Blank Security Deposit Deductions PDF Template

When a tenant's lease comes to an end, the reimbursement of the security deposit often becomes a matter of meticulous accounting and legal compliance. The Security Deposit Deductions form plays a crucial role in this process, providing both landlords and tenants with a clear, itemized statement of how the deposit is allocated. Beginning with the resident's full name and the address of the rented property, including unit and ZIP code, this form ensures transparency by detailing the tenancy's start and end dates, the total amount of all deposits paid, and a comprehensive breakdown of any deductions. These deductions can range from repairs and cleaning to unpaid rent or court judgments. Importantly, the form outlines the expected method and timeline for the return of any balance due to the tenant, and it specifies that if the total amount for repairs or cleaning does not exceed $125, receipts for such expenditures are not mandatory. Moreover, it alerts the tenant to the legal implications of failing to meet their credit obligations, which could result in adverse credit reporting. Finally, the form's footer underscores its validity and restricted access to authorized members, highlighting its formal status as an Approved Form #22.0, revised in May 2011. This document encapsulates the need for meticulous record-keeping and adherence to legal standards in the landlord-tenant relationship, particularly in the critical phase of lease termination and deposit reconciliation.

Preview - Security Deposit Deductions Form

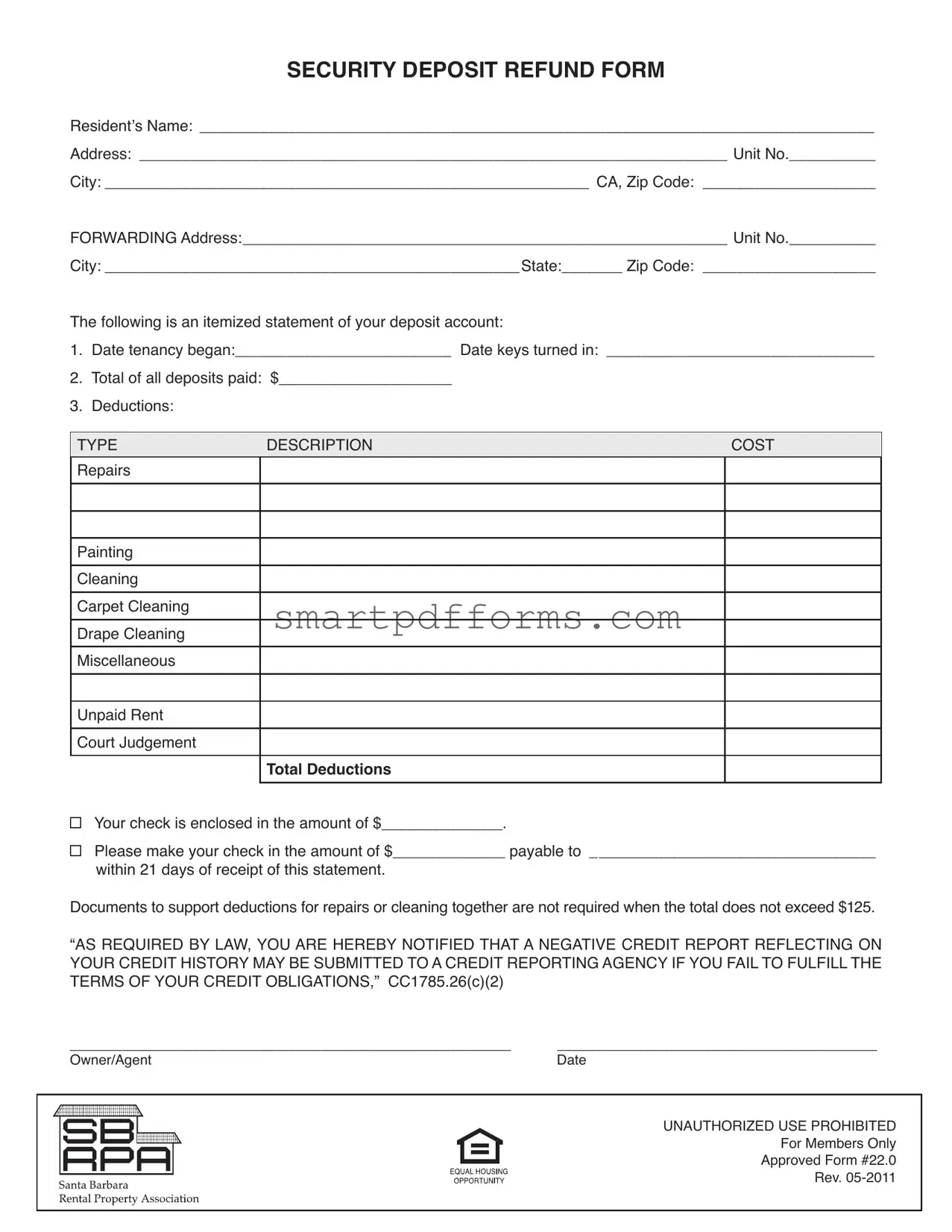

SECURITY DEPOSIT REFUND FORM

Resident’s Name: ______________________________________________________________________________

Address: ____________________________________________________________________ Unit No.__________

City: ________________________________________________________ CA, Zip Code: ____________________

FORWARDING Address:________________________________________________________ Unit No.__________

City: ________________________________________________State:_______ Zip Code: ____________________

The following is an itemized statement of your deposit account:

1.Date tenancy began:_________________________ Date keys turned in: _______________________________

2.Total of all deposits paid: $____________________

3.Deductions:

TYPE |

DESCRIPTION |

COST |

|

|

|

Repairs

Painting

Cleaning

Carpet Cleaning

Drape Cleaning

Miscellaneous

Unpaid Rent

Court Judgement

TOTAL DEDUCTIONS

Your check is enclosed in the amount of $______________.

Please make your check in the amount of $_____________ payable to _________________________________

within 21 days of receipt of this statement.

Documents to support deductions for repairs or cleaning together are not required when the total does not exceed $125.

“AS REQUIRED BY LAW, YOU ARE HEREBY NOTIFIED THAT A NEGATIVE CREDIT REPORT REFLECTING ON YOUR CREDIT HISTORY MAY BE SUBMITTED TO A CREDIT REPORTING AGENCY IF YOU FAIL TO FULFILL THE TERMS OF YOUR CREDIT OBLIGATIONS,” CC1785.26(c)(2)

___________________________________________________ |

_____________________________________ |

Owner/Agent |

Date |

UNAUTHORIZED USE PROHIBITED

For Members Only

Approved Form #22.0

Rev.

Form Data

| Fact Number | Description |

|---|---|

| 1 | Governing Law for Negative Credit Reporting: California Civil Code 1785.26(c)(2). |

| 2 | Deadline for Refund: The owner/agent must return the security deposit within 21 days of receipt of the itemized statement. |

| 3 | Itemization Requirement: A detailed itemization of deductions from the security deposit is required. |

| 4 | Documentation Threshold: Supporting documents for repairs or cleaning are not required if total deductions do not exceed $125. |

| 5 | Deduction Categories Included: Repairs, Painting, Cleaning, Carpet Cleaning, Drape Cleaning, Miscellaneous, Unpaid Rent, and Court Judgement. |

| 6 | Format: The form is approved as Form #22.0 Rev. 05-2011, indicating formal approval and revision status. |

| 7 | Unauthorized Use Warning: The form explicitly states "UNAUTHORIZED USE PROHIBITED," limiting its use to authorized members only. |

| 8 | Contains Credit Report Warning: informs the resident that failure to fulfill credit obligations may lead to a negative credit report. |

| 9 | Requirement for Forwarding Address: Residents must provide a new forwarding address for the return of their deposit. |

| 10 | Residency Information Required: Includes fields for resident’s name, original address, unit number, city, and zip code. |

Instructions on Utilizing Security Deposit Deductions

Upon vacating a rental property, tenants often anticipate the return of their security deposit. The Security Deposit Deductions form plays a crucial role in this process, providing an itemized statement for the tenant, detailing any deductions from the deposit for repairs, cleaning, or other charges. Filling out this form correctly is critical to ensure both parties understand the breakdown of deductions. Here's a step-by-step guide to completing the Security Deposit Deductions form:

- Resident’s Name: Start by entering the full name of the tenant whose deposit is being processed.

- Address: Fill in the property address, including the unit number if applicable.

- Add the city, followed by "CA" for California, and include the zip code to complete the property address section.

- FORWARDING Address: Enter the tenant’s new address, ensuring you include the unit number, city, state, and zip code. This is where any refund check will be sent.

- Under the section titled "the following is an itemized statement of your deposit account," start with Date tenancy began and Date keys turned in, providing the relevant dates in the spaces provided.

- Enter the Total of all deposits paid by the tenant in the space provided.

- Under Deductions, list each type of deduction made from the deposit. This includes repairs, painting, cleaning, and any other applicable expenses. For each type, describe the reason for the deduction and note the cost in the columns provided.

- If there were unpaid rent or court judgments, list these under the ‘miscellaneous’ category with the appropriate costs.

- Add up all deductions listed and enter this total under TOTAL DEDUCTIONS.

- Subtract the total deductions from the total deposit paid to determine the refund amount, if any, and enter this amount where indicated.

- Provide the details for the check payable to the tenant, including the recipient's name and the amount, if applicable.

- Note that supporting documents for deductions are not required if the total does not exceed $125, but it’s good practice to keep these records should any disputes arise.

- Include the warning about a negative credit report as per CC1785.26(c)(2), ensuring the tenant understands the implications of failing to fulfill their credit obligations.

- Finish by having the owner or agent sign and date the form.

Once the form is fully completed, it's ready to be sent to the tenant at their forwarding address. It’s important to send this form within the legally required timeframe, usually within 21 days in California, to avoid any legal complications. Properly documenting and communicating these deductions helps maintain a transparent landlord-tenant relationship and ensures both parties are on the same page regarding the security deposit settlement.

Obtain Answers on Security Deposit Deductions

-

What is a Security Deposit Refund Form and why is it important?

A Security Deposit Refund Form is a document that landlords provide to tenants detailing the return of their security deposit. It itemizes any deductions made from the deposit for repairs, cleaning, unpaid rent, or other charges. This form is essential because it ensures transparency between the landlord and the tenant regarding the use of the security deposit and helps prevent disputes by clearly outlining any financial deductions.

-

What should be included in the itemized statement of deductions?

The itemized statement should list all the deductions from the security deposit, including the type and description of each deduction, such as repairs, painting, cleaning (with subcategories for carpet and drape cleaning), and any other miscellaneous charges. If applicable, unpaid rent and court judgments should also be included. Each deduction should have the associated cost listed next to it, providing a clear breakdown of how the security deposit has been allocated.

-

Is documentation required for all deductions from the security deposit?

No, documentation to support the deductions for repairs or cleaning is not required when the total amount of these deductions does not exceed $125. However, transparency and providing documentation, when possible, can help in maintaining a good landlord-tenant relationship and can be useful if any disputes arise.

-

What is the significance of notifying the tenant about a possible negative credit report?

Notifying the tenant about the potential for a negative credit report reflects the seriousness of fulfilling credit obligations. It is a legal requirement to inform the tenant that failure to pay any owed amounts could result in adverse effects on their credit history. This clause underscores the importance of addressing any pending charges promptly to avoid negative implications on one’s credit score.

-

How long does the landlord have to return the security deposit or provide the Security Deposit Refund Form?

Landlords are obligated to return the security deposit or provide the Security Deposit Refund Form within 21 days of the tenant turning in the keys and vacating the property. This timeframe ensures a prompt resolution and return of funds, which is crucial for former tenants, especially if they need the deposit for their new residence.

-

What actions should a tenant take if they disagree with deductions made from their security deposit?

If a tenant disagrees with any deductions made from their security deposit, they should first contact the landlord or agent to discuss the discrepancies. It’s advisable to provide any evidence that supports their case, such as photographs or receipts. If an agreement cannot be reached, seeking mediation services or legal advice may be necessary to resolve the dispute appropriately.

-

Are there any restrictions on the use of the Security Deposit Deductions form?

Yes, the form should be used only as authorized, with a note indicating "UNAUTHORIZED USE PROHIBITED." It is intended for members (presumably of a housing or landlord association) and adheres to a specific approval form number and revision date. This restriction ensures the form is used correctly and remains up-to-date with current laws and practices.

Common mistakes

When filling out the Security Deposit Deductions form, common mistakes could potentially lead to misunderstandings or disputes. Avoiding these errors is crucial for a transparent and fair process.

Incorrect or incomplete resident information: Failing to provide the full Resident’s Name or accurate Address details can cause confusion and delays. This information is essential for identifying the agreement and ensuring the right party receives the documentation and any refund due.

Not specifying the date tenancy began and the date keys were turned in: These dates are crucial for calculating prorated amounts, if applicable, and for confirming the period the tenant was responsible for the unit. Accuracy here helps prevent disputes over timing and responsibility.

Omitting details in the deductions section: Simply listing "Repairs" or "Cleaning" without descriptions or explaining the necessity of each cost leads to a lack of transparency. Detailed explanations and the cost associated with each deduction help justify the amounts withheld from the deposit.

Not communicating properly about remaining funds: If there's a remaining balance to be refunded to the tenant, ensuring that the check amount enclosed is correct and that clear instructions are provided for the check to be made payable to the appropriate party is crucial. Misunderstandings here can delay the tenant receiving their refund.

Ignoring legal notifications: The form includes a notice regarding the potential for a negative credit report if obligations are not fulfilled. Failing to include this notice, or not adequately drawing the tenant's attention to it, overlooks a mandatory legal requirement and could lead to consequences for the tenant they weren't properly warned about.

Addressing these common mistakes ensures both parties are on the same page, reducing the potential for disputes and ensuring a smoother transition at the end of a tenancy.

Documents used along the form

When managing a property, particularly at the end of a tenancy, the Security Deposit Deductions form plays a crucial role. However, it rarely stands alone. Various other documents are frequently used alongside it to ensure a comprehensive and lawful approach to the process of handling security deposits, repairs, and move-out inspections. These documents help landlords and property managers to track the condition of the property, communicate effectively with tenants, and comply with legal requirements. Let’s take a closer look at some of these essential documents.

- Move-In Inspection Checklist: This form is filled out at the beginning of the tenancy to document the condition of the property prior to the tenant moving in. It helps to compare the property's condition at move-out.

- Move-Out Inspection Checklist: Similar to the move-in checklist, this document is used to record the state of the property when the tenant leaves, making it easier to identify any new damages for which the tenant may be responsible.

- Rent Ledger: This record tracks all the payments made by the tenant, including dates and amounts. It’s useful for identifying any unpaid rent that can be deducted from the security deposit.

- Repair Orders: When repairs are needed, this document provides the details of the work to be done, who authorized it, and the associated costs. It offers clear evidence of the repair expenses deducted from the security deposit.

- Cleaning Invoices: Professional cleaning services used at the end of a tenancy will often provide invoices. These serve as proof of the cleaning costs deducted from the security deposit.

- Photographic Evidence: Photos or videos taken before move-in and after move-out provide visual documentation of the property’s condition. This evidence can be crucial in disputes over deductions from the security deposit.

- Lease Agreement: The lease agreement itself is a critical document, detailing the terms agreed between the landlord and the tenant, including any provisions related to the security deposit and the responsibilities of each party.

- Communication Records: Any emails or written notices regarding the deductions, repair needs, or other relevant communications should be kept. They might be needed if there is a dispute or if the situation escalates to legal action.

- Itemized Statement of Deductions: This is a detailed list that complements the Security Deposit Deductions form, offering explanations and breakdowns for each deduction. It ensures transparency and can help prevent misunderstandings.

Together, these documents form a comprehensive toolkit for property managers and landlords, ensuring that every step of the move-out, inspection, and security deposit process is well documented and transparent. This not only helps in maintaining good relationships with tenants but also protects the property owner’s interests and ensures compliance with housing laws and regulations. Properly utilized, these documents can significantly streamline the end-of-tenancy procedures and help avoid potential legal complications.

Similar forms

Rental Application Form: Similar to the Security Deposit Deductions form, a Rental Application Form collects personal information about the prospective tenant, such as their name and current address, but it is used to screen potential renters before a lease is signed. Both forms are integral parts of the leasing process, handling essential details about the residents and maintaining records related to housing transactions.

Lease Agreement: This document outlines the terms and conditions agreed upon by the landlord and the tenant, including rent, security deposit amounts, and the duration of the tenancy. The Lease Agreement and the Security Deposit Deductions form share a connection in that both deal with financial arrangements and terms associated with renting property, though the latter specifically addresses deductions from the deposit for repairs and cleaning.

Property Inspection Report: Conducted at both move-in and move-out, this form details the condition of the rental unit. It is similar to the Security Deposit Deductions form because it provides a basis for any deductions made for repairs or cleaning, offering a documented account of any damages or issues that warrant withholding funds from the security deposit.

Notice to Vacate: This document is given by tenants to landlords or vice versa to signal the end of a tenancy. It correlates with the Security Deposit Deductions form as it precedes the period when assessments for damage or cleaning needs occur, ultimately influencing the deductions from the security deposit based on the property's condition upon the tenant's departure.

Eviction Notice: While an Eviction Notice is a legal declaration requiring a tenant to leave the premises, it indirectly relates to the Security Deposit Deductions form. In cases where eviction is due to damage or contract breaches related to the property's condition, the security deposit may be used to cover those damages, similar to deductions outlined for repairs and cleaning.

Rent Receipt: Rent Receipts document each payment a tenant makes. Analogous to the Security Deposit Deductions form, they both track financial transactions between the landlord and tenant. However, while rent receipts confirm payments made, the deductions form itemizes the use of the security deposit post-tenancy.

Move-out Reminder Letter: This letter from the landlord to the tenant outlines important move-out procedures and sometimes includes a checklist for cleaning or repairing the unit to avoid deductions from the security deposit. It is akin to the Security Deposit Deductions form in guiding tenants on how to leave the unit to ensure the return of their deposit.

Dos and Don'ts

When filling out the Security Deposit Deductions form, there are specific actions that one should take to ensure accuracy, compliance, and fairness, as well as actions one should avoid. Here is a comprehensive list:

Things You Should Do:

- Provide a detailed itemization of deductions: Specify the type, description, and cost for each deduction such as repairs, painting, cleaning, and any miscellaneous charges. This clarity helps prevent disputes and ensures both parties understand the basis of each charge.

- Include the dates of tenancy and key return: Accurately providing the date the tenancy began and the date the keys were turned in is crucial for calculating the period the deductions are pertaining to.

- Issue the refund or balance due in a timely manner: Ensure the remaining balance of the security deposit, after deductions, is sent to the tenant's forwarding address within 21 days of receipt of this statement, as stated in the form.

- Maintain compliance with local laws: Adhere to the legal notice concerning potential negative credit reporting, and ensure all deductions are in compliance with applicable laws and regulations, including the threshold for providing receipts or documents for repairs or cleaning.

Things You Shouldn't Do:

- Omit the forwarding address: Failing to include or confirm the tenant's forwarding address can result in delayed or misdirected return of the security deposit balance.

- Exclude necessary documentation: While the form states that documents supporting deductions are not required for totals under $125, for higher amounts, it's important to provide documentation to support the legitimacy and accuracy of the deductions.

- Make unauthorized deductions: Avoid making deductions that are not legally permissible or not covered under the lease agreement, such as for normal wear and tear or pre-existing conditions.

- Delay in issuing the statement or refund: Refrain from exceeding the 21-day period for issuing the statement and refund to the tenant as this can lead to potential legal complications and strain landlord-tenant relations.

Misconceptions

There are several misconceptions about the Security Deposit Deductions form that people often encounter. Understanding these can help ensure that both landlords and tenants are more aware of their rights and responsibilities.

- Misconception 1: Landlords can deduct for any type of repair, regardless of the reason. The truth is, landlords can only deduct for damages that go beyond normal wear and tear. Repairs for items that wore out due to age or normal use should not be charged to the tenant.

- Misconception 2: The form must always include receipts or quotes for deductions. While it's good practice to include these, it's not always required. For example, when the total deductions for repairs and cleaning do not exceed $125, detailed receipts or invoices are not mandated.

- Misconception 3: Landlords have no timeframe to return the security deposit or itemized deductions. Landlords are actually required to send the itemized list of deductions and any remaining deposit amount within 21 days of the tenant vacating the property.

- Misconception 4: Tenants cannot contest the deductions made from their security deposit. Tenants have the right to dispute deductions they believe are unfair or incorrect. They can do this by communicating with the landlord or, if necessary, through legal action.

- Misconception 5: The form is the final step in the process. In reality, the form is part of a dialogue. If there are disagreements or errors, either party can and should seek to resolve them through discussion or mediation before taking further steps.

- Misconception 6: All types of cleaning can be deducted from the security deposit. Only cleaning necessary to return the property to the condition it was in at the beginning of the tenancy, minus normal wear and tear, is deductible. For instance, if the property was professionally cleaned before moving in, then similar cleaning can be required. Otherwise, routine cleaning cannot be charged to the tenant.

- Misconception 7: Unpaid rent and court judgments are always deductible from the security deposit. While these are commonly deducted items, it's not a carte blanche. The deductions must still be justified, particularly with court judgments directly related to the tenancy.

It's important for both parties to understand these details to ensure a fair and transparent process regarding security deposit deductions. When both landlords and tenants are informed, disputes can be minimized or avoided altogether.

Key takeaways

Understanding the nuances of the Security Deposit Deductions form is essential for both landlords and tenants to ensure transparency and fairness in the handling of security deposits. Here are key takeaways to guide you through filling out and utilizing this form effectively:

- Accuracy is paramount. Ensure all personal information, such as the resident's name, address, and forwarding address, is accurate to prevent delays or issues in processing the form.

- Itemized statement clarity. The form provides a clear, itemized statement of deposit accounts, including deductions. This encourages a transparent breakdown of charges, which could include repairs, cleaning, and unpaid rent, among others.

- Documenting tenancy dates. Recording the date the tenancy began and the date keys were turned in is crucial for accurately determining the period of occupancy and corresponding responsibilities.

- Detailed deduction descriptions. Each deduction must be clearly described and itemized with the associated cost. This includes painting, carpet cleaning, and any miscellaneous charges, ensuring transparency.

- Threshold for documentation. No documents to support deductions for repairs or cleaning are required when the total does not exceed $125. This simplifies the process for minor deductions.

- Timely refund processing. The form stipulates a 21-day period within which the balance of the deposit, if any, must be returned to the tenant, emphasizing the importance of timely settlement.

- Legal notifications. It includes a legal notification about the potential impact on the tenant's credit history if they fail to fulfil their credit obligations, underscoring the legal ramifications of non-compliance.

- Signature and date. The form must be signed and dated by the owner or agent, providing an official record of the deductions and ensuring that both parties acknowledge the accuracy of the information provided.

By adhering to these guidelines, both landlords and tenants can navigate the process of security deposit deductions with greater ease and understanding, fostering a fair and transparent relationship.

Popular PDF Forms

Puppy Application Template - Reasons for choosing an Australian Shepherd as a pet are explored to understand the applicant's preference.

How to Get Certified to Teach Cpr American Heart Association - Contributes to the ongoing development and effectiveness of AHA instructors, enhancing the overall quality of emergency cardiovascular care training.

Pool Service Contract Template - By signing this agreement, the client commits to the payment schedule selected and agrees to the rates and additional charges for services rendered by Alison Pools.