for employers to accurately report employee wages and contributions. Dispelling these misconceptions ensures compliance with Florida's reporting standards and avoids potentially costly errors.

Key takeaways

When filling out the RT-8A form, employers are correcting previously submitted information for quarterly or annual domestic reports. Here are key takeaways to guide you through the process:

- Specific Reasons for Corrections: The form lists specific reasons for making corrections, such as SSN correction, adding or decreasing wages, out-of-state wages, and more. If your reason doesn't fit any category, use the "Other" option.

- Important Identifiers: Start by providing your RT Account Number and Federal Employer Identification Number (F.E.I. Number) at the top of the form.

- Detailed Employee Information: The form requires detailed information for each employee, including Social Security Number, name, and corrections to wages.

- Correcting Multiple Quarters: Annual filers must complete a separate RT-8A form for each quarter needing corrections.

- Original vs. Corrected Amounts: You must report both the original wages and the corrected wages for a comprehensive overview of the adjustments made.

- Calculating Taxes: After corrections, calculate the difference in taxes owed or the amount to be credited.

- Electronic Filing Preference: If you are required to file and pay reemployment tax electronically, then corrections to prior returns should also be made online, avoiding the use of this form.

- Payment Coupon: Even if no additional tax is due, complete the payment coupon. If you owe additional taxes, make your check payable to the Florida U.C. Fund.

- Confidentiality of Social Security Numbers: SSNs are treated as confidential information and are protected under Florida laws.

To ensure compliance and accuracy in your tax reporting, follow the instructions carefully and consult the provided guidelines or reach out to the Florida Department of Revenue for any assistance needed.

Popular PDF Forms

I 751 - The form has designated sections for information about the U.S. citizen or permanent resident spouse or stepparent.

1099r Tax Form - Required for reporting any money withdrawn from a retirement account during the tax year.