Blank Rv F1315201 PDF Template

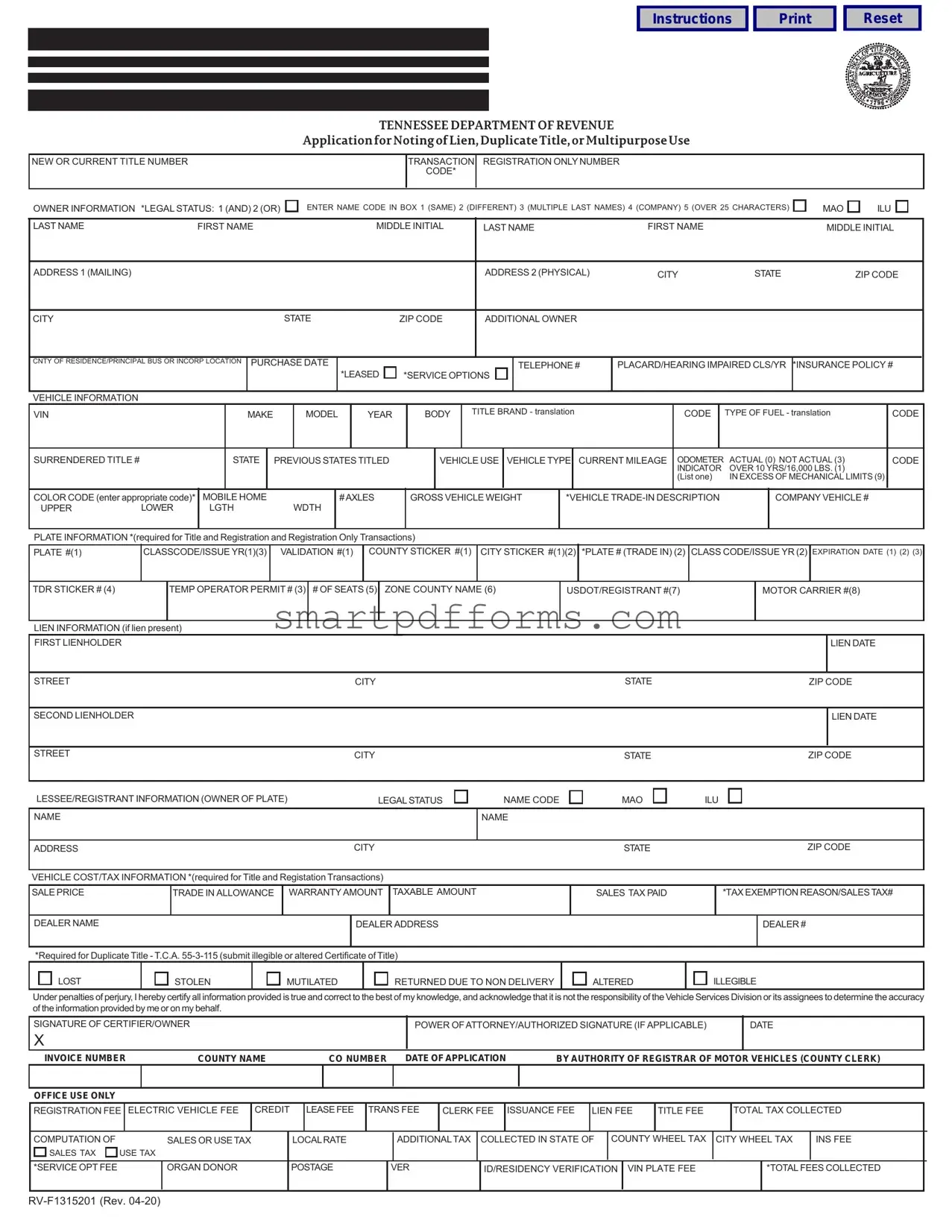

In the realm of vehicle administration, the RV F1315201 form plays a pivotal role within the Tennessee Department of Revenue’s suite of applications, facilitating several key transactions such as noting of a lien on a vehicle, requesting a duplicate title, or engaging in multipurpose use scenarios. This comprehensive document is meticulously designed to capture an array of information spanning from owner specifics—inclusive of legal status and address—to intricate details about the vehicle itself, like its identification number, make, model, and year, alongside lien particulars if applicable. Serving both individuals and companies alike, its structure accommodates a wide variety of vehicle types and situations by incorporating fields for mobile homes, trade-ins, and more, ensuring a versatile application process. Required sections on the form seek to outline sale price, trade-in allowances, and pertinent tax information, streamlining the process for calculating dues accurately. Moreover, the importance of completing the form with precision is underscored by a declaration that all information provided is true, under penalties of perjury. The form further elaborates on the procedural specifics for noting of a lien and acquiring a duplicate title, including necessary fees and instructions for submission, highlighting the need for supporting documents and the circumstances under which the application may be returned if improperly filled. Such detailed provision positions the RV F1315201 as a crucial instrument for managing vehicular documentation within Tennessee, underscoring the necessity of thoroughness and accuracy in its completion.

Preview - Rv F1315201 Form

Instructions

Reset |

TENNESSEE DEPARTMENT OF REVENUE

ApplicationforNotingofLien,DuplicateTitle,orMultipurposeUse

NEW OR CURRENT TITLE NUMBER

TRANSACTION REGISTRATION ONLY NUMBER CODE*

OWNER INFORMATION *LEGAL STATUS: 1 (AND) 2 (OR) |

ENTER NAME CODE IN BOX 1 (SAME) 2 (DIFFERENT) 3 (MULTIPLE LAST NAMES) 4 (COMPANY) 5 (OVER 25 CHARACTERS) |

|

MAO |

ILU |

||||||||||||||||||||||||||||||||||||||||

LAST NAME |

|

|

|

FIRST NAME |

|

|

|

|

|

|

|

MIDDLE INITIAL |

|

LAST NAME |

|

|

|

|

FIRST NAME |

|

|

|

|

|

|

MIDDLE INITIAL |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS 1 (MAILING) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS 2 (PHYSICAL) |

|

CITY |

|

STATE |

|

|

|

ZIP CODE |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

|

ZIP CODE |

|

ADDITIONAL OWNER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

CNTY OF RESIDENCE/PRINCIPAL BUS OR INCORP LOCATION |

PURCHASE DATE |

*LEASED |

*SERVICE OPTIONS |

TELEPHONE # |

|

PLACARD/HEARING IMPAIRED CLS/YR |

*INSURANCE POLICY # |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VEHICLE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VIN |

|

|

|

|

|

MAKE |

|

|

|

MODEL |

|

|

YEAR |

|

BODY |

|

TITLE BRAND - translation |

|

|

CODE |

|

TYPE OF FUEL - translation |

|

CODE |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

SURRENDERED TITLE # |

|

|

|

|

STATE |

|

PREVIOUS STATES TITLED |

|

|

VEHICLE USE |

VEHICLE TYPE |

|

CURRENT MILEAGE |

ODOMETER ACTUAL (0) NOT ACTUAL (3) |

|

CODE |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INDICATOR |

OVER 10 YRS/16,000 LBS. (1) |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(List one) |

IN EXCESS OF MECHANICAL LIMITS (9) |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

COLOR CODE (enter appropriate code)* |

MOBILE HOME |

|

|

WDTH |

# AXLES |

|

GROSS VEHICLE WEIGHT |

*VEHICLE |

|

|

COMPANY VEHICLE # |

|||||||||||||||||||||||||||||||||

UPPER |

LOWER |

LGTH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

PLATE INFORMATION *(required for Title and Registration and Registration Only Transactions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

PLATE #(1) |

CLASSCODE/ISSUE YR(1)(3) |

|

VALIDATION #(1) |

|

COUNTY STICKER #(1) |

|

CITY STICKER #(1)(2) |

*PLATE # (TRADE IN) (2) |

CLASS CODE/ISSUE YR (2) |

EXPIRATION DATE (1) (2) (3) |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

TDR STICKER # (4) |

|

TEMP OPERATOR PERMIT # (3) |

# OF SEATS (5) |

ZONE COUNTY NAME (6) |

USDOT/REGISTRANT #(7) |

|

MOTOR CARRIER #(8) |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN INFORMATION (if lien present) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

FIRST LIENHOLDER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN DATE |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

STREET |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

|

|

|

|

|

ZIP CODE |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

SECOND LIENHOLDER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN DATE |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

STREET |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

|

|

|

|

|

ZIP CODE |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

LESSEE/REGISTRANT INFORMATION (OWNER OF PLATE) |

|

|

|

|

LEGAL STATUS |

|

|

NAME CODE |

|

|

|

|

MAO |

|

ILU |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

|

|

|

|

|

ZIP CODE |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

VEHICLE COST/TAX INFORMATION *(required for Title and Registation Transactions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

SALE PRICE |

|

|

TRADE IN ALLOWANCE |

|

WARRANTY AMOUNT |

|

TAXABLE AMOUNT |

|

|

|

SALES TAX PAID |

|

|

|

|

*TAX EXEMPTION REASON/SALES TAX# |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

DEALER NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEALER ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEALER # |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

*Required for Duplicate Title - T.C.A. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

LOST |

|

|

STOLEN |

|

|

MUTILATED |

|

|

|

|

RETURNED DUE TO NON DELIVERY |

|

|

|

ALTERED |

|

ILLEGIBLE |

|

|

|

|

|

||||||||||||||||||||||

Under penalties of perjury, I hereby certify all information provided is true and correct to the best of my knowledge, and acknowledge that it is not the responsibility of the Vehicle Services Division or its assignees to determine the accuracy of the information provided by me or on my behalf.

SIGNATURE OF CERTIFIER/OWNER |

|

|

|

|

|

|

POWER OF ATTORNEY/AUTHORIZED SIGNATURE (IF APPLICABLE) |

|

|

DATE |

|

|

|||||||||||||||

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INVOICE NUMBER |

|

|

COUNTY NAME |

|

|

CO NUMBER DATE OF APPLICATION |

|

BY AUTHORITY OF REGISTRAR OF MOTOR VEHICLES (COUNTY CLERK) |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OFFICE USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REGISTRATION FEE |

|

ELECTRIC VEHICLE FEE |

CREDIT |

|

LEASE FEE |

TRANS FEE |

CLERK FEE |

ISSUANCE FEE |

LIEN FEE |

TITLE FEE |

|

TOTAL TAX COLLECTED |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

COMPUTATION OF |

|

|

|

|

SALES OR USE TAX |

LOCALRATE |

|

|

ADDITIONAL TAX |

COLLECTED IN STATE OF |

COUNTY WHEEL TAX |

CITY WHEEL TAX |

INS FEE |

|

|||||||||||||

SALES TAX |

USE TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

*SERVICE OPT FEE |

|

|

|

|

ORGAN DONOR |

POSTAGE |

|

|

VER |

|

ID/RESIDENCY VERIFICATION |

VIN PLATE FEE |

|

|

|

*TOTAL FEES COLLECTED |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INSTRUCTIONS FOR NOTING OF LIEN

Please read instructions carefully before completing this application. Failure to provide all information may result in your application being returned.

Complete the above application. Supporting documents must include a copy of the lien instrument, owner's Tennessee Certificate of Title* (if no existing lien) and corresponding payment. Please remit to your local county clerk's office. For a listing of county clerk contact information and locations, please visit http://www.tn.gov/revenue/

Fee Information: Fee for Noting of Lien is $11.00 per new lien plus $11.00 title fee (please contact county for additional county fees).

Note: The requirements for noting a second lien are the same as above except the Certificate of Title is not necessary. Name and address of Lienholder must be shown in the space indicated "Second Lienholder."

A Conditional Sales Contract is not acceptable as a Lien Instrument unless previously recorded and merely being assigned.

INSTRUCTIONS FOR FOR DUPLICATE TITLE

Please read instructions carefully before completing this application. Failure to provide all information may result in your application being returned.

Fee Information: The cost for a Duplicate Title is $11.00 (Additional county fees may apply).

If a lien exists in the records of the Vehicle Services Division, a duplicate title can only be issued to the lienholder. When a lien has been discharged, the owner may apply for a duplicate title, which will be mailed to the owner’s address as shown on the application. If the owner has proof of the discharge, it should accompany the owner’s request for a duplicate title.

This completed application should be signed and submitted to the County Clerk with supporting documentation, when applicable. Please indicate the reason a duplicate is being requested in the "Required for Duplicate Title" section of this application.

Form Data

| Fact | Description |

|---|---|

| Form Identification | The form is identified as RV-F1315201. |

| Purpose | This form is used for noting of lien, requesting a duplicate title, or for multipurpose use in Tennessee. |

| Governing Body | Tennessee Department of Revenue is responsible for this form. |

| Key Components | The form includes sections for owner information, vehicle information, lien information, legal status, and vehicle cost/tax information. |

| Legal Basis for Duplicate Title | The legal basis for requesting a duplicate title is outlined under T.C.A. 55-3-115. |

| Fee for Noting of Lien | The fee for noting of lien is $11.00 per new lien, plus an $11.00 title fee. |

| Fee for Duplicate Title | The cost for a duplicate title is $11.00, with additional county fees potentially applicable. |

| Submission Instructions | Completed applications, along with required documents and payment, should be submitted to the local county clerk's office. |

| Requirement for Lienholder on Duplicate Title | If a lien exists in the records, a duplicate title can only be issued to the lienholder. Upon discharge of the lien, the owner can request a duplicate title. |

Instructions on Utilizing Rv F1315201

Filling out the RV F1315201 form is a necessary step for individuals who need to note a lien, request a duplicate title, or for multipurpose use related to vehicle documentation in Tennessee. It is crucial to provide accurate and complete information to ensure successful processing. The form requires detailed owner information, vehicle details, and, if applicable, lien information. To help you navigate the process, here is a step-by-step guide for completing the form.

- Start by entering the new or current title number and transaction registration only number in the designated areas at the top of the form.

- Under Owner Information, choose the legal status by entering the appropriate code in the box provided.

- Fill in the last name, first name, and middle initial of the owner(s) as directed. If there are additional owners, ensure their details are fully entered.

- Provide both the mailing and physical addresses, including city, state, and zip code. For additional owner information, specify county of residence or principal business location, and purchase date.

- If the vehicle is leased, mark the leased box and fill in the required service options and telephone number.

- In the Vehicle Information section, provide all requested details such as VIN, make, model, year, and so on. Pay close attention to specifics, including title brand code, type of fuel, color code, and previous states titled.

- For plate information, complete all required fields depending on your transaction type (Title and Registration or Registration Only), including plate number, class code, sticker numbers, and expiration dates as relevant.

- If a lien is present, enter first and second lienholder information including name, lien date, and address details.

- Complete the Lessee/Registrant Information section with the owner of the plate's details.

- For Title and Registration transactions, fill in the Vehicle Cost/Tax Information section with the sale price, trade-in allowance, warranty amount, taxable amount, and sales tax paid. Indicate tax exemption reason or sales tax number if applicable.

- If applying for a Duplicate Title, indicate the reason in the provided section by selecting from lost, stolen, mutilated, etc., and ensure supporting documentation is attached.

- Sign and date the application at the bottom under Signature of Certifier/Owner. If applicable, an authorized signature for Power of Attorney must be provided.

- Finally, verify the invoice number, county name, CO number, and date of application which will be used for office use only.

After completing the form, gather any supporting documents necessary for your specific transaction. This might include a copy of the lien instrument, Tennessee Certificate of Title, or proof of lien discharge. Submit the completed form and documents to your local county clerk's office. For further assistance, county clerk contact information and locations can be found online. Remember, precise and accurate completion of the RV F1315201 form facilitates a smoother transaction process.

Obtain Answers on Rv F1315201

What is the RV F1315201 form used for?

This form is utilized by the Tennessee Department of Revenue for several purposes, including noting a lien on a vehicle's title, requesting a duplicate title if the original is lost, stolen, mutilated, returned due to non-delivery, or altered, and for multipurpose use such as updates to owner information or vehicle details.

How can I submit the RV F1315201 form?

The completed form along with any required supporting documents must be submitted to your local county clerk's office. For a complete list of county clerk offices and contact information, please visit the Tennessee Department of Revenue's official website.

What fees are associated with the RV F1315201 form?

For noting of a lien, there is an $11.00 fee for each new lien plus an $11.00 title fee. Additional county fees may also apply. The fee for requesting a duplicate title is $11.00, excluding any additional county fees. Please contact your local county clerk for the exact fee details.

What supporting documents are needed for noting a lien?

You must include a copy of the lien instrument and the owner's Tennessee Certificate of Title if no existing lien is noted. If a second lien is being noted, the certificate of title is not required, but you must provide the name and address of the second lienholder.

What should I do if I need a duplicate title?

To request a duplicate title, complete the form and indicate the reason for the duplicate in the specified section. Submit this application and any proof of lien discharge (if applicable) to the county clerk. If a lien is present on record, the duplicate title will only be issued to the lienholder.

How do I know if I filled out the form correctly?

Ensure all sections of the form are filled out accurately, including owner information, vehicle details, and lien information if applicable. Incorrect or missing information may result in your application being returned.

Can I use this form for making changes to owner or vehicle information?

Yes, the RV F1315201 form can be used for multipurpose transactions, which include updates to owner or vehicle information.

What happens if I do not provide all the required information?

Failure to provide all necessary information or documentation may lead to your application being returned or delayed.

Is a Conditional Sales Contract acceptable as a Lien Instrument?

No, a Conditional Sales Contract is not acceptable unless it has been previously recorded and is merely being assigned.

What if the original title was altered or illegible?

If the original title was altered, illegible, lost, stolen, mutilated, or returned due to non-delivery, you must request a duplicate title and provide the reason for this request on the form. Remember to submit any supporting documentation to validate the reason.

Common mistakes

When filling out the Rv F1315201 form, it’s important for applicants to pay close attention to detail to ensure the information provided is accurate and complete. However, there are common mistakes that can occur during this process:

- Not reading the instructions carefully before starting the application, leading to missed or incorrectly provided information.

- Failing to complete all required sections of the form, which can result in the application being returned or delayed.

- Incorrectly entering the VIN (Vehicle Identification Number), which is crucial for the vehicle’s identification.

- Choosing the wrong legal status code or entering it incorrectly in the designated box, leading to confusion about the owner’s information.

- Leaving the lienholder information blank or incomplete when a lien is present on the vehicle.

- Not specifying the correct title brand translation code, which could affect the vehicle’s status and future sales.

- Misidentifying the type of fuel, which is needed for both registration and environmental purposes.

- Overlooking the odometer code indicator, leading to potential issues with vehicle mileage accuracy.

- Forgetting to include the sale price and related tax information, required for title and registration transactions.

- Not signing the form or omitting the date, which are necessary steps for validating the submission.

Additionally, here’s a list of supporting documents often missed or incorrectly submitted:

- A copy of the lien instrument when noting a new lien on the vehicle.

- The owner’s Tennessee Certificate of Title if there’s no existing lien, for relevant transactions.

- Proof of lien discharge, required when applying for a duplicate title without a lien.

- Correct payment for fees associated with the transaction, including noting of lien, duplicate title, and any county fees.

To ensure a smooth process, it's advised that applicants double-check their form against these common mistakes and required documents. Accurate completion and submission of this form are key to avoiding delays and ensuring your application is processed in a timely manner.

Documents used along the form

When dealing with the intricacies of vehicle registration, titling, and liens, it's common to encounter a variety of documents that serve different purposes within this landscape. The RV-F1315201 form, specifically utilized within the Tennessee Department of Revenue for noting of liens, duplicate titles, or a multipurpose use, is often accompanied by several other forms and documents to ensure full compliance and accuracy in vehicle administration. Exploring these complementary documents provides insight into the broader context of vehicle management processes.

- Bill of Sale: This document serves as a record of the transaction between the seller and the buyer, detailing the vehicle's purchase price, date of sale, and identifying information about the vehicle.

- Odometer Disclosure Statement: A required form that documents the vehicle's mileage at the time of sale. It is crucial for preventing odometer fraud and ensuring the buyer is aware of the vehicle's condition.

- Vehicle Title: The official document indicating the ownership of the vehicle. This document is necessary for the transfer of ownership and updating records with the Department of Revenue.

- Lien Release: If there was a previously noted lien on the vehicle, a lien release document is required to prove that the lien has been satisfied and the vehicle is free of financial encumbrances.

- Power of Attorney: In cases where the vehicle owner cannot handle the documentation personally, a power of attorney allows a designated individual to act on their behalf.

- Proof of Residence: To register a vehicle or apply for a duplicate title, proof of residence in the corresponding state or county may be required.

- Proof of Insurance: Documents indicating that the vehicle is insured are often required for registration purposes, confirming compliance with state laws.

- Inspection Documents: Some jurisdictions require a vehicle inspection for safety and/or emissions before registration or title transactions can be completed.

- Application for Title and Registration: In instances where a new title is being sought alongside registration, this comprehensive form combines both processes, streamlining paperwork for the applicant.

This overview of forms and documents, commonly paired with the RV-F1315201 form, underscores the complexity and multifaceted nature of vehicle-related administrative processes. Ensuring all requisite paperwork is accurately completed and submitted is essential for legal compliance and the smooth facilitation of transactions related to vehicles. Utilizing these documents effectively supports not only the legal aspects of vehicle ownership and usage but also contributes to the maintenance of accurate and up-to-date records within the Department of Revenue's vehicle services division.

Similar forms

The Application for Title or Registration form is similar to the RV F1315201 form because both are used to document the ownership of a vehicle and record any liens against the vehicle. These forms collect detailed information about the vehicle, including make, model, year, and VIN, and require the owner's contact information. They also have sections dedicated to lienholder information if the vehicle is financed.

The Notice of Transfer and Release of Liability form shares similarities with the RV F1315201 form in that it is also involved in the process of documenting changes in vehicle ownership. While the RV F1315201 form is used to apply for noting of lien, duplicate title, or for multipurpose use such as registration, the Notice of Transfer and Release of Liability form is specifically aimed at ensuring the previous owner is no longer liable for anything that happens with the vehicle after the sale. Both forms facilitate a change in records held by the Department of Motor Vehicles.

The Application for Duplicate Title form is closely related to the RV F1315201 form in its specific use for requesting a duplicate title. The RV F1315201 includes an option for applying for a duplicate title if the original is lost, stolen, mutilated, or not delivered. Both forms require the vehicle identification number (VIN), make, model, year, and owner information, ensuring the entity processing the form can accurately identify the vehicle in question and its rightful owner.

The Vehicle Registration Application form shares characteristics with the RV F1315201 form by addressing the needs for vehicle registration. However, the RV F1315201 form encompasses a broader range of transactions including lien noting and duplicate title application in addition to registration. Both forms collect information on the vehicle and owner to establish legal ownership and the right to operate the vehicle within the state, recording key data such as the VIN, make, model, and year, alongside the owner's personal details.

Dos and Don'ts

When filling out the RV F1315201 form, there are certain practices you should follow to ensure the process goes smoothly and your application is processed without unnecessary delay. It's equally important to be aware of common mistakes to avoid, ensuring your submission is accurate and compliant with the requirements set by the Tennessee Department of Revenue. Here is a list of dos and don'ts to guide you through completing this form:

Do:

- Read the instructions carefully before starting your application. This ensures you understand all requirements and prepare the necessary supporting documents.

- Provide all the required information in the respective fields. Incomplete applications can result in delays or the return of your application.

- Include accurate vehicle and owner information. This includes the Vehicle Identification Number (VIN), make, model, and year of the vehicle, as well as the correct name and address details for the owner(s).

- Sign and date the application. Unsigned applications are considered incomplete and will not be processed until correctly signed.

Don't:

- Leave required fields blank. If a section of the form does not apply to your situation, mark it as "N/A" instead of leaving it empty to indicate that you did not overlook it.

- Use inaccurate or outdated information. For instance, ensure the vehicle's mileage is correctly stated and your contact information is current.

- Forget to include the fee payment. Check the latest fee requirements on the Tennessee Department of Revenue website or contact your local county clerk's office to confirm the exact amount.

- Submit without reviewing. Double-check your application for any errors or omissions before submission to avoid any potential processing issues.

Misconceptions

There are several misconceptions surrounding the Tennessee Department of Revenue's RV-F1315201 form, which is used for noting liens, applying for duplicate titles, or for multipurpose use related to vehicle titles and registrations. Understanding these misconceptions can help streamline the process and set correct expectations for individuals navigating through these transactions.

Misconception 1: The RV-F1315201 form is only for vehicles that are financed. In reality, this form is versatile and used for various purposes, including noting a lien, requesting a duplicate title if the original is lost or damaged, and other multipurpose vehicle-related transactions, not just those involving financed vehicles.

Misconception 2: You can only submit the form in person. While many people believe this form must be submitted in person at a county clerk’s office, it can also be submitted by mail to your local county clerk’s office, offering convenience for those unable to visit in person.

Misconception 3: Completing the form guarantees immediate issuance of a title or note of lien. Completing the RV-F1315201 form is a critical step, but accuracy and completeness, along with providing all necessary supporting documents and payment of fees, impact the processing time. Incorrect information or missing documentation can lead to delays.

Misconception 4: A second lien requires a new certificate of title. When noting a second lien, the original certificate of title is not necessary as long as the name and address of the second lienholder are clearly indicated in the designated space on the form.

Misconception 5: There is no fee for noting a lien or requesting a duplicate title. There are specific fees associated with noting a lien and requesting a duplicate title, including potential additional county fees. Understanding the fee structure is essential to avoid surprises.

Misconception 6: Any type of lien document is acceptable. The form stipulates that a Conditional Sales Contract is not acceptable as a lien instrument unless it has been previously recorded and is simply being reassigned. This distinction is crucial for ensuring the proper documentation is submitted.

Misconception 7: A duplicate title issued while a lien is present can be sent directly to the vehicle owner. In cases where a lien is recorded, a duplicate title can only be issued to the lienholder until the lien has been discharged. Once proof of the discharge is provided, the duplicate title can then be mailed to the owner’s address as noted on the application form.

Dispelling these misconceptions ensures individuals are better prepared when dealing with vehicle title and registration processes using the RV-F1315201 form, leading to a smoother and more efficient experience.

Key takeaways

Understanding the RV F1315201 form is essential for anyone looking to navigate various transactions regarding vehicle titles and liens in Tennessee. This document serves multiple purposes, including the application for noting a lien, requesting a duplicate title, or even for combined services involving vehicle registration. Here are four key takeaways to keep in mind when filling out and using this form:

- Complete Information is Crucial: The form requires detailed owner information, vehicle details, lien information if applicable, and specific transaction types (e.g., noting of lien or request for a duplicate title). It's essential to fill in every required field accurately to avoid any delays or issues with your application.

- Supporting Documents: Depending on the transaction you're completing, varying supporting documents are necessary. For noting a lien, you'll need a copy of the lien instrument and the owner's Tennessee Certificate of Title if no existing lien is noted. For a duplicate title request, evidence such as proof of lien discharge may be required. Ensuring you have all the correct paperwork ready when submitting your application will streamline the process.

- Fees: The form outlines specific fees for different transactions – noting a lien carries a fee of $11.00 plus an $11.00 title fee, with potential additional county fees. The cost for obtaining a duplicate title is also $11.00, with the possibility of extra county fees. Checking the current fee structure with your local county clerk's office is advisable, as these fees are subject to change.

- Submission and Processing: Once completed, the form, along with any supporting documents and applicable fees, should be submitted to your local county clerk's office. The Tennessee Department of Revenue's website provides contact information and locations for county clerks, helping you find the correct office for submission. Timely submission ensures your transactions are processed without unnecessary delays.

By keeping these key points in mind, individuals can navigate the processes related to vehicle titles, liens, and registrations in Tennessee more efficiently. Remember, accuracy and completeness in your application, along with adhering to the proper submission procedures, are vital to a successful transaction.

Popular PDF Forms

Free Diabetic Log Book by Mail - Its compact format makes the logbook an ideal companion for on-the-go monitoring, enabling consistent diabetes management regardless of daily routines.

Bravecto Rebate 2023 - Intended to provide a rebate to those who have purchased Bravecto, making pet maintenance more budget-friendly.