Blank Self Employment Ledger PDF Template

Embarking on the journey of self-employment can be both exhilarating and daunting. The freedom to pursue one's passions and the responsibility for one's financial well-being are two sides of the same coin. An essential tool in this journey is the Self Employment Ledger form, a document designed by the Iowa Department of Human Services. This form serves as a record-keeping tool, enabling self-employed individuals to meticulously track their monthly income and expenses. Each entry on the ledger must include the date and a description, offering a clear overview of the financial health of the self-employed individual. The form not only facilitates the organization of financial records but also plays a crucial role when information is requested by the Department of Human Services (DHS). Providing a copy for the client and another for the case record, this document becomes an invaluable asset for ensuring transparency and compliance. With sections for personal details such as the case name, SSN, worker, and case number, along with detailed fields for logging each financial transaction, the Self Employment Ledger form is a pivotal component for anyone navigating the complexities of self-employment.

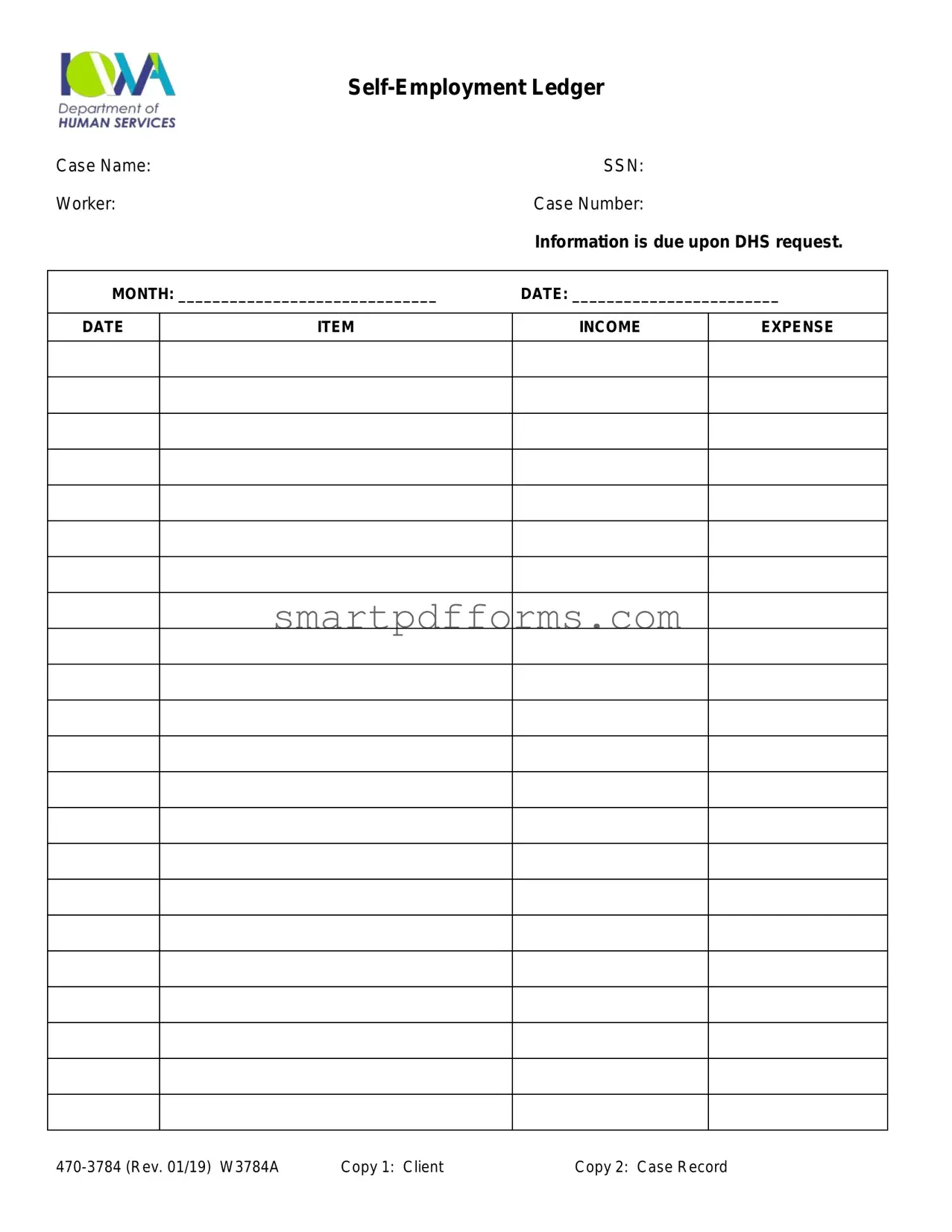

Preview - Self Employment Ledger Form

Case Name: |

|

SSN: |

|

Worker: |

|

Case Number: |

|

|

|

Information is due upon DHS request. |

|

|

|

|

|

MONTH: ______________________________ |

DATE: ________________________ |

||

|

|

|

|

DATE |

ITEM |

INCOME |

EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Copy 1: Client |

Copy 2: Case Record |

Form Data

| Fact Number | Detail |

|---|---|

| 1 | The form is issued by the Iowa Department of Human Services. |

| 2 | It is specifically designed for individuals who are self-employed. |

| 3 | Used to record both income and expenses on a monthly basis. |

| 4 | Information must be provided upon request by the DHS. |

| 5 | Form number is denoted as 470-3784 (Rev. 3/12) W3784A. |

| 6 | The form necessitates details such as Case Name, SSN (Social Security Number), Worker, and Case Number. |

| 7 | There are copies designated for both the client and the case record. |

| 8 | Governing law includes state-specific regulations and policies established by the Iowa Department of Human Services. |

| 9 | The ledger facilitates tracking of financial activities, crucial for eligibility and assistance assessments. |

| 10 | The form aids in maintaining organized records for both the Self-Employed individual and the Iowa DHS, ensuring transparency and accurate assessment of needs. |

Instructions on Utilizing Self Employment Ledger

Filling out a Self-Employment Ledger form is a critical step for individuals managing their own business or freelance work, particularly when required by the Department of Human Services (DHS). This document helps to organize and present your income and expenses, providing a clear overview of your financial situation. It's essential for accurately reporting your earnings and can play a crucial role in applications for various services or benefits. Follow these steps carefully to ensure that your ledger is complete and accurate.

- Start by noting down the Case Name at the top of the form. This is usually the name under which your case is filed with the DHS.

- Enter the Social Security Number (SSN) associated with your case. This ensures that the form is accurately matched to your records.

- Fill in the name of the worker if it’s different from the case name. This could be relevant in situations where you are filing on behalf of another individual, or if there is a specific case worker assigned to you by DHS.

- Write down your Case Number. This unique identifier is critical for tracking your case across DHS systems.

- Specify the Month for which you are reporting. The ledger is designed to capture monthly income and expense data, so ensure you correctly identify the reporting period.

- Under the Date Item column, list each date within the month that corresponds to a transaction (income or expense).

- Next, document each specific instance of income or expense against its respective date. Use the columns marked Income and Expense to record the amounts. Make sure to include all sources of income and all business-related expenses.

- It’s crucial to keep your entries detailed yet concise. For each transaction, a brief description can help clarify the nature of the income or expense, aiding in accurate record-keeping.

- After completing the ledger for the month, double-check all entries for accuracy. Mistakes in reporting can lead to complications with DHS or impact the services and benefits for which you may be eligible.

- Last, ensure you keep a copy for your records. The form mentions Copy 1: Client and Copy 2: Case Record. It’s important to maintain your copy in case questions arise or if there is a need for future reference.

Once the Self-Employment Ledger form is filled out, you have successfully documented your business transactions for the specified month. This organized approach not only helps in maintaining accurate records for your own management but is also essential when dealing with DHS requirements. Keep the form safe, and remember to update it monthly or as often as DHS requests.

Obtain Answers on Self Employment Ledger

-

What is a Self-Employment Ledger?

A Self-Employment Ledger is a document that outlines and records an individual's earnings and expenses from self-employment over a specific period. This form is essential for people who work for themselves and do not receive regular payslips. It provides a detailed account of their financial activity, which is especially important for tax purposes and when applying for financial assistance or benefits from agencies like the Iowa Department of Human Services.

-

Why do I need to fill out a Self-Employment Ledger?

Filling out a Self-Employment Ledger is crucial for accurately reporting your income and expenses. It is often a required document for self-employed individuals seeking assistance or benefits, as it offers a clear picture of your financial situation. This documentation helps agencies determine your eligibility for services based on your income. Additionally, it is an essential record for tax filing and for keeping track of your business's financial health.

-

How often should the Self-Employment Ledger be updated?

The Self-Employment Ledger should be updated regularly, typically on a monthly basis. This frequency ensures that your records are current and accurately reflect your financial activity. Regular updates are vital for maintaining an accurate ongoing record of your business transactions, which can be beneficial for financial planning and eligibility assessments for various services.

-

What information is required on the Self-Employment Ledger form?

The Self-Employment Ledger form requires detailed information about your income and expenses related to self-employment. This includes the date of each transaction, a description of the item (income or expense), and the amount. Additionally, you must provide your case name, Social Security Number (SSN), worker name (if applicable), and case number. It is crucial to fill out this form accurately and comprehensively to ensure a precise financial record.

-

Who should use the Self-Employment Ledger form?

Any individual who earns income through self-employment should use the Self-Employment Ledger form. This includes freelancers, contractors, and business owners who do not receive a regular salary from an employer. The form is particularly important for those applying for or receiving benefits from the Department of Human Services, as it is used to verify income and determine eligibility.

-

Where can I submit the completed Self-Employment Ledger?

The completed Self-Employment Ledger should be submitted to the agency requesting it, such as the Iowa Department of Human Services if you are applying for or receiving benefits in Iowa. It's important to keep a copy for your records (Copy 1: Client) and submit the necessary copies to your case record. Specific submission instructions, including mailing addresses or online submission options, should be provided by the requesting agency.

-

Can I correct errors on the Self-Employment Ledger after submission?

If you discover errors on your Self-Employment Ledger after submission, it's important to correct them as soon as possible. You should notify the agency to which you submitted the form and inquire about the correct procedure for making amendments. Providing accurate information is crucial for maintaining eligibility and ensuring that records are correct, especially for tax and benefit purposes.

-

Do I need to keep a copy of my Self-Employment Ledger?

Yes, it's essential to keep a copy of your Self-Employment Ledger for your records (Copy 1: Client). This copy serves as a personal backup and can be invaluable for future reference, tax preparation, and income verification. It also facilitates the correction of potential errors and provides a personal financial history that can be useful for business assessment and planning.

Common mistakes

Filling out the Self Employment Ledger form provided by the Iowa Department of Human Services requires attention to detail and accuracy. However, a few common mistakes can impact the submission. Being aware of these can help ensure the form is completed correctly.

Not Updating Monthly Details: A frequent mistake is failing to update the ledger monthly. Each month's income and expenses must be recorded accurately, reflecting the exact dates and amounts. This oversight can lead to discrepancies in reported income or expenses.

Incorrect or Missing Dates: It's essential to include the specific dates for each income received and expense incurred. Omitting dates or entering them incorrectly can lead to questions regarding the timing and validity of the transactions.

Not Keeping Copies: When you submit your ledger, it's important to keep a copy for your records. Each submission might be referenced in future inquiries or needed for personal verification of income and expenses.

Incomplete or Incorrect Information: Sometimes, entries on the ledger are not fully completed or contain inaccuracies. Each field should be filled out with the correct information to ensure the Department of Human Services can process the ledger without needing further clarification or amendments.

Not Including All Sources of Income: It's critical to report all income sources on the ledger. Sometimes individuals forget or choose not to include smaller or irregular income sources. This can lead to reporting inaccuracies and complications with the Department of Human Services.

Proper completion of the Self Employment Ledger is crucial for accurate income and expense reporting. Avoiding these common mistakes can help streamline the process, ensuring that the information provided to the Iowa Department of Human Services is both accurate and complete.

Documents used along the form

When individuals are self-employed, documenting income and expenses becomes crucial for an array of reasons, including tax preparation, loan applications, and various government assistance programs. The Self Employment Ledger form used by the Iowa Department of Human Services is a primary document for tracking such financial information meticulously. However, to provide a comprehensive view of one's financial situation or to fulfill specific legal or application requirements, additional forms and documents are often utilized alongside the Self Employment Ledger. Here's a rundown of some of these essential documents.

- 1040 Schedule C (Profit or Loss from Business): A federal tax form used by sole proprietors to report their business income and expenses. It helps in calculating the business's net profit or loss, which is then reported on the individual's personal tax return.

- Bank Statements: They serve as a third-party verification of the cash flow into and out of an individual's business accounts, helping to corroborate the income and expenses reported.

- Quarterly Estimated Tax Payments: Records or receipts of these payments are critical for self-employed individuals since they do not have taxes withheld from their income by an employer and must instead make these payments directly to the IRS and state tax agencies.

- 1099-MISC Forms: Documents received from clients or customers for whom an individual has performed work but was not considered an employee. These are crucial for reporting income received outside of traditional employment.

- Receipts for Business Expenses: Keeping detailed receipts allows for accurate reporting of business expenses, which can be used to offset income and lower tax liability.

- Vehicle Mileage Log: Necessary for individuals who use their vehicle for business purposes. The log should detail the mileage, dates, and reasons for business-related trips to deduct vehicle expenses.

- Home Office Documentation: For those claiming a home office deduction, records showing the size of the home office and expenses related to its upkeep are necessary to calculate the deduction accurately.

- Health Insurance Payments: Records of health insurance payments are essential for self-employed individuals to deduct their health insurance premiums, a significant expense for many.

Together, these documents complement the Self Employment Ledger form, providing a full picture of an individual's financial health and compliance with various legal requirements. Keeping these records organized and up-to-date simplifies the process of financial reporting and tax filing, besides ensuring that individuals can efficiently manage their business operations and plan for their financial future.

Similar forms

The Self Employment Ledger form, primarily utilized for tracking income and expenses by individuals who are self-employed, shares similarities with various other documents used in professional and personal finance management. These documents serve as tools for recording financial activities, budgeting, or providing evidence of financial status, each adapting to specific use cases but fundamentally rooted in the principle of documenting financial transactions over time.

Profit and Loss Statement: This document, often used by businesses, summarizes the revenues, costs, and expenses incurred over a specific period. Like the Self Employment Ledger, it provides a clear picture of financial performance, but it’s more detailed, typically used to inform investors and tax authorities about a company's financial status.

Balance Sheet: While a balance sheet provides a snapshot of a company's financial condition at a specific moment—including assets, liabilities, and owner's equity—it shares the concept of tracking financial activities with the Self Employment Ledger. The key difference lies in the Balance Sheet's focus on the overall financial health at a point in time, rather than the ongoing recording of income and expenses.

Income Statement: Similar to the Self Employment Ledger, an Income Statement details a company's revenues and expenses over a period, showing the net profit or loss. It is more formal and used in the broader context of financial reporting within the business sector.

Cash Flow Statement: This document tracks the flow of cash in and out of a business, which includes operating, investing, and financing activities. The Self Employment Ledger and the Cash Flow Statement both monitor financial activity over time; however, the Cash Flow Statement offers a more detailed analysis of how and where cash is generated and spent in a business operation.

Personal Budget Tracker: A tool commonly used by individuals to manage personal finances, it records expected versus actual income and expenses, similar to the Self Employment Ledger. The main distinction is that a budget tracker is more oriented towards forecasting and controlling personal spending rather than documenting it for official purposes.

Financial Affidavit: This is a sworn statement of an individual's income, expenses, assets, and liabilities. Like the Self Employment Ledger, it’s used to provide a transparent account of financial status, commonly in legal settings such as divorce or bankruptcy filings, showcasing its legal affinity with documented financial evidence.

Tax Return: Specifically, the Schedule C form used by sole proprietors to report income and expenses to the IRS. This form resembles the Self Employment Ledger in its purpose to document business operations over the fiscal year, geared specifically towards assessing tax liability based on business profit and loss.

Overall, while each document serves a specific function, from legal affidavits to internal business reviews, the core principle they share with the Self Employment Ledger is the systematic recording of financial transactions to monitor growth, manage budgets, comply with legal requirements, or plan for future financial decisions.

Dos and Don'ts

When completing the Self Employment Ledger form, particularly the one provided by the Iowa Department of Human Services, accuracy and transparency are your guiding principles. Keeping track of your income and expenses meticulously can not only ensure compliance but also support your financial management practices. Here are essential dos and don’ts to follow:

Do:- Ensure that all the information you provide is accurate and truthful. Misrepresenting your income or expenses can have serious consequences.

- Use the exact dates for income received and expenses incurred. Approximations can lead to inaccuracies that may affect your eligibility or benefits.

- Maintain receipts, invoices, and bank statements as supporting documentation for the figures you enter. These may be requested for verification.

- Include all sources of self-employment income, even if they seem minor. It’s important to report the complete financial picture.

- Regularly update your ledger, ideally as transactions occur. This habit prevents the backlog and ensures the ledger remains current.

- Leave sections blank. If a particular income or expense item does not apply, clearly mark it as “N/A” (Not Applicable) rather than leaving it empty.

- Overlook small expenses or occasional income. They can add up over time and significantly impact your financial assessment.

By adhering to these guidelines, you can ensure that your Self Employment Ledger accurately reflects your business activities, which is crucial for both compliance with the Department of Human Services requirements and effective management of your self-employment finances. Remember, this ledger is not only a requirement but a tool that can help you understand and improve the financial health of your business.

Misconceptions

The Self Employment Ledger form, specifically the one provided by the Iowa Department of Human Services, is an essential tool for individuals who are self-employed to accurately report their monthly income and expenses. However, there are common misconceptions surrounding its use and purpose:

- Only for Tax Purposes: Many believe this ledger is solely for tax purposes. While it is true that the ledger can aid in preparing annual tax returns by keeping track of income and expenses, its primary function is to provide current financial information to the Department of Human Services (DHS). This information is crucial for determining eligibility for various assistance programs.

- Only Detailed Records Required: Another misconception is that the ledger needs highly detailed entries similar to accounting books. In reality, the ledger serves as a summary document where self-employed individuals report their total monthly income and expenses. The key is maintaining consistent and accurate records that reflect the financial situation.

- Income Only Matters: Some people might focus exclusively on reporting income, neglecting to document expenses thoroughly. It is essential to understand that accurately reporting both income and expenses is vital. It provides a more accurate picture of the net income, which DHS uses to determine program eligibility.

- No Regular Submission Required: There's a belief that once submitted initially, there's no need for regular updates. This form, however, should be updated and submitted upon DHS's request, which can vary depending on individual circumstances and the specific requirements of the assistance program. Regular updates ensure that the information reflects the current financial status, which is critical for continued eligibility for support services.

Correcting these misconceptions is vital for self-employed individuals seeking assistance through programs offered by the Department of Human Services or other similar entities. By understanding the true purpose and requirements of the Self Employment Ledger form, individuals can ensure they are accurately and effectively communicating their financial situations, thereby maintaining their eligibility for necessary support services.

Key takeaways

The Self Employment Ledger form provided by the Iowa Department of Human Services serves as a crucial document for individuals managing their own business or working as independent contractors. This form, aiding in the documentation of monthly income and expenses, must be filled out with accuracy and completeness. Here are key takeaways for effectively utilizing this form:

- Always specify the month for which you are reporting at the top of the form, ensuring clear tracking of financial activities over time.

- Document each entry with the corresponding date, aligning items chronologically for organized record-keeping.

- The income section should include all money earned within the month, meticulously noting the source and amount of each entry.

- In the expense section, list all costs associated with the operation of your self-employment, such as supplies, rent, and utility expenses. This is critical for understanding your net income.

- Utilization of the form should be done on a regular basis, preferably monthly, to maintain up-to-date records of your financial status.

- Keep Case Name, SSN, Worker, and Case Number information at the top of the form to ensure your ledger is properly filed and associated with the correct case.

- Remember, the information you provide may be requested by the Department of Human Services (DHS) at any time, emphasizing the importance of accurate and current data.

- Keeping copies of each completed form is vital for your records, offering a reference for future queries or audits.

- The form allows for a clear representation of your financial standing, supporting applications for assistance or services through the DHS.

Comprehensive understanding and diligent management of the Self Employment Ledger can significantly impact individuals' financial assessment and services eligibility. It is beneficial to approach this task with attention to detail and an understanding of its wider implications for self-employed individuals.

Popular PDF Forms

Ntsa Form C - It emphasizes the legal obligation to transfer the vehicle's registration book to the new owner upon sale.

T4s - A comprehensive federal tax return form designated for S Corporations filing their annual income taxes.

How to Claim Rent on Taxes Ontario - Organizes all expense-related information in one place, potentially reducing the time and cost of tax preparation.