Blank Salvation Army Tax Receipt PDF Template

When you decide to donate to The Salvation Army, you're not just giving to an organization; you're offering a lifeline to those in need while benefiting from a tax deduction for your kindness. The process of making a financial contribution is streamlined with the Salvation Army Tax Receipt Form, an essential tool for ensuring your generosity is officially acknowledged come tax time. Whether you're making a one-time gift, setting up monthly donations, or giving in memory or honor of someone special, this form accommodates your intentions neatly. It gathers all necessary donor information, including name, contact details, and preferred donation method, ranging from traditional cheques to various credit cards. Furthermore, the form emphasizes the importance of consent, allowing The Salvation Army to contact donors via email, and specifies that tax receipts are issued for contributions of $10.00 or more, or upon request. Should the donation serve to commemorate someone, the form even facilitates the sending of acknowledgment cards, ensuring the gesture's significance is fully recognized. Underneath the meticulous attention to donation logistics, the form underscores The Salvation Army's commitment to donor privacy and its policy against selling or sharing personal information. This comprehensive approach not only facilitates a smoother donation process but also nurtures trust and transparency between the donor and The Salvation Army.

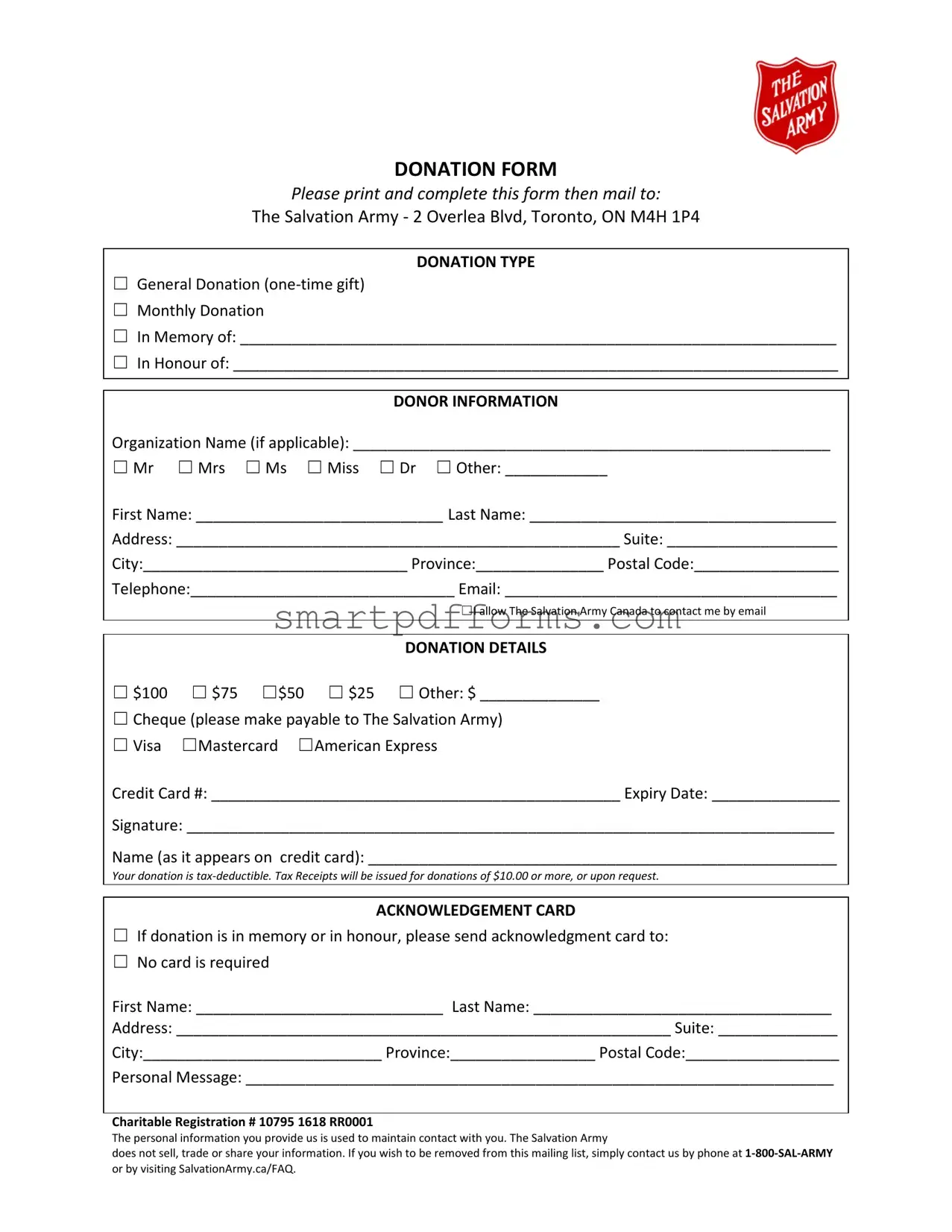

Preview - Salvation Army Tax Receipt Form

DONATION FORM

Please print and complete this form then mail to:

The Salvation Army - 2 Overlea Blvd, Toronto, ON M4H 1P4

DONATION TYPE

☐General Donation

☐Monthly Donation

☐In Memory of: ______________________________________________________________________

☐In Honour of: _______________________________________________________________________

DONOR INFORMATION

Organization Name (if applicable): ________________________________________________________

☐ Mr ☐ Mrs ☐ Ms ☐ Miss ☐ Dr ☐ Other: ____________

First Name: _____________________________ Last Name: ____________________________________

Address: ____________________________________________________ Suite: ____________________

City:_______________________________ Province:_______________ Postal Code:_________________

Telephone:_______________________________ Email: _______________________________________

☐I allow The Salvation Army Canada to contact me by email

DONATION DETAILS

☐ $100 ☐ $75 ☐$50 ☐ $25 ☐ Other: $ ______________

☐Cheque (please make payable to The Salvation Army)

☐Visa ☐Mastercard ☐American Express

Credit Card #: ________________________________________________ Expiry Date: _______________

Signature: ____________________________________________________________________________

Name (as it appears on credit card): _______________________________________________________

Your donation is

ACKNOWLEDGEMENT CARD

☐If donation is in memory or in honour, please send acknowledgment card to:

☐No card is required

First Name: _____________________________ Last Name: ___________________________________

Address: __________________________________________________________ Suite: ______________

City:____________________________ Province:_________________ Postal Code:__________________

Personal Message: _____________________________________________________________________

Charitable Registration # 10795 1618 RR0001

The personal information you provide us is used to maintain contact with you. The Salvation Army

does not sell, trade or share your information. If you wish to be removed from this mailing list, simply contact us by phone at

Form Data

| Fact Name | Detail |

|---|---|

| Form Purpose | The form is used to make donations to The Salvation Army, either as a general one-time gift, a monthly donation, or as a tribute in memory or honour of someone. |

| Mailing Address | Donations by mail are directed to The Salvation Army - 2 Overlea Blvd, Toronto, ON M4H 1P4. |

| Donor Information | Donors need to provide personal information, including name, address, contact number, and email, with an option for organizational donations. |

| Email Communication Consent | Donors can opt to allow The Salvation Army Canada to contact them via email. |

| Donation Details | The form allows for donations of preset amounts or a custom amount, with payment options including cheque and major credit cards. |

| Tax Receipt Eligibility | Tax receipts will be issued for donations of $10.00 or more, or upon request, implying the donations are tax-deductible. |

| Acknowledgement Card | If the donation is a tribute, an acknowledgment card can be sent to a designated recipient with a personal message, or no card if so chosen. |

| Privacy Policy | Personal information provided is used for maintaining contact and is not sold, traded, or shared, with options to be removed from the mailing list. |

| Charitable Registration Number | The form lists The Salvation Army's Charitable Registration # 10795 1618 RR0001, verifying their registered non-profit status. |

Instructions on Utilizing Salvation Army Tax Receipt

When contributing to The Salvation Army, filling out the tax receipt form correctly is essential to ensure your donation is acknowledged appropriately, and you receive any due tax benefits. This process isn't complicated but requires careful attention to detail to make sure everything is in order.

Follow these steps to complete the Salvation Army Tax Receipt form:

- Choose the type of donation you're making by ticking the appropriate box: General Donation (one-time gift), Monthly Donation, In Memory of, or In Honour of. If choosing In Memory of or In Honour of, make sure to write the person's name clearly.

- If you're donating on behalf of an organization, enter the Organization Name in the space provided.

- Select your title (Mr, Mrs, Ms, Miss, Dr, or Other) by ticking the appropriate box. Fill in your First Name and Last Name in the spaces provided.

- Enter your Address, including the Suite number if applicable, City, Province, and Postal Code in their respective fields.

- Provide your Telephone number and Email address. Tick the box if you allow The Salvation Army Canada to contact you by email.

- Under DONATION DETAILS, select how much you wish to donate by ticking the box next to one of the preset amounts, or if you're donating a different amount, tick Other and specify the amount in the space provided.

- Choose your payment method. If paying by cheque, remember to make it payable to The Salvation Army. If paying by credit card (Visa, Mastercard, American Express), fill in your Credit Card number and Expiry Date, then sign your name where indicated and print the Name as it appears on credit card.

- If your donation is in memory or in honour of someone and you would like an acknowledgement card sent, tick the appropriate box and provide the recipient's First Name, Last Name, Address, Suite (if applicable), City, Province, Postal Code, and a Personal Message. If no card is required, tick the box to indicate so.

Remember, donations of $10.00 or more automatically receive tax receipts, or you can request one for smaller amounts. Review your information carefully before mailing the completed form to The Salvation Army at the provided address. Keeping personal information accurate is crucial not only for acknowledgment but also to maintain contact as per your preference, in line with The Salvation Army's privacy policies.

Obtain Answers on Salvation Army Tax Receipt

Frequently Asked Questions about the Salvation Army Tax Receipt Form

How can I make a donation to the Salvation Army?

Donations can be made by completing the Salvation Army Tax Receipt Form, which allows you to select the donation type such as General Donation, Monthly Donation, or a donation In Memory of or In Honour of someone. You can donate via cheque, Visa, Mastercard, or American Express. Please mail the completed form to: The Salvation Army - 2 Overlea Blvd, Toronto, ON M4H 1P4.

Is my donation to the Salvation Army tax-deductible?

Yes, your donation is tax-deductible. The Salvation Army issues tax receipts for donations of $10.00 or more, or upon request. Ensure you provide accurate donor information on the form to receive your tax receipt.

How do I request a tax receipt for my donation?

Tax receipts will be automatically issued for donations of $10.00 or more. If your donation is below this amount or if you didn't receive a receipt for any reason, you can request a tax receipt by contacting The Salvation Army directly. Make sure to provide details of your donation for verification.

Can I decide how my donation is used by The Salvation Army?

While selecting the donation type, you have options to contribute towards a general donation, a monthly recurring donation, or make a donation in memory or in honor of someone. While general donations allow The Salvation Army the flexibility to allocate funds where they are needed most, donations in memory or in honor can be a meaningful way to acknowledge someone special. Specific instructions related to the fund allocation can be provided in the Personal Message section of the form.

What personal information do I need to provide for my donation?

You must complete the DONOR INFORMATION section with your name, address, telephone, and email address. An acknowledgment card can be sent if the donation is in memory or in honor of someone, for which you'll also need to provide the recipient's information. The Salvation Army safeguards your personal information and does not sell, trade, or share it.

What if I want to change or remove my information from The Salvation Army mailing list?

If you wish to update your contact information or be removed from The Salvation Army's mailing list, you can contact them by phone at 1-800-SAL-ARMY or visit SalvationArmy.ca/FAQ. The Salvation Army values your privacy and allows you to control the communication you receive from them.

Common mistakes

When filling out the Salvation Army Tax Receipt form, people often make a series of mistakes that can affect the processing of their donation and the issuance of their tax receipt. Being aware of these common errors can help donors ensure their contribution is processed smoothly and efficiently.

- Not specifying the donation type: It's essential to indicate whether your contribution is a general donation, a monthly donation, or a tribute (in memory or in honor of someone). Without this specification, the Salvation Army may not allocate your donation according to your wishes.

- Incomplete donor information: Skipping any part of the donor information section, such as not providing a complete address or forgetting to include your email, could lead to delays in receiving your tax receipt.

- Forgetting to choose a title: Although it might seem minor, not selecting a title (Mr, Mrs, Ms, etc.) can lead to incorrect or impersonal communication from the Salvation Army.

- Incorrect donation amount: Entering an unclear amount or forgetting to specify the amount if you choose "Other" can result in the donation not being processed as you intended.

- Omission of payment information: Neglecting to provide complete payment details, whether by cheque or credit card, including forgetting to sign the form, can delay the donation process significantly.

- Using an expired credit card: If the credit card information provided is out of date or the card is expired, the donation cannot be processed until correct details are supplied.

- Failure to allow contact: Not checking the box to allow The Salvation Army to contact you by email can mean missing out on essential updates, including the arrival of your tax receipt.

- Failing to request a tax receipt for donations under $10: Since tax receipts are only automatically issued for donations of $10.00 or more, not requesting one for smaller amounts means you won't receive it unless you specifically ask.

- Incorrect or incomplete acknowledgement card information: When making a donation in tribute to someone, not fully completing the acknowledgement card section can mean the intended recipient does not receive the card, detracting from the personal aspect of your gift.

In summary, donors should take care to fully complete the Salvation Army Tax Receipt form, paying special attention to the donation type, personal information, and payment details. Ensuring accuracy in these areas helps facilitate the processing of donations and the issuing of tax receipts, making the act of giving smoother and more fulfilling for everyone involved.

Documents used along the form

When navigating the philanthropic aspect of tax planning, donors often find that supporting organizations like The Salvation Army is not only an act of goodwill but also offers tangible tax benefits. The documentation accompanying a donation, such as the Salvation Army Tax Receipt, is crucial for ensuring that benevolent gestures are acknowledged appropriately from a legal standpoint. Below are ten relevant documents and forms that often accompany or are used in conjunction with the Salvation Army Tax Receipt, each playing a vital role in the donation process.

- Gift Aid Declaration Form: Utilized by taxpayers in certain jurisdictions to allow charities to reclaim tax on a donation made by a taxpayer, thereby increasing the value of the donation.

- Non-Cash Donation Form: Completed when donations in kind, such as clothing or furniture, are given, this form helps document the item's value and condition at the time of donation.

- Bank Statements or Credit Card Statements: Provide third-party verification of the donation made and are often retained for personal records and potential audit documentation.

- Donor Advised Fund (DAF) Recommendation Form: For donors who contribute through a DAF, this form directs the fund to distribute donations to the chosen charity, like The Salvation Army.

- Corporate Matching Gift Form: Used when an employer matches an employee’s donation, this document is necessary to confirm the arrangement and process the additional contribution.

- Volunteer Time Donation Forms: Although volunteer time is not tax-deductible in the U.S., some organizations maintain records of volunteer hours, which may have implications for grant applications or corporate sponsorships.

- Securities Transfer Form: When donating stocks or mutual funds, this form facilitates the transfer of securities from the donor to the charity, bypassing capital gains taxes.

- Planned Giving Documentation: Involves legal documents like wills or trust agreements for donations that will be made as part of a donor’s estate planning.

- Appraisal Forms for High-value Donations: Required for non-cash donations over a certain value to ensure the donor and the recipient organization correctly report the item’s value.

- Event Sponsorship Forms: For donations made in the context of event sponsorships, these forms outline the terms of the sponsorship, including any reciprocal benefits for the donor.

Ensuring that donations are accompanied by the appropriate supporting documents safeguards both the donor's interests and those of the recipient organization. In the case of The Salvation Army, these forms and documents not only facilitate the ethical management of contributions but also strengthen the organization’s ongoing mission to serve those in need. Managing these materials effectively lays a foundation for transparency, accountability, and mutual respect between donors and charitable entities.

Similar forms

Goodwill Donation Receipt Form: Similar to the Salvation Army Tax Receipt form, Goodwill's version also facilitates donations to the organization but with a focus on material goods rather than monetary contributions. Both forms allow donors to specify the type of donation—financial or material goods—and both ensure that donors receive acknowledgment for their contributions for tax deduction purposes. However, the Goodwill form typically includes detailed descriptions of the items donated for accurate valuation.

Charitable Contribution Deduction Form for IRS purposes: This document is used by donors to claim charitable contributions on their federal income tax returns in the United States. Like the Salvation Army Tax Receipt form, it provides a way to formalize a donation for tax deduction eligibility. Both documents require detailed information about the donation and the donor, ensuring that the contribution can be properly acknowledged and recorded for tax purposes. Importantly, both forms serve to establish the necessary paper trail for tax reporting and compliance.

United Way Pledge Form: United Way's pledge form is used for individuals to commit to monetary donations, similar to the Salvation Army Tax Receipt form's function for financial gifts. Both forms collect detailed donor information, including donation amount and preferred payment method. However, United Way's form may also focus on workplace giving programs, illustrating a broader range of donation collection methods. Like the Salvation Army form, United Way's documentation ensures donors receive acknowledgment of their contribution for tax deduction and personal records.

Nonprofit Event Sponsorship Form: This form is utilized by organizations to gather sponsorships for events, closely paralleling the Salvation Army Tax Receipt form in its purpose of collecting monetary support. Both forms include sections for donor or sponsor details, the amount contributed, and payment information. While the event sponsorship form is more specific to funding a particular event, both documents share the objective of formalizing donations for both acknowledgment and tax deduction purposes, ensuring that contributors receive necessary documentation for their generosity.

Dos and Don'ts

When filling out the Salvation Army Tax Receipt form, it's important to adhere to specific guidelines to ensure the process is smooth and your donation is properly documented. Here are some key dos and don'ts to keep in mind:

- Do print the form clearly and legibly to avoid any misunderstandings or processing delays.

- Do complete all required sections of the form accurately, providing all the necessary donor information and donation details.

- Do check the appropriate box to specify the type of donation you're making, whether it is a general donation, a monthly donation, or a donation in memory or honour of someone.

- Do choose your preferred method of payment and make sure to accurately fill in the payment information, especially if you're using a credit card.

- Do sign the form where required, as your signature is necessary to authorize the donation and the charge to your credit card, if applicable.

- Don't leave the donation amount blank or unspecified; always enter the amount you wish to donate, even if it's different from the options provided on the form.

- Don't forget to include your contact information, such as your email and telephone number, to enable The Salvation Army to reach you if needed.

- Don't neglect to check the box if you wish to allow The Salvation Army Canada to contact you by email for future communications.

- Don't ignore the section regarding the acknowledgment card if your donation is in memory or in honour of someone. It's important to fill out the recipient's information if you want an acknowledgment card sent.

By following these guidelines when completing the Salvation Army Tax Receipt form, donors can ensure their contributions are processed efficiently and correctly, supporting the vital services provided by The Salvation Army.

Misconceptions

Understanding the Salvation Army Tax Receipt Form can sometimes be confusing. Here are six common misconceptions:

- Any donation amount automatically qualifies for a tax receipt. This is incorrect. The Salvation Army issues tax receipts for donations of $10.00 or more, or upon request for smaller amounts.

- Personal information provided is shared with third parties. The Salvation Army respects your privacy. They do not sell, trade, or share your personal information with third parties.

- Donation type doesn’t influence the tax receipt. Whether your donation is a one-time gift, monthly, in memory of, or in honor of someone, it's important to indicate this on the form, as it could impact how your donation is acknowledged and processed.

- A tax receipt is issued immediately after donation. Processing time is needed. Your tax receipt will be issued and mailed to you, so it's important to provide accurate contact details.

- You cannot choose how to receive future communications. This is a misconception. By checking the appropriate box on the form, you can opt to allow The Salvation Army Canada to contact you by email or choose not to be contacted at all.

- Online donations do not qualify for a tax receipt. Regardless of the method—whether online, by check, or credit card—your donation is eligible for a tax receipt, provided it meets the minimum amount requirements or you have requested a receipt.

Correcting these misconceptions ensures that your generosity is acknowledged appropriately and that you receive the benefits to which you are entitled. If you have any questions or need clarification, The Salvation Army provides resources and contact information to assist you.

Key takeaways

Understanding the Salvation Army Tax Receipt Form process is essential for making the most out of your charitable donations. Here are several key takeaways to ensure everything goes smoothly.

- Minimum Donation for a Tax Receipt: A tax receipt will be issued for donations of $10.00 or more. Below this amount, a receipt will be provided upon request, ensuring even small contributions are acknowledged for tax purposes.

- Donation Types: The form accommodates various types of donations including general one-time gifts, monthly donations, or tributes in memory or honour of someone. This flexibility allows donors to contribute in a way that is meaningful to them.

- Donor Information Is Key: Completing the donor information section thoroughly is crucial. This includes your name, address, and contact details, which are necessary for the tax receipt processing.

- Payment Methods: Donations can be made via check or through major credit cards including Visa, Mastercard, and American Express. It's important to follow the instructions for each payment method closely.

- Privacy Concerns: The Salvation Army assures donors that their personal information will not be sold, traded, or shared. If donors do not wish to be contacted, they have the option to express this preference.

- Charitable Registration Number: The form includes the Salvation Army’s Charitable Registration Number, 10795 1618 RR0001, which is important for verifying the organization's charitable status and ensuring that your donation is eligible for a tax deduction.

- Email Communication Consent: If willing to receive email communications from The Salvation Army Canada, donors must explicitly indicate this preference on the form. This helps in maintaining open lines of communication for updates or future needs.

- Acknowledgement Cards: For donations made in memory or honor of an individual, there is an option to send an acknowledgement card. This is a thoughtful way to inform others of a donation made in their name or a loved one’s name.

- Credit Card Information Security: Donors should ensure they complete the credit card information section securely and double-check details to prevent errors. The signature is also a required part of this section, confirming the authorization of the transaction.

- Keeping Records: Finally, it's advisable for donors to keep a copy of the completed form and any related documentation for their records. This can be helpful for personal tracking of donations and for tax purposes.

By keeping these points in mind, donors can ensure their generous contributions are recognized and properly accounted for when tax season arrives, all while supporting the crucial work of The Salvation Army.

Popular PDF Forms

Who Delivers Court Summons - Highlights the Respondent’s right to decide against receiving legal notice through official process serving methods.

Ysq-r - Offers a rating scale to gauge how closely statements align with one’s personal experiences.

Hyundai Mpg Reimbursement Program - Invitation for Hyundai customers to authorize contact from Hyundai Motor America regarding their MPG claim.