Blank Secure Party Creditor PDF Template

In the realm of personal finance and legal identity, the Secure Party Creditor form emerges as a critical document for those seeking to navigate the intricacies of debt and asset management under the UCC (Uniform Commercial Code). At its core, this application facilitates the process of establishing oneself as a secured party creditor, a legal position that can offer significant leverage and protection in financial dealings. The document requires detailed personal information, including full names of the secured party and the debtor, contact details, physical characteristics, and crucial identification metrics such as date of birth, hair and eye color, as well as physical dimensions. Further essential elements encompass the date of UCC-1 financing statement filing, the filing number, and the state where the filing occurred, alongside a mandate for a high-resolution color photo adhering to strict guidelines to ensure clear identification. The procedure culminates with the applicant's signature and thumbprint, coupled with a declaration of intent to responsibly use the document and a verification of the information's accuracy. This meticulous compilation of data aims not just to create an ID card, but to solidify a legal status that has the potential to impact one's financial and legal maneuvers profoundly.

Preview - Secure Party Creditor Form

Secured Party Creditor ID Card Application

SPC Full Name: _______________________________________

Debtors Full Name: ____________________________________

Address:_____________________________________________

City: ________ State: _________ Zip:_________ |

Phone: |

|

Email:__________________________________________________ |

||

DOB: |

Eye Color:__________• Sex: |

|

Weight: ______________ Height:______________ |

|

|

Date of |

Expiration Date: |

|

State

Copy of

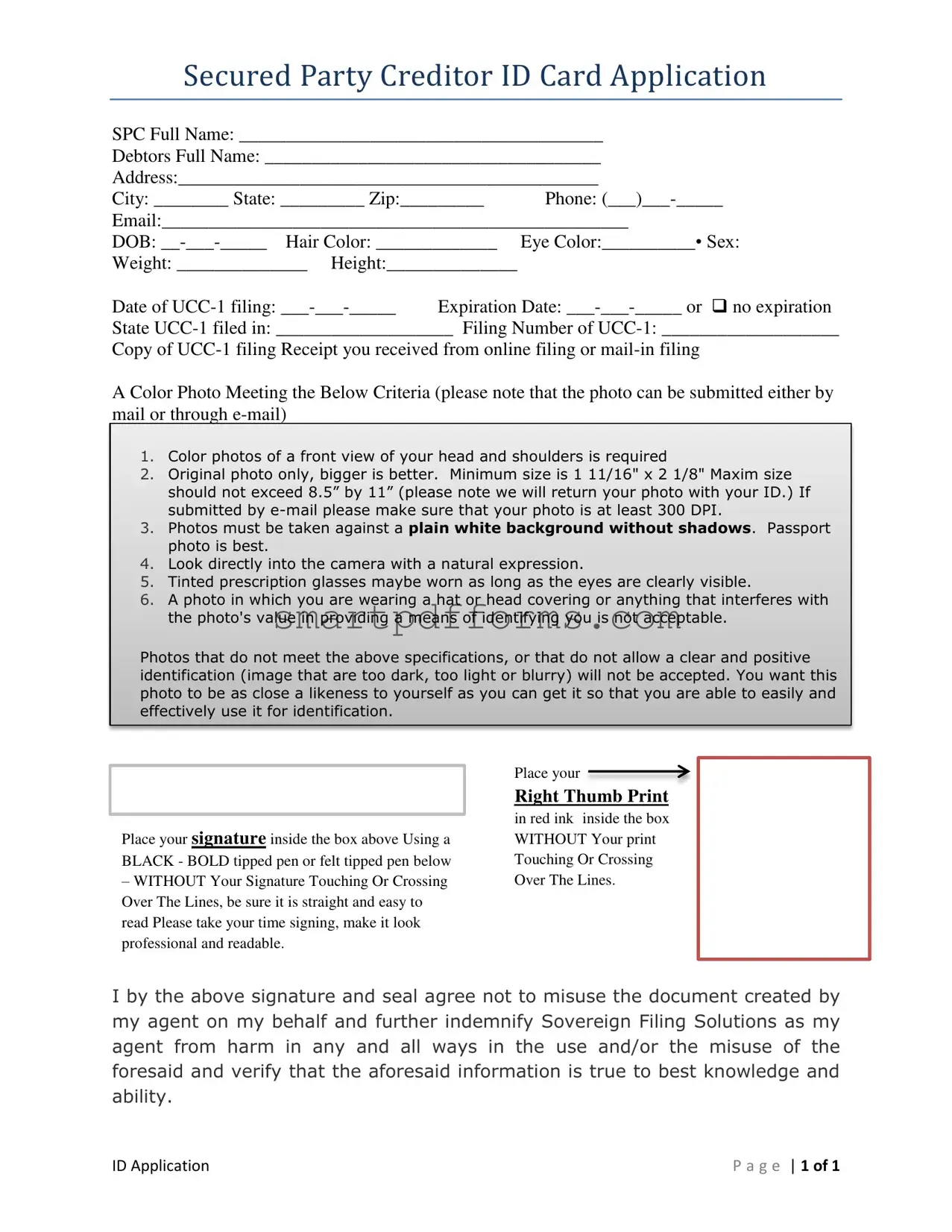

A Color Photo Meeting the Below Criteria (please note that the photo can be submitted either by mail or through

1.Color photos of a front view of your head and shoulders is required

2.Original photo only, bigger is better. Minimum size is 1 11/16" x 2 1/8" Maxim size should not exceed 8.5” by 11” (please note we will return your photo with your ID.) If submitted by

3.Photos must be taken against a plain white background without shadows. Passport photo is best.

4.Look directly into the camera with a natural expression.

5.Tinted prescription glasses maybe worn as long as the eyes are clearly visible.

6.A photo in which you are wearing a hat or head covering or anything that interferes with the photo's value in providing a means of identifying you is not acceptable.

Photos that do not meet the above specifications, or that do not allow a clear and positive identification (image that are too dark, too light or blurry) will not be accepted. You want this photo to be as close a likeness to yourself as you can get it so that you are able to easily and effectively use it for identification.

Place your signature inside the box above Using a BLACK - BOLD tipped pen or felt tipped pen below

–WITHOUT Your Signature Touching Or Crossing Over The Lines, be sure it is straight and easy to read Please take your time signing, make it look professional and readable.

Place your

Right Thumb Print

in red ink inside the box WITHOUT Your print Touching Or Crossing Over The Lines.

I by the above signature and seal agree not to misuse the document created by my agent on my behalf and further indemnify Sovereign Filing Solutions as my agent from harm in any and all ways in the use and/or the misuse of the foresaid and verify that the aforesaid information is true to best knowledge and ability.

ID Application |

P a g e | 1 OF 1 |

Form Data

| Fact Name | Description |

|---|---|

| Application Basics | The Secure Party Creditor (SPC) ID Card Application requires detailed personal information, including full name, address, contact details, and physical characteristics. |

| Photo Requirements | Applicants must submit a color photo following specific guidelines, such as a front view of the head and shoulders against a plain white background, with a minimum size of 1 11/16" x 2 1/8". |

| UCC-1 Filing Information | The application necessitates details of a UCC-1 filing, including the filing date, expiration date (if any), state filed in, and the filing number, along with a copy of the filing receipt. |

| Signature and Thumb Print | Applicants are required to sign using a black, bold-tipped pen without touching or crossing over the lines and place their right thumbprint in red ink within a specified box on the form. |

| Indemnification Clause | The form includes a clause where the applicant agrees not to misuse the document and indemnifies Sovereign Filing Solutions against any harm in the use or misuse of the created document. |

| Verification of Information | Applicants must verify that all the information provided on the application is true to the best of their knowledge and ability. |

| Governing Laws | While the application is related to the UCC-1 filing, specific governing laws may vary by state, as the UCC is adopted individually by each state. |

Instructions on Utilizing Secure Party Creditor

Filling out a Secure Party Creditor form might seem like a formidable task at first glance, but it's essentially just a matter of breaking the process down into manageable steps. The goal here is to create a document that presents your basic personal information alongside specific legal identifiers. By carefully following these steps, you'll prepare a form that accurately reflects your identity and legal standing.

- Start by printing or typing your full name where it says "SPC Full Name:" ensuring it matches your official documents.

- Input the debtor's full name in the “Debtor's Full Name:” section, adhering to the same standards of accuracy as for your own name.

- For the address section, fill in your current residential address. This should include any apartment or suite number if applicable.

- Enter the city, state, and zip code of your residence in the respective fields.

- Provide your phone number, including the area code, in the format indicated.

- Include an email address you regularly use in the "Email:" field.

- Fill out your date of birth (DOB) using the indicated format of day, month, and year.

- State your hair and eye colors in the respective fields.

- Fill in your sex, weight, and height with the current and accurate information.

- Make sure to record the date of your UCC-1 filing, the expiration date, and the state in which it was filed.

- Input the filing number of your UCC-1. This is a critical piece, as it links your application to your UCC filing.

- Attach a copy of the UCC-1 filing receipt. This can be a photocopy if you're mailing in the form or a digital copy if submitting online.

- Provide a color photo that meets the specified criteria – this is crucial for visual identification.

- Sign your name within the designated box using a black, bold-tipped pen. Ensure your signature is professional and does not touch or cross over the box's borderlines.

- Stamp your right thumbprint inside the outlined box. Use red ink and ensure the print doesn't touch or overlap the edges.

- Read the final agreement statement carefully, understanding your responsibilities concerning the use of the document.

- Finalize the form by verifying all entered information is true to the best of your knowledge and ability.

After completing these steps, you’ll have successfully prepared your Secure Party Creditor form, ready for submission to the appropriate parties. Ensuring accuracy and following the guidelines closely are key to a seamless process. Remember, this form is a declaration of your position and legal standing, warranting careful attention and precision in its preparation.

Obtain Answers on Secure Party Creditor

What is a Secure Party Creditor (SPC)?

A Secure Party Creditor is an individual or entity that has filed a UCC-1 Financing Statement, establishing a secured interest in their personal property. This legal position aims to protect the individual's assets from creditors and establishes a priority claim over the assets specified in the UCC-1 filing. It's a concept embraced by some to assert control over personal assets and navigate financial responsibilities differently.

How does one become a Secure Party Creditor?

To become a Secure Party Creditor, an individual must complete several steps, including filling out and submitting a UCC-1 Financing Statement to the appropriate state's filing office. The UCC-1 form should accurately list the individual as the secured party and detail the collateral (assets) over which they are claiming a security interest. Following this, attaching a Secure Party Creditor ID Card Application, providing personal details along with the UCC-1 filing information, is recommended to substantiate the secured party status further. Proper documentation, such as a color photo and identification information detailed in the SPC ID Card Application, is also required.

What is the purpose of the Secure Party Creditor ID Card Application, and what details must be provided?

The Secure Party Creditor ID Card Application is a document that solidifies an individual's status as a Secure Party Creditor. It serves as a form of identification, acknowledging the individual's secured interest in their assets as declared in their UCC-1 filing. The application requires detailed personal information, including full name, address, contact details, and physical characteristics, along with specifics of the UCC-1 filing like the filing number and state of filing. Additionally, a color photo and signature, following specified guidelines, are necessary to ensure the ID card can be used effectively for identification.

Are there any specific requirements for the photo submission for the SPC ID Card Application?

Yes, the photo submitted alongside the Secure Party Creditor ID Card Application must meet specific criteria to be accepted. It needs to be a color photo presenting a frontal view of the applicant’s head and shoulders against a plain white background, mirroring the standards of a passport photo. The photo should be original, with a recommended minimum size and not exceed 8.5" x 11". The applicant’s face must be clearly visible, with a natural expression and direct gaze into the camera. Tinted prescription glasses are permitted if they do not obscure the eyes. Hats or any head coverings that could hinder identification are not acceptable. If submitted electronically, the photo must be at least 300 DPI to ensure clarity.

Common mistakes

Filling out the Secure Party Creditor form requires attention to detail. Common mistakes can delay the process or undermine the validity of the application. By avoiding these errors, applicants ensure smoother processing and strengthen their positions as secured parties.

Not providing the full name exactly as it appears on legal documents. The secured party creditor and debtor's full names must match official identification to avoid discrepancies.

Leaving the address fields incomplete. Each part of the address, including city, state, and zip code, is essential for a valid application.

Submitting a photo that does not meet specified requirements. The photo should be a color front view of the head and shoulders, against a plain white background, with a natural expression, and without any accessories that obscure identification.

Using an incorrect size or quality for the submitted photo. Photos must adhere to the minimum and maximum size restrictions and, if emailed, have a resolution of at least 300 DPI.

Signing the document improperly. Signatures should be in black, bold ink, without touching or crossing over the border lines, ensuring legibility and professionalism.

Failing to place the right thumbprint correctly. The thumbprint must be in red ink and within the designated box without touching or crossing the lines.

Incorrect or incomplete UCC-1 filing information. The date of UCC-1 filing, the state where filed, and the filing number must be accurately provided to establish the secure party's status effectively.

Avoiding these mistakes not only expedites the processing of the Secure Party Creditor form but also ensures the form's acceptability and the legal standing of the secured party creditor.

Documents used along the form

In the realm of legal documentation, particularly when one is dealing with matters relating to becoming a Secured Party Creditor (SPC), a plethora of forms and documents are typically required to ensure that the process is undertaken meticulously and is in full compliance with legal standards. Besides the Secure Party Creditor ID Card Application, several other documents play crucial roles in establishing one's position as a Secured Party Creditor and managing related financial transactions. Here's a list of such forms and documents that are often utilized in conjunction with the SPC process:

- UCC-1 Financing Statement: Forms the foundation of the SPC process by officially recording the secured interest of the creditor in the assets of the debtor with the relevant legal authority.

- UCC-3 Amendment Form: Used for making any amendments to the original UCC-1 filing, such as address changes, adding or removing collateral, or terminating the filing.

- Security Agreement: A contract that establishes the secured party's interest in the collateral offered by the debtor, detailing the terms and conditions of this security interest.

- Commercial Lien: Documents the creditor's right to take possession of the collateral mentioned in the Security Agreement in case of a default by the debtor.

- Notice of Security Interest: Officially notifies third parties of the secured party's interest in the debtor's assets, serving as a public declaration.

- Hold Harmless and Indemnity Agreement: Protects the drafting agent or any involved third parties from legal liability in the case that the document's use is contested or causes harm.

- Power of Attorney: Grants the agent or another third party the legal authority to act on behalf of the Secured Party Creditor in matters related to the filed documents.

- Bill of Exchange: Used in the settlement of debts between the Secured Party Creditor and debtors, operating as a form of negotiable instrument.

- Birth Certificate Authentication or Acknowledgment: Required in some processes related to securing party creditor filings to authenticate the individual's identity and status.

- Private Agreement: A contract between the Secured Party Creditor and debtors that may outline specific terms of their agreement not covered by the standard documents.

Thorough understanding and proper utilization of these documents are essential for anyone engaging as a Secured Party Creditor. This ensures not only the lawful and efficient execution of the related financial and legal processes but also significantly mitigates the risks of disputes. It's imperative for individuals to familiarize themselves with the requirements and implications of each document to maximize their benefits in their role as Secured Party Creditors.

Similar forms

Uniform Commercial Code (UCC-1) Financing Statement: Similar to the Secure Party Creditor form, the UCC-1 Financing Statement is a critical document for declaring a security interest in a debtor's assets. Both require detailed information about the debtor and the secured party, and both must be filed with a designated public office to perfect the security interest, ensuring it's publicly acknowledged and legally enforceable.

Passport Application: Like the Secure Party Creditor form, a passport application necessitates personal identification data, including full name, address, and date of birth. Additionally, both require a color photo meeting specific criteria to verify the applicant's identity.

Driver's License Application: This document shares similarities with the Secure Party Creditor form in its requirement for personal information, a color photo that adheres to precise standards, and a signature. Both serve as identification and must be completed accurately to be considered valid.

Voter Registration Form: Voter registration forms require individuals to provide personal details such as name, address, and date of birth, similar to the Secure Party Creditor form. Both are essential for participation in legal processes and require accurate information to be processed.

Bank Account Opening Form: Opening a bank account requires submitting personal identification information akin to that on the Secure Party Creditor form. Both necessitate detailed personal data, a signature, and, often, additional verification means like a thumbprint or photo ID for security purposes.

Employment Application Forms: These forms resemble the Secure Party Creditor form as they gather personal details and employment history for identity verification and assessment. Both require truthful information and possibly a signature for validation.

Loan Application Forms: Similar to the Secure Party Creditor form, loan applications necessitate comprehensive personal and financial details, including a signature and often a form of photo identification to confirm the applicant’s identity and evaluate their creditworthiness.

Security Clearance Application: This application, much like the Secure Party Creditor form, demands detailed personal information for identification, including a signature and thorough background information to establish trust and verify identity.

Birth Certificate Application: Applicants must provide personal details about themselves or the person for whom they're applying, similar to the Secure Party Creditor form. Both are vital for legal identification and must be accurately completed and filed with the appropriate authorities.

Membership Application Forms for Clubs or Organizations: These applications often require similar elements to the Secure Party Creditor form, such as personal information, a photo for identification, and a signature to verify the applicant’s agreement with the organization’s terms and conditions.

Dos and Don'ts

When filling out the Secure Party Creditor (SPC) form, it is crucial to understand the dos and don'ts to ensure the application process is smooth and successful. Below are lists of five things you should do and five things you should avoid.

What You Should Do:

- Ensure all the information you provide on the form is accurate and up to date. This includes your full name, address, date of birth, and contact details.

- Adhere to the specified photo requirements. Use a color photo of your head and shoulders against a plain white background, ensuring it’s a front view with a natural expression.

- Sign your name inside the designated box using a black, bold-tipped pen without your signature touching or crossing over the lines.

- Place your right thumb print in red ink inside the specified box, making sure it does not touch or cross over the lines.

- Include a copy of the UCC-1 filing receipt you received from online or mail-in filing, ensuring it matches the details you entered on the form.

What You Shouldn't Do:

- Don’t leave any required fields blank. Incomplete forms are likely to be rejected or returned, causing unnecessary delays.

- Avoid using photos that don’t meet the requirements. Photos that are too dark, too light, blurry, or not against a plain white background will not be accepted.

- Do not sign over the lines or in an unclear manner. Your signature is a critical part of personal identification and needs to be clear and within the designated area.

- Refrain from submitting a hat or head covering in your photo unless it’s for religious reasons, and ensure your eyes and face are clearly visible even with prescription glasses.

- Never submit false information or falsify documents as part of your application. Doing so may lead to legal consequences and the rejection of your application.

Misconceptions

When it comes to the Secure Party Creditor (SPC) process, various misconceptions swirl around its purpose, functionality, and legal standing. It's critical to address these misconceptions to ensure individuals have accurate information before proceeding with any SPC-related processes.

SPC status provides complete immunity from laws: Some individuals believe that achieving Secure Party Creditor status exempts them from all statutory laws and taxes. However, this is not accurate. Being an SPC does not place one outside the jurisdiction of federal and state laws.

Filing an SPC form eradicates all debts: Another common misconception is that once you file as a Secure Party Creditor, all your debts are automatically nullified. The reality is, while the process may offer avenues for managing debts differently, it does not erase them.

SPC status lets you access unlimited credit: The notion that becoming an SPC grants access to unlimited government credit is false. The SPC process involves the understanding of commercial and financial instruments, not creating limitless credit.

No legal basis for SPC: Contrary to this belief, the concept of Secure Party Creditor comes from the U.S. Uniform Commercial Code (UCC). However, the interpretations of how SPC works vary widely and are often misconstrued.

SPC status changes your citizenship: Becoming a Secure Party Creditor has no impact on one's citizenship status. Some individuals mistakenly think it reclassifies their legal standing or citizenship, which is not the case.

It's a quick process: The process is detailed, requiring careful attention to legal forms and filings. The belief that it can be achieved quickly or effortlessly is misleading.

SPC can stop all legal actions: Individuals sometimes are under the impression that SPC status can halt legal proceedings like foreclosures or lawsuits against them. In reality, the effectiveness of SPC strategies in court is heavily disputed and varies case by case.

A Secure Party Creditor ID card is a government-issued ID: The ID card generated through the SPC process is not government-issued nor recognized as a formal identification document by any state or federal agency.

SPC documentation is foolproof: No document or process can guarantee protection against every possible legal or financial challenge. It's critical to understand the limitations of SPC filings and documentation.

Every and an attorney will support SPC claims: Due to the controversial nature of some interpretations of the SPC process, not all legal professionals support or advocate for the use of SPC filings as a defensive legal strategy.

There's an urgent need for clarity and correct information surrounding Secure Party Creditor status and its implications. Individuals considering this path must thoroughly research and possibly consult with a legal professional to understand the potential benefits and limitations of the SPC process.

Key takeaways

Understanding the process of becoming a Secure Party Creditor (SPC) requires careful attention to detail, beginning with accurately completing the Secure Party Creditor form. Here are 10 key takeaways for individuals considering filling out and using the SPC form:

- Complete all sections accurately: Ensuring all information provided on the SPC form, including full name, address, and other personal details, is accurate and up to date is crucial for the form's acceptance and subsequent processing.

- Understanding the UCC-1 filing: The Date of UCC-1 filing and the Filing Number of UCC-1 are essential components that link your SPC form to the UCC-1 financing statement, a public declaration of your status as a secured party. Misinterpreting or incorrectly entering these details can invalidate your SPC claim.

- Photo specifications are stringent: The requirement for a color photo with a plain white background, direct gaze, and a natural expression must be strictly adhered to. This photo represents your physical likeness in official documents and aids in identification.

- Size and quality of the photo matter: The stipulated size and resolution (at least 300 DPI if submitted electronically) of the photo ensure that it is of high enough quality to serve its purpose without being too large to process or store.

- Proper execution of the signature: The instructions for signing the form indicate that the signature must be clear, professional, and within certain bounds, highlighting the formal and legal nature of the document.

- Right thumb print in red ink: The specific requirement for a red ink thumbprint adds a unique personal identifier, making it more difficult to forge or misappropriate your identity.

- Legal obligations and indemnification: By signing the form, you agree to use the document appropriately and indemnify the processing agent against misuse, underscoring the legal responsibilities attached to the SPC status.

- Email submission of photos: Offering the option to submit photos by email provides convenience but also requires adherence to digital quality standards, such as resolution, to ensure the photo remains effective for identification purposes.

- No head coverings or tinted glasses: Restrictions on head coverings and tinted glasses unless absolutely necessary for medical reasons, emphasize the importance of unobstructed and clear identification.

- Accuracy and truthfulness pledge: The declaration that all information provided is true to the best of your knowledge underscores the need for honesty and the potential consequences of falsifying information in legal documents.

Comprehensively understanding and meticulously adhering to the requirements and implications of the Secure Party Creditor form not only facilitates the smooth processing of your application but also ensures that you are adequately informed about the responsibilities and legal implications of attaining SPC status.

Popular PDF Forms

Australia Visa Requirements - Accuracy in filling out the form is crucial, as it includes a declaration section where applicants assure the information is complete and correct.

Workers Comp Exemption New York - The Workers' Compensation Board mandates the submission of the CE-200 form for entities seeking formal acknowledgment of their exempt status.

Cn22 Form - Instructions for completeness and accuracy underscore the importance of reliable information for smooth customs clearance and compliance.