Blank Sedgwick Direct Deposit PDF Template

Embarking on the journey of managing long-term disability can be a daunting experience, especially when it involves ensuring that your benefit payments seamlessly find their way to your bank account. At the heart of this process for members of the Arizona State Retirement System is the Sedgwick Direct Deposit Authorization Form, a crucial document designed to simplify the lives of beneficiaries. This form serves as a bridge between your employer, Sedgwick—a company that administers disability benefits—and your financial institution, enabling the direct deposit of disability benefit payments. By filling out this form, you grant Sedgwick and your employer the discretion to deposit these payments directly into your specified account, ensuring timely and secure access to your funds. Moreover, it includes options to establish, change, or cancel the direct deposit arrangement, providing flexibility and control over how you receive your payments. The form also outlines responsibilities and procedures for correcting any erroneous overpayments, thereby protecting all parties involved. Completing and submitting the form is made easy with options to fax or mail it directly to Sedgwick, streamlining the process of initiating or modifying your direct deposit arrangement. This introductory exploration aims to unwrap the layers of the Sedgwick Direct Deposit form, highlighting its key aspects and operational nuances to guide you through a smoother transition into managing your disability benefits.

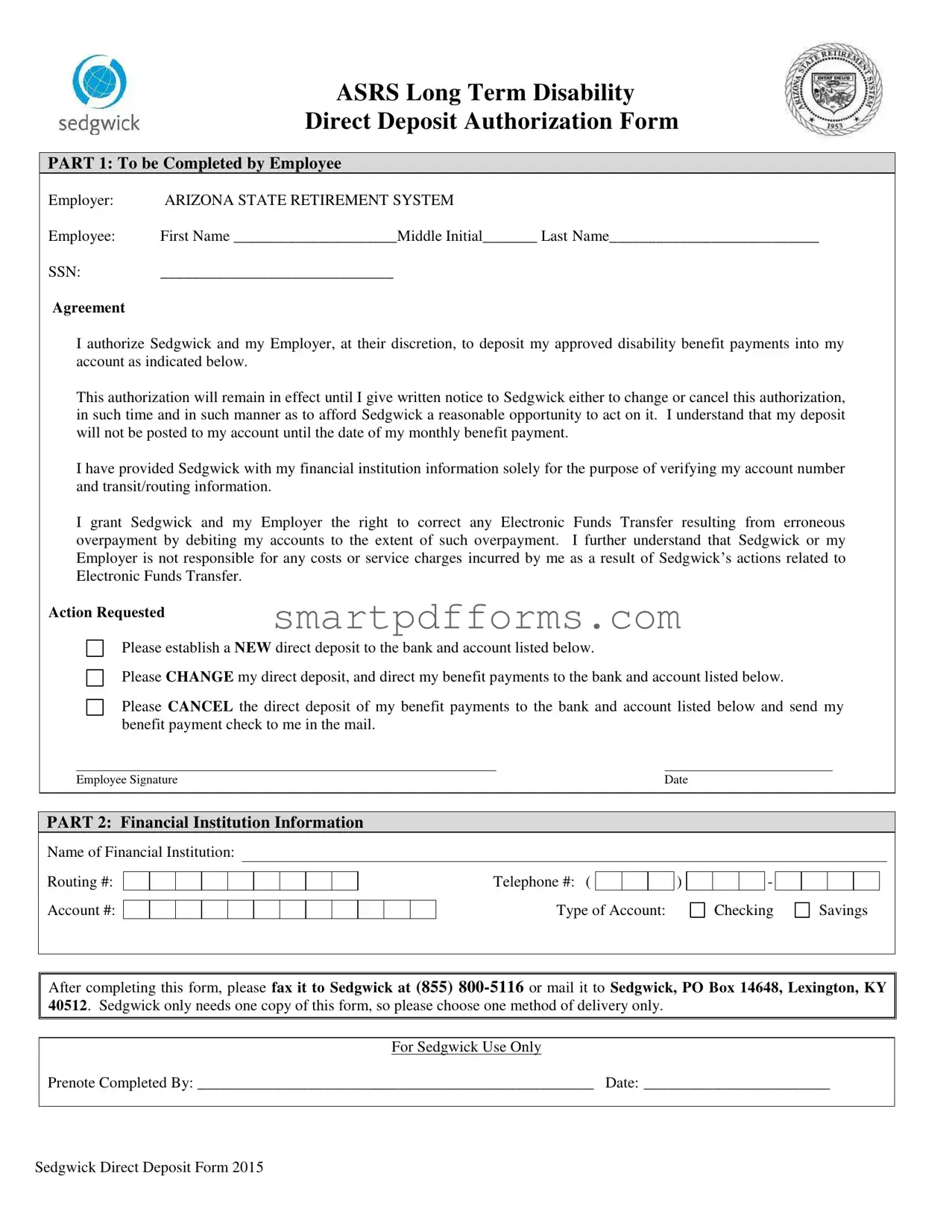

Preview - Sedgwick Direct Deposit Form

ASRS Long Term Disability

Direct Deposit Authorization Form

PART 1: To be Completed by Employee

Employer: |

ARIZONA STATE RETIREMENT SYSTEM |

Employee: |

First Name _____________________Middle Initial_______ Last Name___________________________ |

SSN: |

______________________________ |

Agreement

I authorize Sedgwick and my Employer, at their discretion, to deposit my approved disability benefit payments into my account as indicated below.

This authorization will remain in effect until I give written notice to Sedgwick either to change or cancel this authorization, in such time and in such manner as to afford Sedgwick a reasonable opportunity to act on it. I understand that my deposit will not be posted to my account until the date of my monthly benefit payment.

I have provided Sedgwick with my financial institution information solely for the purpose of verifying my account number and transit/routing information.

I grant Sedgwick and my Employer the right to correct any Electronic Funds Transfer resulting from erroneous overpayment by debiting my accounts to the extent of such overpayment. I further understand that Sedgwick or my Employer is not responsible for any costs or service charges incurred by me as a result of Sedgwick’s actions related to Electronic Funds Transfer.

Action Requested

Please establish a NEW direct deposit to the bank and account listed below.

Please CHANGE my direct deposit, and direct my benefit payments to the bank and account listed below.

Please CANCEL the direct deposit of my benefit payments to the bank and account listed below and send my benefit payment check to me in the mail.

Employee SignatureDate

PART 2: Financial Institution Information

Name of Financial Institution:

Routing #: |

|

|

|

|

|

|

|

|

|

|

|

|

Telephone #: ( |

|

|

|

) |

|

|

|

- |

|

|

|

|

Account #: |

|

|

|

|

|

|

|

|

|

|

|

|

Type of Account: |

|

|

Checking |

|

Savings |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

After completing this form, please fax it to Sedgwick at (855)

For Sedgwick Use Only

Prenote Completed By: ___________________________________________________ Date: ________________________

Sedgwick Direct Deposit Form 2015

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The Sedgwick Direct Deposit Authorization Form is designed for employees under the Arizona State Retirement System (ASRS) to authorize direct deposit of their disability benefit payments. |

| Participant Requirements | Employees must complete part one of the form, providing personal and employer information, to initiate, change, or cancel direct deposit arrangements. |

| Financial Information | Employees need to provide their financial institution's name, routing number, account number, and type of account (checking or savings) for the direct deposit. |

| Authorization Details | By signing the form, employees allow Sedgwick and their employer to deposit benefit payments directly into the specified account and to correct any transfer errors by adjusting the deposits. |

| Change of Authorization | This authorization remains effective until the employee provides written notice to Sedgwick to modify or withdraw the authorization, allowing sufficient time for Sedgwick to process the request. |

| Delivery Instructions | After completion, the form can be faxed to Sedgwick at (855) 800-5116 or mailed to Sedgwick, PO Box 14648, Lexington, KY 40512. Only one submission method is required. |

| Governing Law | This form and its proceedings are governed by the laws of the State of Arizona, under the jurisdiction of the Arizona State Retirement System (ASRS). |

Instructions on Utilizing Sedgwick Direct Deposit

Filling out the Sedgwick Direct Deposit form is a straightforward process that allows you to manage how you receive your disability benefit payments. By completing this form, you can have your benefits deposited directly into your bank account, which is often faster and more secure than receiving a check by mail. Additionally, you can change or cancel your direct deposit instructions using the same form. It's important to fill out the form accurately and review all provided information to avoid delays or errors in your benefit payments. Here are the steps you need to follow:

- At the top of the form, where it says "Employer," fill in "ARIZONA STATE RETIREMENT SYSTEM."

- Enter your first name, middle initial, and last name in the designated spaces under "Employee."

- Provide your Social Security Number (SSN) in the space provided.

- Read the agreement carefully to understand the terms, including the authorization to Sedgwick and your employer to deposit your disability benefits into your account, the conditions for changing or canceling this authorization, the processing timeline, and how corrections for overpayments will be handled.

- Under "Action Requested," mark the appropriate option to either establish a new direct deposit, change your current direct deposit details, or cancel your direct deposit.

- Sign your name and enter the date to verify that all the information you've provided is correct and to signify your agreement with the terms.

- In "PART 2: Financial Institution Information," enter the name of your bank in the field for "Name of Financial Institution."

- Provide the routing number of your bank in the space labeled "Routing #."

- Enter the telephone number of your bank where indicated.

- Fill in your account number in the space for "Account #."

- Indicate the type of account you have by marking either "Checking" or "Savings."

- Finally, you have the option to fax the completed form to Sedgwick at (855) 800-5116 or mail it to Sedgwick, PO Box 14648, Lexington, KY 40512. Remember, only one method of delivery is necessary.

Once Sedgwick receives your completed direct deposit form, they will process your request according to the action you've requested. By ensuring all information is accurate and clearly written, you help facilitate a smooth update to how you receive your disability benefit payments. If you choose to change or cancel your direct deposit in the future, this same form can be utilized, following the provided instructions accordingly.

Obtain Answers on Sedgwick Direct Deposit

Welcome to our FAQ section on the Sedgwick Direct Deposit form for ASRS Long Term Disability. Whether you're considering setting up direct deposit for your disability payments or need to make changes to your existing setup, we've compiled a list of common questions to help guide you through the process.

What is the purpose of the Sedgwick Direct Deposit Authorization Form?

The Sedgwick Direct Deposit Authorization Form allows individuals receiving long-term disability benefits from the Arizona State Retirement System (ASRS) to have their payments directly deposited into their bank accounts. This form facilitates a safer, faster, and more convenient method of receiving benefits, avoiding the delays and risks associated with paper checks.

How can I submit the Sedgwick Direct Deposit Authorization Form?

You can submit the completed form to Sedgwick either by fax at (855) 800-5116 or by mail to Sedgwick, PO Box 14648, Lexington, KY 40512. It’s important to send only one copy of the form via your chosen method to ensure that your request is processed efficiently.

When will the direct deposits start?

Direct deposits will not be initiated immediately after the form submission. Your deposits will start on the date of your monthly benefit payment, once your bank account information has been verified and processed by Sedgwick.

Can I change the bank account to which my disability benefits are deposited?

Yes, you can change the bank account for your benefit payments. Just fill out the Sedgwick Direct Deposit Authorization Form with your new bank account details and select the option to change your direct deposit. Remember to submit the form in time for Sedgwick to process the change.

What happens if I want to cancel my direct deposit?

If you decide to cancel your direct deposit, fill out the form and choose the cancel option. Upon receiving your cancellation request, Sedgwick will process it, and future benefit payments will be sent to you by mail in the form of a check.

What should I do if there's an overpayment to my account?

In the case of an overpayment due to an error, Sedgwick and your employer have the authority to rectify the mistake by debiting your account for the amount overpaid. It's important to review your bank statements regularly to ensure the accuracy of the deposited amounts.

Am I responsible for any bank fees associated with direct deposits?

While Sedgwick facilitates the direct deposit of your disability benefits, any costs or service charges imposed by your financial institution as a result of these deposits are your responsibility. It’s beneficial to understand your bank's policy on direct deposits and any potential fees.

Who do I contact for questions or issues with my direct deposit?

If you have any questions or encounter issues with your direct deposit, such as delayed deposits or incorrect amounts, you should first verify the details with your bank. If the problem persists, you can contact Sedgwick for assistance with resolving issues related to the direct deposit process.

Managing your disability benefits through direct deposit with the Sedgwick Direct Deposit Authorization Form can streamline the process, making it a convenient option. Remember to review your payments regularly and update your information as needed to ensure continuous and accurate benefit deposit.

Common mistakes

When filling out the Sedgwick Direct Deposit form, careful attention to detail is crucial to ensure that disability benefit payments are correctly processed and deposited. However, some common mistakes can delay the process or result in incorrect payments. Here are four of those mistakes:

**Incomplete or Incorrect Financial Institution Information**: Entering incorrect routing or account numbers is a common mistake. Each digit in your bank's routing number and your account number must be correct to ensure that the funds reach the right place. The name of the financial institution should also be accurately provided to avoid any confusion.

**Choosing the Wrong Account Type**: Marking the wrong type of account (checking instead of savings, or vice versa) can lead to processing delays or failed deposit attempts. This choice dictates the path the deposit takes and must match the account information provided.

**Failure to Sign or Date the Form**: The form requires the employee's signature and the date to authorize Sedgwick and the employer to deposit funds directly. Skipping this step renders the form incomplete and can result in it being returned unprocessed.

**Using Multiple Methods to Submit the Form**: Sedgwick requests that the form be submitted either by fax or mail, not both. Submitting the form through multiple channels can cause confusion and delay the processing time.

These mistakes, though common, can be easily avoided by reviewing the form carefully before submission. Ensuring accuracy in the provided information and adhering to Sedgwick's submission guidelines will help in the smooth processing of your direct deposit authorization request.

Documents used along the form

When managing disability benefit payments through Sedgwick, ensuring smooth and timely transactions is crucial for beneficiaries. The Sedgwick Direct Deposit Authorization Form is an essential document for recipients of long-term disability benefits provided by the Arizona State Retirement System (ASRS), facilitating the electronic transfer of funds to their bank accounts. However, to ensure the accuracy of the process and compliance with various procedural requirements, other forms and documents are often used in conjunction. Below is a list of five significant documents that usually accompany the Sedgwick Direct Deposit form.

- Benefit Payment Authorization Form: This form authorizes the release and payment of disability benefits. It is a critical document that must be completed and submitted by the beneficiary. The form outlines the terms and conditions under which the payments are made and may require periodic updates to reflect changes in the beneficiary's condition or entitlement status.

- Proof of Identity and Residency Documentation: To prevent fraud and ensure benefits are disbursed to the rightful recipient, beneficiaries are often required to provide proof of identity and residency. This can include government-issued identification, utility bills, or other official documents that verify the beneficiary’s identity and address.

- Bank Verification Letter: This document is obtained from the beneficiary's bank to verify the account details submitted for direct deposit. The letter must confirm the account number and routing number, and it may also certify the account type and the account holder’s name.

- Change of Information Form: Should any personal information change, such as name, address, or banking details, this form allows the beneficiary to update their records with Sedgwick. Keeping information current ensures that there are no interruptions or errors in benefit payments.

- Disability Status Report: Depending on the policy of the Arizona State Retirement System and Sedgwick, beneficiaries might be required to submit regular updates on their disability status. This report, completed by a medical professional, provides an update on the beneficiary’s health and ability to return to work, which may affect the continuation of benefits.

The process of filing for and receiving disability benefit payments involves multiple steps and the submission of several important documents. The Sedgwick Direct Deposit Authorization Form is just one component of a larger paperwork ecosystem that ensures benefits are accurately and efficiently distributed to those in need. Having a clear understanding of the associated documents can help beneficiaries navigate the process with greater ease and confidence.

Similar forms

The Sedgwick Direct Deposit form is primarily used to authorize the deposit of disability benefit payments into an individual's bank account. This form is comparable to several other documents that facilitate various forms of financial transactions or authorizations. Here are nine documents similar to the Sedgwick Direct Deposit form:

- Payroll Direct Deposit Authorization Form: This form allows employees to authorize direct deposit of their paychecks into their designated bank accounts. It's similar because it also requires bank information and permission to electronically transfer funds.

- Social Security Direct Deposit Enrollment Form: Individuals receiving Social Security benefits can use this form to start or change the direct deposit of their benefits. The similarity lies in the electronic transfer of funds to a beneficiary's account.

- IRS Direct Pay Authorization: Used for authorizing the direct payment of taxes from a bank account to the IRS. While it's for tax payments, the process of authorizing electronic withdrawals is akin to the direct deposit authorization.

- Bank Account Auto-Debit Authorization Form: This document allows various organizations to automatically debit an individual's account for bills or fees. It's similar due to the need for account information and authorization for automatic transactions.

- VA Benefits Direct Deposit Enrollment Form: Veterans or their beneficiaries use this form to initiate or change direct deposit information for VA benefits. It requires similar information and consent for electronic transactions.

- Direct Deposit Enrollment Form for State Benefits: Many states offer direct deposit for state-level benefits, requiring a form similar to the Sedgwick Direct Deposit form for the enrollment process.

- Rental Property Direct Deposit Form: Landlords may use this form to collect rent directly from tenants' bank accounts, needing tenant authorization and bank details just as the Sedgwick form does.

- Investment Dividends Direct Deposit Form: Investors can receive their dividends directly in their bank accounts by filling out this form, which parallels the Sedgwick form's mechanism for transferring funds electronically.

- Pension Plan Direct Deposit Authorization Form: Retirees can have their pension payments deposited directly into their bank accounts, requiring similar procedural steps as the Sedgwick form to set up the direct deposit.

Each of these documents shares a common thread with the Sedgwick Direct Deposit form, as they all include the need for bank account details, the authorization of electronic funds transfers, and typically, an undertaking to notify the authorizing entity in the event of any changes. They streamline financial transactions by reducing the need for physical checks and enhancing the efficiency of fund transfers.

Dos and Don'ts

When filling out the Sedgwick Direct Deposit form, there are certain dos and don'ts to keep in mind to ensure the process is smooth and your request is processed without delays.

Do's:

- Double-check the routing and account numbers: Before submitting the form, ensure the financial institution information is accurate. A simple mistake in these numbers can direct your payments to the wrong account.

- Choose the correct type of account: Clearly indicate whether your account is a checking or savings account. This information helps in correctly processing your direct deposits.

- Sign and date the form: Your signature is a crucial part of the authorization process. Make sure to sign and date the form to validate your consent for the direct deposits or any changes to existing information.

- Use one method of delivery: After completing the form, choose either fax or mail to send it to Sedgwick, but not both. Using multiple delivery methods can create confusion and might delay the processing of your direct deposit request.

Don'ts:

- Leave sections blank: Do not skip any parts of the form, especially in part 1, where your consent and personal details are required, and part 2, which involves your financial institution information. Incomplete forms are likely to be returned or delayed.

- Ignore to specify the action requested: Be clear about whether you are setting up a new direct deposit, changing an existing one, or canceling it. This instruction guides Sedgwick on how to proceed with your request.

- Forget to update your form in case of changes: If your banking details change after submitting the form, remember to fill out a new form and submit it to Sedgwick. This ensures that your disability benefit payments aren't interrupted.

- Use pencil or erasable ink: For permanence and clarity, fill out the form using a pen. Entries made in pencil or erasable ink might smudge or erase, leading to errors in processing your direct deposit request.

Misconceptions

When it comes to managing your disability benefits through the Sedgwick Direct Deposit system, several misconceptions may arise. Understanding these misconceptions can help streamline the process, ensuring that beneficiaries can receive their payments efficiently and securely. Let's clarify some of the common misunderstandings.

- Direct deposit is optional: Many believe that enrolling in direct deposit for disability payments is optional. However, direct deposit is a secure and efficient method to receive your benefits quickly and directly into your bank account, minimizing delays often associated with mailing checks.

- Authorization can only be changed or canceled via mail: There's a misconception that changes to your direct deposit authorization with Sedgwick, such as updating your bank information or canceling the service, can only be done through postal mail. In truth, these modifications can be communicated in writing through various means, providing reasonable time for Sedgwick to implement the changes.

- Deposits occur immediately: Some individuals might think their disability benefits will be deposited immediately after approval or submission of the direct deposit form. However, deposits will not be posted to the account until the scheduled monthly benefit payment date.

- Personal information is shared broadly for verification purposes: The form requires your financial institution information to verify your account number and routing information. This detail may lead to worries about extensive sharing of personal data. In reality, this information is utilized solely for the purpose of setting up and verifying the direct deposit, ensuring the correctness of the transaction.

- Sedgwick and employers are responsible for all related costs: Another common misconception is that Sedgwick or the employer will cover any costs or service charges incurred from setting up or maintaining the direct deposit. Individuals should be aware that they are responsible for any fees their bank may charge as a result of these electronic funds transfers.

- Overpayments are your responsibility to correct: It's often misunderstood that if an overpayment occurs, it's the recipient's responsibility to arrange repayment to Sedgwick. Legally, Sedgwick and your employer have the right to correct any overpayment by debiting your account for the amount overpaid, highlighting the importance of monitoring your account regularly.

- Submitting multiple copies of the Direct Deposit Authorization Form will expedite the process: Some might think that sending multiple copies of the form via different methods (fax and mail) might speed up the processing. However, Sedgwick specifies that only one copy of the form is needed, and submitting multiple copies does not influence the processing time.

- Any financial institution can be used: While most banks and financial institutions can accommodate direct deposits, not all might meet the requirements for receiving disability benefit payments via direct deposit. It’s always best to confirm with your chosen institution that they can handle these transactions to avoid any inconvenience.

Clearing up these misconceptions ensures you are better prepared to use the Sedgwick Direct Deposit system effectively, allowing you to manage your disability benefits with confidence and ease.

Key takeaways

When dealing with the Sedgwick Direct Deposit form, particularly for receiving Arizona State Retirement System (ASRS) long-term disability benefit payments, it's essential to understand several key points to ensure a smooth process. Here are five key takeaways:

- Before submitting the form, double-check that you've filled out every required field accurately. This includes your name, social security number, and the essential agreement section. An incomplete or inaccurately filled form could delay the direct deposit setup.

- The form gives you the option to either establish a new direct deposit, change an existing one, or cancel it altogether. Be clear about the action you're requesting by checking the appropriate box. This clarity helps Sedgwick process your request without unnecessary delays.

- Providing your financial institution information accurately is critical. This information includes the bank's name, routing number, account number, and whether it's a checking or savings account. Mistakes in this section can lead to your benefits being misdirected.

- It's essential to understand that this authorization allows Sedgwick and your employer to deposit your benefits directly into your account and make corrections in case of an erroneous overpayment. This means if an overpayment occurs, they can deduct the overpaid amount from your account. Awareness and monitoring of your deposits are important to catch any discrepancies early.

- The form's flexibility in terms of submission is convenient, allowing you to fax or mail in your form. However, it's important to only use one method to avoid confusion or processing delays. Whether you choose to fax the form to (855) 800-5116 or mail it to the provided Sedgwick address, ensure you keep a copy for your records.

Proper attention to these details when completing and submitting the Sedgwick Direct Deposit Authorization Form can significantly streamline the process of receiving your disability benefit payments, making it a hassle-free experience.

Popular PDF Forms

Is a Notice of Commencement a Lien - Ensures that Miami-Dade County construction projects are embarked upon with full regulatory compliance.

The Trustee for Commonwealth Essential Super - Stay informed about the unit price calculation schedule and how it affects withdrawals from your super fund.

Ldss 3370 - Instructions on the reverse side of the LDSS-3370 form provide detailed guidance on filling it out correctly and whom to contact for help.