Blank Separation Notice For Ga PDF Template

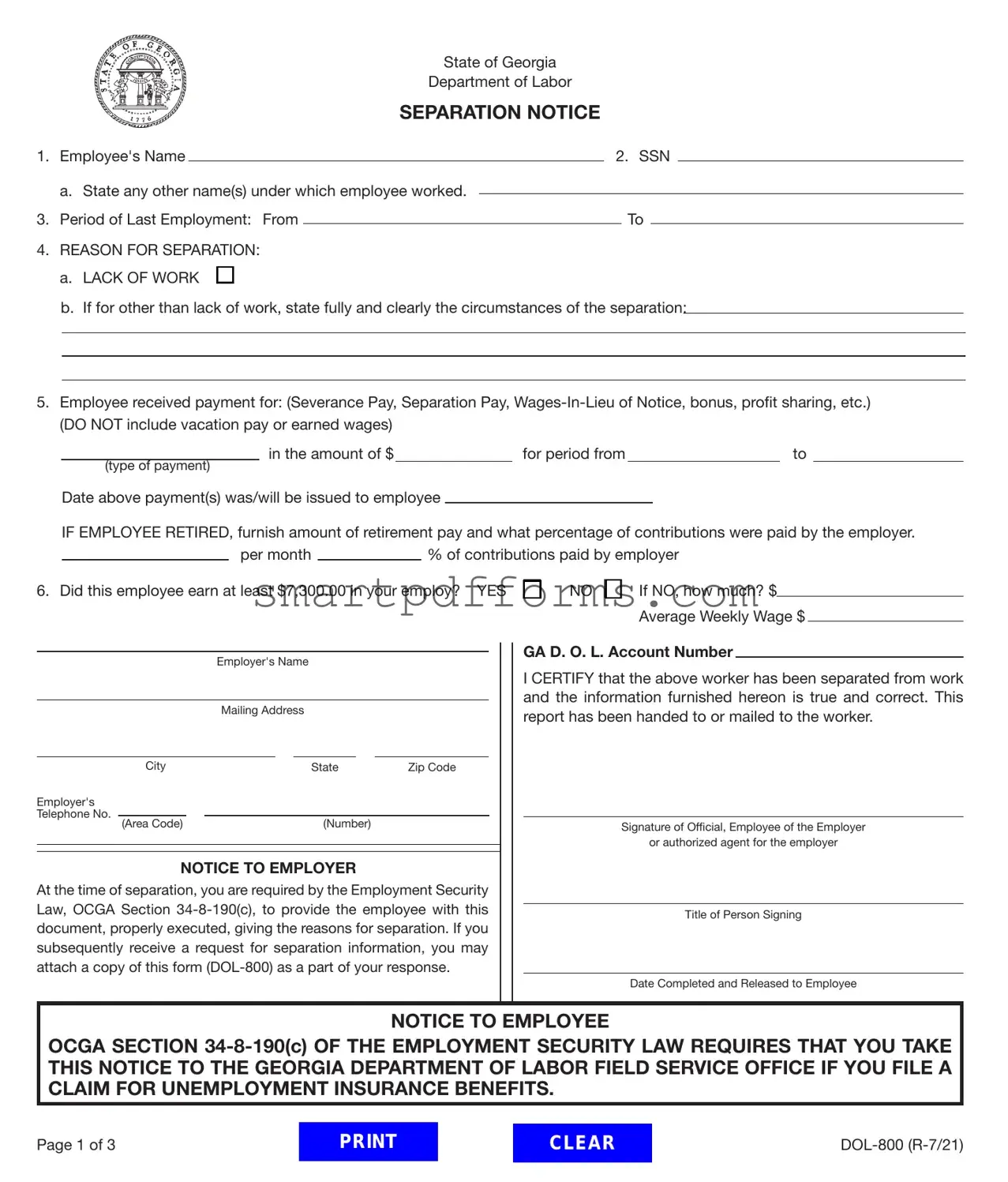

Navigating through the process of employment separation in Georgia involves various legal requirements, one of which includes the Separation Notice For Ga form, a crucial document mandated by the State of Georgia's Department of Labor. This form, officially recognized as DOL-800, serves as a comprehensive record that details the circumstances surrounding an employee's departure from their job. Employers are tasked with meticulously completing this form each time an employee leaves the company, whether voluntarily or involuntarily, except in cases involving employer-filed claims or mass separations. A critical aspect highlighted in the form is the reason for the separation, distinguishing between a lack of work and other reasons, with a section dedicated to elaborating on the specifics if the separation is for causes other than layoffs. Besides capturing basic information such as the employee’s name, social security number, and employment period, the form also delves into details about any compensations like severance pay or wages in lieu of notice, excluding vacation pay or earned wages. Additionally, it queries if the employee met a certain earnings threshold during their tenure at the company. The procedural requirements, including a reminder for employers on the legal necessity of issuing this notice upon separation and instructions for employees on how to proceed with an unemployment insurance claim, underscore the form’s relevance in ensuring a smoother transition for both parties. It also encapsulates safeguards for information accuracy and confidentiality, reinforcing the importance of this document in the employment separation process.

Preview - Separation Notice For Ga Form

State of Georgia

Department of Labor

SEPARATION NOTICE

1. |

Employee's Name |

|

|

|

2. SSN |

|

||

|

|

|

|

|||||

|

a. State any other name(s) under which employee worked. |

|

|

|

|

|

||

|

|

|

|

|

|

|||

3. |

Period of Last Employment: From |

|

|

To |

|

|

||

|

|

|

|

|||||

4.REASON FOR SEPARATION:

a.LACK OF WORK

b.If for other than lack of work, state fully and clearly the circumstances of the separation:

5.Employee received payment for: (Severance Pay, Separation Pay,

(DO NOT include vacation pay or earned wages)

(type of payment)

in the amount of $for period fromto

Date above payment(s) was/will be issued to employee

IF EMPLOYEE RETIRED, furnish amount of retirement pay and what percentage of contributions were paid by the employer.

per month |

|

% of contributions paid by employer |

|

6. Did this employee earn at least $7,300.00 in your employ? YES

NO

If NO, how much? $

Average Weekly Wage $

Employer's Name

Mailing Address

|

City |

|

State |

|

Zip Code |

||

Employer's |

|

|

|

|

|||

Telephone No. |

|

|

|

|

|

|

|

(Area Code) |

|

|

(Number) |

|

|||

NOTICE TO EMPLOYER

At the time of separation, you are required by the Employment Security Law, OCGA Section

GA D. O. L. Account Number

I CERTIFY that the above worker has been separated from work and the information furnished hereon is true and correct. This report has been handed to or mailed to the worker.

Signature of Official, Employee of the Employer

or authorized agent for the employer

Title of Person Signing

Date Completed and Released to Employee

NOTICE TO EMPLOYEE

OCGA SECTION

Page 1 of 3

CLEAR

INSTRUCTIONS TO EMPLOYER FOR COMPLETION

OF THIS SEPARATION NOTICE

In accordance with the Employment Security Law, OCGA Section

Item 1. Enter employee’s name as it appears on your records. If it is different from the name appearing on the employee’s Social Security Card, report both names.

Item 2. Enter the employee’s Social Security Number. Verify for accuracy.

Item 3. Enter the dates of employee’s most recent work period.

Item 4. a. If the reason for separation is for “LACK OF WORK,” check box indicated.

b. If the reason for separation is OTHER THAN “lack of work,” give complete details about the separation in space provided. If needed, add a separate sheet of paper.

Item 5. If any type payment, (i.e. Separation Pay,

Item 6. Check the appropriate block YES or NO to indicate whether this employee earned at least $7,300.00 in your employ. If you check NO, enter amount earned in your employ. Give average weekly wage (without overtime) at the time of separation.

Employer’s Name. |

Give full name of employer under which the business is operated. |

Address. Give full mailing address of the employer where communications are to be sent regarding a potential claim.

GA DOL Account Number Employer’s

Your state DOL Unemployment Insurance Account Number as it appears on your Quarterly Tax and Wage Report.

Signature. This notice must be signed by an officer or employee of the employer or authorized agent for the employer, and this person’s title or position held with the employer must be shown.

Date. This notice must be dated as of the date it is handed to the worker. If the employee is no longer available at the time employment ceases, mail this form

OCGA Section

PENALTY FOR OFFENSES BY EMPLOYERS. “Any employing unit or any officer or agent of an employing unit or any other person who knowingly makes a false statement or representation or who knowingly fails to disclose a material fact in order to prevent or reduce the payment of benefits to any individual entitled thereto or to avoid becoming or remaining subject to this chapter or to avoid or reduce any contribution or other payment required from an employing unit under this chapter or who willfully fails or refuses to make any such contributions or other payment or to furnish any reports required under this chapter or to produce or permit the inspection or copying of records as required under this chapter shall upon conviction be guilty of a misdemeanor and shall be punished by imprisonment not to exceed one year or fined not more than $1,000.00 or shall be subject to both such fine and imprisonment. Each such act shall constitute a separate offense.”

OCGA Section

PRIVILEGED STATUS OF LETTERS, REPORTS, ETC., RELATING TO ADMINISTRATION OF CHAPTER. “All letters, reports, communications, or any other matters, either oral or written, from the employer or employee to each other or to the department or any of its agents, representatives, or employees, which letters, reports, or other communications shall have been written, sent, delivered, or made in connection with the requirements of the administration of this chapter, shall be absolutely privileged and shall not be made the subject matter or basis for any action for slander or libel in any court of the State of Georgia.”

Page 2 of 3 |

EMPLOYER NOTIFICATION TO EMPLOYEES OF THE

AVAILABILITY OF UNEMPLOYMENT COMPENSATION

Unemployment Insurance (UI) benefits are available to workers who are unemployed and who meet the state UI eligibility laws. You may file a UI claim the first week that your employment stops or your work hours are reduced.

For assistance or more information about filing a UI claim visit the Georgia Department of Labor’s website at dol.georgia.gov. You will need to provide the following information in order for the state to process your claim:

•Your legal name as it appears on your Social Security card

•Social Security Number

•Georgia Driver’s License, if applicable

•Work authorization documents, if you are not a U.S. citizen

•Bank’s routing number and your account number, if you want to receive your benefit payments via direct deposit

•Work history information for the last 18 months, to include your separation notice, if provided by your employer You can file your claim online using any Internet accessible device. Follow these steps to file your claim online:

1.Go to dol.georgia.gov.

2.Select Apply for Unemployment Benefits.

3.Answer the questions completely.

4.Download and read the UI Claimant Handbook. Information in this handbook provides detailed instructions regarding the unemployment insurance (UI) program and the “Next Steps” to follow after submitting your claim.

5.Record your Confirmation Number. A confirmation email will be sent to the email address provided when completing the claim application. (If you do not receive a confirmation number, the application was not successfully completed. It remains on the system for 24 hours. Log in again and make sure you select FINISH to receive a confirmation number.)

If you have questions about the status of your claim, you can check the status of your claim online at dol.georgia.gov by using My UI (Check My UI Claim Status).

For assistance, contact UI Customer Service at 1.877.709.8185

Page 3 of 3 |

Form Data

| Fact | Detail |

|---|---|

| Form Name | Separation Notice |

| State | Georgia |

| Department | Department of Labor |

| Governing Law | Employment Security Law, OCGA Section 34-8-190(c) |

| Form Number | DOL-800 (R-7/21) |

| Purpose | To provide the reason for an employee's separation from employment |

| Who Completes It | Employer or authorized agent |

| Penalty for Non-Compliance | Misdemeanor, fines up to $1,000, and/or up to one year imprisonment per OCGA Section 34-8-256(b) |

| UI Benefits Information | Includes notification to employees about the availability of Unemployment Insurance benefits |

| Required Information | Employee's name, SSN, employment period, reason for separation, payments issued, and employer's details |

| Instructions for Employees | Take Separation Notice to the Georgia Department of Labor Field Service Office if filing a claim for unemployment insurance benefits |

Instructions on Utilizing Separation Notice For Ga

When an employment relationship ends in the state of Georgia, it's crucial for the employer to accurately complete and submit a Separation Notice, Form DOL-800. This form serves a critical function in the unemployment insurance claims process for former employees. Step-by-step instructions ensure this documentation is filled out correctly, securing compliance with state laws while assisting former employees in their transition. Below are the detailed steps to properly fill out the form.

- Enter the employee's name as it appears on your records in Item 1. Include any other names the employee may have worked under in the space provided.

- Input the employee's Social Security Number (SSN) accurately in Item 2.

- Document the dates of the employee’s most recent period of employment in Item 3, including both the start and end dates.

- Check the box in Item 4a if the reason for separation is due to "lack of work." If the separation is for another reason, fully explain the circumstances in the space provided in Item 4b. Attach an additional sheet if necessary.

- In Item 5, state any payments made to the employee upon separation (other than vacation pay or earned wages), the type of payment, the amount, and the period it covers. Also, include the date the payment was or will be issued.

- Mark YES or NO in Item 6 to indicate whether the employee earned at least $7,300.00 while employed with you. If NO, specify the amount earned and the average weekly wage.

- Provide the employer's name, mailing address, city, state, and zip code, as well as your telephone number with area code.

- Fill in the GA D.O.L. Account Number assigned by the Georgia Department of Labor.

- An authorized individual must sign the form. Include the title of the person signing and the date the notice is completed and released to the employee.

Once the Separation Notice (Form DOL-800) is accurately filled out and signed, it's important to either hand it directly to the employee or mail it to the employee's last known address if the employee is not available. By adhering to these steps and completing the form with careful attention to detail, employers fulfill their obligation under Georgia's Employment Security Law and assist their former employees in initiating their claim for unemployment benefits if applicable. Additionally, maintaining a copy of this notice could be vital for future reference or in response to any inquiries about the separation.

Obtain Answers on Separation Notice For Ga

Understanding the Separation Notice for Georgia can be challenging. Here are the answers to some frequently asked questions to help guide you through the process:

What is the purpose of the Separation Notice (DOL-800) in Georgia?

The Separation Notice serves a critical role in the unemployment insurance process. This document must be completed by the employer when an employment relationship ends, regardless of the reason for separation. It provides the Georgia Department of Labor (GDOL) with necessary information to process unemployment benefits claims efficiently.

When should an employer issue a Separation Notice?

According to the Employment Security Law, OCGA Section 34-8-190(c), employers are required to furnish this completed document at the time of the employee's separation. If the employee is unavailable at the time employment ceases, the employer must mail the form to the employee's last known address immediately.

What information needs to be provided on the Separation Notice?

The form necessitates detailed information, including the employee's name and social security number, the period of the last employment, reasons for separation, any post-employment compensation (excluding vacation pay or earned wages), and whether the employee earned at least $7,300 during their employment. Also, employer details, including name, address, and telephone number, must be accurately filled in.

Is the Separation Notice required for all types of employment termination?

Yes, this notice must be provided to any worker who leaves the employment, irrespective of the reason for their separation. However, it is not to be used when employer-filed claims (partial) or mass separation (DOL-402) notices are filed.

What happens if an employer fails to provide a Separation Notice?

Failing to provide a Separation Notice, knowingly providing false information, or failing to disclose material facts can lead to severe penalties under OCGA Section 34-8-256(b). Consequences may include fines up to $1,000, imprisonment for up to one year, or both, for each violation.

Can an employee file for unemployment benefits without a Separation Notice?

While the Separation Notice significantly aids in the unemployment claim process, employees can still file for benefits without it. They will need to furnish equivalent information through other means, which may include contacting the employer or providing employment and payment proofs directly to the GDOL.

Where can more guidance be found regarding the Separation Notice or unemployment claims in Georgia?

For more information and assistance, employers and employees are encouraged to visit the Georgia Department of Labor’s website at dol.georgia.gov. Here, individuals can find detailed instructions, the UI Claimant Handbook, and contact details for UI Customer Service for further queries related to unemployment insurance benefits.

Common mistakes

When employers are filling out the Separation Notice for Georgia (form DOL-800), accuracy and thoroughness are key to ensuring compliance with state regulations and to facilitate the potential unemployment claims process for the separated employee. However, mistakes can occur, often due to oversight or misunderstanding of the requirements. Here are six common mistakes to avoid:

Not verifying the employee's Social Security Number (SSN) for accuracy: Item 2 on the form requires the employer to enter the employee's SSN. Ensuring this information is correct is crucial, as inaccuracies can lead to delays or issues with the employee's claim for unemployment benefits.

Failing to provide detailed reasons for separation when it is not due to a lack of work: Item 4 necessitates that employers specify if the separation was for reasons other than lack of work. Vague or incomplete explanations can complicate the unemployment insurance process, delaying potential benefits for the employee.

Omitting details about any separation pay: In Item 5, employers must not include vacation pay or earned wages but should accurately report other types of separation payments. Overlooking this information can affect the determination of unemployment benefits.

Incorrectly reporting wages: Item 6 asks whether the employee earned at least $7,300.00 during their employment. Reporting this inaccurately, along with the average weekly wage, can mislead unemployment benefit calculations.

Not using an additional sheet when necessary: If more space is needed to provide a clear and complete explanation of the circumstances surrounding the employee's separation (Item 4.b), failing to attach a separate sheet of paper can lead to insufficient documentation for the unemployment insurance claim process.

Inaccurate employer information: Providing incorrect or incomplete employer information, including the name, address, and Georgia Department of Labor account number, can result in misdirected communications or processing errors.

By avoiding these mistakes, employers can improve the efficiency and accuracy of the separation information process, benefiting both the separated employee and ensuring compliance with Georgia's Employment Security Law.

Documents used along the form

When dealing with employment separation in Georgia, the Separation Notice (DOL-800) form is a crucial document provided by the employer to the employee. This form outlines the reason for separation, any payout received, and serves as a key piece of documentation for unemployment insurance claims. However, this is just one of several documents that may be necessary throughout the process. Here are seven other forms and documents that are often used alongside the Separation Notice For GA form:

- Employment Contract: This document outlines the original terms of employment, including job responsibilities, salary, and grounds for termination. It can provide context for the separation.

- Employee Handbook Acknowledgment Receipt: Acknowledgment that the employee received and understands the company's policies, including those regarding separation and termination procedures.

- Performance Reviews: Documentation of the employee's performance over time can be relevant, especially if the separation is related to performance issues.

- Disciplinary Action Records: If the separation is due to policy violations or misconduct, any records of prior disciplinary actions may be pertinent.

- W-4 Form: Initially used for tax withholding purposes, this form may need to be referenced for final paycheck calculations.

- Direct Deposit Authorization Form: If the final payout is to be directly deposited, this form provides the necessary account information.

- COBRA Notification: For companies subject to COBRA, a notification about the availability of continued health insurance coverage is required upon separation.

Each of these documents plays a role in ensuring a smooth transition for both the employer and the employee during the separation process. They help manage expectations, clarify any final compensation, and provide important information regarding post-separation benefits and requirements. In the event of a dispute or an unemployment insurance claim, these documents collectively support the circumstances of the separation, making them invaluable for both parties involved.

Similar forms

Unemployment Insurance Application Form: Similar to the Separation Notice, an unemployment insurance application form requires detailed information regarding the employee's work history, reasons for separation, and earnings. Both documents play crucial roles in determining eligibility for unemployment benefits. The application form, like the Separation Notice, typically requests the employee’s name, Social Security Number, and details about their last employment, including the period of employment and reason for separation.

Employee Exit Interview Form: This form is used when an employee is leaving a company, much like the Separation Notice. It often includes sections that address the employee's reason for leaving, their employment period, and sometimes, their earnings or final pay details. While the exit interview form focuses more on feedback about the employee's experience, both documents cover the employee's departure and can include comments on the separation circumstances.

Last Paycheck Acknowledgment Receipt: This document, which employees receive along with their final paycheck, shares similarities with the Section 5 of the Separation Notice regarding payments. Both documents detail any additional pay the employee receives upon separation, like Severance Pay, Separation Pay, or Wages-In-Lieu of Notice, excluding regular wages or vacation pay. They're critical for clarifying the final compensation the employee receives from the employer.

Employee Warning Notice: Although an Employee Warning Notice is used prior to separation, it can precede the issuance of a Separation Notice. It documents issues or reasons that could lead to an employee's separation if not resolved. Like the Separation Notice, it often includes the employee's name, period of employment, and a detailed account of the issue at hand, resembling the "reason for separation" section but used at an earlier stage in the employment relationship.

Dos and Don'ts

When dealing with the Separation Notice for GA form, it’s crucial to handle the document correctly to avoid potential issues for both the employer and the employee. Here’s a comprehensive guide on what to do and what not to do:

Things You Should Do:

- Provide accurate information: Ensure all details filled in are correct, including employee's name, Social Security Number, and dates of employment.

- Explain the reason for separation clearly: Whether it was due to lack of work or other reasons, provide a clear and full explanation.

- Include all necessary documents: If additional explanation is needed beyond the space provided, attach separate sheets.

- Report any separation pay accurately: Do not include vacation pay or earned wages, but do report any severance pay, wages-in-lieu of notice, etc.

- Sign and date the form: Ensure an authorized person signs the form and dates it on the day it’s handed to the worker or mailed.

Things You Shouldn't Do:

- Leave sections blank: If a section does not apply, clearly mark it as ‘Not Applicable’ instead of leaving it empty.

- Guess on details: Verify all information, especially the Social Security Number and dates of employment, for accuracy.

- Include prohibited information: Avoid including payments that should not be on the form, like vacation pay or earned wages, unless specifically instructed.

- Forget to provide the document to the employee: It’s required by law to hand this form to the employee at the time of separation.

- Fail to keep a copy for your records: It’s good practice to keep a copy of the completed form for your records in case of future inquiries or disputes.

Handling this form responsibly ensures both the employer and the employee are protected under the law and that the separation process proceeds as smoothly as possible.

Misconceptions

When it comes to the Separation Notice for Georgia form, also known as DOL-800, there are several misconceptions that employers and employees alike may have. Understanding these misconceptions is crucial for compliance with Georgia Department of Labor requirements and ensuring that all parties know their rights and responsibilities.

- Misconception 1: The Separation Notice is only required for employees who are laid off.

This is not accurate. The notice must be completed for every worker who leaves employment, regardless of the reason for separation, including resignation, termination, lack of work, or any other reason.

- Misconception 2: Vacation pay must be reported on the Separation Notice.

Contrary to this belief, the form specifically instructs not to include vacation pay or earned wages in the section detailing payments like separation pay or severance pay.

- Misconception 3: The form is complicated and requires legal assistance to complete.

Although it's important to be accurate, the form is designed to be straightforward. Employers should carefully follow the provided instructions for each section to ensure compliance.

- Misconception 4: Small businesses are exempt from issuing a Separation Notice.

All employers, regardless of size, must issue this notice to all separated employees if they operate within Georgia. This is a state-wide requirement enforced by the Georgia Department of Labor.

- Misconception 5: Employees do not need the Separation Notice to file for unemployment benefits.

In fact, the notice is crucial for filing unemployment claims. Employees are instructed to take this form to the Georgia Department of Labor field service office when filing a claim. It provides essential information for processing the claim.

- Misconception 6: The reason for separation can be vaguely described.

The form requires employers to state clearly and fully the circumstances of the separation. If the separation is for a reason other than lack of work, detailed information must be provided.

- Misconception 7: The Separation Notice is only a formality and carries no legal weight.

This is untrue. Providing false information on this form or failing to provide it at all can lead to penalties under Georgia Employment Security Law. This underscores the importance of the notice in the unemployment insurance system.

- Misconception 8: Only the employee can file a claim for unemployment benefits once they have the Separation Notice.

While the employee does need this notice to file a claim, employers can also be involved in the claims process, particularly when providing additional information or contesting a claim. The form serves as an initial piece of documentation in these processes.

It is essential for both employers and employees in Georgia to understand these points about the Separation Notice to ensure proper compliance with state labor laws and to facilitate the unemployment claims process.

Key takeaways

Understanding the proper completion and utilization of the Separation Notice for Georgia (Form DOL-800) is crucial for both employers and employees navigating the process of separation from employment. Here are several key takeaways that encapsulate the form's requirements and its importance in the unemployment insurance (UI) claims process:

- Employers are mandated by the Employment Security Law, OCGA Section 34-8-190(c), to furnish a duly completed Separation Notice to any employee who is separated from their job, irrespective of the reason for such separation.

- The notice must comprehensively detail reasons for the separation, distinguishing between lack of work and other causes, and should include any additional documentation if the space provided is insufficient.

- Special attention is required when reporting any type of payment made to the employee upon separation, such as Severance Pay, Separation Pay, or Wages-In-Lieu of Notice. However, compensation like vacation pay or earned wages prior to the separation should not be included.

- It is essential to accurately report the employee’s earnings, especially if they earned at least $7,300 during their employment period, to determine their eligibility for unemployment benefits accurately.

- Fraudulent reporting by employers, including failure to report accurately or attempting to manipulate an employee’s eligibility for benefits, is subject to legal penalties including fines and imprisonment.

- Upon completion, the notice must be provided to the employee promptly; if the employee is no longer available, it should be sent to their last known address. This ensures that employees have the required documentation to file a claim for unemployment benefits with the Georgia Department of Labor.

- The form serves not only as a notice of separation but also as an advisory for the employee on the steps to file for unemployment compensation, directing them towards the necessary documentation and online resources to initiate their claim.

Proper adherence to these guidelines ensures that the process of separation is managed fairly and transparently, safeguarding the interests of both the employer and the employee. It also facilitates the smooth processing of unemployment claims, allowing former employees to access support during their period of unemployment.

Popular PDF Forms

What Must Be Included on the Cd If You Have an Other? - This document serves as the final breakdown of your loan's interest rate, monthly payments, and the total cost over the life of your loan, allowing you to compare it with your initial Loan Estimate.

What to Bring to K1 Visa Interview - IMBRA’s guidance document is crucial in applying regulations related to the protection of immigrants and the role of marriage brokers.

Da 5823 - Designed to help operators and supervisors manage maintenance, the DA Form 5823 includes spaces for serial numbers and NSNs.